Accounting and Reporting Periods

Overview

This document covers everything that you need to know about Accounting and Reporting periods, and how you can manage them for your business on the RevRec site.

What is an Accounting Period?

The accounting period is a primary time concept used in any accounting system. Typically, it is a range of time periods during which accounting functions and financial statements are prepared for an organization. It is the period for which the most up-to-date revenue recognition is reported. RevRec uses the accounting period to categorize what transactional data belongs to which period.

Accounting periods are usually determined by calendar periods. With RevRec, you can adjust the accounting periods to match your fiscal year if it does not end in December. For example, if your fiscal year starts in July, the accounting period for July 2023 would be 2024-01 instead of 2023-07.

Please contact RevRec support to enable fiscal year functionality on your tenant.

Managing your Accounting Period

Follow these steps to set the Accounting Period on your RevRec site:

- Log in to your RevRec site and switch to the right environment.

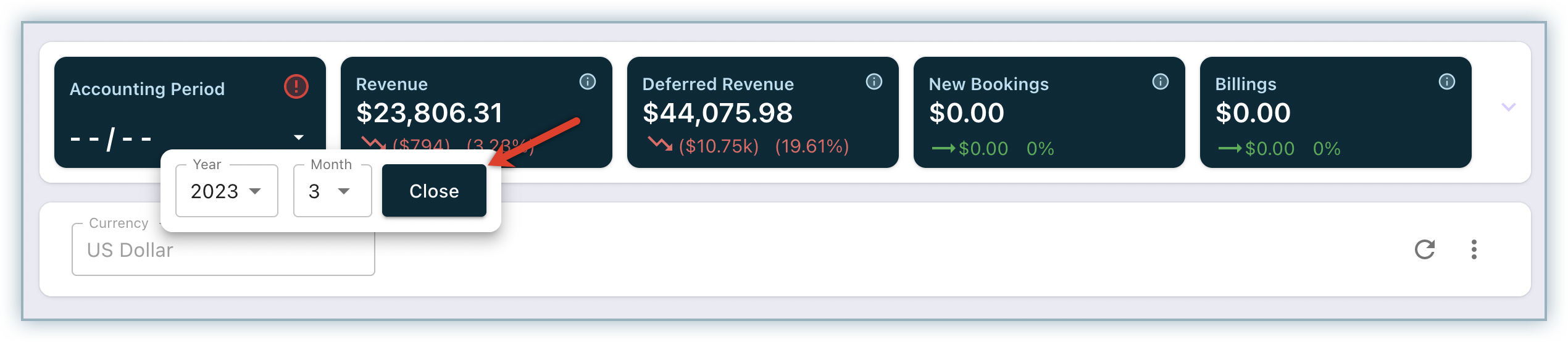

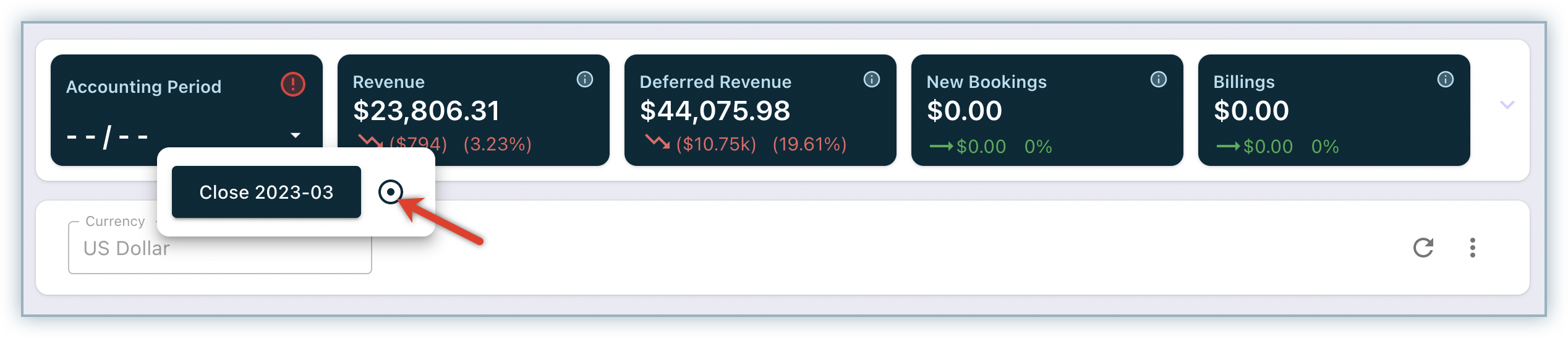

- On the Home page, the Accounting Period is visible in the top toolbar.

- Click the Accounting Period drop-down and click the more icon to set the period.

- Set the Year and Month fields using the respective drop-downs as required.

Once you click Close, the selected period gets marked as "closed" and the revenue for that period is closed or locked. You cannot change the revenue recognition or accounting numbers for that period in RevRec.

When you make any modifications to sales orders from prior periods that are closed, the net effect or impact of your modifications gets recognized in the current open period.

Auto-Accounting Close

RevRec allows you to configure an automatic closure of the accounting period. You can schedule a date on which you want to close the accounting period, and RevRec performs the accounting period close automatically as per schedule.

Follow these steps to enable the auto-accounting close on your RevRec site:

-

Log in to your RevRec site and switch to the right environment.

-

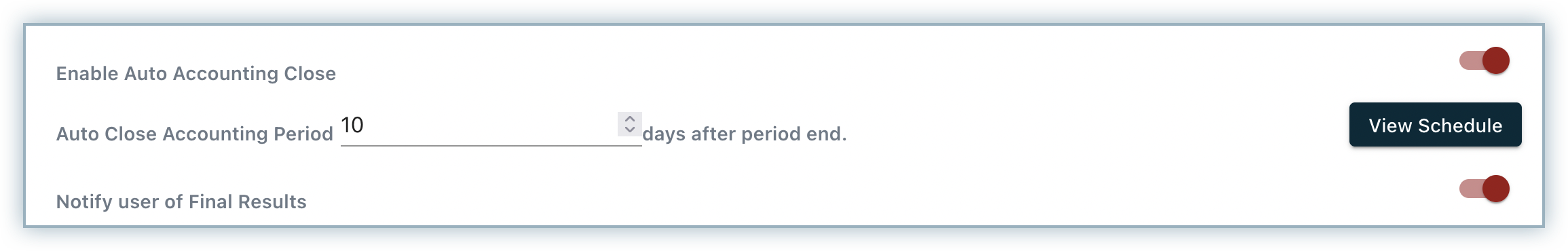

Click Settings > Configure RevRec > Configure Accounting Close.

-

Turn the toggle on to enable auto accounting close.

-

Specify the number of calendar days after which you want the accounting period closed after the period ends.

-

Turn the toggle on to share the final results with users.

Running Preliminary Results

RevRec allows you to configure and run preliminary results automatically to review the monthly results as soon as the last day in the accounting period has passed. The sooner the results are available to review, the more timely and thorough your analysis of results can be.

Follow these steps to configure this setting on your RevRec site:

- Log in to your RevRec site and switch to the right environment.

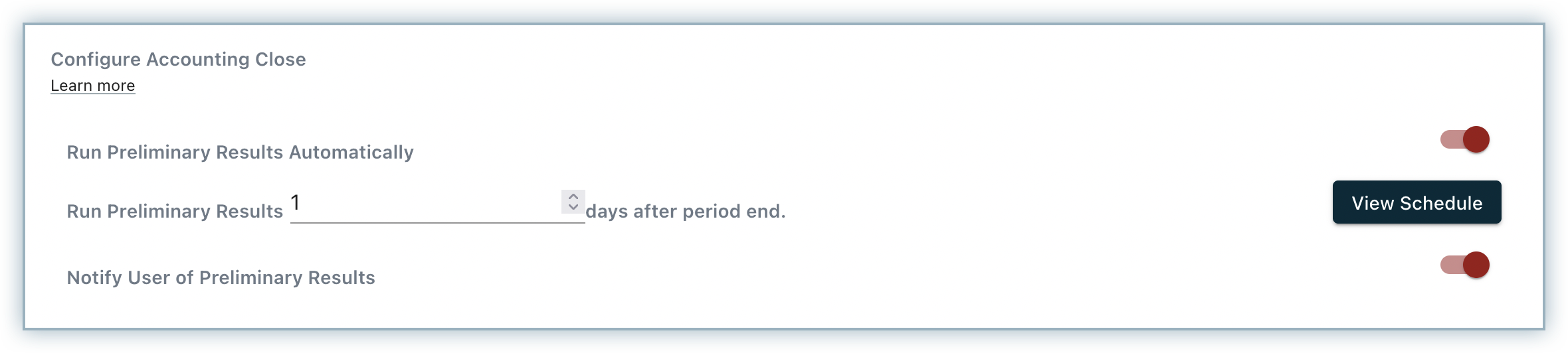

- Click Settings > Configure RevRec > Configure Accounting Close.

- Turn the toggle on to run preliminary results automatically.

- Specify the number of days after the last day of the accounting period to run the preliminary results.

- Turn the toggle on, if you'd like to receive a notification. An email with the summary results and a link to see the results is sent to you.

Note:

While setting the date to run preliminary results, consider any time lag expected for data updates. For example, if it's likely to take up to three days after the last day of accounting period, for new sales orders to reflect in the source system, you can choose to run the preliminary results on the fourth day so that RevRec captures the complete information.

Re-opening Accounting Period

Re-opening a closed accounting period allows you to re-generate the accounting journal entries and adjust the results for the respective period.

Note:

If you want to re-open a closed accounting period to reset your historic accounting results, we strongly suggest that you consult with your accounting policy to ensure the circumstance warrants to re-open a closed period.

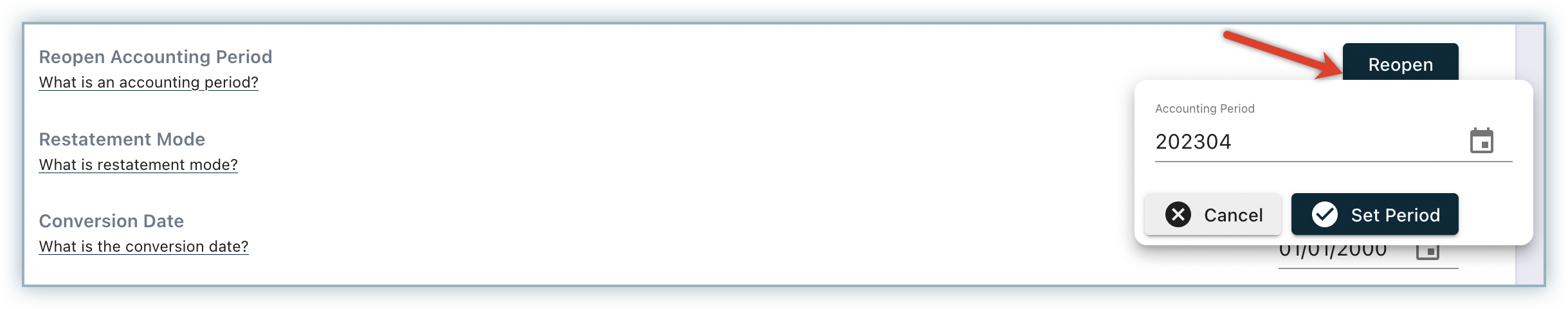

To re-open a closed accounting period in RevRec, follow these steps:

-

Click Settings > Configure RevRec.

-

Under Reopen Accounting Period, click Reopen.

-

Select the month after which you want to reopen and click Set Period.

RevRec will display a warning pop-up to notify you that you will have to manually remove the RevRec journal entries posted for the re-opened periods from your accounting system.

-

On the warning pop-up, click Continue > OK.

Your accounting period is successfully reopened and the close period is reset accordingly. You can re-generate the journal entries as required, and close the accounting period to repost the results to your accounting system.

Restatement Mode

A Restatement mode is where all accounting periods are open, so the revenue recognition is based on the effective date of a transaction. It is the default mode when you first import historic data into RevRec as per your conversion settings. Your RevRec site is in restatement mode until the first accounting period is set.

You can set the site to restatement mode on demand, at any time, to re-process your data and do over the journal postings to your accounting general ledger system. RevRec reopens all closed accounting periods and you will have to manually remove the RevRec journal entries posted for the re-opened periods from your accounting system.

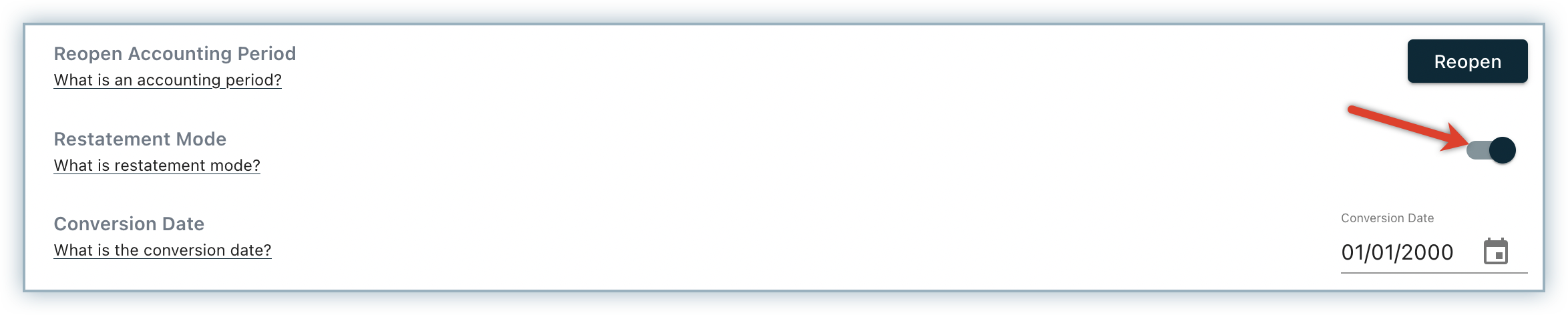

To set your site to restatement mode, follow these steps:

-

Click Settings > Configure RevRec.

-

Turn the toggle on for Restatement mode.

-

A warning popup is displayed to inform you that all prior RevRec postings in your external accounting system will become invalid. Click Continue.

All accounting periods are open.

Effects of Closing

When you close an accounting period, you might want to post your journal entries to your accounting general ledger system at the same time. If you have integrated with an accounting system, RevRec automatically posts your journal entries for you, after you close the period.

If not, you can use the journal entry reports to manually record ledger transactions at any level as required.

What is a Reporting Period?

The reporting period is a concept that helps control the amount of historical data that is displayed within RevRec's MicroStrategy-based reports. It is the historical period for which the RevRec reports display data from the current closed period.

Managing your Reporting Period

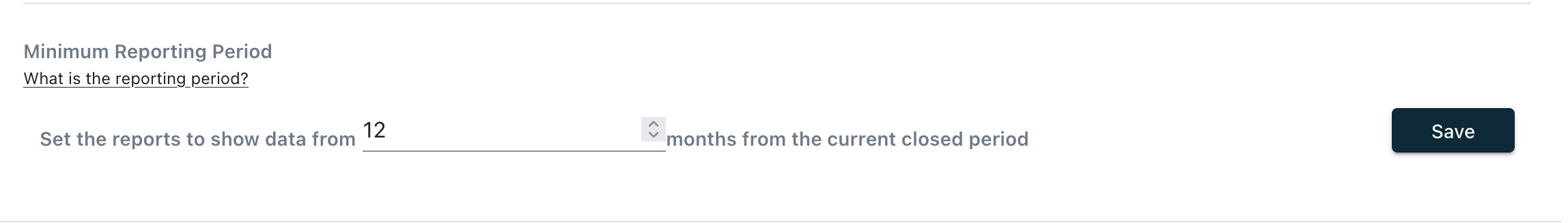

Follow these steps to set the reporting period on your RevRec site:

-

Log in to your RevRec site and switch to the right environment

-

Click Settings > Configure RevRec > Minimum Reporting Period.

-

Select the number of months for which you want the reports to display data from the current close period. This setting defaults to 12 months, you can increase or decrease this based on your requirement.

-

Click Save.

Note that this only affects how far in the past you can see plan data on the reporting and in no way affects any of the internally computed schedules in RevRec.

Was this article helpful?