You are viewing:

Product Catalog 2.0

EBANX

EBANX is a payment gateway and financial technology company that focuses on facilitating local payments for businesses operating in Latin America. As a payment gateway, EBANX provides a range of services to enable international merchants to accept payments from customers in Latin American countries.

A key benefit of EBANX is its capability to enable businesses to accept and process payments within Latin America locally, rather than as cross-border transactions, without the need to establish a local entity in Latin American markets. By utilizing a domestic processor, businesses can potentially achieve higher payment authorization rates, minimize payment failures, and save on processing and international fees. Moreover, this approach eliminates the expenses associated with setting up and maintaining a local entity solely for local payment processing purposes.

Supported countries and currencies

This integration between EBANX and Chargebee supports the following countries and their currencies:

| Country | Currency | Country | Currency | Country | Currency |

|---|---|---|---|---|---|

| Argentina | ARS (Peso) | Bolivia | BOB (Boliviano) | Brazil | BRL (Real) |

| Chile | CLP (Peso) | Colombia | COP (Peso) | Costa Rica | CRC (Costa Rican Colon) |

| Dominican Republic | DOP (Peso) | Ecuador | USD (Dollar) | El Salvador | USD (Dollar) |

| Guatemala | GTQ (Quetzal) | Mexico | MXN (Peso) | Panama | PAB (Balboa) |

| Paraguay | PYG (Guarani) | Peru | PEN (Nuevo Sol) | Uruguay | UYU (Peso) |

Supported local card schemes

In addition to supporting major global card schemes like Visa and Mastercard, this integration extends its capabilities to include popular local card schemes across Latin America. This expansion enhances your regional presence, granting access to a broader customer demographic. Notable schemes included in this integration are Elo and Hipercard in Brazil, along with others such as CMR_FALABELLA, ARGENCARD, and CENCOSUD, providing comprehensive coverage across the region's diverse payment landscape.

Integration options

Chargebee offers the following options to integrate with EBANX:

- Chargebee hosted pages

- Chargebee API + EBANX

- Chargebee.js

- EBANX.js + Chargebee API

Review the table below for additional information:

| Integration Method | Description | PCI Requirements |

|---|---|---|

| Chargebee Hosted PagesNOTE: HPv3 is supported. | In this method, the card information of the customers are collected by Chargebee's checkout and directly passed on to EBANX. | Low(Your PCI compliance requirements are greatly reduced due to usage of Chargebee's checkout) |

| Chargebee API + EBANX Gateway | In this method, collecting card information should be handled at your end and passed on to Chargebee via the API. Chargebee will route this card information directly to EBANX. | High(card information will be collected by you directly, you will have to take care of PCI Compliance requirements) |

| Chargebee JS | Raw card detailsYou will collect raw card details via your custom checkout and pass them to Chargebee.js 3DS Helper to conduct 3DS flow. However, this will need you to ensure PCI compliance. | High(card information will be collected by you directly, you will have to take care of PCI Compliance requirements) |

| Chargebee JS (Chargebee Components and Fields) | In this method, the card information of the customers are collected by Chargebee's components and fields and tokenized with Ebanx. | Low(Your PCI compliance requirements are greatly reduced due to usage of Chargebee's components and fields) |

| EBANX.js + Chargebee API | Using **EBANX's Web Components+Chargebee.js.**Collect Card details using EBANX's hosted fields and tokenize using Chargebee.js. | Low |

Note:

- Currently, EBANX supports 3DS authentication exclusively for credit cards issued within Mexico. As a result, this integration facilitates 3DS authentication solely for credit cards issued in Mexico.

- This integration does not support debit cards.

Retrieve Information from your EBANX Account

Follow the steps below to fetch the information that you will be required to enter during your gateway configuration in your Chargebee site:

-

Login to your EBANX account.

-

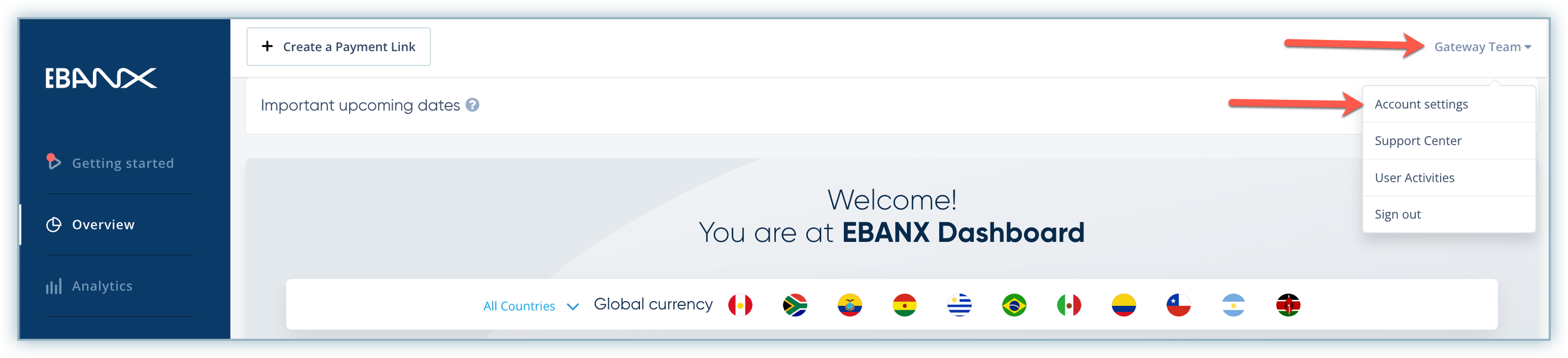

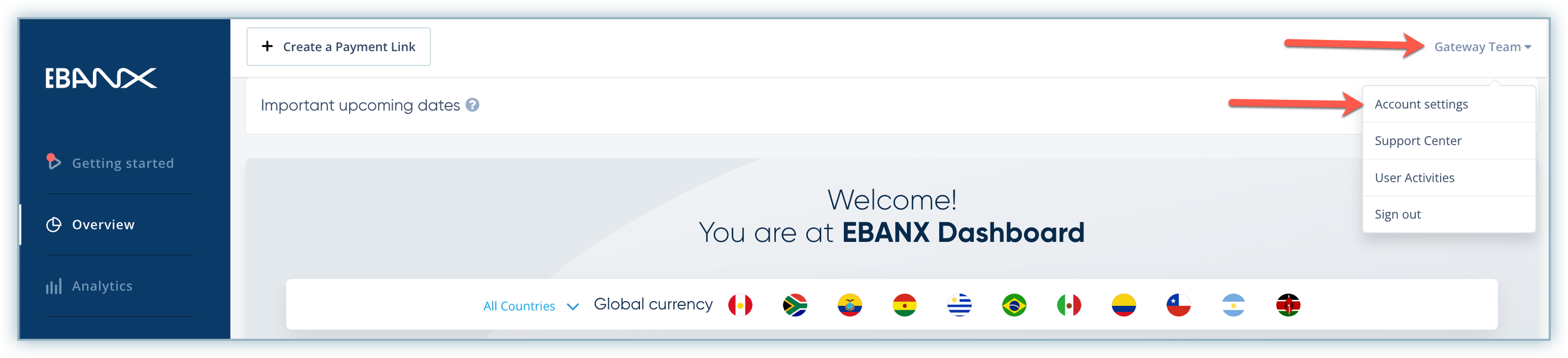

Click on your profile name to expand the drop-down menu, and click Account Settings.

-

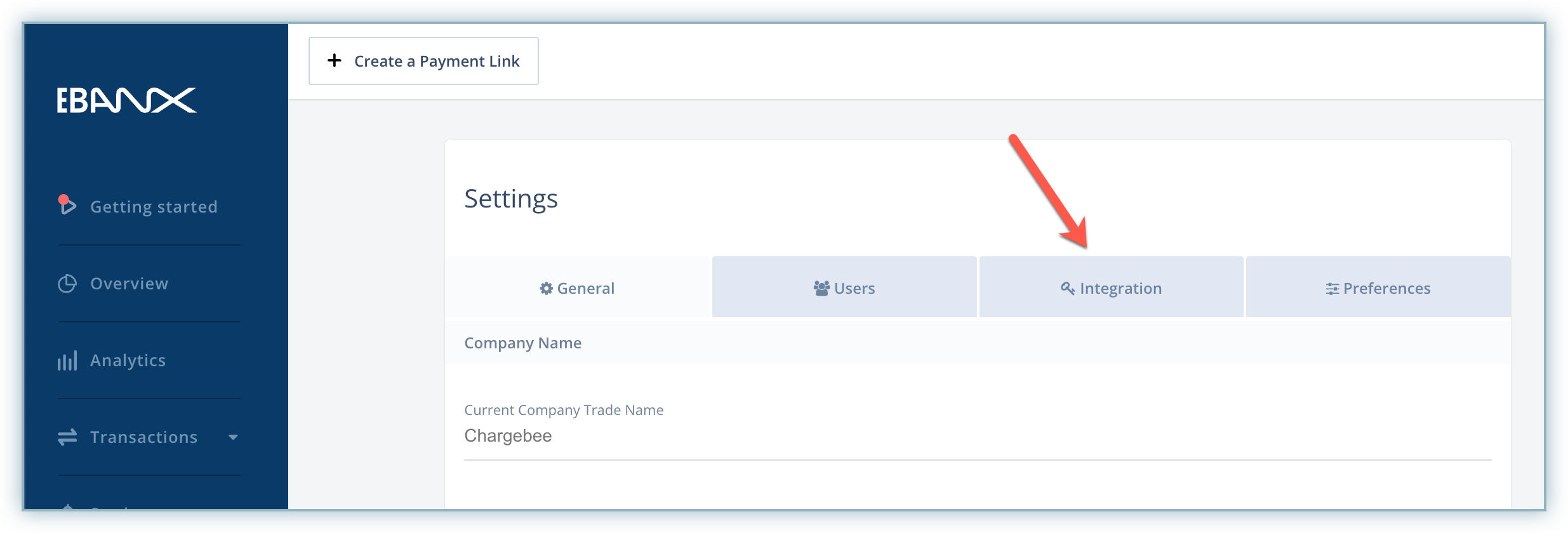

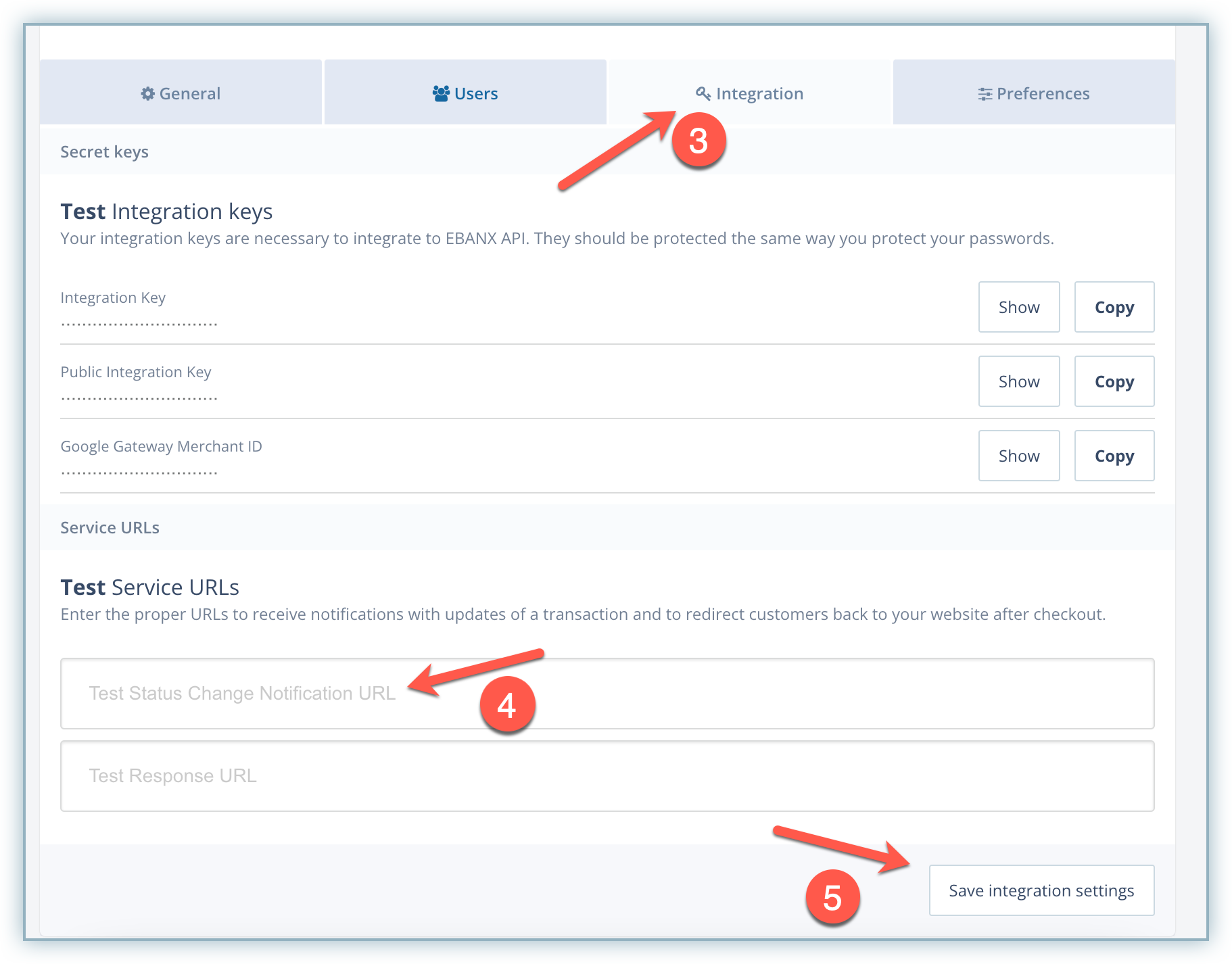

Select the Integration tab on the Settings page.

-

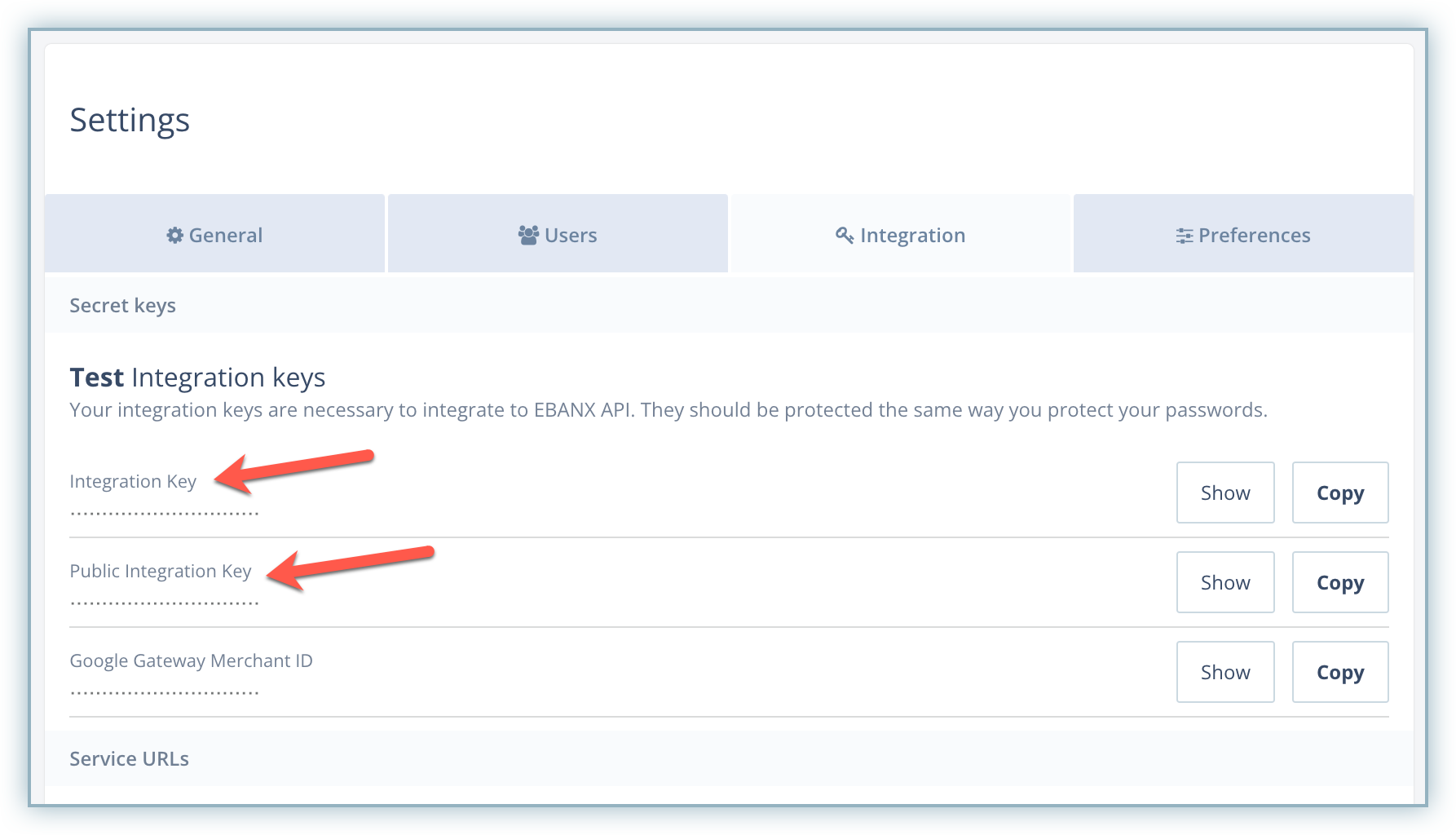

Copy the Integration Key and Public Integration Key under the Test Integration Keys section. Save these for future use during the gateway configuration in your Chargebee site.

Configure EBANX in your Chargebee Site

Follow the steps below to add and configure EBANX as a gateway in your Chargebee site:

-

Login to your Chargebee site.

-

Go to Settings > Configure Chargebee > Payment Gateways.

-

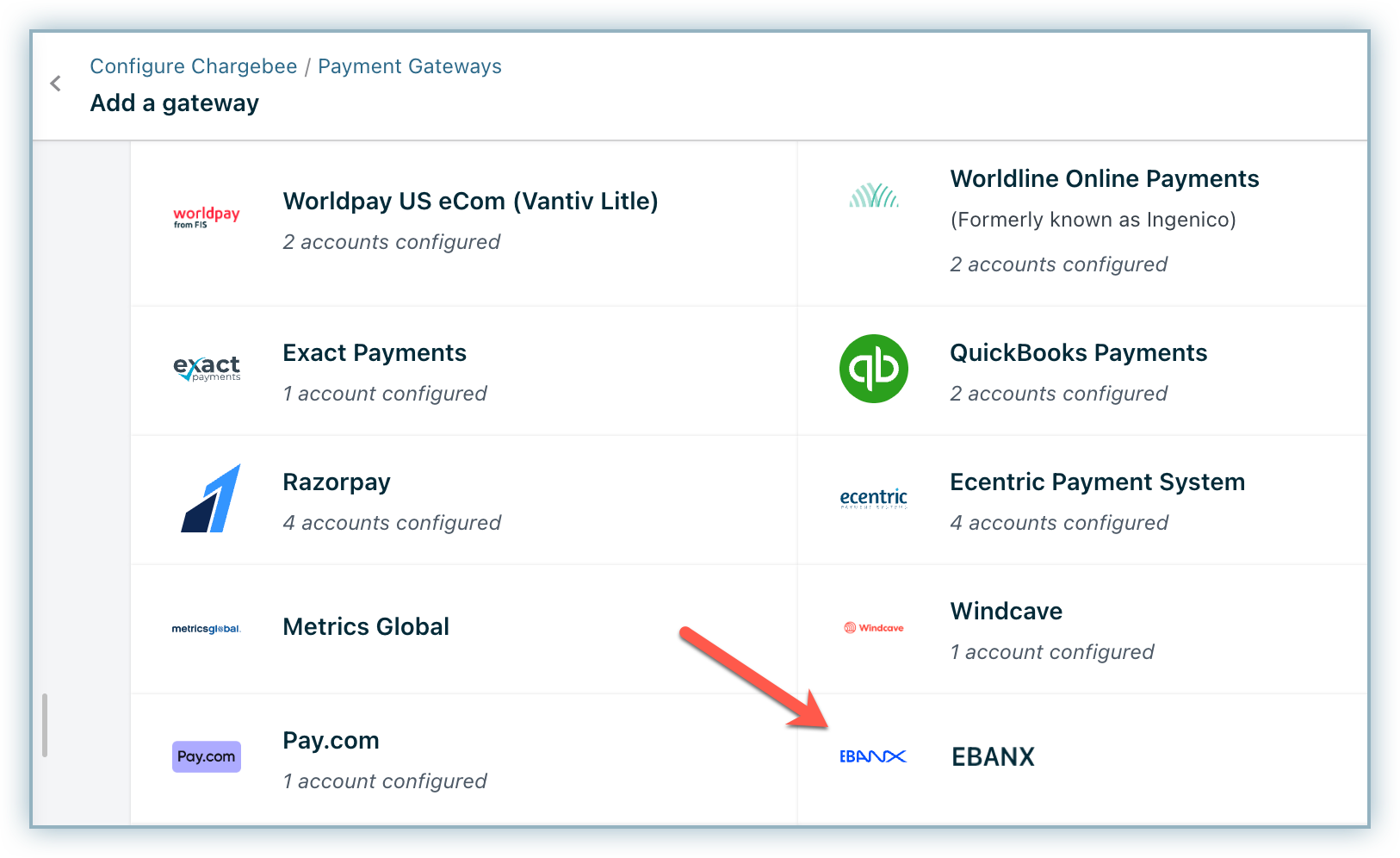

Click the Add Gateway button in the top right corner and select EBANX from the list of gateways.

-

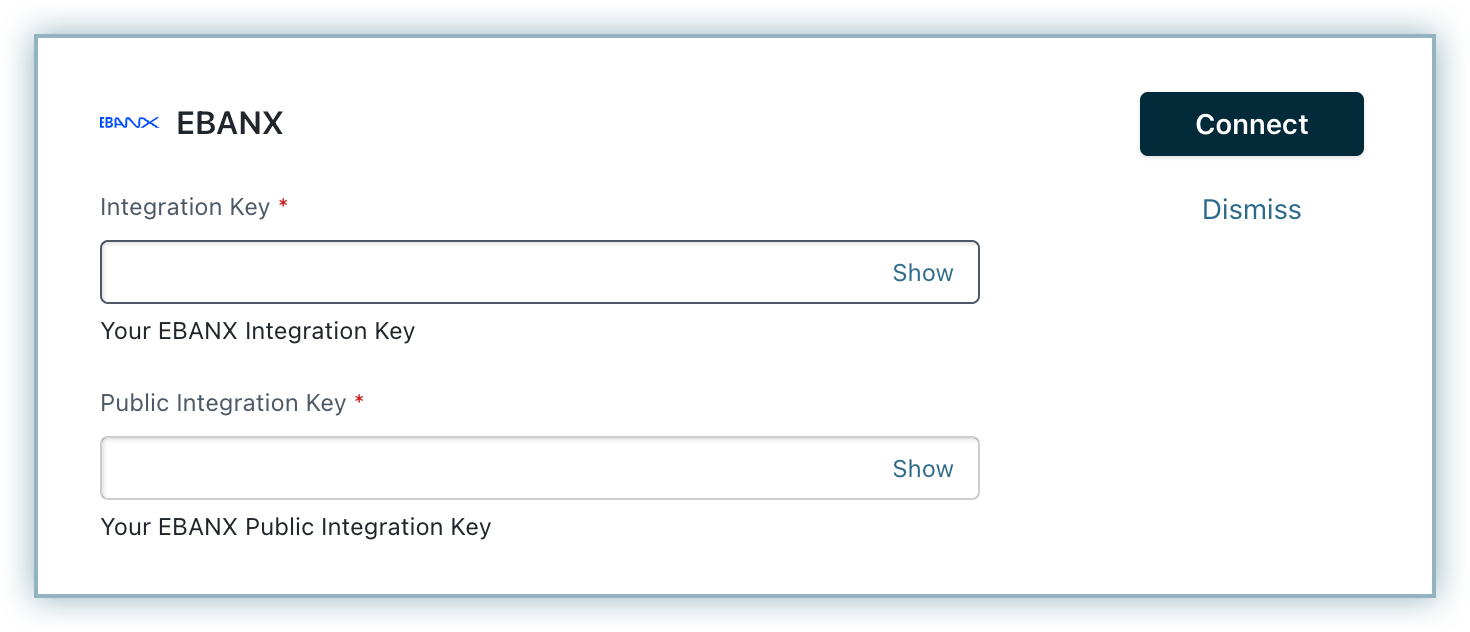

Enter the Integration Key and Public Integration Key in the dedicated fields as copied from your EBANX account.

-

Click Connect. EBANX will be added to your account successfully if the added credentials are correct.

-

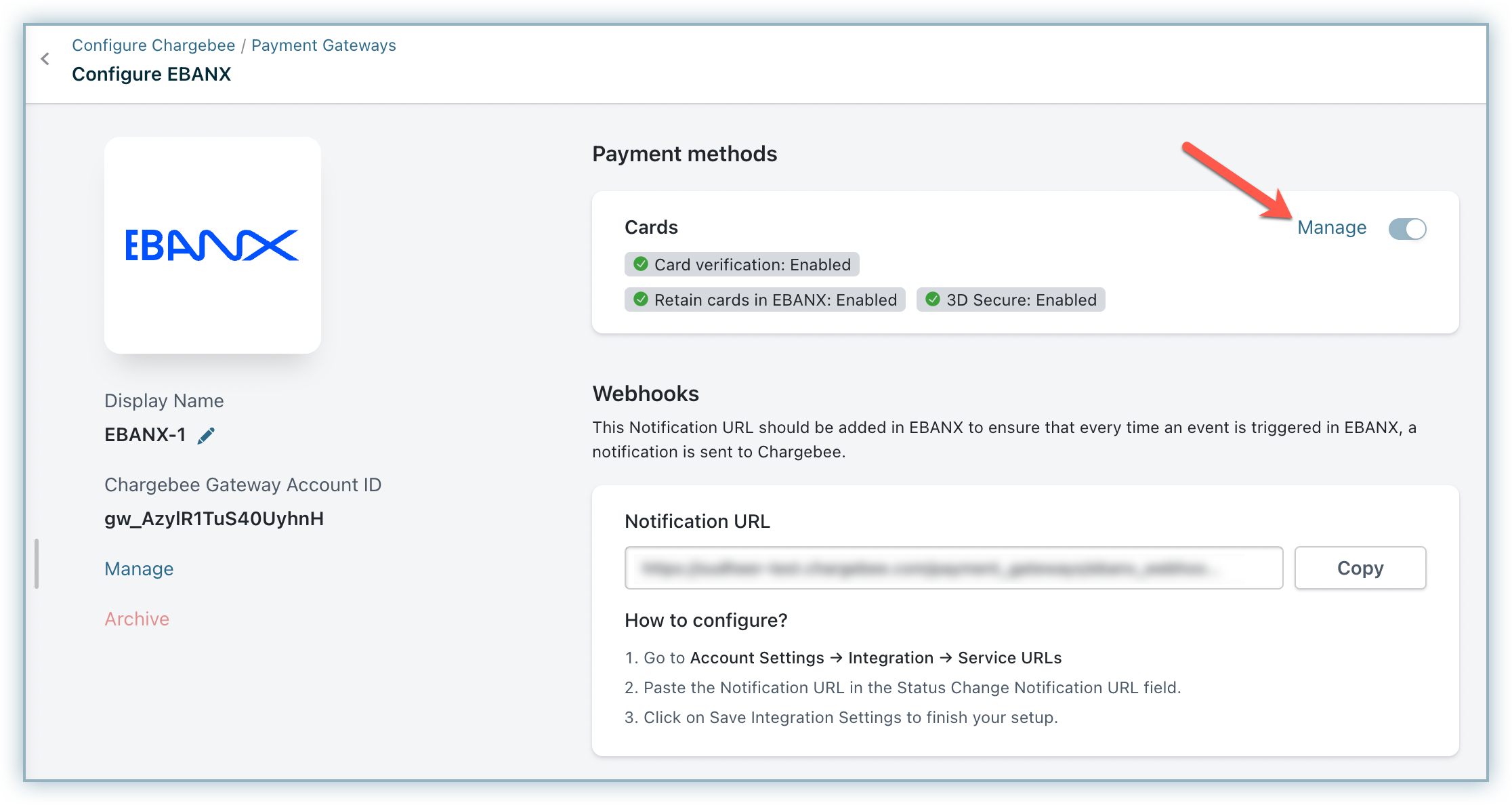

Click Manage to set up card-related settings on the Configure EBANX page.

-

Enable the following as per your requirements:

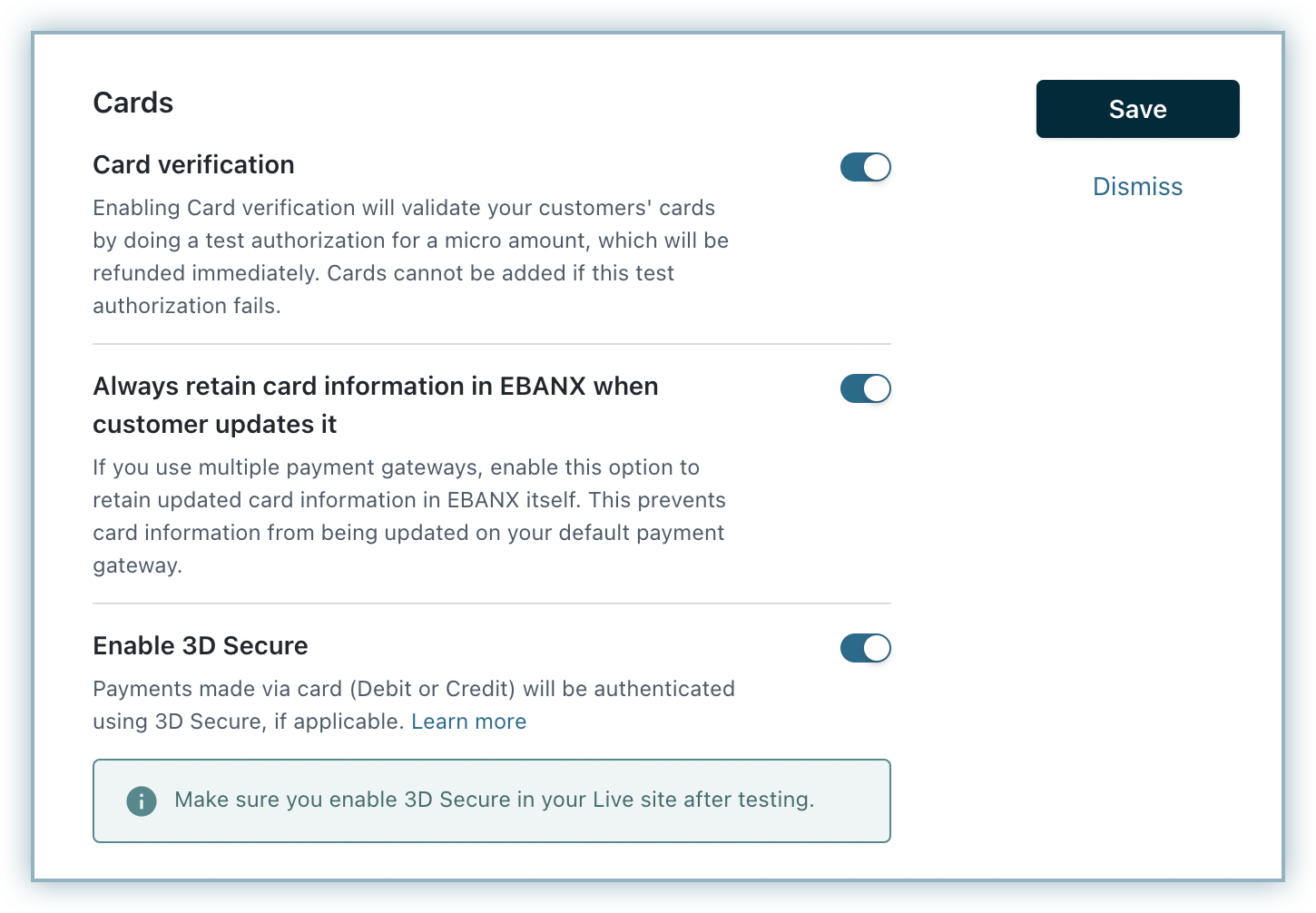

- Card Verification: Enable this option if you wish to allow verification while the customer is adding a card.

- Always retain card information in EBANX when customer updates it: This option determines where updated cards will be vaulted for existing customers when using multiple gateways. Enable to retain cards in EBANX, even if smart routing is updated to a new gateway. Disable to gradually migrate customers to the new gateway as they update their cards. Learn more.

- Enable 3D Secure: Enable this option if you wish to enable authentication for payments made via cards.

-

Click Save and then click Apply on the Configure EBANX page.

Configure Webhooks

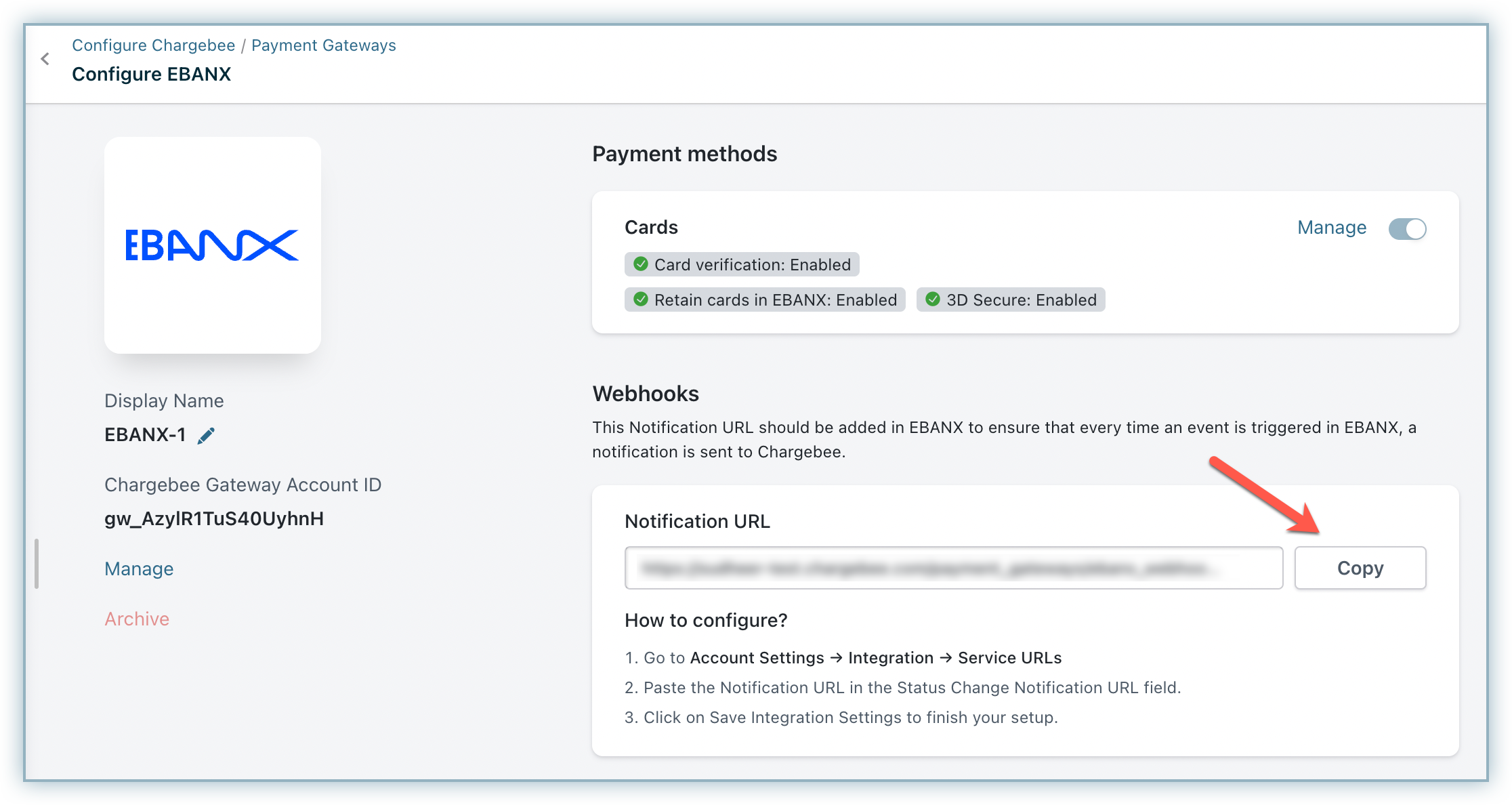

Webhooks are indispensable when it comes to integrating Chargebee with EBANX as they pass crucial payment information such as payment status, based on which users can take action. Webhooks in this integration should be configured manually. In this integration, the webhooks are used for information regarding refunds and chargebacks.

Follow these steps to configure Webhooks:

-

Copy the Notification URL from the Configure EBANX page in your Chargebee site.

-

Move to your EBANX account, click on your profile name to expand the drop-down menu, and click Account Settings.

-

Select the Integration tab on the Settings page.

-

Paste the Notification URL copied from your Chargebee site into the Test Status Change Notification URL field under the Test Service URLs section.

-

Click Save Integration Settings.

Fraud Management

Chargebee supports the use of EBANX Device Fingerprint as the Device ID for fraud management. This Device ID is linked to the payment. Anti-fraud tools utilize this information to detect potential fraud attempts. Learn more about Device Fingerprint by EBANX.

This feature is supported if you are using the following integration options:

Additional mandatory settings

EBANX integration requires the following information, especially in the Latin American region:

- Customer Email ID is mandatory.

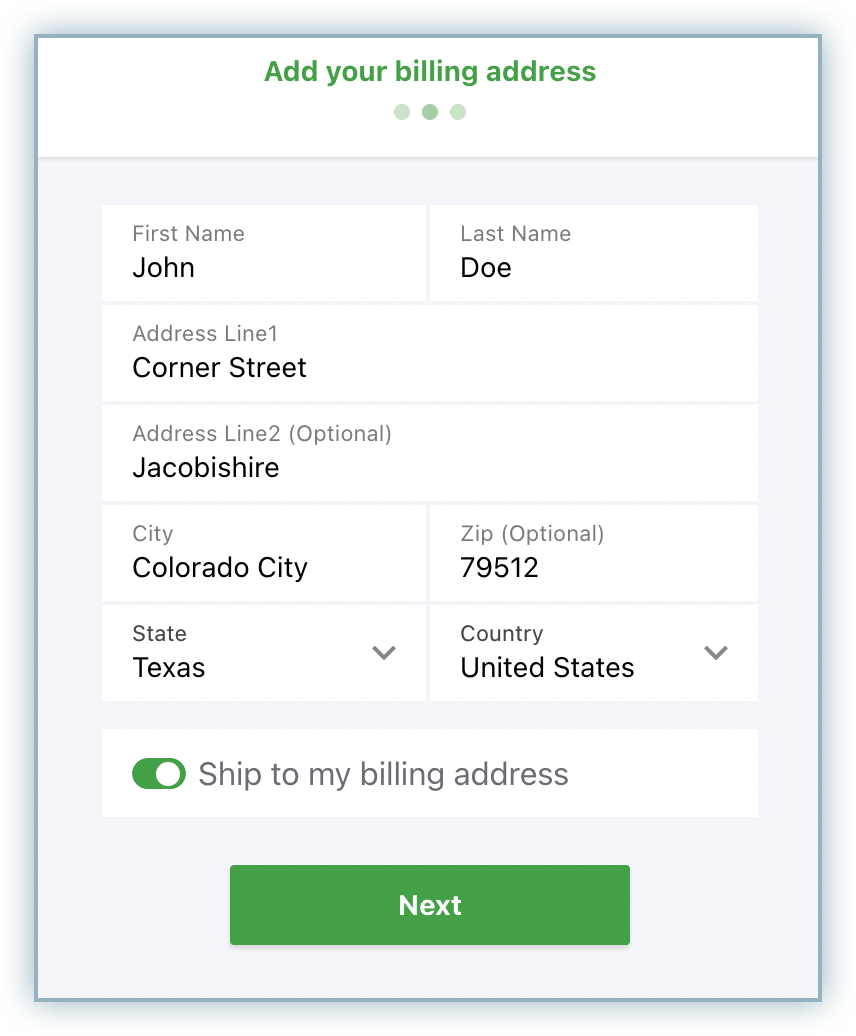

- Billing address and customer name: To gather the billing address details and customer name from your customers, you must enable the full billing address fields for your checkout flow and make them mandatory in checkout. Further details can be found in the Billing Address section below.

- Document ID: Document ID must be collected from customers for successful payment processing. It is mandatory in many Latin American countries. For more information, refer to the Document ID section below.

Let us dive deeper into each setting:

Billing address

Follow these steps to enable this from your Chargebee site:

-

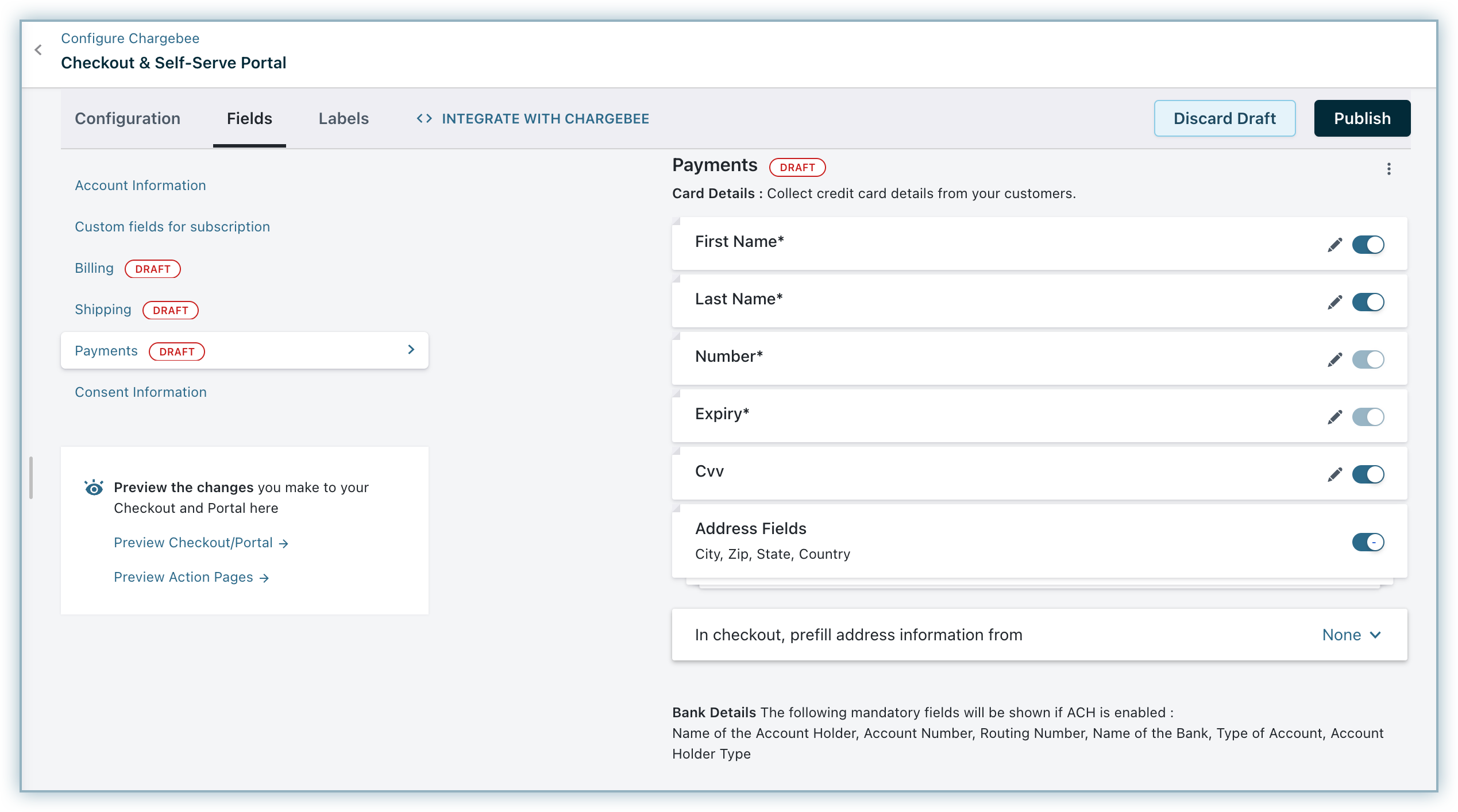

Go to Settings > Configure Chargebee > Checkout and Self-Serve Portal.

-

Switch to the Fields tab and select Payments. You must enable the above-listed fields and make them mandatory, including the first and last name.

-

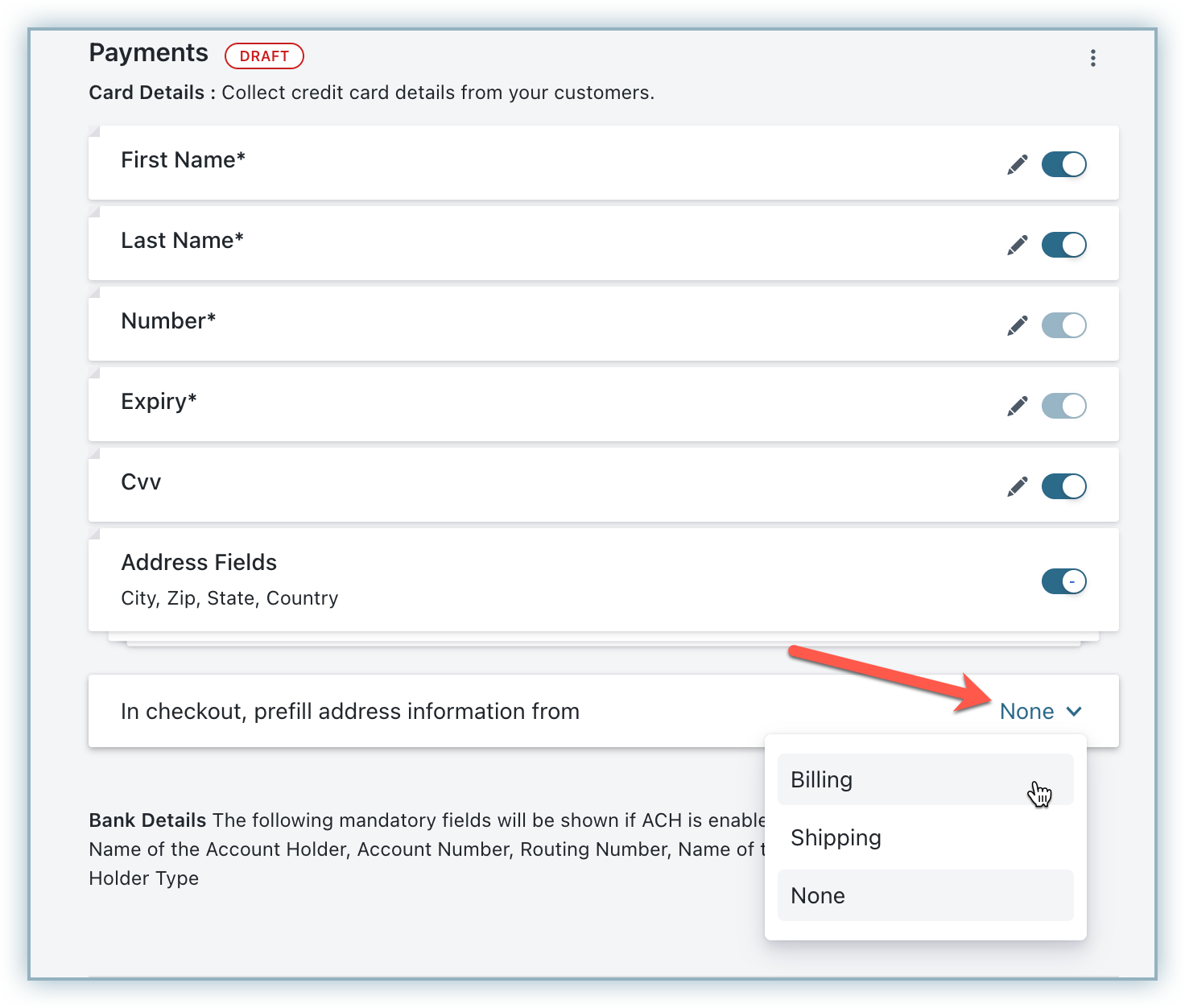

Click Publish. Address fields will appear only if None is selected from the In checkout, prefill address information from drop-down menu.

-

Choose to prefill address-related information from Billing or Shipping details by selecting the relevant option under the In checkout, prefill address information from drop-down menu.

Document ID

Document ID is a unique number used to verify an individual's identity, and its format varies based on the customer's country of origin. For instance, Argentina uses CDI and CUIL, while Brazil uses CNPJ and CPF, among others. Document ID is mandatory in certain Latin American markets for successful payment processing.

The Document ID is required for payment processing in the following countries:

- Brazil

- Mexico

- Chile

- Argentina

- Ecuador

- Peru

- Uruguay

Document ID collection and basic validation

- When using Chargebee hosted checkout, the Document ID becomes accessible within your checkout flow as an input field, facilitating its retrieval as customers complete their purchase. Chargebee integrates this feature into the checkout form, dynamically adjusting based on the availability of EBANX as a payment option, determined by your configured smart routing settings. There's no requirement for additional setup to collect the Document ID. Upon receipt, Chargebee automatically verifies the Document ID format using EBANX.js, ensuring smooth processing.

- When using Chargebee.js, you must incorporate the collection of the Document ID into your checkout process and validate it before sending it through the Chargebee API.

- When using the Chargebee API, ensure you include the document parameter in your API request. Within the Payment Sources document, locate the additional_information parameter, then navigate to

Ebanx > payer > documentunder it. It is advisable to perform validation for this parameter on your front end.

Learn more about document validation.

Workflows

- Chargeback Management: EBANX notifies only when the Chargeback is initiated.

- Account Updater: Account Updater is not supported in this integration.

- Migration Flow: When you are migrating into Chargebee and bringing in either existing tokens from Ebanx or moving cards from a different gateway to Ebanx, make sure to pass and send the Document ID and the Billing Address along with the permanent token in Chargebee which is mandatorily needed in many markets in Latin America to process payments successfully. This needs to be sent as Additional Info. To learn more about the migration process, refer to a detailed document on Migrating Cards.

- Stored Credential Parameters: For Customer-Initiated Payments (CIT), Chargebee will send

providedas the value in thecard_cvv_modefield to Ebanx. Conversely, for Merchant-Initiated Payments (MIT), Chargebee will send recurrent as the value in thecard_cvv_modefield to Ebanx, ensuring proper classification as recurring/MIT payments. - Statement Descriptor: Ebanx doesn't have an option to specify a dynamic Statement / Transaction Descriptor.

Checkout flow

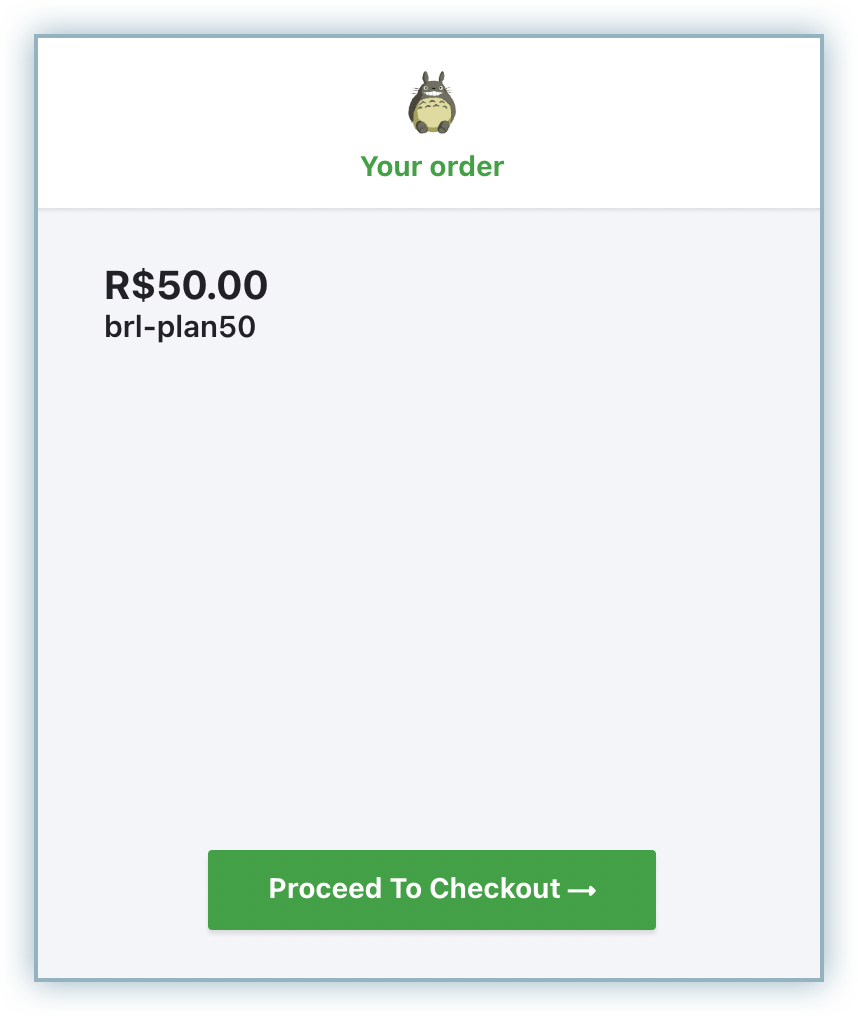

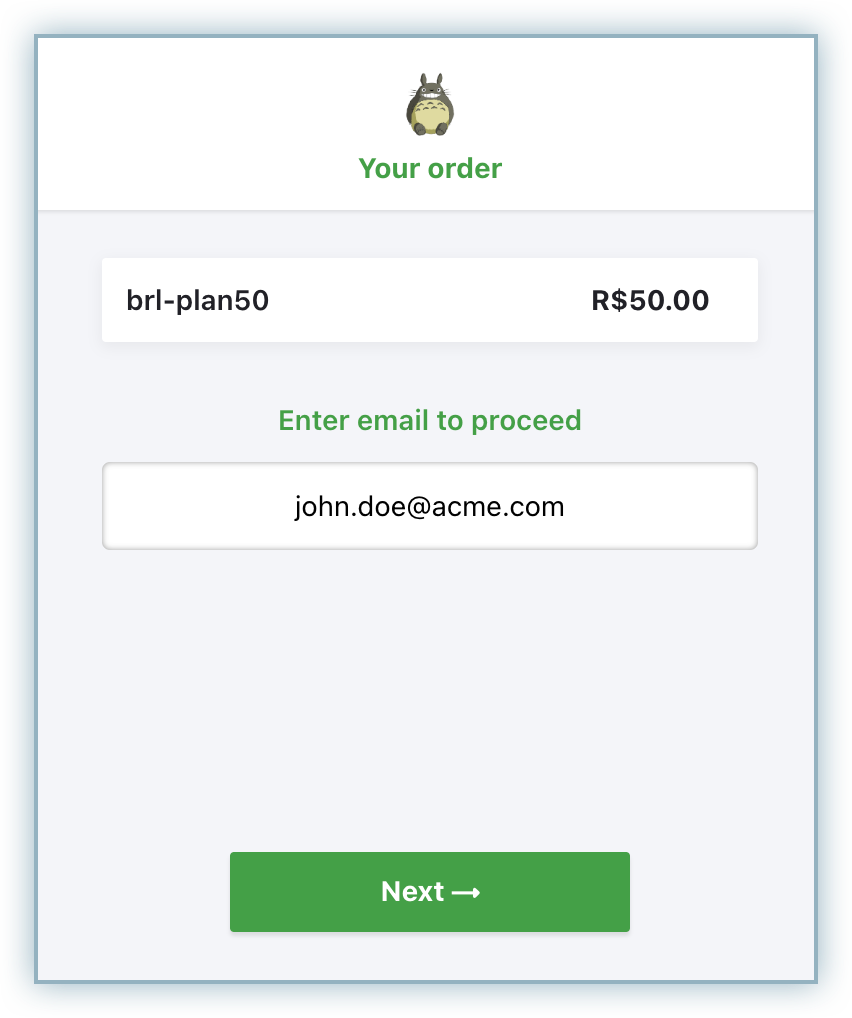

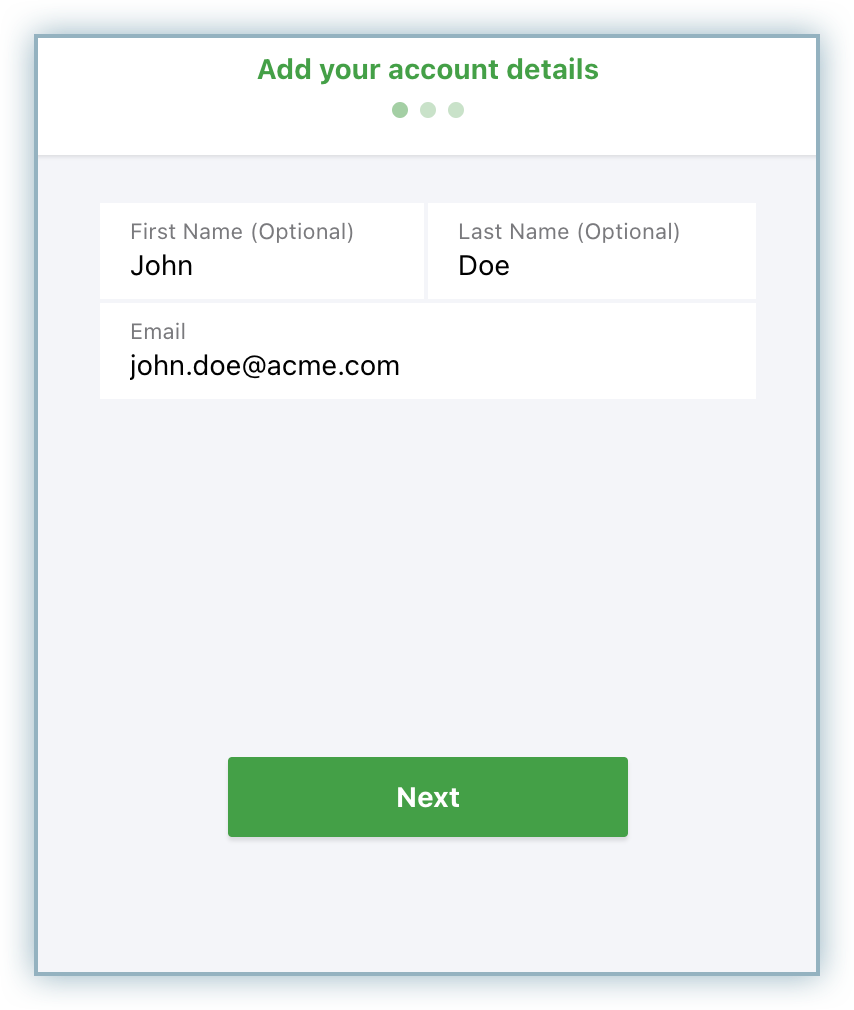

Your customers perform the following steps through the checkout flow using EBANX:

-

Review the plan details and click Proceed to Checkout.

-

Enter the email address to proceed and click Next.

-

Enter relevant information for your Account Details and click Next.

-

Enter the relevant information for your Billing Address and click Next.

-

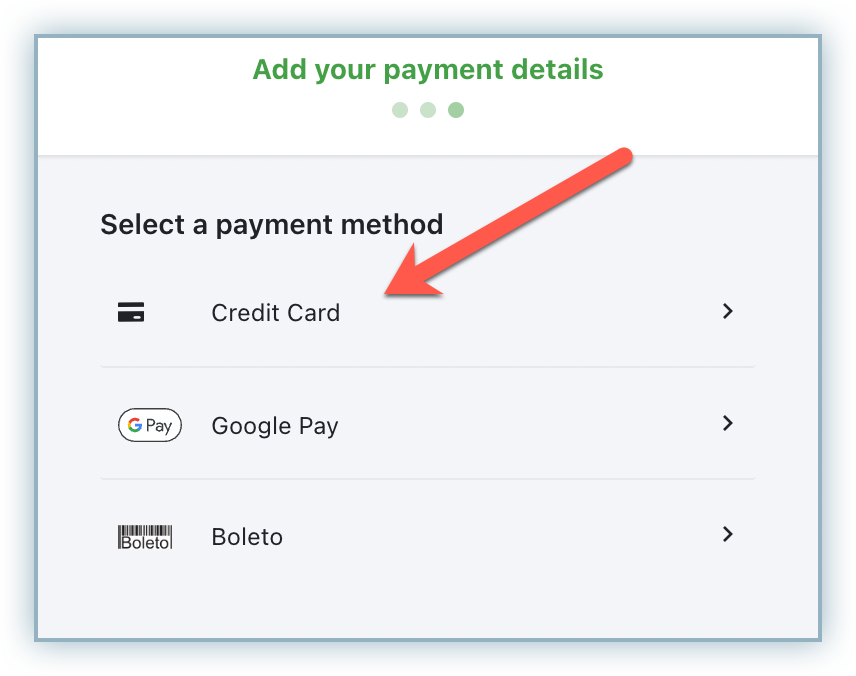

Select Credit Card as the payment method.

-

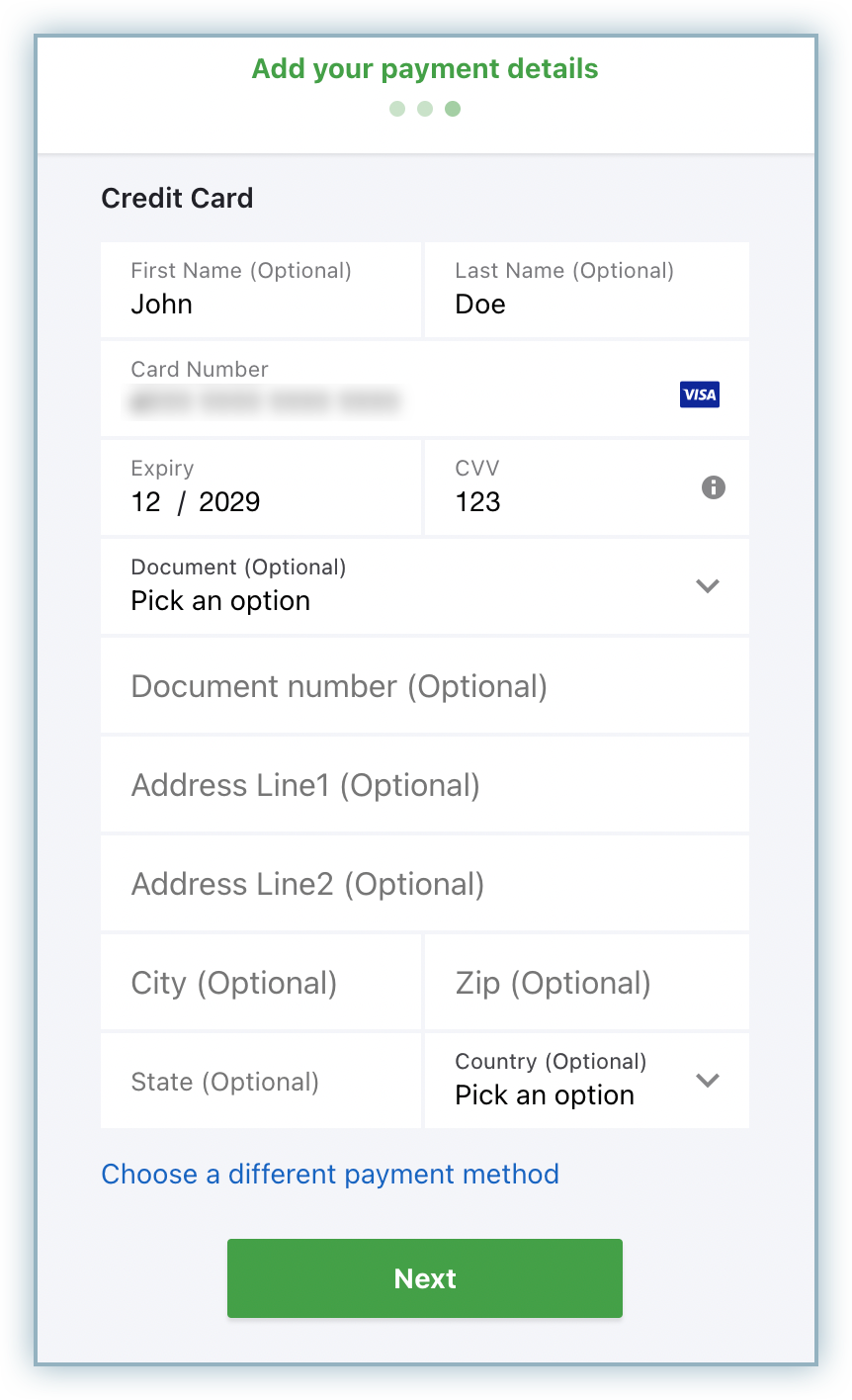

Enter the payment (credit card in this case) details, select the document type and enter the document number. Click Next. These document-related fields will be enabled only when EBANX is used as the payment gateway and appropriate smart routing settings have been done.

-

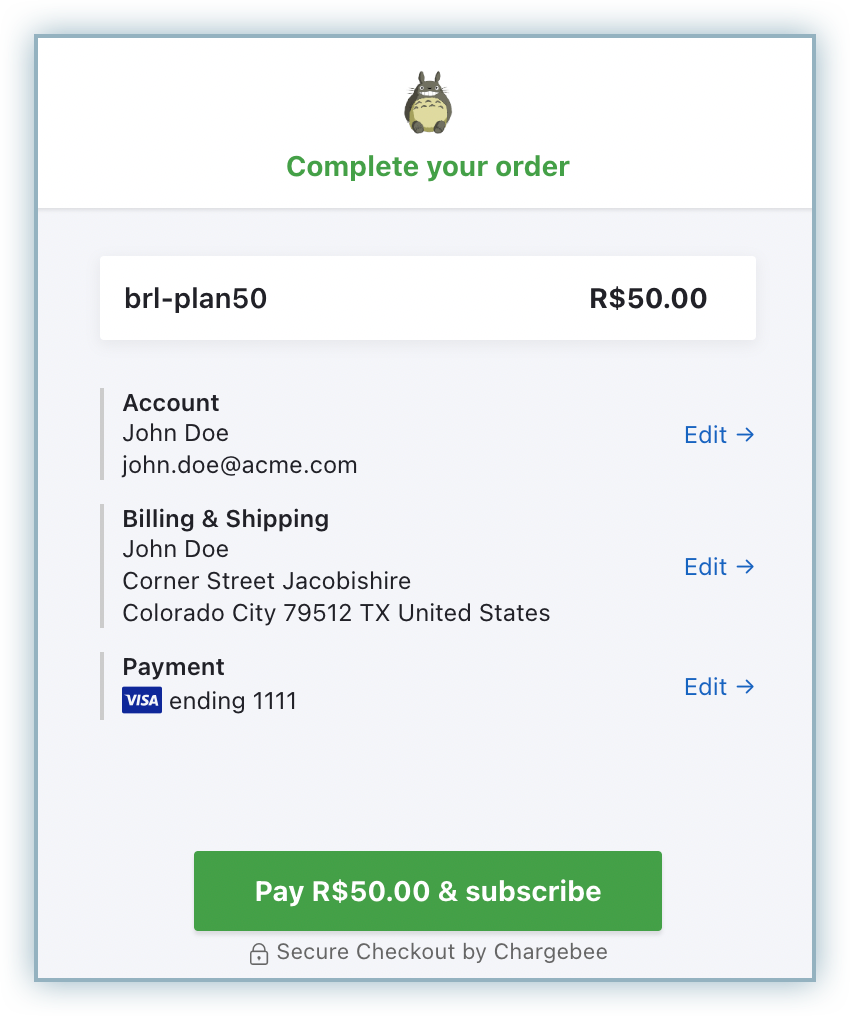

On the Complete Your Order page, review the plan and payment-related details and then click Pay and Subscribe to complete the purchase. On completing the payment, the subscription creation process will be initiated.

Was this article helpful?