Multi-Currency

Overview

If your business sells in multiple regions, you may manage sales and invoices in several currencies. The multi-currency feature in RevRec helps you consolidate foreign currencies to view metrics in your home currency. RevRec currently uses ECB Exchange Rates, Fixer, and Open Exchange Rates—widely used foreign exchange data sources.

For orders transacted in foreign currencies, RevRec translates metrics such as deferred revenue and revenue to the home currency amount based on the Foreign Exchange (FX) rate as of the transaction date (contract date or invoice date). All reports and accounting journal entries related to revenue, such as the unearned revenue roll-forward and journal entry reports, are shown in the home currency. You can still track your orders and invoices in the transaction currency to reconcile with source records.

RevRec handles the accounting for foreign currency change impact as it relates to revenue recognition. For example, when you receive an advance payment for a subscription, it results in a non-monetary liability, which is captured as deferred revenue.

Non-revenue-related foreign currency change impacts are not handled by the RevRec multi-currency feature. For example, gains or losses from foreign currency exchange rate differences between invoice date and payment date, or month-end remeasurement of monetary assets and liabilities, should be managed directly in your accounting system.

Configuring Multi-Currency Feature

Follow these steps to configure and use the multi-currency feature:

- Step 1: Enable: Enable the feature on your RevRec site and configure your home/reporting currency. Each RevRec tenant has a single home/reporting currency for revenue recognition. If you have multiple subsidiaries with different home currencies, set up a separate tenant for each subsidiary.

- Step 2: Provide Currency Information with Your Data: When adding transaction data in RevRec through the User Interface (UI) or bulk upload, you must provide the transaction currency along with other data. For third-party integrations, supported direct integrations automatically sync currency details with the transaction data.

- Step 3: Review Results and Post Accounting Entries: Review results in the home currency across the dashboard, revenue, and accounting journal entry reports. Finally, post the accounting journal entries in the home currency to your accounting system.

Enabling Multi-currency

Note:

To enable the multi-currency feature on your RevRec site, contact your account executive, implementation team specialist, or support.

After having the multi-currency feature enabled on your RevRec site, follow these steps to configure your home currency:

-

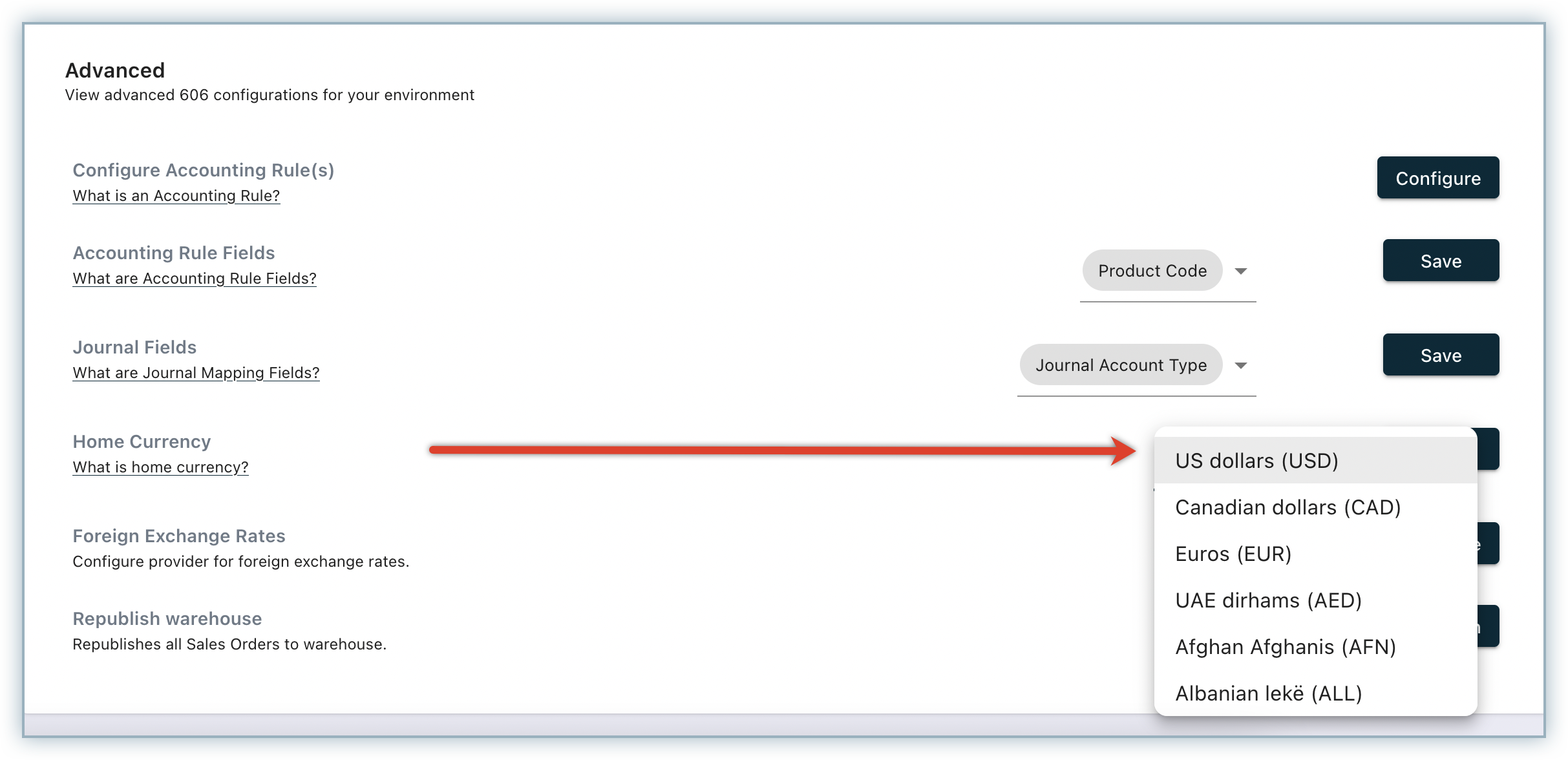

Click Settings > Configure RevRec > Home Currency.

-

Select the Home Currency from the drop-down.

-

Click Save.

-

To obtain exchange rates from a third-party source, contact RevRec Support to configure your site with your preferred option from the available sources. You can select from the following options:

- ECB Exchange Rates

- Fixer.io

- Open Exchange Rates

Alternatively, if you are not using any third-party systems as foreign exchange rate data sources, you can use the bulk upload option to add the foreign exchange rates along with your transaction data.

Changing the Foreign Exchange Rate Source

RevRec currently uses three foreign exchange data sources: ECB Exchange Rates, Fixer.io, and Open Exchange Rates. You can switch between these predefined sources at any time as needed. When you select a new forex data source, RevRec applies the exchange rates from the newly selected source for future transactions. Orders and invoices with start dates before the forex source switch will continue to use forex rates from the previous data source, even if reprocessing is triggered.

Providing Currency Information with your Data

Once the multi-currency feature is enabled on your RevRec site, all channels to provide transaction data are available as follows:

RevRec User Interface

When creating a new Customer, Product, Sales Order, or Invoice record on your RevRec site, you will see an additional Currency drop-down that allows you to specify the transaction currency.

Bulk Upload

When you import your transaction data in RevRec through bulk upload, and if the multi-currency feature is enabled, the Currency column is a required field. You can also upload the Foreign Exchange rates manually using this file.

Third-party Integration

If you have integrated your RevRec site with any sales, billing, delivery, or accounting systems to auto-sync your data, currency information is synced directly from these systems.

Custom FX Rates Upload

RevRec also allows you to upload your own custom FX rates using the following bulk upload file format. You must upload the custom rates before the accounting period closes. The custom FX rates you upload manually will take precedence over the FX rates added from any other source. After you upload the custom FX rates file, you need to reprocess the sales orders for the month manually to apply the newly uploaded FX rates. RevRec does not reprocess the sales orders based on custom FX rates automatically.

Alternatively, you can upload the custom FX rates file at month end with daily rates populated for the upcoming month. RevRec will automatically apply these custom rates, and you do not have to reprocess the sales orders. You can use this approach if your accounting policy uses one FX rate for the entire month.

Validating Data

In addition to the Currency field for Order, Invoice, Customer, and Product, ensure that the contract associated with a billing/invoice for multi-currency transactions is also captured. This is used to identify the transaction/contract date and calculate the impact of foreign exchange rate changes wherever applicable. RevRec's data validation process automatically checks and reports any missing or invalid data related to multi-currency transactions.

To access any sync errors from validation, click Reports > Data Errors > Sync Errors.

Reports

All metrics on the Dashboard are displayed as translated amounts in the home currency. This includes the revenue figures displayed for the top-customer list on the Dashboard. The total contract value is translated to the home currency amount if it is transacted in a foreign currency.

Note:

The translation of the total contract amount is only performed for the top-customer list on the Dashboard.

A new Forex category of reports is added with the Forex Exchange Rates and Forex Translation by Order reports.

For the Revenue reports, all revenue-related metrics such as revenue, deferred revenue, and foreign exchange change impact are in the home currency only. A new metric called Foreign Currency Change is added to capture the impact of exchange rate changes in the Unearned Revenue Roll-forward report. Positive foreign exchange change impact (gain) is reported as a positive amount and vice versa.

For the Sales and Billing reports, the actual transaction currencies are used. For example, if you have received orders transacted in US Dollars and Euros, the Sales and Billings reports display the relevant information in USD and EUR, respectively.

The Accounting Journal Entry report and the journal entries are displayed in the translated home currency amount.

Journal Entries

Journal entries for multi-currency transactions can be generated and posted automatically or manually to your accounting system. Ensure that the home currency is consistent between your accounting system and RevRec.

Exchange of Foreign Currency for Home Currency

RevRec translates foreign transaction currency into home currency for revenue recognition, based on the foreign exchange rate at the time of the transaction.

For transactions that require the establishment of deferred revenue and ratable revenue recognition, the revenue is recognized over the contract term based on the foreign exchange rate as of the contract date. For example, if a customer purchases an annual subscription and is invoiced upfront on January 1, 2022, the revenue is recognized based on the foreign exchange rate as of January 1, 2022. Subsequent changes in the foreign exchange rate will have no impact on revenue recognition.

For transactions that have multiple payment-in-advance invoices over the contract period that require the recognition of deferred revenue, the revenue is recognized based on the exchange rate as of the contract date, and the change in the foreign exchange rate between the contract date and invoice date(s) is recorded as revenue adjustment(s). If you want to treat the change impact as foreign exchange gain or loss, you need to create General Ledger (GL) entries to reclassify the impacts from revenue adjustments to foreign exchange gain or loss. Refer to Multi-Currency Examples for more details.

Contract Modifications

When order items are changed in a foreign currency contract (for example, adding or removing a new order item), revenue recognition is adjusted retrospectively using the foreign exchange rate at the time the contract was established (order date).

For Chargebee users, when a customer changes the subscription plan (for example, upgrading from a basic plan to a premium plan), Chargebee issues a prorated credit note to cancel the original plan and issues a new invoice for the remaining contract period based on the new plan with the same order ID. RevRec recognizes the change in the foreign exchange rate from the contract date to the plan change date as a revenue adjustment and will continue to recognize revenue based on the foreign exchange rate as of the original contract date. Alternatively, instead of changing a subscription plan in Chargebee, you could cancel the original subscription and start with a new plan. In this scenario, RevRec uses the foreign exchange rate at the change date for the new plan, and there will be no foreign exchange rate adjustment.

Contract Cancellations

In the case of a cancellation, the foreign exchange rate as of the contract date is used to reverse revenue and generate adjusting entries to zero out revenue recognition.

Reports

All metrics on the Dashboard are displayed as translated amounts in the home currency. This includes the revenue figures displayed for the top-customer list on the Dashboard. The total contract value is translated to the home currency amount if it is transacted in foreign currency.

Note:

The translation of the total contract amount is only done for the top-customer list on the Dashboard.

For the Revenue reports, all revenue-related metrics such as revenue, deferred revenue, and foreign exchange change impact are in the home currency only. A new metric called Foreign Currency Change is added to capture the impact of exchange rate change in the Unearned Revenue Roll-forward report. Positive foreign exchange change impact (gain) is reported as a positive amount and vice versa.

For the Sales and Billings reports, the actual transaction currencies are used. For example, if a user has received orders transacted in US Dollars and Euros, the Sales and Billings reports display the relevant information in USD and EUR respectively.

Accounting Journal Entry Report and the journal entries are displayed in the translated home currency amount.

Multi-currency Sample Transactions

The following examples illustrate a few multi-currency transactions and types of entries created for each.

Example 1: Foreign currency contract with an upfront invoice for the total contract value.

Month 1

On December 12, 2020, an entity enters into a foreign currency subscription contract with a customer for three months starting from January 1, 2021. The customer is billed via an invoice on December 12, 2020 for the entire contract value of EUR 300 (EUR 100/month), which is payable by January 1, 2021. The home currency is USD and the exchange rate as of December 12, 2020 is USD 1.20/EUR.

On December 31, the entity has an outstanding A/R balance of EUR 300. The exchange rate on December 31, 2022 is USD 1.19/EUR, resulting in a decrease of USD 3.00 on A/R due to the decrease in the value of the home currency against the foreign currency since the invoice day. Note: This remeasurement process is handled in the accounting system and is self-reversed in the next month.

Month 2 On January 15, a EUR 300 payment is received and converted at the exchange rate of USD 1.185/EUR, for a total of USD 355.50. The accounting system recognizes the payment and foreign currency loss due to loss of value in home currency against foreign currency.

On January 31, RevRec recognizes revenue based on obligation performance, at USD 1.20/EUR (the original foreign exchange rate as of the contract establishment date). The foreign currency rate changes do not have any impact on revenue recognition.

Month 3 (February 28) and Month 4 (March 31)

Similar to Month 2, RevRec continues to recognize revenue based on the original foreign exchange rate as of the contract date.

Example 2: Foreign currency contract with monthly upfront invoices

Month 1 On January 1, 2021, an entity enters into a foreign currency contract with a customer for EUR 100/month for a two-month term starting from January 1, 2021. The plan includes two monthly pre-billed invoices, with the first EUR 100 payable on January 1, 2021. The home currency is USD and the exchange rate as of January 1, 2021 is USD 1.20/EUR.

On January 1, payment of EUR 100 is received and converted to USD at the exchange rate of USD 1.20/EUR. There is no gain or loss from foreign currency as the payment is received on the same day as the invoice.

On January 31, RevRec recognizes the earned revenue based on the foreign currency rate as of the contract date.

Month 2 On February 1, the invoice for the second month of EUR 100 is billed, with the FX rate at USD 1.21/EUR. The accounting system records the A/R and revenue at USD 121. RevRec reclassifies USD 121 out of revenue into deferred revenue.

On February 1, EUR 100 payment is received and converted to USD at the exchange rate of USD 1.21/EUR. Similarly, there is no foreign currency gain or loss associated with the payment, as it is received immediately.

On February 28, RevRec processes revenue recognition. It is based on the foreign exchange rate as of the invoice date and treats it as the transaction date. The FX impact is recognized as revenue directly.

Another accounting view is to not book the FX rate change impact through revenue, but to recognize it as a gain or loss.

Note:

If you would like to use this approach, contact the RevRec Support team and ask for early access to this feature.

Was this article helpful?