Payconiq by Bancontact via Adyen

This feature is a Private Beta Release. Contact Chargebee Support to enable Payconiq by Bancontact via Adyen for your live and test sites.

Overview

Chargebee now supports Payconiq by Bancontact through the Adyen payment gateway, enabling merchants to offer seamless mobile and desktop payment experiences for customers in Belgium.

Payconiq by Bancontact is a widely used mobile payment method that merges the strengths of Bancontact and the Payconiq mobile app. Customers can complete secure payments by scanning QR codes or being redirected to their mobile banking apps.

With this integration, merchants using Chargebee and Adyen can accept:

- One-time payments via mobile or desktop

- Recurring payments using Bancontact tokenization

This setup leverages Adyen's support for both Bancontact tokenization and Payconiq mobile payment flows:

Key capabilities

Following are the key capabilities of Payconiq by Bancontact via Adyen:

| Feature | Support |

|---|---|

| One-time payments (desktop) | Supported |

| One-time payments (mobile) | Supported |

| Recurring payments | Supported (via Bancontact tokenization) |

| Refunds | Supported |

| Webhooks | Supported |

Prerequisites

Before you can enable Payconiq by Bancontact in Chargebee, make sure the following requirements are met:

- Your Adyen merchant account has both Bancontact and Payconiq by Bancontact enabled.

- Tokenization for Bancontact is enabled in your Adyen account (required for recurring payments).

- You are using Chargebee's latest Adyen gateway version.

- The EUR currency is enabled for your Chargebee site.

- Payconiq by Bancontact is enabled on your Chargebee account. Contact Chargebee Support to have this enabled.

- The Adyen payment gateway and webhooks are properly configured in Chargebee. Learn how to configure Adyen

Payment flow

Following are the payment flows supported by Payconiq by Bancontact via Adyen:

Desktop Flow

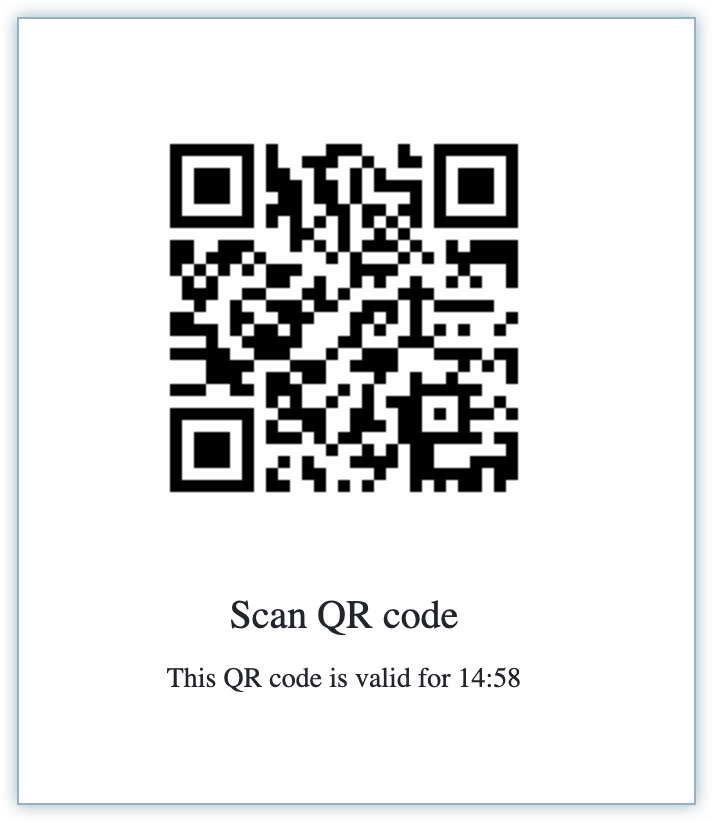

- The customer selects Payconiq by Bancontact at checkout.

- A QR code is displayed on the screen.

- The customer scans the QR code using their banking app or the Payconiq app.

- The payment is authorized and completed.

Mobile Flow

- The customer selects Payconiq by Bancontact on their mobile device.

- They are redirected to their banking or Payconiq app.

- The payment is confirmed within the app.

- The customer is redirected back to your site.

Recurring Payments with Bancontact

Chargebee supports recurring payments via Bancontact tokenization through Adyen:

- The initial payment must be completed using Bancontact (mobile or desktop).

- Adyen returns a payment token, which Chargebee securely stores.

- Future payments are processed using this stored token, without further customer interaction.

Note:

Payconiq is used only for the initial payment. All subsequent recurring payments are processed via the Bancontact network using the stored token.

Refunds

Refunds for payments made using Payconiq by Bancontact can be initiated through:

- The Chargebee Admin Console

- The Chargebee API

Refunds are processed via Adyen and returned to the customer's original payment method.

Integration options

You can integrate Payconiq via Bancontact via Adyen using the following integration methods:

| Integration Method | Description | PCI Requirements |

|---|---|---|

No payment details are collected directly on the site. Customers are redirected to the Payconiq app or can scan a QR code to complete the payment. Once done, the page is auto-submitted. | Low (Your PCI compliance requirements are greatly reduced due to the usage of Chargebee's checkout) | |

This option enables customization of the pop-up headings shown during the Payconiq flow. If no custom configuration is provided, defaults from hosted pages will be used. | High | |

Requires calling Chargebee’s API to retrieve the QR payload and the Payconiq app redirect URL to initiate the payment process. | High |

Supported tokens

Chargebee supports the following tokens for Payconiq by Bancontact:

| Token | Description | Format and Sample |

|---|---|---|

A permanent token is the payment method ID available at the gateway. It serves as the gateway's identifier for the specific payment method resource. | Format:

Sample:

| |

This is the Payment Intent ID returned after a successful authorization process in Chargebee JS. | Format: |

Configuring Payconiq by Bancontact in Chargebee

Follow these steps to configure Payconiq by Bancontact via Adyen in Chargebee:

- Log in to your Chargebee Billing site.

- Go to Settings > Configure Chargebee > Payment Gateways.

- Select Adyen from the list of configured gateways.

- Enable Payconiq via Bancontact.

- Click Apply to save changes.

- Save and test the integration using Chargebee's test site before going live.

Configure Smart Routing

When you enable Payconiq by Bancontact through Adyen, Smart Routing for the EUR currency will be automatically enabled. If another gateway is already designated for the respective currency, you can manually adjust the Smart Routing configuration to allocate Payconiq by Bancontact.

Follow these steps to modify Smart Routing settings:

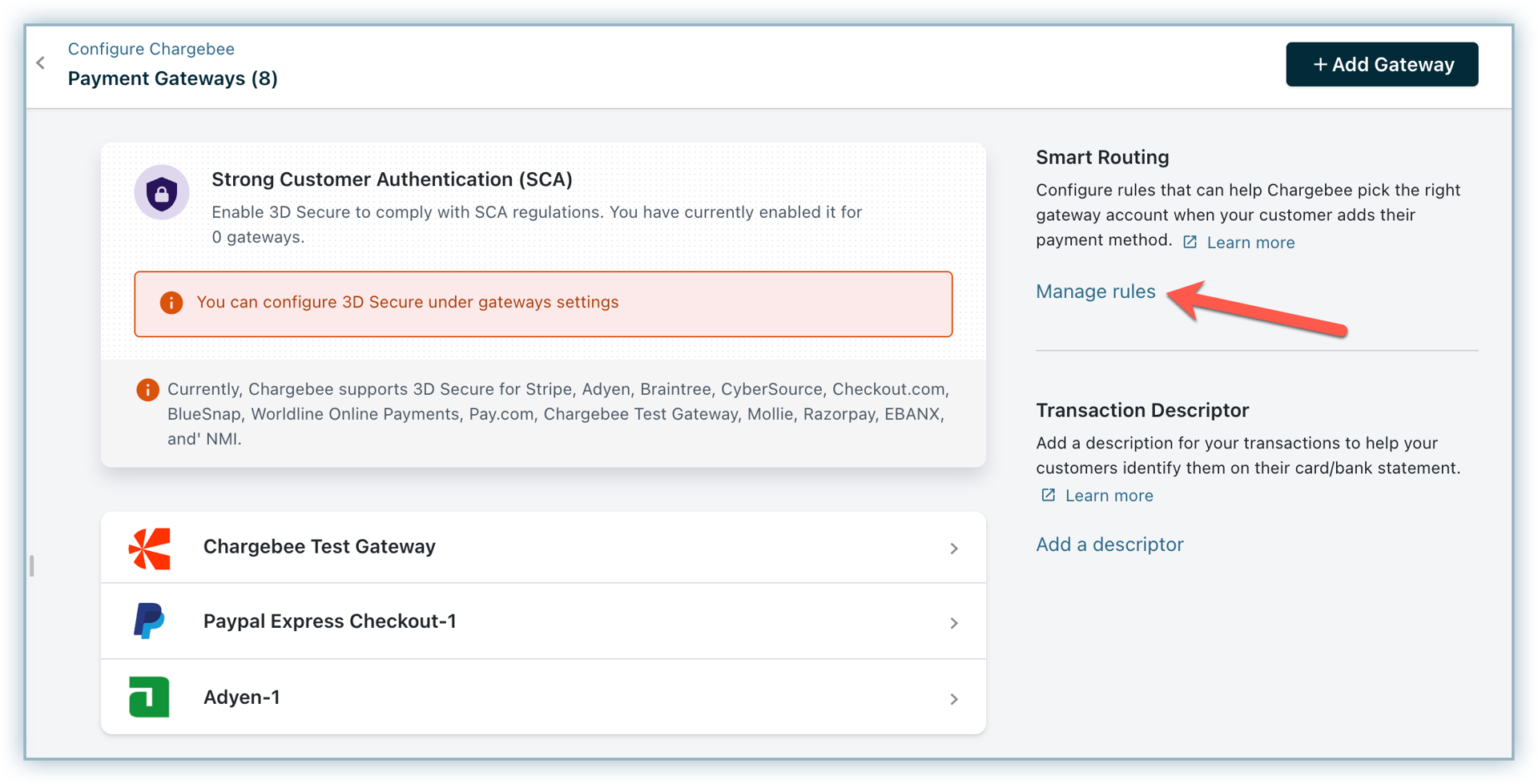

- Go to Settings > Configure Chargebee > Payment Gateways.

- Click Manage rules under Smart Routing.

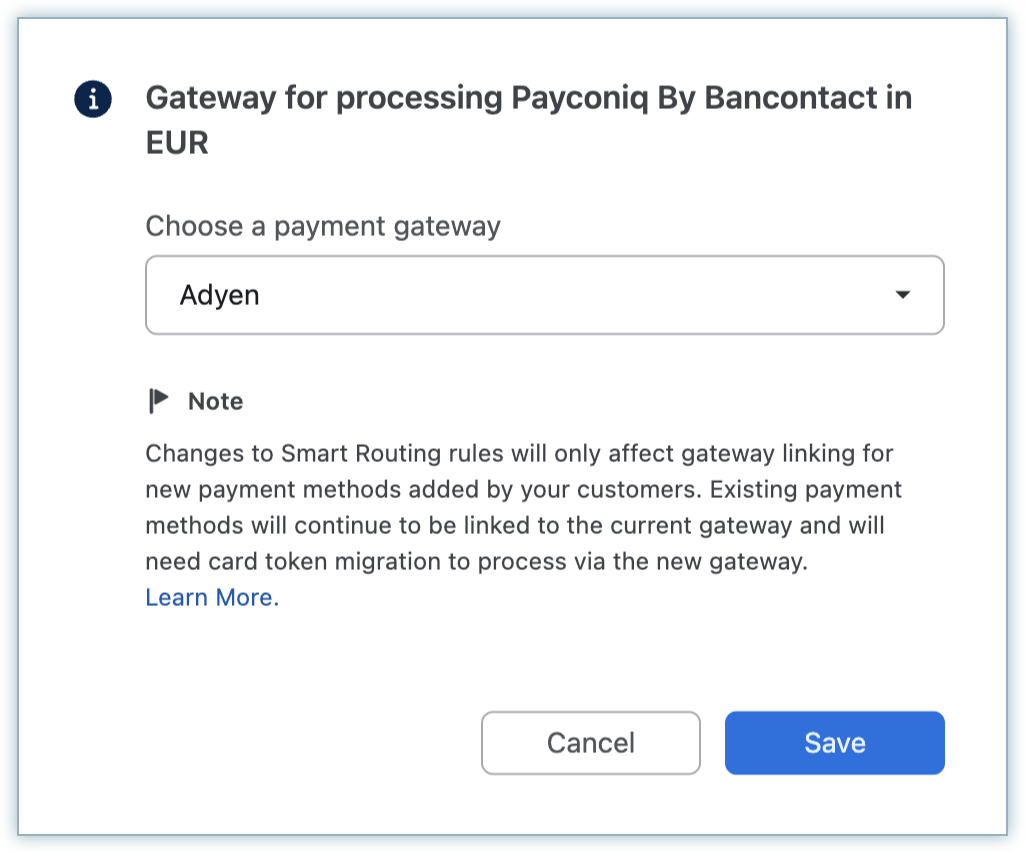

- Go to the Payconiq by Bancontact section and click the edit button for EUR.

- From the Choose a payment gateway drop-down menu, select the relevant Adyen instance with Payconiq By Bancontact enabled.

- Click Save.

Checkout flow

Note:

If you are collecting the billing address, enable the First Name and Last Name fields from the Checkout settings in Chargebee. Instructions on modifying the Checkout fields are given here.

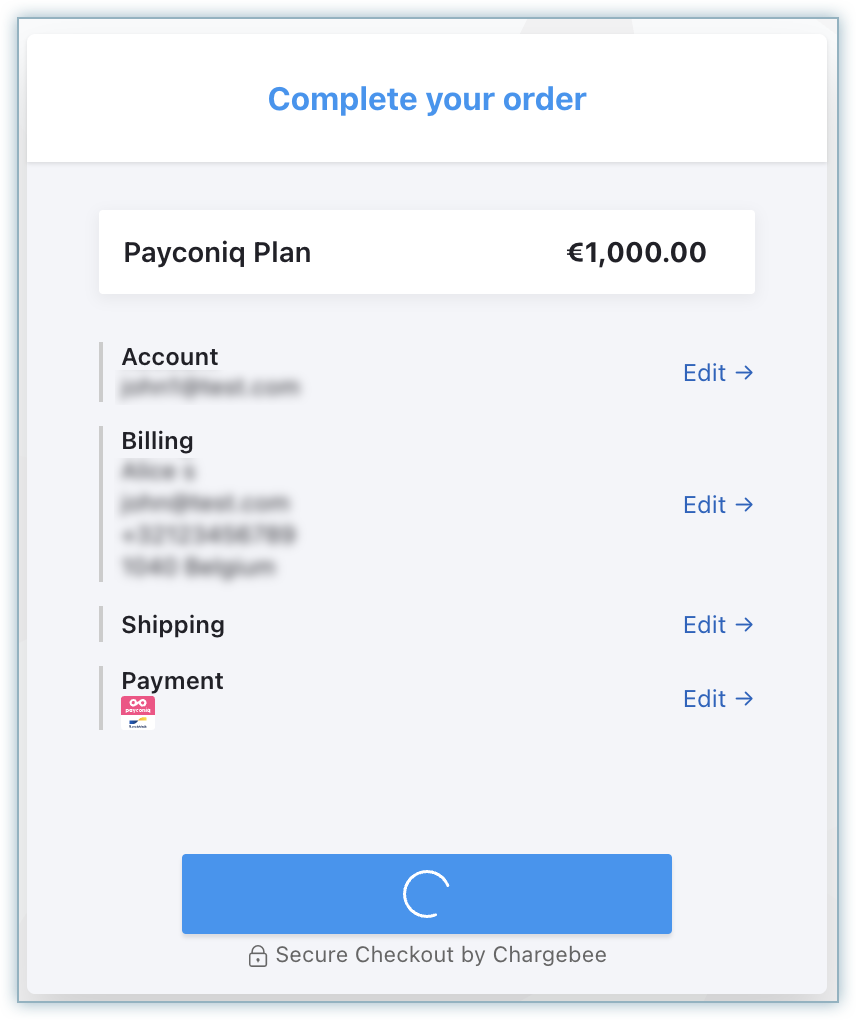

Your customer performs the following set of steps during checkout using Payconiq by Bancontact via Adyen:

- Initiates checkout and proceeds to the next step.

- Enters the billing address details.

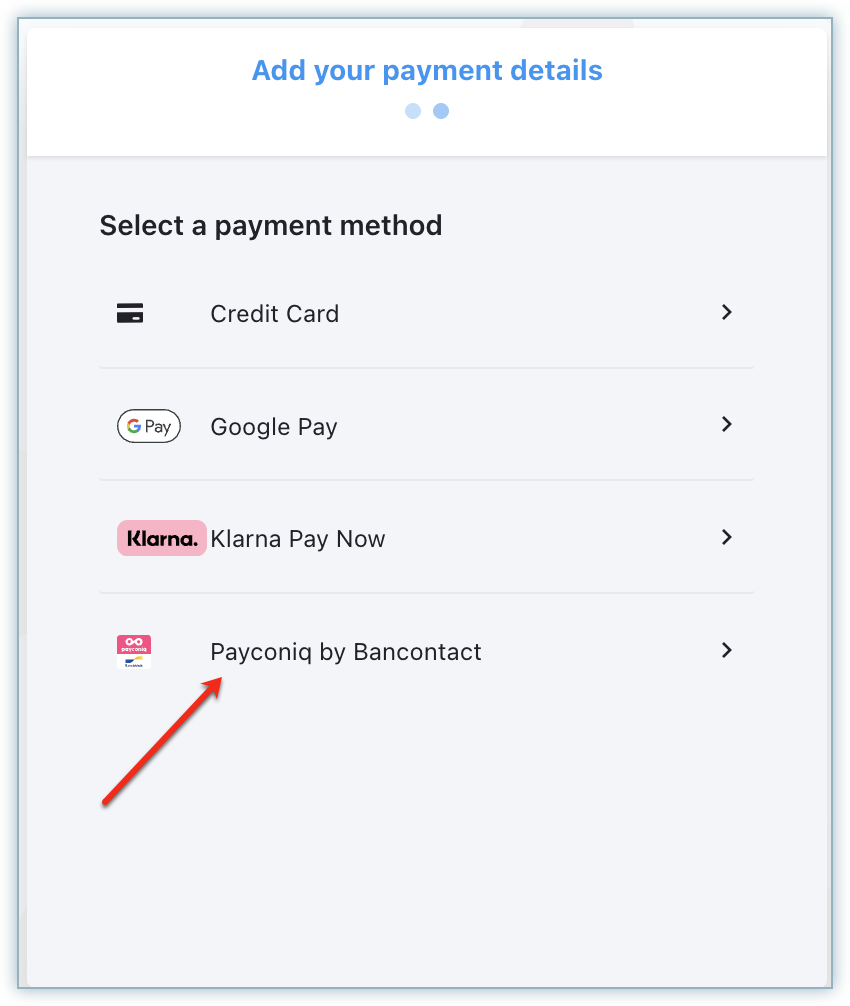

- Selects Payconiq by Bancontact as the payment method.

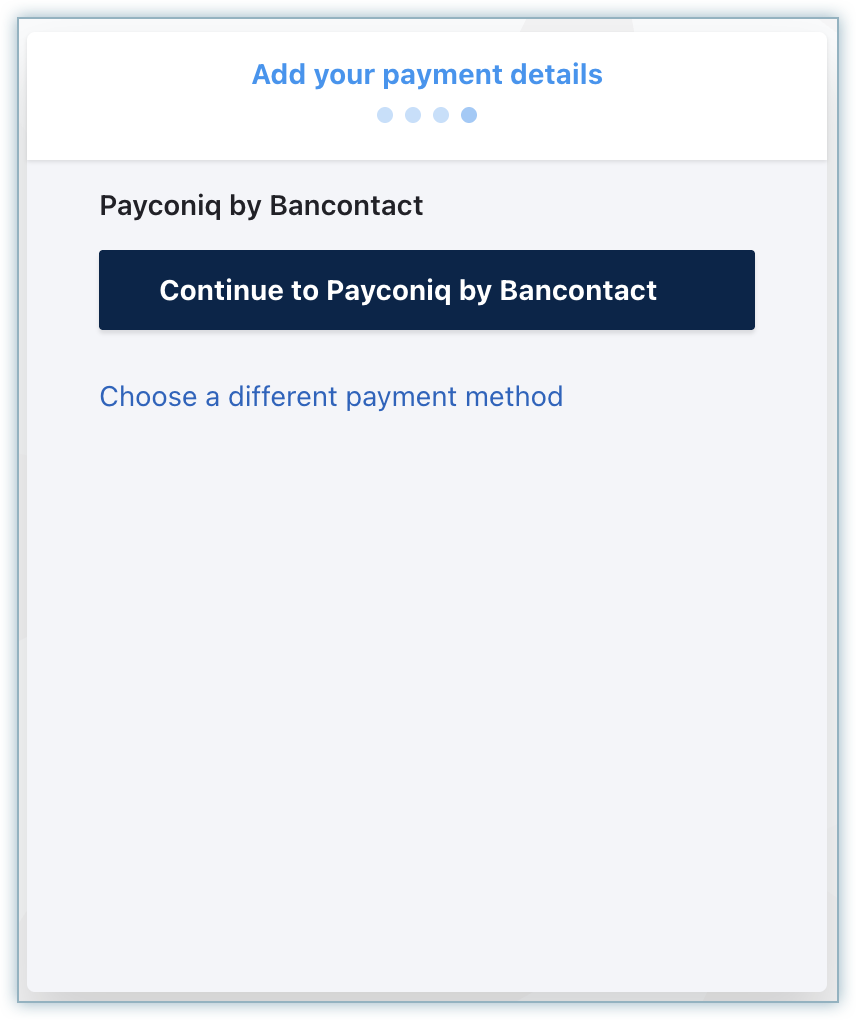

- Clicks Continue to Payconiq by Bancontact.

- A QR code pop-up appears and remains active for up to 15 minutes, allowing the customer time to complete the payment. Once the payment is completed and the customer receives confirmation from Adyen, the pop-up closes automatically, and the customer is redirected to the next page.

- The Pay <amount> & subscribe is automatically submitted once this page loads.

- Once the checkout is completed, Payconiq by Bancontact is added to the customer profile as a payment method with a recurring token, which will be used for subsequent recurring payments.

Testing

Adyen provides test cards and QR codes for Bancontact flows in sandbox mode. For integration and test parameters, refer to Adyen's API-only documentation.

Was this article helpful?