RevRec Premium Standard Reports

Introduction

RevRec Premium offers a comprehensive suite of standard reports designed to give you visibility into key financial areas such as revenue, receivables, cash, tax, and the general ledger. These reports are organized by category to help you efficiently monitor, reconcile, and analyze financial performance.

The following table lists all standard reports under their respective categories:

| Category | Report Name |

|---|---|

| Accounting Entries |

|

| Accounts Receivable (A/R) |

|

| Payment |

|

| Sales Tax |

|

| Control Reports |

|

| Exported Data |

|

| Security and Audit |

|

| Forex |

|

Favorite Reports

The Favorites folder contains your favorite reports for convenient access to the reports you use most. You can mark a report as a favorite by clicking the star icon next to any report name.

Accounting Entries

These reports provide ledger-level postings and balances to support period close, reconciliation, and audit traceability.

Account Activity Summary by Period

Summarizes journaled debits and credits by account for selected periods, helping validate posting balances and control totals. This report is essential for period-end checks.

Detailed Journal Entries

Provides a line-item listing of postings by GL account and currency, with transaction period filters. Includes drill-through to originating transactions (invoices, credit notes, payments, revenue recognition) for reconciliation and audit.

Accounts Receivable (A/R)

These reports show customer receivable status and movements to support collections and reconciliation.

A/R Aging Summary

Displays outstanding receivables by transaction currency in standard aging buckets (typically 0–30, 31–60, 61–90, 90+ days). Users can drill into each bucket to view related invoices. This report supports collections prioritization and period-end reconciliation.

Reconciliation with Monthly AR Rollforward

The Total Outstanding Balance shown on the AR Aging Summary Report may not, on its own, tie directly to your monthly AR roll-forward balance. To reconcile, you need to include Refundable Credits and Unapplied Payments.

Step 1: Add Columns

Use the column chooser to add the following to your aging report:

- Refundable Credits

- Unapplied Payments

Step 2: Apply the Formula

[Net Outstanding Balance] = [Total Outstanding Balance] + [Unapplied Payments] + [Refundable Credits]

Step 3: Verify Reconciliation

The resulting Net Outstanding Balance should align with your Monthly AR Roll-Forwards or General Ledger Ending AR Balance.

Example

- Total Outstanding Balance = $100,000

- Unapplied Payments = $5,000

- Refundable Credits = $2,000

- Net Outstanding Balance = 100,000 + 5,000 + 2,000 = $107,000.

This $107,000 should reconcile with your monthly AR roll-forward balance.

Reconciliation with RevenueStory AR Balance

When reconciling the Outstanding Balance from the AR Aging Report in RevRec Premium with the AR balance in Chargebee RevenueStory, you may notice differences. The following section explains why those differences occur and how to configure RevRec Premium to align with RevenueStory.

Why Differences Occur

The difference arises from how payments are tracked:

- RevenueStory: Uses the Payment Date to determine when an invoice is considered paid.

- RevRec Premium: Uses the Applied Date (the date a payment is applied to an invoice).

Because these systems rely on different dates, discrepancies can appear in the AR Aging and Outstanding Balance for historical periods.

Solution: Configure RevRec Premium

To resolve these differences, you can configure RevRec Premium to use the Payment Date instead of the Applied Date for AR aging calculations.

Step 1: Update Reporting Settings

- Log in to your RevRec Premium environment.

- Navigate to Settings > Accounting > Site Settings.

- In the Reporting section, enable the toggle Use Payment Date for AR Aging Calculation.

- Click Save.

Once this setting is enabled, the AR Aging Report in RevRec Premium will use the payment date for balance calculations.

Step 2: Ensure Correct Payment Date Handling

By default, in RevRec Premium, “payment date” refers to the payment settlement date. If you want the system to use the actual payment date (not settlement date):

- Navigate back to the Site Settings.

- In the General section, disable the configuration Use Payment Settlement Date as Transaction Date.

This ensures that AR Aging will rely only on the payment date to determine when an invoice was open, paid, or outstanding.

Step 3: Validate Migration Settings

If you have migrated data into RevRec Premium:

- Ensure that no conversion date discards invoices or payments.

- If invoices or payments are excluded due to conversion date filters, the AR Aging report may not correctly reflect whether an invoice was paid in the correct period.

Outcome

After applying these configurations:

The Outstanding Balance in the RevRec Premium AR Aging Report will be based on the Payment Date, aligning with the RevenueStory AR balance in Chargebee.

This makes reconciliation straightforward and consistent across both systems.

Key Notes

- Always check both the Reporting and General site settings to ensure correct date handling.

- Avoid applying conversion date filters during migration if reconciliation accuracy is required.

- Once configured, both systems will produce comparable balances for AR reconciliation.

With these steps, you can confidently reconcile AR Aging in RevRec Premium with RevenueStory balances in Chargebee.

Troubleshooting Discrepancies

Even after applying the recommended settings, you may still encounter discrepancies. When this happens, you can use the VUD export of the reports to isolate and resolve issues.

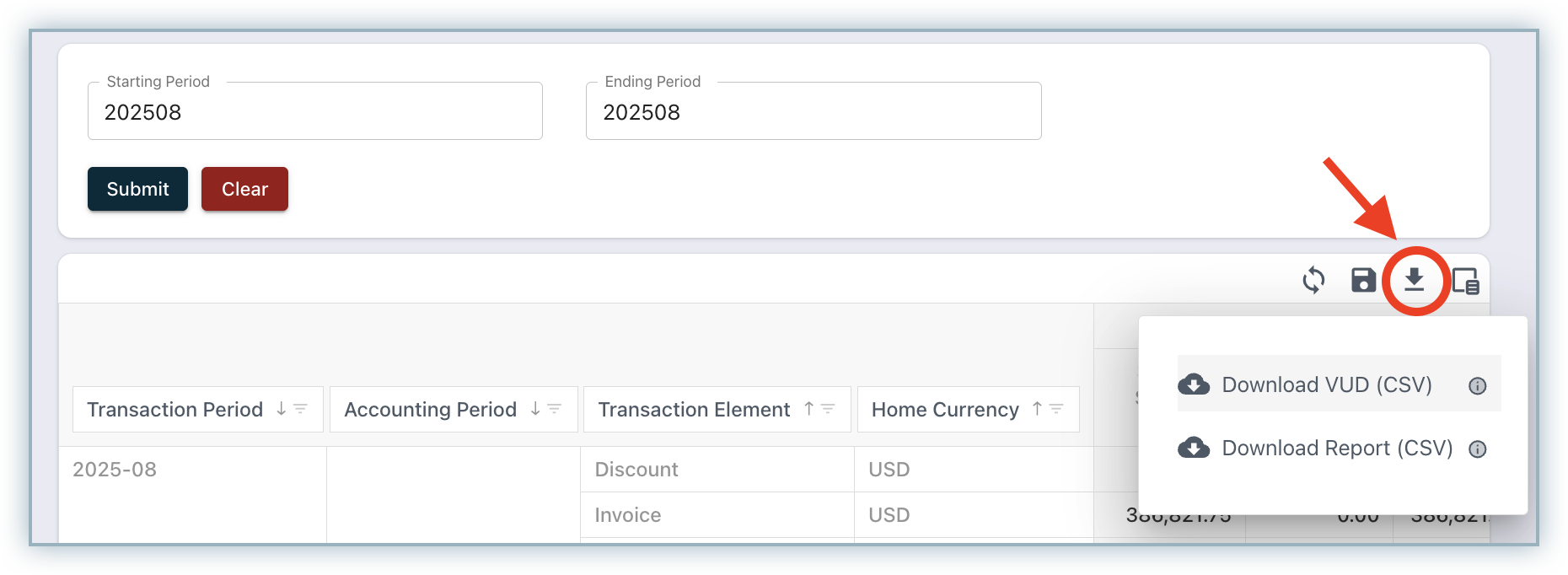

Step 1: Download the VUD Versions

-

Export the VUD version of both reports:

- RevRec Premium AR Aging / Roll-Forward Report

- RevenueStory AR Report

-

Save both reports in a comparable format (e.g., Excel or CSV).

Step 2: Reconcile at Customer Level

- Compare balances customer by customer across both reports.

- Identify which customers show differences in their outstanding balance.

Step 3: Investigate the Differences

For customers with mismatches, check for:

- Missing Invoices: Verify if an invoice exists in one system but not in the other.

- Unapplied or Missing Payments: Confirm whether payments are applied correctly in Billing and RevRec Premium.

- Data Capture Issues: Look for payments or invoices that were not imported, or that errored out during sync.

Step 4: Resolve or Escalate

- Correct any identified issues (e.g., reapply payments, re-import invoices).

- If the discrepancy persists or the cause is unclear, contact the LabRack Support Team for assistance. They can review the underlying data and help resolve reconciliation errors.

Scope of Reconciliation

It’s important to note that:

-

All of the above steps apply only when reconciling:

- Aging Report to Monthly AR Roll-Forward in RevRec Premium, OR

- Aging Report in RevRec Premium to RevenueStory AR Roll-Forward.

-

Not Supported: Reconciling the Monthly AR Roll-Forward in RevRec Premium with the Chargebee RevenueStory AR Balance.

Reason for differences

-

In Chargebee Billing (RevenueStory):

- There is no concept of accounting periods.

- AR balances exclude unapplied payments and other accounting adjustments.

-

In RevRec Premium:

- Monthly AR Roll-Forwards are built on accounting principles (including unapplied payments and refundable credits).

Because these are based on different methodologies, it is not possible to reconcile the Monthly AR Roll-Forward in Premium with the AR Balance in Chargebee RevenueStory.

Best Practices

- Always start reconciliation at the summary level, then drill down to customer-level detail.

- Keep a record of any recurring mismatches — they may point to system configuration issues.

- Use the VUD export regularly as part of your month-end reconciliation checklist.

Using the VUD version of the reports gives you full visibility and makes it easier to isolate discrepancies down to specific customers, invoices, or payments.

Monthly A/R Rollforward

Summarizes the movement in accounts receivable by accounting period, reconciling the beginning and ending balances through billings, collections, credits/adjustments (and FX where applicable). Supports drill-down to customer-level detail to analyze drivers and validate reconciliations.

This report is an essential tool for finance teams to validate balances, track cash flow, and analyze customer payment behavior. It also supports drill-down to customer-level details, enabling root-cause analysis of variances and smoother reconciliations.

Layout & Column

| Column | Definition / What it shows |

|---|---|

| Accounting Period | The reporting month (or cycle) in which transactions are posted. |

| Home Currency | Reporting currency of the company. |

| Beginning A/R Balance | The receivables are carried forward from the prior period. |

| Billings | Total invoices issued during the accounting period. |

| Collections (Net) | Cash received and refunds issued were applied against outstanding receivables. |

| Unapplied Payments | Customer payments have not yet been matched to invoices. |

| FX Gain/Loss (if applicable) | Currency revaluation adjustments impacting receivable balances. |

| Credit Notes | Adjustments reducing A/R due to cancellations, disputes, or other credits issued. |

| Ending A/R Balance | The reconciled receivable balance at the end of the period. |

Optional / drill-down columns

| Column | Definition |

|---|---|

| Customer ID | Shows the customer ID associated with the invoice or line item. |

| Customer Name | Shows the customer name associated with the invoice or line item. |

Exports

- Standard Export - current layout (what you see on screen).

- VUD Export - detailed, customer-level dataset for deep investigation.

Payments

Reports cash collection activity and trends, including net collections and gateway-level breakdowns, to monitor inflows and payment operations.

Net Payments

Shows the trend of net cash collected over a selected time range (collections minus refunds/chargebacks), with an optional comparison to gross payments. Useful for monitoring cash inflows, spotting anomalies, and assessing collection performance; supports drill-down to underlying payment and refund transactions where available.

Optional / drill-down columns (add via Column Chooser)

| Column | Definition |

|---|---|

| Accounting Period | This is the period in which the payment is booked. |

| Transaction Period | This is the period in which the payment occurs; it is driven by the payment date or payment settlement date. |

| Payment ID | ID of the Payment. |

| Business Event Group | This is the category of the transaction in the system. |

| Business Event | Elements of the payment, i.e., Payment, Payment Reversal, Refund Authorization, and more. |

| Creation Date | Shows when the payment is created in the source system. |

| Transaction Date | Shows when the payment is made or when the gateway receives money. |

| Record Date | Shows the date on which the payment is recorded in the system. |

| Event Status | Shows the status of the payment. E.g., Success or Failure. |

| Event Type | Shows the payment type for a similar business event. E.g., Payment, Refund, Overpayment, or Authorization. |

| Gateway | Gateway through which this transaction was done. Applicable only for ‘Card’ Payment Method. |

| Gateway Transaction ID | The ID with which this transaction is referred in the gateway. |

| Gateway Account ID | The gateway account used for this transaction. |

| Payment Method | The medium used to make the transaction. E.g., Bank Transfer, Card, PayPal Express Checkout, and more. |

| Reference Invoice ID | The ID of the instrument against which this payment is made. E.g., Invoice, Credit Note, or Payment (Chargebacks). |

| Customer ID | Shows the customer ID associated with the payment or line item. |

| Customer Name | Shows the customer name associated with the payment or line item. |

| Transaction Currency | Shows the currency of the transaction. |

| Transaction Amount | Shows the payment amount in the transaction currency. |

| Home Currency | Reporting currency of the company. |

| Home Amount | Shows the payment amount in the home currency. |

Payments by Gateway

Breaks down collections by payment gateway/provider (e.g., Stripe, Chargebee Payments) over the selected period, showing transaction counts, gross amounts, refunds/chargebacks, and net payments. Useful for comparing gateway performance and optimizing routing; supports drill-down to underlying payment records where available.

The optional / Drill-down column available for this report is the same as the net payment report.

Sales Tax

Details the calculation and period rollforward of sales-tax liabilities to support compliance, reconciliation, and statutory reporting.

Sales Tax Rollforward

Reconciles beginning to ending sales-tax payable by accounting period, detailing increases from tax assessed on billings and decreases from credit-note reversals. Enables jurisdiction-level analysis and drill-through to invoices and credits, supporting compliance and the period-end close.

Optional / drill-down columns (add via Column Chooser)

| Column | Definition |

|---|---|

| Event ID | Unique identifier of the invoice or credit note against which tax is calculated and reported. |

| Event Line Item ID | An identifier for each line item on the invoice or credit note, allowing tax to be tracked at the line-item level. |

| Business Event Group | This is the category of the transaction in the system. Either Invoice or Credit Note. |

| Invoice/Credit Note Date | The official issue date of the invoice or credit note determines the tax period in which the transaction is reported. |

| Home Currency | The reporting currency of the company. |

| Amount (Home Currency) | Shows the tax amount in the home currency. |

| Exchange Rate | The rate applied to convert the transaction currency into the home currency. |

| Transaction Currency | The currency in which the invoice or credit note was issued. |

| Amount (Transaction Currency) | The tax amount in the transaction’s original currency. |

| Invoice/Credit Status | The current status of the invoice or credit note (e.g., Posted, Paid, Voided) determines whether the tax amount is active, adjusted, or reversed in reporting. |

| Subscription ID | An identifier linking the taxable event to the underlying subscription. |

| Product ID | Identifier of the product or service line, used to determine applicable tax treatment and rates. |

| CN Reason Code | The reason for issuing a credit note to clarify whether tax is reversed due to cancellation, refund, or adjustment. |

Control Reports

The Control Reports help you validate that billing activity in your source system matches accounting/posting activity in RevRec Premium. Each transaction report is available in two versions:

- Home Currency - amounts in your tenant’s base currency.

- Transaction Currency - amounts in the instrument’s currency (e.g., the invoice, credit note, or payment currency), useful for isolating FX effects.

All three reports share the following user controls:

- Period From / Period To (YYYYMM) - runs the reconciliation for a specific transaction-period range.

- Drill-through (default layout) - click any value in the default grid to open the underlying transaction-level records for investigation.

- Column Chooser - add/remove fields (including drill fields) to tailor the layout.

- Export - Standard (current layout) and VUD (Very Detailed, transaction-level) exports.

Key Calculations (Common Across Reports)

- Difference = Source System Amount − RevRec Premium Amount

- Remaining Difference = Difference − adjustments for Voided/Deleted/Settled/Skipped items (as applicable to the report)

Scope & Assumptions (Common)

- Timing cutoffs follow the Transaction Period logic; mismatches can occur if your revenue/billing timezone differs from the RevRec Premium configuration.

- Reversals occurring within the same period are netted (no separate “difference” presented for the reversal).

Invoice Reconciliation

Compares invoicing activity (including credits applied to invoices) with posted amounts to ensure every billed amount landed in the ledger as expected.

Layout & Column

| Column | Definition / What it shows | Example / Notes |

|---|---|---|

| Accounting Period | Posting period for the accounting entry. | 2025-01 |

| Transaction Period | Period derived from the invoice date. | 2025-01 |

| Transaction Element | Component of the invoice being reconciled. | Base Invoice, Discount, Tax |

| Home Currency | Reporting currency of the company. Available only in the home currency version of the report. | USD |

| Transaction Currency | Currency of the invoice. Available only in the transaction currency version of the report. | EUR |

| Source System | Amount from the billing/source system for the element/period. | Positive for charges/tax; negative for discounts. |

| RevRec Premium | Amount posted by RevRec Premium for the same element/period. | Mirrors posting to the subledger/GL mapping. |

| Differences | Variance between Source System and RevRec Premium. | Formula: Source System − RevRec Premium. |

| Voided Transactions | Offsets for items voided within scope. | Amount in the home currency. |

| Deleted Transactions | Offsets for items deleted within scope. | Amount in the home currency. Invoices deleted before migration/conversion do not appear here. |

| Pre-Conversion Transactions | Offsets for legacy/migrated items are not expected to post in RevRec Premium. | Amount in the home currency. |

| Remaining Difference | Residual variance after applying offsets. | Formula: Differences + Voided + Deleted + Pre-Conversion. Zero indicates reconciled. |

Totals row: Use the bottom “Total” line to confirm that offsets fully explain differences (e.g., Differences = (300), Offsets = +300 → Remaining Difference = 0).

Optional / drill-down columns

| Column | Definition |

|---|---|

| Invoice ID | ID of the invoice. |

| Line Item ID | Line item ID of the invoice. |

| Transaction Date | Shows the business date of the invoice. |

| Creation Date | Shows when the invoice record was created in the billing system. |

| Invoice Status | Shows the invoice status when the invoice is initially processed or later voided/deleted in the billing application. |

| Customer ID | Shows the customer ID associated with the invoice or line item. |

| Customer Name | Shows the customer name associated with the invoice or line item. |

| Subscription ID | Shows the ID of the subscription associated with the invoice or line item. |

| Transaction Currency | Shows the instrument currency of the invoice. |

| Exchange Rate | Shows the rate used to translate to the home currency. |

| Home Currency | Reporting currency of the company. |

| Product ID | Shows the product ID associated with the invoice or line item. |

| Product Name | Shows the product name associated with the invoice or line item. |

| Local Currency Code | Shows the local currency where enabled for the transaction element “Tax”. |

| Local Exchange Rate | Shows the rate used for local currency translation for the transaction element “Tax”. |

| Local Currency Amount | Shows the translated amount in the local currency for the transaction element “Tax”. |

| Business Entity ID | Shows the business/legal entity ID associated with the invoice (if configured). |

| Business Entity Name | Shows the business/legal entity name associated with the invoice (if configured). |

Exports

-

Standard Export - current layout (what you see on screen).

-

VUD Export - detailed, transaction-level dataset for deep investigation.

In addition to the drill-down fields listed above, the VUD(Very Detailed) export includes the following additional columns.

| Column | Purpose |

|---|---|

| Is Deleted | Boolean (Yes/No). Indicates the invoice or line item was deleted in the billing application. |

| Is Skipped | Boolean (Yes/No). Indicates the invoice or line item was excluded from processing/posting by RevRec Premium because it was voided, deleted, or dated pre-conversion. |

| Price Type | Indicates the line’s tax treatment—Tax Exclusive (tax added on top of the price) or Tax Inclusive (tax included in the price). |

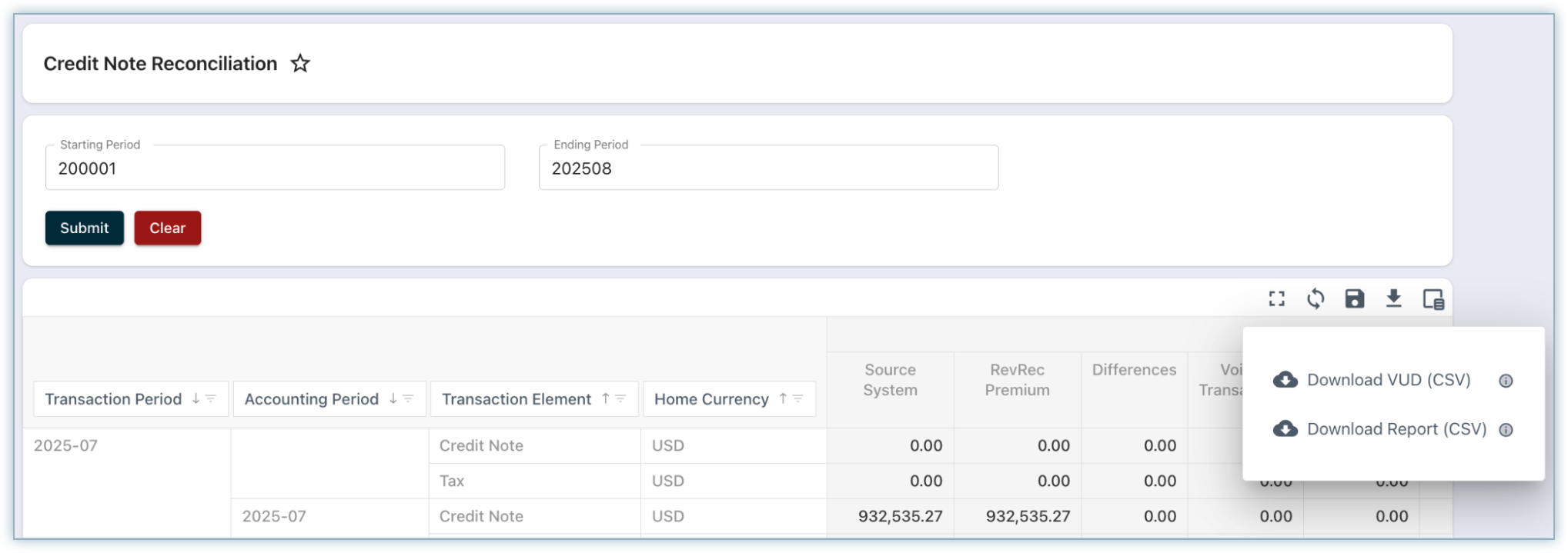

Credit Note Reconciliation

Ensures credit note activity (refunds/adjustments) in the source system aligns with postings in RevRec Premium, preventing understatement/overstatement of revenue and A/R.

Layout & Columns

| Column | Definition / What it shows | Example / Notes |

|---|---|---|

| Accounting Period | Posting period for the accounting entry. | 2025-01 |

| Transaction Period | Period derived from the credit note date. | 2025-01 |

| Transaction Element | Component of the credit note being reconciled. | Base Credit Note, Discount, Tax |

| Home Currency | Reporting currency of the company. Available only in the home currency version of the report. | USD |

| Transaction Currency | Currency of the credit note. Available only in the transaction currency version of the report. | EUR |

| Source System | Amount from the billing/source system for the element/period. | Positive for charges/tax; negative for discounts. |

| RevRec Premium | Amount posted by RevRec Premium for the same element/period. | Mirrors posting to the subledger/GL mapping. |

| Differences | Variance between Source System and RevRec Premium. | Formula: Source System − RevRec Premium. |

| Voided Transactions | Offsets for items voided within scope. | Amount in the home currency. |

| Deleted Transactions | Offsets for items deleted within scope. | Amount in the home currency. Credit Notes deleted before migration/conversion do not appear here. |

| Pre-Conversion Transactions | Offsets for legacy/migrated items that are not expected to post in RevRec Premium. | Amount in the home currency. |

| Remaining Difference | Residual variance after applying offsets. | Formula: Differences + Voided + Deleted + Pre-Conversion. Zero indicates reconciled. |

Totals row: Use the bottom “Total” line to confirm that offsets fully explain differences (e.g., Differences = (300), Offsets = +300 → Remaining Difference = 0).

Optional / drill-down columns (add via Column Chooser)

| Column | Definition |

|---|---|

| Credit Note ID | ID of the credit note. |

| Line Item ID | Line item ID of the credit note. |

| Transaction Date | Shows the business date of the credit note. |

| Creation Date | Shows when the credit note record was created in the billing system. |

| Credit Note Status | Shows the credit note status when the credit note is initially processed or later voided/deleted in the billing application. |

| Reason Code | Shows the reason for issuing this credit note. |

| Credit Note Type | The credit note type. Possible values are adjustment, refundable, etc. |

| Allocated On | Shows the Invoice ID the credit note is applied to. Blank if the credit is unapplied. |

| Reference Invoice ID | The ID of the invoice against which this Credit Note is issued. |

| Customer ID | Shows the customer ID associated with the credit note or line item. |

| Customer Name | Shows the customer name associated with the credit note or line item. |

| Subscription ID | Shows the ID of the subscription associated with the credit note or line item. |

| Transaction Currency | Shows the instrument currency of the credit note. |

| Exchange Rate | Shows the rate used to translate to the home currency. |

| Home Currency | Reporting currency of the company. |

| Product ID | Shows the product ID associated with the credit note or line item. |

| Product Name | Shows the product name associated with the credit note or line item. |

| Local Currency Code | Shows the local currency where enabled for the transaction element “Tax”. |

| Local Exchange Rate | Shows the rate used for local currency translation for the transaction element “Tax”. |

| Local Currency Amount | Shows the translated amount in the local currency for the transaction element “Tax”. |

| Business Entity ID | Shows the business/legal entity ID associated with the credit note (if configured). |

| Business Entity Name | Shows the business/legal entity name associated with the credit note (if configured). |

Exports

-

Standard Export - current layout (what you see on screen).

-

VUD Export - detailed, transaction-level dataset for deep investigation.

In addition to the drill-down fields listed above, the VUD (Very Detailed) export includes the following additional columns.

| Column | Purpose |

|---|---|

| Is Deleted | Boolean (Yes/No). Indicates the credit note or line item was deleted in the billing application. |

| Is Skipped | Boolean (Yes/No). Indicates the credit note or line item was excluded from processing/posting by RevRec Premium because it was voided, deleted, or dated pre-conversion. |

| Price Type | Indicates the line’s tax treatment — Tax Exclusive (tax added on top of the price) or Tax Inclusive (tax included in the price). |

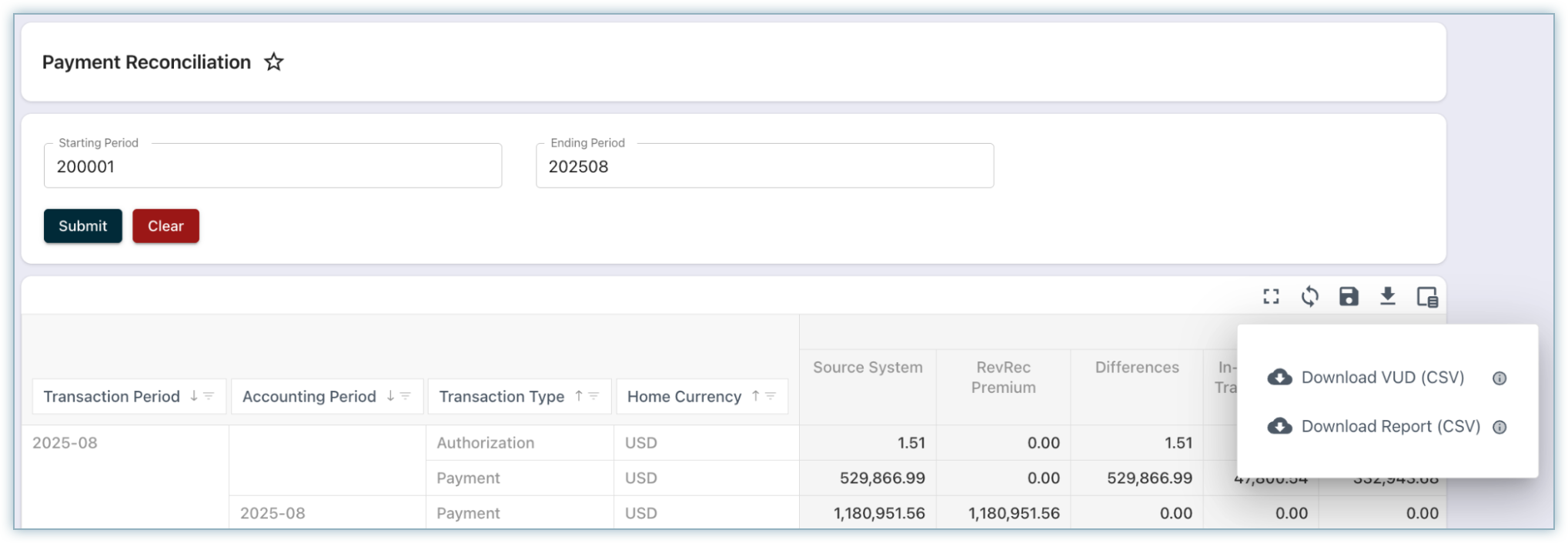

Payment Reconciliation

Compares payments, refunds, and unapplied payment amounts to the journaled cash/cash-clearing activity to confirm all collections were posted.

Layout & Columns

| Column | Definition / What it shows | Example / Notes |

|---|---|---|

| Transaction Period | Period derived from the payment/refund date. | 2025-08 |

| Accounting Period | Posting period for the accounting entry in RevRec Premium. | 2025-08 |

| Transaction Type | Payment event category. | Examples: Payment, Refund, Authorization, Unapplied Payment, Payment Reversal. |

| Home Currency | Tenant/reporting currency for the row’s amounts. | Shown only in the Home Currency version of the report (e.g., USD). |

| Source System | Amount from the billing/payment source for the event and period. | Positive for payments/authorizations/unapplied; negative for refunds/reversals. |

| RevRec Premium | Amount posted by RevRec Premium to cash/cash-clearing (or reversals). | Mirrors the accounting postings for the same event/period. |

| Differences | Variance between Source System and RevRec Premium. | Formula: Source System − RevRec Premium. |

| In-Progress Transactions | Amounts are still processing at the gateway/source and have not yet been posted. | Common for recent authorizations/captures. Explains temporary differences. |

| Error Out Transactions | Amounts that failed to process/post due to errors (e.g., gateway or validation issues). | Use to identify items needing remediation; explains differences until resolved. |

| Pre-Conversion Transactions | Legacy items dated before the migration/conversion cut-over that are not expected to post. | Offset used to explain historical activity excluded from posting. |

| Deleted Transactions | Offsets for deleted/canceled payments/refunds within scope. | Presented as signed amounts. |

| Remaining Difference | Residual variance after applying offsets. | Formula: Differences − In-Progress − Error Out − Pre-Conversion − Deleted. Zero indicates reconciled. |

Totals row: Use the bottom “Total” line to confirm that offsets fully explain differences (e.g., Differences = (300), Offsets = +300 → Remaining Difference = 0).

Optional / drill-down columns (add via Column Chooser)

| Column | Definition |

|---|---|

| Transaction ID | ID of the Payment. |

| Transaction Type | Type of the transaction, i.e., Payment, Payment Reversal, Refund Authorization, and more. |

| Transaction Date | Shows the business date of the payment. |

| Payment Settlement Date | Shows when the payment is settled or the gateway receives money. |

| Applied Date | Shows the date on which the payment is applied to the invoice or credit note. |

| Payment Status | Shows the status when the payment is initially processed or later voided/deleted in the billing application. |

| Gateway | Gateway through which this transaction was done. Applicable only for 'Card' Payment Method. |

| Gateway Transaction ID | The ID with which this transaction is referred in the gateway. |

| Gateway Account ID | The gateway account used for this transaction. |

| Transaction Method | The medium used to make the transaction. E.g., Bank Transfer, Card, PayPal Express Checkout, and more. |

| Reference Transaction ID | The ID of the instrument against which this payment is made. E.g., Invoice, Credit Note, or Payment (Chargebacks). |

| Customer ID | Shows the customer ID associated with the payment or line item. |

| Customer Name | Shows the customer name associated with the payment or line item. |

| Transaction Currency | Shows the currency of the transaction. |

| Exchange Rate | Shows the rate used to translate to the home currency. |

| Home Currency | Reporting currency of the company. |

| Business Entity ID | Shows the business/legal entity ID associated with the transaction (if configured). |

| Business Entity Name | Shows the business/legal entity name associated with the transaction (if configured). |

Exports

-

Standard Export - current layout (what you see on screen).

-

VUD Export - detailed, transaction-level dataset for deep investigation.

In addition to the drill-down fields listed above, the VUD (Very Detailed) export includes the following additional columns.

| Column | Purpose |

|---|---|

| Is Deleted | Boolean (Yes/No). Indicates the payment or line item was deleted in the billing application. |

| Is Skipped | Boolean (Yes/No). Indicates the payment or line item was excluded from processing/posting by RevRec Premium because it was voided, deleted, or dated pre-conversion. |

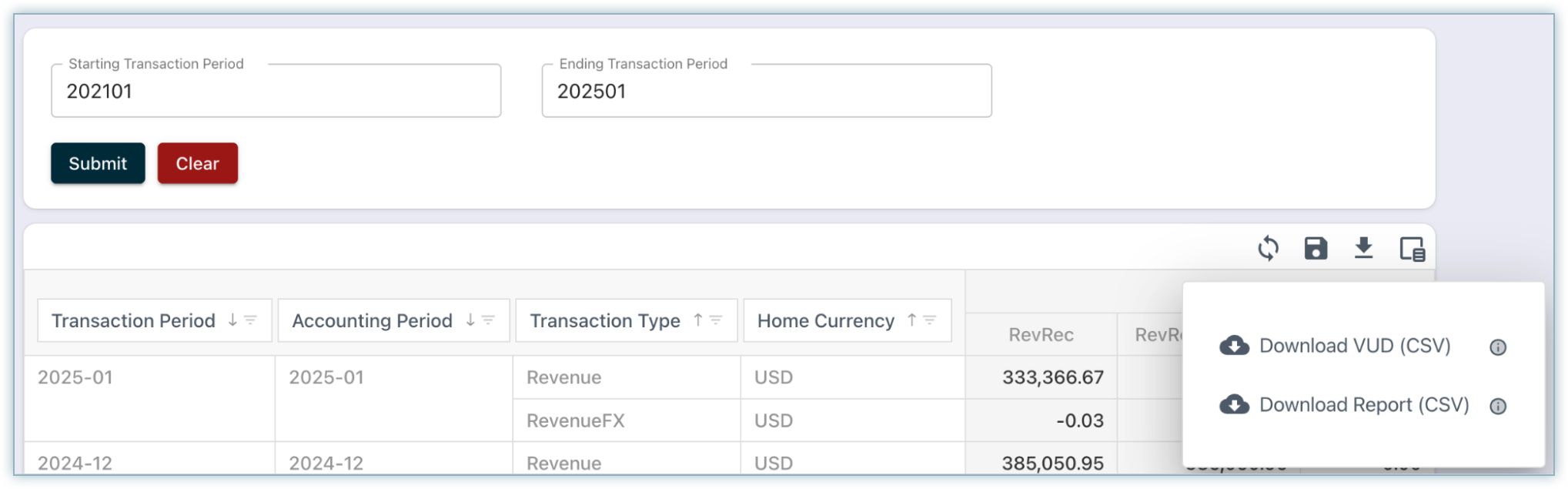

Revenue Reconciliation

Compare recognized revenue in RevRec with recognized revenue in RevRec Premium. It helps validate that both systems are aligned and highlights any variances that may need review.

Layout & Columns

| Column | Definition / What it shows | Example / Notes |

|---|---|---|

| Transaction Period | Period in which revenue is recognized for the related invoice or credit note in RevRec. | 2025-08 |

| Accounting Period | Posting period for the accounting entry in RevRec Premium. | 2025-08 |

| Transaction Type | Revenue event category. | Examples: Revenue or RevenueFX (Gain/Loss) |

| Home Currency | Tenant/reporting currency for the row’s amounts. | Shown only in the Home Currency version of the report (e.g., USD). |

| RevRec | Amount from the RevRec for the event and period. | Positive for Revenue and RevenueFX (Gain); negative for RevenueFX (Loss)/Reversals. |

| RevRec Premium | Amount posted by RevRec Premium to Revenue/Revenue FX (Gain/Loss) or reversals. | Mirrors the accounting postings for the same event/period. |

| Differences | Variance between RevRec and RevRec Premium. | Formula: RevRec − RevRec Premium. |

Optional / drill-down columns (add via Column Chooser)

| Column | Definition |

|---|---|

| Transaction ID | ID of the Sales Order against which the revenue is recognized. |

| Transaction Line Item ID | Line Item ID of the Sales Order against which the revenue is recognized. |

| Transaction Status | Indicates whether the revenue was posted to RevRec Premium during the period close or posted later due to the period being reopened. |

| Transaction Type | Type of the transaction, i.e., Revenue, RevenueFX. |

| Transaction Currency | Shows the currency of the transaction. |

| Exchange Rate | Shows the rate used to translate to the home currency. |

| Home Currency | Reporting currency of the company. |

| Customer ID | Shows the customer ID associated with the sales order or line item. |

| Customer Name | Shows the customer name associated with the sales order or line item. |

| Subscription ID | Shows the subscription ID associated with the sales order or line item. |

| Product ID | Shows the product ID associated with the sales order or line item. |

| Product Name | Shows the product name associated with the sales order or line item. |

| Reference Invoice ID | The ID of the instrument against which this sales order is made. E.g., Invoice, Credit Note. |

| Business Entity ID | Shows the business/legal entity ID associated with the transaction (if configured). |

| Business Entity Name | Shows the business/legal entity name associated with the transaction (if configured). |

Exports

-

Standard Export - current layout (what you see on screen).

-

VUD Export - detailed, transaction-level dataset for deep investigation.

Deferred Revenue Balance Reconciliation

Compare the deferred revenue balances between RevRec and RevRec Premium. This comparison validates system alignment and highlights any variances that require review.

Note:

This report relies on the period close process being completed in RevRec. During close, RevRec finalizes its deferred revenue balance. If the period has not been closed, the report may display differences because the RevRec balance is not yet finalized for reconciliation.

Layout & Columns

| Column | Definition / What it shows | Example / Notes |

|---|---|---|

| Accounting Period | Posting period for the accounting entry in RevRec Premium. | 2025-08 |

| Home Currency | Tenant/reporting currency for the row’s amounts. | Shown only in the Home Currency version of the report (e.g., USD). |

| RevRec | Balance from RevRec for the period. | Positive for Deferred Revenue; negative for Unbilled AR. |

| RevRec Premium | Balance from RevRec Premium for the period. | Mirrors the deferred revenue balance for the period. |

| Differences | Variance between RevRec and RevRec Premium. | Formula: RevRec − RevRec Premium. |

Optional / drill-down columns (add via Column Chooser)

| Column | Definition |

|---|---|

| Customer ID | Shows the customer ID associated with the sales order or line item. |

| Customer Name | Shows the customer name associated with the sales order or line item. |

| Business Entity ID | Shows the business/legal entity ID associated with the transaction (if configured). |

| Business Entity Name | Shows the business/legal entity name associated with the transaction (if configured). |

Exports

- Standard Export - current layout (what you see on screen).

- VUD Export - detailed, transaction-level dataset for deep investigation.

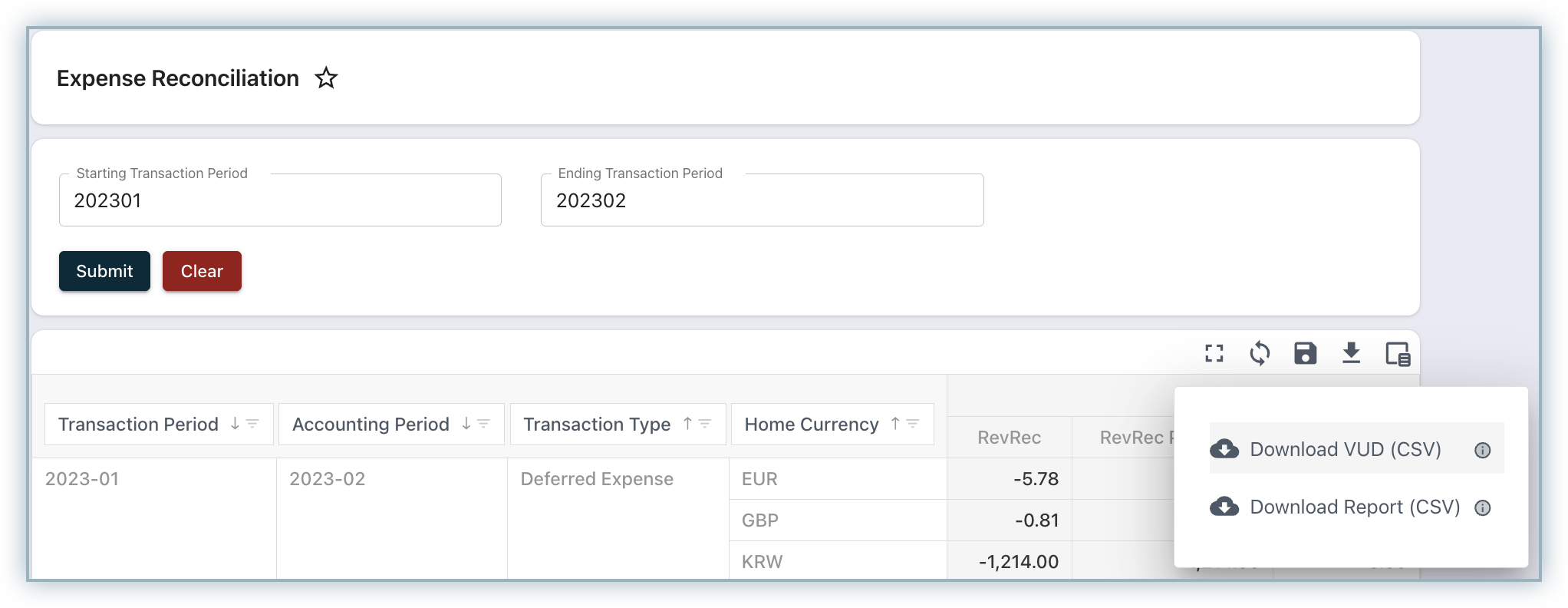

Expense Reconciliation

Compare the recognized expense in RevRec with the recognized expense in RevRec Premium. It helps validate that both systems are aligned and highlights any variances that may need review.

Layout & Columns

| Column | Definition / What it shows | Example / Notes |

|---|---|---|

| Transaction Period | Period in which the expense is recognized for the related invoice or credit note in RevRec. | 2025-08 |

| Accounting Period | Posting period for the accounting entry in RevRec Premium. | 2025-08 |

| Transaction Type | Expense event category. | Examples: Deferred Expense or Expense |

| Home Currency | Tenant/reporting currency for the row’s amounts. | Shown only in the Home Currency version of the report (e.g., USD). |

| RevRec | Amount from the RevRec for the event and period. | Positive for Deferred Expense and Expense Reversal; negative for Deferred Expense and Expense. |

| RevRec Premium | Amount posted by RevRec Premium to Deferred Expense/ Expense or reversals. | Mirrors the accounting postings for the same event/period. |

| Differences | Variance between RevRec and RevRec Premium. | Formula: RevRec − RevRec Premium. |

Optional / drill-down columns (add via Column Chooser)

| Column | Definition |

|---|---|

| Transaction ID | ID of the Sales Order against which the revenue is recognized. |

| Transaction Line Item ID | Line Item ID of the Sales Order against which the revenue is recognized. |

| Transaction Status | Indicates whether the revenue was posted to RevRec Premium during the period close or posted later due to the period being reopened. |

| Transaction Type | Type of the transaction, i.e., Revenue, RevenueFX. |

| Transaction Currency | Shows the currency of the transaction. |

| Exchange Rate | Shows the rate used to translate to the home currency. |

| Home Currency | Reporting currency of the company. |

| Customer ID | Shows the customer ID associated with the sales order or line item. |

| Customer Name | Shows the customer name associated with the sales order or line item. |

| Subscription ID | Shows the subscription ID associated with the sales order or line item. |

| Product ID | Shows the product ID associated with the sales order or line item. |

| Product Name | Shows the product name associated with the sales order or line item. |

| Reference Invoice ID | The ID of the instrument against which this sales order is made. E.g., Invoice, Credit Note. |

| Business Entity ID | Shows the business/legal entity ID associated with the transaction (if configured). |

| Business Entity Name | Shows the business/legal entity Name associated with the transaction (if configured). |

Exports

-

Standard Export - current layout (what you see on screen).

-

VUD Export - detailed, transaction-level dataset for deep investigation.

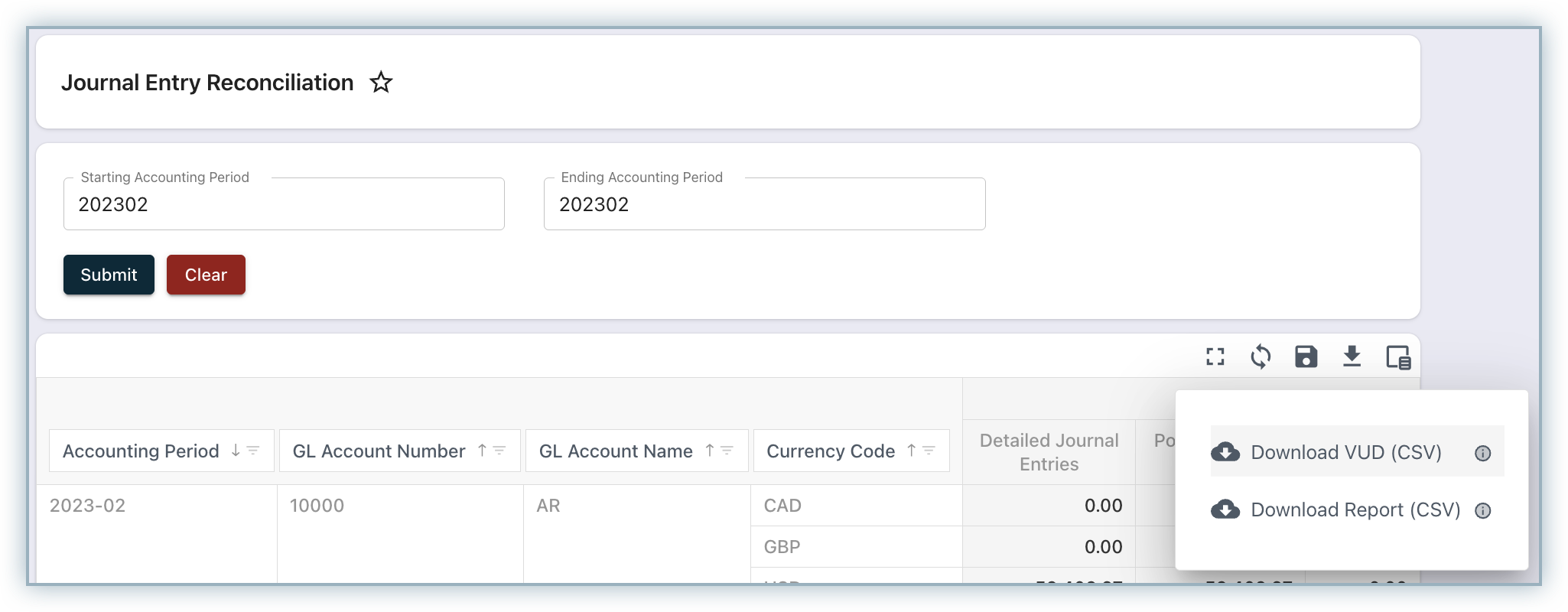

Journal Entry Reconciliation

Compares Detailed Journal Entries (transaction-level) with Posting Journal Entries (system-posted aggregates) to ensure they match for each accounting period, GL account, and currency.

-

Detailed Journal Entries are created at the transaction or event level and then aggregated to show balances.

-

Posting Journal Entries are aggregated journals that the system generates through automated or manual posting schedules (daily, weekly, monthly, or manual).

The reconciliation compares both sets of entries at the level of Accounting Period, GL Account Number, GL Account Name, and Currency. Since Posting Journal Entries are derived from Detailed Journal Entries, both should always match.

Common Scenarios Causing Mismatches

- Posting Schedule Not Run

If Posting Journal Entries have not been created because the journal creation job has not yet run (based on the defined posting schedule), reconciliation will show differences.

- Unmapped Accounts (/N values)

If an account is not assigned in the Journal Account Mapping, the UI will show /N in the GL Account Number and GL Account Name columns.

Resolution:

- Navigate to Settings > Accounting > Journal Account Mapping.

- Download the rules file by clicking the down arrow button.

- Filter for records with account number /N.

- Assign the correct account number to the rule either by uploading the updated rules file or by editing directly in the UI.

- Once corrected, rerun the journal creation job to update Posting Journal Entries.

Key Tip: Reconciliation should be used as a control checkpoint. If mismatches are found, always confirm whether they are timing-related (jobs not run yet) or configuration-related (account mappings, rules, currencies).

Contact Support if you are still blocked.

Layout & Columns

This report compares Detailed Journal Entries with Posting Journal Entries to ensure accuracy and consistency.

| Column | Definition / What it shows | Example / Notes |

|---|---|---|

| Accounting Period | Posting period for the accounting entry in RevRec Premium. | 2025-08 |

| GL Account Number | The account number to which the journal entry is posted in the General Ledger. | 10000 |

| GL Account Name | The name of the General Ledger account associated with the journal entry. | Account Receivable |

| Currency Code | Represents the currency used when posting the journal entry. | USD |

| Detailed Journal Entries | Amount of the Journal entries created at the individual transaction or event level. | 10,000 |

| Posting Journal Entries | Aggregated journal entries created from Detailed Journal Entries for posting to the accounting system. | 10,000 |

| Differences | Variance between Detailed Journal Entries and Posting Journal Entries. | Formula: Detailed Journal Entries − Posting Journal Entries. |

Optional / drill-down columns (add via Column Chooser)

| Column | Definition |

|---|---|

| Transaction Date | The date of the original transaction (e.g., invoice date, credit note date, or payment date). Journal entries in the reconciliation report are aggregated at this date level. |

| Posting Id | The unique identifier assigned to an aggregated journal entry created from detailed entries. This ID represents the journal that will be posted to the accounting system. |

| Posting State | The status of the posting, showing whether the aggregated journal entry is prepared, ready to post, successful, or failed. |

| Type | Indicates whether the journal entry line is a debit or a credit. |

Exports

-

Standard Export - current layout (what you see on screen).

-

VUD Export - detailed, transaction-level dataset for deep investigation.

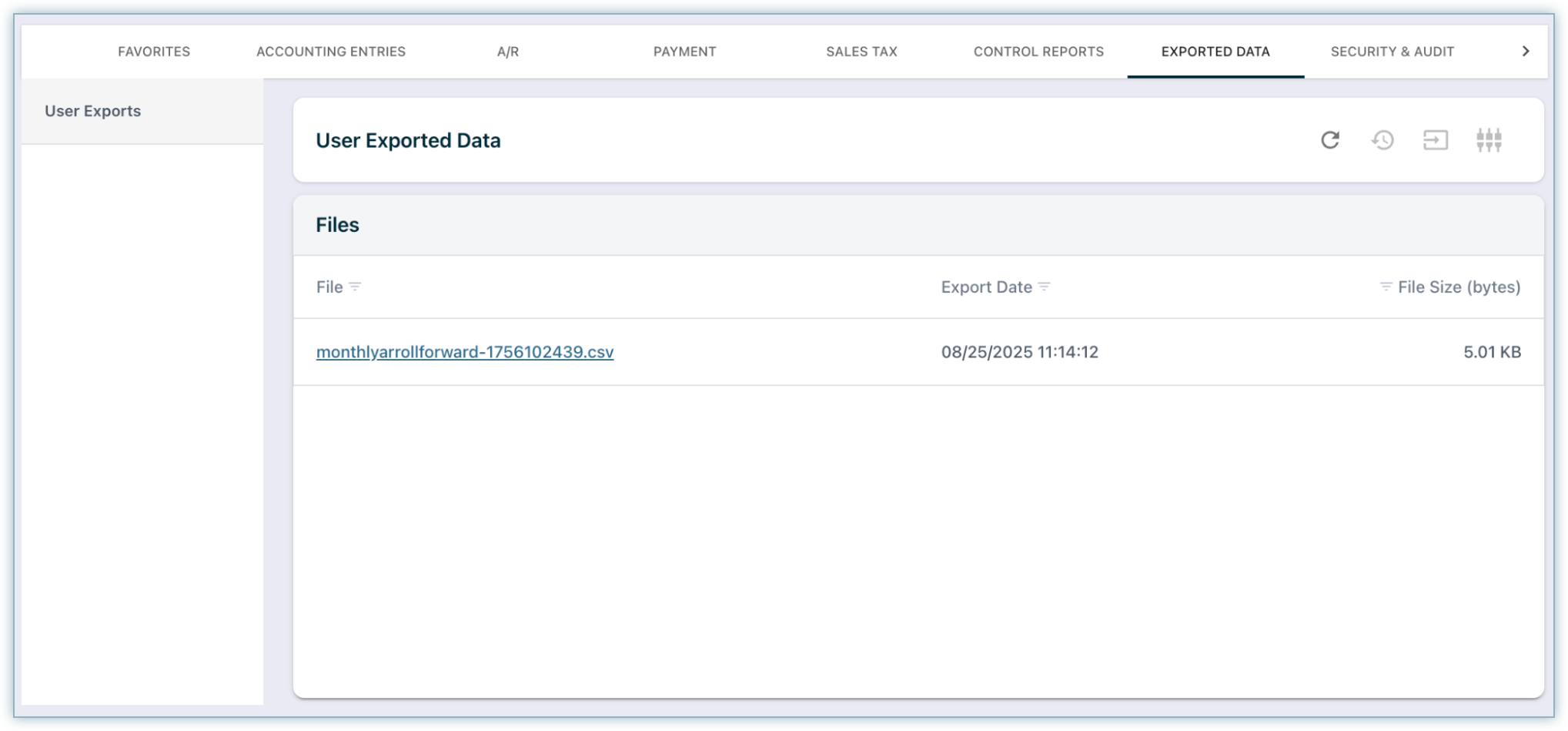

Exported Data

Centralizes access to previously generated data extracts for controlled retrieval and tracking.

- User Exports - A centralized list of files you’ve exported (name, date, size) with quick download/refresh, useful for managing previously pulled datasets.

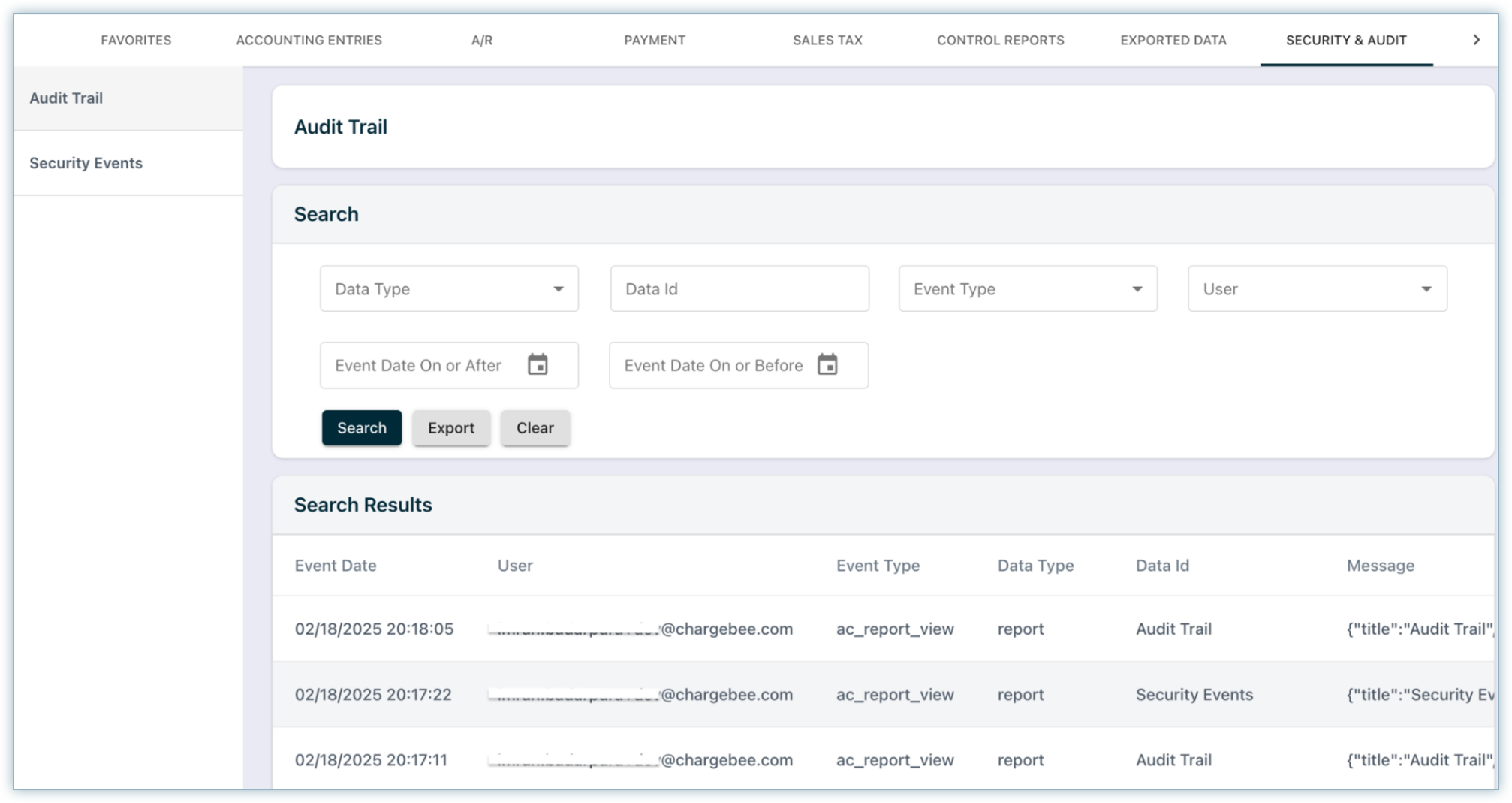

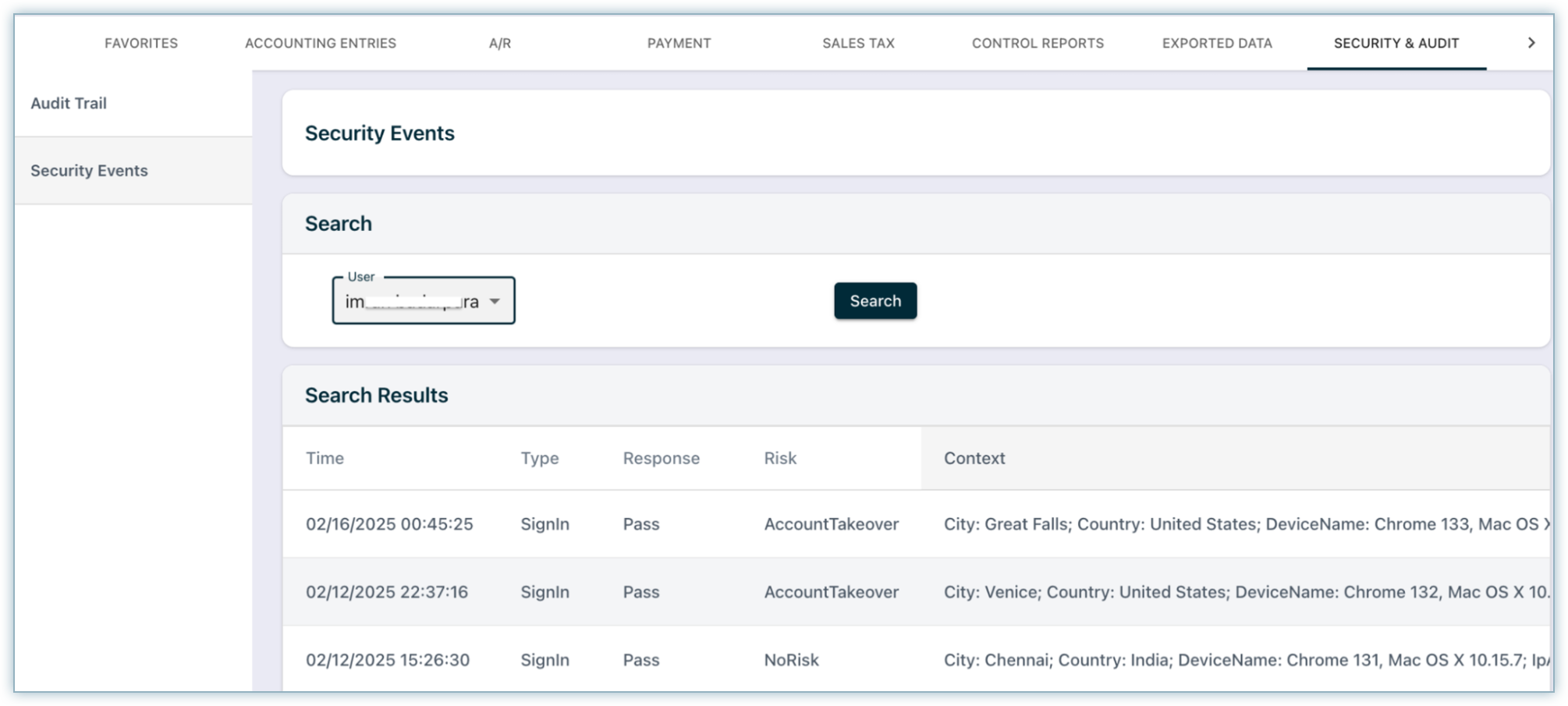

Security & Audit

Captures user activity and data-change events to enable access reviews, governance, and compliance audits.

-

Audit Trail - A permanent event log of data changes and system/user actions with filters by data type, ID, event, user, and date, critical for SOX-style review.

-

Security Events - Authentication activity (sign-in/sign-up, etc.) for your tenant to help with access reviews and incident checks.

Forex

Supplies reference exchange rates for multi-currency recognition, analysis, and reporting.

- Forex Exchange Rates - Daily close FX rates used by RevRec Premium for revenue and expense recognition; note that the exchange rate available on the Chargebee Billing will be used for the A/R, deferred, tax, or payout journal entries creation.

Rates are fetched from the 3 configurable forex libraries, i.e., Open Exchange, ECB Exchange, and Fixer API - Foreign Exchange Rates & Currency Conversion API. You can select the library of your choice from Settings > Accounting > Site Settings > Foreign Exchange Library.

Note:

When a report has a Transaction Currency variant, it shows amounts in the instrument’s currency (e.g., the currency of the invoice or credit note) rather than home/reporting currency. This comes handy for untangling FX from operational variances.

Was this article helpful?