Payment Verification

This is a Private Beta Release and is available only to users of Chargebee Hosted Pages using the In-App Checkout layout. To enable Verification Controls for your test and live sites, request access.

Verification Controls provide a centralized way to manage payment flows within Chargebee, independent of any payment gateway. They help optimize your payment workflow by allowing you to filter out specific card payment methods that may not be ideal for recurring transactions or reject high-cost card types before they reach the payment gateway. By enforcing these verifications at the Chargebee level, you can prevent unnecessary processing costs.

Since this feature operates at Chargebee and is gateway-agnostic, it takes priority over any overlapping rules (such as smart routing rules) set at the gateway level for Chargebee checkout flows.

Benefits of using Verification Controls for your business

This feature helps optimize revenue by reducing transaction failures, minimizing processing costs, and improving overall payment efficiency. Here's how:

- Block cards based on funding type

Preventing certain funding types, such as prepaid cards, from being used for billing can reduce transaction failures and unnecessary processing fees for your customers. This ensures a higher success rate for recurring payments and improves revenue stability. - Decline cards based on brand

Restricting specific card brands can help lower transaction fees and reduce financial losses. Some card brands may have higher chargeback rates, leading to increased costs and operational inefficiencies. By blocking them, you can optimize payment processing and reduce disputes. - Restrict cards issued from specific countries

Blocking cards from certain countries helps prevent fraud, ensures compliance with legal requirements, and reduces cross-border transaction costs. This is particularly useful for businesses that need to adhere to regional regulations or minimize risks associated with high-fraud regions.

Supported payment method

- Card payment method

Information

Currently, this feature supports card-based payments. We plan to expand supported payment methods in the future.

Supported variables for controlling verification

The following are the variables supported for controlling verification for your payments:

- Card type

- Card brand

- Card issuing country

Looking for other variables?

Please submit a request here. We will consider them in our next iteration.

Limitations

While Verification Controls provide significant benefits, there are some current limitations:

- Limited to card payments: Verification Controls currently apply only to card payment methods, and the outcome is a declined transaction during checkout.

- Limited availability and future expansion: This feature is currently supported only for Card Component & In-App Checkout within Chargebee Hosted Pages. Support for Full-Page Checkout and other forms of checkout is in progress and will be available in future updates.

Configuring Verification Controls in Chargebee

Verification Controls enable you to create rules that determine which payments to decline or take other actions on. To access the Verification page, follow these steps:

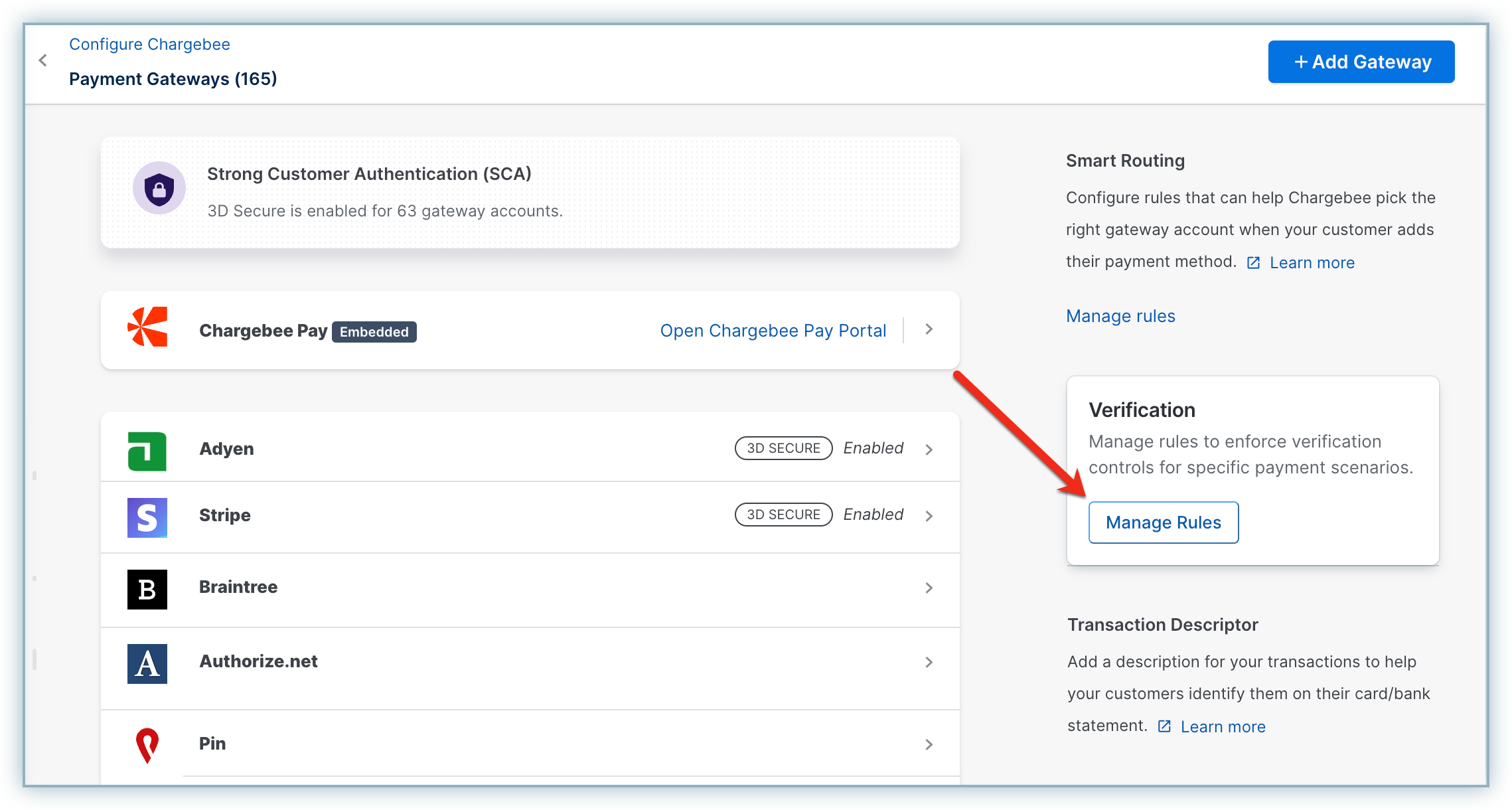

- Log in to the Chargebee app.

- Go to Settings > Configure Chargebee > Payment Gateways.

- Click Manage Rules under Verification.

Creating a verification rule

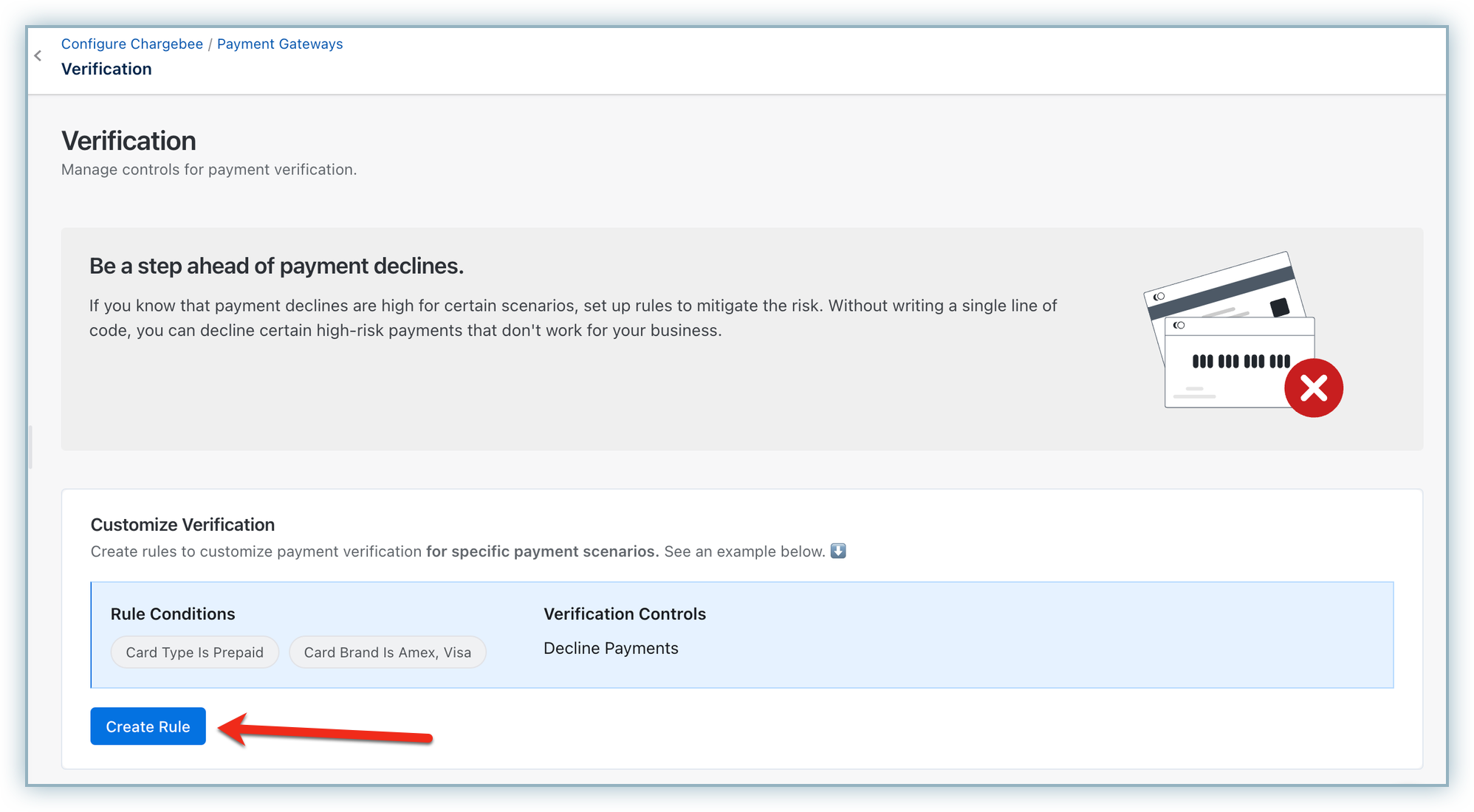

Once you've reached the Verification page, you can create a verification rule. Creating a verification rule allows you to tailor your verification strategy based on your business needs. Verification Controls enable you to define multiple conditions within a single rule to achieve the desired outcome.

For example, a composite rule could be:

"If the card brand is AMEX and the card issuing country is Curacao, then decline the payment."

This flexibility helps you enforce specific payment policies, reduce costs, and minimize risks effectively.

Follow these steps to create a new verification rule:

- Go to the Verification page.

- Click Create Rule.

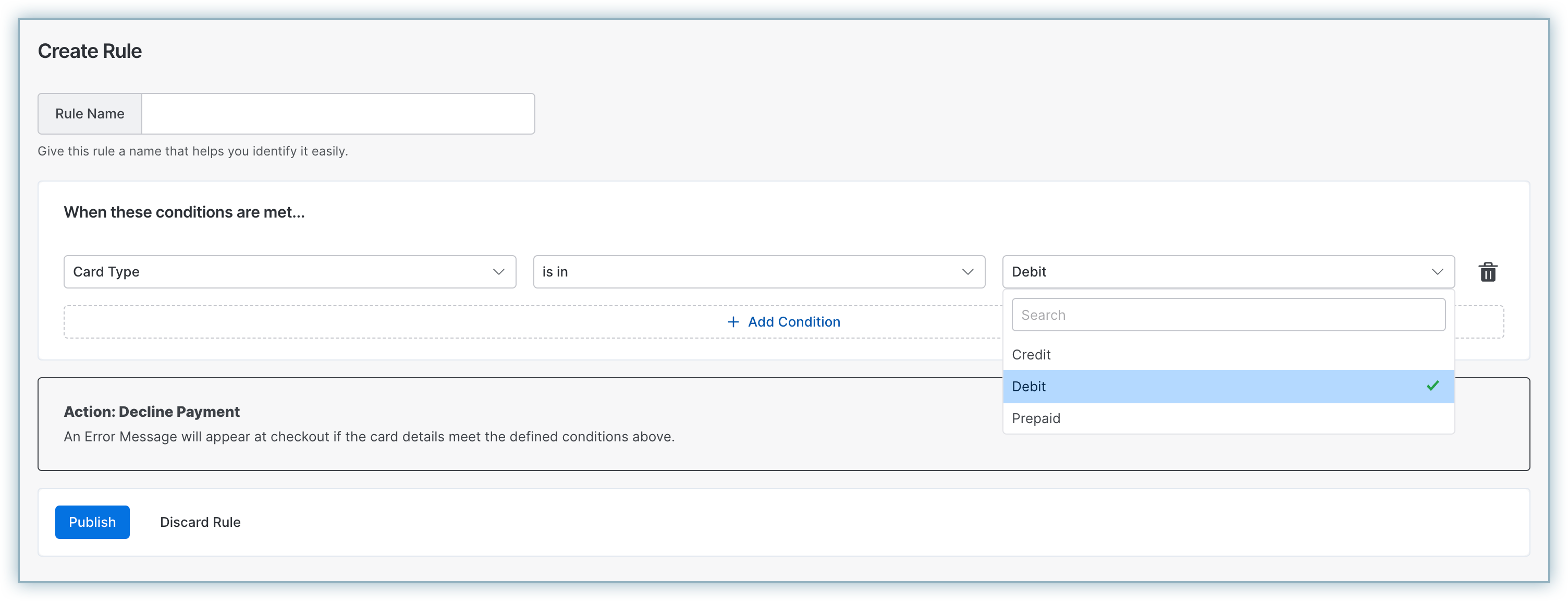

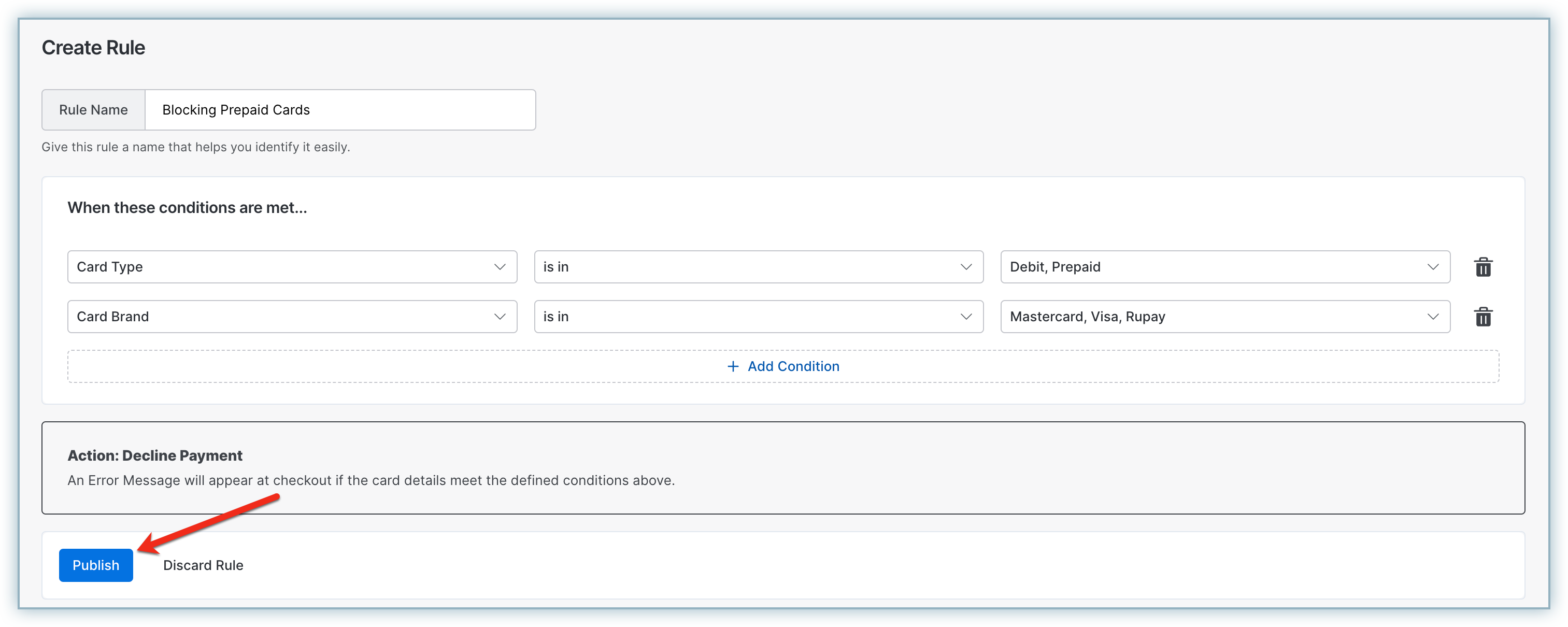

- Configure the rule on the Create Rule page:

- Enter a Rule Name.

- Add the required conditions, such as Card Type, Card Brand, or Card Issuing Country.

- The actionable outcome for the selected conditions is currently defaulted to Decline Payment.

- Verify the rule settings and click Publish to activate the rule.

Note:

- Multi-selection for filters: You can select multiple options for all supported filters. These selections function as an OR operator, meaning the rule will apply if any of the selected conditions are met.

Example: If the Card Type is set to Prepaid and Debit, the rule will trigger if the card is either Prepaid, Debit, or both, resulting in a declined payment. - Composite rules with multiple conditions: When multiple conditions are configured within a single rule, they function as an AND operator, meaning all conditions must be met for the rule to apply.

Example: If the Card Type is set to Prepaid and the Card Brand is AMEX, the rule will only be enforced if both conditions match during evaluation.

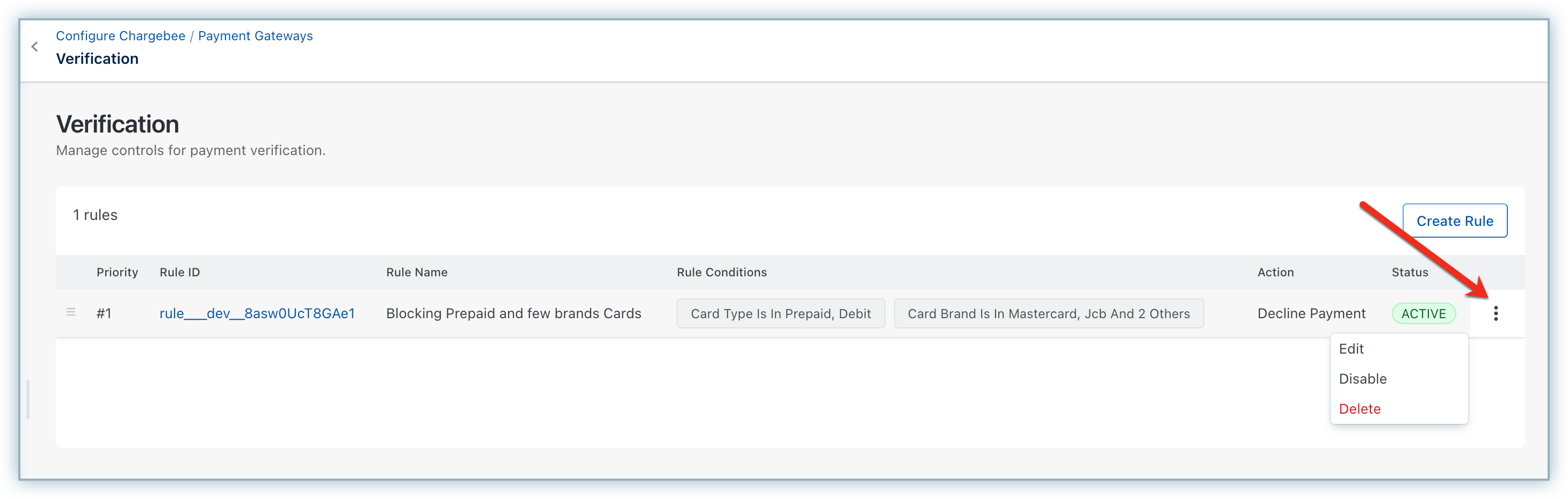

The verification home page will reflect the published rules.

Note:

While evaluating rules, if none of the rules match, then no action will be taken and the customer will move to the next step in the checkout process.

Managing rules

You can update, delete, disable, and sort the rules for Verification Controls using the following operations:

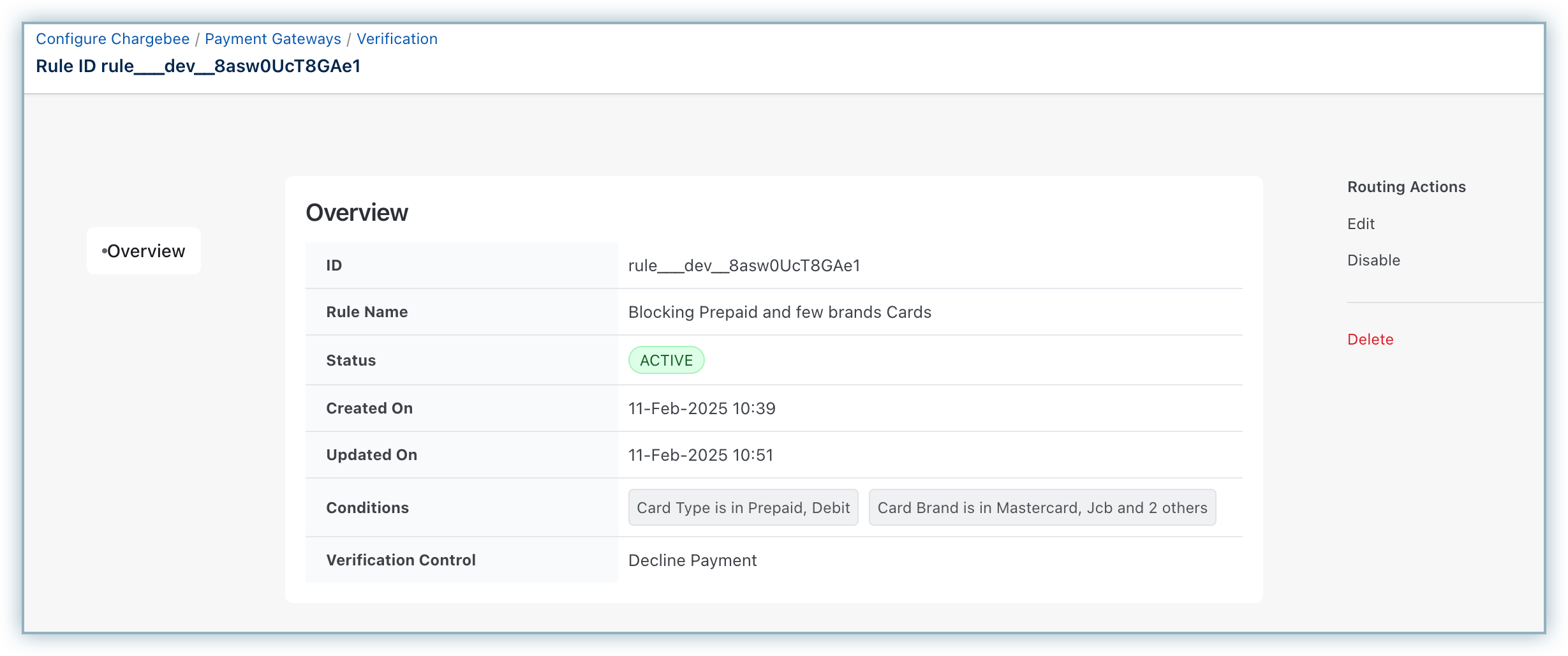

- View Rule Details: Click on the Rule ID to view the details of a configured rule.

- Edit, Enable, Disable, or Delete Rules: Click the ellipsis icon next to a rule to perform these actions as needed.

- Set Priority Order: When multiple rules overlap, the rule with the highest priority is executed first. To adjust priorities, click the hamburger icon next to a rule, drag it to the desired position, and publish the changes.

Need help?

If you have any questions or need assistance with Verification Controls, please reach out to Chargebee Support.

Verification Controls - Test cards

To effectively test the various rules you plan to establish within the Verifications control, please refer to the curated list of test cards provided below. Each card possesses distinct characteristics that will allow you to simulate and comprehend the functionality of different rules under varying parameters. Utilize these cards to gain a deeper understanding of how each rule operates within this setup.

For Chargebee Test Gateway, please use the below cards:

| Parameter Basis | Value for the parameter | Card Number | Card CVC | Card Expiry (Month/Year) | Gateways that support this card |

|---|---|---|---|---|---|

| Card Funding Type | Prepaid | 5105105105105100 | 123 | 12/34 | Chargebee Test Gateway |

| Credit | 5555555555554444 | 123 | 12/34 | Chargebee Test Gateway | |

| Brand of the Card | Amex | 378282246310005 | 123 | 12/34 | Chargebee Test Gateway |

| JCB | 3566002020360505 | 123 | 12/34 | Chargebee Test Gateway | |

| Visa | 4111111111111111 | 123 | 12/34 | Chargebee Test Gateway | |

| Visa | 4012888888881881 | 123 | 12/34 | Chargebee Test Gateway | |

| Discover | 6011111111111117 | 123 | 12/34 | Chargebee Test Gateway | |

| Mastercard | 2223003122003222 | 123 | 12/34 | Chargebee Test Gateway |

Information

If you are looking for any specific test card scenario apart from the ones listed above for Chargebee test gateway, submit your request here.

For other selected gateways, use the below cards:

| Parameter Basis | Value for the parameter | Card Number | Card CVC | Card Expiry (Month/Year) | Gateways that support this card |

|---|---|---|---|---|---|

| Brand of the card | Amex | 378282246310005 | 1234 | 12/34 | Stripe, Mollie |

| JCB | 3566002020360505 | 123 | 12/34 | Stripe | |

| Visa | 4242424242424242 | 123 | 12/34 | Stripe | |

| Visa | 4111111111111111 | 100 | 12/26 | Braintree | |

| Card funding type | Prepaid | 5105105105105100 | 123 | 12/34 | Stripe |

| Prepaid | 4500600000000061 | 100 | 12/26 | Braintree | |

| Prepaid | 4487315030000000 | 123 | 12/24 | Worldpay | |

| Credit | 5555555555554444 | 123 | 12/34 | Stripe, Braintree | |

| Issuing country of the card | Brazil | 4000000760000002 | 123 | 12/34 | Stripe |

Was this article helpful?