Data Visibility

It is very important for a merchant to view and analyze the data related to payment failures easily and understand the reason behind the failures and how they can manage it. With Chargebee Receivables, you get easy access to all the metrics, charts, and other sets of customer-specific data to efficiently manage everything.

The data visibility offering comprises three value propositions:

- Ease of Data Access - The data is presented to you instead of you looking for it.

- Merchant Empowerment - Diverse data sets in a single view to drive the right course of action.

- Putting Things in Perspective - Cohort-based quick filters to help you leverage the relevant data.

Let's start with ease of data access in detail:

There are mainly three places in the app to look for the most significant sets of data:

- Home (Dashboard)

- Customer View under the Receivables View

- Invoice View (Open Data) under the Receivables View

Using Dashboard

The Know Your Numbers! section offers a comprehensive overview of all relevant numerical data, allowing for easy and efficient monitoring of key information at a glance.

Here, the Payments Failed metric shows the total amount of unique invoice payments that failed during the current month (as of today).

The Payment Failures chart gives you a complete overview of errors that have caused payments to fail for customers in the current month. The chart also displays the overall retries (dunning) status of customers experiencing failures for the month.

The Payment Errors chart on the left indicates the reason behind most payment failures and their severity. On the other hand, the Retries Exhausted chart on the right indicates how urgently you need to act to prevent or manage failures.

With this information, you can take the necessary actions for the error identified as causing the most payment failures. For example, if the most failures occurred due to Insufficient Funds, you can view the list of customers using the View Customers button on the right and send a reminder to them to maintain sufficient balance before the next payment retry date.

Using Receivables View

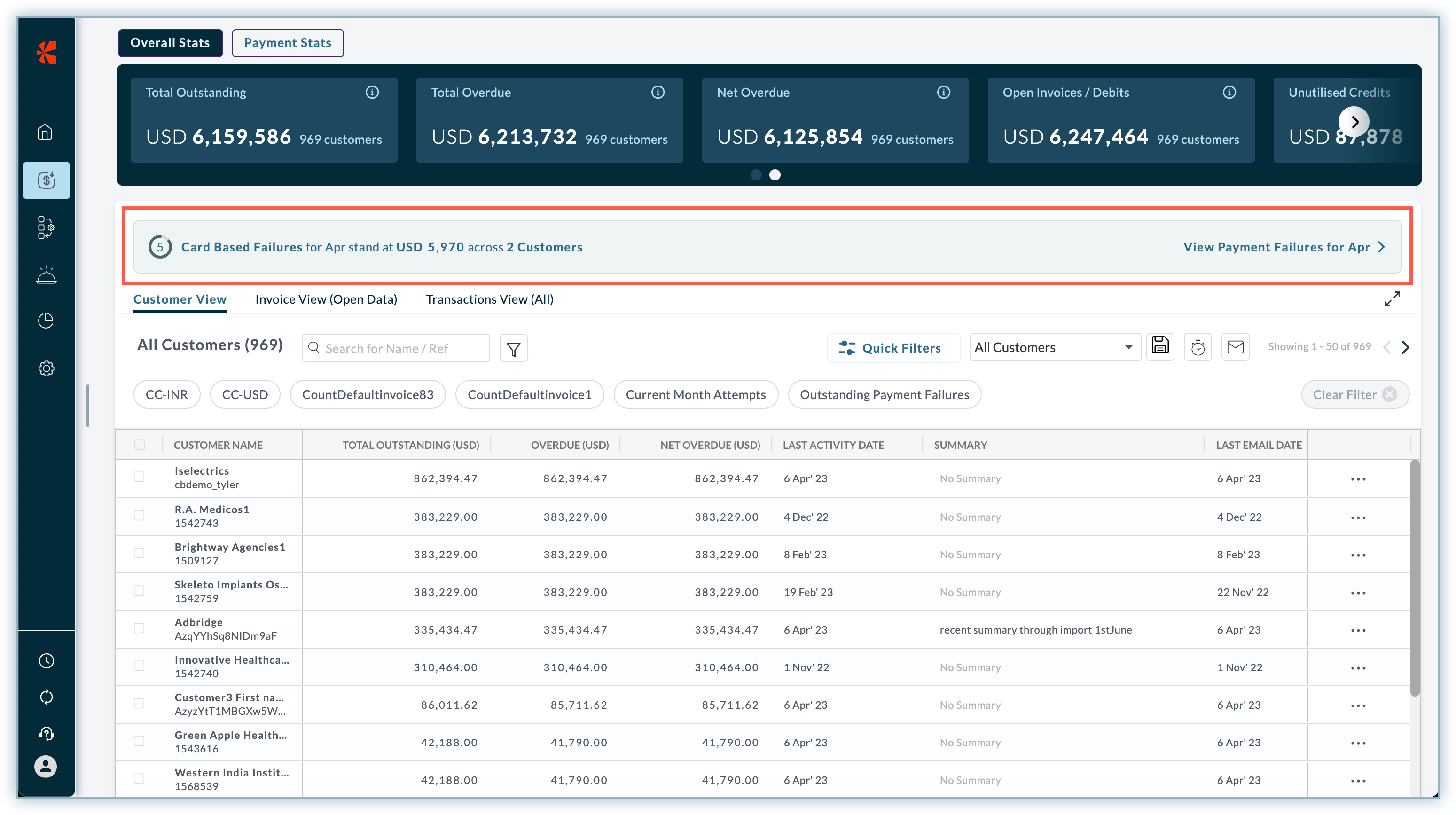

As you move to the Receivables section, the Customer View page is displayed. This view contains the majority of the customer-specific data that you need to effectively prevent and manage payment failures.

Let us see how you can fetch the required data.

-

View Payment Failures for [current month]: This link on the right side of the scroller is a shortcut to apply the relevant filters to retrieve the list of all customers who had payment failures in the current month. On the left, the scroller provides a quick glance at some payments-related metrics for your customers.

-

Creating a Targeted Cohort: A cohort is a result of relevant filters (quick or advanced) used to group the customers based on similar traits.

This offering revolves around provisioning multiple cohorts of customers based on their payment patterns, retries, payment methods, email engagement, overdue, aging buckets, and certain other derived data fields.

a. Quick Filters: It is a one-click solution to filter diverse datasets and create the desired cohort. You can find some quick filters visible already (such as Current Month Attempts, Outstanding Payment Failures, and more) and you can select more from the list using the Quick Filters button. Learn more.

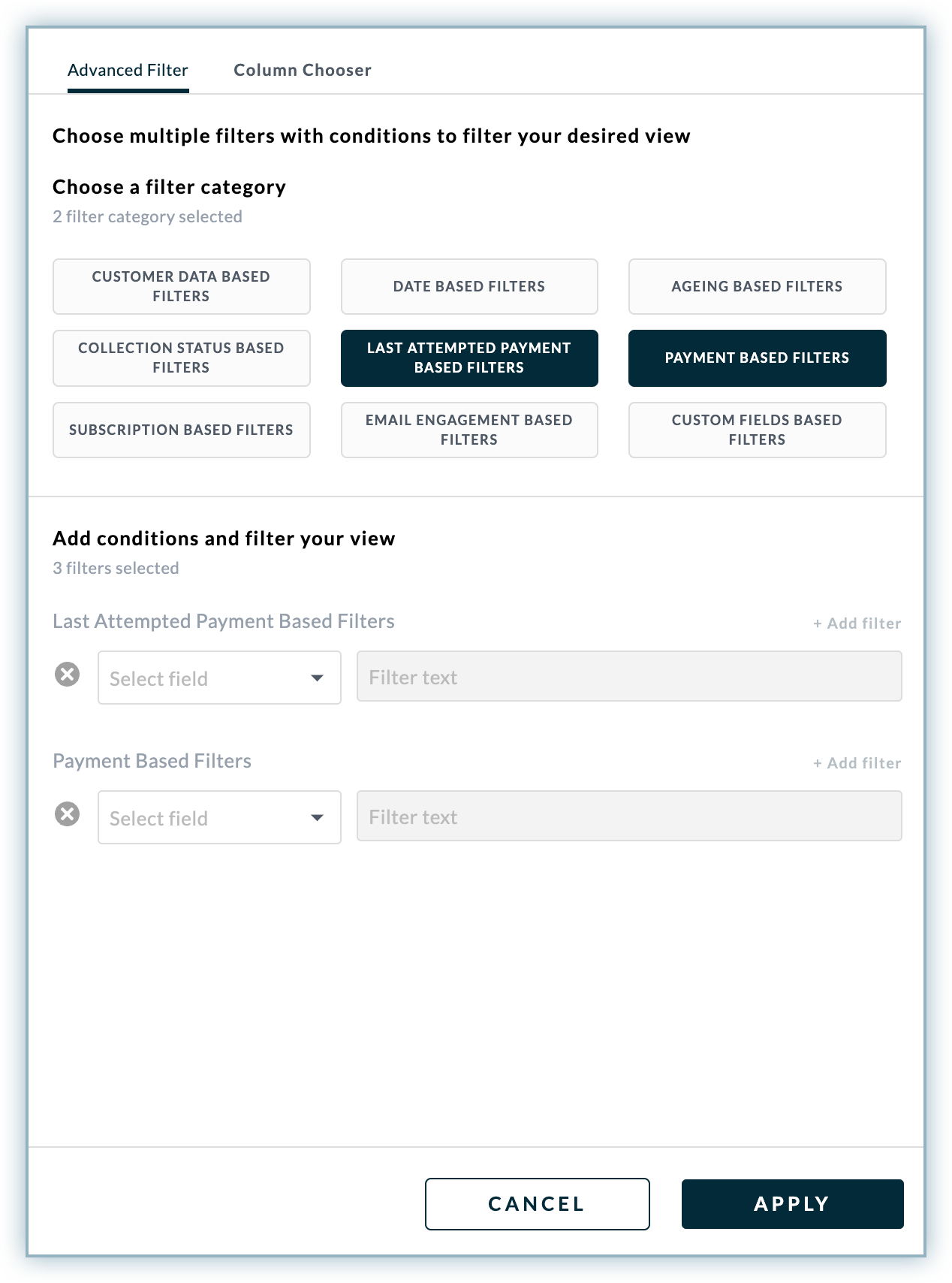

b. Advanced Filters: To add another level of refining to your search, you can use Advanced Filters. You can select the filter category, the desired filters, and the desired values to restrict the search to. Learn more

You can save the view and use it to subscribe to a report based on it. Alternatively, use the email option to engage customers and remind them to perform a relevant action to minimize the chances of failure in the next retry. With each cohort, the merchant is expected to engage with the set of customers in terms of dedicated customized targeted emails with the relevant CTAs as applicable. Learn more.

-

Value Added Fields: Out of all the fields represented as columns in the Customer View, some fields are the most vital for understanding the aspects of payment failures. You can find the value-added fields for payment failures under the Column Chooser section.

a. Click the filter button. b. Select the Column Chooser tab. c. Click Payment Based Column to view the list of fields.

Out of all the fields, the following are the value-added fields:

| Field Name | Description |

|---|---|

| Payment Risk (Most Important) | The probability of the customer defaulting on their next payment. |

| Open Invoices Unpaid Since (Days) | Days since the last open invoice has been unpaid. |

| Count of Invoices Unpaid | Number of unpaid invoices for a customer. |

| Count of Defaulted Invoices in the Past | Number of invoices for which the customer missed on-time payments in the past. |

| Average Payment Attempts per Invoice | The average number of attempts a customer consumes to complete a payment for an invoice. |

| Payment Error with Max Failure | The error because of which most of the payments failed for a particular customer. |

| Invoices that Crossed Max Retries | Count of invoices that have been in the Retries Exhausted bucket in the past. |

- Invoice View (Open Data): This view provides clear visibility into the invoices. It also provides quick and advanced filters similar to the Customer View enabling you to identify the payment risk associated with invoices and help you engage customers to manage payment failures effortlessly.

Let us dive deeper into the Quick Filters to know more about using them properly:

Quick Filters

Quick Filters enables you to filter diverse datasets and create cohorts (groups) of customers based on a particular use case in a single click.

For example, a cohort of all the customers who had outstanding payment failures due to insufficient funds on the card during the current month.

Once the cohort is ready, you can save the view and subscribe to the email report based on weekly, monthly, and yearly frequency.

Here is the list of all the available Quick Filters:

| Field Name | Description |

|---|---|

| Current Month Attempts | Payment attempts made in the current month. |

| Outstanding Payment Failures | Payments which have the last attempt status as failure. |

| Payment Failure Error | Error reasons due to which payment failures occurred. |

| Card Updated (Non Primary) | A new card has been added but hasn't been set as the Primary card. |

| Offline Customers | Last used payment method is offline (Cash, Bank Transfer, or Cheque). |

| Retries Exhausted | Payments that have dunning status as 'Exhausted'. |

| Unattempted Payments (Current Month) | Customers whose outstanding amount is greater than zero but have no payment attempts made in the current month. |

| Retries Underway | Payments that have dunning status as 'In Progress'. |

| Next Retry (Current Week) | Payments with the next retry scheduled in the current week. |

| No Backup Card | Customers who haven't added/registered a backup card. |

| Multiple Unpaid Invoices | Customers who have multiple unpaid invoices. |

| Card Expiring | Customers who have their cards expiring soon. |

| Outstanding > 30 days | Customers who have had an outstanding amount greater than zero for more than 30 days. |

What is Payment Risk?

Payment Risk is the probability of a customer defaulting on his next payment. The risk levels are derived from the historic data of customers based on their payment punctuality (on-time or delayed), recovery rate, and the payment method used.

The following are the risk levels:

- High: Customers who have been habitual defaulters all through and carry the risk of defaulting on their next attempt as well.

- Medium: Customers who are majorly consistent with their payments barring a few occasional defaults.

- Low: Customers who have had an excellent payment record all through their journey.

- No-Payment: Customers who have not made a single payment to date.

How to use Quick Filters? (Explained with Use Cases)

As discussed above, there are 3 different stages at which you can act upon the Payment Failures. Following are three use cases that describe how you can use Quick Filters for all three conditions and find the suitable resolution for them:

Use Case 1: Avoiding a Payment Failure

Desired Cohort: Customers who are usually punctual with their payments but often tend to consume multiple attempts to complete payment.

Usually, they don't have a backup card that can save them if a payment from their existing primary card fails. So, you need a cohort of all such customers with attempts in the current month, no backup card registered & most importantly the willingness to pay.

Quick Filters required: Current Month Attempts and No Backup Card

Payment Risk: Medium and Low (High shall be avoided as in this case, the cohort is targeted at occasional defaulters & not habitual ones)

Merchant Action: You can save the view and use it to subscribe to a report based on it. Alternatively, use the email option to engage customers and remind them for adding a backup card or perform a similar action to minimize the chances of failure.

Use Case 2: Managing a Payment Failure

Customers who have had card-based failures in the current month due to the 'Insufficient Funds' error and have the willingness to pay on time.

Here, the cohort can be refined by restricting the filter to the customers having the next retry in the current week.

Quick Filters required: Current Month Attempts, Payment Failure error > Insufficient Funds, and Next Retry (Current Week)

Payment Risk: Medium, and Low

Use Case 3: Recovering from a Payment Failure

Desired Cohort: Customers who have been habitual defaulters with a track record of delayed payments, with multiple outstanding invoices, and whose dunning attempts have been exhausted.

Quick Filters required: Current Month Attempts, Retries Exhausted, and Multiple Unpaid Invoices

Payment Risk: High

Merchant Action: You can send an email reminder warning the customer of serious consequences such as termination of a subscription, late payment fee, etc.

Was this article helpful?