Automating Payment Failure Management

Managing payment failures by engaging manually is possible only for a small number of customers. However, the process should be automated if the number of customers increases or when you need to target a complex cohort of customers.

You can automate how you want to engage with your customers in different scenarios using Auto Engagement. It allows you to fetch the desired set of customers (cohort-based targeting) and set the rules for engaging with them.

Let's see how it works and how you can best use it.

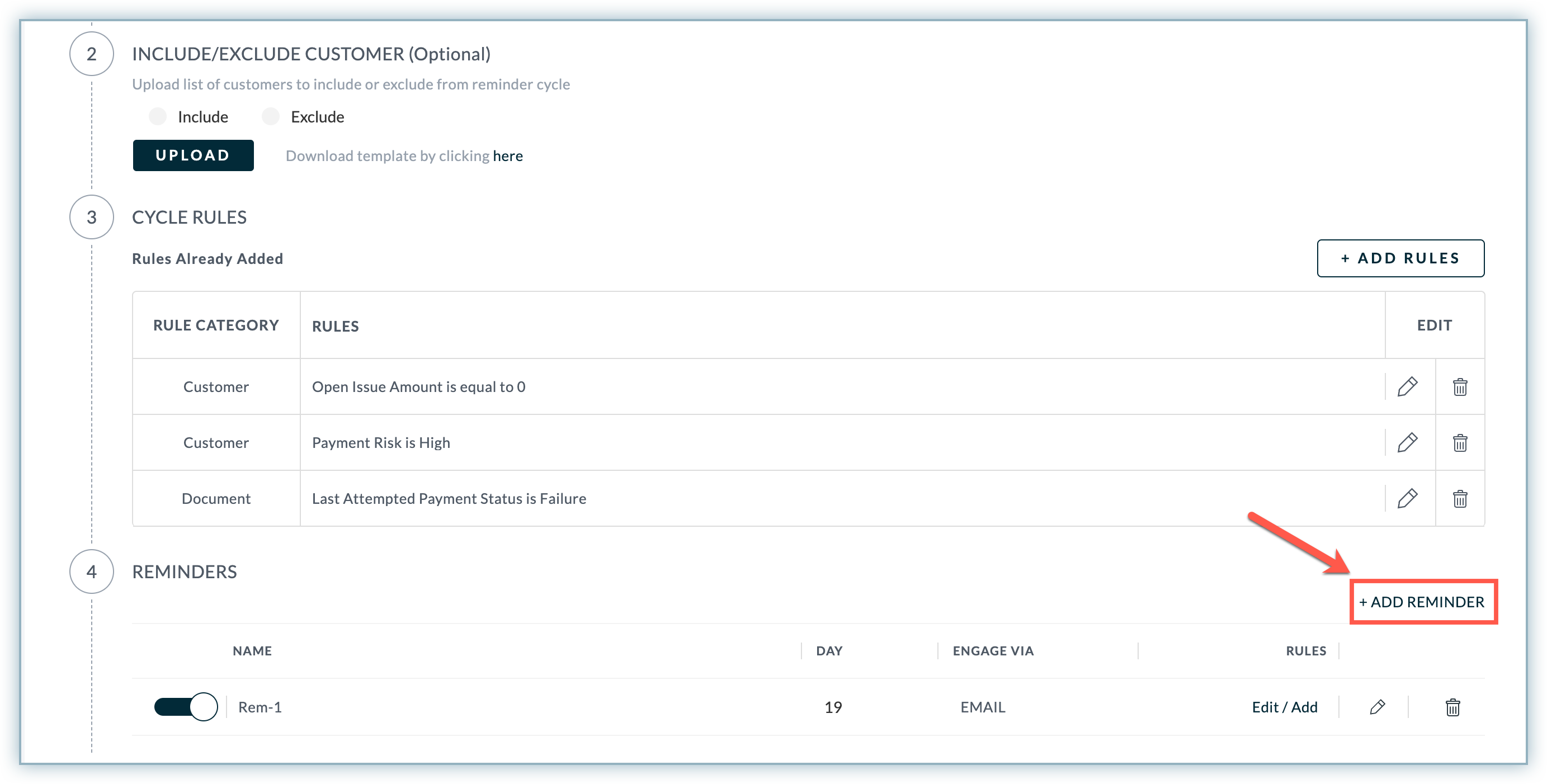

Adding Cycle Rules

If you are new to Auto Engagement Rules, you have the option to create a useful cohort with ready-made Cohort Templates. These templates have a collection of dynamic fields that you can edit and configure as required.

For example, one of the cohort templates says: "Payment risk is High and invoices with Active subscription had their last payment failed in the Last 30 Days due to Insufficient Funds error with transaction amount greater than $10,000."

In this example, High, Active, Last 30 Days, Insufficient Funds, and $10,000 are dynamic fields that you can click and select a different value for, as shown below.

You can move to the Rules Added section and edit or delete the added rules.

If a cohort template fulfills your requirements, you can use it and proceed. If not, the templates give you an idea of setting your rules by adding the relevant fields to create a cohort for your use case.

- Once you understand the usability, navigate to the top section and select the relevant field category, such as Last Attempted Payment, Payment Methods, Payment Terms, or Email Engagement, and then select the relevant fields from the Select field drop-down menu.

- Once you select the desired field, the Select Value drop-down appears.

- Select the relevant value from the menu and click the + button.

Here are all the fields and their respective values that you can add as a rule:

| Field | Entity | Value |

|---|---|---|

| Last Attempted Payment Date | Invoice | Current Month, Last 7 Days, Last 15 Days, Last 30 Days, Custom |

| Last Attempted Payment Status | Invoice | All, Success, Failure, Voided, In Progress, Timeout |

| Last Attempted Payment Amount | Invoice | greater than, lesser than, in between, equal to, not equal to |

| Last Attempted Payment Method | Invoice | None, All, Cash, Card, Cheque, Chargeback |

| Last Attempted Payment Failure Error | Invoice | None, All, Cash, Card, Cheque, Chargeback |

| Last Attempted Payment Date | Invoice | Based on the defined scnerios./td> |

| Last Payment Gateway Used | Invoice | All Payment Gateway supported by Chargebee. Learn more |

| Dunning Status of Last Attempted Payment | Invoice | In Progress, Exhausted, Stopped, Success |

| Count of Payment Attempts | Invoice | greater than, lesser than, in between, equal to, not equal to |

| Next Scheduled Retry | Invoice | Tomorrow, Current, Next Week, Next Month, Custom |

| Primary Payment Method | Customer | None, All, Cash, Card, Cheque, Chargeback |

| Backup Payment Method | Customer | None, All, Cash, Card, Cheque, Chargeback |

| Masked Credit Card Numbers | Customer | Primary CC same as last updated and Primary CC not the same as last updated. |

| Auto Collection | Invoice | On, Off |

| Net Term Days | Customer | greater than, lesser than, in between, equal to, not equal to |

| Payment Risk | Customer | High, Medium, Low |

| Payment Source Status | Customer | Valid, Invalid, Expiring, Expired |

| Average Payment Attempts Per Invoice | Customer | greater than, lesser than, in between, equal to, not equal to |

| Subscription Status | Invoice | Future, In-trial, Active, Canceled, Paused, Non-renewing |

| Last Email | Invoice | Last Email Sent, Last Email not Sent |

| Last Reply | Invoice | Last Reply Received, Last Reply Not Received |

| Last Email Bounced | Invoice | True, False |

| Last Email Replied | Invoice | True, False |

| No. Of Emails Sent | Invoice | greater than, lesser than, in between, equal to, not equal to |

| No. of Manual Emails Sent | Invoice | greater than, lesser than, in between, equal to, not equal to |

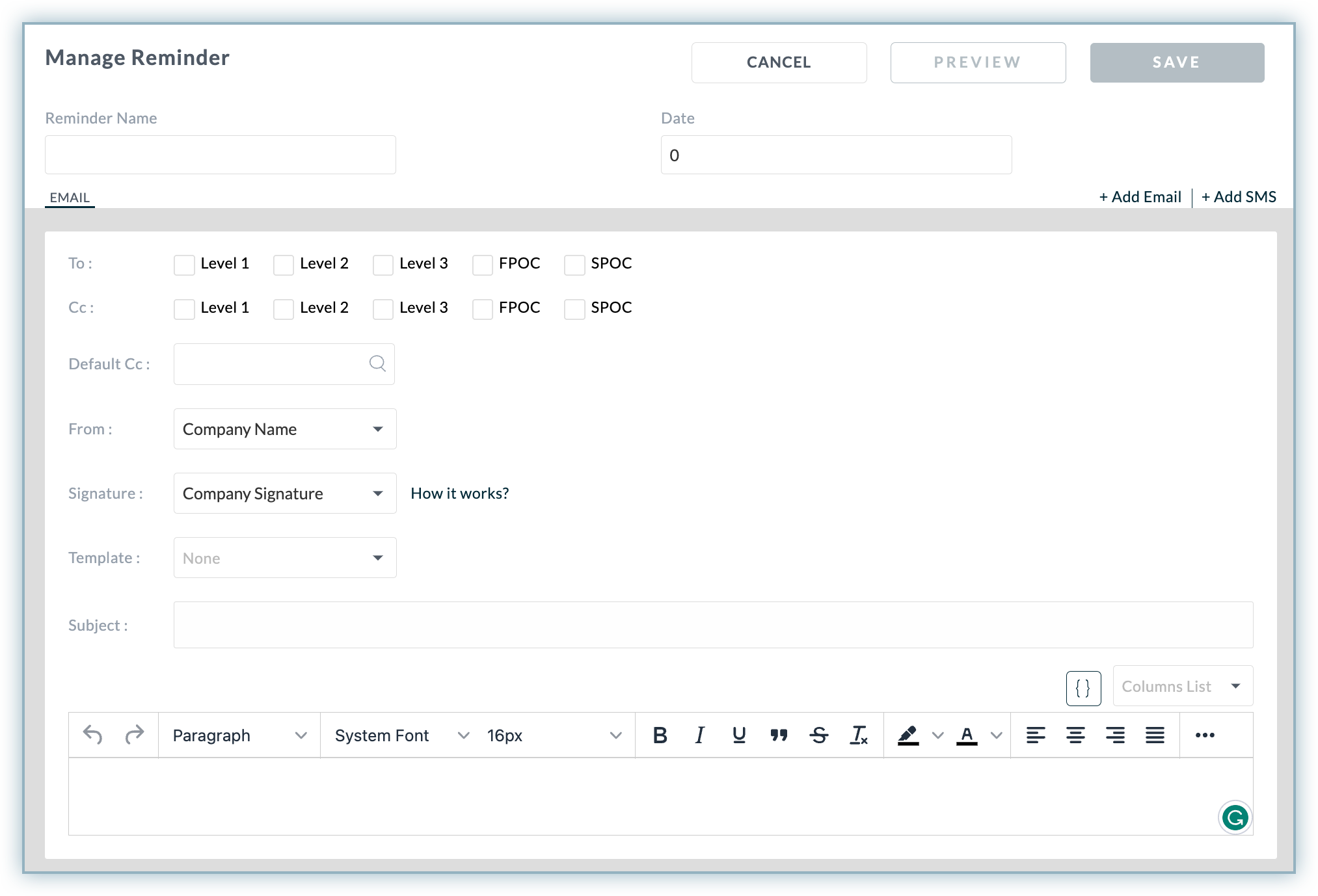

Adding a Reminder

On the Automation page, in the Reminders section, you can add reminders (emails) that you want to send to the customers who fall under the configured cohort.

- Click Add Reminder.

- In the Manage Reminder window, add the Reminder Name.

- Select one of the following reminder options:

- Click +Add Email to add an email reminder and specify the following details:

- Recipient: Select contacts to include all the customers for each of the contacts at various levels of escalation. You can also select the customer's contact to whom you want to send the reminders.

- Sender: Select a sender from the dropdown menu. You can choose between the company name and other points of contact (POCs) such as sales point of contact (SPOC) and finance point of contact (FPOC).

- Signature: Select the signature from the dropdown menu to include the signature between yourself, the company name, and other people on the team. Once a specific signature is selected, you can use the

signaturetemplate variable in the email body. - Select an email template, subject, template variables, and column list to customize the invoice table in the email body.

- Click Save.

- Click +Add Email to add an email reminder and specify the following details:

You can learn more about editing, deleting, or disabling a reminder. Learn more.

Advanced Cohorts

Every customer is unique in the way they subscribe, pay, and engage. Therefore, your engagement with them cannot be generic. While cohorts allow you to bundle customers with similar criteria, it is also important to know how cohorts can be used at an advanced level to target a specific group of customers and engage with them effectively.

The following are the cohorts and their variables to be used:

| Cohort Description | Cohort Variables |

|---|---|

| Engaging with customers who had a payment failure but had a higher transaction value. These customers cannot be treated the same as the one with a basic plan. | Customers with Active subscription, whose last payment ** Failed ** due to ** ** where the ** Last updated card isn't registered as primary ** and the last email was sent more than ** One day ago ** . |

| Engaging with customers to inform them about their next retry date. | Customers with ** Active ** subscription, whose last payment ** Failed ** in the ** Last X Days ** due to ** ** where the overdue amount is ** Greater than $Y ** and subscription MRR is ** Greater than $Z ** and the last email was sent more than ** One day ago ** . |

| Engaging with customers who haven't made a single payment to date against the subscription. | Customers with ** Active ** subscription, whose last payment ** Failed ** in the ** Last X Days ** due to ** <error reason> ** and payment risk status is ** No Payment ** and the last email was sent more than ** One day ago ** . |

| Engaging with customers with the first invoice payment failed. | Customers with ** Active ** subscription, whose last payment ** Failed ** in the ** Last X Days ** due to ** <error reason> ** where the invoice failed was the very ** First Invoice ** and the last email was sent more than ** One day ago ** . |

| Engaging with customers who updated a new card but did not assign it as their primary payment method. | Customers with ** Active ** subscription, whose last payment ** Failed ** due to ** <error reason> ** where the ** Last updated card isn't registered as primary ** and the last email was sent more than ** One day ago ** . |

| Engaging with customers with a certain monthly amount at stake with multiple invoices unpaid and needs immediate attention. | Customers with ** Active ** subscription, whose last payment ** Failed ** in the ** Last X Days ** due to ** <error reason> ** where the overdue amount is ** Greater than $Y ** and subscription MRR **** is ** Greater than $Z ** and the last email was sent more than ** One day ago ** . |

| Engaging with loyal customers to retain them by asking them to register a backup card while they start suffering failures. | Customers with ** Low ** risk, ** Active ** subscription, invoices with the last payment ** Failed ** in the ** Last X Days, ** with ** No backup card registered ** and the last email was sent more than ** One day ago ** . |

| Engaging with customers whose card is about to expire to prevent payment failure. | Customers with ** Active ** subscription having **** their ** Primary card expiring soon ** . |

| Engaging with high-risk customers who fail at their Xth attempt while their usual average number of attempts is below X. | Customers with ** High ** risk, ** Active ** subscription, invoices having their last payment ** Failed ** in the ** Last X Days, ** retries are ** In Progress, ** the **** number of payment attempts is ** Greater than X ** , **** the average number of attempts is ** Lesser than X ** and the last email was sent more than ** One day ago ** . |

| Engaging with customers who had a successful last payment but still have an invoice with pending payment. In this scenario, we know that the customer is willing to pay & continue the subscription. | Customers with ** Active ** subscription and invoices having their last payment ** Succeeded ** in the ** Last X Days w ** ith ageing in ** X-Y bucket. ** |

Was this article helpful?