You are viewing:

Product Catalog 2.0

Open Banking via GoCardless

This feature is a Private Beta Release. Request access to enable Open Banking payment methods via GoCardless for your test and live sites.

Chargebee now supports the following payment methods for instant payments via Open Banking:

| Payment Method | Country | Currency |

|---|---|---|

| PayTo | Australia (AU) | Australian Dollars (AUD) |

| SEPA Instant Transfer | Germany (DE) | EURO (EUR) |

| Faster Payments | United Kingdom (UK) | Great Britain Pound (GBP) |

These payment methods are designed to work harmoniously with traditional bank debit systems by leveraging Open Banking. Open Banking allows users to securely connect their bank accounts to third-party applications like GoCardless, enabling seamless initiation and management of payments directly from their bank accounts.

These bank-to-bank transactions provide immediate confirmation, ensuring enhanced transparency for you and your customers. While Direct Debit can be used for all recurring payments, Instant Bank Pay serves as the best and fastest option for your one-time payment for the first time.

Information

All merchant-initiated transactions (MIT) for SEPA Instant Transfer and Faster Payments will be routed through SEPA and BACS respectively. Additionally, both merchant-initiated and customer-initiated transactions for PayTo will be exclusively conducted within the PayTo platform.

Integration options

You can integrate the payment methods via GoCardless using the following integration methods:

Configuring Open Banking payment methods via GoCardless in your Chargebee site

Before moving ahead with the configuration, make sure you have PayTo, SEPA Instant Transfer, and Faster Payments enabled for your Chargebee site. Contact Chargebee Support to get it enabled if you haven't already.

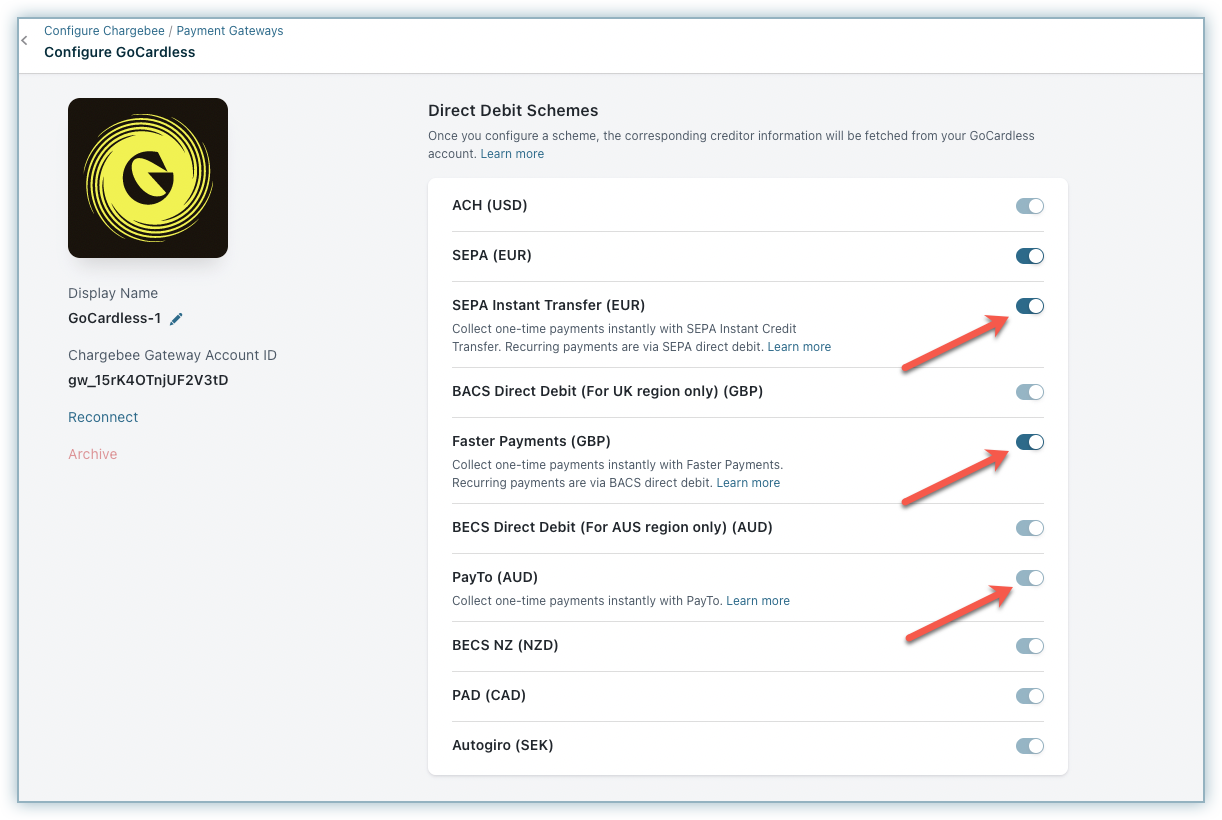

Follow these steps to configure Faster Payments, PayTo, and SEPA Instant Transfer for GoCardless:

- Log in to your Chargebee site.

- Go to Settings > Configure Chargebee > Payment Gateways.

- Click GoCardless from the list of added gateways. If you haven't added and configured the GoCardless payment gateway, click here to learn more.

- Enable the required payment method for Open Banking based on your region.

- Click Apply to save the changes.

Note:

- You can enable Faster Payments only if BACS Direct Debit (GBP) is enabled.

- You can enable SEPA Instant Transfer only if SEPA (EUR) is enabled.

Payment Flow

Chargebee supports two types of payment and checkout flows for instant payments via GoCardless:

- GoCardless Hosted Pages (also known as GoCardless Redirection Flow): In this flow, the merchant uses the Chargebee checkout initially, but after fetching the basic details (check the info box below for a list of fields), they are redirected to GoCardless Hosted Pages in an iFrame (a page loaded within the current page) where the checkout process including the bank authorization is completed.

- Chargebee Hosted Checkout: In this flow, the merchant completes the entire checkout process within Chargebee's hosted checkout using GoCardless APIs.

Information

In the GoCardless Redirection Flow, basic details refer to First name, Last name, Email, and Billing Address fields. This flow does not require the banking account details.

Let us look at the payment flow for each of these flows:

GoCardless Hosted Pages Flow

- The end customer initiates the checkout and enters the basic details like First Name, Last Name, Billing Address, etc.

- Chargebee creates a Billing Request by prefilling the above-fetched details along with the plan amount, currency, etc.

- Using the BillingRequest ID, a Billing Request Flow object is created i.e. the GoCardless Hosted Pages object.

- Then, the GoCardless Hosted pages redirect URL is loaded in an iFrame and the payment is processed at the GoCardless end.

- Once the bank authorization redirection is over, the customer is redirected to Chargebee where the status of the payment is checked and the transaction status is updated accordingly in Chargebee.

- The transaction is settled instantly in the same session or via webhooks mostly on the same day.

Chargebee Hosted Checkout Flow

- The end customer initiates the checkout and enters the basic details like First Name, Last Name, Billing Address, etc.

- In the case of FasterPayments, the end customer selects the Bank from the drop-down which contains the list of supported banks. Bank selection is not applicable for PayTo.

- Chargebee then creates a Billing Request by prefilling the above-fetched details along with the plan amount, currency, and so on.

- Once the Billing Request is filled with all required details, Chargebee creates a Bank Auth object at GoCardless which will authorize the payment at the selected bank's end.

- Once the bank authorization redirection is over, the customer is redirected to Chargebee where the status of the payment is checked and the transaction status is updated accordingly in Chargebee.

- The transaction is settled instantly in the same session or via webhooks mostly on the same day.

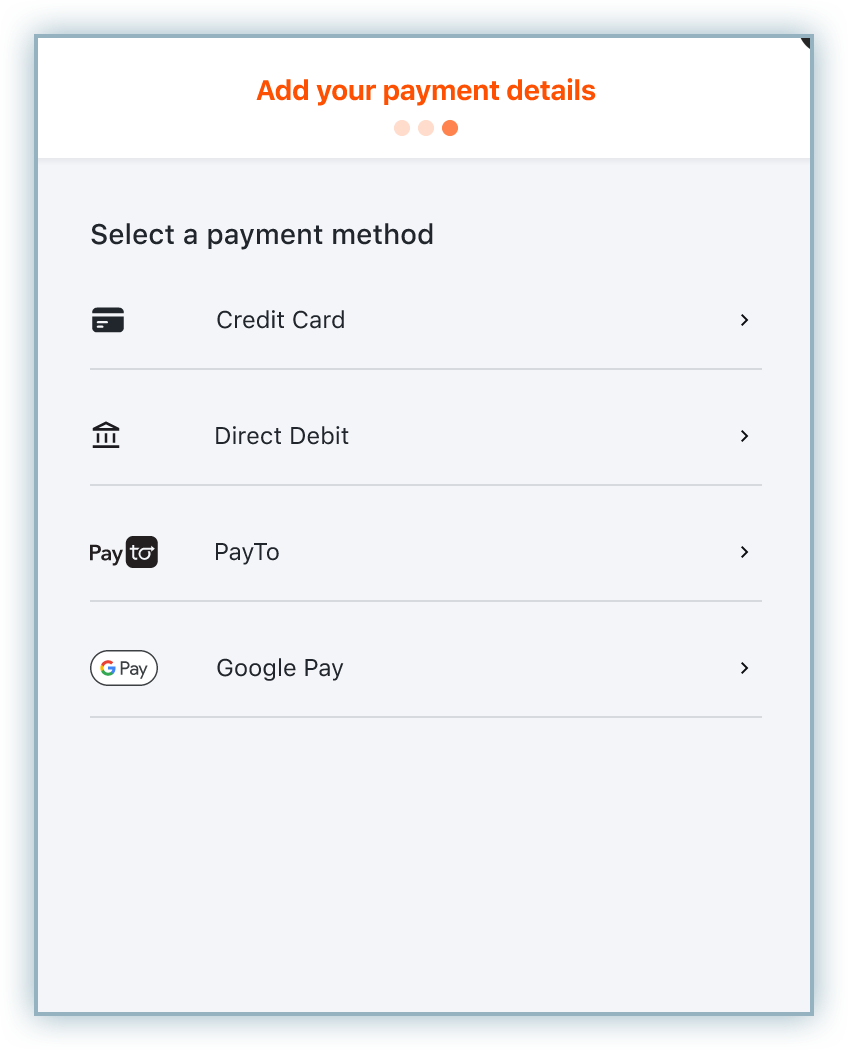

Checkout Flow

Let us look at the checkout flow for Faster Payments and PayTo for the Chargebee Hosted Checkout flow and for SEPA Instant Transfer for the GoCardless Redirection Flow:

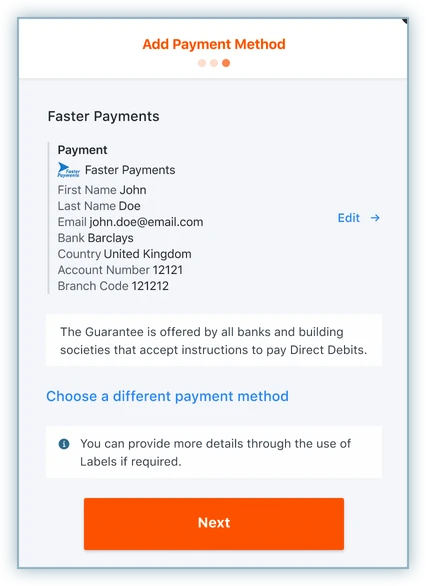

Faster Payments

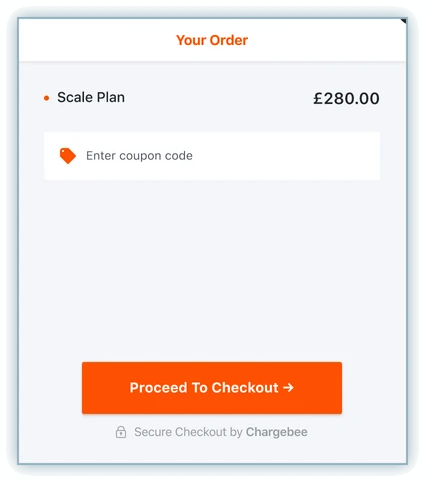

The checkout process for Faster Payments appears as follows:

-

Once you initiate the checkout, click Proceed To Checkout on the Your Order page after confirming the plan details.

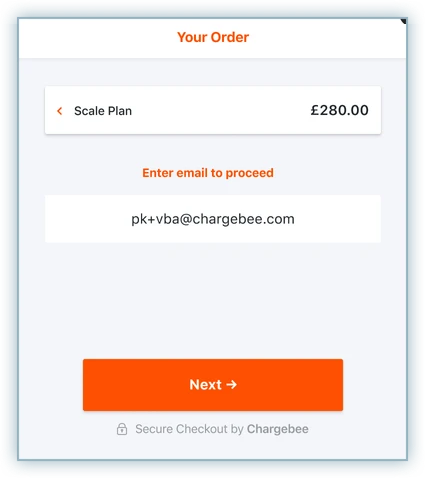

-

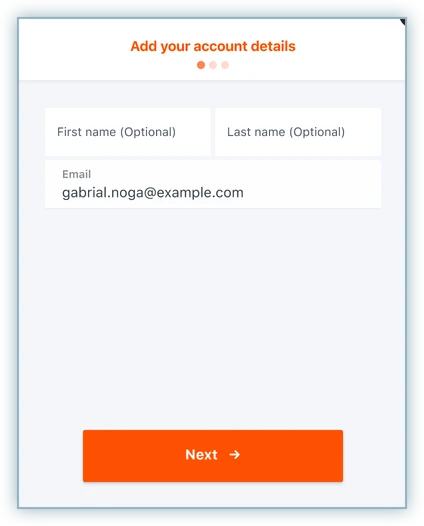

Enter your email address and click Next.

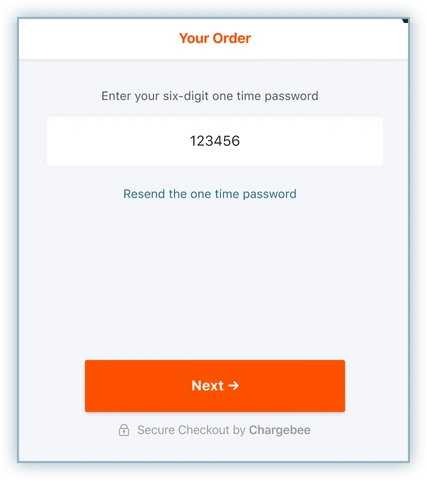

-

Enter the one-time password received on the email that you entered in the previous step and click Next.

-

Enter your First name, Last name, and Email and click Next.

-

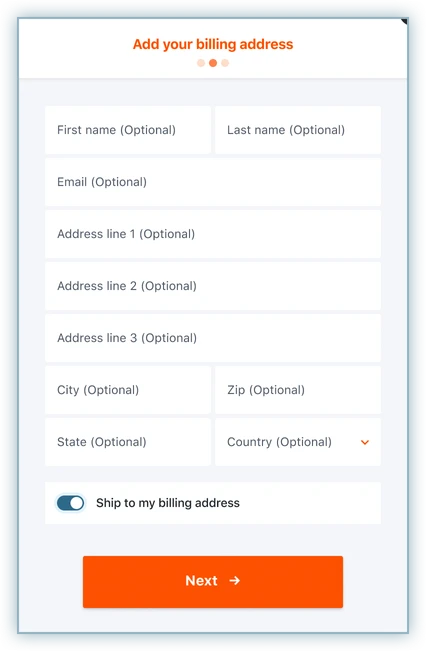

Add your billing address and click Next.

-

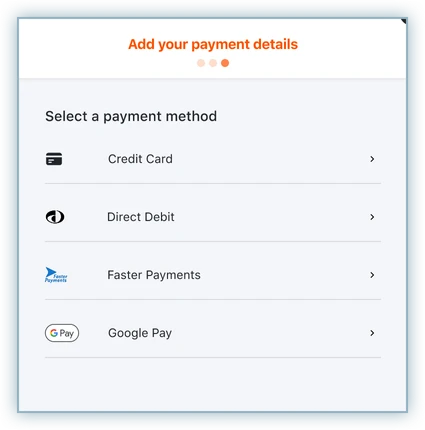

Select Faster Payments as the payment method.

-

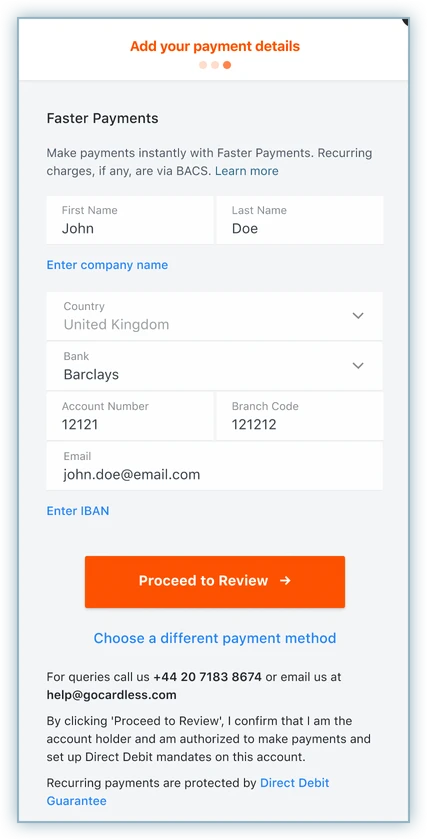

Add your bank account details by selecting the bank account from the Bank drop-down menu and adding other required details. Click Proceed to Review.

-

Review the displayed information and click Next.

-

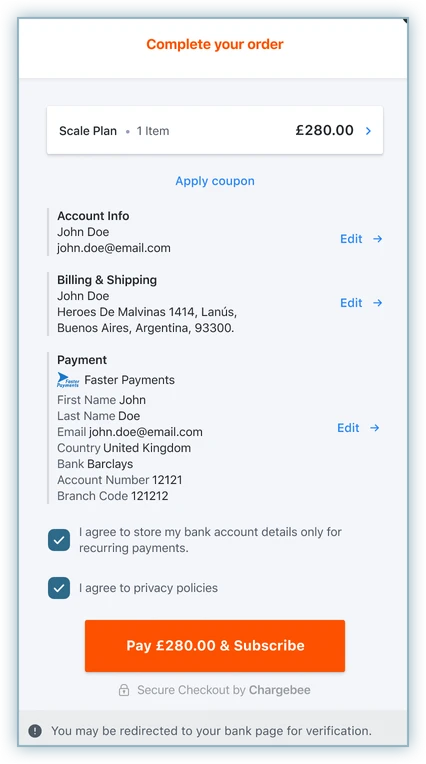

Review the plan, account, billing and payment details. Check the relevant boxes at the bottom and click Pay & Subscribe.

-

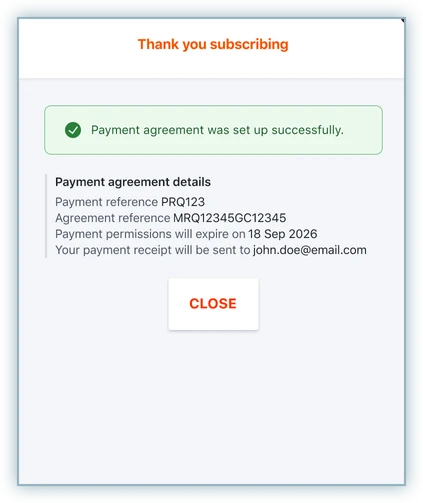

You will be redirected to your bank website. Log in to your bank account, select the account type (current or savings), and approve the transaction.

-

Once approved, you will be redirected to Chargebee's checkout. If the transaction is successful at GoCardless, your order is confirmed at Chargebee.

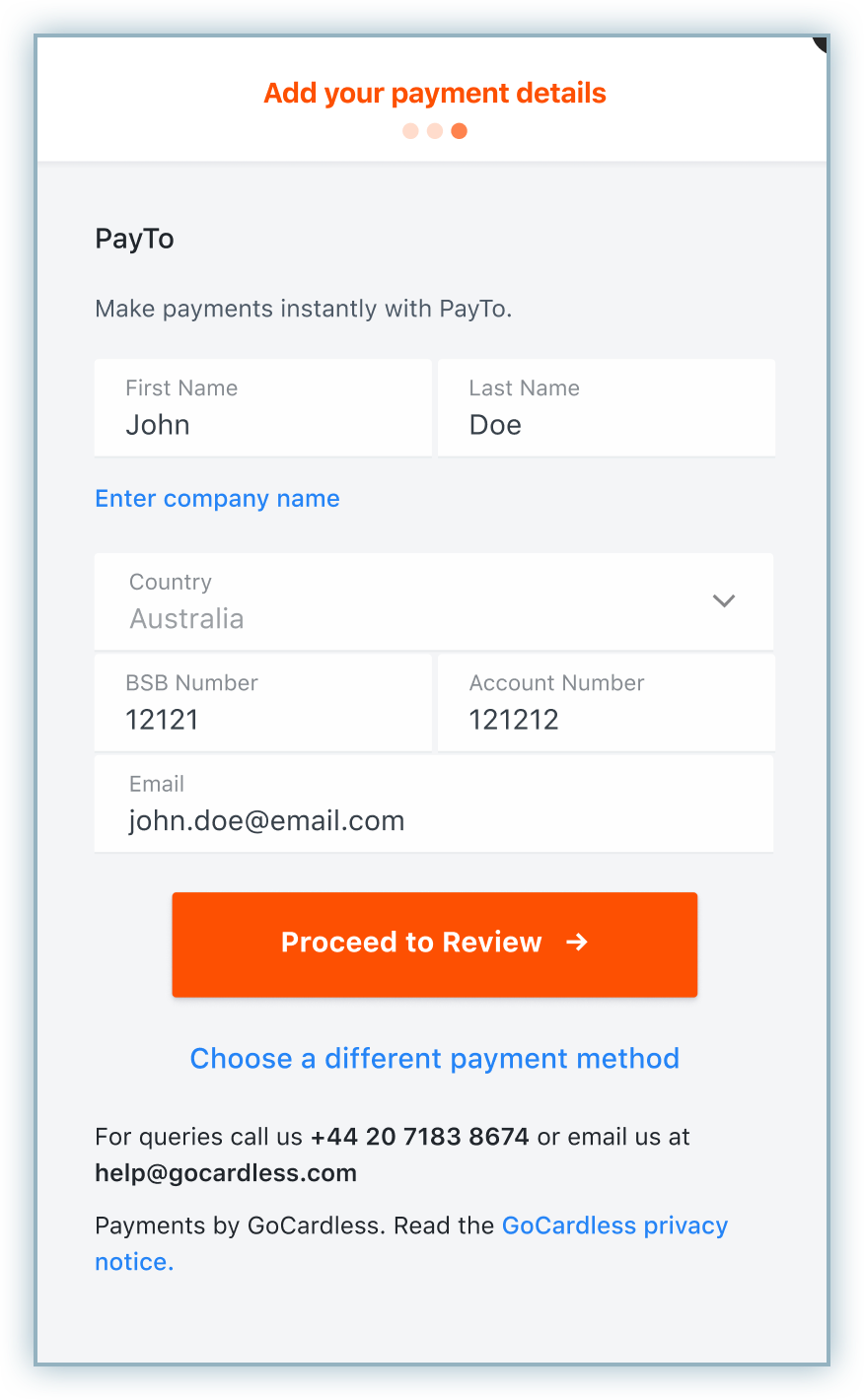

PayTo

The checkout process for PayTo appears as follows:

-

Once you initiate the checkout, select PayTo as the payment method.

-

Add your bank account details such as BSB Number and Account Number, and click Proceed to Review.

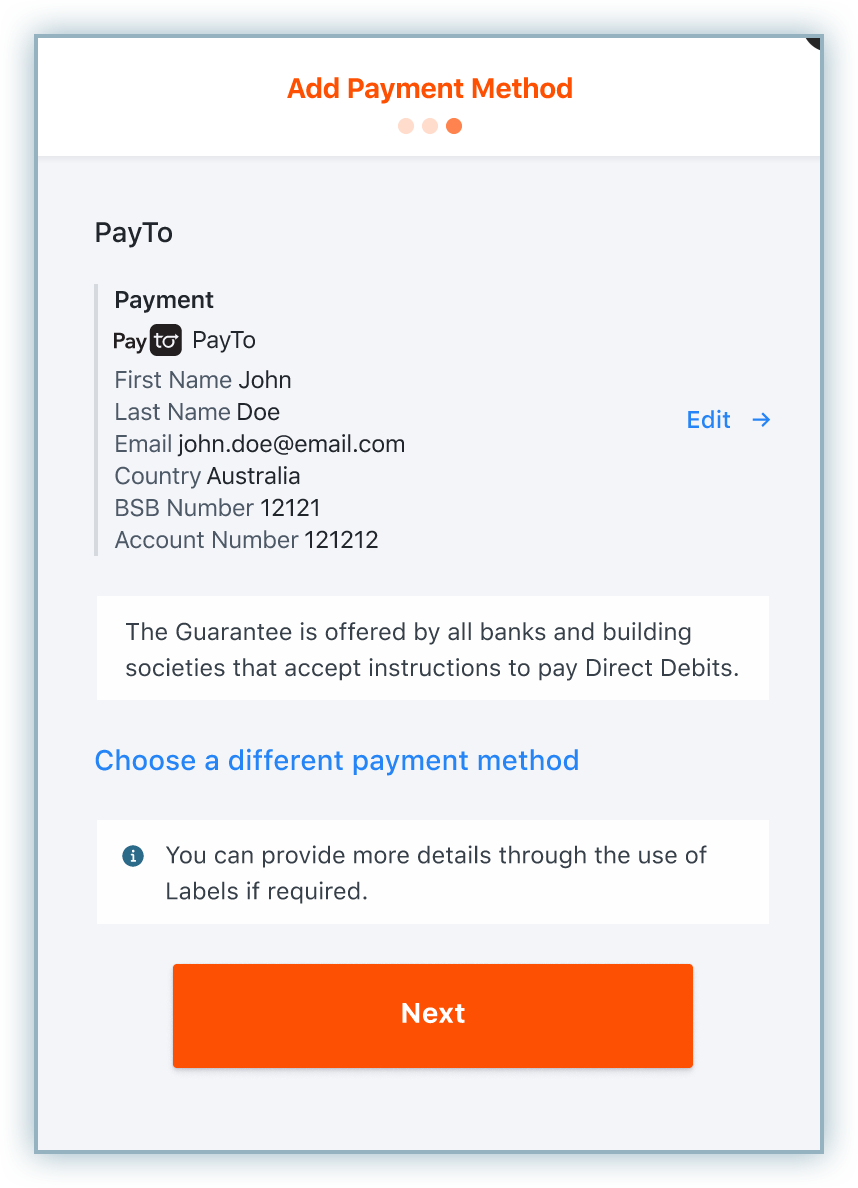

-

Review the displayed information and click Next.

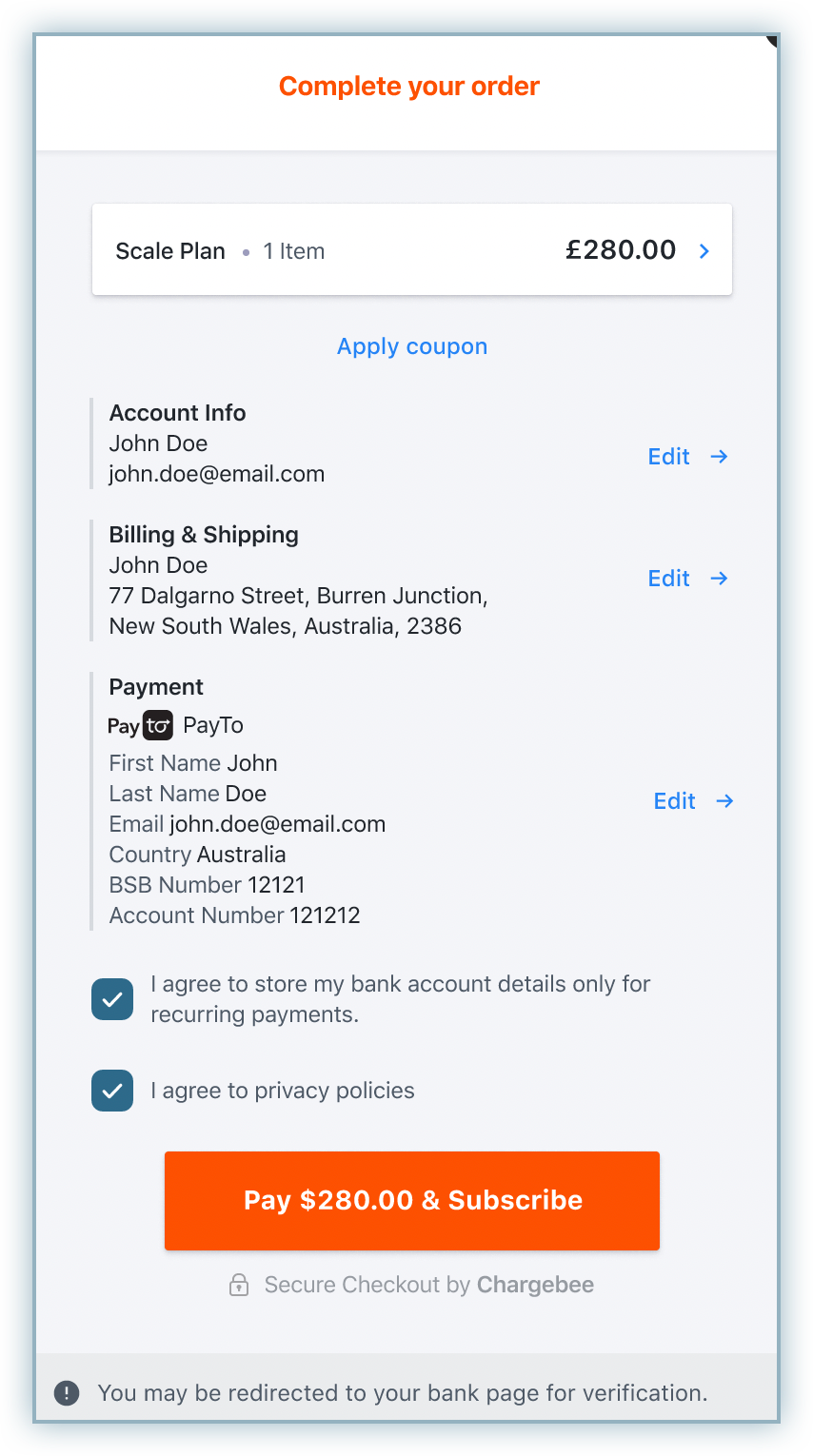

-

Review the plan, account, billing and payment details. Check the required boxes at the bottom and click Pay & Subscribe.

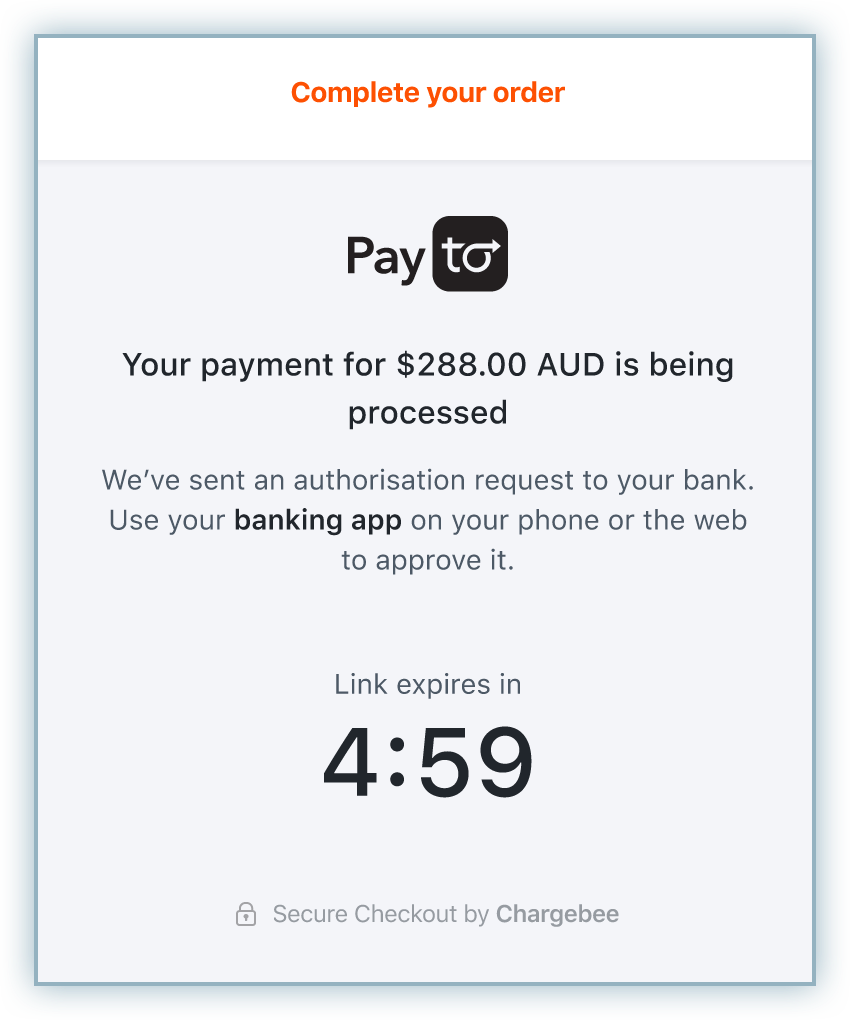

-

The Complete your order page appears with a timer for you to complete the transaction in your banking application.

-

You will receive a push notification in your banking application. Complete the transaction in the app and go back to Chargebee.

-

Once your payment is successful, your order is confirmed and a subscription is created in the background.

SEPA Instant Transfer

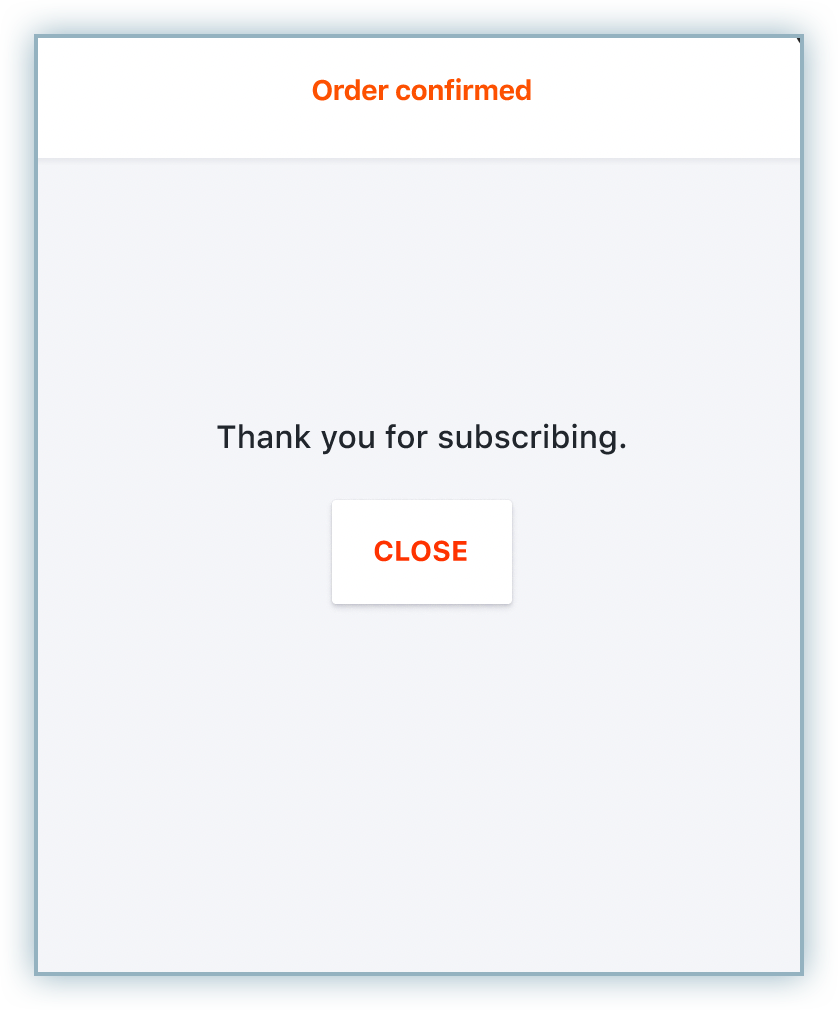

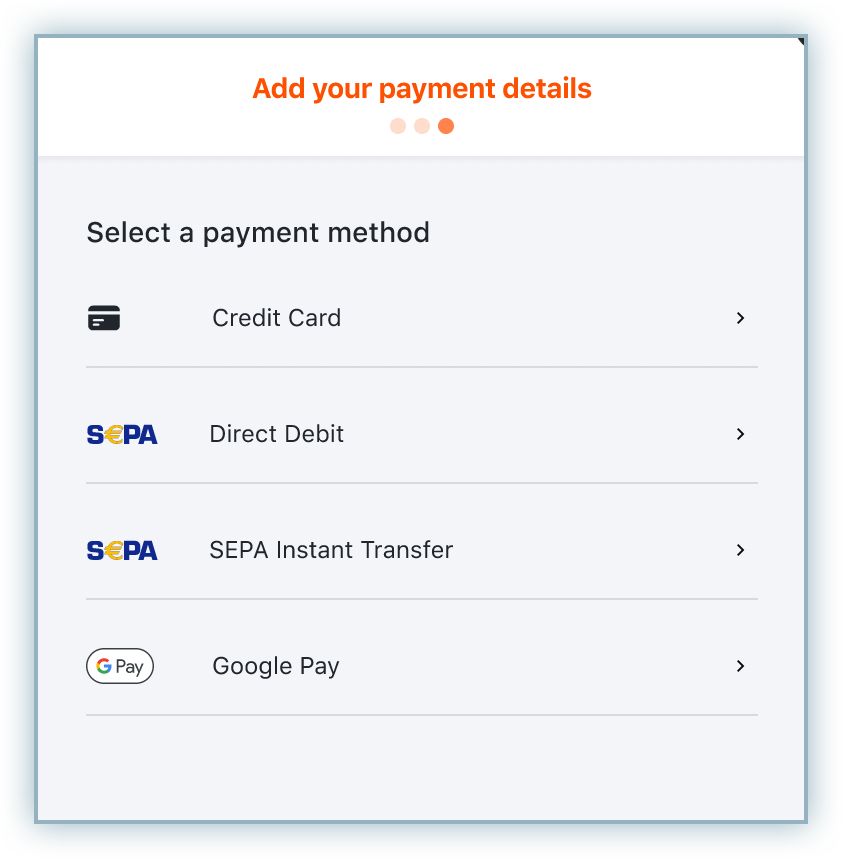

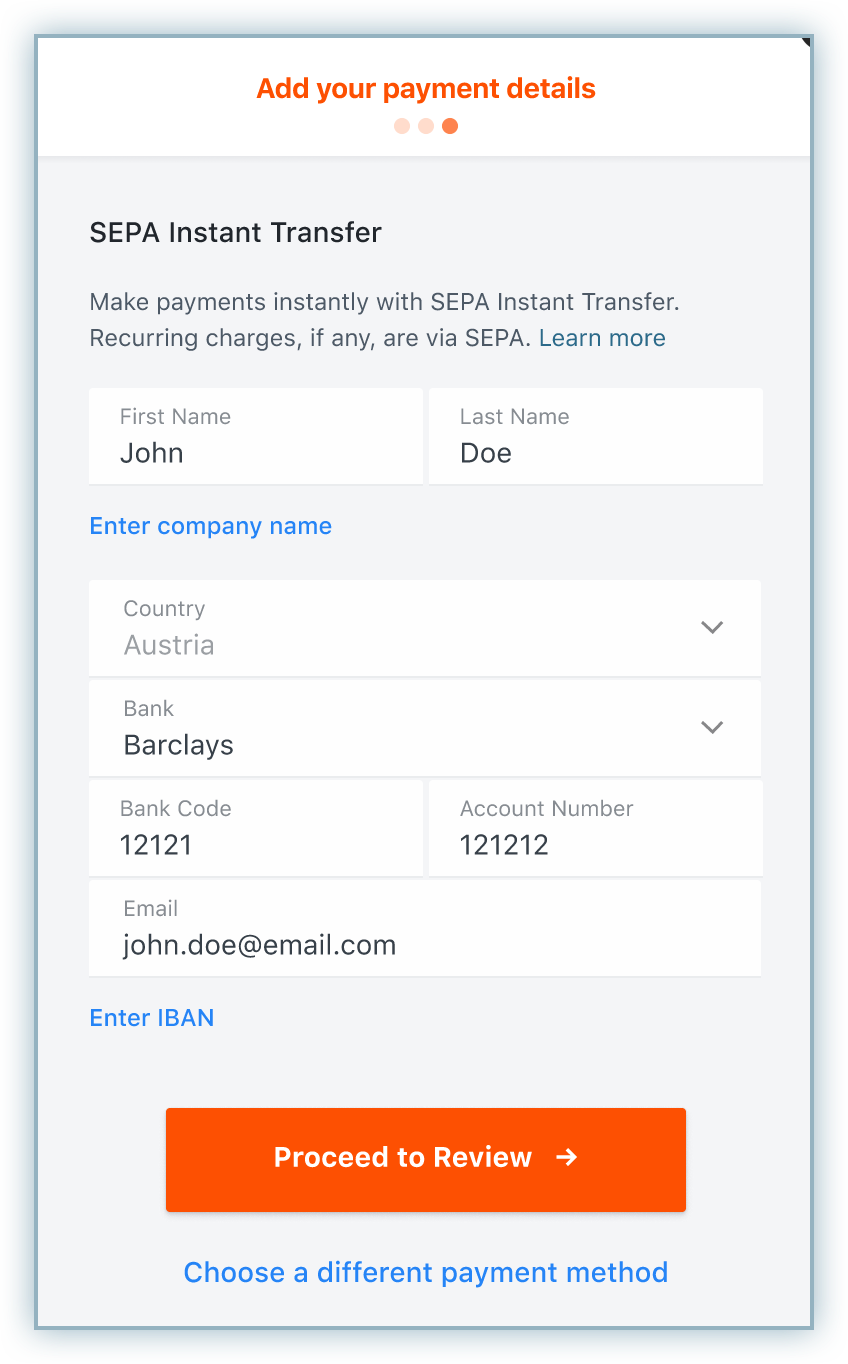

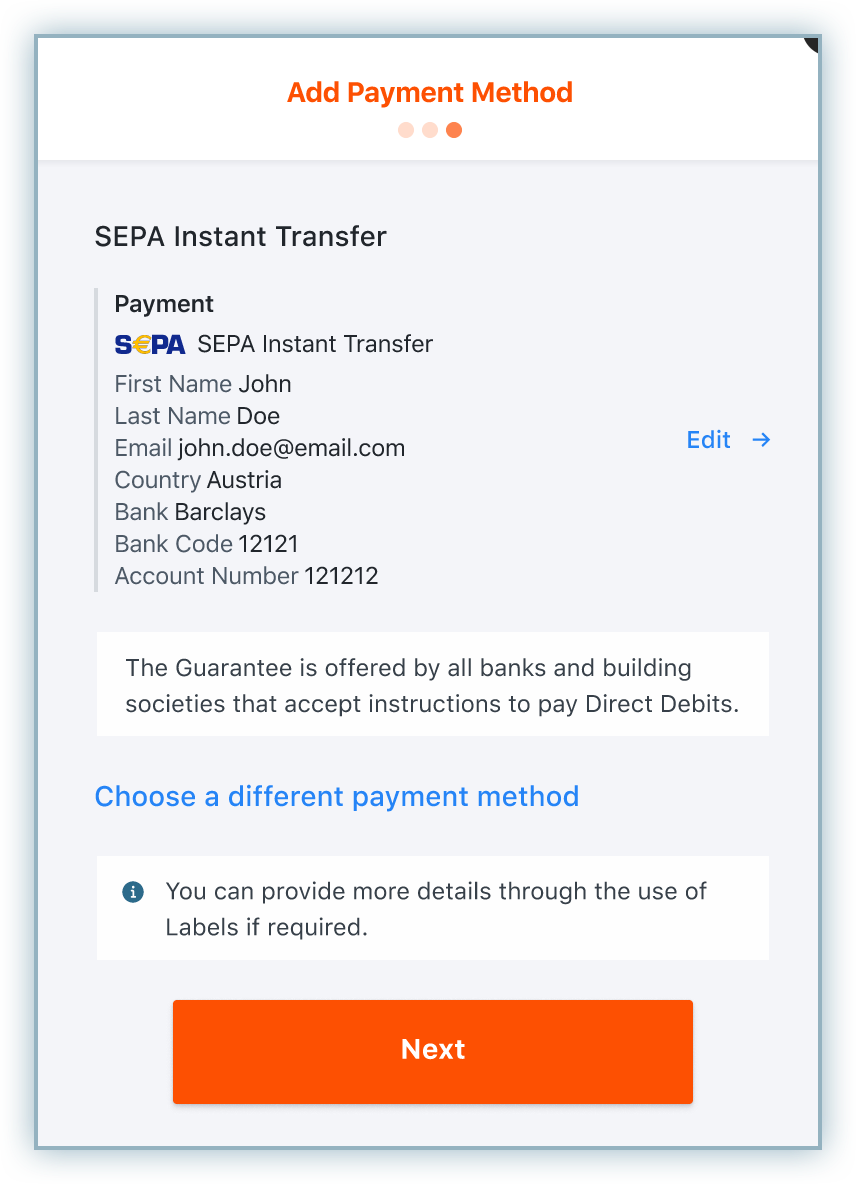

The checkout process for SEPA Instant Transfer appears as follows:

-

Once you initiate the checkout, select SEPA Instant Transfer as the payment method.

-

Add your bank account details by selecting the bank account from the Bank drop-down menu and adding other required details. Click Proceed to Review.

-

Review the displayed information and click Next.

-

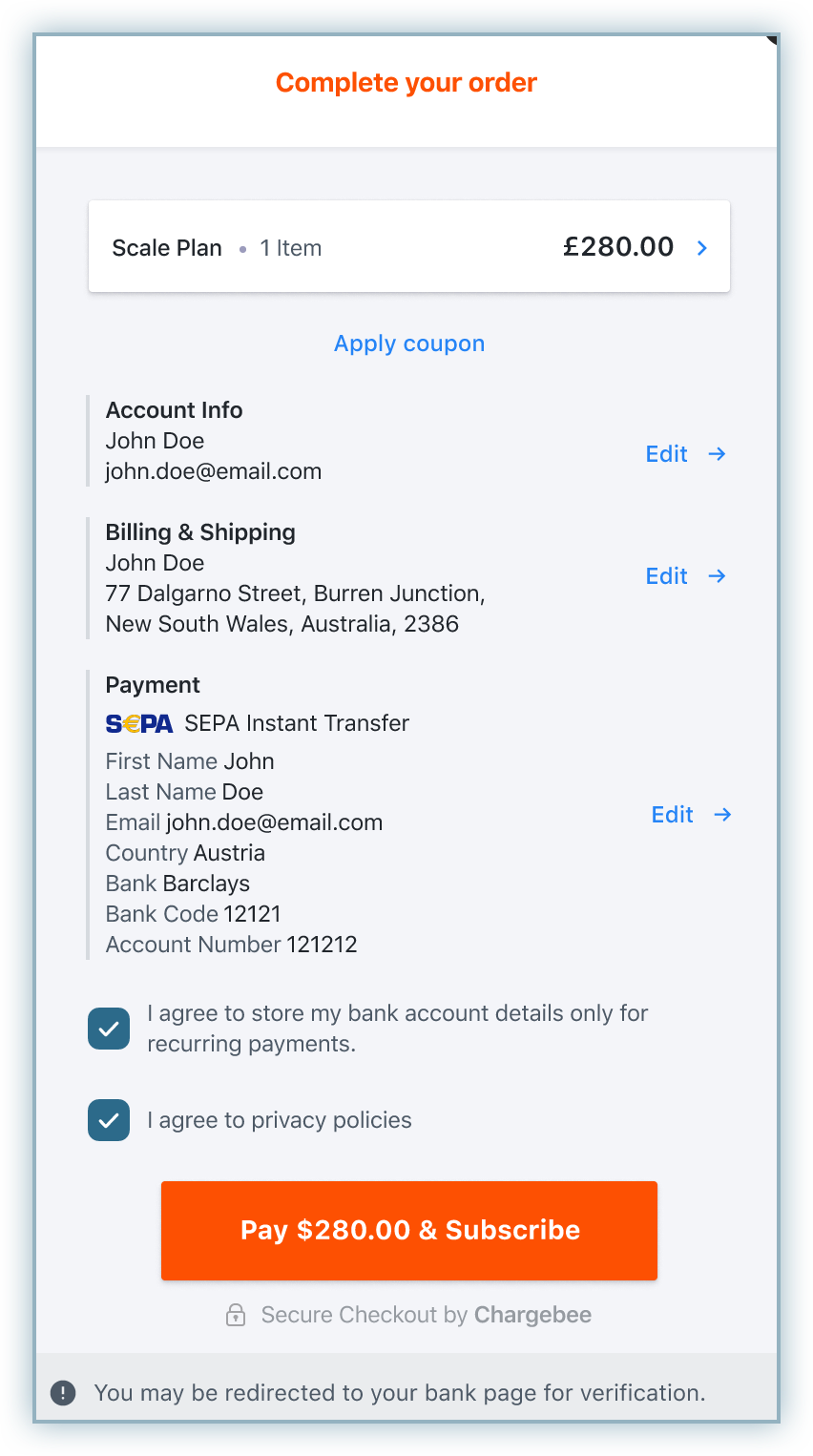

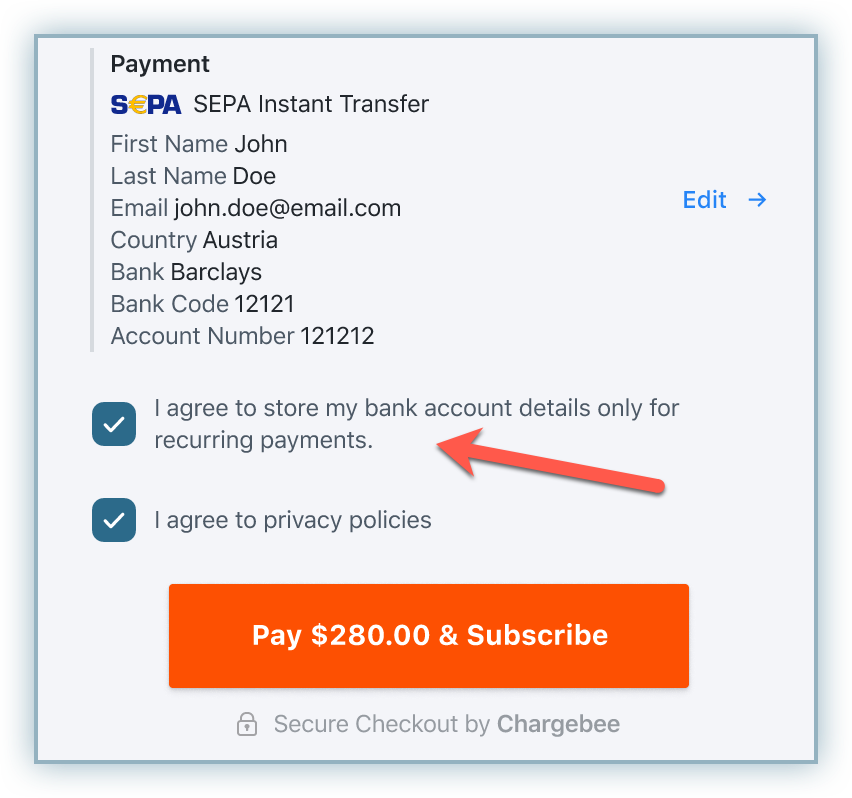

Review the plan, account, billing and payment details. Check the required boxes at the bottom and click Pay & Subscribe.

-

You will be redirected to your bank website. Log in to your bank account, select the account type (current or savings), and approve the transaction.

-

Once approved, you will be redirected to Chargebee's checkout. If the transaction is successful at GoCardless, your order is confirmed at Chargebee.

Supported Tokens

This integration supports the following tokens in the mentioned format:

Payment Source | Token | Passed Data | Parameter Format |

Faster Payments | REFERENCE ID | CustomerID/MandateID | payment_method[reference_id] NOTE: If the token is used only to add a Payment method without attempting a payment, BACS should be used as the payment source type. |

CHARGEBEE PAYMENT INTENT ID | Chargebee Payment Intent ID | payment_intent[id] | |

Sepa Instant Transfer | REFERENCE ID | CustomerID/MandateID | payment_method[reference_id] NOTE: If the token is used only to add a Payment method without attempting a payment, SEPA should be used as the payment source type. |

CHARGEBEE PAYMENT INTENT ID | Chargebee Payment Intent ID | payment_intent[id] | |

PayTo | REFERENCE ID | CustomerID/MandateID | payment_method[reference_id] |

CHARGEBEE PAYMENT INTENT ID | Chargebee Payment Intent ID | payment_intent[id] |

Adding or Updating Payment Method for a Customer

You can add or update the Open Banking payment methods for a customer in the following ways:

- Using Customer Portal: Only PayTo and FasterPayments can be added as payment methods using the Customer Portal.

- During Checkout: All three payment methods can be added during checkout. As shown in the checkout flow, when the customer fills through the Checkout flow and checks the box at the end for vaulting (storing or saving) the payment method for future use, it automatically gets saved for that customer.

Configure Email Notifications

It is recommended to send email notifications for payments done using all Open Banking payment methods. In this process, you need to set up and enable the following email notifications:

- Mandate Creation

- Payment pre-notification

Follow the steps below to navigate to these notifications:

- Go to Settings > Configure Chargebee > Email Notifications.

- Select the Payments and Credits category. Both notifications will be available there. You can edit the template as per your requirements.

Limitation

SEPA Instant Transfer does not support refunds.

Was this article helpful?