Journal Account Mapping

Overview

You can customize RevRec's default chart of accounts and map them to the actual accounts that are used in your ledger package or accounting systems. Furthermore, if you are a business selling multiple offerings with a complex accounting use case, you can configure advanced journal account mapping in bulk through product code, type, or family. RevRec comes with a default chart of accounts that gets applied automatically in the absence of any account mapping provided by you.

Journal Account Types

The journal account types help categorize all financial transactions into specific types of accounts for accurate bookkeeping, reporting, and reconciling of your financial data. RevRec uses the following journal account types:

Revenue Account Types

The revenue accounts report all the income earned by your business from selling your products or services. RevRec comes with the following default revenue accounts:

-

Contra Revenue: The clearing account used to re-class revenue from the current period recognition, for the purpose of deferring revenue recognition over the performance period.

-

Deferred Revenue: Liability on the company's balance sheet that represents pre-payments by customers for goods or services.

-

Revenue: Income earned from providing products and services in the current period.

-

Unbilled Receivable Asset: Unbilled receivables are recognized revenue that you have accounted for but have not yet been invoiced to the customer.

-

Bad Debt Expense: An accounting entry that lists the dollar amount of receivables your company does not expect to collect.

Expense Account Types

The expense accounts help you track and report various costs or expenses incurred by your business. RevRec comes with the following default expense accounts:

-

Expense Clearing: The clearing account used to re-class expenses from current period recognition, for the purpose of amortizing expenses over the lifetime of the contract, or over a specific term.

-

Deferred Expense: Expense costs that are already paid are yet to be recognized until a later period.

-

Expense Amortization: Costs that are recognized as expenses incurred for the current period.

Tax Account Types

The tax accounts help you track and report various taxes collected by your business that needs to be paid to the government. RevRec comes with the following default tax accounts:

-

Tax Payable: The amount of tax that a taxpayer owes to the government. This amount is calculated based on the amount invoiced for a subscription and the applicable tax rates.

-

Cash Tax: Cash Tax is an estimate of the tax amount actually collected from customers in a given period.

You can map the above-mentioned account types to the corresponding account numbers in your accounting General Ledger (GL). When you do not map the accounts, RevRec uses the following default chart of accounts.

RevRec Default Chart of Accounts

RevRec is pre-configured to produce Journal Entries based on the chart of accounts shown below.

| Account Number | Account Name | Account Type |

|---|---|---|

| 1000 | Deferred Expense (DE) | Deferred Expense |

| 2000 | Deferred Revenue (RL) | Deferred Revenue |

| 2500 | Unbilled Receivable Asset(UR) | Unbilled Receivable |

| 3000 | Contra Revenue (RL) | Contra Revenue |

| 4000 | Revenue (RL) | Revenue |

| 5000 | Expense Clearing (EC) | Expense Clearning |

| 6000 | Expense Recognized (ER) | Expense Ammortization |

| 7000 | Bad Debt Expense (BDE) | Bad Debt Expense |

| 8000 | Tax payable (TP) | Tax payable |

| 9000 | Cash Tax (CT) | Cash Tax |

Journal Mapping Fields

For a simple ledger configuration, you can use the default setup with a single account for each account type. For example, when you have a single deferred revenue account and revenue account for your company, the default chart of accounts in RevRec would suffice.

If you are selling multiple products or services, or to customers at multiple regions and need an advanced setup to better track the GL account balances based on these different attributes, RevRec allows you to further define the journal account mapping fields, to set up multiple GL accounts for the same account type, for example, you can have multiple GL accounts for revenue.

Follow the steps below to configure journal fields on your RevRec site:

-

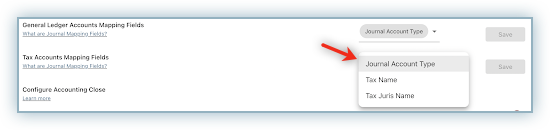

Click Settings > Configure RevRec, and navigate to General Ledger Accounts Mapping Fields.

-

Click the drop-down and select the desired fields. You can select one or more fields from the following options:

- Journal Account Type: When you select this field, RevRec allows you to map accounts based on their journal account type.

- Product Code: When you select this field, RevRec allows you to map accounts based on each product.

- Product Family: When you select this field, RevRec allows you to map accounts based on each product family.

- Product Type: When you select this field, RevRec allows you to map accounts based on each product type.

- Custom Fields: Any custom fields that are created in RevRec are also listed here for selection. For example, let's say you have created a custom field "Region" to track this data in your sales orders, customers, and so on. You can do the journal account mapping based on the field "Region" to track your journal entries in region-specific accounts.

-

Click Settings > Configure RevRec > Tax Accounts Mapping Fields.

-

Click the drop-down and select the desired fields. You can select one or more fields from the following options:

- Journal Account Type: When you select this field, RevRec allows you to map accounts based on their tax related journal account type.

- Tax Name: When you select this field, RevRec allows you to map accounts based on each tax name.

- Tax Juris Name: When you select this field, you can map accounts based on each Tax jurisdiction name.

- Tax Custom Fields: Any Tax-related custom fields that are created in RevRec are also listed here for selection.

-

Once you're done, click Save.

Once a field is configured, it shows up in the journal account mapping fields table. You can configure the journal account mapping for all accounts based on these new fields.

Note:

It is required to configure Journal Account Mapping fields upfront before any data is loaded into RevRec.

Mapping Accounts

RevRec comes with a default chart of accounts that gets applied automatically in the absence of any account mapping provided by you. However, you can customize and map the default chart of accounts used by RevRec to the actual accounts that are used in your ledger package or accounting systems.

-

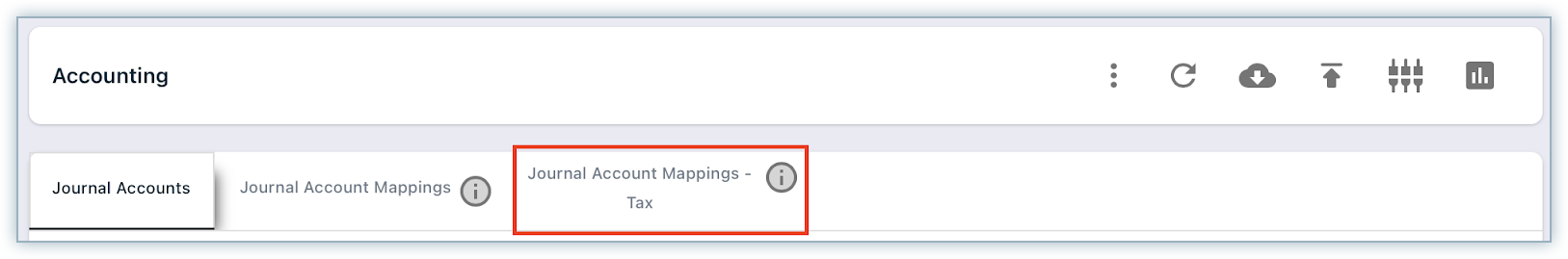

Access the Journal Account Mapping tab to view and customize revenue and expense related journal mappings.

-

Access the Journal Account Mapping - Tax tab to view and customize tax related journal mappings.

Simple Journal Account Mapping

If your company has a single account for each account type as described above, you can customize and map each RevRec internal account type with a ledger account. For example, while the default account name is Revenue, you might call it Sales based on your business requirements.

Follow these steps to customize and map the internal accounts in RevRec with your ledger accounts:

-

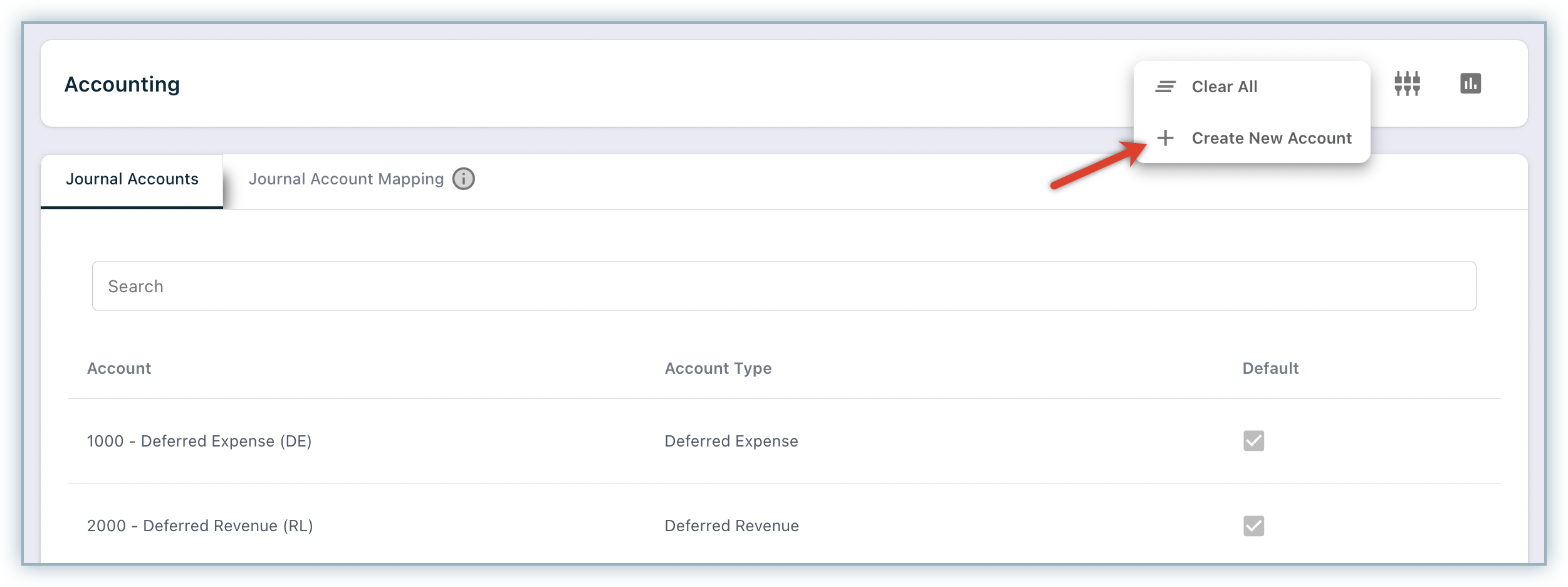

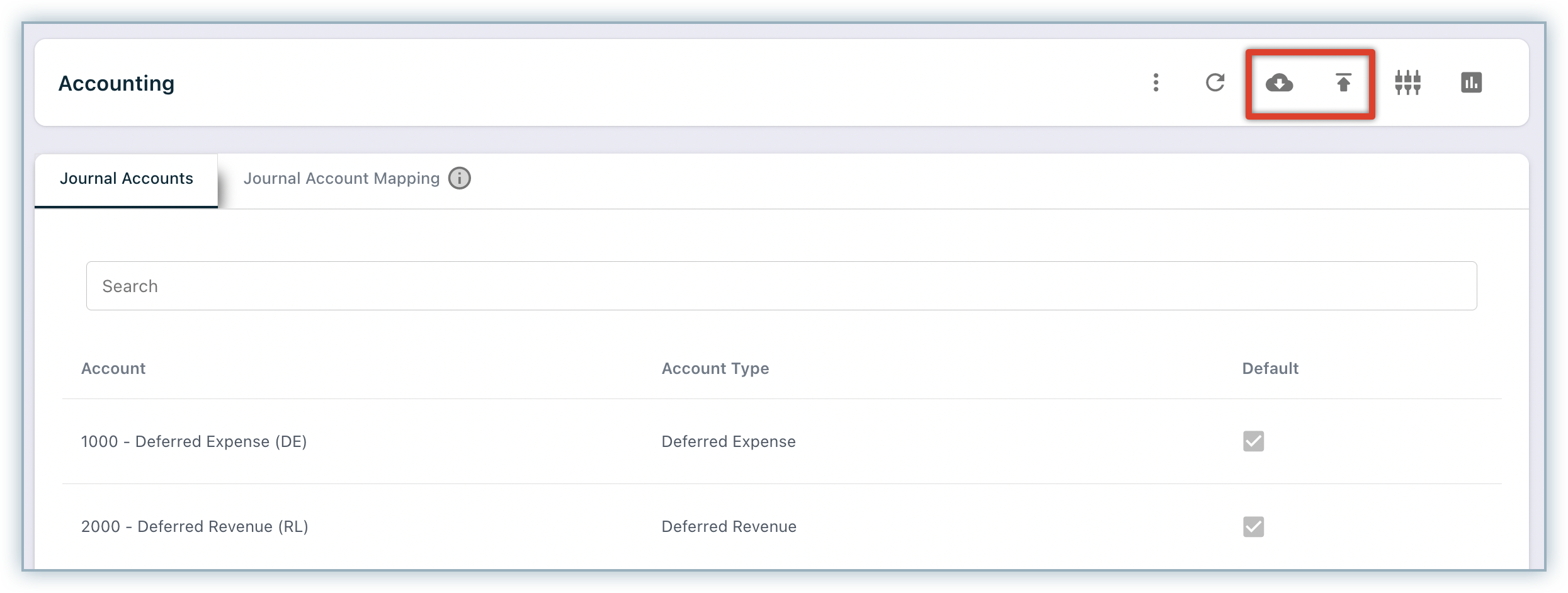

Click Accounting on the left navigation bar.

-

On the Accounting page, click the ellipsis icon and select Create New Account.

-

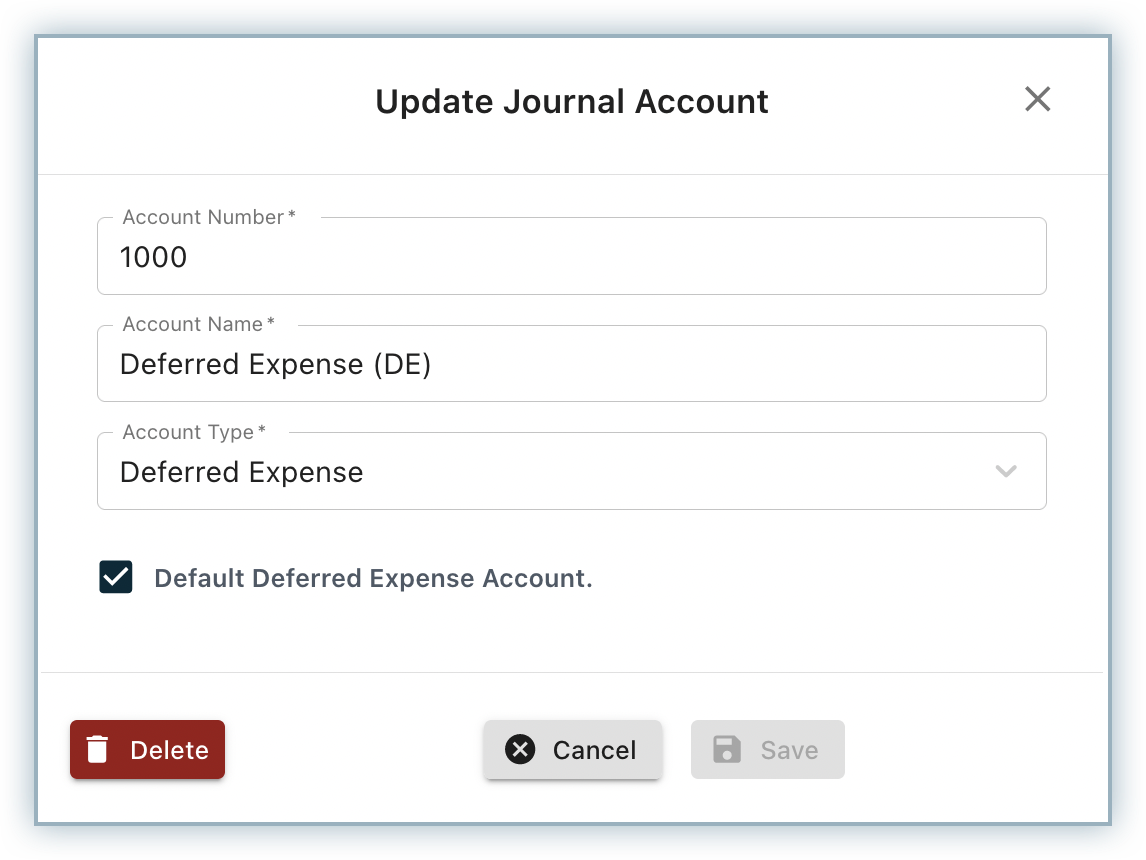

On the Create Journal Account pop-up, specify Account Number, and Account Name, and select an Account type. Any additional field configured for journal mapping would also be displayed.

-

Click the toggle to mark this Account as Default.

-

Click Save.

You have successfully added a new Journal Account mapping. This will be used as the default Journal Account for your selected account type.

Advanced Journal Account Mapping

If you have enabled advanced journal mapping fields for your complex use case, you can use the bulk upload feature to provide the details of GL account mapping.

Follow these steps to do a bulk update of your journal account mapping:

-

Click the Download Data icon and download the template as an Excel file.

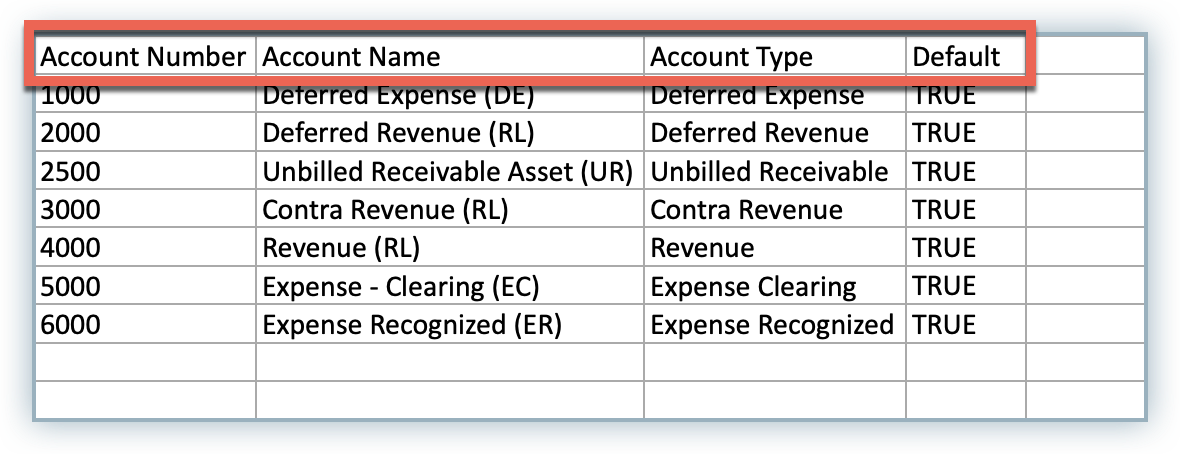

The Excel file comes in two tabs, one each for Journal Accounts and Journal Account Mappings. In addition to the following default fields, the fields that you configure under Journal Mapping fields would also be displayed, based on which you can map the accounts. Journal Account Tab:

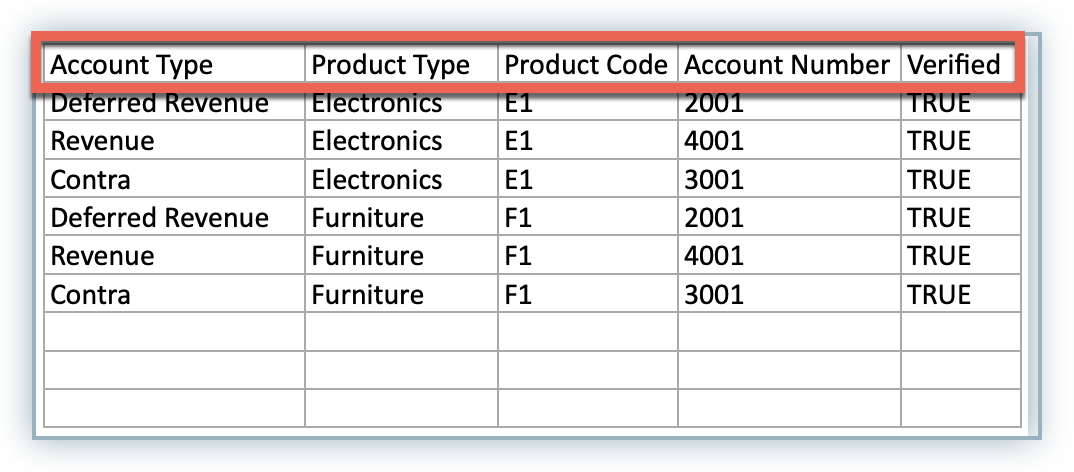

Journal Account Mappings Tab: In the following use case, note that the journal fields selected for advanced mapping are Product Type and Product Code.

| Tab Name | Field Name | Description |

|---|---|---|

| Journal Accounts | Account Number* | The unique account number. |

| Account Name* | A descriptive name for the account. | |

| Account Type* | Denotes the type/nature of the account. You can select from the pre-configured internal chart of accounts. | |

| Default | Set this value to be TRUE if you want RevRec to use this as the default account. | |

| Journal Account Mappings | Account Type* | Denotes the type/nature of the account. |

| Account Number* | The unique account number. | |

| Verified | Denotes if the mapping is verified by you. Set the value as TRUE upon verification. |

Fields marked with * are mandatory fields.

- Update the mapping on the excel file as required and save the file.

- Click the Upload Data icon and upload the new mapping in bulk.

Note:

If you do not define the account mapping in Revrec, the default mapping gets loaded and applied.

We recommend that you verify your account mapping before generating the journal entries.

Was this article helpful?