RevRec Quick View Reports

What are RevRec Quick View Reports and who can benefit from these reports?

RevRec Quick View Reports are designed to replace the revenue recognition reports under RevenueStory and Classic Reports on your Chargebee site. These new reports allow you (Chargebee users) to track revenue recognition results based on US GAAP (ASC 606) and International Financial Reporting Standards (IFRS 15) requirements.

RevRec automatically integrates with your Chargebee site and applies a standard configurations and rules to calculate revenue. Similar to the reports under RevenueStory and Classic Reports, RevRec Quick View provides two key revenue reports:

- Monthly recognized revenue

- Deferred revenue balance

These reports are viewable by customers, invoices, products, subscriptions, and monthly summary. The reports are fully exportable into csv file format.

RevRec Quick View reports benefit those of you who are already using Chargebee with relatively simple sales contracts and reporting requirements. You can benefit from a standard revenue recognition tool without the need for customization, configuration, or additional implementation.

If your sales practices involve complex arrangements such as embedded performance obligations that require allocation of revenue based on Standalone Selling Price (other than sales price), different pricing for multi-year contracts, start dates different from the invoicing date, or other complex arrangements, or if you are looking for a revenue sub-ledger system that manages accounting close, Journal Entry posting, and other key functions in control, audit, and analytics, the advanced Chargebee RevRec licenses would be a better solution.

Why is Chargebee replacing the revenue recognition reports in RevenueStory and Classic Reports?

In 2021, Chargebee acquired RevRec, a leading revenue recognition accounting software, and rebranded it as Chargebee RevRec. This acquisition made the revenue recognition reports in RevenueStory and Classic Reports obsolete, as RevRec offers a more comprehensive solution for discounting and contract modifications that conform to revenue recognition standards.

Upgrading to Chargebee RevRec from RevenueStory and Classic Reports offers increased flexibility as your company evolves and your revenue recognition becomes more complex. With its advanced features and functionalities, Chargebee RevRec offers different plans to cater to the growing needs of your company. Moving to the RevRec platform simplifies and streamlines your future revenue recognition requirements.

How can I sign up and start to use Chargebee RevRec Reports?

RevRec automatically integrates with your Chargebee data to get the transactions from January 01, 2022, till your current date to process revenue recognition. Follow the steps below to sign up with Chargebee RevRec and view your revenue recognition reports:

-

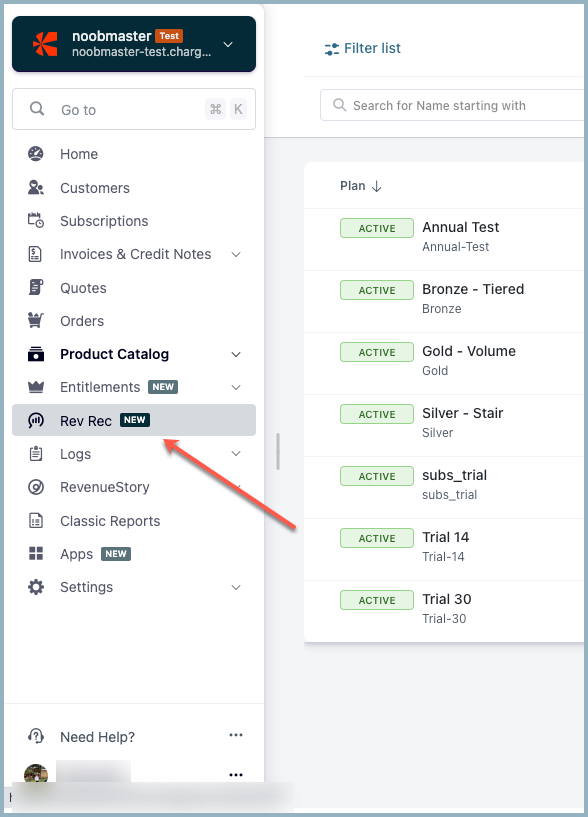

Log in to your Chargebee site, and you will notice a new module called RevRec added to the left navigation panel. Click this option and you will be redirected to the RevRec QuickView Reports.

-

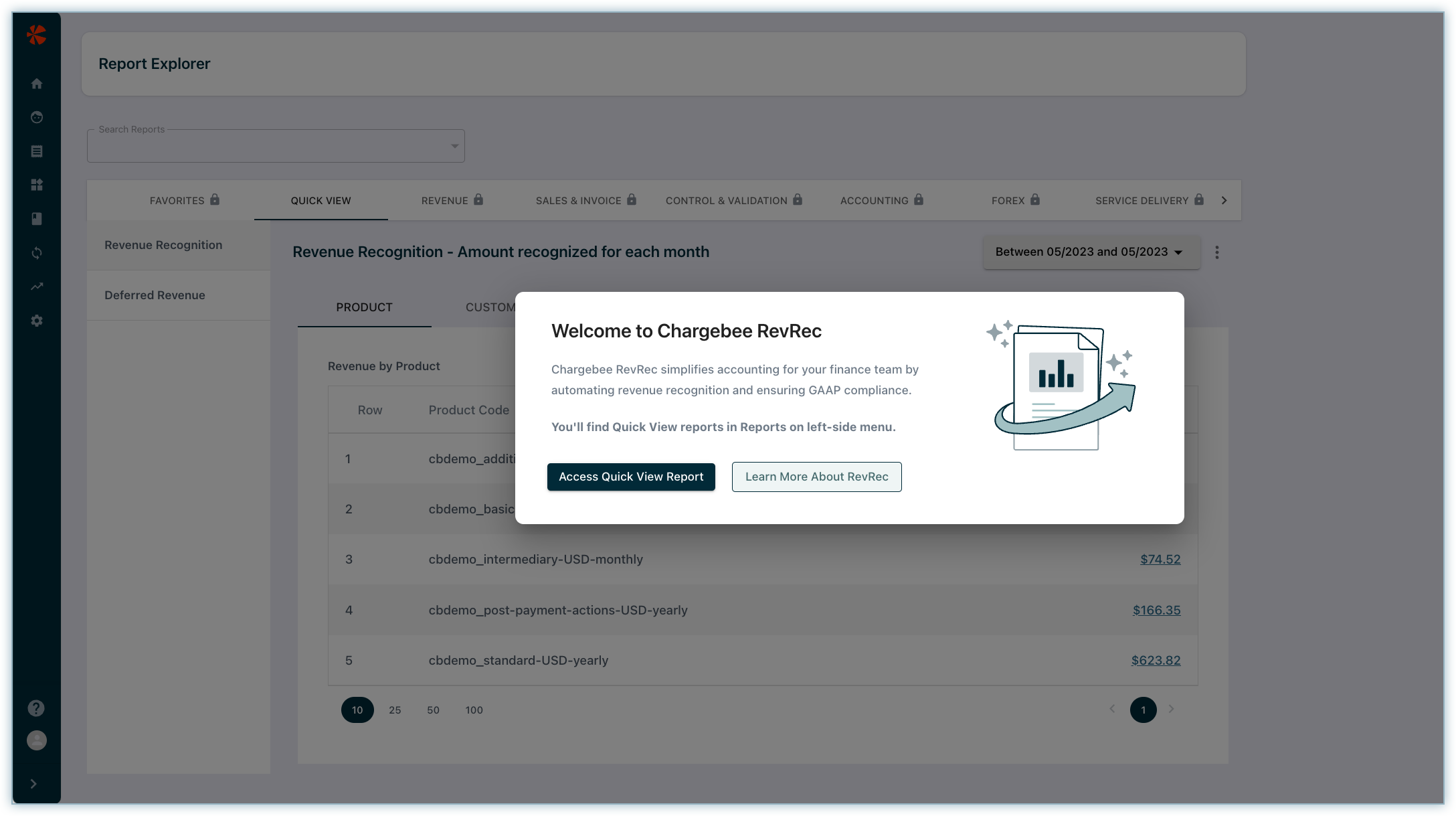

For a first time visitor, a welcome pop-up is displayed from which you can access Quick View Report or learn more about Chargebee RevRec.

-

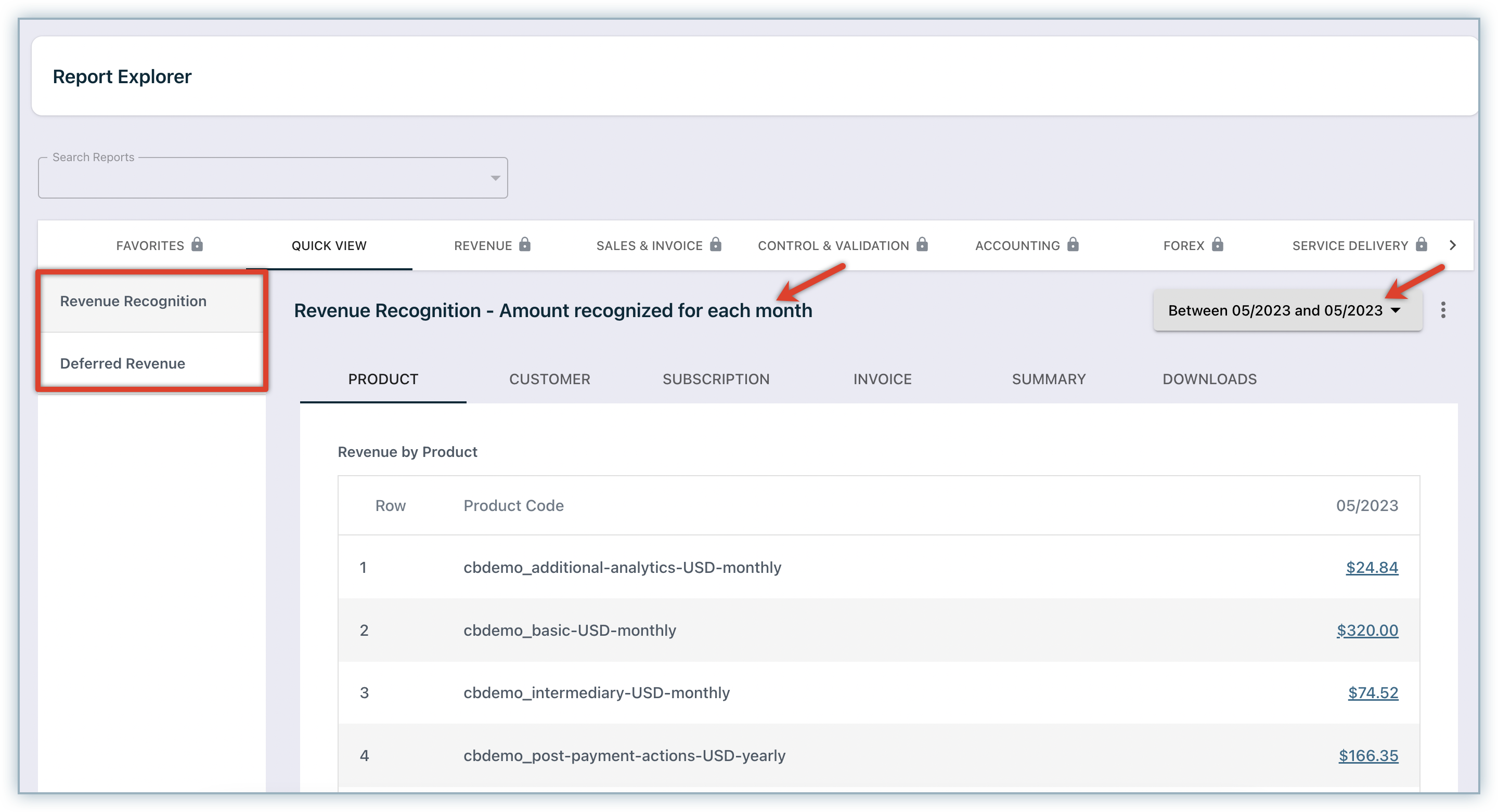

Quick View includes two single-metric reports that provide monthly revenue and deferred revenue balance. These reports are viewable by customer, subscription, invoice, product, and monthly summary. Use the period filter on the top to populate the reports for a specific time period.

-

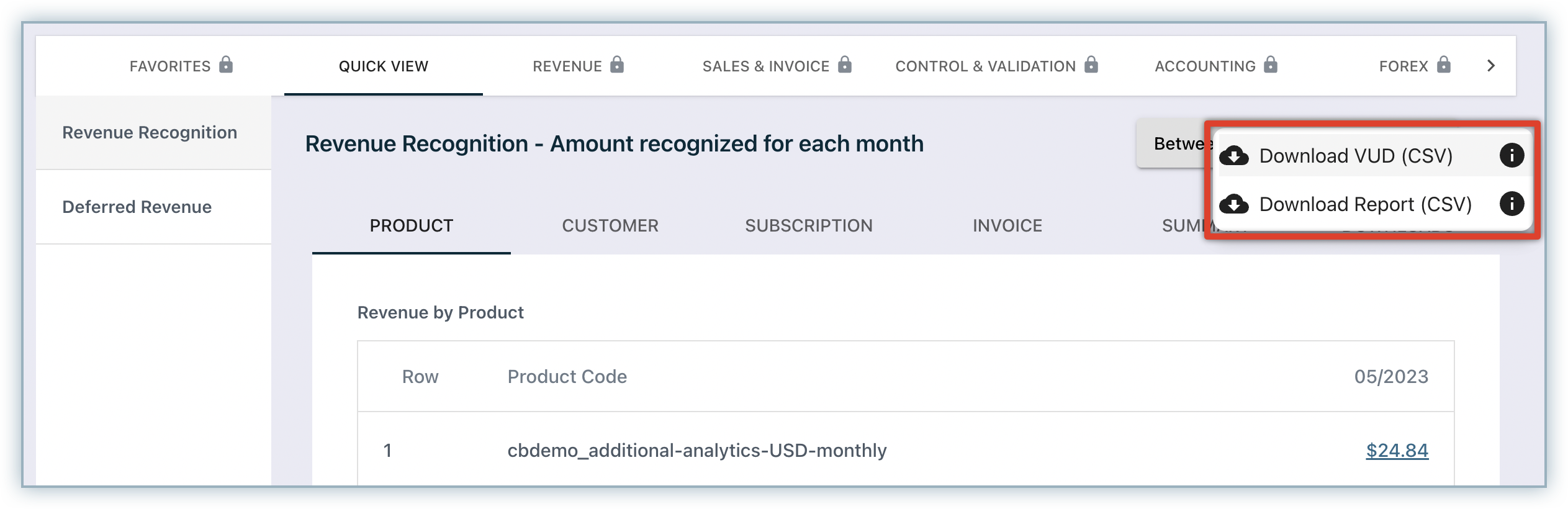

Report data is downloaded in two ways:

- Download VUD: To get the granular line item level data for all the underlying tabs.

- Download CSV: To get summary level data as displayed on the grid.

Click the ellipses icon to download a report.

-

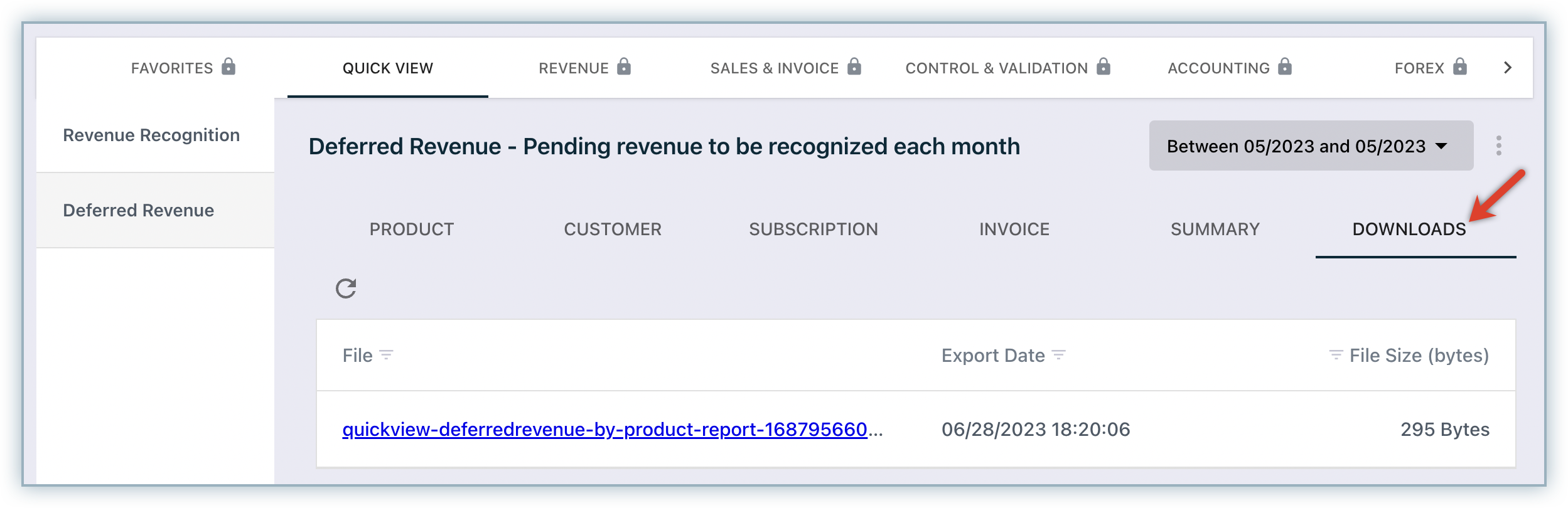

After the download is complete, Navigate to the Quick View > Downloads tab to access the downloaded reports.

-

You can add up to five additional users to your site. If you need more than five users, contact RevRec Support.

-

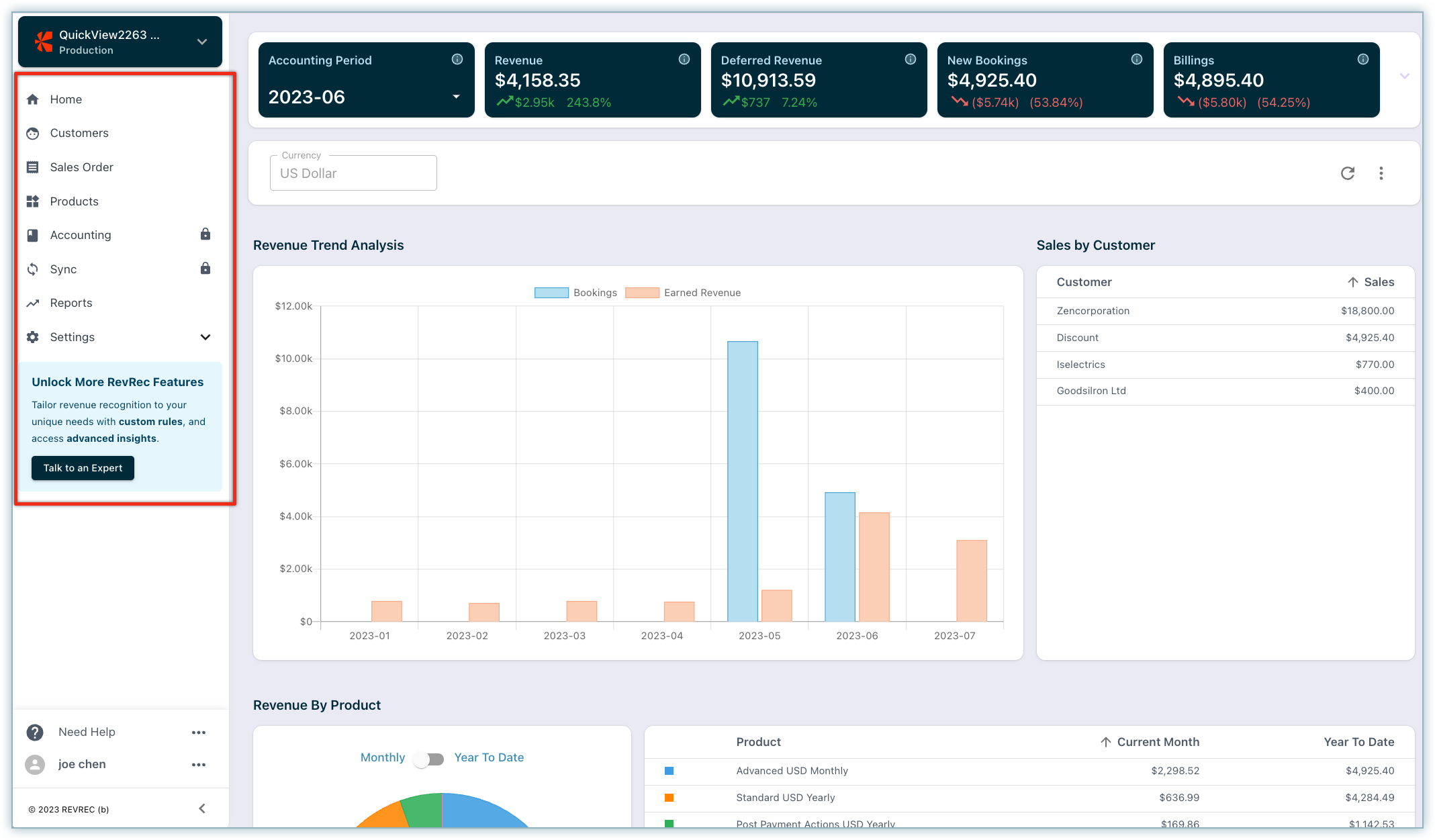

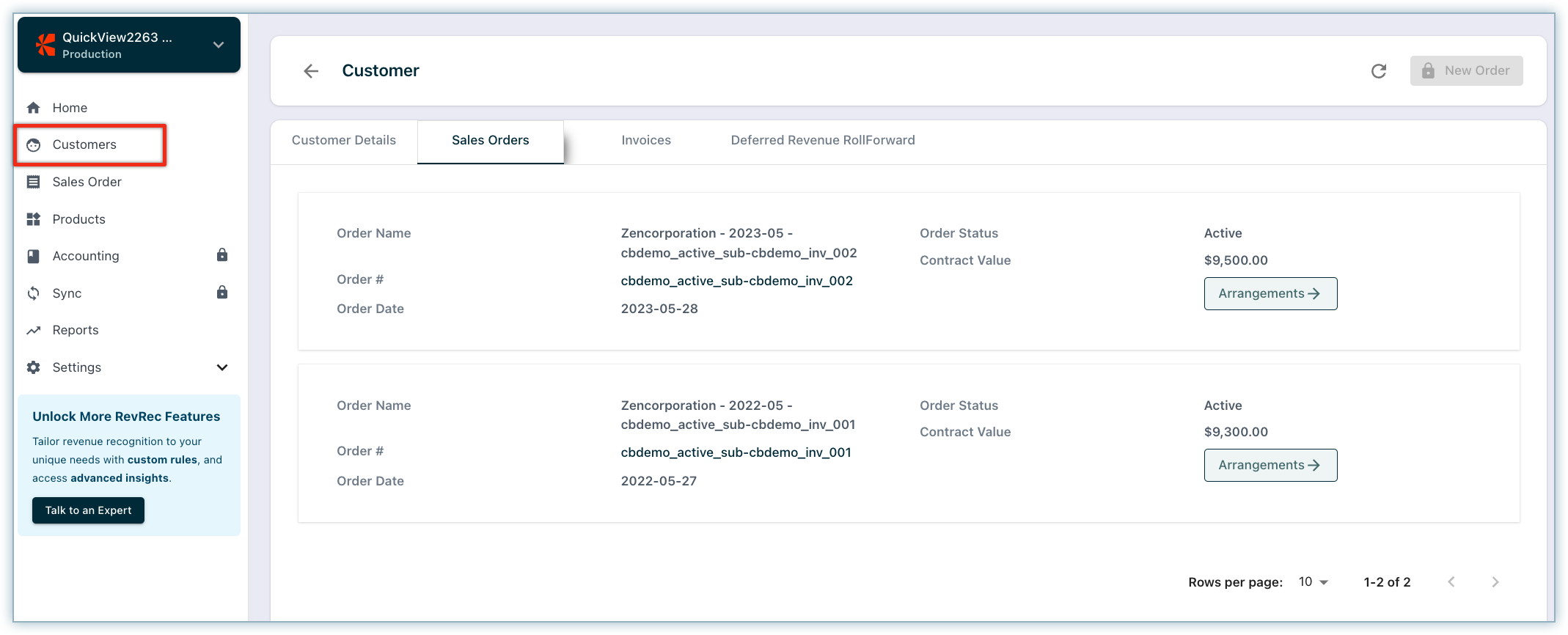

Explore your RevRec site further by navigating to pages such as Home, Customers, Sales Order, Products, and more (on a read-only mode) from the left navigation panel.

If you come across interesting features that are restricted for you, learn how you can upgrade to other licenses and get access.

Note:

If you are a non-admin user, please contact your RevRec site admin or owner to get access.

Are the other reports in RevenueStory or Classic Reports impacted by this change?

No. All the other reports currently available in RevenueStory and Classic Reports will continue to be available.

What are the main differences between RevRec Quick View Reports and the revenue recognition reports in RevenueStory and Classic Reports?

RevRec Quick View reports are largely similar to the revenue recognition reports in Chargebee (revenue recognition based on sale prices in the invoice). There are five key differences as follows:

Discount recognition: RevRec Quick View reports allocate the discount across all products in the invoice and use post discount adjusted sale price for revenue recognition, while Chargebee revenue reports do not process this allocation and recognize the discount directly against the line item's sale price for revenue. For example, consider an invoice containing two products: a subscription plan of $9,000 sale price and an implementation charge of $1,000, with a discount of -$1,000 applied to the implementation, for a net total sale price of $9,000. RevRec Quick View reports will allocate the -$1,000 discount to both products and recognize $8,100 revenue for the subscription plan and $900 revenue for implementation respectively; while Chargebee reports will recognize $9,000 for the subscription plan and $0 for implementation.

Recognition periods: RevRec Quick View reports have an automated monthly book closure process that occurs on the second business day of each calendar month. As a result, any changes made for previous periods will cumulatively be accounted for in the current period, given that the books for prior periods have been closed. In contrast, Chargebee billing does not adhere to an accounting period concept. However, it offers a configuration that allows changes to be recognized either retrospectively in historic months (with all periods open) or prospectively (where historic periods are closed, and the cumulative impact is recognized in the current period).

Proration: Chargebee Billing provides a configurable 'billing mode' option, allowing users to choose between millisecond-based mode (the default setting) or day-based mode. To illustrate, let's consider a monthly billing cycle. In the millisecond-based mode, an invoice's billing period would span from January 1, 2023, to February 1, 2023. On the other hand, in the day-based mode, the billing period would cover January 1, 2023, to January 31, 2023. Currently, the Quick View results in RevRec are based on the millisecond mode as the default setting. If you have selected the day-based billing mode and would like the proration in the Quick View report to reflect this preference, please comtact RevRec support team for assistance in updating the results.

Credit Note treatment: RevRec Quick View reports retrospectively apply credit notes leveraging the start and end date of the original invoice, effectively offsetting the original revenue. In contrast, Chargebee allows credit notes to be applied from the date of credit note creation to the end of the invoice, resulting in a prospective impact on revenue. However, in cases of subscription cancellation with full credits, Chargebee applies a retrospective treatment on revenue to match the original invoice. These contrasting approaches in applying credits lead to variations in revenue calculations due to the differing treatment of credit note application.

Multi-currency: RevRec Quick View reports facilitates seamless translation of multi-currency transactions into the entity's home currency. It relies on day-end rates from Open Exchange Rate as the foreign exchange rate source. In contrast, Chargebee utilizes rates from various sources, including Open Exchange Rate, Currency Layer, or the option to manually upload custom rates for these transactions. However, it is important to note that disparities may arise due to fluctuations between the manually uploaded rates, rates from Currency Layer with exchange rates used by RevRec using Open Exchange Rate as source.

What are the key differences between RevRec Quick View Reports and the full RevRec license products?

RevRec Quick View reports provide a convenient reporting package comprising two reports: revenue recognition and deferred revenue. Additionally, they offer an automated accounting period close feature that effectively locks your books, preventing any changes in past periods. However, for a more comprehensive revenue accounting solution, the full RevRec license products offer advanced features such as sub-ledger capabilities for revenue accounting. These robust features include general ledger account mapping, the ability to manage monthly period close timelines, and configurable options for Standalone Selling Price and revenue methods for credit notes. Furthermore, the full license products seamlessly integrate with various billing, CRM, control, and audit functions, ensuring a streamlined workflow.

The table below is a high-level summary of comparison between RevRec Quick View Reports vs RevRec full license. For more information, please contact us at revrec-reporting-support@chargebee.com.

Features and Functions | RevRec Quick View Reports | RevRec Full License |

|---|---|---|

Use sale prices at the line item level in invoice for revenue recognition, with either pro-rata or point-in-time method based on product type and invoice period. | Yes | Yes |

Yes | Yes | |

Yes | Yes | |

Discount reallocation based on pro-rata sales price. | Yes | Yes |

No | Yes | |

Revenue recognition policy configuration, such as advanced SSP setup and configuration of revenue methods, including proportion performance. | No | Yes |

Advanced revenue features - such as using subscription contract terms for revenue recognition, consolidated invoices, un-billed charge, collectibility assurance, and using custom fields to set revenue periods or for reporting purposes etc. | No | Yes |

No | Yes | |

Multi-Entity Support - consolidating reporting for multiple entity/RevRec sites. | No | Yes |

Journal entry functions: GL account configuration and mapping, manage accounting close, JE generation and posting, 4/4/5 accounting calendar. | No | Yes |

Integration with 3rd party systems, including billing, CRM and ERP and GL systems; data import and export functions. | No | Yes |

Control, audit functions and robust analytics and reports such as roll-forward waterfall, trend reports. | No | Yes |

Rich web-based UI with search functions that allow users to look at the full life cycle events and revenue recognition at sales order or customer level. | No | Yes |

What revenue recognition rules are used in RevRec Quick View Reports?

Below is a summary of the methods and revenue recognition rules applied in RevRec Quick View reports:

- Invoice as contract: The revenue recognition is based on the sale prices listed at line item/product level in the invoice, and each invoice is treated as a separate sales order.

- Revenue recognition methods: Depending on the specific performance obligation, RevRec Quick View reports automatically apply either ratable revenue recognition or point-in-time revenue recognition method. For example, subscription fees over a 12-months period are recognized ratably over the period, and one-time implementation fees are recognized at a point in time when implementation is performed.

- Discount: RevRec Quick View reports always allocate discounts across all the products/line items in an invoice based on each product's sale price, and recognizes the revenue for each product based on its reallocated value and revenue recognition methodology. This is a key concept of ASC 606 and IFRS 15.

- Credit notes: RevRec Quick View reports apply credit notes based on the start and end date for each line item in the invoice. For example, a subscription plan starts on 1/1/2021 and ends on 12/31/2021 with a price of $100 per month or $1,200 in total. A credit note of (-$120) is issued at the beginning of month 4. RevRec will recognize $-120 credit note ratably over the same period as the invoice, from 1/1/2021 to 12/31/2021, or -$10 per month, for net monthly revenue of $90 per month.

- Foreign currency: The revenue and deferred revenue balances are reported in the home currency, as specified in the user's Chargebee site.

- Recognition is performed only in open periods to reflect the latest updates and adjustments. To continue the credit note example above, with the accounting period close feature included in this license, and assuming month 1 through month 3 are closed and therefore no longer subject to change, the credit note would be recognized as following: -$40 in month 4 which includes the cumulative impact of -$30 from month 1 through month 3, and -$10 for month 4.

How can I upgrade from RevRec Quick View Reports to other RevRec licenses?

To upgrade from RevRec Quick View Reports to other RevRec licenses, we recommend reaching out to a RevRec Expert who can guide you through the process. Upgrading your RevRec license will provide you with access to additional features and functionalities that can further enhance your business operations. Our expert will also address any questions or concerns you may have regarding the upgrade process. They can provide insights into the benefits and capabilities of the different licenses available, helping you make an informed decision based on your business objectives.

After successfully logging in, when you attempt to access any page with a lock icon that is not included in the RevRec Quick View reports, you will be presented with a prompt that gives you a quick overview of the feature along with a document link to learn more, and an option to Talk to an Expert. You can connect with a RevRec Expert or contact RevRec Support to complete the upgrade.

Was this article helpful?