You are viewing:

Product Catalog 1.0

How to configure Reverse Charge?

Scope

Does Reverse charge support transactions within the country?

What are the countries that support the Reverse charge mechanism?

Summary

A reverse charge is a tax mechanism where the liability to pay taxes falls upon your customer - the buyer of your products or services, and not on you - the supplier. The reverse charge mechanism is applicable in various countries and based on your requirements, you can configure to collect reverse charges from customers in specific countries.

Chargebee applies the reverse charge mechanism only when:

- The customer is from a country that is different from the country specified in your organization's address.

- The customer is from a country you have configured to collect reverse charges.

Solution

To enable Reverse Charge for customers of specific countries in your Chargebee site, follow these steps:

-

Click Settings > Configure Chargebee > Taxes.

-

On the Configure Taxes page, click Add Region and select the country from the drop-down list.

-

Enable the setting Reverse Charge.

- Reverse charge is supported only in cases of cross-border transactions and is not supported for domestic transactions on Chargebee manual taxation. Chargebee only checks whether the country of the buyer and the supplier are different. So even if there's a tax registration number in the buyer's country, reverse charges will be applied

- In the case of third-party tax integrations, if the tax provider categorizes a transaction for a reverse charge, the same will be applied irrespective of the configuration

- You can also enable the setting to Show note on reverse charge to display a note on invoices when the reverse charge is applied. The Reverse charge note is a common feature applicable for both Chargebee taxes and third-party taxes.

-

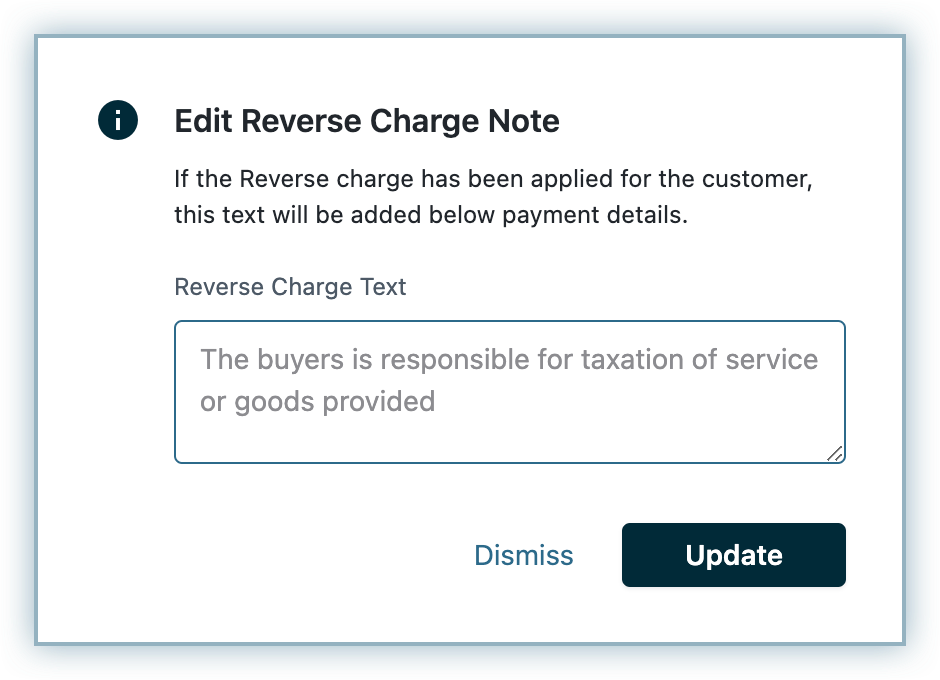

Click Edit Note to modify the default note message for reverse charge.

-

On the Edit Reverse Charge Note popup, type your new message and click Update.

You have successfully enabled the setting to apply reverse charges for the country.

- For certain countries like Australia and India, this setting will be enabled by default.

- However, for most countries, it will be disabled by default, and you need to manually enable the setting

- For the European Union(EU) and the United Kingdom(UK), you can only edit the reverse charge note but whether or not to display a VAT exemption note for the reverse charge is not customizable

When a subscription is created for a customer from a different country than your organization address for which you have configured to collect reverse charge, tax is not applied on the invoice, and the Reverse Charge note gets displayed.

Was this article helpful?