Acquisition

What is Customer Acquisition Costs?

Why is CAC important?

Let's assume you're the founder of a fictitious helpdesk company named Helpme.

You're at the funding party, celebrating your Series-A when an old but wise friend walks up to you.

After congratulating you on acquiring the 85349th helpdesk customer, she utters the dreadful three words: "Are you profitable"? You are unsure because you haven’t dove into one of the most important metrics for determining profitability. The simple math to build a profitable business is to make sure you make more money from customers in their lifetime than you spent in acquiring them.

Understanding CAC is vital to understand how cash efficient your SaaS business is and how successful it could be in the future. CAC often determines the marketing spend for companies. A clear picture of your CAC gives you a better perspective and helps you balance your spending and inches you towards profitability.

Customer lifetime is roughly the average number of years customers use your product and contribute to revenue growth. Similarly, customer lifetime value (CLV), or the average value of that individual customer’s lifetime is critical information in determining if your business is profitable.

When you know your customer base down to how long they will likely be a customer and how much revenue they will likely contribute, you can effectively optimize the cost of acquisition and your marketing efforts and marketing expenses can be better tailored toward a more successful business.

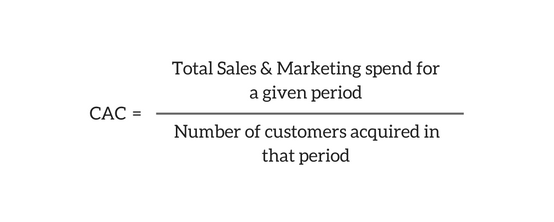

How to calculate CAC?

CAC is calculated by first adding the marketing & sales spend for a given period and dividing that total spend by the number of customers gained during that given period.

What forms the total sales and marketing spend? It's made up of any costs that you incur in acquiring a customer. It could be money spent on ad campaigns, events, cost of PPC campaigns, SEO, content marketing, etc.

Some factors to consider while calculating CAC.

If you have a freemium product, it's important to add the product & support costs to the total sales and marketing cost too. This is because your product acts as your acquisition channel.

The number of customers taken into account should be your new paying customers that you acquired in that given period.

Most people tend to miss out on some of the following expenses

Cost of all tools used

Salaries of the marketing & sales teams

Referral costs

Overhead costs

It's important that sales and marketing salaries are considered because ultimately, these teams are on the ground rallying for the cause. They are contributing to an increase in the revenue directly. If salaries, or any of the other commonly missed costs are forgotten, your customer acquisition costs are going to be inaccurate.

The missing piece: Time Period

The way customers discover your product might be different. Here's a common discovery process:

Prospect reads a blog -> comes to your website -> evaluates your product -> comes back later to make a purchase.

After the initial discovery, for someone to recognize your product and come back to make a purchase, it takes a considerable amount of time.

If you calculate CAC for just a month, it might not be the ideal measure of what happened in that month. Say you spent $20000 in the month of January but your revenue was $10,000 it's not necessarily from this month. And the amount you spend now could be helping you in acquiring customers the following month.

It's advisable to look at CAC over a period of time say 3 months.

You can also try Hubspot's way of calculating CAC which factors in the sales cycle.

How do you look at CAC?

CAC can be evaluated in two ways: Blended and Paid.

Blended CAC is when you account for all different types of marketing channels including the ones you don't pay for directly such as: content marketing. It's the total acquisition cost for a period / total customers acquired in that period.

Paid CAC, on the other hand, is the total acquisition cost / customers acquired via paid channels.

While blended CAC gives you an overall snapshot of your business, looking at Paid CAC will help you figure out the channels that need work and if your paid channels are profitable.

It's crucial to break down your cost of acquisition and segregate what matters. There might be sunken costs that did not necessarily lead to any revenue. It’s always best to include the costs that have a direct correlation to your revenues.

But understanding CAC is just a part of the picture. To completely understand the unit economics of a customer, you should consider it in tandem with the Lifetime Value (LTV) of a customer.