Charts

Refunds

This chart displays the total value of refunds processed for customers during the period. Refunds are reported based on the transaction date and include only successful refunds.

Voluntary Cancellation MRR

Monthly Recurring Revenue lost from voluntarily canceled Subscriptions.

Note:

Cancellations within the same month of activation are not included.

This metric helps to evaluate product offerings, plan pricing, and onboarding experience. It can be used to understand voluntary churn where dissatisfied customers cancel their subscriptions due to a lack of perceived value.

Chargebee uses the values of cancel_reason for classifying churn into voluntary or involuntary. Chargebee classifies this value as a Voluntary Churn if the Cancellation Reason is unavailable. Refer to the API documentation for more information.

Why Voluntary Churn? Voluntary churn happens when customers leave because they are no longer happy with the product, its features, or its pricing.

Voluntary Cancellation MRR = Total MRR lost from subscriptions canceled due to voluntary reasons.

Example

In a given period, 15 customers on a $10 per month plan churned voluntarily, and 10 on a similar plan involuntarily.

Cancellation MRR (Voluntary churn): [15 × 10] = $150

Involuntary Cancellation MRR

Monthly recurring revenue lost from involuntarily canceled subscriptions.

Note:

Cancellations within the same month of activation are not included.

Why Involuntary Churn?

Involuntary churn happens when a customer cannot continue using a service for reasons partially or entirely out of their control, mostly related to payment processing issues.

Involuntary Cancellation MRR = Total MRR lost from subscriptions canceled due to involuntary reasons. This metric helps to understand the MRR lost from canceled subscriptions due to payment failures. It can happen due to the following reasons:

- Payment failures due to card expiry, bank declines, or no card available.

- Other reasons could be non-compliant customers, tax calculation failures, and so on.

Chargebee uses the values of cancel_reason for classifying churn into voluntary or involuntary. If the cancel_reason has one of the possible values (not_paid, no_card, fraud_review_failed, non_compliant_eu_customer, tax_calculation_failed, currency_incompatible_with_gateway, non_compliant_customer), Chargebee classifies this as an Involuntary Churn.

For more information, refer to the API documentation for more information.

Example

In a given period, 15 customers on a $10 per month plan churned voluntarily, and 10 on a similar plan involuntarily.

Cancellation MRR (Involuntary Churn): [10 × 10] = $100

Total MRR

Total monthly recurring revenue earned from subscriptions.

Total MRR from all subscriptions in Active and Non-Renewing status as of date. Non-recurring addons and coupons are included based on configurations. Refunds, taxes, and ad hoc charges are not included.

Monthly Recurring Revenue(MRR) is normalized monthly revenue, based on all recurring and non-recurring (such as non-recurring addons, one-time coupons, metered charges) components of a subscription. As the name indicates, MRR is calculated for a monthly "duration". The MRR amount shown on the dashboard is a total of all your subscriptions' MRR.

For example, a $1,200 paid annually should be normalized as $100 per month in MRR.

It is fairly straightforward when all the charges are simple recurring charges. But as a subscription business, you tend to have a mix of one-time and recurring charges for a customer and it helps to understand what is considered as part of MRR calculation and what is excluded, by default.

What is included in the MRR calculation?

- All recurring plans & addons

- Recurring Coupon discounts

- Non-recurring addons (as per configuration)

- One time coupons (as per configuration)

- Metered charges (as per configuration)

MRR takes into account all the Active and Non-Renewing Subscriptions. Subscriptions in "Future" and "In Trial" states are not included in the calculation.

What is excluded in the MRR calculation?

- Setup fee

- Credit adjustments

- Any non-recurring ad-hoc charges

- Amount charged towards tax

Note:

- One time coupons are not included in the MRR calculation unless or otherwise specified in the configuration. However, if the same coupon is applied in subsequent renewal, it gets included in MRR calculation.

- Since the MRR reflects immediate changes made to your subscriptions, it can sometimes fluctuate by accounting for activations, upgrades, cancellations, downgrades, and any other changes made to your active subscriptions (like charges for addons and coupons) over the course of the current month.

- Learn how you can include metered plans and addons in MRR calculation.

Click here to know more about MRR.

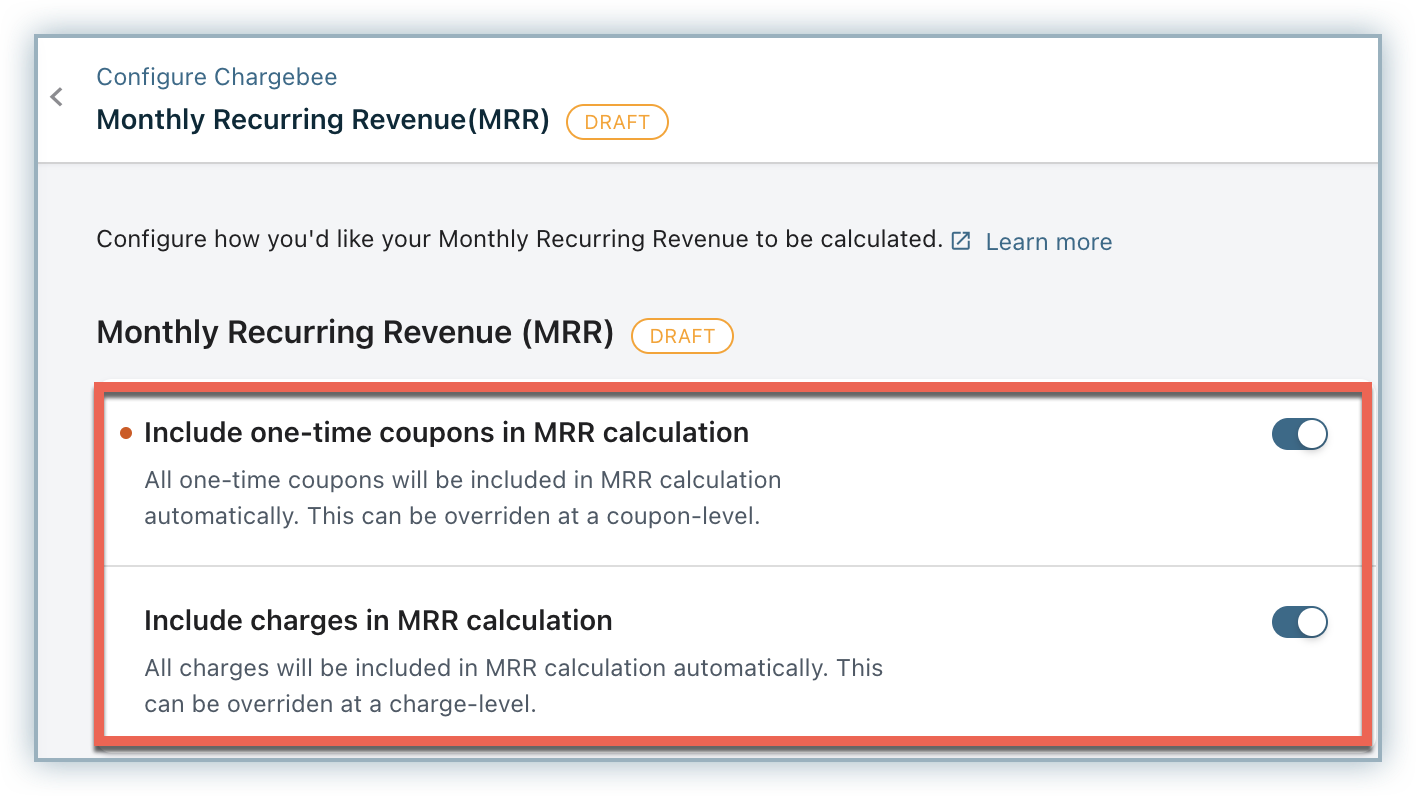

Flexible MRR Calculation

By default, Chargebee computes the MRR of a subscription-based on only the recurring charges such as recurring plans, addons, and coupons applied to the subscription. One-time coupons and charges that are non-recurring are not included in the MRR calculation.

You can customize this default setting as per your business requirements. Chargebee allows a flexible MRR calculation to include one-time coupons and charges. These non-recurring charges are included in the MRR calculation of the specific period as applicable.

Kindly contact support to avail this feature.

To configure flexible MRR calculation, follow these steps in your Chargebee site:

-

Click Settings>Configure Chargebee>Monthly Recurring Revenue(MRR).

-

In the Monthly Recurring Revenue (MRR) settings page, click Enable to customize your MRR calculation.

-

Enable the settings to Include one-time coupons in MRR calculation and to Include charges in MRR calculation. You can override these settings for specific coupons or charges, if required.

-

Click Apply.

After you click Apply, the MRR calculations are updated to include all one-time coupons and charges for the subscriptions in their respective terms.

Note:

Any changes to the MRR settings do not reflect in the historical and current MRR dashboard. The changes are effective and displayed in the dashboard only from the subsequent MRR computation, either during a subscription renewal or a subscription change.

You can override the above global setting to avoid a one-time coupon or a charge from being included in the MRR calculation, while creating or editing the coupon and charge.

Here is an example to understand how MRR is calculated:

Example

Subscription details

Plan: $100/month

Recurring addon: $100/month

Charge: $100

Discount Coupon: $50/month.

The total invoice amount for the subscription is: $250

When Flexible MRR calculation is not enabled:

MRR for this subscription is: $150.

Here is how it is calculated: (Plan price of $100) + (Addon price of $100) – (Discount of $50) = $150 in MRR.

When Flexible MRR calculation is enabled:

MRR for this subscription is: $250.

Here is how it is calculated: (Plan price of $100) + (Addon price of $100) + (Charge Price of $100) – (Discount of $50) = $250 in MRR.

Metered Billing

Metered billing or usage-based billing is a billing structure that helps charge users based on their monthly usage of the products/services. It usually works well with a plan that includes a base fee and a usage fee. Some businesses also have overage charges when users exceed the base limit as specified in their subscription. So, a customer gets charged a flat fee for their plan and a usage fee if they exceed the allocated amount.

Note:

The changes are effective and displayed in the dashboard only from the subsequent MRR computation once metered billing is enabled. Click here to learn more about metered billing.

Here are a few scenarios to understand how the Monthly Recurring Revenue (MRR) along with metered components is calculated within Chargebee.

Example

Scenario 1: Monthly plan with a base fee = $100 and a metered component fee = $3 per unit per month. Plan price = $100 Metered component fee = $3 per unit per month Metered revenue calculation for the recurring month (say February 2020) = Metered component fee per unit ($3) * Number of units (30) = $90 MRR with metered revenue = (Plan price of $100) + (Metered revenue of $90) = $190 in MRR. The following table provides information on how the MRR with metered components is calculated for a monthly plan:

Example

Scenario 2: Plan with a base fee = $1200 yearly and a metered component fee = $30 per unit per year. Plan Price per year = $1200 Metered component fee per year = $30 per unit Metered Revenue per year = Metered component fee per unit ($30) * Number of units (30) = $9000 Metered revenue per month = Metered Revenue per year/12 = $9000/12 = $750 MRR with metered revenue (say for the Year 2019) = (Plan price per month of $100) + Metered revenue per month($750 in metered MRR) = $850 The following table provides information on how the MRR with metered components is calculated for yearly plans:

Signups

This chart displays the count of the total number of signups. Reported based on the earliest date out of the subscription start date, activation date, trial start date, and creation date.Sign up simply means to register. It means you have to register to become a registered user of an account. Sign up is a phrase referring to the creation of an online account using an e-mail address or a username and password. Once someone has signed up for a service, they can access their account by logging in.

Note:

If you are on the Classic dashboard the Signups is defined as: The total number of subscriptions signed up during the period and is reported based on the creation date.

Activations

The total number of subscriptions activated during the period. Reported based on the first activation date of a subscription. It includes Trial to Active conversions and ignores reactivations.

Note:

If you are on the Classic dashboard the Activations is defined as: The total number of subscriptions activated during the period that is reported based on activation date. Trial to active conversions is included.

Total Subscription Churn rate

The percentage of subscribers who discontinue using your service during the period. The ratio of the total number of subscriptions canceled during the period and total active subscriptions at the beginning of the specific period. Trial expirations are not included.

This is the percentage of subscriptions that are canceled in the reporting period.

This report shows the day-wise canceled subscription count and churn rate of the previous and current month.

To calculate the churn rate, we consider:

A - Number of active subscriptions at the beginning of the month.

B - Number of subscriptions that were active at the beginning of the month but canceled for the reporting period. Formula: Churn rate = (B/A) x 100

Note:

Subscriptions activated and canceled in the same month will not be included when calculating churn rate for that month.

For example, if there are 100 active subscriptions on June 1, and 10 of them were canceled during the month, the churn rate is calculated as follows:

(10/100) x 100 = 10%

Total Credit Notes amount earlier known as Sales Reversals

This chart displays the total value of credit notes generated. This includes refunds, and credits provided. Reported based on Credit note date. Voided credit notes are not included. Taxes are excluded.

CMRR

Committed Monthly Recurring Revenue (CMRR) is similar to MRR except that it takes into account all the future pending changes for the month in consideration. The pending changes could include upgrades, downgrades, cancellations, and activations. For example, if there are lots of pending cancellations, MRR will not reflect this until the cancellations happen, but CMRR will reflect these in advance. You can take corrective action more accurately using CMRR in these scenarios.

What is included in the CMRR calculation?

In addition to MRR, CMRR will include pending changes such as:

- Upgrades

- Downgrades

- Cancellations

- Activations

CMRR takes into account all the subscriptions in "Future" and "In Trial" state.

What is excluded in the CMRR calculation?

- Setup fee

- Charges

- Credit Adjustments

- Quick charges

- Amount charged towards tax

These examples will help you understand how CMRR is calculated:

Example

Change Subscription on Next Renewal

Subscription Details:

Plan: $10/month Addon: $5/month Current Billing Period: June 10 to July 10 Current CMRR: $15/month

If you schedule an upgrade/downgrade (Change Subscription on next renewal) on June 20 for the subscription then the new plan would look like this:

New Plan: $20/month Addon: $10/month Current Billing Period: June 10 to July 10 Current CMRR: $15/month

In this example, the CMRR from June 20 to the end of the month will remain the same as the next renewal date falls on July 10 which is not considered for the current period of calculation.

On July 1 CMRR will be changed to $30 as the changes are applied to the subscription from this month.

This calculation does not apply to upgrades/downgrades for ‘Change Subscription Immediately' as the CMRR will reflect the changes immediately.

Example

Cancel Subscription on Next Renewal

Subscription Details: Plan: $10/month Addon: $5/month Current Billing Period: June 10 to July 10 Current CMRR: $15/month

Scheduled Cancellation: Next Renewal Date - July 10

In this example, CMRR will be changed to $0 on July 1 as the subscription is scheduled to cancel in that month.

Example

Trial and Future Subscription with card or Customer Auto Collection set to false

Subscription Details: Plan: $15/month Trial Period: 1 Month Activation Date: July 10

If a customer has subscribed to a plan on June 10 and has added their card details, then the CMRR value will be $0. From June 10 to the end of the month the CMRR will remain $0 as the activation date does not fall under the current period of calculation.

On July 1, CMRR will be changed to $15 as the activation date falls under the current period of calculation.

Was this article helpful?