Why traditional billing or accounting system sucks for SaaS?

It’s no secret to subscription business entrepreneurs that SaaS has changed business technology as we know it. Cloud-based solutions place control in the hands of the consumer, allowing them to nimbly manage their subscriptions and upgrade or downgrade service levels on a month-to-month basis.

SaaS providers who survive and thrive are ones who adopt a nimble corporate culture and business model. Many traditional approaches to business simply aren’t a feasible solution for the modern SaaS provider, and old-fashioned billing and accounting systems tops the list.

Why Subscription Billing Can’t Be an Afterthought

A single point of failure in the industry can be leaving subscription billing processes as an afterthought. While it’s undoubtedly true that your business can’t compete in the market without a stellar product, if your business can’t collect monthly recurring revenue, that’s a problem. We’ll examine several of the ways that traditional accounting solutions simply aren’t a reasonable answer for subscription billing:

Flexibility and Self-Service Matter

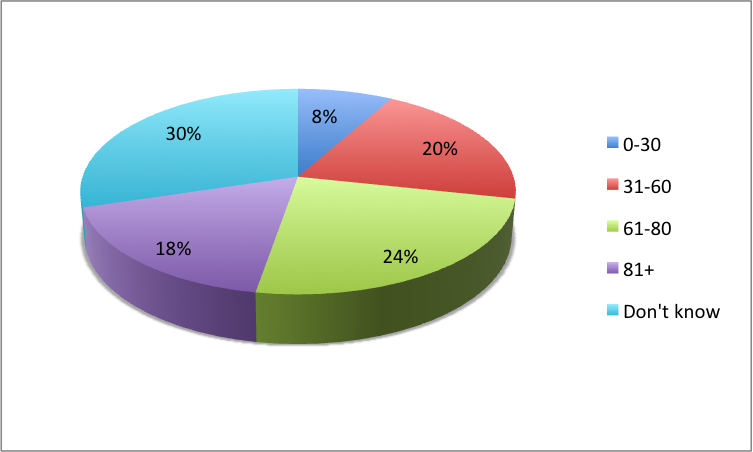

The success of your SaaS company depends on building and maintaining relationships with your current clientele. Recent research by Marketo and Totango indicates that nearly 1 in 5 companies receive more than 81% of revenue from existing customers.

Source: www.totango.com

Your employees’ need to focus on marketing and maintaining relationships with existing customers, not manually adjusting their billing when a client decides to upgrade their service level. Researcher Dwight Davis has found that many subscription businesses handle billing manually through spreadsheets, which simply isn’t a scalable model.

Your Invoices Need to Be On Your Customers’ Terms

Traditional accounting softwares lack the flexibility critical for the average subscription business. According to Dharmesh Mistry, it’s critical that your accounting system have the ability to manage and track payments due on a monthly, quarterly or annual basis, so you can “receive, reconcile and manage recurring payments at any frequency.” Traditional systems which are built to bill customers at the beginning of the month lack the flexibility needed for subscription billing.

Your System Needs to Nimbly Scale

Some of the world’s most successful subscription businesses beat their competitors simply because they were built to scale. Your subscription billing plan needs to scale as gracefully as you do, regardless of the growth you achieve in a month or year.

Account-Based Payment History

Your customers expect tools that allow them to manage their billing and payment. Whether they’re paying their own bill or interacting with one of your employees, they need access to tools which provide the ability to quickly access payment history information.

Companies which put obtaining a scalable, efficient system for collecting revenue as last priority simply can’t expect to succeed. The costs of building a custom system for subscription billing are simply prohibitive to most providers, and traditional accounting software doesn’t provide the flexibility your business needs.

So, are you having your developers focusing on building a billing solution rather than having them focus on building an awesome product? If so, why did you chose that way? Please share your thoughts below.