If you’re running a finance team at a fast-growing SaaS company, chances are sales tax is somewhere on your radar. But too often, sales tax compliance is considered low-ROI and ends up at the bottom of the priority lists.

In reality, if you’re not collecting sales tax from your customers today, you’ll end up paying those taxes out of pocket later—plus penalties, fees, and interest. The average SaaS business loses 4.3% of revenue to non-compliance.

Here’s the good news: It’s easier to solve sales tax than you might think. Here’s how SaaS companies at any stage can save time—and future-proof their revenues—by automating sales tax compliance.

What SaaS businesses need to know about sales tax

Sales tax is an important box to check for any business, but developments in the past few years have made it especially difficult for SaaS companies to do so.

As the digital economy has grown, governments around the world have shifted their tax policies to keep up. Laws requiring remote sellers to collect sales tax are in place in all 50 U.S. states, and more than 80 countries worldwide. Regulations vary widely—from tax rates to how much economic activity triggers sales tax obligations—as do definitions of digital products like SaaS.

This can all add up to a very confusing set of tax rules for any specific business to follow. SaaS companies need to know where their customers are located, how their products are classified and taxed in those jurisdictions, and whether they’ve reached the sales thresholds set by local governments—just to understand where they have sales tax obligations. Then there’s the process of collecting sales tax from customers, remitting tax collected to the right jurisdictions, and filing plenty of paperwork.

Fortunately, there’s a simpler solution for today’s finance teams: sales tax automation.

How sales tax automation works

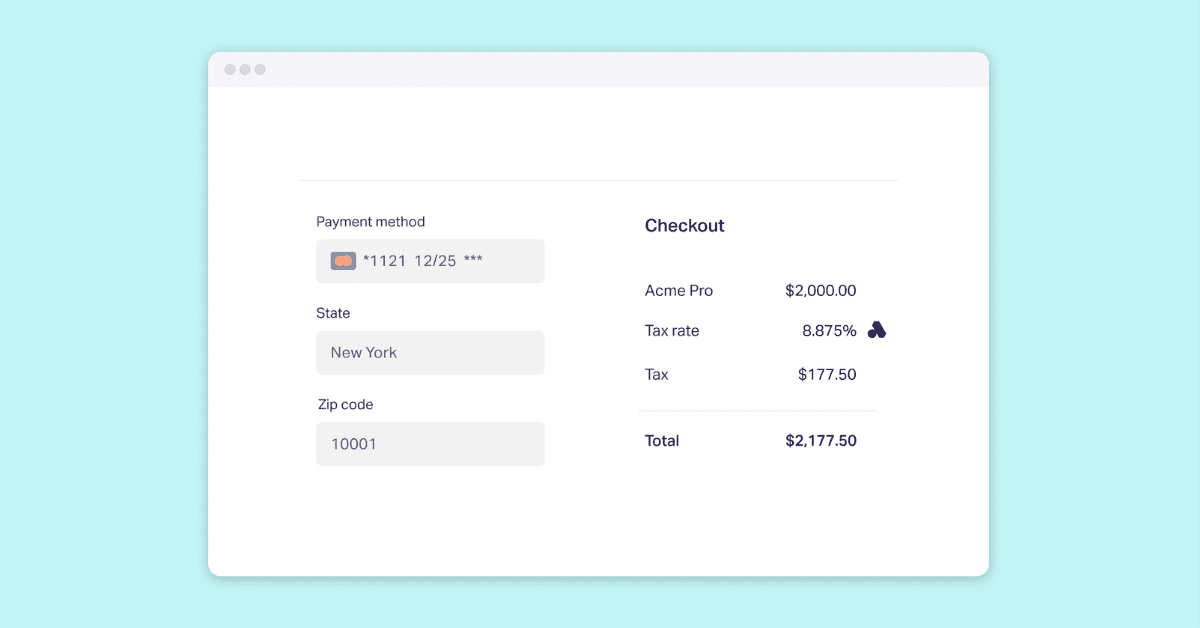

Sales tax automation begins with automatically monitoring your transactions to see if and how sales tax should be applied. A good sales tax automation platform will ingest every transaction from your billing system and keep up to date with all the latest local sales tax regulations to assess taxability. Then, the automation tool can calculate sales tax on each transaction and apply it to the charge in real-time.

But that’s not all. Once you start collecting sales tax from your customers, you also have to start filing and paying those taxes to the local jurisdictions. A good sales tax automation tool will file returns on your behalf so you’re not left dealing with government forms and payments systems.

Finally, as a SaaS business, you’ll want to make sure that your revenue tech stack can handle the needs of a fast-growing software company. This is where Anrok and Chargebee combine to make the checkout-to-billing process simpler, giving businesses a complete overview of their sales tax exposure and automatically adding the right tax to invoices.

The nuances of SaaS business models can be tricky for some sales tax tools to manage, especially when you’re focused on implementing sales tax without adding friction to your checkout and billing processes.

As the only sales tax platform built specifically for SaaS, Anrok offers this extra functionality out of the box, along with access to a team of SaaS sales tax experts. It’s also the only tool to directly integrate with your HR platform to show how hiring impacts your sales tax liability.

How to automate sales tax with Anrok and Chargebee

Anrok integrates with Chargebee to bring sales tax automation directly into your billing system, no code required. Here’s how it works:

- Connect your Chargebee account to Anrok to import past transactions and instantly see your sales tax exposure

- Enable Anrok to automatically calculate and add the right sales tax to your Chargebee invoices in real time

- Monitor sales tax obligations, register in new jurisdictions and approve sales tax returns from your Anrok dashboard

Most Anrok customers spend less than an hour a month dealing with sales tax. Don’t wait to get started—connect Anrok and Chargebee today.