Handling Chargebacks and Late Payment Failures in Chargebee

This article explains why certain chargebacks, especially for Direct Debit payments processed through gateways like Mollie and Adyen, may not be automatically marked as chargebacks in Chargebee.

In such cases, while the payment may be reversed and the invoice updated to Not Paid, the subscription remains active, and no chargeback notification or dunning workflow is triggered.

We'll also clarify how to distinguish true chargebacks from late payment failures, and guide you on configuring Chargebee to better manage these events through dunning and notifications.

Understanding Late Payment Failures

Not all gateway-reported chargebacks are genuine chargebacks. Some are actually late payment failures, which occur when a previously successful Direct Debit payment later fails due to:

- Insufficient funds

- A closed or deactivated customer bank account

- Other unforeseen banking issues

This issue is primarily seen with Mollie SEPA and Adyen ACH/SEPA payment methods.

How Late Payment Failures Occur

When Chargebee requests a Direct Debit payment, the customer's bank may provide provisional approval within 5–7 days. However, the actual funds settlement happens later. If the transaction ultimately fails during this period, the initial "successful" status is reversed, and the payment is marked as failed.

How Gateways and Chargebee Handle These Failures

Different gateways handle late failures differently:

- Mollie SEPA and Adyen ACH/SEPA treat late failures as chargebacks, sending appropriate notifications to Chargebee.

- Chargebee reads the reason code in these notifications to determine whether it qualifies as a legitimate chargeback.

- Legitimate chargebacks are processed through Chargebee's chargeback system.

For Non-Legitimate Chargebacks or Late Payment Failures

When the failure does not qualify as a genuine chargeback:

- The original successful transaction is detached from the invoice.

- As a result, the invoice status is updated to Payment Due or Not Paid.

- A reversal transaction is automatically created to reflect the failed payment.

- A comment is added to both the invoice and associated transactions for traceability.

Example of System Comment:

Payment of $XX removed due to late failure against transaction parent_success_transaction_ID in gateway_name. Invoice moved to 'Not Paid' state.

Preventing and Managing Late Payment Failures

To stay proactive and ensure timely handling of these failures:

-

Enable Dunning for Direct Debit Payments:

To trigger email notifications for late payment failures, you must first activate dunning for Direct Debit payments in the Chargebee app:

a. Navigate to Settings > Configure Chargebee > Dunning for online/offline payments > Dunning for Direct Debit payments, and click Activate Dunning.

b. Customize your retry strategy as needed.

c. Reach out to Chargebee Support to enable late payment failure dunning feature for Direct Debit.

-

Enable Notifications for Late Payment Failures:

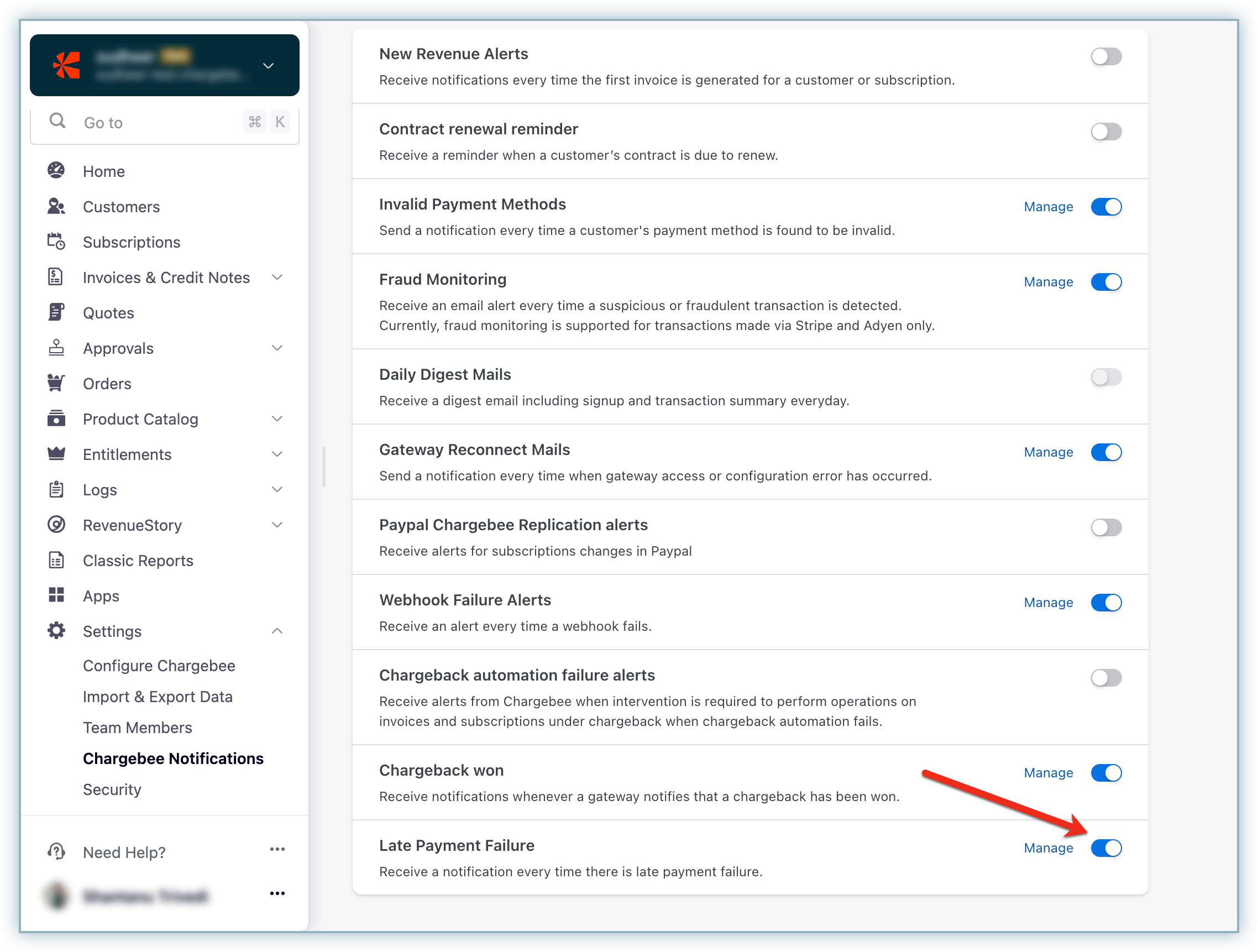

Set up alerts to notify your team when a late failure occurs. Follow these steps:

a. In the Chargebee Billing app, navigate to Settings > Chargebee Notifications. b. Enable Late Payment Failure and configure email or webhook notifications for internal teams.

Was this article helpful?