ACH Payments via BlueSnap

ACH is a US-based payment method available for processing recurring or one-time payments. Chargebee allows you to configure ACH (Direct Debit) payments using BlueSnap. This document helps you set up ACH payments via BlueSnap in your Chargebee account.

Note:

- ACH is applicable only for payments made in USD.

- There is a plan-based limitation for configuring ACH in multiple gateways. To learn more, visit our plans and pricing page.

- Currently, this integration is possible via Gateway JS and APIs.

- If there are three consecutive payment failures using the direct debit payment method, it will be marked as invalid in Chargebee. In such cases, you should remove the existing payment method and ask your customer to add a new one.

Prerequisites

To accept ACH payments using Chargebee, you must:

- Be a US-based merchant selling to customers residing in the US.

- Have a US/USD bank account configured with Chargebee.

- Have configured the BlueSnap payment gateway in your Chargebee account. Learn more

Accepting ACH payments in Chargebee

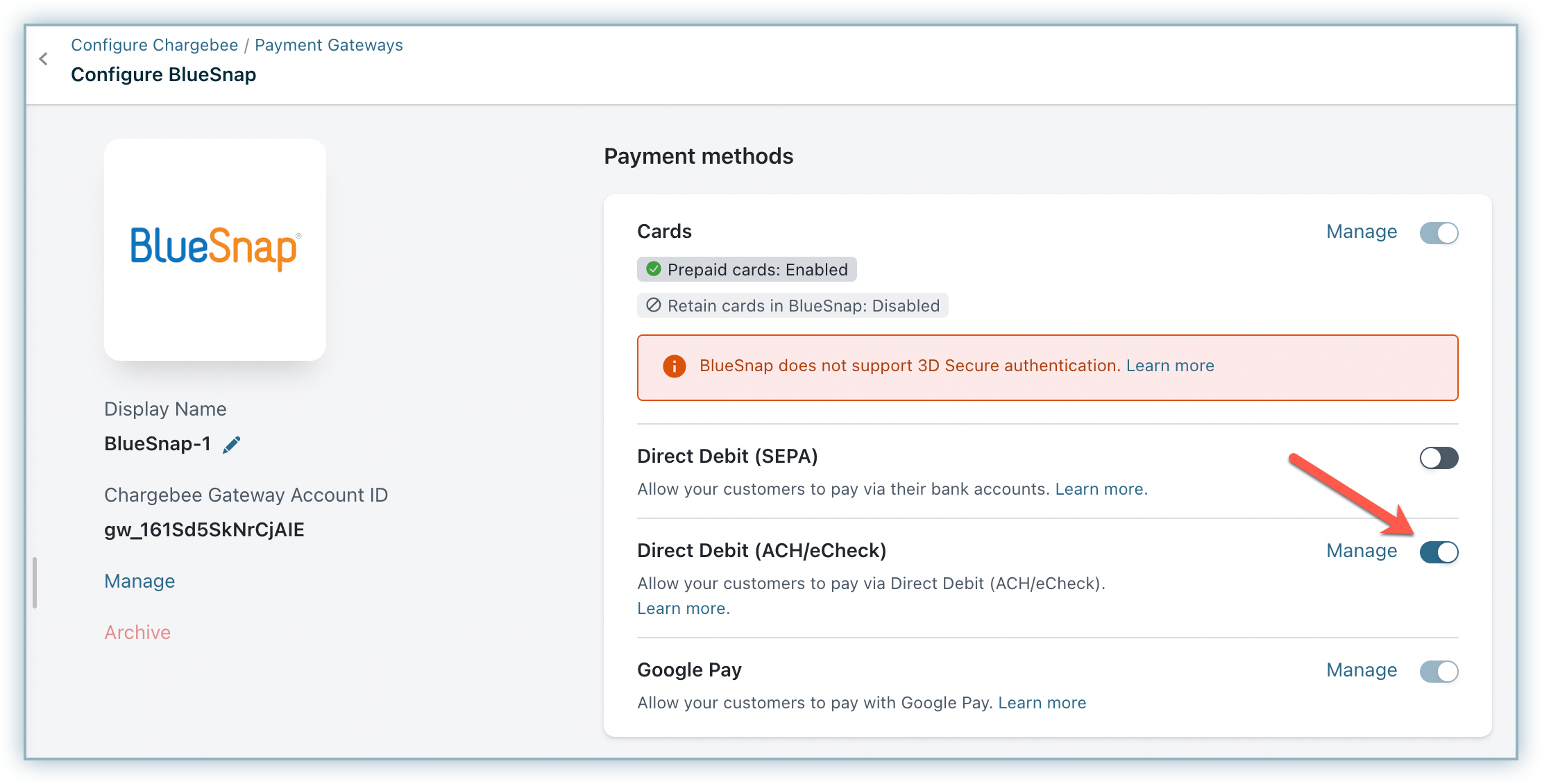

- Go to Settings > Configure Chargebee > Payment Gateways > BlueSnap.

- Enable Direct Debit (ACH/eCheck).

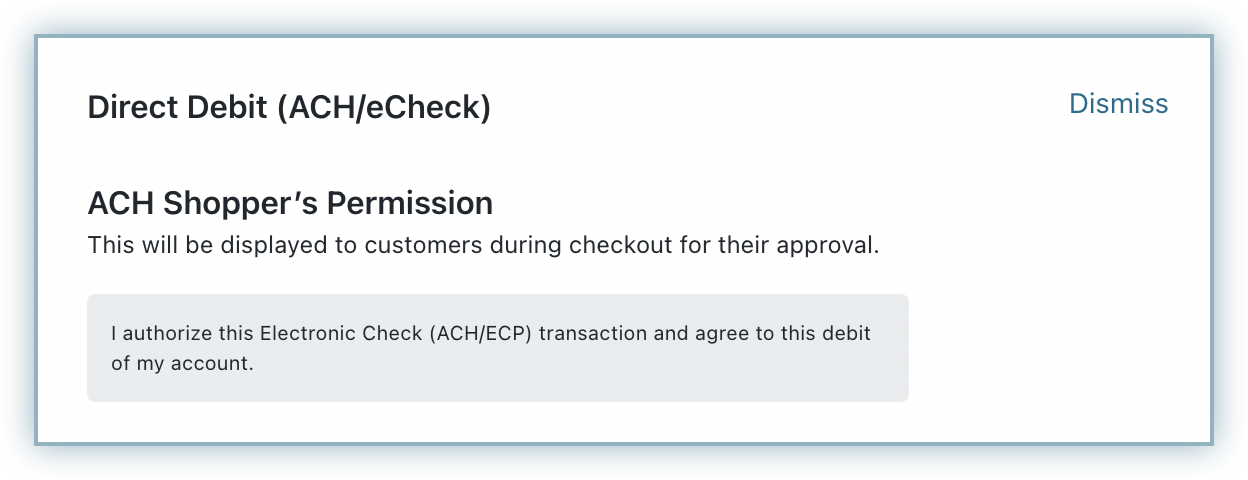

- Enable the ACH Shopper's Permission (Authorization).

Note:

This payment method can be enabled only if it is already enabled in BlueSnap.

Adding bank account details

To add a customer's bank account on the Chargebee interface, navigate to the Payment Method section on the customer's details page and click Add Bank Account.

This option will be unavailable if the Allow customer to pay via their bank account option is disabled when creating this customer. Learn more

To add a bank account, you will need the following information:

- Payer Info

- Account Number

- Routing number

- Account Type

You can also use an API to collect the bank details from the customer Refer to our API documentation to learn more.

ACH transaction flow via BlueSnap

Here's what the workflow looks like:

- The customer selects ACH, adds their bank account in the checkout, and submits a transaction request.

- BlueSnap then verifies if the bank account is valid using their account and routing numbers immediately.

- If found valid, BlueSnap creates an invoice in pending status and sends the transaction to the bank for processing.

- If found invalid, an error message is displayed to the customer and the transaction is not sent for processing.

- After this verification, BlueSnap waits for up to three working days for the notification from the bank.

- If the bank sends no response, the invoice is approved.

- If the bank sends a response with payment rejection, the invoice is rejected.

- BlueSnap sends a webhook to Chargebee informing the success or failure of the transaction.

To learn in detail about what the workflow looks like on BlueSnap, check out their ACH guide.

Card payments vs ACH payments: The waiting period

Unlike card payments, where the authorization and transfer of funds happen immediately, the authorization and transfer process has a waiting period for payments via ACH. This waiting period is typically up to four business days.

ACH email notifications

Two types of email notifications are available for ACH payments:

- Payment Initiated: To inform customers that a payment has been initiated via Direct Debit from their bank accounts.

- Refund Initiated: To inform customers that a refund has been initiated towards their bank account.

Additionally, we would strongly recommend enabling the Subscription Renewal Reminder notification, as customers have to be given notice before they are charged via Direct Debit.

Invalid payment method email notifications

You can also configure the Invalid Payment Method notifications to inform your customers about card expiry or payment failure.

You can set up these notifications by clicking Settings > Configure Chargebee > Email Notifications > Invalid Payment Method.

Articles & FAQs

Was this article helpful?