Advance Invoices

Some subscription models allow advance payments for a particular number of future terms in a subscription, a week or two before the subscription begins. This is to plan or budget for on-time shipping or accommodate a sudden hike in demand for a non-renewing subscription.

If you're running a business model that requires advance invoicing, this feature allows you to optimize your billing flow with advance invoices that work for you and your customers.

Note:

To know more, visit our plans and pricing page.

An advance invoice differs from a regular (single term) invoice by allowing you to collect payments for one or more terms in a subscription at one time. Here is a sample advance invoice that includes three billings terms in future, billed together:

Additionally, an advance invoice contains the following information:

- The dates specifying when each billed term begins and ends, so the duration of the future terms of the subscription paid for are clear.

- The next billing date, so your customer knows when they get charged next.

In addition to creating a single advance invoice for one or more terms in the future for a subscription, you can also set up an advance invoicing schedule to automate the generation of multiple advance invoices into the future for the subscription.

Request access to avail this feature.

Generating an Advance Invoice

You can generate an advance invoice for an existing subscription in your Chargebee site by following these steps:

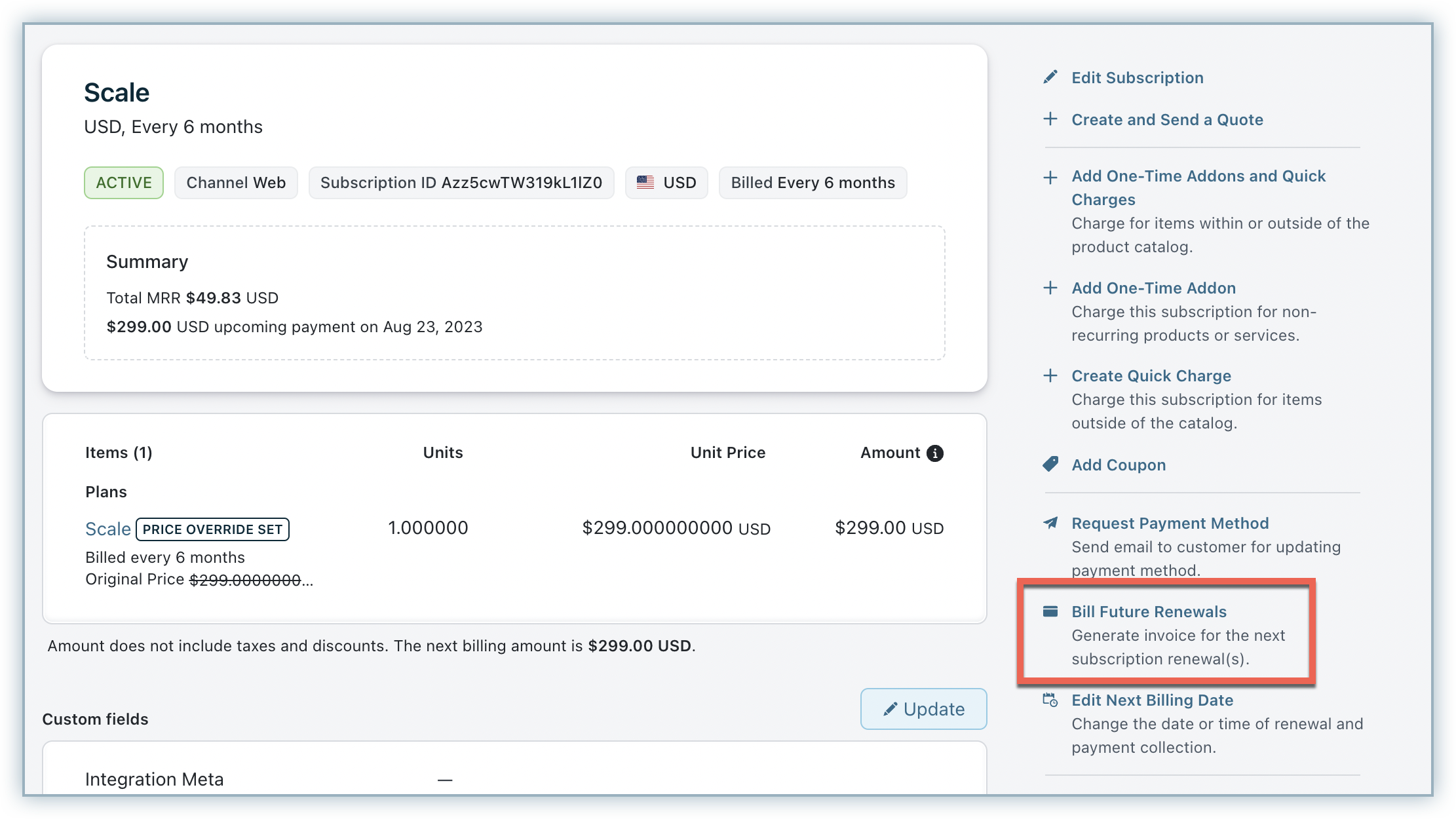

-

Navigate to the subscription details page and click Bill Future Renewals under the Actions tab.

-

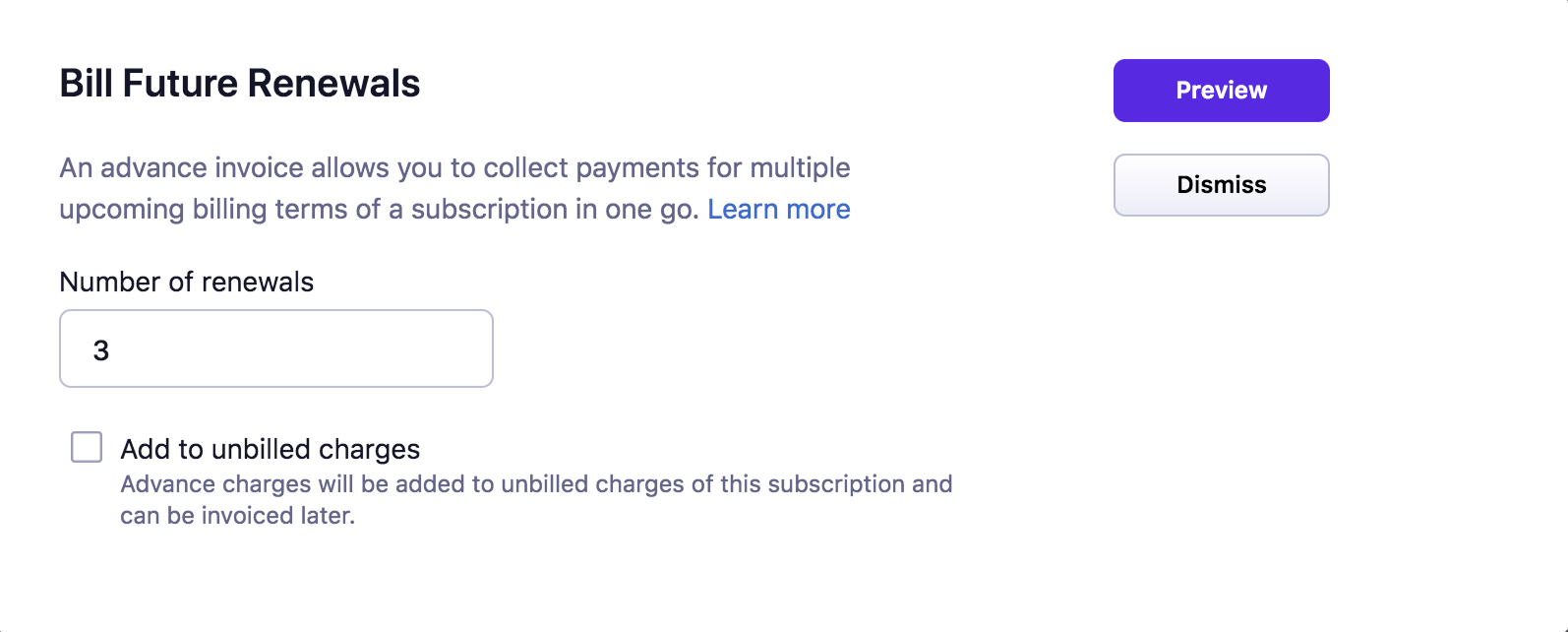

In the Bill Future Renewals dialog, specify the Number of Renewals that you would like to charge for. For example, if you are running a monthly subscription service and would like to bill your customer for the next three terms, enter ‘3' into the Number of Renewals field.

-

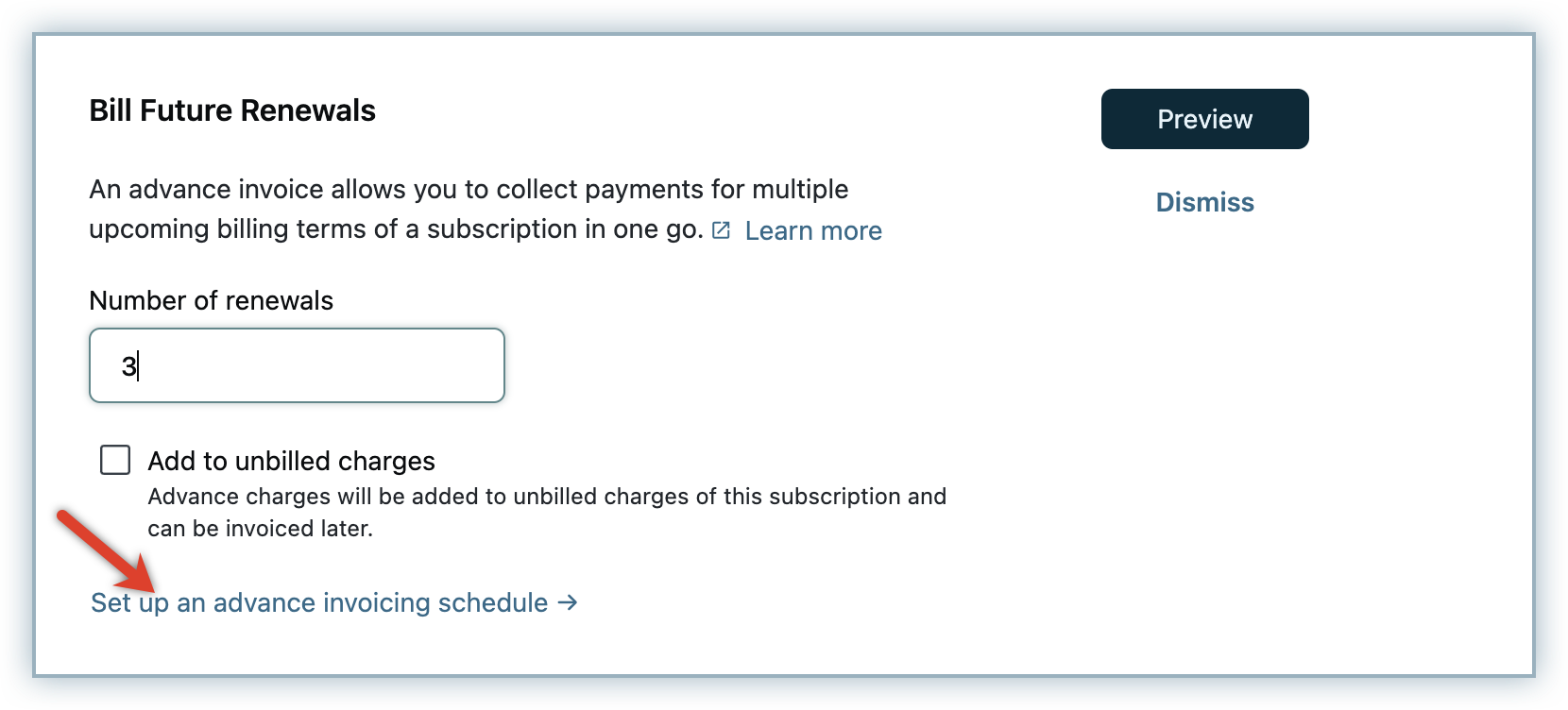

You can also optionally set up an Advance Invoicing Schedule to schedule automatic generation of advance invoices for further renewals in the future.

-

You can select Add to Unbilled Charges option, if unbilled charges are enabled for Advance Invoices. Instead of being invoiced immediately, the advance charges are added to unbilled charges and can be invoiced at a later point of time.

-

Click Preview Changes to review the terms, taxes, coupons in the invoice, and click Generate.

Raising an advance invoice for a specific number of terms in the future for a subscription allows your customer to pay for those terms in advance. However, when this term comes to an end and when you'd like to repeat the same advance invoicing, instead of keeping a manual reminder, you can set up an advance invoicing schedule for the subscription.

Setting up an Advance Invoicing Schedule

While generating an advance invoice for a subscription, you can optionally set up an advance invoicing schedule to schedule automatic generation of advance invoices for further renewals in the future for the subscription.

Note:

- Kindly contact support to avail this feature.

- Dunning for advance invoices should be configured for advance invoicing schedule to work properly. If dunning is not enabled and payment collected fails, the invoice does not get generated.

You can set up an advance invoicing schedule by following these steps:

-

Navigate to the subscription details page and click Bill Future Renewals under the Actions tab.

-

In the Bill Future Renewals dialog, click Set up advance invoicing schedule.

-

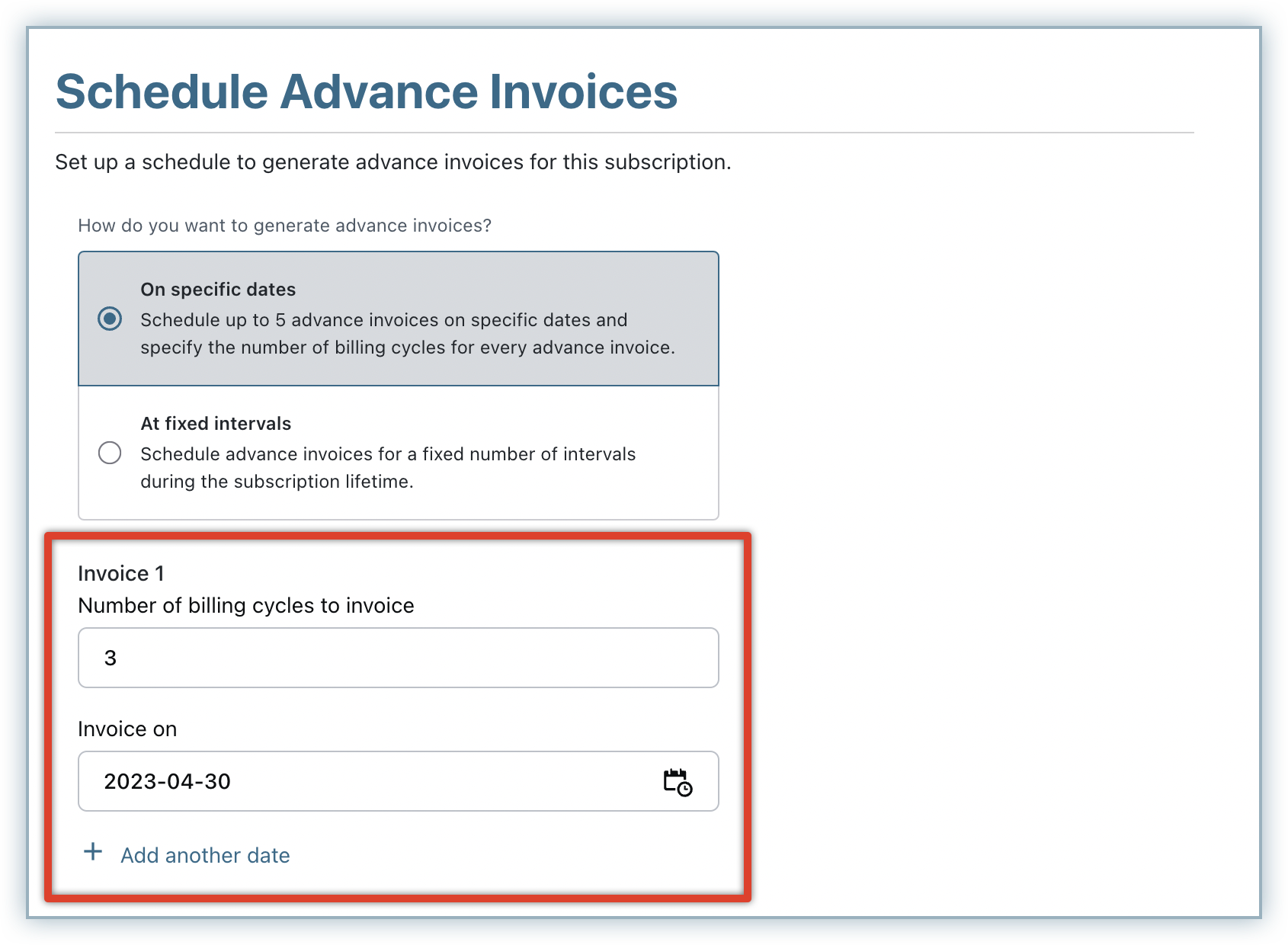

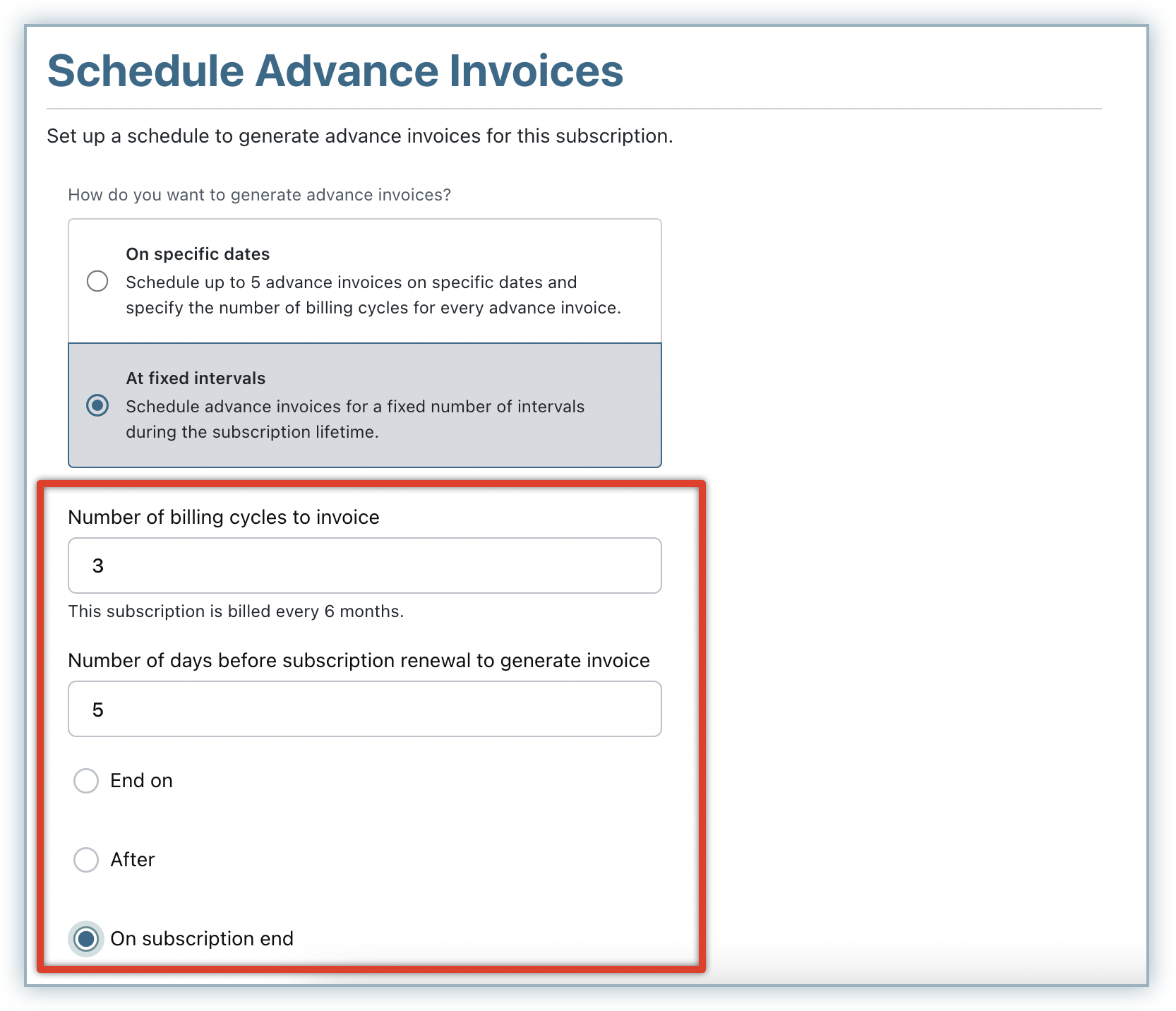

Under "How do you want to generate advance invoices?" you can select from the following options:

- On Specific Dates – You can schedule up to five advance invoices to be generated on specific dates by specifying the number of billing cycles to invoice and the invoice date for each invoice. You need to select a date range that falls after the latest renewal date and one day before the last renewal date for which the advance invoice is being raised.

- At a Fixed Interval – You can schedule future advance invoices to be generated at regular intervals during the subscription lifetime.

- Specify the Number of Billing Cycles to Invoice – The frequency of the advance invoice is based on the number of billing cycles that are invoiced each time through the subscription lifetime. For example, consider a subscription for a monthly plan with 12 billing cycles. If you specify the number of billing cycles to be invoiced in each advance invoice as 3, advance invoices are scheduled at a quarterly frequency. If you specify the number of billing cycles for each advance invoice as 5, three advance invoices are scheduled. The first two advance invoices are raised for 5 billing cycles each, and the 2 billing cycles that remain are adjusted in the final advance invoice that is scheduled.

- Specify the Number of Days Before Subscription Renewal to Generate Invoice – Specify the number of days in advance before the subscription renews when you want to generate the advance invoice. Based on the plan frequency, you can specify the number of days as follows:

- Weekly frequency – You can specify up to 5 days for a weekly frequency plan.

- Monthly frequency – You can specify up to 25 days for a monthly frequency plan.

- Yearly frequency – You can specify up to 363 days for a yearly frequency plan.

- When Do You Want to End This Schedule? – Select when you want to stop the advance invoicing schedule.

- End on – You can enter a specific date when the advance invoicing schedule will end.

- After – The advance invoicing schedule will automatically end after a specified number of occurrences.

- On subscription end – The schedule continues to generate advance invoices until the subscription ends.

- On Specific Dates – You can schedule up to five advance invoices to be generated on specific dates by specifying the number of billing cycles to invoice and the invoice date for each invoice. You need to select a date range that falls after the latest renewal date and one day before the last renewal date for which the advance invoice is being raised.

-

Click Proceed.

-

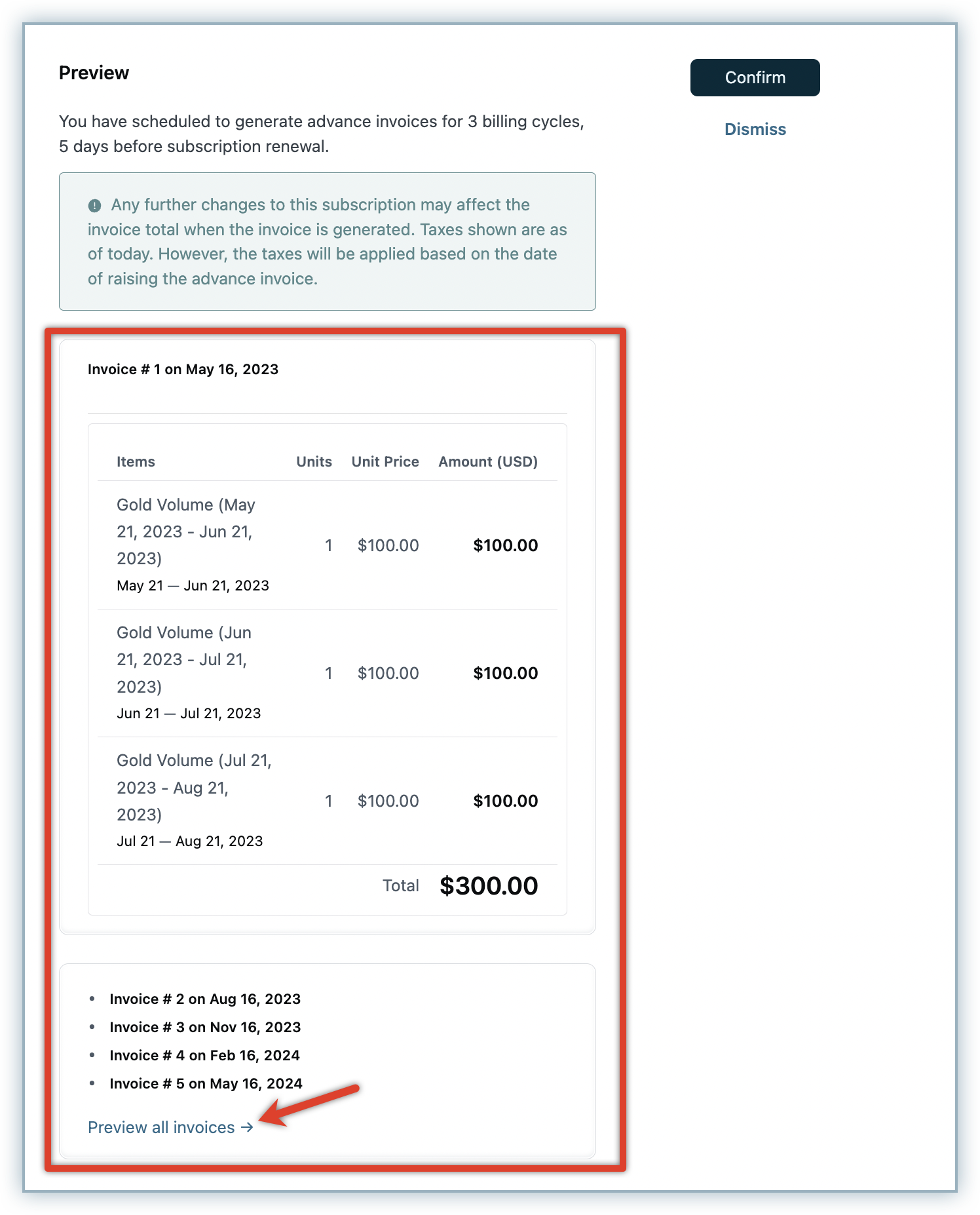

Click Preview all invoices to review the terms, taxes, and additional items (like coupons and addons) in each invoice and click Confirm.

Note:

- Although taxes are shown in preview, the actual taxes for the advance invoice are as per taxes applicable at the time of generating the invoice.

- Note that Advance invoicing and Calendar billing features do not function together.

- Dunning for advance invoices should be enabled before scheduling advance invoices.

Editing an Advance Invoicing Schedule

You can view the advance invoice that is generated in the respective subscription details page, along with the advance invoicing schedule (if configured) for the subscription.

You can edit the schedule anytime as required, by following these steps:

- In the subscription details page, click Edit Invoicing schedule.

- The popup displays the list of advance invoices that are scheduled for the subscription. You can click Edit.

- In the Edit Invoicing Schedule page, you can make necessary changes.

- Click Proceed and click Confirm to apply the changes to the schedule.

- You can Preview the updated invoicing schedule and click Generate.

Configuring Advance Invoice Settings

You can generate advance invoices for your subscriptions by default. To configure the behaviour of the advance invoices that you generate, follow these steps:

-

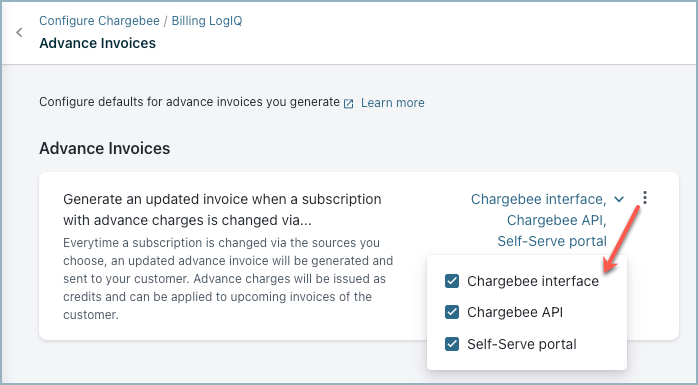

Click Settings > Configure Chargebee > Billing LogIQ > Billing & Invoices > Advance Invoices.

-

In the Advance invoices page, you can enable the setting to Generate an updated advance invoice when a subscription with advance charges is changed. You can select the sources in which when subscription changes are done, an updated advance invoice gets generated and sent to the customers. You can select one or more of the following sources:

- Chargebee Interface

- Chargebee API

- Self-serve portal

-

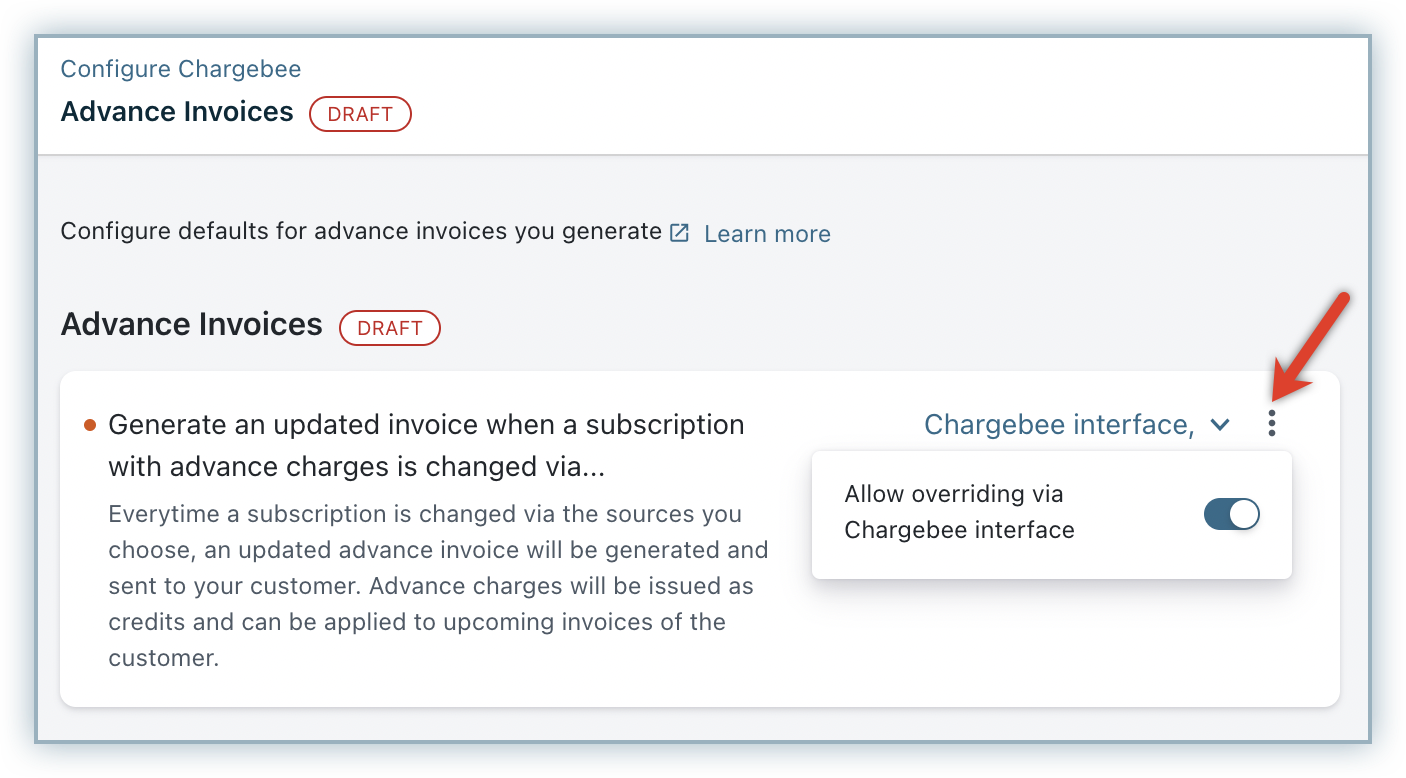

Additionally, you can click the ellipsis icon and select Allow overriding via Chargebee Interface. When overriding is allowed, users will be able to change the default setting at the subscription level.

-

If you have configured Calendar billing in your Chargebee site, you can enable the setting under Calendar Billing, to align your advance invoicing schedule with your calendar billing configuration.

-

Click Apply, review the changes that you have made, and click Confirm.

Subscription Changes and Advance Invoices

Subscription changes can be done via Chargebee's user interface, Chargebee API, or by your customers from the Self-Serve Portal. Changes made to a subscription with advance charges can have possible effects on one or all of the following:

- The advance invoice that has already been charged.

- The advance invoicing schedule.

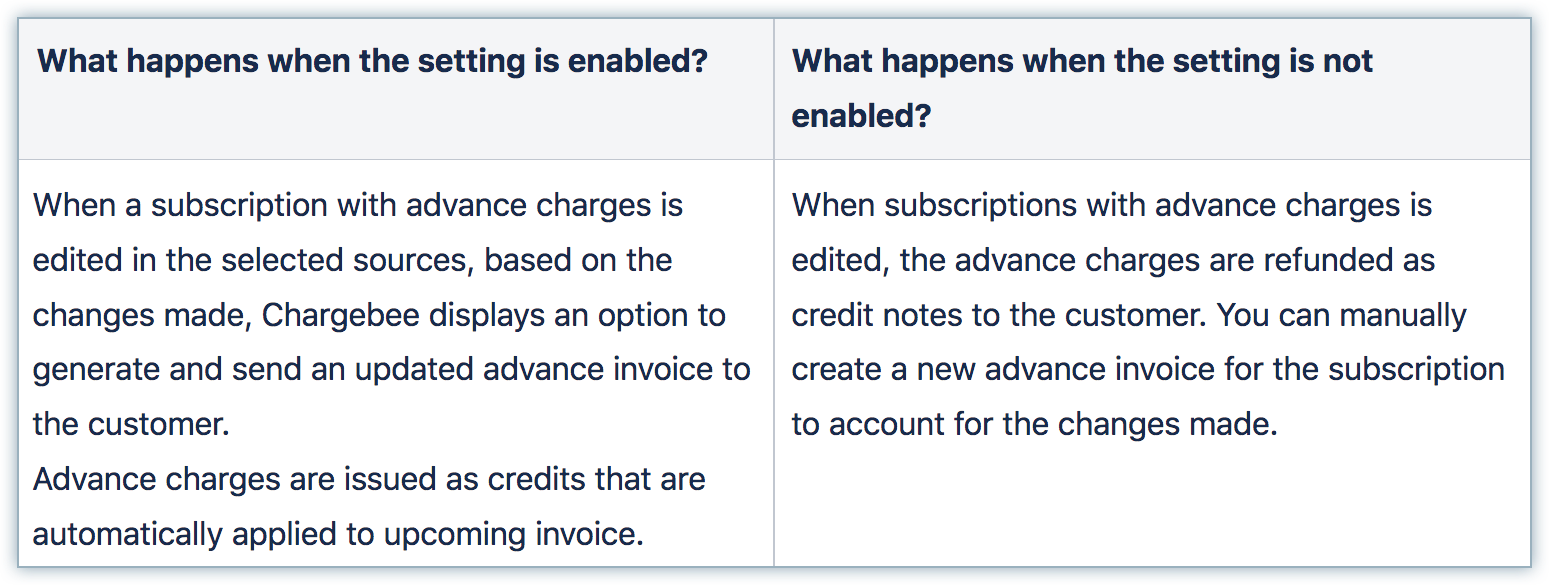

If you have enabled the necessary settings to generate an updated advance invoice when a subscription is edited, Chargebee gives you an option to generate an updated advance invoice along with the subscription changes.

When you select yes, an updated advance invoice gets generated that includes the current term charges raised from the subscription changes and updated advance invoice charges. The credits are automatically applied on this invoice.

If the subscription has an advance invoicing scheduled, the schedule is removed or retained based on the subscription changes as follows:

- The schedule is removed if the billing frequency, or next billing date is changed.

- The schedule is not removed, when the plan/addon quantity or price is changed. Chargebee displays an option to update the advance invoice as per the setting.

When the subscription with advance charges is paused, the advance charges are issued as credits to the customer and the advance invoicing schedule (if applicable) gets removed.

When the subscription with advance charges is cancelled, the advance charges are issued as credits to the customer at the time of subscription cancellation and the advance invoicing schedule (if applicable) is removed immediately. However, if the subscription cancellation is scheduled for future, the advance charges for the billing cycle that fall beyond the scheduled cancellation are issued as credits. The invoicing schedule that falls after the subscription cancellation gets removed. However, the advance invoicing schedule that falls until the scheduled cancellation remains undisturbed.

Following is an example to understand how subscription cancellation impacts the advance invoice schedule:

Example

Consider a monthly subscription that is set to renew at the beginning of every month.

On the 10th of January, you generate an advance invoice(for billing cycles of February, March, and April) along with creating a quarterly advance invoicing schedule. Advance invoices are scheduled to be generated every once in three months.

- Advance Invoice #1 (on the 10th of January) - February, March, and April.

- Advance Invoice #2 (1st of May) - May, June, and July.

- Advance Invoice #3 (1st of August) - August, September, and October.

- Advance Invoice #4 (1st of November) - November, December, January; and so on.

When the subscription is cancelled on the 15th of May, effective immediately, the advance changes raised via the advance invoice for May, June and July are issued as credits to the customer at the time of cancellation, and the schedule is removed immediately.

If in the month of May, the subscription is scheduled for cancellation starting November 20th, the advance invoicing schedule from November gets removed. The advance invoices are raised until the 1st of August as per schedule. At the time of actual cancellation, on November 20th, the advance invoicing schedule is removed.

If the setting is disabled to generate an updated invoice when a subscription is changed, the advance charges are refunded as credit notes to the customer. You can manually create a new advance invoice for the subscription to account for the changes made.

The following table displays the impact of all subscription change scenarios on the advance invoice and advance invoicing schedule of the subscription:

Note:

Removing unbilled charges for advance invoice terms:

While removing unbilled charges of a subscription for advance invoice terms, the unbilled charges of the succeeding terms get removed automatically, while the unbilled charges of the preceding months remain.

Consolidated Invoicing for Advance Invoices

A single customer may subscribe to two or more of your products/services through multiple subscriptions. Instead of raising and sending multiple invoices for each subscription to the same customer, you can consolidate all the charges in a single invoice by enabling consolidated invoicing feature in Chargebee.

When you have enabled consolidated invoicing in your Chargebee site, the advance invoices raised against multiple subscriptions for the same customer can be consolidated into a single invoice (provided, the subscriptions and the unbilled charges meet the invoice consolidation prerequisites).

Unbilled Charges for Advance Invoices

Chargebee allows you to configure unbilled charges for advance invoices. To enable unbilled charges for advance invoices in your site, follow these steps:

- Click Settings > Configure Chargebee > Unbilled Charges.

- You can select either invoice immediately or add them to unbilled charges for when advance charges are created.

- Click Apply > Confirm to save your changes.

Users can choose to override these default settings while creating charges on the Chargebee interface. However, if you wish to prevent them from doing so, click the ellipsis icon and disable the Allow overriding via Chargebee interface toggle.

Dunning for Advance Invoices

Note:

Dunning for advance invoices should be configured for advance invoicing schedule to work properly. If dunning is not enabled and payment collection fails, the invoice does not get generated.

To enable dunning for advance invoices in your Chargebee site, follow these steps:

- Click Settings > Configure Chargebee > Dunning for Online/Offline Payments > Dunning for cards, e-wallet payments.

- Dunning for advance invoices: Enabling this option starts dunning for advance invoices.

- When the terms in the advance invoice are in progress, then the final action mentioned in ‘' are carried out.

- However if the terms in the advance invoice have not started as yet, the subscription does not get cancelled (even if set to cancel in the dunning process). Instead, a cancellation is scheduled for the end of the current term and the full amount gets refunded as a credit note. If the payment has not been collected as yet, an adjustment credit note is created. If the payment has been partially collected, the amount that has been collected is refunded as a refundable credit note, while the reminder is refunded as an adjustment credit note.

Note:

- Advance invoicing is not supported for Dunning v1 users.

- When advance charges are added to unbilled charges, they follow the normal dunning rules and are not considered for advance invoice dunning rules.

FAQ

1. If an advance invoice was generated incorrectly, how do I modify it?

You cannot modify an advance invoice that was generated already. However, you can ‘Void' the invoice and generate a new one. However, if you have already collected payments against the invoice, make sure to remove the payment before voiding the invoice.

2. What date appears on the advance invoice? The advance invoice will carry the date that it was generated on. The invoice line items will have the period for which it has been charged. For example, If you have a monthly subscription that renews itself on the 22nd of every month, an advance invoice for the next two months created on the 22nd of Feb will contain two line items: Silver Plan for the billing period of 22nd March to 22nd April, and Silver Plan for the billing period of 22nd April to 22nd May. The Invoice date will be the 22nd of Feb.

3. How are coupons applied?

If you have configured coupons that are applicable to the subscription, for which the advance invoice has been created, they will be applied automatically. Note that they will be applied as they are usually - per term.

Example

If you are charging a customer for the next three terms with your advance invoice and you have a coupon for $10 dollars applicable to each term, a coupon amount of $30 will be applied to the advance invoice.

One time coupons - One time coupons are applied only if they are valid at the time you are creating the advance invoice for the subscription. If a one-time coupon is valid, it will be applied to the total amount in the advance invoice and will not be applied per term.

Example

If you are charging the customer for the next four terms (where one term costs $100) and you have a one time coupon of $50 that is valid at the time you are creating the advance invoice, a coupon amount of $50 will be applied to the total amount of $400.

Limited period coupons - A limited period coupon is applied to an advance invoice only if it is valid for the entire duration of the terms specified in the invoice.

Example

An advance invoice is created against a subscription for the next five terms, where one term is one month that is, five months. If a limited period coupon is valid for an amount of time less than five months from the generation of the invoice, it will not be applied to the final invoice amount. If a limited period coupon is valid for an amount of time that is greater than five months from the generation of the invoice, it will be applied based on the discount type.

The following table captures coupon applicability for advance invoices, based on their validity:

| Coupon Value | Coupon Validity | Duration of the advance invoice (5 terms) | Will the coupon be applied to the advance invoice? |

|---|---|---|---|

| $50 | The next 3 months | The next 5 months | No |

| $65 | The next 12 months | The next 5 months | Yes |

Was this article helpful?