Apple App Store

Overview

The sales and finance reports provided by Apple's App Store are often at an aggregated level, on a daily basis. These reports are focused on cash payments such as the Customer Price, which is the amount that customers pay and can include taxes (like VAT) and the Developer Proceeds; or Partner Share, which is the amount that app developers receive after Apple deducts its platform fee charge (15% or 30% of price net of tax).

Contact Support to enable this feature for your site if you don't have it.

RevRec's App Store integration automates revenue recognition for your Apple App Store subscriptions. It syncs detailed subscription transaction data from your App Store's Subscriber report on a monthly basis, and applies the revenue recognition rules based on the subscription's duration. Additionally, RevRec offers configurable functions to recognize Apple's platform fee charge based on the countries your subscriptions are sold in, and your qualification for Apple's Small Business Program.

| App Store's Sales and Finance Reports | RevRec App Store Solution |

|---|---|

| Aggregated, summary app sales data | Detailed transaction level data |

| Monthly update | Daily update |

| Cash Payments focused | Out-of-Box Revenue Recognition Solution |

| Manual process to prepare Journal Entry | Automated Journal Entry generation |

| Need to consolidate with other sales channels (E.g. Google Store, direct sale website, etc) | One revenue subledger, for all your subscriptions sales |

Sync Overview

It is important to understand the key terms used in RevRec and how it leverages them from the App Store Reports.

| Subscriber Report Fields | RevRec Fields |

|---|---|

| Event Date | Order Date and Billing Date, and Service Start Date. |

| Subscriber ID | Customer ID. It is also concatenated with the Event Date and Subscription Name to populate Order Number and Invoice Number. |

| Customer Currency | Customer currency. |

| Subscription Apple ID | Product Code: the unique identifier of the product. |

| Subscription Name | Product Name. |

| Subscription Group ID | Product Family. |

| Standard Subscription Duration | Product Term (in months). |

| Customer Price | Sales Order amount and billing amount, for tax exclusive pricing subscriptions. |

| Customer Currency | Sales Order and Billing currency, for tax exclusive pricing subscriptions. |

| Line ID | Order Item ID. |

| Developer Proceeds | Input to calculate Platform Fee and Revenue recognition for tax inclusive pricing subscriptions. |

| Proceeds Currency | Sales Order and Billing currency, for tax inclusive pricing subscriptions. |

| Refund | If 'Yes', RevRec will create a credit note. |

Prerequisites

Log in to your App Store Connect and retrieve the following details that are essential to connect the two applications:

- Key Id: Navigate to Users and Access. The key IDs will appear in a column under the Active heading.

- Issuer Id: Navigate to Users and Access, and select the API Keys tab. The issuer ID appears near the top of the page.

- Vendor Id: From the homepage, click Payments and Financial Reports. Your Vendor Number appears in the top left hand corner under your Legal Entity Name.

- Private key: You need an Admin account in App Store Connect to generate API key. Navigate to Users and Access, and select the API Keys tab. Click Generate API Key. Enter a name for the key. Under Access, select the Finance role for the key.

Connecting App Store and RevRec

You can connect your RevRec site with your App Store data, along with other subscription sales channels such as Google Play Store and Chargebee. You can connect one or more of your App Store accounts to your RevRec site.

Note:

Only users with Admin role access can set up the AppStore integration.

Follow these steps to integrate RevRec with your App Store account:

-

After logging in to your RevRec site, navigate to the right environment in which you are integrating App Store.

-

Click Sync > Connect to other systems icon.

-

On the Connect your DataS pop-up, select Invoices > App Store Connect.

-

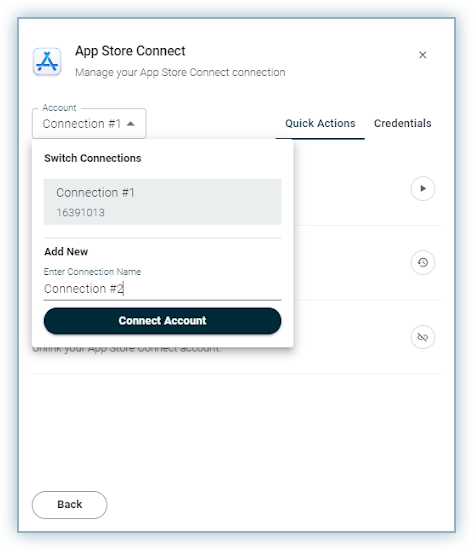

Click Account > Add New.

-

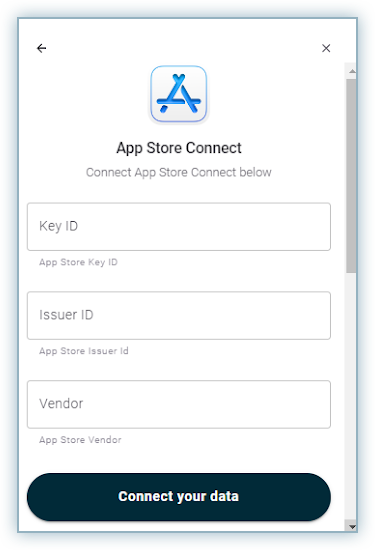

On the Configure App Store screen, specify the following details:

- Enter the Key Id, Issuer Id, Vendor Id, and Private Key details that you retrieved from your App Store.

- Click Connect.

-

After connecting your first App Store account, you can continue to add more accounts by clicking Accounts > Add New, and entering a connection name for the new connection. Click Connect Account.

Ensure that your use unique account names for each connection.

-

Configure your connection by specifying further details as required and click Connect your Data.

-

Define the country codes(as used by Apple App Store) that you recognize Customer Price as revenue and the difference between Customer Price and Developer Proceeds as the platform fee. The default country codes are US, and CA. You can add additional country codes that are using tax exclusive prices for App Store subscriptions.

-

Configure Platform Fee for tax inclusive price countries. Define if you qualify for Apple's Small Business program so that the platform fee is always 15% for all subscriptions. The default method is to recognize 15% platform fee for subscriptions that are 12 months or longer, and 30% for subscriptions that are in effect for less than 12 months.

-

Configure accounting rules. Define the accounting rules for revenue recognition of your mobile subscription products, and expense policy for the Apple platform fee charge (e.g. point-in-time or pro-rata).

-

Enable multi currency and configure your home currency.

Once your App Store accounts are successfully connected to your RevRec sites, RevRec will automatically import App Store's subscribers data on a daily basis to generate sales order, invoice, customer and product, with a new field Channel set to Apple App Store.

Revenue and Expense Recognition

Revenue and direct sale cost recognition for mobile subscriptions follow the same ASC 606/IFRS 15 guidelines.

Customer Price vs Developer Proceeds

Customer Price is the amount that Apple charges to the end user, and defined as is inclusive of any applicable taxes we collect and remit per Schedule 2 of the Paid Applications agreement per Apple's note.

Developer Proceeds is the amount that app developers would receive from Apple after Apple platform fee charge or any applicable tax.

Let's look at some examples:

| Price Type | Customer Price | Examples |

|---|---|---|

| Tax Exclusive Price (e.g. the U.S.) | Developer Proceeds + Apple's Platform Fee Charge | Example 1: Customer Price: $100 Platform Charge: $15 Developer Proceeds: $85 |

| Tax Inclusive Price (e.g. European countries) | Developer Proceeds + Apple's platform Fee charge + VAT tax | Example 2: Customer price: EURO 100 20% VAT Tax: EURO 100 / (1+20%) X 20% = EURO 16.67 Platform Charge (assuming 15%): EURO 100 / (1+20%) * 15% = EURO 12.50. Developer Proceeds: EURO 100 / (1+20%) * (1-15%) = EURO 70.83 |

Customer Price as Revenue (tax exclusive price countries)

For mobile subscriptions sold in countries that use tax exclusive price, RevRec recognizes the Customer Price as the total transaction price for revenue recognition, and the difference between Customer Price and Developer Proceeds, as the Apple platform fee.

With Example 1 above, RevRec recognizes $100 as total transaction price for revenue recognition and $15 as Apple Platform fee.

Note:

Contact RevRec Support to configure the country code(s) where the subscriptions are sold to apply this gross revenue approach.

Developer Proceeds and Platform fee as Revenue (tax inclusive price countries)

For mobile subscriptions sold in countries that use tax inclusive price, RevRec will recognize the Developer Proceeds + Apple Platform fee as revenue. See the next section for platform fee calculation.

Apple Platform Fee

RevRec calculates the platform fee as follows:

- For tax exclusive price countries, platform fee = Customer Price - Developer Proceeds.

- For tax inclusive price countries, platform fee = Developer Proceeds / (1 - Platform fee %) * Platform fee %, whereas the platform fee % is determined as following:

- If you qualify for Apple's Small Business Program, the platform fee is set at 15% for all subscriptions.

- Otherwise (by default), it is set at each subscription level: 15% for subscriptions over 12 months in duration or active, or 30% for subscriptions with less than 12 months duration or active (including renewal).

- To continue the Example 2 above, for tax inclusive price countries, the platform fee and revenue are calculated as following:

| Platform Fee Percentage | Platform Fee | Revenue (Tax inclusive price) |

|---|---|---|

| 15% | EURO 70.83 / (1 - 15%) X 15% = EURO 12.50 | EURO 70.83+EURO 12.50 = EURO 83.33 |

| 30% | EURO 70.83 / (1 - 30%) X 30% = EURO 30.35 | EURO 70.83+EURO30.35 = EURO 101.18 |

You can set the accounting policy for the platform fee in RevRec's expense policy configuration, to apply either point-in-time or pro-rata recognition method.

Note:

For tax exclusive price countries, RevRec requires the currency for Customer Price and Developer Proceeds to be the same for Platform fee expense calculation. RevRec will report the expense as pending if the currencies are different, and you can manually upload the translated expense into RevRec. Note that the sales orders and invoices are still processed, and only the expenses are not.

Other Use Cases

New Subscription

Each subscription transaction record on the Subscriber report is treated as a sales order. RevRec establishes the total transaction price on either gross or net basis and sales expense where applicable, as described above and captures the product, subscription duration, service start/end date, and applies the configured accounting rules for revenue and expense recognition.

Invoice

Each transaction on the Subscriber report reflects payment activities on App Store, and is processed as an invoice.

Renewal

RevRec treats renewal as a new order based on the new subscription start date. Renewal will have the same Subscriber ID.

Discount

Discount is considered to be reflected directly in the Customer Price and Developer Proceeds. As a result, there is no separate discount line item in invoice or sales order.

Refund and Cancel

App Store allows for full refund when a user cancels a subscription, in which case RevRec reverses the cumulative revenue recognized and zeros out deferred revenue.

Refunds are processed as credit notes in RevRec. The refunds are recognized based on the subscription product's service start and end date, with the cumulative impact recognized in the current open period. Refunds on subscriptions also include the reversal of platform charge. RevRec will recognize the platform charge associated with the refunds and recognize the cumulative impact for the charge in the current open period.

Change of Plan

Users can change a subscription plan (upgrade, downgrade or crossgrade) during the active period of a subscription. A partial refund is issued for the remaining period of the existing plan and a new charge is issued for the new plan. RevRec will stop revenue recognition for the existing subscription and recognize revenue for the new plan starting at the time of plan change.

User Interface

Sync

RevRec syncs data from all the connected app store accounts to your site. You can view each sync job status from the Sync page.

The Recent Jobs section shows all jobs that ran within a day. In this section, you can identify different app jobs using the Connection column. In the example below, the connection name Parent depicts the first app store connection, and Connection # 2 is the app name provided for the second app store connection.

Customers

You can identify the customers for each app from the Customers page using the App Name column.

Products

You can identify the products related to each app from the Products page using the App Name column.

Sales Orders

You can identify the sales orders created from the subscription from the respective Sales Order page using the App Name column.

Reports

Unearned Revenue Rollforward Report

This report displays your aggregate revenue and expense recognition information. You can also drill down using the various filters available like App Name, Channel, and Products in the drill hierarchy.

Learn more about the Reports & Analytics and Standard Reports.

Limitations

- One-time purchases or paid apps are not considered.

- No separate data is reported for discount. RevRec currently captures the net price.

Was this article helpful?