Nobody likes to be told they’ve spent too much on marketing their business.

In the cutthroat world of SaaS sales, in which everyone is often chasing the same customers, you might think you’ve succeeded the moment you capture a commanding share of those customers for yourself.

But while you’re popping the champagne, one armor-piercing question remains: are you profitable?

If you’re spending more money to bring in one daily active user than you make from that user, your business model is unsustainable. Period. This makes customer acquisition cost — the money you spend to bring in one new customer — your most important business metric.

But there’s hope. Understanding your business’ customer acquisition cost is the first step toward reducing it. This article will tell you how to calculate CAC, what CAC should be for a healthy SaaS business, and what you can do to get your numbers down.

Finding Your Customer Acquisition Cost (CAC Formula)

Customer Acquisition Cost (CAC) is calculated for a certain period of time. You can do CAC calculation for a month, a quarter, a year, etc., so long as you know what you’re sales and marketing costs are for that time.

To figure out your CAC for a given period, use the following simple formula:

Customer Acquisition Cost = Total cost of marketing & sales ➗ Number of customers acquired

Let’s run through an example.

Suppose you run a SaaS business called HelpMe — a subscription based tech support helpdesk. In Q1, your customer acquisition budget includes social media ads, content marketing posts, a Salesforce subscription, salaries for your marketing team and sales team, and some miscellaneous expenses. For the ease of math (rather than because it’s accurate in any way), let’s say it all adds up to $10,000.

With all that spend, you managed to add 500 new subscribers. Dividing $10,000 by 500 equals a CAC of $20.

Now, this is basic math. And yet (despite being some of the smartest and most driven people on the planet), SaaS entrepreneurs and CEOs don’t always pause to look over sobering CAC statistics.

So here’s a number you really shouldn’t miss…

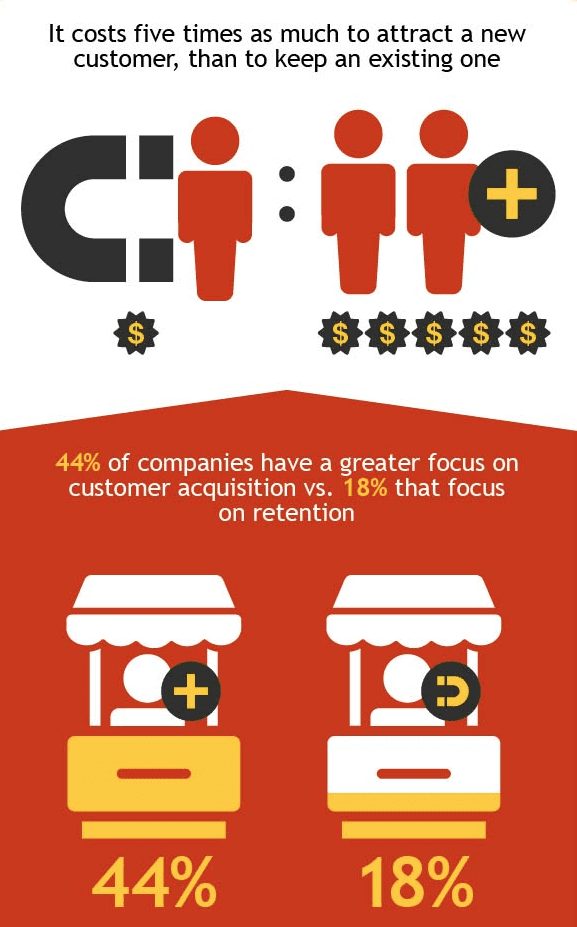

On average, it costs 5 times as much to acquire a new customer as it does to keep an existing one. That’s something we forget. Something our growth teams tend to skip over when allocating budget.

Yet 44% of companies spend more on customer acquisition than customer retention — compared to just 18% who go the other way.

Customer acquisition is expensive. If you’re going to make it the cornerstone of your marketing strategy — and don’t let anyone stop you! — you need to make sure you’ve got a CAC that will let you stay profitable.

So, is HelpMe’s CAC of $20 good?

There’s no way to know. On its own, CAC doesn’t tell you much. To get any value out of this statistic, you’ve got to consider it as a ratio with another number: LTV.

What is LTV?

Customer lifetime value, abbreviated as CLTV (or sometimes CLV), is partners and opposites with CAC.

CAC is how much you spend to get a customer. LTV is how much you make from that customer.

In more detail, a customer’s lifetime value is the entire profit you make from any given customer, from their very first transaction with your business to their last. In business parlance, that last moment is called the churn — the moment when you can be more than 50% sure a customer is gone and isn’t coming back.

To calculate lifetime value, you’ll need a few numbers from your database. First, pick the time period you’re calculating for. Then find:

- Your total revenue for the period.

- The number of purchases in that period. For a SaaS business, a multi-month subscription counts as one purchase.

- The number of unique customers who made purchases in the time period.

- Your average customer lifespan.

That last one will be expressed in units of your chosen time period. Find the difference in days between the first and last order dates of every unique customer in your database. Determine the average of all those differences, then divide it by the number of days in the time period you’re solving for.

Now you’ve got all the info you need to find your LTV. Divide your revenue by your purchases to get your average revenue per purchase, then divide your purchases by your unique customers to get your average purchases per customer.

The equation looks like this:

Customer Lifetime Value = Average revenue per purchase x Average purchases per customer x Average customer lifespan

For an example, imagine you’re back at HelpMe. In Q1 2020, HelpMe generated $10,000 in revenue from 2,000 subscriptions. Those 2,000 purchases were made by 1,000 unique customers.

The average difference between a customer’s first and last HelpMe subscriptions is 3 years. Since you’re working in quarters, that’s an average customer lifespan of 12 quarters.

$10,000 divided by 2,000 equals an average revenue of $5 per subscription. 2,000 subscriptions divided by 1,000 unique customers equals 2 average purchases per customer.

Plug all that into our formula. $5 x 2 x 12 = A Customer Lifetime Value of $120 for HelpMe.

CAC benchmarks in the SaaS industry

Don’t think about getting a “good CAC.” It’s all relative.

Instead, think about a healthy LTV/CAC ratio.

As a SaaS business owner, your overhead costs are far lower than they’d be in another industry. Most of your budget goes toward growing your business. That makes marketing spend a canary in the profitability coal mine.

You should be getting more out than you put in. But that’s not enough. If a software company only grows at 20% per year, it has a very good chance of ceasing to exist within five years. That’s an LTV/CAC ratio of 1.2.

What’s the lower boundary for likely success? 3.9. Every dollar you spend acquiring a new customer needs to make you at least $3.90 in revenue.

HelpMe, our fictional SaaS company, had an LTV of $120, and a CAC of $20. Their LTV/CAC ratio is 6. That’s excellent. HelpMe has a good chance of staying profitable in the long run.

If you’ve been reading closely, you might have spotted something off. HelpMe’s sales and marketing expenses was $10,000 in Q1 2020 to raise $10,000 in revenue. That’s not an accident. The company is on a path to long-term health — even though its sales/marketing spend and quarterly revenue were exactly the same.

Why? Because the customers acquired in one quarter carry over to the next. Some will churn out, but not enough to put HelpMe in the red.

Early on, we mentioned that most businesses spend too much on customer acquisition, and not enough on customer retention. Now you understand why. Customer retention is an incredibly powerful investment.

In fact, research has demonstrated that keeping 5% more customers from one period to the next can boost your profits by up to 95%. Not only that, but customer retention improves each customer’s lifetime value, which in turn improves your LTV/CAC ratio.

One last word on all the arithmetic. Approach these statistics with a bit of caution. LTV and CAC are based on averages, projections, and extrapolations. They don’t account for a devastating bug, a competitor roaring onto the scene, or any other black swan events. Too many leaders don’t account for that, and end up spending money they don’t have.

The LTV/CAC ratio is a measure of how healthy your business is at a moment in time. It’s not meant to be used to plan your budgets.

3 ways to improve your LTV/CAC ratio

So you’re worried about profitability. As a SaaS entrepreneur, that’s not a bad thing. Better to spend time thinking about it than to get blindsided by a bad quarterly report.

When it comes to performing first aid on your SaaS profits, you get the basics. Keep your customer acquisition cost low, and your lifetime value high. But how?

As the formulas suggest, there are three main ways to go.

You can get a number of new customers (and lower the cost of doing so).

You can retain the existing customer base (and lower the cost of doing so).

Or you can get more revenue per customer (without driving them away).

#1: Get new customers for less money

Step 1 is all about getting your CAC down. Your goal is to build a pipeline that brings in more customers, without increasing how much you spend on each one.

One way to do this is to experiment with free trials. Potential customers are skittish about spending their money, especially on an unknown SaaS.

A free trial is your chance to convince them you’re a worthy investment.

But you can’t just throw a free trial onto your landing page and wait for the customers to come in. The sad fact is that most people who sign up for your free trial won’t convert to a paid subscription.

Take time to optimize, though, and those conversion rates start looking a lot better. At Chargebee, we were able to boost free-to-paid conversions from 8% to 15% by paying attention to how our free users behaved.

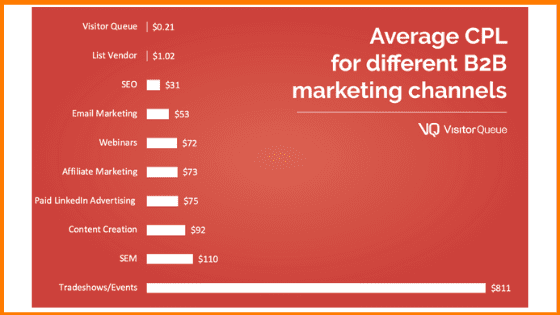

Gaining more customers will lower your CAC, but the math says there’s another way: spend less. As a new SaaS company, allocating your resources effectively might be the biggest step you can take towards long-term health.

That starts with automating your workflows.

Nursing a lead into a customer takes a lot of labor. Busywork distracts your marketers’ attention, and leads to less effective work overall.

If you can automate sales, marketing, and customer acquisition tasks, you can reposition your talent to where you need it most.

Look into Chargebee’s tools, and you’ll realize you can automate things you haven’t even thought of. Taking payments. Tracking customer activity. Capturing buyer information. The list goes on and on.

#2: Keep existing customers for less money

For this step, focus on getting your customer retention cost down.

Retention almost always costs less than acquisition — it’s why 44% of businesses overlook it. Yet with the dividends it can pay, you’d be a fool not to pay attention.

The best thing you can do to retain customers starts before they’ve handed you any cash at all.

Few things will lose your SaaS more business than friction in the checkout process. If you’ve ever signed up for an exciting product, only to have it force you to create an account and verify your email to get access, you know how fast a bad checkout can drain your enthusiasm.

Here at Chargebee, we noticed we were getting way more hits to our site than we had paying customers. People showed up, but they weren’t staying. As an experiment, we simplified our checkout process as far as we possibly could.

The result: a 100% surge in signups.

Your other secret weapon is email.

At every stage of the sales funnel — from before a customer checks out to after they’ve made multiple purchases — emails are the cheapest, easiest way to keep them engaged.

When customers fall out of the funnel, it’s not always because they don’t think your SaaS has value. On the contrary, if they showed up at all, you probably have something they want.

Instead, your biggest enemy is indifference and neglect. Customers who let their subscriptions lapse might not be dissatisfied. They might have just forgotten their plans are about to run out. Email is a low-cost, low-impact way to remind them.

#3: Get more revenue per customer

We know: this part feels impossible. If you raise your prices, customers drop out until you’re left with the same revenue as before.

But it’s more complex than a simple matter of up and down. We analyzed the prices of three successful SaaS companies over 10 years — here’s what we learned.

The key to finding the right price is experimenting. The key to experimenting is a deep understanding of your audience. Gather information on what parts of your product they value, and adjust your prices to match.

There’s another side to this coin: strategic discounts, deployed with tactical precision.

Think of a SaaS discount as a volatile chemical. It’s useful, but not if you spray it all over the place. If a customer hasn’t even hit your product page yet, and you start offering discounts, they’re going to suspect there’s something wrong with your service.

Instead, you should use discounts to add perceived value, not subtract it. Suppose a customer is willing to pay $20 for your Basic plan. They may see the benefit of upgrading to Premium, but at $40, it’s just too steep.

That’s when you drop in the discount. Compared to $40, $30 doesn’t sound steep at all. Congratulations — your revenue per customer just rose.

Conclusion

Customer acquisition cost (CAC) is the money you pay to add a single new customer to your SaaS. When paired with lifetime value (LTV), it’s like a thermometer for your business.

If your LTV/CAC ratio is greater than 3.9, you’re doing something right. If it’s lower, you need a course correction.

If you’re serious about reducing your CAC, Chargebee is the best money you’ll ever spend. It lets you automate subscription management and billing so you can focus on delivering the perfect product — and making a profit. Schedule a demo today.