Pending Collectibility by Invoice Dunning Status

Overview

The revenue recognition principle governs how and when revenue is documented and acknowledged in a company's financial reports. According to accounting standards, it's essential to assess collectibility during the initial stage of the revenue recognition process. When collectibility is uncertain, revenue can only be recognized when certainty is established. RevRec provides two approaches to evaluate collectibility, based on:

- Individual customer-level assessment

- Invoice's dunning status

Configuration

To enable pending collectibility based on the invoice dunning status, reach out to revrec-support@chargebee.com.

Integration with Chargebee

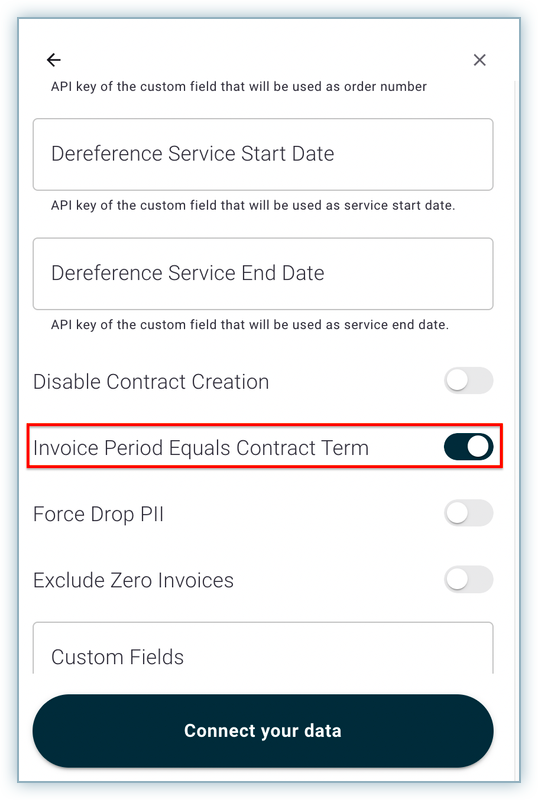

Note: This feature is only applicable to the Invoice as Contract feature and is not compatible with the Contract Term functionality. For contract term-based subscriptions, only customer-level collectibility is supported.

To enable the Invoice as Contract feature, follow these steps:

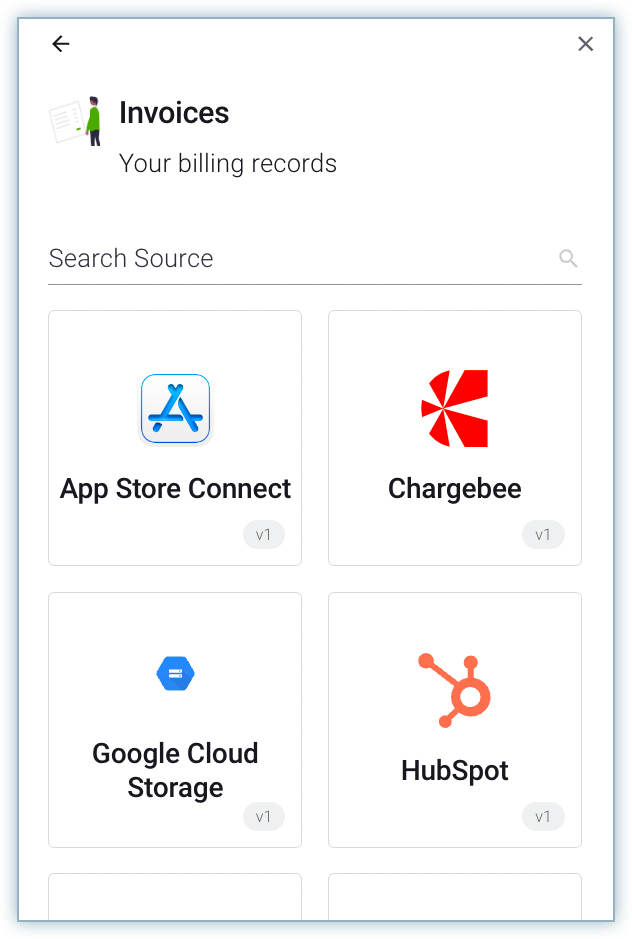

- On the Manage your Chargebee connection popup, select Sync > Connect > Invoices > Chargebee.

- Enable the Invoice Period Equals Contract Term.

- Click Connect your data.

Accounting

RevRec sets the pending collectibility based on the invoice dunning status as displayed here:

Dunning Status | Invoice Status | Pending Collectability |

In Progress | Payment Due | Y |

Stopped | Payment Due | Y |

Stopped | Paid | N |

Exhausted | Payment Due | Y |

Exhausted | Paid | N |

Success | Paid | N |

Learn more about Dunning Status.

RevRec uses the Pending Collectibility flag to determine whether revenue should be recognized for the sales order.

- Revenue is recognized for the sales order if the pending collectability flag is set to N or not provided.

- If the pending collectability flag is set to Y then no revenue is recognized for the sales order, and any previously recognized revenue is reversed in the current period.

- When payment is collected, RevRec resumes revenue recognition and books catch-up for the cumulative revenue to make recognition up-to-date.

- When payment collection retries are exhausted then a credit note is issued for order write-off or termination, and any associated deferred revenue balance is duly adjusted and written off accordingly.

Here is an example: A new customer record is added to Chargebee on January 01, and the invoice of $12,000 is created on the same day with a due date of February 01. Chargebee tries to collect the payment, but it fails, and the invoice goes into dunning. The system sets the pending collectability flag to Y on February 01. RevRec will recognize the revenue of $2,000 in January, and a reversal of ($2,000) will be booked in February for the previously recognized revenue.

Original Invoice | Revenue |

| January | $2,000 |

| February | -$2,000 |

| March | 0 |

| April | 0 |

| May | 0 |

| June | 0 |

Continuing with the above example, let's assume that payment is received and the pending collectibility flag is set to N on March 01. RevRec will book the catchup of $4,000 for the revenue of the period Jan ($2,000) and Feb ($2,000) in March. The system will also resume revenue recognition of $2,000/month from Mar to Jun, which is the end of the contract.

The revenue plan for the above scenario should be as follows.

Original Invoice | Revenue |

| January | $2,000 |

| February | -$2,000 |

| March | $6,000 |

| April | $2,000 |

| May | $2,000 |

| June | $2,000 |

Bulk Upload

You can enable Pending Collectability for an order also while uploading order records to your RevRec site in bulk. A new column, Pending_Collectability, is added to the Order Details sheet. The default value for the field is N. You can enable Pending Collectability for select records by setting it to Y.

Reports

Revenue recognition for orders with Pending Collectability enabled will not be included in any deferred revenue, forecast, backlog, or journal entry report. Any deferred revenue balance from an invoice will be part of the Revenue reports.

The following reports contain a Pending Collectability attribute within the Sales Order drill map to identify customers with doubtful collectibility:

- All Revenue Reports

- Accounting Reports

- All Billing Reports

- All Sales Report

Was this article helpful?