You’d think that in today’s world of payment gateways, wallets, bitcoin and blockchains, or even credit cards, cheques, cash, and standing orders, something like Direct Debit would be old fashioned and less preferred.

I have a surprise for you.

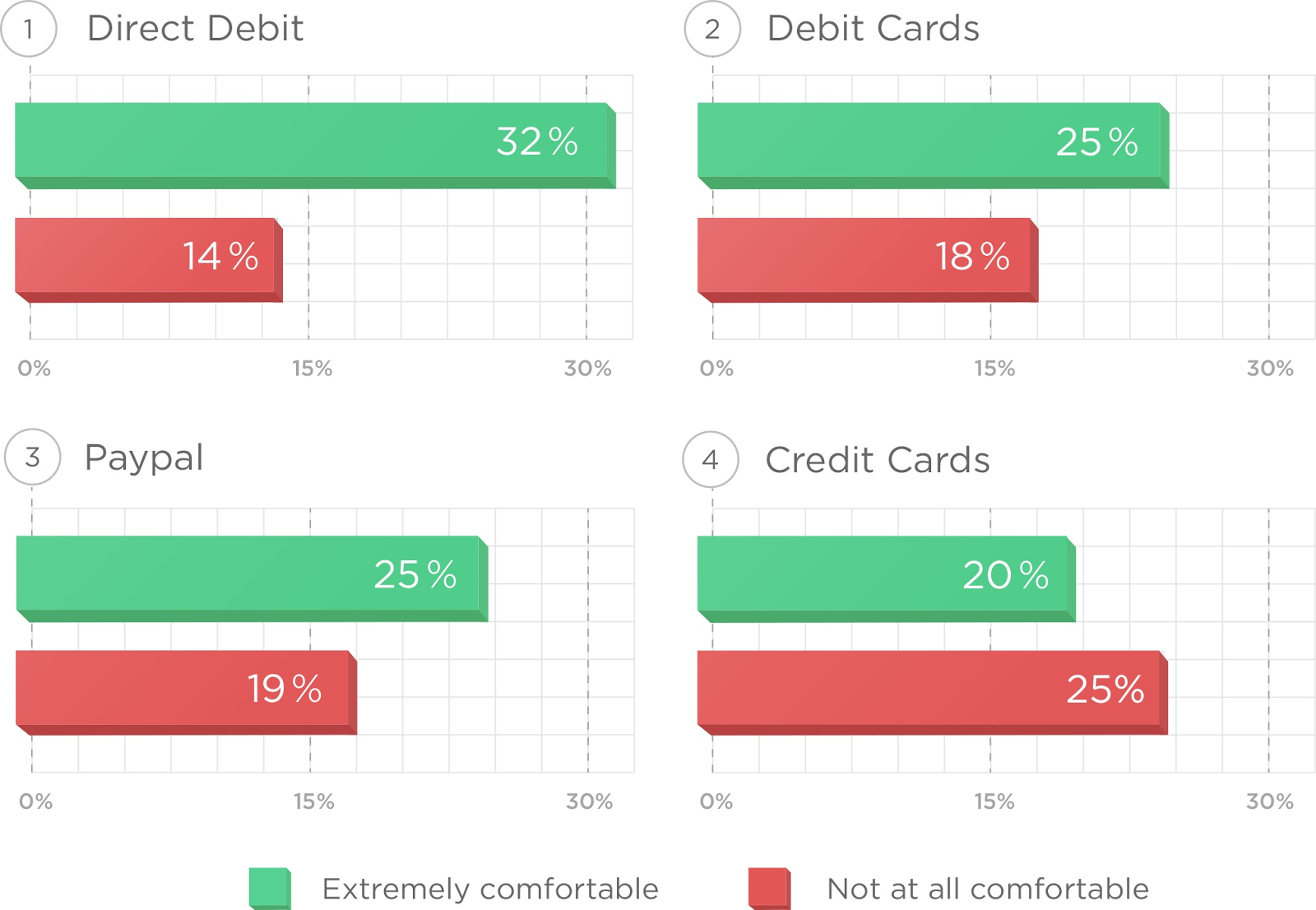

I came across a survey by a UK-based market research firm, YouGov, that explored UK’s favourite method of payment. The survey, commissioned by GoCardless, had something interesting to show -

They broke down the usage of of different payment methods. And 32% 0f the respondents showed that they were extremely comfortable using Direct Debit.

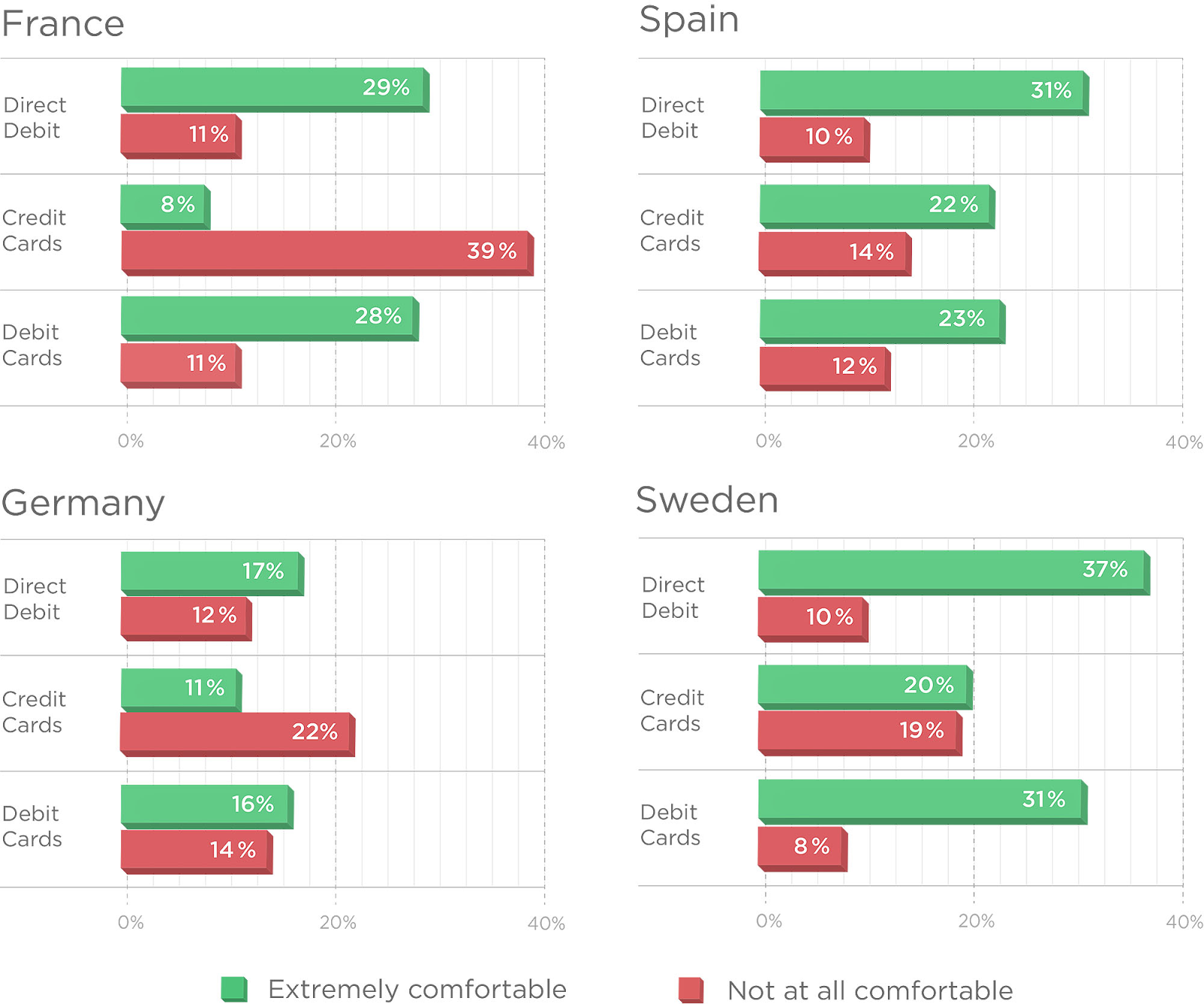

And the scene in the rest of Europe including France, Spain, Germany, and Sweden, wasn’t any different.

To put that in perspective, it had the least number of people least comfortable using Direct Debit, and the most number of people most comfortable with it, as opposed to the other options.

The real deal is, it reduces the hassle of transferring money by eliminating administrative pains.

That got me curious about the (not-so) brief history and workings of Direct Debit, the banks that offered that function, and how the landscape is changing today.

Direct Debit is an authority that you give your bank, so that a business to whom you want to pay recurring payments, can claim money from your bank account. And you can have this arrangement for paying utility bills such as mobile, gas, and electricity bills.

This authorization is known as a direct debit mandate - and the receiving end of the payments, such as the payee business is the mandate holder.

And guess who else jumped onto this opportunity. Subscription and SaaS businesses, of course. These include the likes of Box and Sellsy. All this, so that we can make standing in long queues to get our cheques cleared or pay bills, a distant memory.

The man we would want to thank for making us all indolent geniuses is Dennis Gladwell.

We’ve got your BACS

Bankers' Automated Clearing Services (BACS) was introduced by Dennis Gladwell of the Joint Stock Banks Clearing Committee and has been around since its inception in 1968. It started off as the Inter-Bank Computer Bureau and aimed at cutting down the tedious and pointless procedure of paper-based transfers between banks, that would have otherwise taken anywhere from weeks to months to be processed.

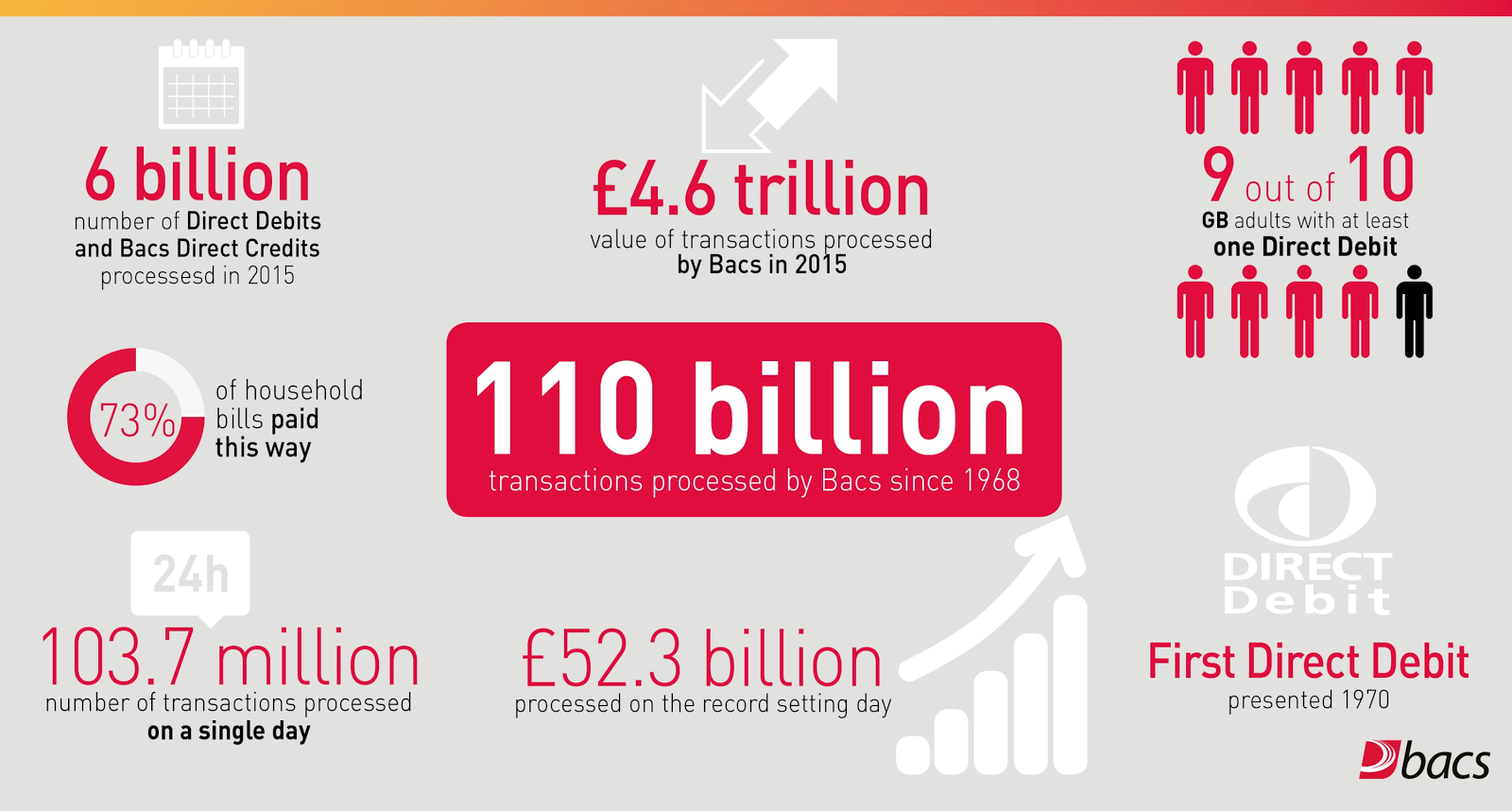

Since its inception, over 110 billion transactions have been processed by BACS and 9 out of 10 adults in Great Britain have at least one Direct Debit account. BACS is an institution that loves to show off its prowess with statistics. In fact the guys from BACS keep throwing one record after another frequently. Here’s a sample.

(Source: BACS Infographic)

Direct debit is available in many countries besides the United Kingdom which uses BACS. Europe uses Single Euro Payments Area (SEPA) which permits Euro-denominated domestic and cross-border direct debits. And in the United States, they are processed through the Automated Clearing House network.

Phew! Bet it was hard to hold your attention without dozing off, right?

But before BACS, it was business as usual, and payments were made typically by cash or cheque by month-end. The problem was, of course, the need for the physical presence of a lot of hard cash. Wages would be handed over in envelopes, and it was typically considered unsafe.

Cheques were then introduced as a big improvement. But that came with its share of administration issues - a missed or mismatched signature, wrong information, incorrect dates.

And that meant, delay in payments.

Of Stuffy Bankers and Alastair

89-year old Alastair Hanton was not joking either when he said he found it ridiculous that banks in the UK opted for anything but direct debit to facilitate transactions. Transactions that involved the transfer of variable amounts of money, at various times, from one bank account to another on a recurring basis.

I hear you, Alastair. It’s easier to turn 90 and continue to remain to Queen of England. Or cycle your way around London.

Oh wait!

(Source: Twitter)

But Alastair is no regular Englishman. Who is Alastair, you ask? He’s the mastermind behind introducing the idea of Direct Debit in UK. And how did he think of this?

Answer: His own problems.

While working at Unilever, one of the most important requirements was to collect money from thousands of small retailers selling ice cream, which would invariably yield in payment inefficiencies and delays.

The motivation was simple - Direct Debit would save costs, improve collections, and bring in convenience, by being authorized by the banking systems to collect money directly from those who owe money. And yes, there was a demand for this as well.

Alastair Hanton floated the idea in 1964, floated the raw campaign for the idea and it took 4 years for the service to be made available to public.

Trust the English to come up with original ideas!

Actually, don’t.

In Germany direct debit has always been in provision by banks since the advent of Giro accounts in the 1950s.

But the banks worked as a cartel and stuffy bankers in the UK, as Alastair likes to call them, continued to push away the idea, as well as customers. Alastair explains how -

So, it wasn’t because banks in the UK were convinced of its benefits, but because there was going to be a giro service competing with them, that acted as the tipping point.

Fooled ya! Let’s go back in time…

Let’s rewind almost 2500 years, to 4th century BC, when the idea of Direct Debit existed in practice.

During the rule of the Greek Ptolemies around 4th century BC, the state granary deposits worked as the banks with huge networks and headquartered at Alexandria - much like the Central Banks in today’s governments.

This place hosted the records of the main accounts from all of the regional grain-banks in Egypt. And from there, a system of payments transfer was implemented - one where balances could be transferred between accounts without the need of physically moving the grain-money. This system was later also implemented by Italian merchants and bankers, where it was known as the “giro” system.

A 2500 year-old system, and yet banks are slow in their design evolution. Well, Alastair Hanton as well as Dennis Gladwell were quite the cheeky revolutionaries in introducing direct debit into the UK.

Banking and the Jurassic Era

Now, moving on to a bigger problem. A continental drift called banking technology evolution.

Dinosaurs - one of the key examples in evolution or ‘Darwinism’, ruled the earth for million years, till they suddenly became extinct. And the factors for their extinction are plenty. But the singular underlying reason was - they did not and could not adapt to changing environment.

And much like these dinosaurs, the banks have been ruling the financial sector for centuries now - difficult to crack through. In Alastair’s words, the banks worked as cartels - they functioned as commercial enterprises, selling services that are difficult to adopt and implement.

In other words, pushing a technology into an existing banking design, was not easy. Traditional banks are still struggling with digital adoption, and design changes.

An investigation by the UK’s Competition and Markets Authority highlighted a pertinent problem in the personal current accounts (PCA) and SME banking markets. It says that 57% of consumers have been sticking to the same PCA provider for more than 10 years, and 37% for more than 20 years.

Why?

Yes, complicated, time-consuming and risky. So some of the folks in Fintech decided to rattle the banks’ cages. And boy was that good!

Fintech? That’s a fine tech!

Enter the fintech revolution. Over the last decade, design-first Fintech companies have been cropping up that change the way we bank. And most of these companies want to do just one thing. Make it easier for customers to bank. Right from setting up an account, to transacting in just a few clicks, fintech is taking over small sections of banking in its entirety.

And they are working towards ensuring that the process and experience is a thousand times better. That is why you have smaller fintech companies like GoCardless and Stripe taking over smaller segments of banking such as Direct Debits and payment processing respectively.

Hiroki Takeuchi, CoFounder & CEO of GoCardless says it best, “When GoCardless first started, it wasn’t possible for small businesses to use Direct Debit at all. Banks wouldn’t give them access to the complex system because they thought small businesses were not sophisticated enough to manage it. Rather than finding a way to give them access only to the parts of the system that they needed, banks just closed them off completely.”

And this wasn’t just Direct Debits or payment services (Venmo,Stripe,Braintree,GoCardless, WePay,Square). Fintech players bloomed in many different categories of banking, including personal finance management, loans & credits, venture capital, investments, B2B financial services, subscription billing.

What were the most common problems that these fintech companies reacted to before building their product? The answers were common - lack of mobility, bad user experience, complex systems, lack of transparency, expensive services, slowness, lack of access, lack of involvement, concentration of power, and finally, lack of optimization and performance.

What would have taken 3 weeks, 4 days, 16 hours, traveling around the world and some blood sacrifice, now takes just 2 steps and a few minutes to set up. That is how companies like GoCardless are beating banks with design.