Bad Debt Expense

Overview

Bad Debt Expense is an accounting entry that lists the dollar amount of receivables your company does not expect to collect. RevRec provides the option to book certain credit notes to the Bad Debt Expense account. You can leverage and configure specific reason codes for this booking approach, such as write-offs or chargebacks, and create GL mapping for the Bad Debt Expense GL account type.

Note:

Bad Debt Expense recognition is supported only for invoices recorded as contracts.

Configuration

Leveraging this feature in RevRec requires the following steps:

- Configuring Bad Debt Expense feature in your RevRec site.

- Setting up journal account mapping and generating journal entries.

Configuring Bad Debt Credit Note Reason Codes

You need to identify the specific credit note reason code that you want to book to the bad debt expense account, and provide this list to the RevRec support or implementation team to configure.

Note:

You can configure Bad Debt Expense only for Journal Entries (JE). No other report will reflect the impact of Bad Debt Expense on revenue numbers.

Setting up Journals

You need to perform the following:

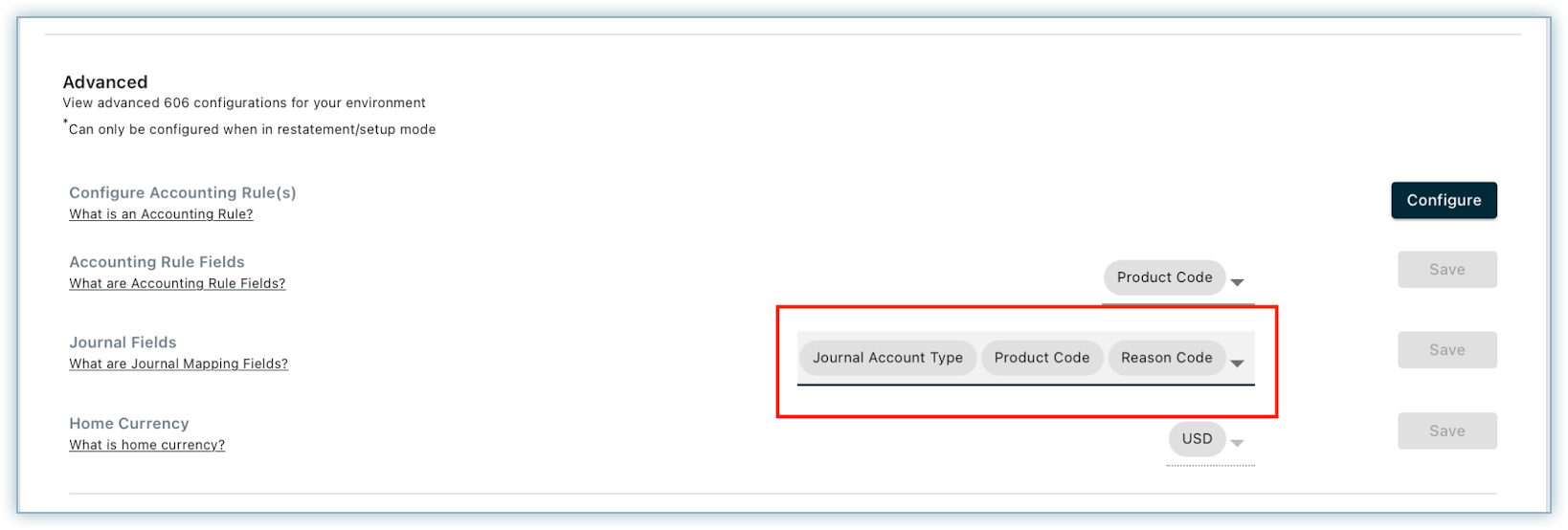

Setting up Journal Fields

To include Reason Code as part of the Journal Fields, follow these steps:

-

Click Settings > Configure RevRec, and navigate to General Ledger Accounts Mapping Fields.

-

Click the drop-down and select the desired field - Reason Code.

-

Click Save.

Setting up Bad Debt Expense GL Mapping

RevRec has created a new journal account type to keep track of the credits categorized as Bad Debt Expense. This type can be set up with specific general ledger accounts leveraging the configured Credit Reason Codes. A Bad Debt credit note is automatically booked in 7000 - Bad Debt Expense (BDE) account by default. However, it is possible to use different Bad Debt Expense accounts based on the Reason Codes for different Credit Notes.

Learn more about setting journal account mapping here.

User Interface

You can view bad debt expenses for the sales order under Arrangement > Revenue Elements. A credit note with a reason code configured as bad debt will appear as a separate line item, and the credit note amount will appear in the bad debt column. The credit note amount will not be used to determine the revenue allocation.

Journal Entry Booking

Currently, any credit issued to an invoice is recognized in RevRec as an adjusting entry to revenue, thus reducing the total recognized revenue and deferred revenue balance. With this functionality, RevRec treats credits separately and recognizes it in a separate account as a Bad Debt Expense. The deferred revenue account will continue to work as it does today and its balance will be eliminated with the credit note amount.

Example

Let's look at an example. On 1st January, an annual contract with 'Ratable' Revenue recognition method was created for an amount of $1200. In February, the contract was written-off and a credit was issued by Chargebee Billing, with the reason code as write-off.

Adjusted with Revenue:

| Month | Account | Dr | Cr |

|---|---|---|---|

| Jan | A/R Cash | $1200 | |

| Deferred Revenue | -$1200 | ||

| Jan | Deferred Revenue | $100 | |

| Revenue | -$100 | ||

| Feb | Deferred Revenue | $1100 | |

| Revenue | -$1100 | ||

| Revenue | $1200 | ||

| Deferred Revenue | -$1200 | ||

| Deferred Revenue | $1200 | ||

| A/R Cash | -$1200 |

Net Impact

- Revenue = $0

- A/R Cash = $0

- Deferred Revenue = $0

In February, the revenue of $1,200 was reversed and adjusted against the revenue account due to the writing-off of the sales order. Additionally, Deferred revenue balance is also reversed.

Treated as an Expense:

| Month | Account | Dr | Cr |

|---|---|---|---|

| Jan | A/R Cash | $1200 | |

| Deferred Revenue | -$1200 | ||

| Jan | Deferred Revenue | $100 | |

| Revenue | -$100 | ||

| Feb | Deferred Revenue | $1100 | |

| Revenue | -$1100 | ||

| Bad Debt Expense | $1200 | ||

| Deferred Revenue | -$1200 | ||

| Deferred Revenue | $1200 | ||

| A/R Cash | -$1200 |

In February, credit of $1,200 is booked against 'Bad Debt Expense' instead of adjusting it with the revenue account. Further, Deferred Revenue balance is also reversed using the Deferred Revenue Account.

Net Impact

- Revenue = $1200

- Bad Debt Expense = -$1200

- A/R Cash = $0

- Deferred Revenue = $0

Was this article helpful?