Subscriptions are increasingly making their presence felt in our everyday lives, from coffee subscriptions to ‘Kindle Unlimited.’ It is no longer a ‘pandemic’ thing, as people begin to value the convenience it offers. Even before the pandemic, traditional non-subscription businesses lured by the flexibility it provides their customers, and the predictable revenue it brings with it were beginning to adopt the subscription model. The pandemic only hastened that process.

Here’s the story of how Study.com, an e-learning platform, leveraged subscriptions to reach millions of users worldwide. Equipped with a single payment gateway and evolving learning material, they set out to monetize courses and transition to a subscription-based model. But soon enough, they realized that the recurring billing model and subscription management got more complex with every growth milestone they unlocked.

So this is also a story of the aftermath of growth.

The growing subscriber bases demanded nuanced use cases. Customers wanted specific payment methods. And then, there were growth plans on the horizon with internationalization and an expanding course catalog. That meant a lot of low-value but high-frequency manual code updates that ate away the developers’ time. They weren’t just building a product anymore; they were responsible for the customer experience and billing. They decided to buy an off-the-shelf solution and partner with Chargebee to handle their subscription billing seamlessly. And soon, they realized that they had found a growth partner that scales with them.

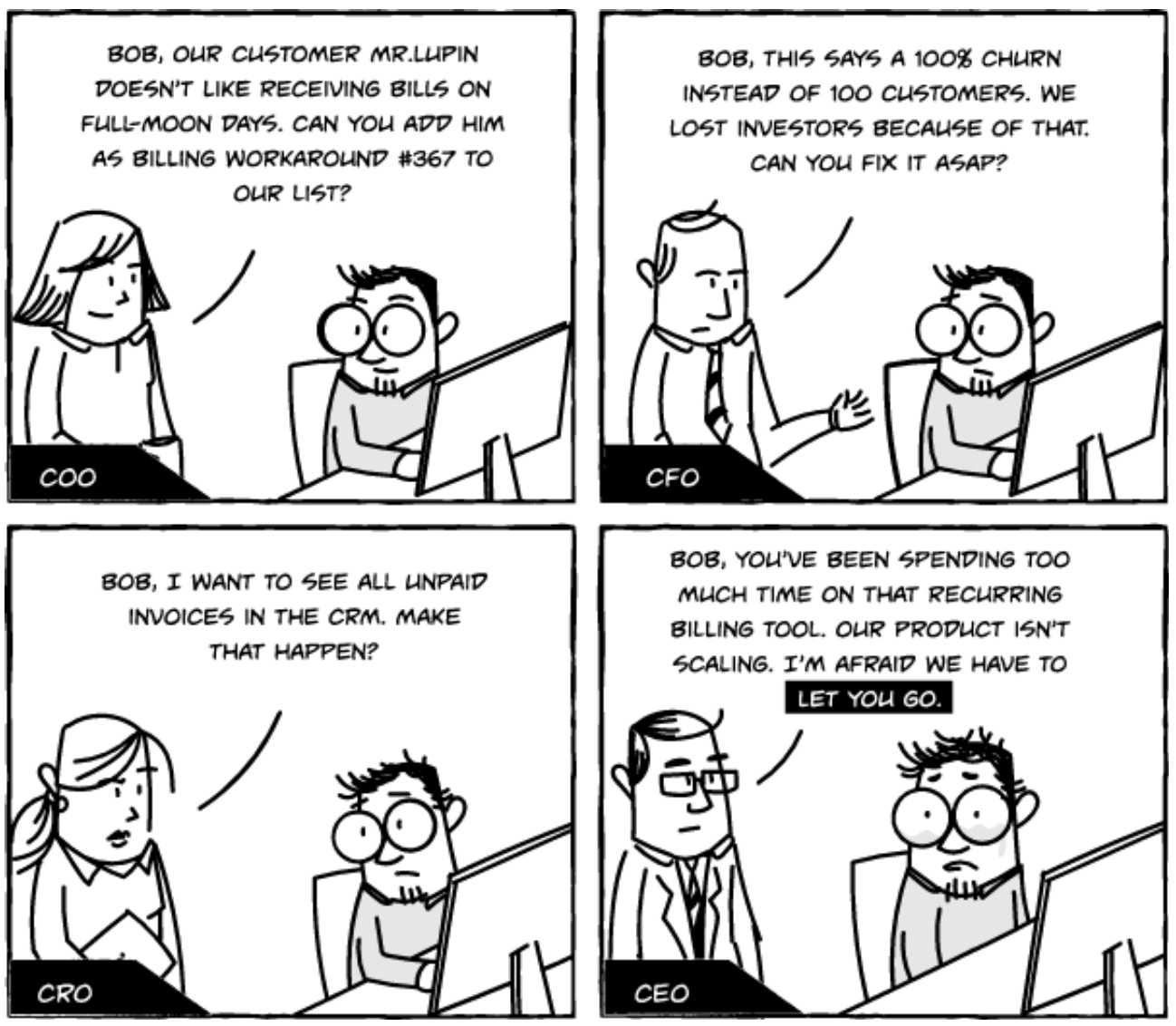

Growth begets complexity. It’s the universal truth. And with scale, this complexity starts adding to the technical debt.

But let’s delve into that for a moment. What makes subscription billing solutions so complex? How can SaaS and other subscription businesses plan for the complexity?

We’ve been helping subscription businesses with their billing and subscription management since 2012. And this is how we’ve learned to think about it along the way.

Subscription Billing: Can you Scale the Complexities?

Recurring billing can be as simple as a few lines of code. There are only three elements to it—collecting a payment, recording the customer’s payment (raising an invoice), and recording the payment information for yourself (so you can pay your taxes, accurately report revenue, or return the money if you have to).

So, where does the complexity come from?

It comes from building on top of those fundamentals to accommodate subscriptions.

Not all customers are in the same billing cycle; they’re not even in the same region geographically.

A few simple lines of code can’t handle tax calculations, discounts, and irregular charges.

Is this change sudden? Not really. But in a competitive market, growth is a differentiator. So these changes will add up to a complex subscription billing scenario sooner than later, which will impede your growth.

When scaling subscription billing, here’s what you should be prepared for:

Great Recurring Billing = Great Subscriptions = Great Customer Experience

Billing gets complex when your subscriptions do. So the line between recurring billing and subscription management gets very hazy once your company is firmly off the ground, with subscriptions flying off the shelves and revenue flying into the bank.

As you start attracting new user personas, expanding into new geographies, and experimenting with your pricing plans, you’ll need to be ready to handle the complexities that creep in:

- New customers mean different payment methods (credit cards, debit cards, wallets, etc.), backup payment gateways, advanced invoicing options, unconventional billing periods, prorations, credits and refunds, promotion support, and payment recovery or dunning.

- New geographies mean new tax laws, currencies, new invoice rules, and support for different languages (what developers call localization).

- New prices mean grandfathering existing subscriptions, cloning subscription models, creating new ones, and support for one-time payments (pricing experiments can cost you a fortune without them).

Your billing system must support charging every use case in any permutation or combination. A failure costs you a subscription. On the other hand, when your recurring billing is seamless, so will your subscriptions, eventually leading to a great customer experience.

Be ready for where customers want to be in future

We’ve been in subscription billing for over ten years, and our customers still surprise us with new ways to mix and match features so they can be creative with their subscriptions. Over the years, we’ve discovered details and microcosms within concepts.

It’s not easy to preempt the future needs of a customer. Moreover, if you’re building billing in-house, all new use cases and edge cases mean you need to spend extra time and energy building and rebuilding.

It needs expertise and domain knowledge to understand your customers’ journey and scale with them. For example, Drawboard, a collaborative PDF markup software, partnered with Chargebee for subscription management because we were already handling every use case they could come up with for the present and near future. In their words,

“Chargebee has allowed us to grow from a local Australian firm with a couple of smaller accounts to being in multiple geographic markets. It has allowed us to scale from licenses in Bullclip to a hundred enterprises using our products. It’s enabled us to actually be a global business, without having to think about billing too hard.”

-Nathan Field

Head of Marketing, Drawboard

When your basic billing starts to unravel under the weight of your subscription complexity added by newer, more significant customers, there’s no other way forward than to revisit your billing system and decide how it should change.

Plan for changes, big and small

Even if you believe you know how your subscriptions will change and can figure out what features you’ll need from a billing system, investing your resources into building them all upfront is risky. You may build features you don’t need or features you do, but a little further from the exact use case you were expecting.

It’s a catch-22. You can build for complexity now and run the risks of over-engineering, or you could address complexity as it comes up, which has its chances of being a tad late, causing you to miss out on opportunities.

The risks of addressing subscription complexity as it comes up

If you choose to accommodate complexities as your subscription needs changes, it’s safe to distinguish between two kinds of changes that you will need to make.

- Minor upgrades or ‘tweaks’ to improve performance and accommodate existing subscriptions better and

- Significant upgrades or ‘alterations’ will fundamentally change how your billing system operates so you can address new subscription use cases.

Why tweaks are difficult to pull off

Every tweak you make is a change to the system, a domino that can set off a series of issues that make the next tweak harder if it isn’t planned for. The only way to work around the domino effect is to document how you’re building your billing system.

There are two advantages to documentation:

- It will serve as a frame of reference in case new developers come aboard for maintenance and

- It will be a lucid record of how features work with each other. It’s worth knowing what changes in one might cripple another.

- The problem is that maintaining documentation is an upward trajectory of difficulty because it is an ongoing, time-consuming process.

An external billing system will eliminate your headaches of maintaining change logs for minor upgrades.

Why Alterations are challenging to pull off

With documentation, tweaks (like making a small change to your checkout page so that you’re collecting a shipping address in addition to billing information) are more than manageable.

However, making an alteration (like changing pricing models) is a slow, research-intensive process.

If you’re wondering what I mean, integration is the perfect illustration of an alteration. An external billing system like Chargebee already comes with pre-built integrations making your life much easier.

And that brings us to our next point.

Be prepared to handle integrations – lots of them

If you have a product manager or are one, you know what tools you’ll need to manage your customers and their ecosystem from the get-go. Integrating these tools with your billing system will ensure that all the information you need from your billing system shows up in the right place at the right time. And vice versa, that information shows up in your billing system when required.

Some integrations are easier to get off the ground than others—your helpdesk, for example. If you’re working with tools that need to exchange information, setting up a line of communication between them is easy (and there are a host of tools that can help you—from Zapier to Cloud Elements to Stitch Labs).

It’s a little harder to integrate with applications that call for more.

Think of your accounting software that requires statements that need to be imported from your gateway. You need them to reconcile payments from your customers with money in the bank, invoices to be synced (not just the information but the document itself) with its record of your customers, and manage separate accounts for each of the products you’re selling.

If you’re building an accounting integration without the aid of an online tool, you would need a dedicated developer with an advanced understanding of your subscription use cases and how they will expand. He also needs to have a grasp of basic accounting and taxes to work with your accounting team (whether that’s one person or six) and address their needs. It will take time and effort to learn and understand both sides of the integration before every limitation (there are lots of ifs and buts to account for when two APIs are involved) in each system can be sidestepped to meet the needs of your business.

At some point, you’ll ask if it’s fair to expect your developers to be subscription, product, and tax experts from the get-go.

It could take anywhere from a few weeks to a few months, depending on how complex your subscription use cases are—it’s an iterative process of simulating needs, running the simulation by all the teams involved, and then coding it. The same goes for a customer management integration, a tax integration, a reporting integration, and a referral marketing integration. Everything requires a solid knowledge base and multiple teams. It is time-intensive.

“The big thing for a billing platform is not just about building, but also maintaining. If our cloud engineers will be building, maintaining, and expanding what our billing architecture looks like internally, then they’re not focused on scaling our core value prop.”

Nathan Field, Head of Marketing, Drawboard

Prioritize must-have features

How do you plan your recurring billing roadmap with a gazillion use cases cropping up with every growth milestone then? If you try to build everything at once, you’re setting yourself up for failure.

You need a list of must-have features critical to your business. From our experience talking to thousands of subscription businesses, we have compiled a list of non-negotiable features that early to mid-stage subscription companies can expect.

Non-negotiable billing features for:

- Plans map out the base price, billing frequency, set up fee, and taxability of your offering, along with support for upgrades to paid plans. Your plans will define your subscriptions.

- A gateway integration – A payment gateway allows you to accept recurring payments from your customers. Here’s a handy guide/post to figure out which one is right for your business.

- PCI-compliant checkout pages

- Trial periods – Essential if your plans are competitively priced. Here’s something to help you decide between a free trial and the freemium model.

- Support for flexible billing periods – Your pricing will change depending on how your business grows. Make sure your billing system can support any changes.

- Support for invoices – Fully customizable, an invoice usually contains an itemized list of charges, including details of the customer’s plan and applicable taxes.

- Communication – Sending out emails of charges, invoices, and other communication is essential if you want to keep your customers up to date on changes to their subscriptions. They’re also an excellent opportunity to build relationships with your customers and maximize customer retention.

- Dunning – 6% of online payments fail. A failure means friction for your customers and revenue that hasn’t reached you. Dunning includes automatic retries to recover a failed payment.

- Metrics – Your billing system can keep you up to date on the health of your business and forecasting with insights on your revenue, churn, and renewals.

Conclusion

When building your billing system, what’s important is to plan for subscription complexity right in the beginning. It’s the only way to ensure your billing system doesn’t stall when you want to meet customer expectations later.

While you’ll know what you are building for and what your system’s limitations are, it takes significant time and effort, which you can otherwise spend on enhancing your product features or introducing new products.

Buying an external billing system from a specialized provider eliminates the complexity of building a robust billing and subscription management platform and lets you focus on your product and scaling your business.

“Everyone needs a secure checkout system, but that’s not something we need to devote our energy to because it’s much better solved by Chargebee. So we decided to focus on what we do best. And that’s how we usually tackle anything: Should we do this on our own? Or should we use somebody who’s solved every use case possible? And in this sense, it made a lot more sense to use an expert like Chargebee.”

– Jose Enrique, Co-founder and CTO, Slidebean

Want to understand how to choose a subscription billing and management platform? Check out this comprehensive checklist of features you should look for in a subscription billing and management platform.