Some of us have heard/read/believed (even before 2023) that retaining customers delivers better ROI for our invested capital than spending additional money to acquire new customers. Leaders and investors across various industries and markets are looking more closely than ever into Net Retention Revenue [NRR], voluntary churn [customers wanting to move out of our platform], and involuntary churn [payment failures, disputes]. We are all entering an era of customer retention wherein retaining customers longer than peers is a competitive advantage.

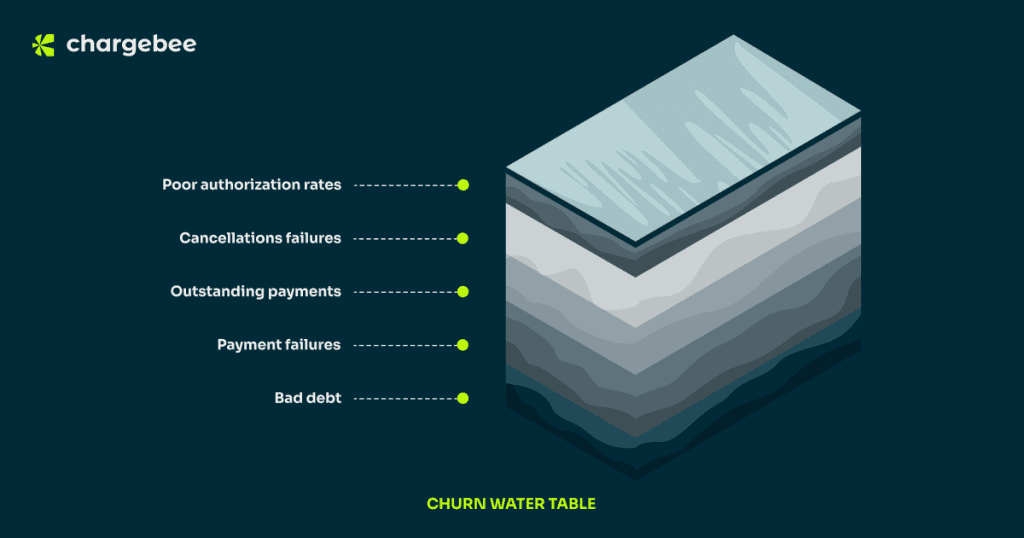

Churn is a deceptively simple concept: Simple because it’s easy to align on the truth that customer churn is terrible for business and should be kept at a desirable minimum level; deceptive because multiple factors lead to churn, but they are all playing off one another – sort of a groundwater table like composition if you visualized churn reasons.

The uppermost layers of the Churn water table [read as most frequent reasons for churn] focus on payment failures – and they are primarily involuntary in nature, meaning our customers aren’t willfully canceling their subscriptions. I call this type of churn – involuntary as the subscriptions are not renewed owing to technical inefficiencies and not the intent of the customer to churn out. Some factors that cause involuntary churn include – downtime during payment transactions, relevancy of payment methods, failure to remind customers to pay on time, expiry of credit cards, etc. They are easy to tackle but require an automated payment reminder and collection platform to handle this at scale. Do remember that finance teams tracking payment cycles and credit card expirations via calendar blocks and sending manual reminders went out of fashion in 2011.

Involuntary churn and its implications remind me of the business case around Xentral GmbH. This lean ERP cloud software automates day-to-day operations for small and medium-sized enterprises. Around 40% of Xentral’s customers paid via SEPA (a direct debit model available in 35+ European countries), requiring manual updates in their legacy ERP system. The remaining 60% relied on invoice-based payments that demanded constant follow-ups.

We helped Xentral move their subscriptions to an online payments model, eliminating the need for manual follow-ups and leading to an impressive 80% reduction in outstanding receivables within just five months. Almost everyone who would have been an involuntary churn risk were now paying on time without manual follow-ups. Despite processing 50% more revenue than the previous year, Xentral’s lean finance team handled the increased workload without requiring additional staff. They used the time saved by automating payment reminders and collections to innovate pricing and packaging. Now, isn’t that what you call a good story!

Involuntary churn is only half the picture as we swim deeper down the churn water table. Here, we see currents from involuntary churn mixing with the voluntary angle. Bad payment experiences, service disputes, changes in the scope of projects, and product/service costs are the top reasons [in no particular order] for voluntary churn. As you have rightly surmised by now, payment experiences seep in from the involuntary side of things and increase the chances of customers deciding to move out of our ecosystem. Chargebacks, bad debts, and cancellations can pummel even good companies into submission.

Product usage signals, patterns from other customers in the same market/industry, NPS scores, helpdesk tickets logged, etc., can all be used to build a predictive model that helps you proactively handle customers looking to churn. You need a platform that can include all these different sources culminating in churn and predict the likelihood to churn and the right offer to retain customers. While everyone is definitely looking to understand the value of our offered products/services better and take the call on retaining or canceling – only some offers should be packaged as a price discount. Some prefer value demonstration in the form of additional features from a higher plan; some need better services, etc.

Since 2009, Vancouver-based conversion intelligence company Unbounce has delivered its 120,000+ customers over 1.5 billion conversions through AI-engineered landing pages and copywriting solutions. With scale and success came the growth pains of managing churn and providing each customer with tailored experiences based on their use cases and conversion goals. To reduce cancellations and uncover valuable feedback hidden within their customer journey flywheel, Unbounce needed a robust tool that did more than analyze exit surveys.

With its ability to analyze and contextualize customer journeys across multiple stages and variables and a penchant for fluid integrations, Chargebee Retention (formerly Brightback) ticked all the right boxes for Unbounce. This kicked off a new initiative to reimagine the cancel experience for their customers. Unbounce was able to deflect 11% of all cancellations, retain cancellation data within their currently live tech stack, and create custom offers based on customer segments without needing additional engineering bandwidth to implement these cancellation workflows.

As we get busy with our 2024 planning meetings, debating and discussing budgets and strategies, I recommend that leaders mandatorily include their plans around combating churn and increasing retention. Running an organization with high churn is akin to navigating the ocean with a gaping hole in your ship.

Chargebee is the world’s leading Revenue Growth Management platform. It supports leaders in the Finance, Product and engineering, and Digital Experiences divisions to run their revenue workflows better. Chargebee’s products help automate billing, invoicing, payment processing, payment collections, and retention workflows. Ready to transform your churn-risk customers into lasting loyalty ones? Experience the Chargebee difference in Retention management.

Click here to schedule your personalized demo and take the first step toward revolutionizing your customer retention strategy with Chargebee!