ACH Payments via Braintree

ACH is a US-based payment method available for processing recurring or one-time payments. Chargebee allows you to configure ACH (Direct Debit) payments using Braintree. This document helps you to set up ACH payments via Braintree in your Chargebee account.

Prerequisites

To accept ACH payments using Chargebee, you must:

- Be a US-based merchant selling to customers based out of the US.

- Have a US or USD bank account configured with Chargebee.

- Have configured the Braintree payment gateway in your Chargebee account. Learn more

Accepting ACH Payments in Chargebee

Login to the Chargebee app.

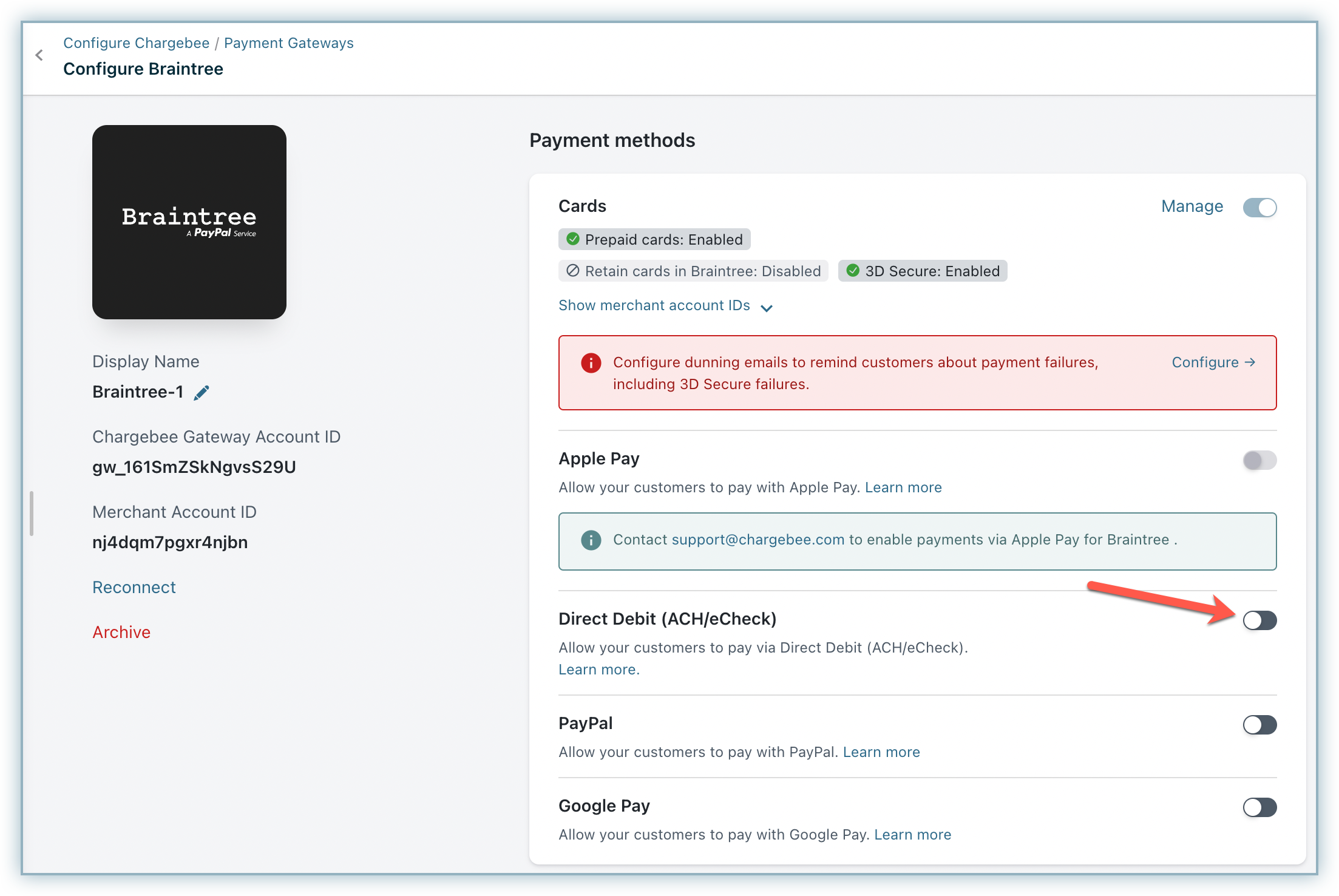

Go to Settings > Configure Chargebee > Payment Gateways > Braintree

Enable Direct Debit (ACH/eCheck)

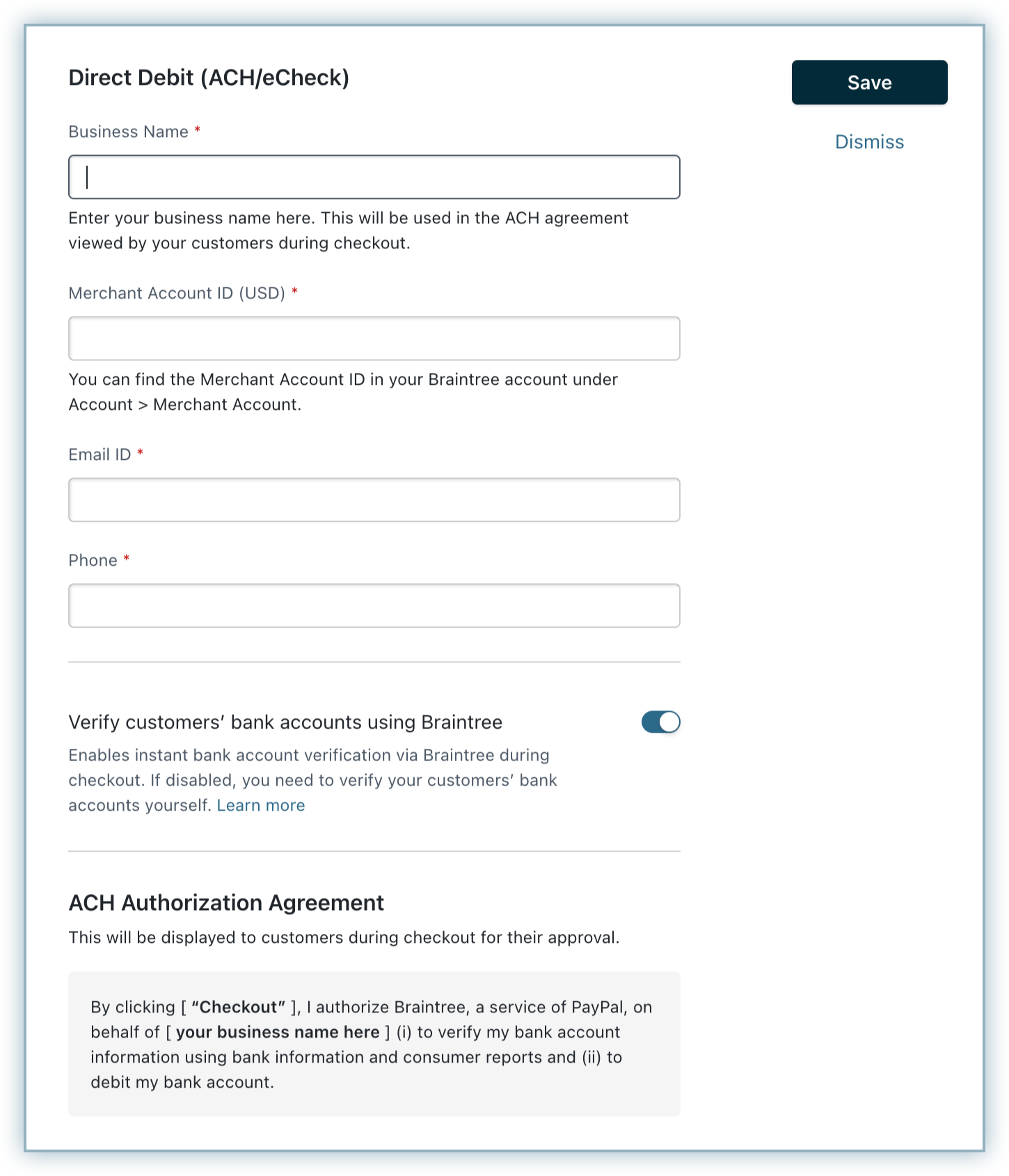

Enter your Business Name, Merchant Account ID, Email, and Phone. The Business Name field value is used in the ACH authorization agreement.

Bank Account Verification

Braintree offers bank account verification via the following three methods:

- Network Check: In this method, customers are required to enter the necessary information (such as routing number, account number, etc.) during checkout. This information is shared with Braintree and the verification is performed instantly.

- Independent Check: In this method, you are allowed to get their customers' bank accounts verified independently either by themselves or via a third-party verification service provider. The customer shares the third-party service provider's account's login credentials with Braintree to confirm the independent check. Once confirmed, Braintree generates a nonce. The merchant can either pass the nonce to Chargebee using Chargebee JS directly, or vault the payment method in Braintree and share the permanent token i.e reference ID (cus_id or src_id) with Chargebee for vaulting the payment method in Chargebee.

Chargebee recommends selecting Network Check as the verification mode as it is quick and the most accurate.

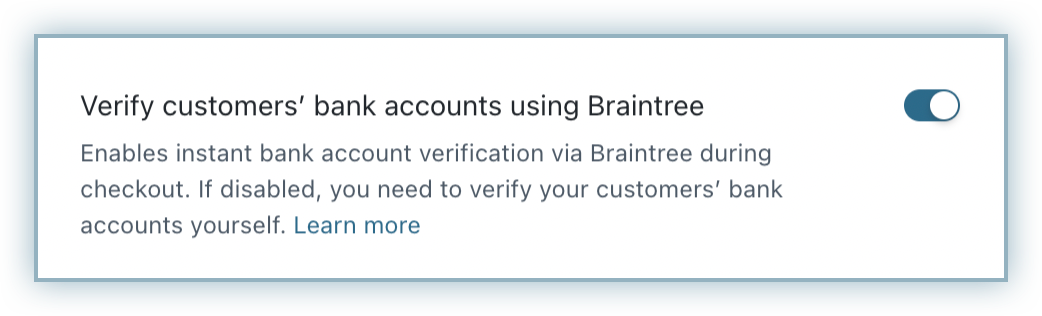

While setting up Direct Debit (ACH/eCheck), you can choose if you want Braintree to perform verification or if you want to do it independently by enabling or disabling the Verify customers' bank accounts using Braintree toggle button.

If enabled, your customer's bank accounts will be verified via Network Check during checkout. If disabled, you need to verify the accounts via Independent Check.

Click Save.

Additional Configuration

If you intend to use Chargebee's Hosted Pages for your integration, some fields must be configured as mandatory in Chargebee's checkout settings.

Follow the steps below to complete this:

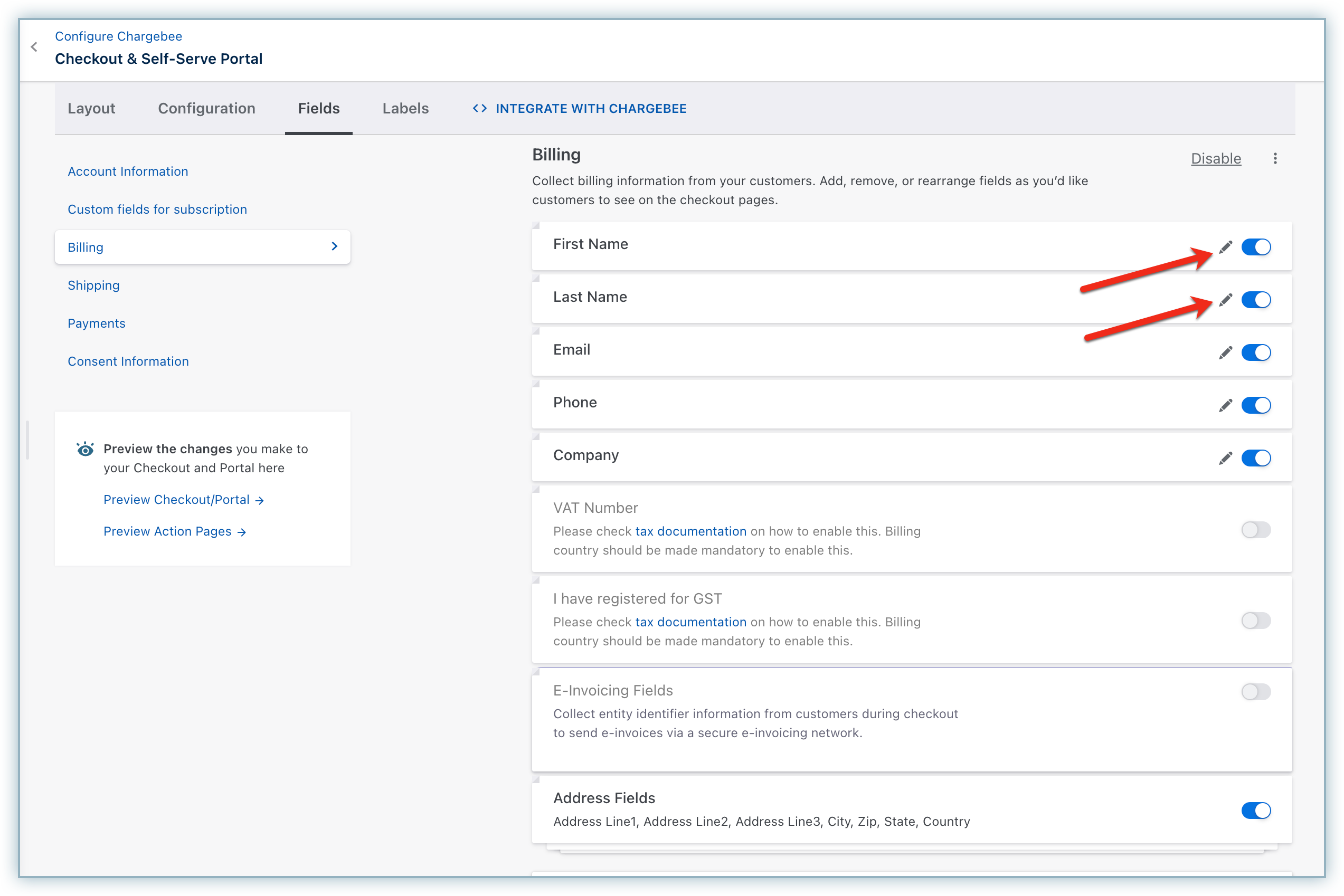

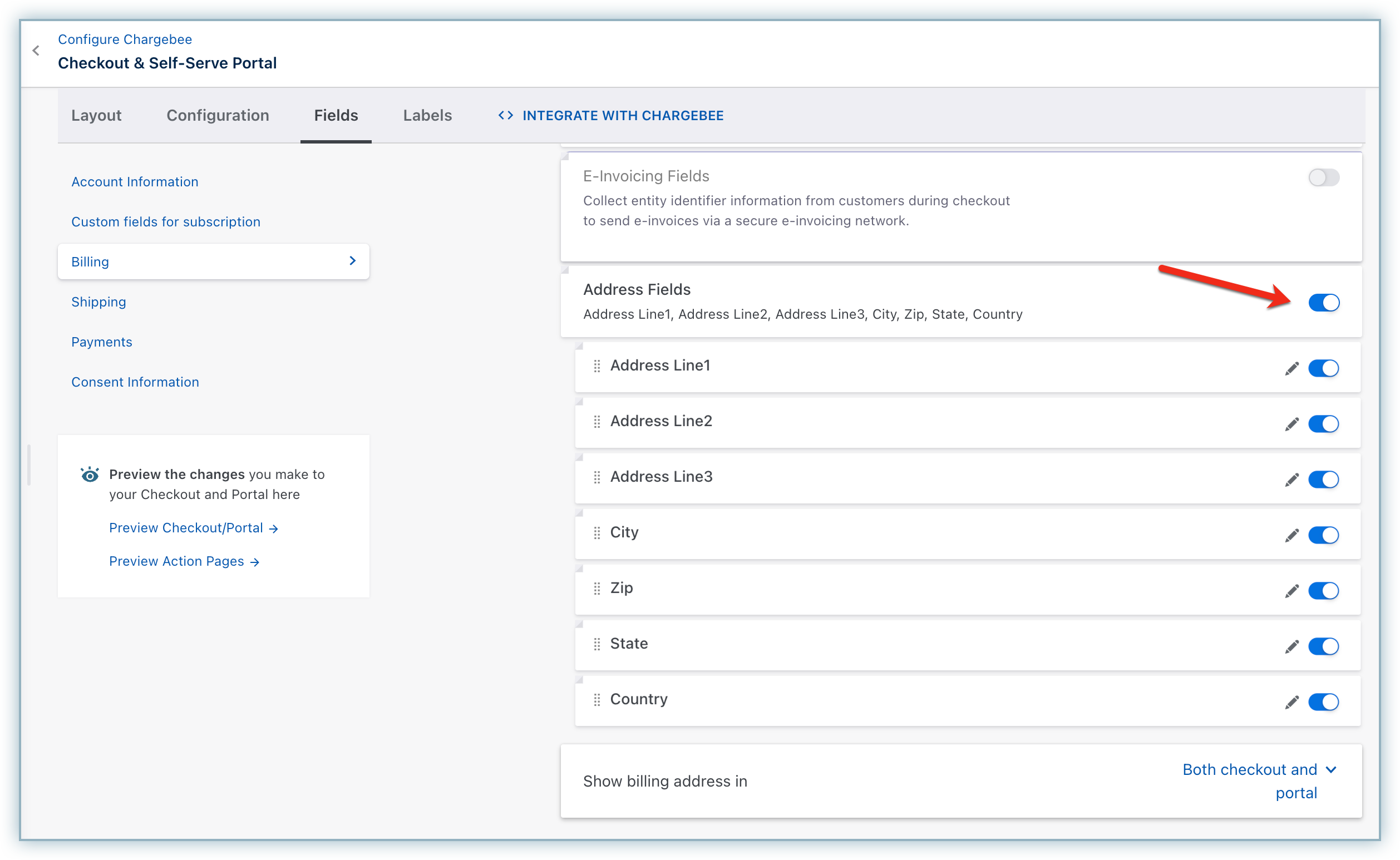

Click Settings > Configure Chargebee > Checkout & Self-Serve Portal > Fields > Billing.

Enable First Name and Last Name within the Fields settings.

Enable Address Fields.

Click the Edit icon and confirm Address Line 1, Address Line 2, City, Zip, State, and Country are listed as Show from the drop-down list.

Click Publish.

Note

Make sure you enable the Address Fields without fail to ensure successful tokenization at Braintree's end. If these fields are not enabled or if an invalid value in entered by the customer, it can result in tokenization failure.

Bank Account Verification Method

The method used for verification depends on the merchant's configuration. Let us see the possible scenarios and the suitable verification methods:

- For an API-based integration,

a. you can share your bank account details with Chargebee which is then passed to Braintree for Network Check.

b. you can get your bank account verified independently (i.e Independent Check) through a third-party service provider and vault the payment method directly or via Chargebee at Braintree.

- If the merchant uses Chargebee's checkout and has enabled the Verify customers' bank accounts using Braintree toggle as shown above, the verification will take place only via Network Check. This is because we require quick verification during checkout when a merchant is about to make a purchase for a subscription.

- If the merchant uses Chargebee's checkout and has disabled the Verify customers' bank accounts using Braintree toggle and chooses to perform verification independently, the following steps will take place:

a. The customer logs into their third-party verification service provider's account and completes the verification.

b. Once done, the customer shares the login information with Braintree.

c. Braintree passes a nonce, based on which the payment method is vaulted and the transaction is processed.

- If the payment method is added using Customer Portal (Hosted Pages), the verification is performed using Network Check.

Note

If there are three consecutive payment failures using the direct debit payment method, it will be marked as invalid in Chargebee. In such cases, you should remove the existing payment method and ask your customer to add a new one.