Pending Collectibility

Overview

The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company's financial statements. The accounting standard requires you to determine the collectibility during step one of the revenue recognition model. If the collectability is not certain, then the accounting standard does not allow you to recognize revenue for the customer until you are certain.

Collectibility can be assessed based on the customer's financial capacity and intent to pay. Further, you may have to reassess collectibility during the life of the contract if there is a significant change in facts or circumstances. RevRec allows you to maintain revenue arrangements where the collectability of compensation is in doubt. You can choose to delay or pause revenue recognition for a certain period until the collectability is assured.

Using Pending Collectibility

You can turn on the Pending Collectibility setting for customer records when the collectability of payment is uncertain. You can do this while adding your customer data through the RevRec User Interface, or through bulk upload.

Using this feature is very simple and requires just a few steps.

User Interface

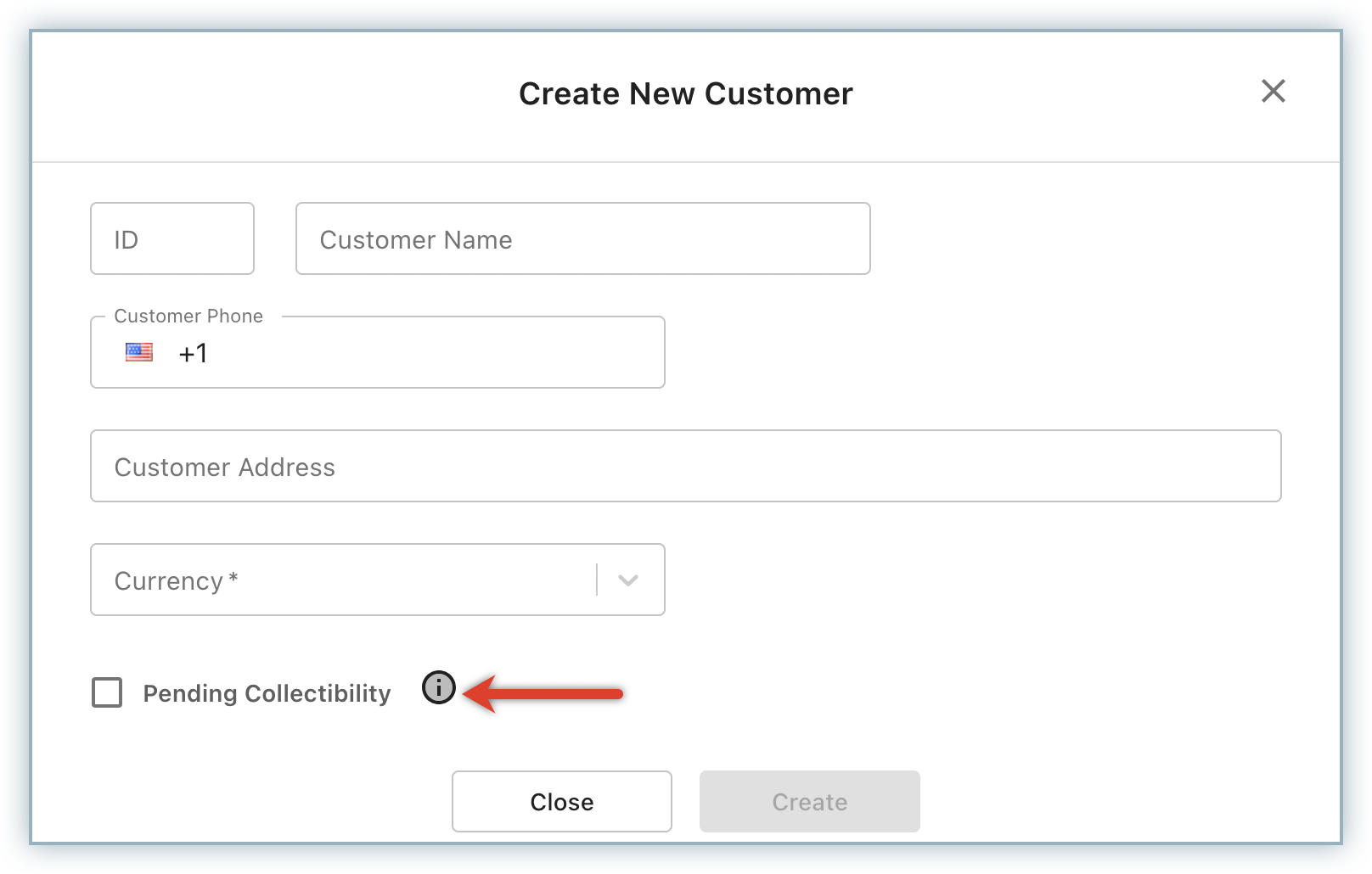

To enable this feature while creating a customer record on your RevRec site, follow these steps:

-

Click Customers > + New Customer.

-

On the customer creation screen, specify the customer details and enable the Pending Collectability option if collectability is uncertain for the customer.

-

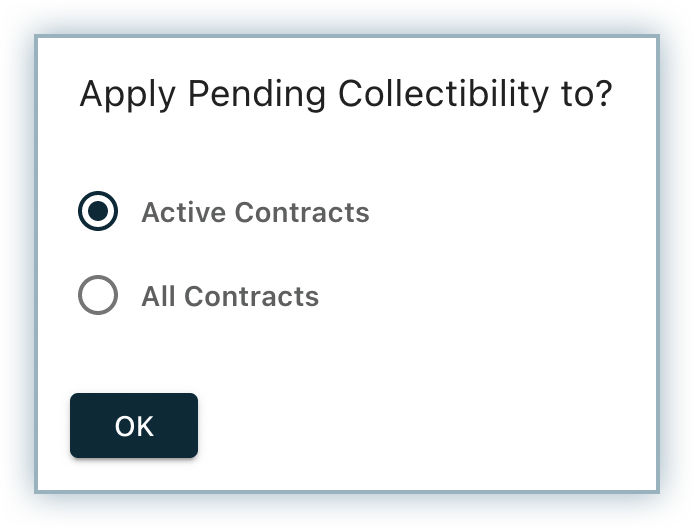

On the Apply Pending Collectibility popup, select if you want to apply this to just Active Contracts or All Contracts that belong to the customer.

Note: Active Contracts are contracts whose service end date is greater than the current accounting period. By default, revenue recognition will stop for active contracts only.

-

Click OK > Create.

RevRec will not recognize any revenue for the contracts associated with that customer if the Pending Collectibility checkbox is enabled.

Bulk Upload

Pending Collectability for a customer can also be enabled while uploading customer records to your RevRec site in bulk. A new column Delayed Revenue is added to the customer sheet. The default value for the field is N. You can enable Pending Collectability for select records by setting it to Y.

Another column is added inside the customer tab called Delay Revenue For Active Contracts which allows you to select whether you want to cease revenue recognition for only active contracts or all contracts for the respective customer. You can set the value as Y (for Active Contracts) or N (for All contracts).

Integration with Chargebee

While integrating your RevRec site with Chargebee by clicking Sync > Connect icon > Invoices > Chargebee, on the Manage your Chargebee connection popup, enable the Payment Required for Revenue Recognition toggle.

When the setting is enabled, RevRec uses a simple logic and checks if each customer record has at least one paid invoice (normally the first invoice) associated. If the customer has not paid even one invoice, RevRec automatically enables the Pending Collectibility flag for the customer record and pauses revenue recognition. RevRec automatically checks for any paid invoices for the customer in subsequent months and disables the setting once the customer pays at least one invoice.

For example, a new customer record is added to Chargebee on the 15th of January, and the invoice is sent on the same day but is not paid till the 15th of February. With the Payment Required for Revenue Recognition toggle enabled, RevRec will not recognize any revenue for this customer record from the 15th of January till the 14th of February as the customer fails the criteria of having paid at least one invoice.

This is a simplified/default logic to determine collectibility and you can use additional business rules to determine the collectibility of each customer and manually update the status on UI as discussed earlier.

Note:

Pending Collectability can be enabled for a customer record only once in RevRec. You cannot enable it again, once disabled.

Pending Collectibility Accounting

RevRec will not recognize any revenue on contracts for a particular customer with Pending Collectability enabled. Once collectability is certain, RevRec will recognize catchup revenue in the current accounting period that should have been recognized if pending collectibility was not enabled earlier. Further, RevRec will continue to recognize revenue for the customer in future periods.

Example: Two contracts are created for a customer on 1st January with contract values as $1200 and $600 respectively. Contract terms for both contracts are six months with a ratable revenue recognition method. Pending Collectability was enabled for the customer on Day 1 and disabled in March.

| Original Invoice | Jan | Feb | March | Apr | May | Jun |

|---|---|---|---|---|---|---|

| Revenue - Contract1 | 0 | 0 | 600 | 200 | 200 | 200 |

| Revenue - Contract2 | 0 | 0 | 300 | 100 | 100 | 100 |

| Rollforward | Jan | Feb | March | Apr | May | Jun |

| Revenue | 0 | 0 | 900 | 300 | 300 | 300 |

If Pending collectability is enabled for customers where revenue is already recognized for the associated contracts, then RevRec will reverse the revenue already recognized in the current accounting period. In the above example, RevRec reverses the revenue recognized for Jan and Feb in March and stops recognizing revenue as long as the pending collectibility is not resolved. Further, RevRec will not book any revenue in future periods until the pending collectibility is disabled.

Example: Two contracts are created for a customer on 1st January with contract values as $1200 and $600 respectively. Contract terms for both contracts are six months. The Pending Collectability flag was enabled for the customer in March.

| Original Invoice | Jan | Feb | March | Apr | May | Jun |

|---|---|---|---|---|---|---|

| Revenue - Contract1 | 200 | 200 | -400 | 0 | 0 | 0 |

| Revenue - Contract2 | 100 | 100 | -200 | 0 | 0 | 0 |

| Rollforward | Jan | Feb | March | Apr | May | Jun |

| Revenue | 300 | 300 | -600 | 0 | 0 | 0 |

Pending Collectibility Reports

Revenue recognition for customers with Pending Collectability enabled will not be included in any deferred revenue, forecast, backlog, and Journal entry report. Any deferred revenue balance arising from an invoice will be made part of Revenue reports.

The following reports contain a Pending Collectability attribute within the Sales Order drill map to identify customers with doubtful collectibility.

- All Revenue Reports

- Accounting Reports

- All Billing Reports

- All Sales Report

Was this article helpful?