UK VAT

Introduction

In the wake of Brexit, the United Kingdom (UK) withdrew from the European Union (EU) and the European Atomic Energy Community (EAEC or Euratom) on January 31, 2020. This mandates that businesses selling within the UK register for the UK VAT number and UK VAT is levied on goods and services that are traded for consumption within the UK. "Value added" in VAT refers to the amount by which the value of a product is increased at each stage of production and distribution.

See also

UK VAT Rules

VAT Registration

If your business is incorporated in the UK, you need to register for VAT in the UK. Depending on the products and services you sell in the UK or other EU member states, you may have to register for VAT in the respective member states as required.

VAT Rates

If your buyer is from the UK where your business is domiciled then the VAT rate of the UK is applied, irrespective of whether the buyer is a consumer or a business.

If your buyer is from a different EU member state, the VAT rates depend on the type of service you are providing:

- Digital Products/Services:

- Your buyer's member states' VAT rates applies (destination-based).

- Other services:

- If you have not registered in your buyer's member state, the VAT rate of the UK applies and you need to select origin based taxation to be applied in Chargebee(origin based).

- If you have registered in your buyer's member state, the VAT rate of your buyer's country applies(destination based).

However, irrespective of the type of service provided, if your buyer has a valid VAT number and is from a different member state, VAT is not applied. This is in keeping with the reverse charge mechanism which puts the tax liability on the business buying from you.

Location Validation (For Digital Services)

If you sell digital products, you have to collect and store proof of your customers' location. Apart from helping calculate an accurate VAT rate, this information helps prevent fraud. The following non-conflicting pieces of evidence are accepted as valid proof of location:

- Customer's billing address country.

- The IP address of the device used by the customer.

- Location of the bank from which payment was made.

- The country code of the Subscriber Identification Module(SIM) card used by the customer.

- The location of the customer's fixed landline.

- Credit Card's Bank Identification Number(BIN).

UK VAT Invoice

A UK VAT Invoice sent to a consumer must contain the following information:

- Merchant's trading name and address

- Merchant's VAT number

- Invoice Date

- Buyer's name or trading name, and address.

The invoice contains the applicable VAT rate for each line item and a subtotal amount before applying VAT and a final invoice amount after VAT is added.

You can configure UK VAT invoices on the Invoice Customization page. Navigate to Settings > Configure Chargebee > Invoices, credit notes, and quotes.

Configuring UK VAT

Step 1: Provide your Organization Address

Make sure that you have added your organization address in your Chargebee site without which taxes cannot be configured. To add your organization address, click Settings > Configure Chargebee > Business Profile.

Step 2: Enable Tax

To enable Taxes in your Chargebee site, click Settings > Configure Chargebee > Taxes > Configure Tax.

Step 3: Choose a Price Type (Tax exclusive or inclusive)

Once taxes are enabled, you will be redirected to a page containing all the currencies that you have enabled for your site. This step is about configuring a price type for each currency.

This decides whether the price that you quote for your product/service/addon is inclusive of tax, where tax is included in the price, or exclusive of tax, where tax is added to the price. VAT invoicing rules call for your invoices to reflect the VAT rate that you are applying. This means that you have to set your Price Type to Tax Exclusive if you are selling to customers residing in the UK or EU.

Once you are done, click I've Reviewed my Price Types button.

Step 4: Configure UK (as a part of Tax jurisdiction)

Follow these steps to configure the UK region as part of your tax jurisdiction:

-

In the Configure Taxes page, click +Add Region and select United Kingdom from the drop-down.

-

Under Pick a mode of configuration, select your preferred mode of tax computation. If you are using a third-party application for automated tax application on your Chargebee invoices, you can select the respective application. Select Manual to configure the tax rates for the UK region manually.

-

Based on the type of product that you sell, select between I sell digital products and I sell Non-Digital products options in the UK VAT configuration page. This helps Chargebee apply an appropriate tax rate to your invoices, as UK VAT regulations specify different tax rates for digital and physical products.

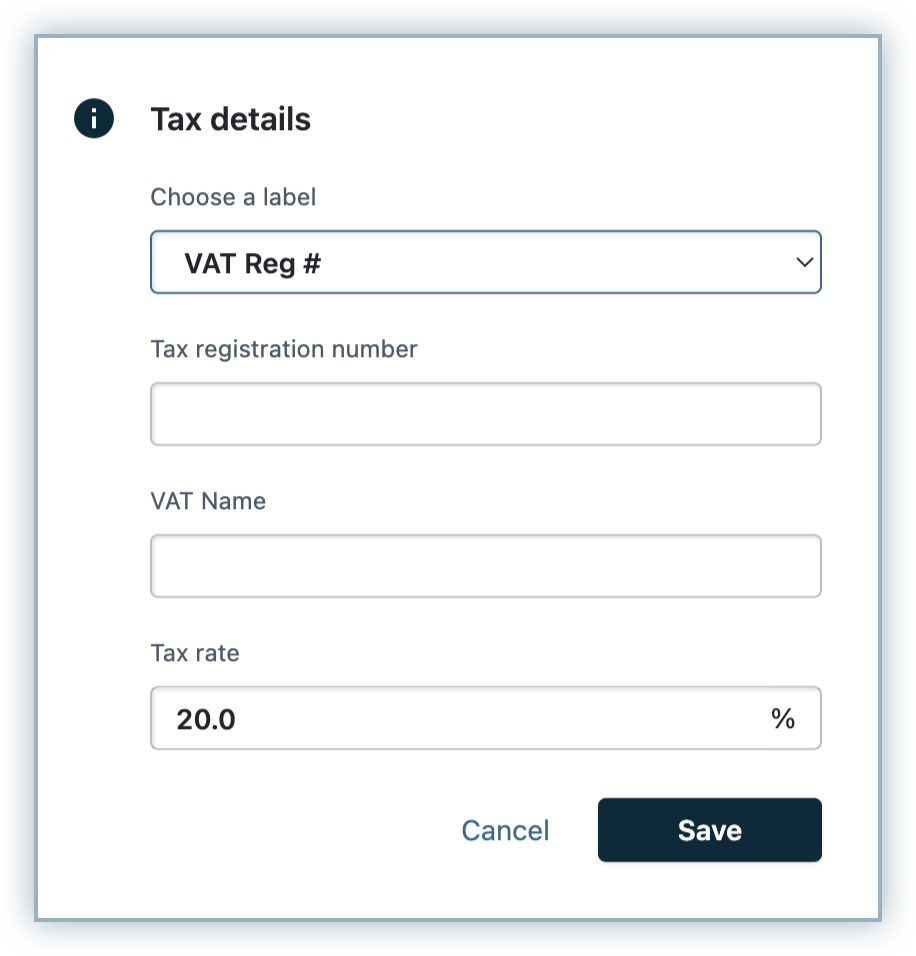

- I sell digital products: Select this option if you are selling online products such as e-magazines, tutorials, or podcasts. In the Tax details modal, do the following:

- Select the VAT Reg # label.

- Specify your Tax registration number for the UK.

- Specify the VAT name.

- Specify the Tax rate, and click Save.

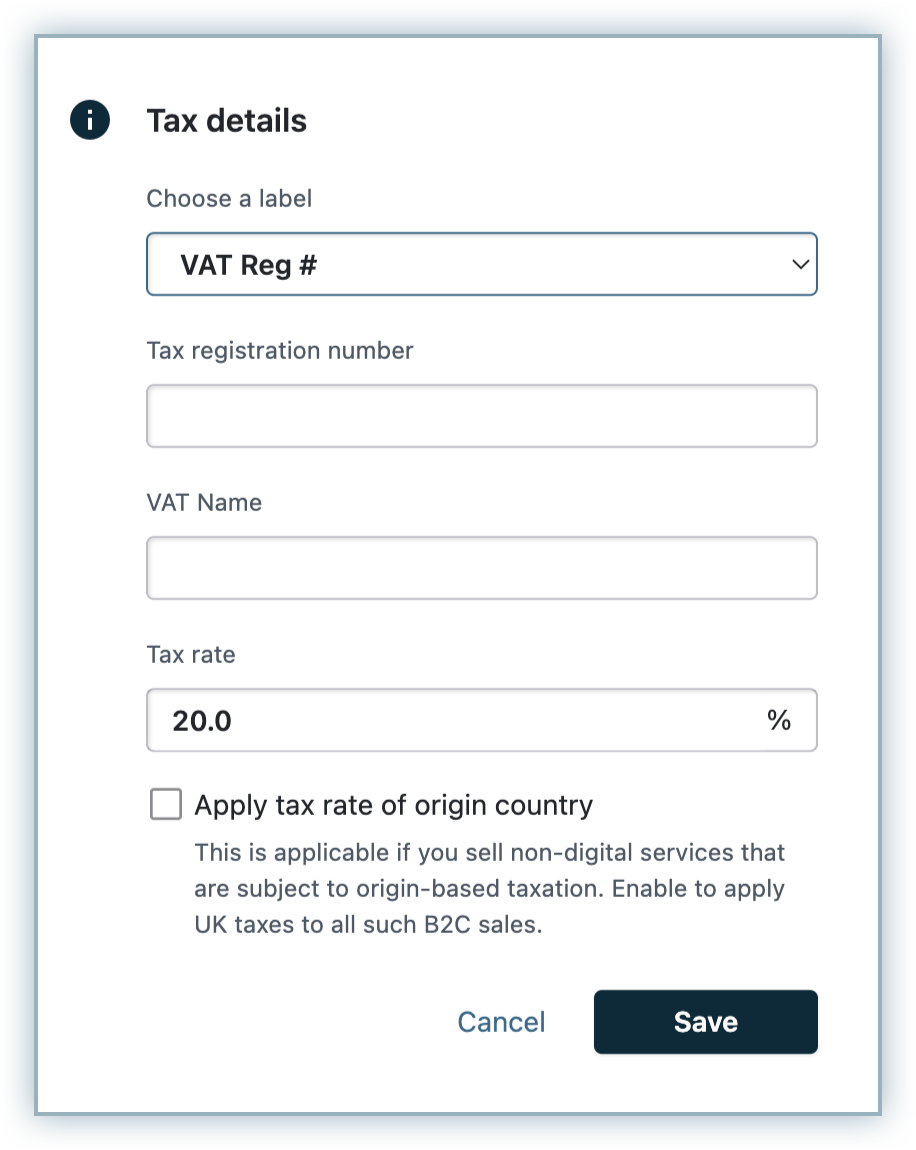

- I sell non-digital products: Select this option if you are selling physical goods such as magazines, cosmetics, or any other goodies. In the Tax details modal, do the following:

- Select the VAT Reg # label.

- Specify your Tax registration number for the UK.

- Specify the VAT name.

- Specify the Tax rate, and click Save. All non-digital products' sales (mapped to this profile) within the UK are charged at this rate.

- If you are selling non-digital services to customers, you can select the Apply tax rate of origin country. This applies origin based taxes for such transactions originating from UK that is mapped to this profile. If you are selling to other EU member states, make sure to configure the EU region also, and add the respective member states, in cases where destination tax is applicable.

- I sell digital products: Select this option if you are selling online products such as e-magazines, tutorials, or podcasts. In the Tax details modal, do the following:

-

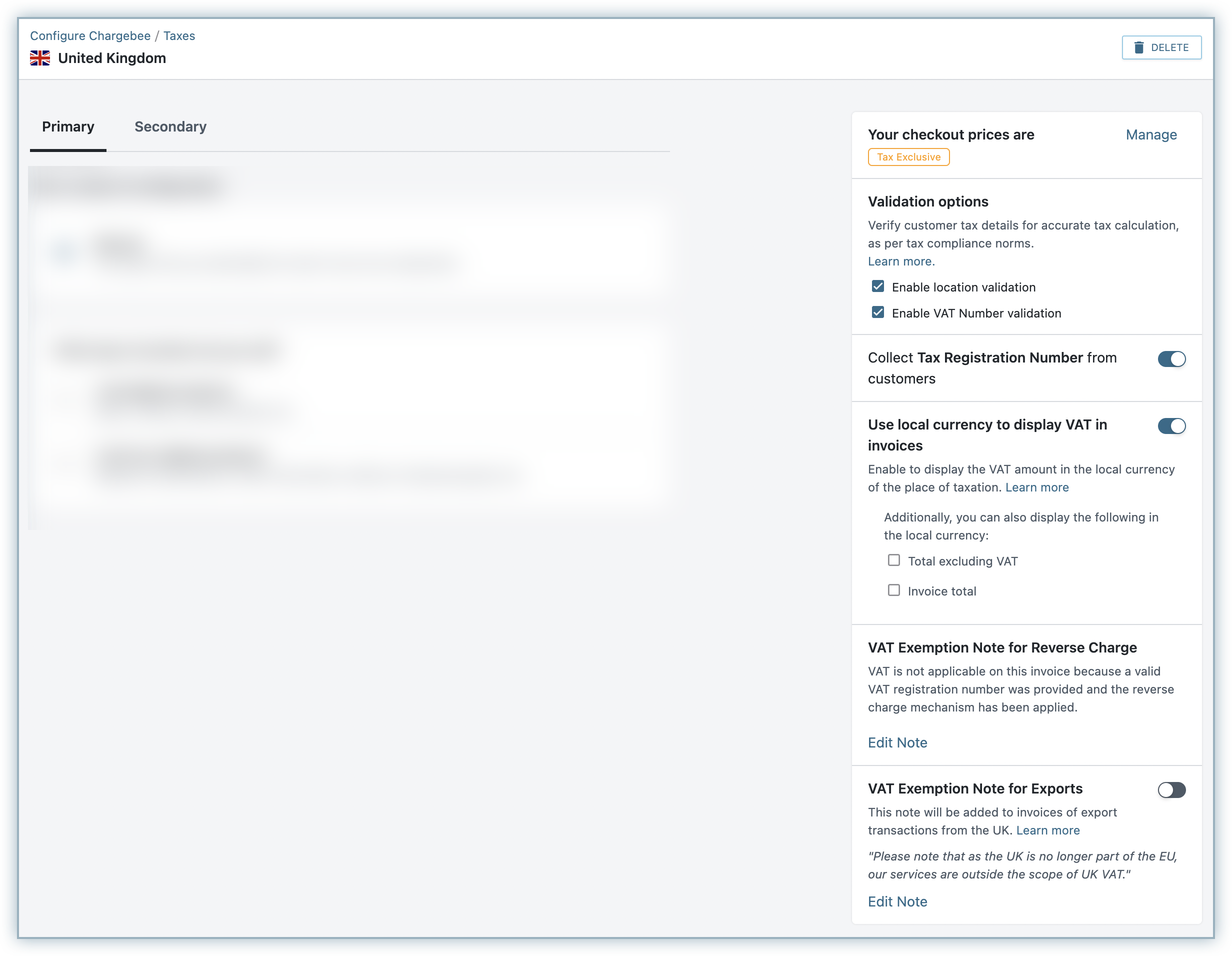

On the UK tax region page, you can configure the following additional settings in the context of the UK tax laws:

- Price type: You can update the appropriate price type for your checkout prices in the UK region.

- Location Validation: Choose this option if you want Chargebee to validate your customer's location information.

- VAT Number Validation: Choose this option to perform UK VAT Validation using the validation service provided by HMRC (Her Majesty's Revenue and Customs (HMRC), when the VAT number is entered by your customers. If you sell to businesses, it is recommended that you collect the VAT Number of your business customers and ensure that it is valid. Chargebee verifies the validity of a VAT number entered against HMRC.

- Collect Tax Registration Number: Enable this option if you expect your customers to enter their VAT Number while subscribing to your products.

- Use local currency to display VAT in invoices: This option is helpful when the invoice currency is different from the local currency of the place of taxation. When enabled, the amount of VAT payable will be displayed in the invoice currency as well as the local currency of the place of taxation, as per Article 230 of the EU VAT Directive. Additionally, you can also choose to display the total amount excluding VAT and the total invoice amount in the respective local currency. The exchange rate applied for this purpose is as per the rates listed on the European Central Bank(ECB) website. In cases where a currency's exchange rate is not listed with the ECB, Chargebee uses the exchange rates available with the currency layer and Open Exchange Rates.

- VAT Exemption Note for Exports: If you export goods/services to other countries from the UK as part of your business, enabling this option adds a note in the respective invoices that refers to the VAT exemption for export transactions. You can edit the note to add or edit the text.

Note:

- Export VAT will not be exempted if other country tax is applied on the same invoice.

- Keep in mind that your organization address must be in UK for the VAT Exemption Note for Exports to work.

Northern Ireland Impacts

Following the Northern Ireland Protocol, Northern Ireland holds a dual position by aligning with the EU VAT rules for trading goods and by remaining as part of the UK's VAT system for trading services(given that the UK VAT rules will apply across the whole of the UK for all service-related transactions). HMRC will continue to be responsible for the operation of VAT and collection of revenues in Northern Ireland. The tax applicability for non-digital/physical goods are as follows:

- All physical goods trade between Northern Ireland(NI) and Great Britain(GB), and within NI, are taxed based on the UK VAT rate.

- B2C physical goods trade between NI and EU countries are subject to EU distance selling threshold rules.

- B2B physical goods trade between NI and EU countries remain intracommunity VAT zero-rated transactions.

If you are an organization selling digital products/services within Northern Ireland, the UK's VAT is applied for all your transactions.

However, if you're selling non-digital products in Northern Ireland, you need to configure Northern Ireland as a separate tax region under the EU.

To configure Northern Ireland as a tax region in your Chargebee site, follow these steps:

- Click Settings > Configure Chargebee > Taxes.

- In the Configure Tax page, Click +Add Region and select European Union from the drop-down.

- Under What type of product do you sell, click I sell non-digital products.

- Click Add your origin country and select the country where you are domiciled. On the Tax modal that appears, select your tax label, add your VAT Number.

If you have already configured non-digital tax profile under the EU region, the origin country's tax rate will be applied for Northern Ireland, as it does for other countries.

For tax calculation, Chargebee considers the country mentioned in the shipping address. However, in the absence of a shipping address, the country in the billing address is taken into account.

If you cross a certain threshold of sales per annum (the threshold figure differs from country to country) you have to register for VAT in the member states where you have a commercial presence.

- Chargebee applies the origin-based tax in case you have not crossed the threshold of sales to a particular EU Member State, i.e., if you have not registered in the country.

- Chargebee applies destination-based tax in case you have crossed the threshold of the sales to an EU Member State, i.e., if you have registered in that country.

You can select and add the countries where you are liable to pay taxes.

Location Validation

Chargebee collects the following address or location information as evidence of a customer's place of residence in adherence to the UK VAT location requirements. If you disable this feature, you have to collect the following evidence by yourself, to ensure that your customer is from the UK.

Customer's IP Address:

-

Hosted Pages: If you have integrated with Chargebee using the hosted pages, the IP Address of the customer is collected automatically.

-

API: If you use the Chargebee API, you have to pass the IP Address of the customer to Chargebee using the User Details Header API.

Card BIN of the Customer:

The first six digits of a card carries the Bank Identification Number (BIN). BIN gives us the information about the card-issuing bank and hence can be used as a way to determine the customer's location.

-

Hosted Pages: If you have integrated with Chargebee using the hosted pages, the BIN of the customer is collected automatically.

-

API: If you use the Chargebee API, you have to pass the BIN of the customer using the card [number] parameter in the Create a customer API.

Once the above evidence is collected, Chargebee attempts to match the customer's billing country with either their IP address or their card issuing country(from the card BIN). Only when either of these evidence matches with their billing country, location validation is successful and the customer can complete their purchase. If the Location Validation option is enabled and the validation fails, the customer can not complete the order.

Location Validation Failure

If your customer's location validation fails, they can not complete the order. They will receive the following error message:

If a customer signs up for a trial plan which involves no immediate payment, the subscription is created irrespective of whether the location validation was successful or not. The details of the customer are marked with a warning indicating that the location validation failed.

UK VAT Validation

VAT Number Validation for the UK is currently being performed by a new service launched by Her Majesty's Revenue and Customs (HMRC), the UK's tax, payments, and customs authority. Chargebee validates the UK VAT Numbers by sending a validation request to this online VAT number validation service via API.

Merchant VAT Validation

You as a merchant may have a tax registration number in the UK. The VAT number(s) you enter gets validated automatically when provided.

Note: While using Chargebee for your recurring billing automation, being Brexit-ready is crucial because it impacts the tax computation of your invoices. When enabled, VAT validation is performed by Her Majesty's Revenue and Customs(HMRC).

Validation Status

As soon as you add/update one of your VAT numbers, it is validated using HMRC, and results are shown. The result of the validation can be one of the following:

| Validation Status | Description |

|---|---|

| Valid | VAT Number validation was successful and the number is valid |

| Invalid | VAT Number validation failed. You can click on Mark as valid to ignore and override the HMRC validation result. |

| Undetermined | No response from HMRC, or other errors. Chargebee retries validation attempts periodically for such VAT numbers. |

Customer VAT Validation

Your customers can enter their VAT Number when you enable the Collect Tax Registration Number option. You can mandate VAT Number validation by enabling the Enable VAT Number Validation option.

Chargebee allows your Northern Ireland customers to enter the VAT number with country code XI or GB depending on the nature of products they trade, and the countries they trade with.

When UK VAT Validation Service is down

When the HMRC service is down due to an internal error, Chargebee cannot determine if the VAT Number was VALID or INVALID. In absence of status, you can configure one of the options:

- Allow to store the VAT number and proceed with creating a subscription - this is the default setting in Chargebee.

- Restrict subscriptions from being created in case VAT number status is not known - contact support to configure this option.

Based on your choice, Chargebee creates subscriptions (or not).

If you have chosen to allow to collect and save the VAT numbers without validation when HMRC service is down, Chargebee checks for VAT number status later, every 24hrs. Based on the response from HMRC, the following actions are taken:

- VALID - If the VAT Number is VALID, then VAT is not applied and the subscription continues to renew.

- INVALID - If the VAT Number is found to be INVALID, VAT gets applied for upcoming invoices. Also, Chargebee sends emails with details of such customers to the site admins and the site owner.

Validate VAT Number Every 3 Months

During subscription renewals, Chargebee validates your customer's VAT Number, if it was not validated in the last three months. If a VAT number is found to be INVALID, VAT is applied on the upcoming invoices.

UK VAT Exemption

There could be instances where a business customer does not have a valid VAT number, say when their sale is below the VAT threshold. In such cases, if you validate the customer as a legitimate business, Chargebee allows you to intervene manually and apply reverse charge - with or without a valid VAT number. You can do so while creating/editing the customer record, in the customer details page under Billing Address, or using the Update Billing Info option on the Action panel.

Under VAT settings, enable This is a business customer and select Enter the VAT Reg Number to specify the VAT number or select This customer does not have a VAT number. In either case, your customers from a different member state other than yours will be exempted from VAT. This is in keeping with the reverse charge mechanism and the appropriate note will be displayed in the invoice.

Note:

- "This customer is exempt from tax payment" overrides the VAT settings where you mark the customer as exempt from VAT. For example, when the customer is marked exempt from taxes, and again under VAT settings, you select This customer does not have a VAT number, taxes will not be applied and at the same time the invoice will not display the VAT Exemption (reverse charge) note.

- When you update the customers' VAT setting or remove their VAT number, a warning note will be displayed. You might make changes in the Chargebee UI or your customer might make changes from the Portal; in any case, the latest updated information will always be maintained for the VAT settings.

FAQ

1. How to enable VAT Number to be displayed in the Hosted Pages?

For a transaction to be considered B2B, a valid VAT number has to be provided by the customer. If you use Chargebee's hosted pages, enabling the VAT number option will display the VAT Number field in the checkout pages.

To enable VAT Number in the hosted pages, if you're using:

- Hosted Pages v2: Navigate to Settings > Configure Chargebee > Checkout & Portal > Field Configurations and enable the VAT Number field under the Tax Information section.

- Checkout Pages v3: Navigate to Settings > Configure Chargebee > Checkout & Portal > Fields > Billing and enable the VAT Number field.

2. How does Chargebee apply taxes when Shipping & Billing addresses are present? Chargebee calculates the taxes based on the country.

Non-Digital: If the shipping address is available for the subscription, then it looks for the country code in the address to calculate the taxes. If the country code is unavailable then taxes will not be calculated. If the shipping address is not available for the subscription, then it looks for the country code in the billing address to calculate the taxes. If the country code is unavailable in the billing address then taxes will not be calculated.

Digital: In this case the country code in the Billing address will be considered. If the country code is unavailable then taxes will not be calculated. The shipping address will not be considered for tax calculation.

3. Can I change the Tax Exclusive/Inclusive settings?

Yes, you can change the Price type, i.e., whether the prices shown during Checkout should be Tax Exclusive or Inclusive.

4. What is the difference between VAT MOSS and non-MOSS registered merchants?

-

VAT MOSS Registered Merchants: If you have registered for VAT MOSS you will need to enter the VAT MOSS registration number. Chargebee will apply destination based tax for VAT MOSS registered businesses, i.e., the VAT rate of the EU Member State where the sale is made to, irrespective of the country you are registered in.

-

Non-VAT MOSS Registered Merchants: If you have not registered for VAT MOSS you will be given options to select the countries in which you have a presence and manually enter the VAT registration number for each country where you sell.

5. When is the Reverse Charge Mechanism applied?

As per the reverse charge mechanism, it is the responsibility of the customer, rather than you(the supplier), to account to HMRC for VAT on supplies of certain goods or services. In order to comply with VAT regulations, Chargebee applies the reverse charge mechanism when the customer record possesses a valid VAT number (indicating that you are transacting with a business).

-

If you are selling physical goods from the UK to other businesses within the EU countries, 0% VAT is applied on reverse charge basis and the reverse charge note gets displayed in the invoice.

-

If you are selling physical goods into the UK from other EU countries, when you have registered for UK VAT and configured UK as a tax region in Chargebee, 0% VAT is applied on reverse charge basis and the reverse charge note gets displayed in the invoice.

6. How does Chargebee differentiate between a B2B and B2C transaction?

VAT numbers are used to distinguish between your individual customers and your business customers.

- If you are selling to a buyer without a VAT number, the transaction is considered a B2C transaction and the buyer is considered an individual/consumer.

- If you are selling to a buyer with a valid VAT number, on the other hand, the transaction is considered B2B and the buyer is treated as a business.

7. How does Chargebee handle location validation when there are multiple payment methods for a customer?

If there are multiple payment methods present against a customer, Chargebee will follow this protocol:

Chargebee will use the customer's IP address to retrieve the physical address of the customer. It will then attempt to verify the physical address with the customer's billing address.

If the country of the physical address (retrieved via the IP addresses) matches the country in the billing address that the customer has provided, the customer's location will be marked as VALID.

If the IP addresses of the customer cannot be captured, Chargebee will attempt to verify the location of the customer by matching the issuing country (of the payment methods added) with the billing address.

If the issuing country of any of the customer's payment methods match the billing address, the customer's location will be marked as VALID.

If the above fails, the customer's location will be marked as INVALID.

Information

- If the customer's billing address is changed, Chargebee will perform its validation checks again. If the recorded IP address information doesn't match the new billing address, the customer's location will be marked INVALID and you will be notified.

- Chargebee performs its location validation at the time of a charge. A customer's location will not be marked as VALID/INVALID when they sign up for a trial plan or if their payment is not charged on sign-up. Upon charging the card, Chargebee will verify the location of the customer and attempt to collect the payment. The payment will fail if the customer's location validation fails.

Was this article helpful?