ACH via Worldpay US eCom

This feature is a Private Beta Release. Contact Chargebee Support to enable ACH via Worldpay US eCom for your test and live sites.

ACH is a US-based payment method available for processing recurring or one-time payments. Chargebee Billing allows you to configure ACH (Direct Debit) payments using Worldpay US eCom (formerly Vantiv Litle). This document helps you set up ACH payments via Worldpay US eCom in your Chargebee account.

- Chargeback management is currently not supported for ACH payments via Worldpay US eCom.

- Currently, Automated Account Updater is not supported for this integration.

Integration options

The following options are available to integrate Worldpay US eCom with Chargebee:

| Integration Method | Description | PCI Requirements |

|---|---|---|

| Chargebee Hosted Pages | In this method, customers' bank information is collected by Chargebee's checkout and directly passed on to Worldpay US eCom. | Low(Your PCI compliance requirements are greatly reduced due to the usage of Chargebee's checkout) |

| Chargebee JS | You will collect raw bank account details via your custom checkout and pass them to Chargebee.js. | High |

| Chargebee API | In this method, you will have to collect bank information yourself and pass it on to Chargebee. Chargebee then routes this bank account information to Worldpay US eCom. Since you will be collecting bank information directly, you will have to take care of PCI compliance requirements. | High |

Prerequisites

To accept ACH payments through Worldpay US eCom using Chargebee, ensure the following prerequisites are met:

Configure a USD bank account

You must be a US-based merchant selling to US customers and your Chargebee site must have a USD bank account configured.

Enable ACH on your Worldpay US eCom account

Contact your Worldpay US eCom relationship manager or Client Success team to enable ACH (eCheck and eCheck Verification) on your Merchant ID (MID).

Configure Worldpay US eCom and ACH in Chargebee

- Set up Worldpay US eCom as a payment gateway in your Chargebee site. Learn more

- Add ACH as a payment method for your customers in Chargebee. Learn more

ACH (eCheck and eCheck Verification) prerequisites

To process ACH (eCheck) payments via Worldpay US eCom:

- ACH must be enabled on your Worldpay US eCom account.

- You must be contracted for ACH and set up to consume the required reports.

- To use eCheck Verification, additional documentation and onboarding with Certegy (Worldpay's ACH verification partner) are required. This may take several weeks.

ACH may appear enabled in Chargebee, but transactions will fail unless the setup is fully complete.

Error Response Code: 956

Error Message: Merchant is not authorized to perform eCheck Verification transactions.

Ensure you're fully authorized by Worldpay and all reporting requirements are met before transacting.

Configure Direct Debit (ACH) in Chargebee

Follow these steps to enable and configure Direct Debit (ACH) via Worldpay US eCom in your Chargebee Billing site:

- Log in to your Chargebee Billing site.

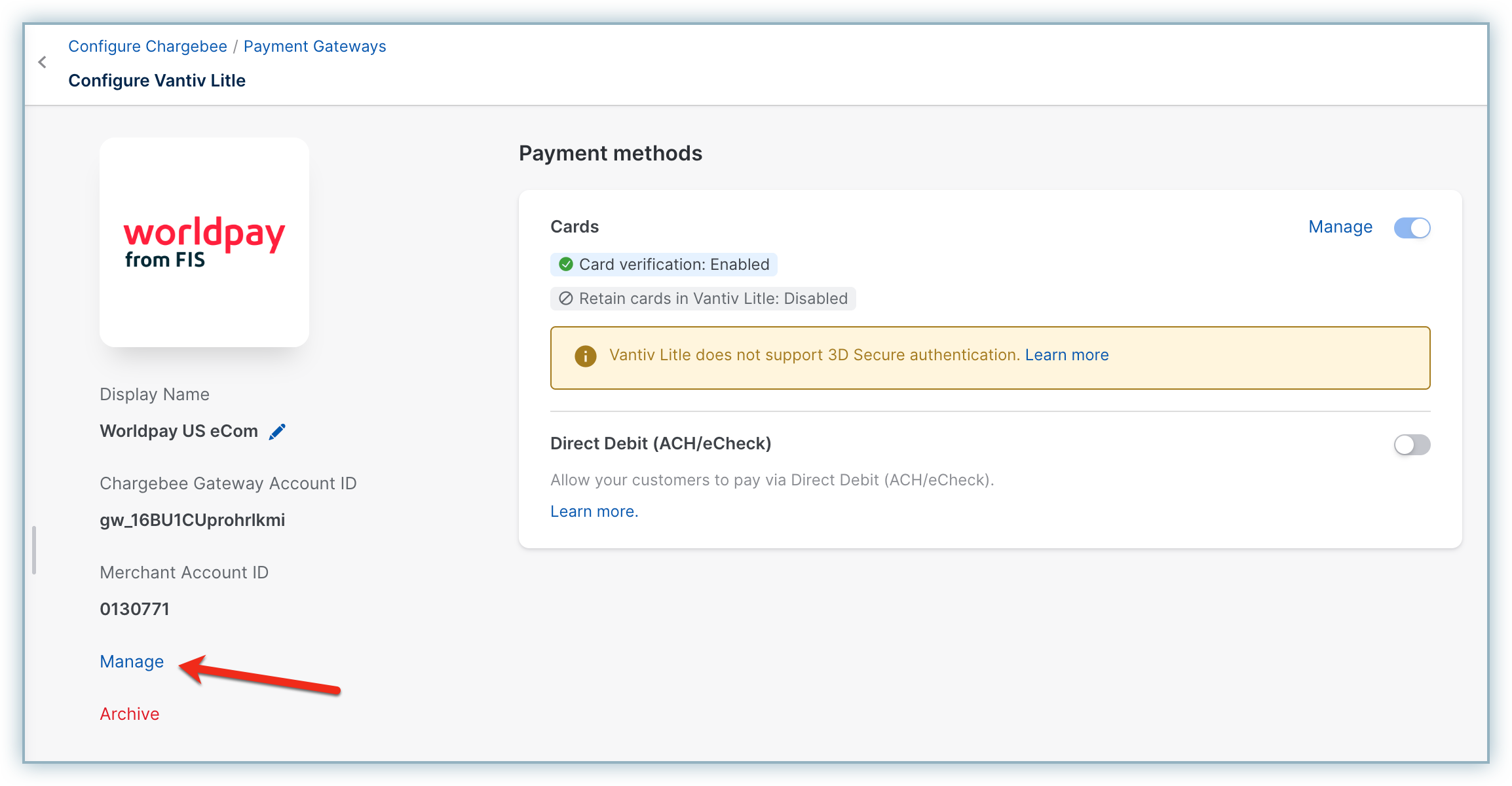

- Go to Settings > Configure Chargebee > Payment Gateways > Worldpay US eCom.

- Click Manage to reconnect your Worldpay US eCom account.

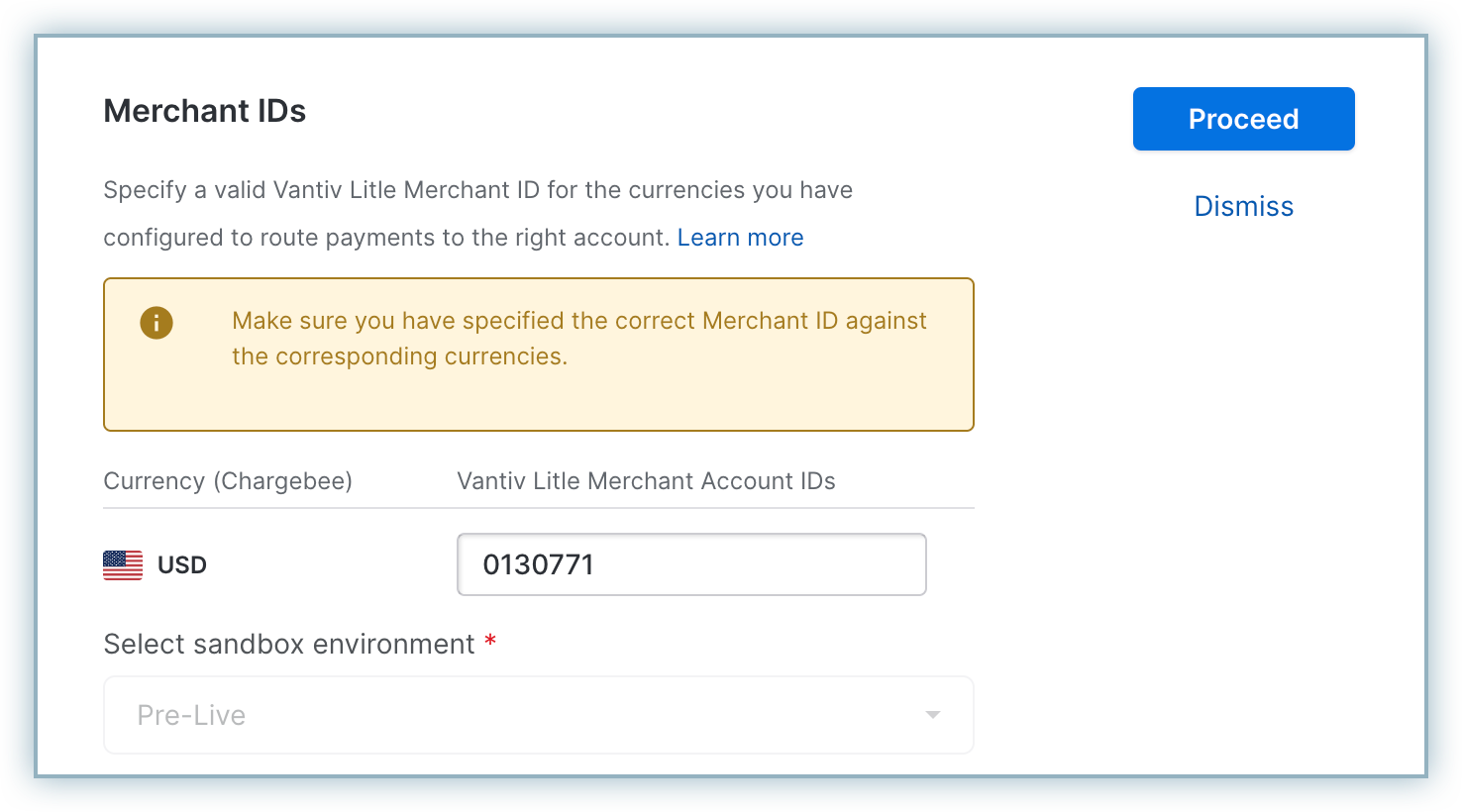

- Click Proceed to update the Worldpay US eCom account and add merchant account information for Direct Debit.

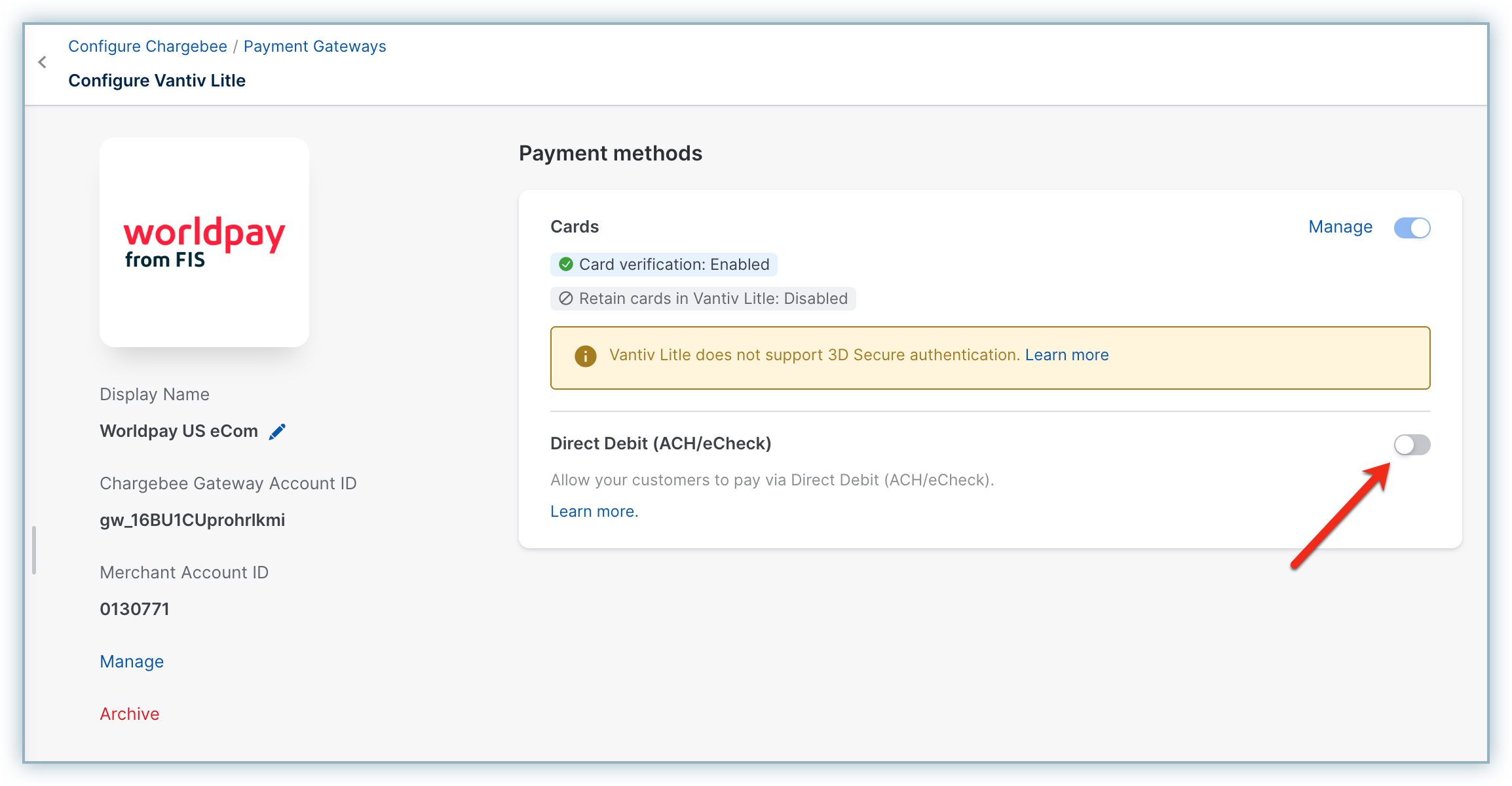

- Enable Direct Debit (ACH/eCheck).

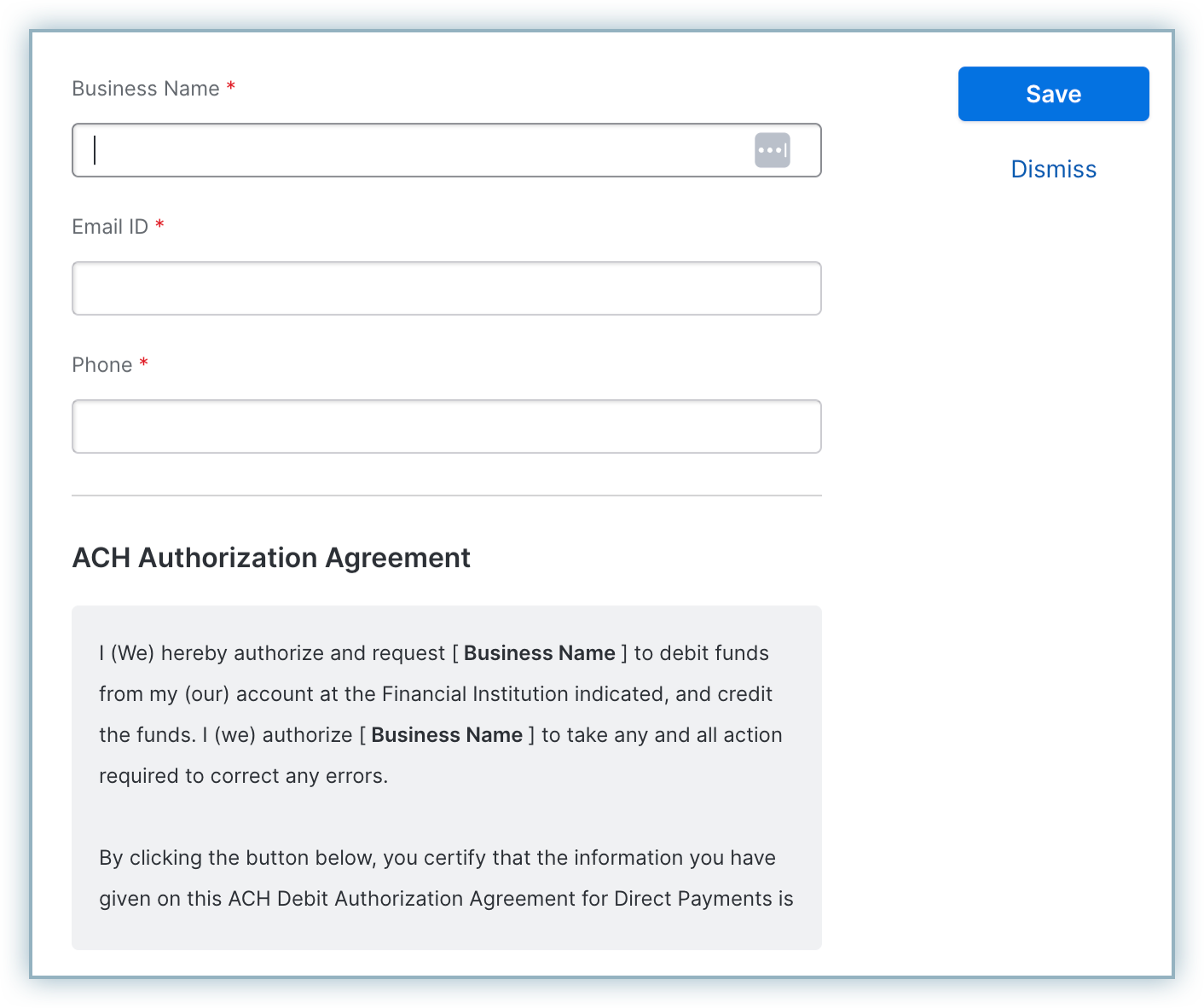

- Enter the Business Name, Email ID, and Phone.

- As required by NACHA (National Automated Clearing House Association) and federal regulations, you must have an ACH Authorization Agreement with your customer before initiating ACH transactions. When a customer selects ACH as a payment method, Chargebee displays an authorization agreement for them to sign, based on where their bank details are entered. You can customize this agreement by configuring your Business Name, Email ID, and Phone in the Worldpay US eCom settings. These details will appear in the agreement shown to customers.

- Click Save.

- In the customer's profile, enable this option to pay via their bank account. This step ensures that payments by ACH are available only for customers you know and trust.

Configure Smart Routing

When you enable ACH via Worldpay US eCom, smart routing for USD Direct Debit is automatically activated. If you have another gateway configured for USD Direct Debit, you can update the routing preferences on the Smart Routing page.

Follow these steps to modify the Smart Routing settings:

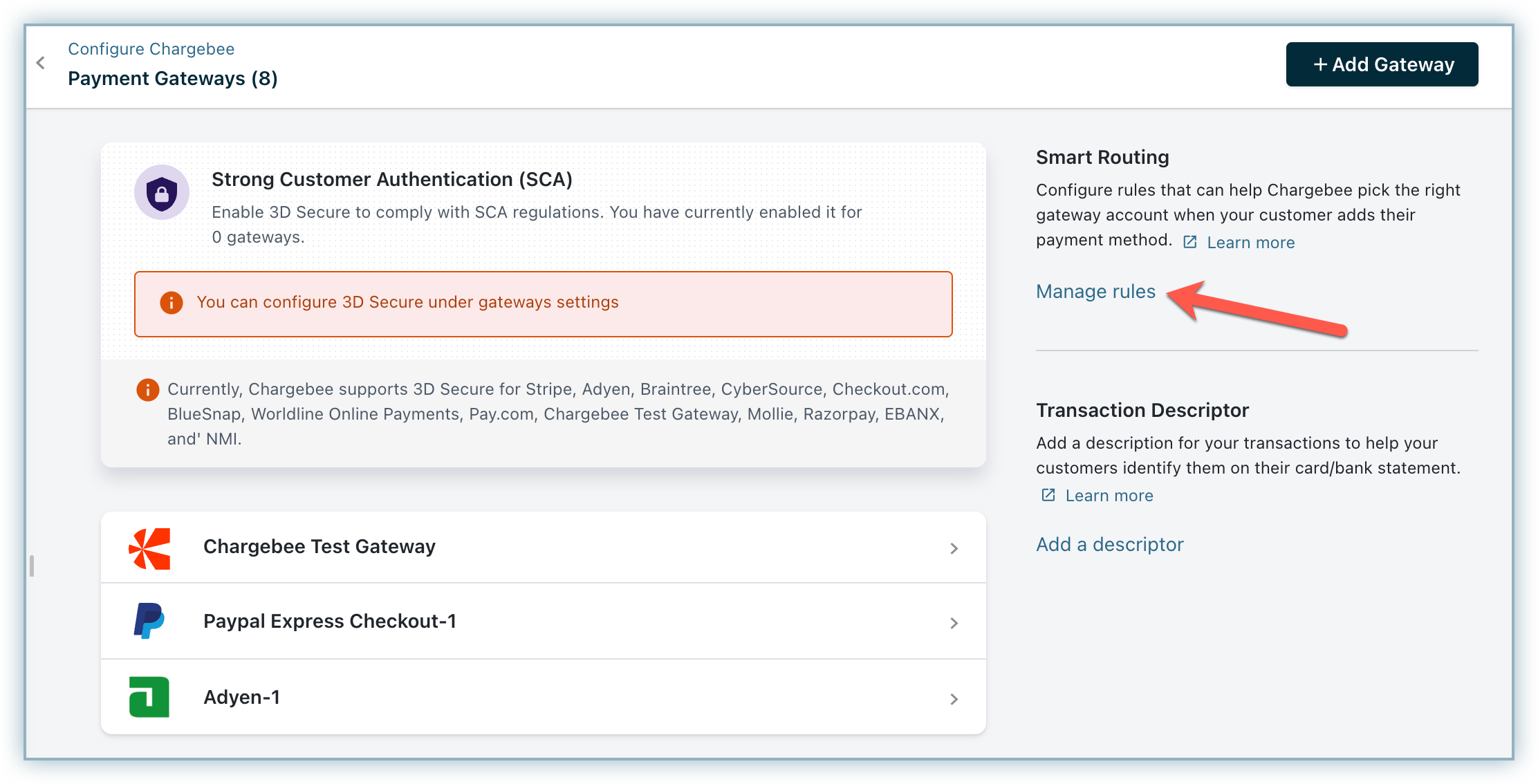

- In your Chargebee Billing site, go to Settings > Configure Chargebee > Payment Gateways.

- Click Manage Rules under Smart Routing.

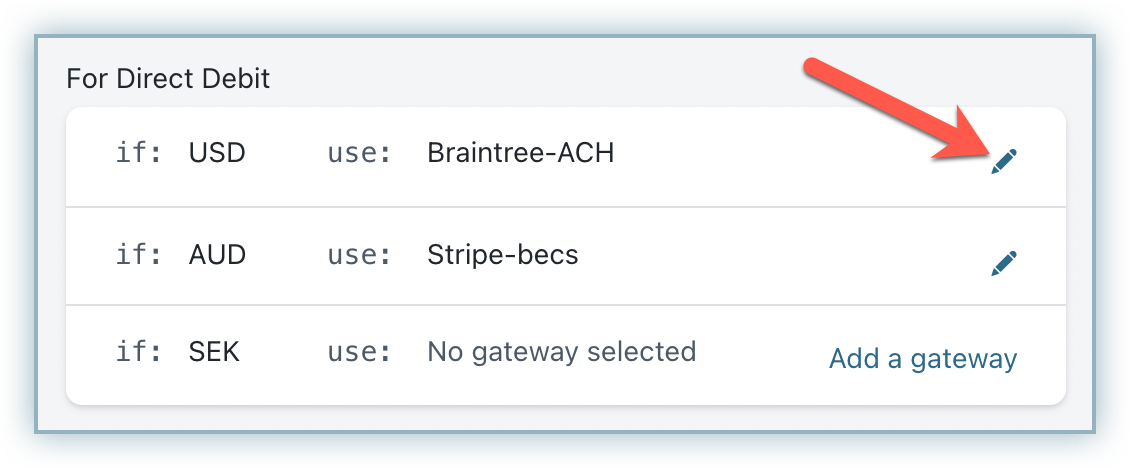

- Go to the For Direct Debit section and click the Edit icon for USD.

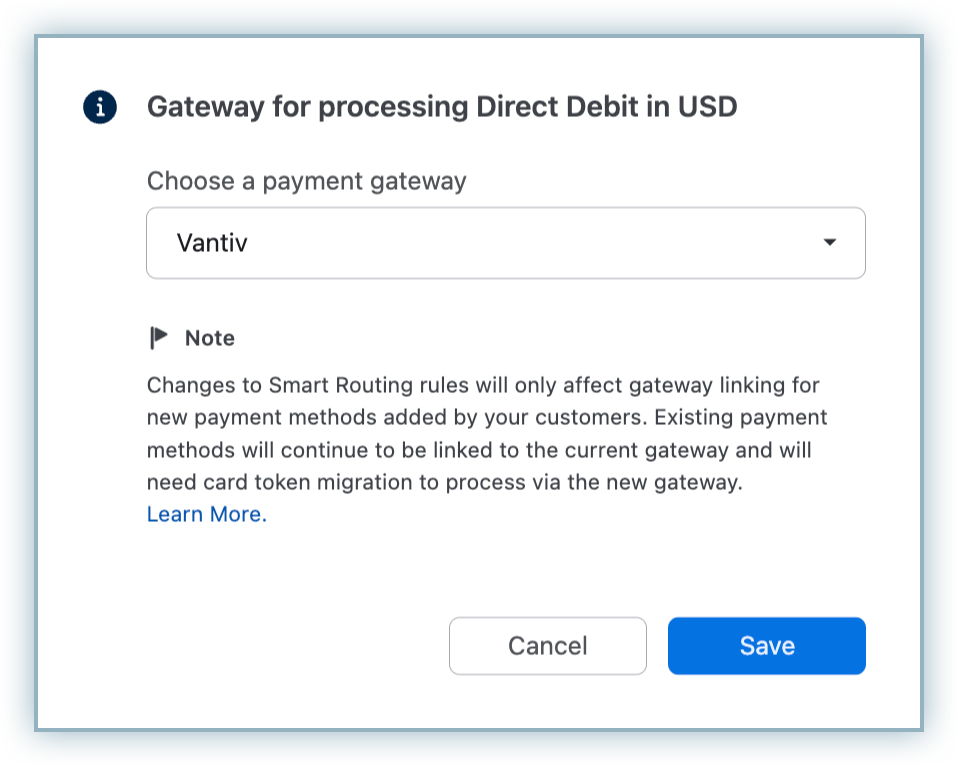

- From the Choose a payment gateway drop-down menu, select the Worldpay US eCom gateway instance from your Chargebee site with ACH enabled.

- Click Save.

If a direct debit payment method fails three consecutive times, Chargebee will mark it as invalid. When this happens, you should remove the existing payment method and request the customer to add a new one.

Adding bank account details

To add a customer's bank account on the Chargebee interface, navigate to the Payment Methods section on the customer's details page and click Add Bank Account.

Note:

Direct Debit (ACH) will be unavailable if the Allow customer to pay via their bank account option is disabled when creating this customer. Learn more.

You are required to enter the following mandatory information while creating a bank account:

- Name on account

- Account Number

- Routing Number

- Account Type

- Account Holder Type

- Phone Number

- Company Name

Note:

- For Individual accounts, both First Name and Last Name are mandatory.

- For Corporate accounts, you must provide the Company name along with First Name and Last Name.

- If the check issuer's name is not available for a corporate account, you can use

unavailableas the value forfirstNameandlastName. - If the First Name and Last Name are not provided for an individual account, Chargebee will attempt to fetch them from the customer details. If unavailable, it will default to

fnu(First Name Unknown) andlnu(Last Name Unknown). - If the Phone Number is not provided, Chargebee will try to retrieve it from the customer's details. If it cannot be found, an error will be returned indicating that mandatory parameters are missing.

- In both account types, you must include the following details: Address, City, State, ZIP Code, and Phone Number.

You can also use the Create a bank account payment source API to collect the bank details from the customer.

Bank Account Type Mapping

When configuring ACH payments via Worldpay US eCom, it is essential to understand how Chargebee's account types map to Worldpay US eCom's account types. The mapping is crucial for ensuring that the correct account type is used for processing payments:

| Chargebee Account Type | Chargebee Account Holder Type | Mapped Worldpay US eCom Account Type |

|---|---|---|

| savings | individual | Savings |

| savings | company | Corp Savings |

| checking | individual | Checking |

| checking | company | Corporate |

| business_checking | any | Corporate |

- Ensure Account Type and Account Holder Type values are always provided. Missing these values will result in validation errors.

- Unsupported combinations or unexpected values for Account Type and Account Holder Type will trigger explicit validation errors, preventing incorrect mappings.

Test Accounts

You can use the following sample test accounts for setting up sandbox configuration:

-

accountNumber: '4999999992', routingNumber: '101075150', accountType: 'checking', accountHolderType: 'individual' -

accountNumber: '6999999992', routingNumber: '101075150', accountType: 'checking', accountHolderType: 'company'

Information

Refer here for more test bank accounts for testing ACH via Worldpay US eCom.

Navigate to the TABLE 2-5 eCheck Sale Test Data section for test bank accounts with multiple scenarios.

Account validation by Worldpay US eCom

Worldpay US eCom automatically validates the Direct Debit routing number to ensure it is correctly formatted and exists in the Federal Reserve (Fed) database. If the routing number fails this validation, the transaction is rejected. This check is performed on all Direct Debit transactions by default.

Certegy Check Services Inc. verification

ACH payments (Direct Debits) inherently involve risk, as they do not include real-time authorization to verify the availability of funds at the time of the transaction. To reduce this risk, Chargebee leverages the optional eCheck Verification service provided by Worldpay US eCom.

When a customer adds a payment method in Chargebee, an eCheck Verification request is triggered by default. This request checks the provided bank account and account holder information against a historical risk database maintained by Certegy Check Services, Worldpay US eCom's verification partner. The process helps identify accounts with potential risk factors such as bad funds history or frequent reversals.

For all ACH payments processed via Chargebee and Worldpay US eCom, the verify parameter is set to true by default, ensuring that every transaction goes through this risk screening step. If the verification or transaction is blocked, helping prevent identity conflict and ensuring payment security.

Refer here to learn more about Worldpay US eCom settlement.

Card Payments vs ACH Payments: The waiting period

Unlike card payments, where authorization and fund transfer occur instantly, ACH payments involve a delayed processing timeline. The authorization and transfer typically take up to five business days, with total settlement usually completing within seven working days.

Refer here for more information about the Worldpay US eCom settlement.

Additional configuration

If you intend to use Chargebee's Hosted Pages for your integration, some fields must be configured as mandatory in Chargebee's checkout settings.

Follow the steps below to configure the additional settings:

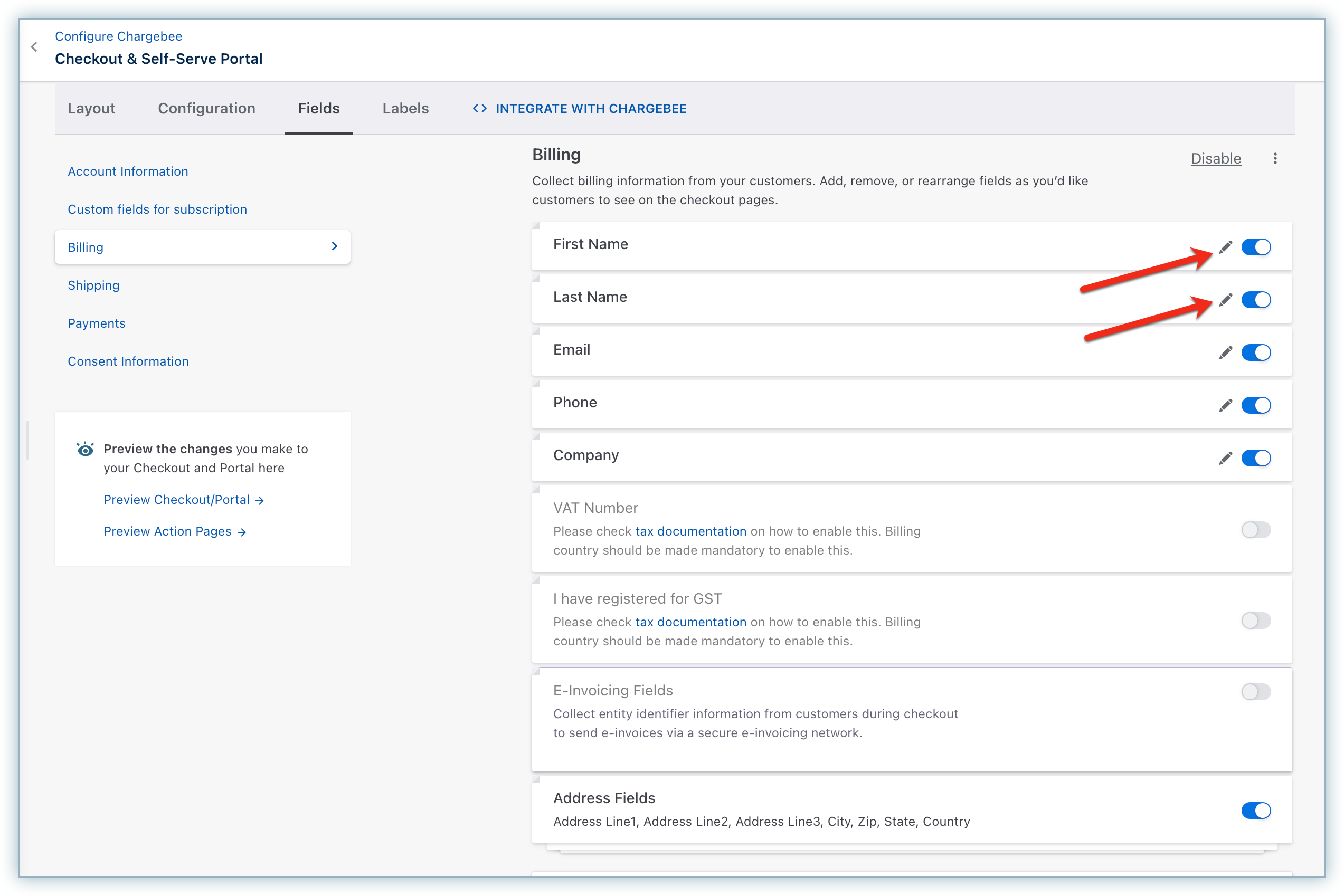

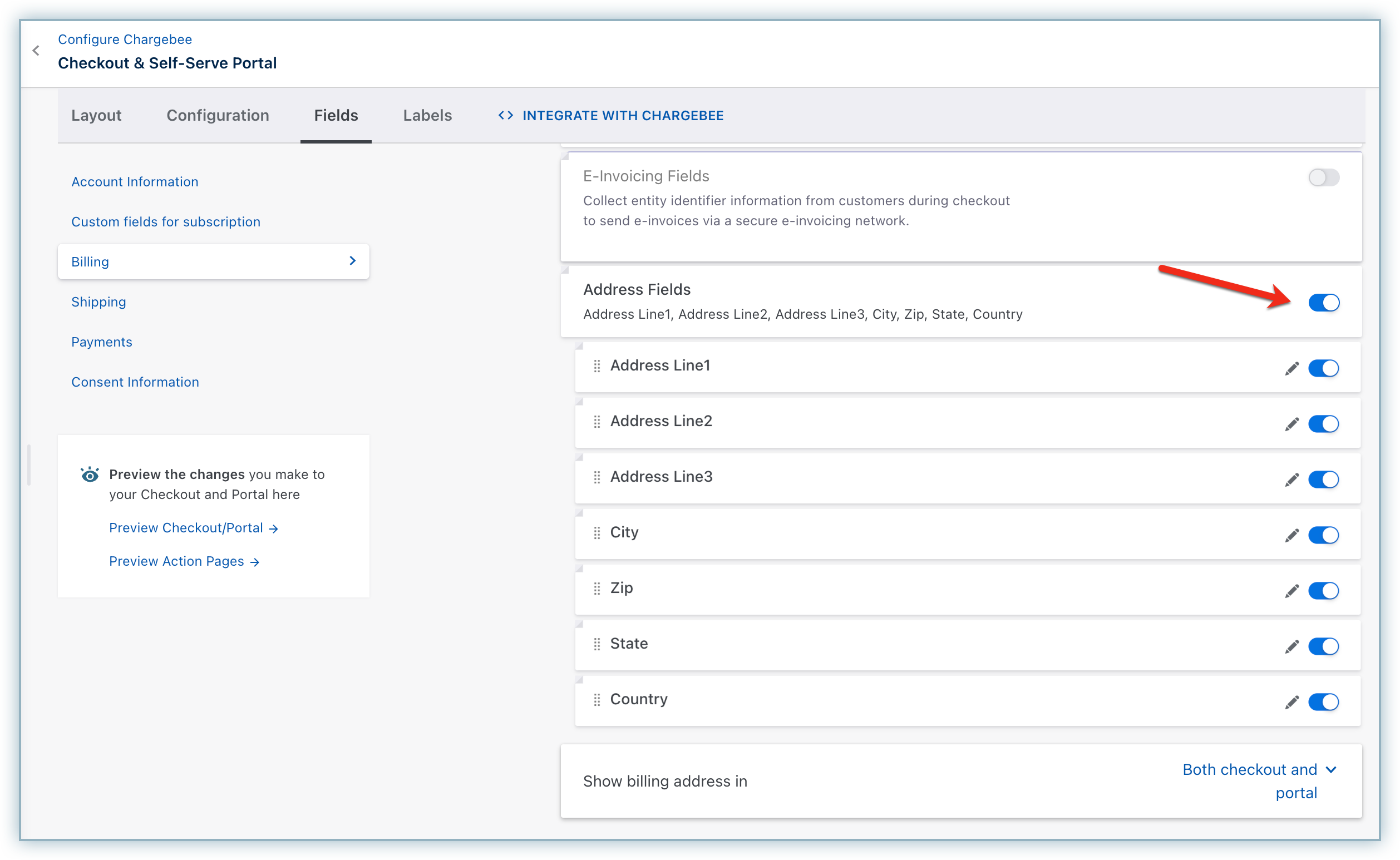

- Click Settings > Configure Chargebee > Checkout & Self-Serve Portal > Fields > Billing.

- Enable First Name, Last Name within the Fields settings.

- Enable Address Fields.

- Click the Edit icon and confirm Address Line 1, Address Line 2, City, Zip, State, and Country are listed as Show from the drop-down list.

- Click Publish.

Enable the Address Fields without fail to ensure successful tokenization at the Worldpay US eCom end. If these fields are not enabled or if the customer enters an invalid value, tokenization can fail.

Was this article helpful?