QuickBooks Online

Introduction

The QuickBooks integration simplifies the accounting process by automatically syncing invoices, payments, and related data from your Chargebee site to QuickBooks Online. As part of this integration you can:

- Sync Invoices, Payments, Credit Notes, Refunds, Customers, Plan/Addon price points, Discounts, and Taxes.

- Integration of Chargebee test and live sites with a QuickBooks Online sandbox account is not supported.

- Generate financial reports in QuickBooks.

- Generate tax liability reports and file returns to specific tax authorities in QuickBooks.

Note

- This integration is with QuickBooks Online edition only. QuickBooks Desktop edition is not supported.

- Integrating the Chargebee test and live sites with the QuickBooks Online sandbox account is not supported.

- This is a one-way sync, all invoices and related information from Chargebee will be updated to QuickBooks.

- If you have multiple tax jurisdictions setup in Chargebee, it is not recommended to connect the Chargebee site to a single account in QuickBooks due to tax implications in QuickBooks.

- This integration supports the multi-decimal feature.

Account Summary Report

If you are processing large volume of invoices and do not prefer to sync each and every invoice to QuickBooks, then you can download the Account Summary Report.

The Account Summary Report summarizes all the billing transactions and provides the net values to be accounted for

- Invoices & Credit Notes

- Discounts

- Taxes

- Bad Debts

- Payments

- Revenue to be recognized

You can add consolidated entries in QuickBooks using this report.

You can also refer to the revenue to be recognized per month in the report.

Sync Overview

WARNING:

This is a one-way invoice integration from Chargebee to QuickBooks. Updates made in QuickBooks will not be updated in Chargebee and will cause data mapping issues. Please get in touch and we will recommend the right approach to update information in QuickBooks without causing sync errors.

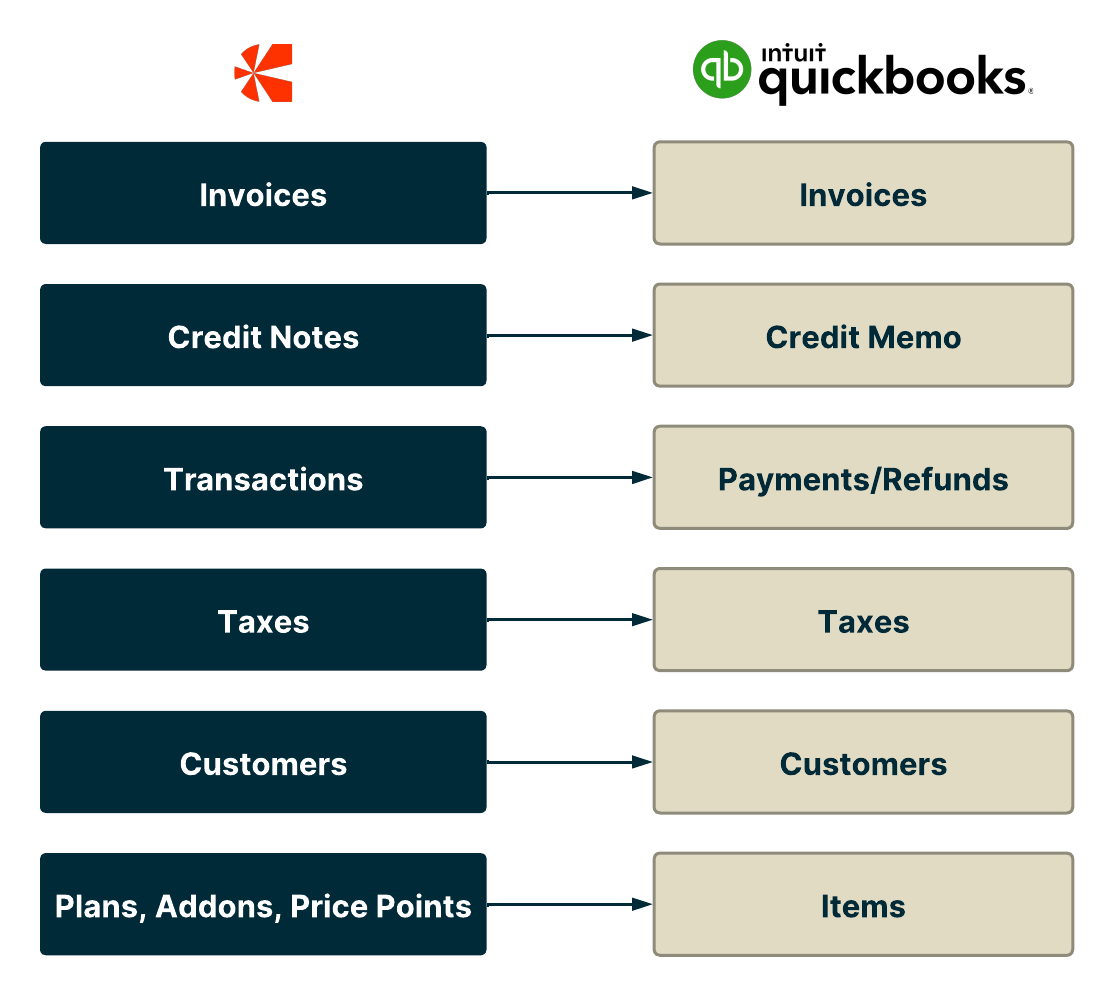

Data syncs from Chargebee to QuickBooks Online as follows:

Customers

- Customer and address details will be synced.

- Chargebee will check if a customer is already present in QuickBooks.

- If a customer is already present, the name will be suffixed by Name (1), Name (2) to differentiate between the customer records. Alternatively, you can map the customers between Chargebee and QuickBooks during the integration setup process.

- The character limit allowed for entering a Customer's name in QuickBooks is 100 characters, lesser than what is supported in Chargebee. So if a Customer name exceeds 100 characters, Chargebee will trim the remaining characters and sync to QuickBooks.

- If you merge a customer/ archive a customer in QuickBooks, it will result in an error in the integration mapping. It is recommended not to update details in QuickBooks after sync has begun.

- The Customer name in QuickBooks is created based on the customer details provided in Chargebee at the time of sync. If the Customer name is left empty in Chargebee, Customer ID will be set as Company name in QuickBooks.

Note

Chargebee provides an account hierarchy feature that is now available with this integration. Click Chargebee Account hierarchy for more details.

Hierarchy information is synced from Chargebee to the accounting tool partially. At the customer level, the hierarchy will not be synced. But if the payment owner is different, when the payment is synced, the relationship of the payment will be synced.

If your Chargebee site has an accounting hierarchy feature enabled, then listed below are the expected outcomes from the QuickBooks integration with Chargebee:

| Invoiced To |

Bill Payment By |

Expected behavior |

| PARENT |

PARENT |

Sync Invoices, Credit notes, payments and refunds. |

| CHILD |

CHILD |

Sync Invoices, Credit notes, payments and refunds. |

| CHILD |

PARENT |

Sync invoices, credit notes,payments, and refunds.The customers relationship of the payment is synced . |

Plans/Addons

- You can provide the GL Account Name for the plan/addon price points in Chargebee before setting up the sync.

- Plan/Addon price points in Chargebee are created as Products of Type ‘Service' in QuickBooks.

- If products are already present in QuickBooks, you can provide the Product Name in Chargebee (Plan > Price Point > SKU) to avoid duplicates from being created.

Invoices/Credit Notes

- Discounts, Ad hoc Charges, Round off, Bad debts are created as line items in QuickBooks such that the Chart of Accounts can be mapped to each type.

- As these need to be created as line items in QuickBooks, these will be created as Products/services.

- If a product/service is already available in the same name, then existing product/service will be used.

- Invoices cannot be voided in QuickBooks via API. Voided invoices will be created as Credit Notes in QuickBooks.

- For multi-currency invoices, Chargebee will send the exchange rate to QuickBooks.

- Fractional correction in the invoice amount in Chargebee will be reconciled by adding a Round-off amount line item automatically. And tax will be exempted for the fractional correction amount.

Payments/Refunds

- Payment & Refund transactions will be synced to Bank/Clearing Account in QuickBooks.

- Refunds will be created as Expenses in QuickBooks. Read more about this limitation in QuickBooks.

- You can choose a Bank account/ Clearing account/Undeposited funds account for the sync.

- You can map different Bank accounts based on Gateways/ Currencies in Chargebee.

- Successful transactions will only be synced (in-progress or failed transactions will not be synced).

- Transactions that are deleted in Chargebee will be synced to QuickBooks and the corresponding transactions will be deleted in QuickBooks as well.

Syncing deleted transactions to QuickBooks feature is currently available for Private Beta Testing. Contact support if you wish to get this enabled for your site.

- For online transactions - the gateway transaction ID will be synced, for offline payments - the payment reference number will be synced to QuickBooks.

- Two-way sync is enabled only for offline payments, i.e., offline payments reconciled in QuickBooks will be synced to Chargebee.

Taxes

- Taxes will be synced to QuickBooks based on the QuickBooks edition.

- Tax mapping will be possible only if you have set up taxes in Chargebee.

- For US edition - taxes will be created automatically in QuickBooks.

- For Canada, EU, Australia, New Zealand, S.Africa, Singapore, Indian editions, you can select from the default tax codes created in QuickBooks.

- If you have multiple tax profiles, then you can select a tax code for each profile.

- Default tax codes can be provided as a fallback option.

- Effective tax rates applied in the invoices via Avalara - AvaTax for Communications can be synced to QuickBooks.

Limitations

Customers

- QuickBooks limits a customer's first name and last name to 100 characters. If a customer is created in Chargebee with a name that is over 100 characters long, Chargebee will trim the name so that the customer details can be synced to QuickBooks.

- If a customer is deleted in Chargebee, the customer record will still be available in QuickBooks, however the customer's invoices, credit notes and other payment related information will be deleted.

- QuickBooks does not allow the customer's shipping address to be captured. Chargebee allows to capture Shipping address at the Subscription level, subscription level shipping address will be synced to QuickBooks.

Coupons

- Chargebee supports percentage and fixed amount discount coupons, both at line item and invoice levels. However, QuickBooks supports percentage and fixed amount discounts only at the invoice level. When the integration is set up, Chargebee will add item level discounts at line item level.

Subscriptions

- When you delete a subscription in Chargebee, the corresponding invoices will be deleted in QuickBooks as well. However, this will not delete the credit notes and other payment related information and will have the status as "Unapplied" in the QuickBooks but deleted in Chargebee.

Multi Currency

- QuickBooks supports only one currency per customer. This means that if a customer has invoices in multiple currencies, they will not all be synced to QuickBooks.

Caution!

The currency that the customer's first invoice was created in, will be the currency associated with the customer in QuickBooks. Invoices created against the same customer in any other currency will not be synced and will show up in the error report.

Invoices

- QuickBooks has a limit on invoice number length - QuickBooks allows only 21 characters and Chargebee allows 50 characters. To automatically sync your invoices with QuickBooks, ensure that your invoice numbers are less than 21 characters. In case you cannot limit an invoice number to 21 characters, you will have to manually sync the invoice in question with QuickBooks using an alternate invoice number.

Note

Note: If you are a merchant operating in the Nordic region, you can enable the invoice voiding feature in Chargebee that automatically creates and applies a credit note against each voided invoice. This is now supported in the QuickBooks integration as well. Please reach out to support to enable this feature.

Refunds/Credit Notes

Refund transactions will be created as Expenses, please read this document from QuickBooks for more details.

Credit Notes voided in Chargebee will not be voided in QuickBooks as QuickBooks does not allow to void via its API.

QuickBooks has a limit on credit note numbers - QuickBooks allows 21 characters and Chargebee allows 50 characters. To automatically sync your credit notes with QuickBooks, ensure that your credit note numbers are less than 21 characters. In case you cannot limit a credit note number to 21 characters, you will have to manually sync the credit note with QuickBooks using an alternate credit note number.