AI has changed how software creates value. Modern AI applications perform complex creative tasks, analyze massive datasets, write research papers, and make sophisticated predictions—capabilities customers recognize as far more valuable than previous solutions. Yet many AI companies struggle to convert this value into revenue because of outdated pricing models and inadequate monetization infrastructure.

The core issue extends beyond pricing; it’s about having systems that can detect, measure, and capture value when AI usage patterns are unpredictable and evolve rapidly. While companies focus on AI model performance, they often overlook the monetization architecture needed to convert their technological breakthroughs into sustainable revenue.

This gap between AI’s potential and actual revenue comes from a critical missing component: a billing infrastructure that enables intelligent monetization.

Let’s explore why traditional approaches fall short and how a new framework for AI monetization can solve this challenge.

The AI Monetization Challenge

AI products differ from traditional software in ways that break conventional pricing models and pose unique challenges:

- Value creation varies unpredictably: Unlike fixed-function software, AI capabilities evolve with use, making it difficult to predict where and how value will emerge.

- Value doesn’t align with headcount: When AI enables one user to do the work of ten, seat-based pricing fails to capture full value.

- Costs vary with usage types: AI inference costs can vary a lot based on request complexity, input types, and output length, making static pricing models unsustainable.

- Value perception changes rapidly: As capabilities that seemed exceptional yesterday become standard tomorrow, perceived value changes faster than traditional pricing can adapt.

To bridge this gap, AI companies need a new monetization framework built on a billing infrastructure designed for AI’s unique challenges.

The Three Pillars of AI Monetization

Pillar 1: Pricing and Packaging Agility

The dynamic nature of AI value requires exceptional pricing flexibility. Companies need to experiment across multiple dimensions:

- Pricing models: Subscription, usage-based, outcome-based, or hybrid approaches

- Value metrics: API calls, tokens, items processed, time saved, or business outcomes

- Packaging structures: Freemium tiers, free/paid pilots, bundling strategies, and feature tiering

If your pricing logic is defined in your application code, it creates choke points that become harder to unblock over time. Each pricing change requires engineering resources, causing delays that prevent rapid market testing. AI companies need metering that adapts to compute-intensive workloads, multi-step processes, and dynamic cost structures, without engineering intervention. Without this flexibility, you risk mispricing high-cost tasks or failing to monetize premium capabilities effectively.

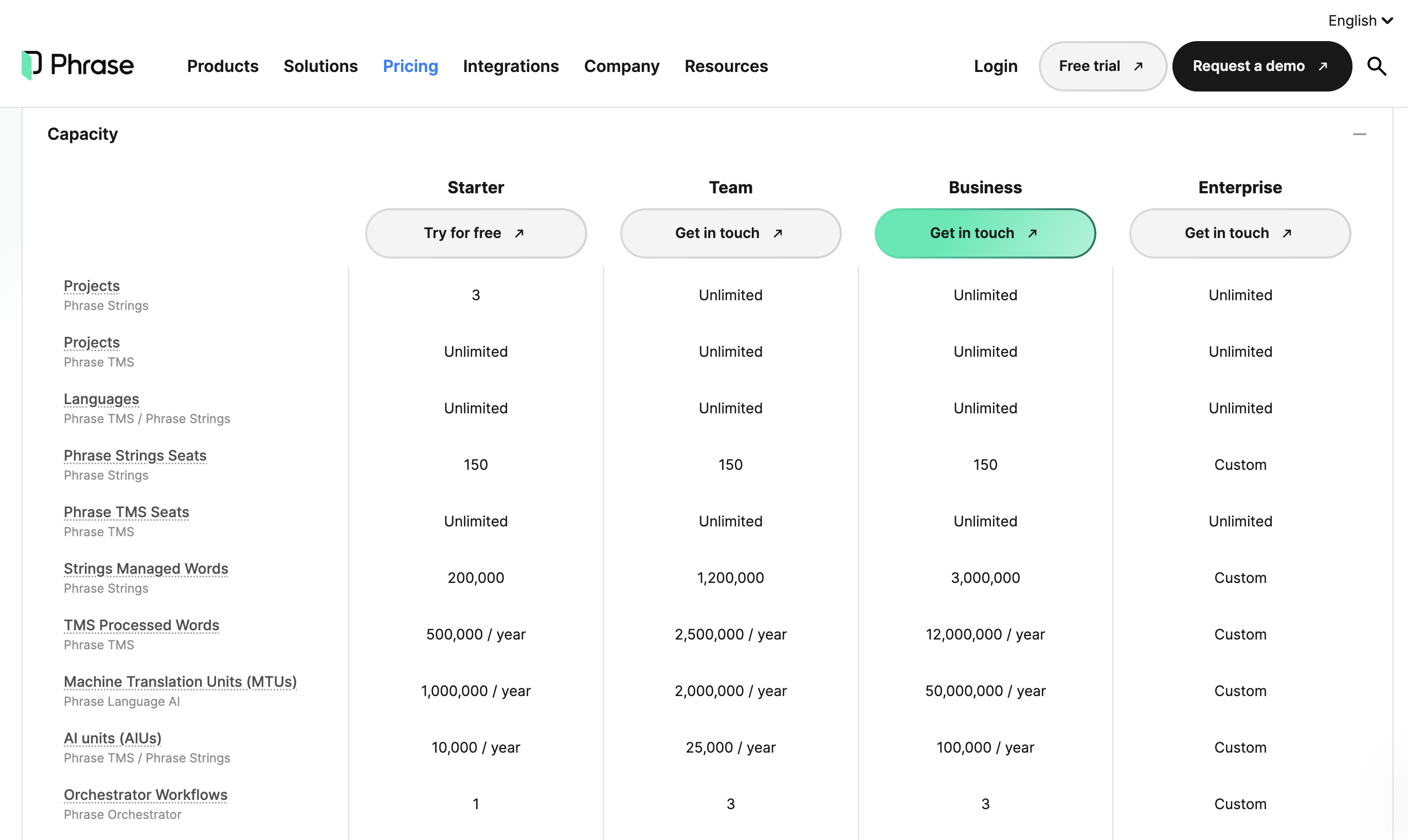

Consider Phrase, the AI-led translation technology leader. When moving from seat-based to usage-based pricing, they implemented a model that:

- Set progressive pricing tiers that scale with usage intensity, ensuring predictable baseline revenue while capturing additional value from power users

- Implemented feature-level entitlements that unlocked premium capabilities, allowing customers to explore their product portfolio without sales intervention

- Created dynamic pricing rules based on usage patterns

- Established granular cost controls that prevented abuse while encouraging adoption

With traditional systems, implementing this strategy would have taken months. With modern billing infrastructure, it was deployed in weeks without engineering dependencies, allowing business teams to adjust pricing through configuration rather than code changes.

Key takeaway: The real power of pricing agility isn’t just speed—it’s the ability to implement precise monetization strategies that reflect actual customer value.

Pillar 2: Usage Intelligence

In traditional software businesses, product teams tracked features through analytics platforms, go-to-market teams relied on CRM data, and finance worked with billing systems, creating siloed views of customer behavior.

With AI products, this fragmented approach creates critical blind spots:

- Product teams can’t see which AI features deliver the most value

- Finance can’t accurately forecast costs or revenue for usage-based AI features

- Sales and Customer Success lack visibility into expansion opportunities within existing accounts

What’s needed is a unified system that tracks meaningful patterns indicating value creation:

- Which AI capabilities drive engagement vs. create friction

- How usage intensity corresponds with customer satisfaction and retention

- Which features customers would pay more for vs. those they expect for free

- The relationship between allocated limits and actual usage across pricing tiers

Modern billing infrastructure provides this unified view. Unlike general analytics platforms that track clicks and sessions, usage intelligence centered on billing data focuses on value metrics that customers will pay for.

Key takeaway: You can’t price what you can’t see. Understanding which AI features customers actually use helps you spot what they value most. A unified view of usage. tied to real customer accounts, guides smarter product and pricing decisions.

Pillar 3: Revenue Intelligence

While usage intelligence tells you what customers do, revenue intelligence reveals how that translates to your bottom line. Specialized billing infrastructure creates a direct connection from usage to financial outcomes, answering crucial business questions:

- Which AI features drive the highest revenue per development dollar?

- How do pricing changes affect adoption and margins across segments?

- Which usage patterns signal expansion opportunities or churn risk?

This intelligence spans the entire customer lifecycle—showing which acquisition channels bring high-value users, how customers reach initial value, and which usage patterns predict long-term retention.

The accuracy of this data is equally critical. For AI companies with complex pricing models, even small gaps in revenue capture can lead to revenue leakage and inaccurate financial reporting. To manage this, you need a single source of truth that aligns your organization around reliable metrics, enabling confident iteration on monetization strategies.

Key takeaway: It’s not just about what customers do, but how that drives revenue. Linking usage to financial impact helps you optimize pricing, reduce revenue leaks, and double down on what works.

Why Billing Is the Missing Link

Having the right instrumentation makes all the difference in your AI monetization journey. Investing in separate systems to measure feature adoption, customer and subscription data, and financial reporting blindsides you to insights.

Billing infrastructure is uniquely positioned to bridge these gaps because:

- It functions as a critical data observability layer. Billing systems provide everyone across the organization with a shared understanding of usage and revenue data. This single source of truth eliminates the discrepancies that often arise between product, sales, and finance teams when tracking feature adoption and value.

- It bridges awareness with action. Beyond just observing patterns, billing infrastructure enables teams to act on insights immediately. From launching experimental pricing tiers to dynamically adjusting feature entitlements, the right system moves you from understanding data to implementing changes that capture more value. It provides the enforcement layer for monetization by actively applying pricing rules and entitlements that capture value appropriately.

- It keeps all systems in sync. Billing infrastructure ensures that customer usage, pricing agreements, and financial reporting remain aligned in your upstream (CRM) and downstream (Revenue Recognition and Accounting) systems.

Effective billing systems serve all teams across your organization – providing product teams with usage insights, enabling go-to-market teams to experiment with pricing, giving finance a single source of truth, and offering executives a strategic dashboard for monitoring business health and growth.

Build Your AI Monetization Journey with Chargebee

Chargebee’s agile billing infrastructure gives AI companies the foundation to solve complex monetization challenges. Our platform helps you track and act on value through usage tracking and billing, flexible pricing experimentation, and entitlements, enabling you to adapt quickly without compromising accuracy or control.

Leading AI companies such as DeepL, Adcreative, Quillbot, and Writesonic rely on Chargebee to implement complex pricing structures that accurately reflect the value of their intelligent products.

Ready to unlock the full revenue potential of your AI products? Learn more about why AI companies choose Chargebee.