Handling Brexit Impacts

Overview

With Brexit, Chargebee is ready to accommodate your changes in tax configuration with respect to the new VAT obligations. Note that these changes are not automatically enabled for your Chargebee site. You have to update them manually based on your business requirements and adhere to the deadline specified in order to avoid incorrect taxation that could lead to fines and interests.

This document captures a gist of Brexit, and all the essential settings that you need to update in Chargebee to stay compliant with the new set of obligations starting January 1st, 2021.

The necessary changes related to Brexit are available for you to update in your Chargebee site as applicable. They require your action to take effect, and will not be automatically updated on your behalf.

What is Brexit?

Brexit is the withdrawal of the United Kingdom (UK) from the European Union (EU) and the European Atomic Energy Community (EAEC or Euratom) on January 31, 2020. It continues to participate in the European Union Customs Union and European Single Market during a transition period that will end on December 31, 2020.

While using Chargebee for your recurring billing automation, being Brexit ready is crucial because it impacts the tax computation of your invoices.

How does it impact your business?

When you have configured taxes in your Chargebee site using the Manual mode or via Third-party integration, Brexit has possible impacts on your business in the following cases:

- If your business(organization address) is based in the UK.

- If your business(organization address) is based in the EU or elsewhere in the world, and you are selling products and services into the UK.

The following table explains the various impacts and their respective behavior before and after Brexit:

| Impact Area | Before Brexit | After Brexit |

|---|---|---|

| Tax Region | UK exists within EU region for which EU VAT is configured in Chargebee. | UK needs to be a separate region going forward, and therefore UK VAT needs to be configured separately. Value Added Tax: Mini One Stop Shop (VAT MOSS) is not applicable for the UK region. |

| Tax rate for UK | 20% | 20%. The tax rate for UK needs to be updated manually in your Chargebee site if there's any change in the tax rate. |

| Location Validation for digital goods | When enabled, Chargebee collects certain address/location information as evidence of the customers' location. | When enabled, Chargebee collects certain address/location information as evidence of the customers' location. |

| VAT Number Validation | When enabled, VAT validation is performed by VAT Information Exchange System (VIES). | When enabled, VAT validation is performed by Her Majesty's Revenue and Customs(HMRC). |

| VIES Consultation number | When enabled, consultation number is generated and provided by VIES on successful validation. | Not applicable for UK as VIES will not be used any more for VAT validation. |

You can read more about these changes for Brexit from the official website of UK.

What needs to be done in Chargebee?

You need to make certain changes to the tax configuration in your Chargebee site, depending on how Brexit impacts your business and based on factors such as:

- Your organization address.

- If you are selling within/into UK, EU, and outside the EU.

- Whether you are selling digital goods or non-digital goods.

- If you are selling to individuals(B2C) or to businesses(B2B).

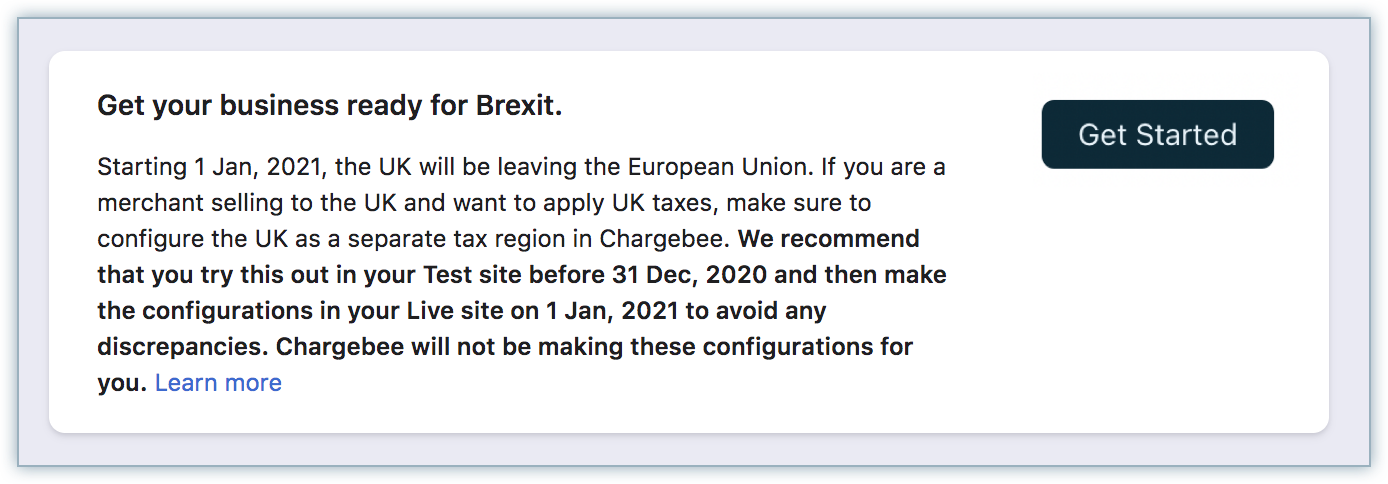

We strongly recommend that you try these settings or configurations in your Test Site first, and then move them to your Live Site. By generating some sample invoices in your Test Site, you can see the new VAT application and avoid any discrepancies. You can then make the same set of configurations in your LIVE Site on January 1, 2021.

If you are not making necessary changes for Brexit in Chargebee, your invoices will continue to carry outdated, error-prone taxes that will not comply with the Brexit laws. You could end up charging your customers wrongly, paying fines for not following the taxation rules, all of which could have a bad impact on your business.

If you're selling digital products

Note:

If you're selling digital products into the UK, you need to do the following things in Chargebee:

- Purge your current settings for the UK from the Brexit banner on Configure Tax page.

- Configure tax for UK region separately, and verify VAT settings based on the new UK tax laws.

- Update VAT MOSS under EU Region (if required).

To make necessary updates for Brexit in your Chargebee site, follow these steps:

-

Click Settings > Configure Chargebee > Taxes.

-

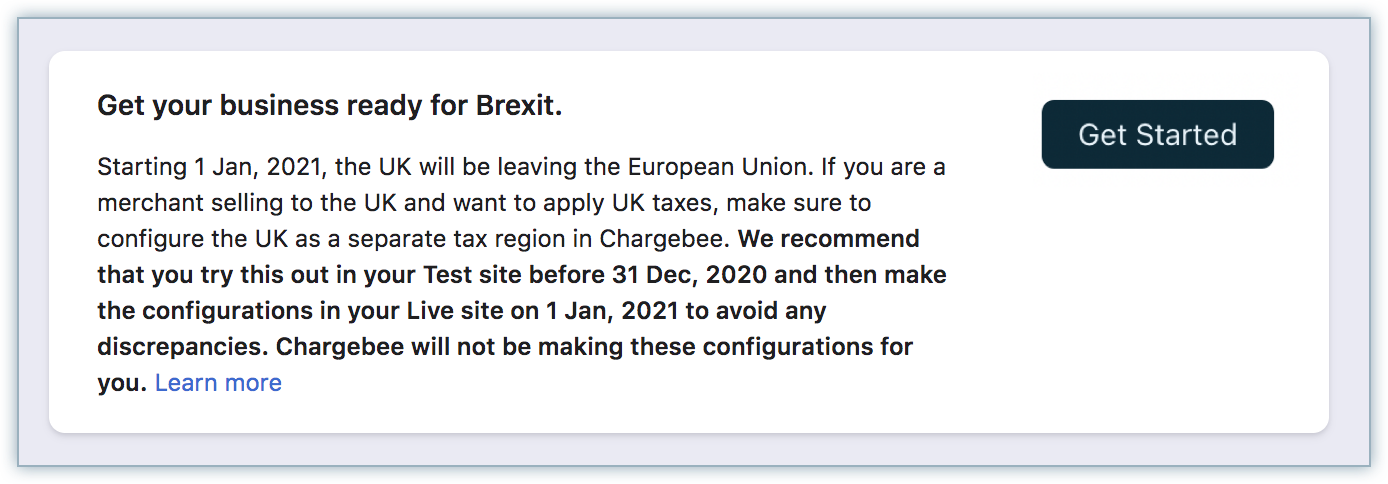

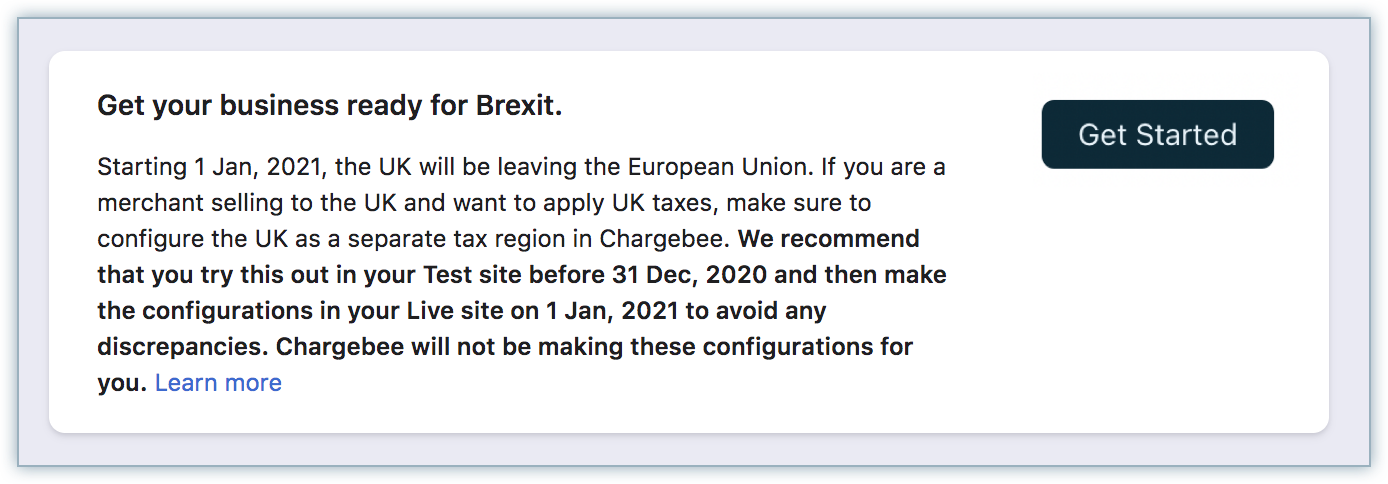

In the Configure Tax page, click Get Started from the Get your business ready for Brexit banner.

-

If you have configured tax for the EU region for digital products, a warning modal is displayed. Click Yes, Continue. The previously configured tax details such as tax labels, tax registration number, tax rates, and so on for the UK are removed.

If you are an organization selling digital products into the UK, you have to configure tax details for the UK separately. To configure taxes for the UK region in your Chargebee site, follow these steps:

-

Click Settings > Configure Chargebee > Taxes.

-

In the Configure Tax page, click +Add Region and select United Kingdom from the drop-down.

-

Under What type of product do you sell, click I sell digital products.

-

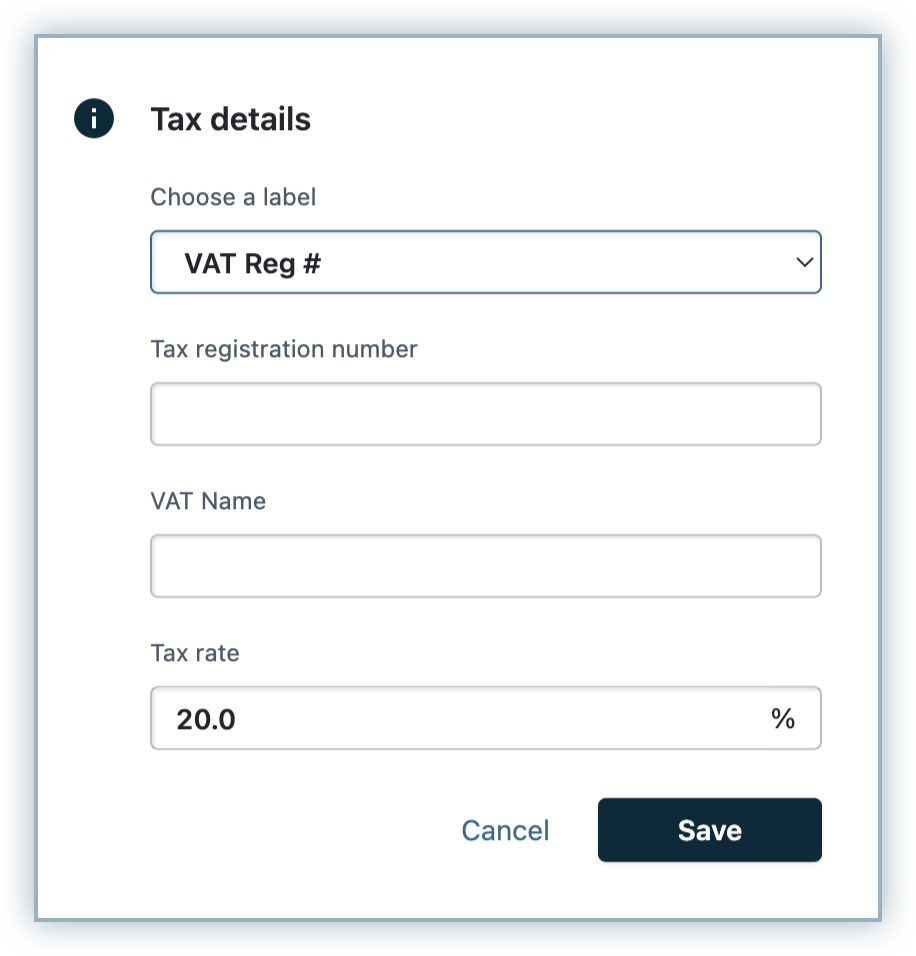

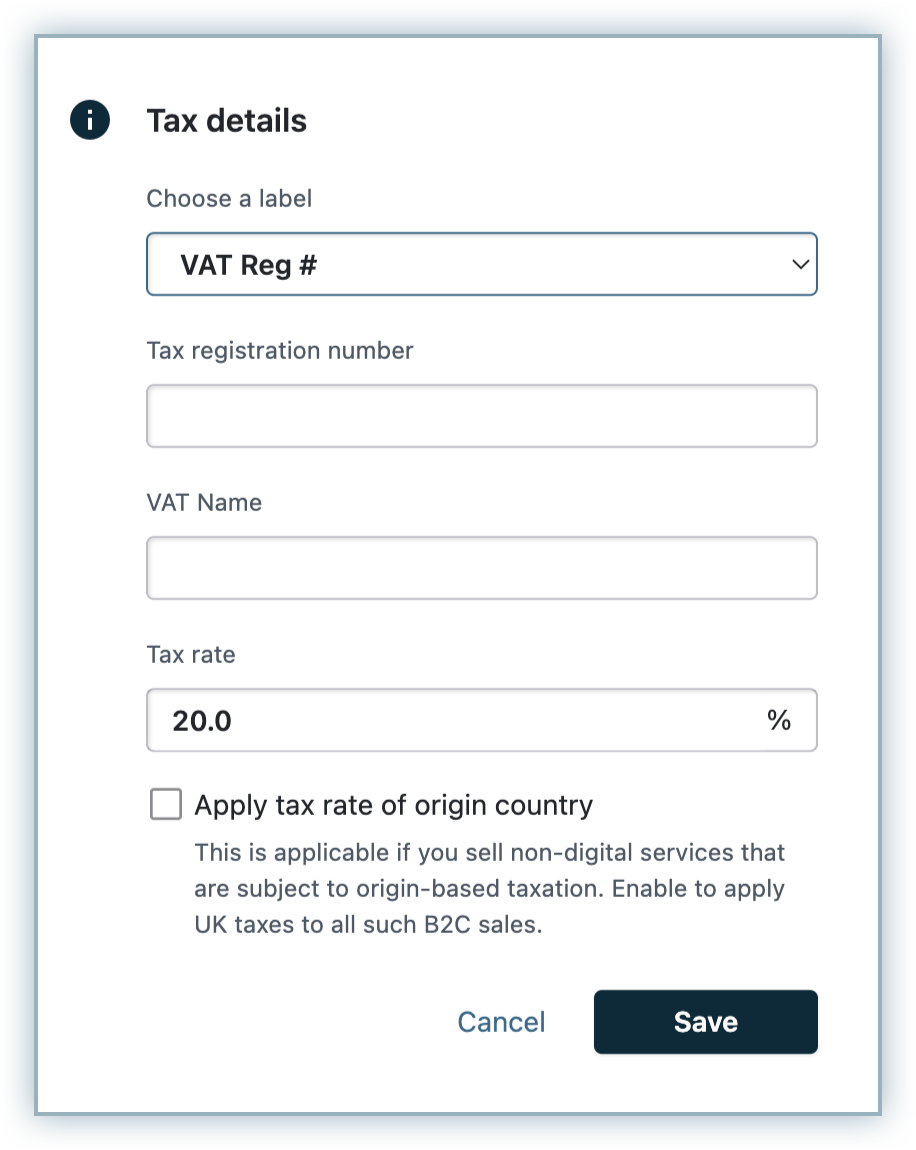

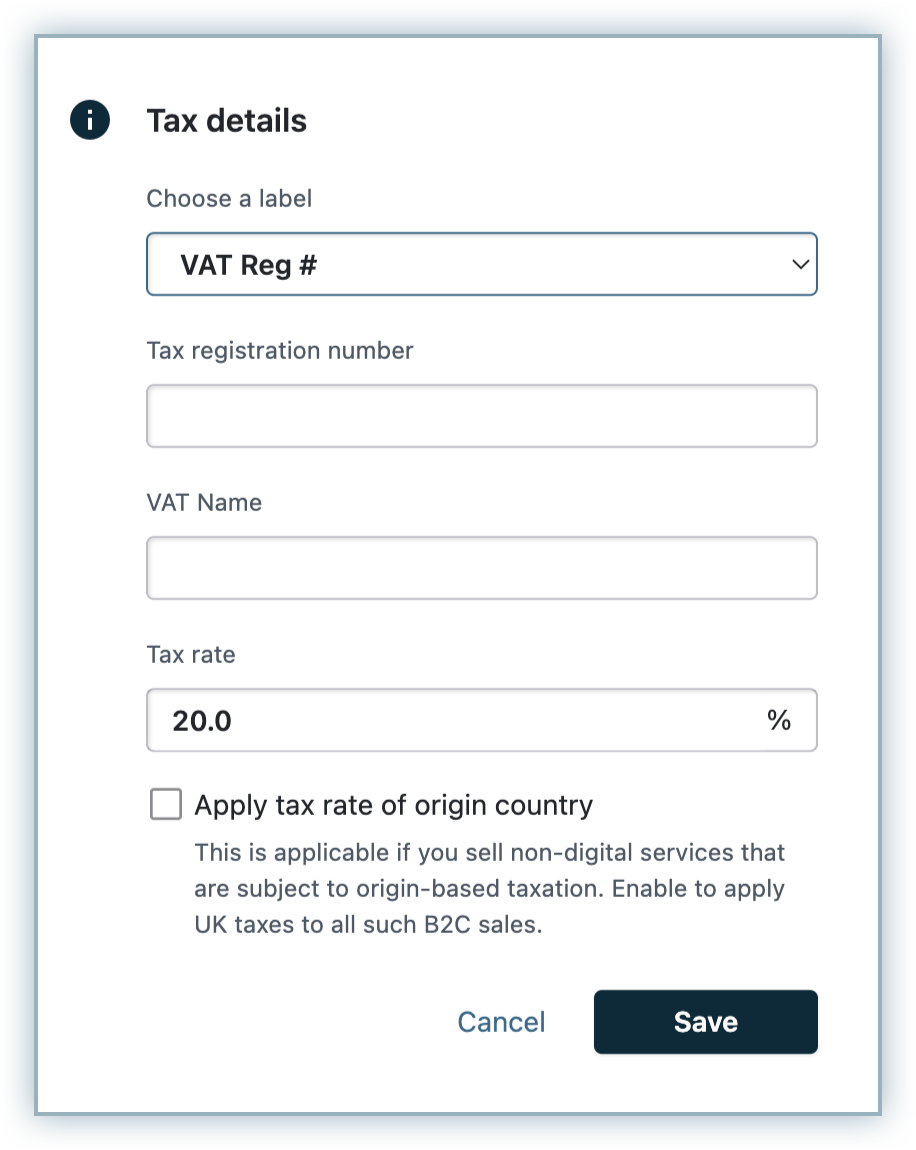

In the Tax details modal, enter the following information:

- Select the Tax label.

- Enter your Tax registration number for the UK.

- Enter the Tax name.

- Verify the Tax rate, and click Save.

-

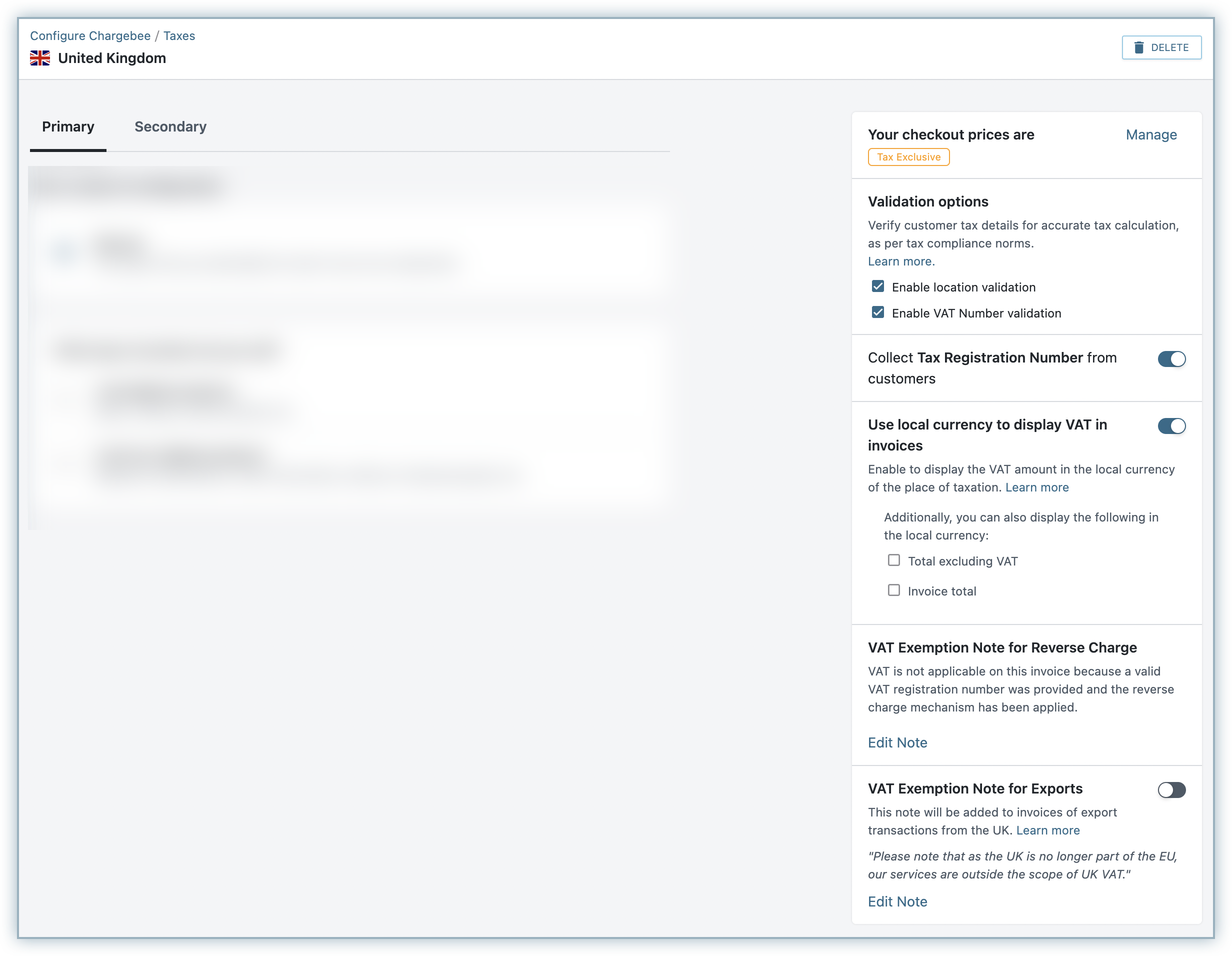

On the UK tax region page, verify the following settings in the context of the new UK tax laws:

- Price type: Select the appropriate price type for your checkout prices in the UK region.

- Validation Options:

- You can enable location validation as required. Chargebee collects certain address or location information as evidence of the customers' location.

- You can enable VAT Number Validation to perform UK VAT Validation using the validation service provided by HMRC (Her Majesty's Revenue and Customs (HMRC), when the VAT number is entered by your customers. If you sell to businesses, it is recommended that you collect the VAT Number of your business customers and ensure that it is valid. Chargebee verifies the validity of a VAT number entered against HMRC.

- Collect Tax Registration Number: Enable this option if you expect your customers to enter their VAT Number while subscribing to your products.

- Use local currency to display VAT in invoices: When this option is enabled, the amount of VAT payable gets displayed in the invoice currency as well as the local currency of the place of taxation. You can also choose to display the total amount excluding VAT and the total invoice amount in the respective local currency. The exchange rate applied for this purpose is as per the rates listed on the European Central Bank(ECB) website.

- VAT Exemption Note for Exports: This option is available when your organization address is based in the UK. If you export goods or services to other countries from the UK as part of your business, enabling this option adds a note in the respective invoices that refers to the VAT exemption for export transactions. You can edit the note to add or edit the text.

If you are an organization selling digital products within the EU, and if you have registered for VAT MOSS, you need to do the following:

- If you were previously using VAT MOSS and still continue to use it, and your Member State of Identification(MSI) was UK for VAT MOSS, the old VAT MOSS becomes invalid with Brexit. Therefore, you have to update your new VAT MOSS number by clicking Settings > Configure Chargebee > Taxes > EU region.

- However, if you had previously used VAT MOSS but you do not use it anymore, you may have to update VAT numbers for the respective countries under the EU region. Click Settings > Configure Chargebee > Taxes > EU region > Manual > I sell digital products > Clear Tax > Manual > I sell digital products > No, I haven't registered for VAT MOSS.

If you're selling non-digital products

When your origin country is the UK

Note:

If you're selling non-digital products within UK, EU, and your organization address is in the UK, you need to do the following things in Chargebee:

- Purge your current settings for UK from the Brexit banner in Configure Tax page.

- Configure tax for UK region separately, and verify VAT settings based on the new UK tax laws.

To make necessary changes for Brexit in your Chargebee site, follow these steps:

-

Click Settings > Configure Chargebee > Taxes.

-

In the Configure Tax page, click Get Started from the Get your business ready for Brexit banner.

-

If you have set UK as your origin country, a warning modal gets displayed. Click Yes, Continue. The previously configured tax details such as tax labels, tax registration number, tax rates, and so on for the UK and overriden countries (for crossing a certain threshold of sales per annum in respective countries) are removed.

If you are an organization selling non-digital products within the UK, you need to configure tax details for UK separately. To configure taxes for the UK region in your Chargebee site, follow these steps:

-

Click Settings > Configure Chargebee > Taxes.

-

In the Configure Tax page, Click +Add Region and select United Kingdom from the drop-down.

-

Under What type of product do you sell, click I sell non-digital products.

-

In the Tax details modal, enter the following information:

- Select the Tax label.

- Enter your Tax registration number for UK.

- Enter the Tax name.

- Verify the Tax rate, and click Save. All non-digital products' sales (mapped to this profile) within UK will be charged at this rate.

-

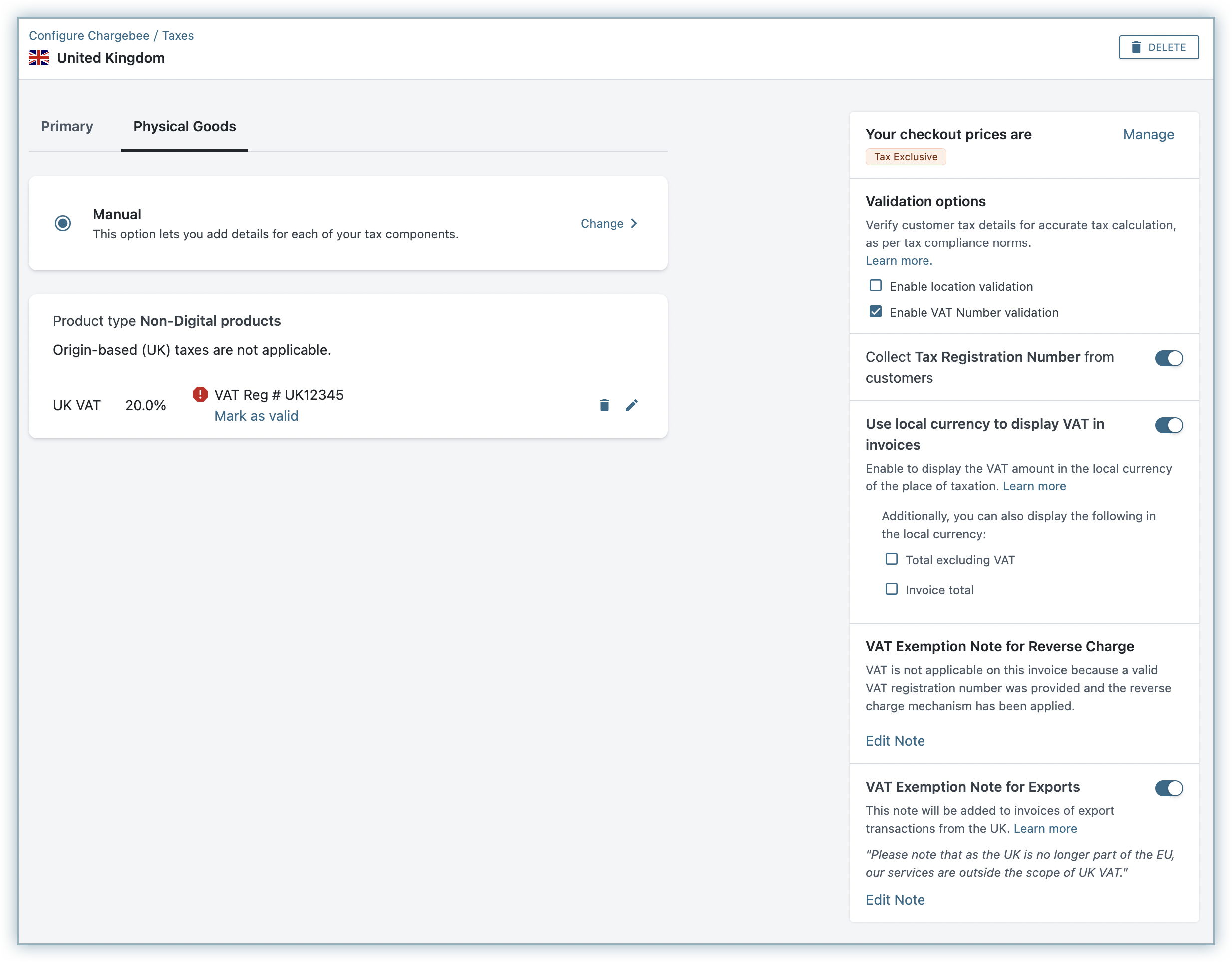

In the UK tax region page, verify the following settings in context of the new UK tax laws:

- Price type: Select the appropriate price type for your checkout prices in the UK region.

- Validation Options: You can enable VAT Number Validation to perform UK VAT Validation using the validation service provided by HMRC (Her Majesty's Revenue and Customs (HMRC), when the VAT number is entered by your customers. If you sell to businesses, it is recommended that you collect the VAT Number of your business customers and ensure that it is valid. Chargebee verifies the validity of a VAT number entered against HMRC.

- Collect Tax Registration Number: Enable this option if you expect your customers to enter their VAT Number while subscribing to your products.

- Use local currency to display VAT in invoices: When this option is enabled, the amount of VAT payable gets displayed in the invoice currency as well as the local currency of the place of taxation. You can also choose to display the total amount excluding VAT and the total invoice amount in the respective local currency. The exchange rate applied for this purpose is as per the rates listed in the European Central Bank(ECB) website.

- VAT Exemption Note for Exports: This option is available when your organization address is based in the UK. If you export goods or services to other countries from UK as part of your business, enabling this option adds a note in the respective invoices that refers to the VAT exemption for export transactions. You can edit the note to add or edit the text.

If you are an organization selling non-digital products within the EU countries, the VAT application works as follows:

- If you are selling physical goods to other businesses: 0% VAT is applied on reverse charge basis and the reverse charge note gets displayed in the invoice.

- If you are selling physical goods to customers: 0% VAT is applied and the export note configured for UK gets displayed in the invoice. However, when you want to apply destination based VAT for such invoices, click Configure Tax > +Add Region, and select EU Region from the drop-down. Click I sell non-digital products and select the destination country as Origin.

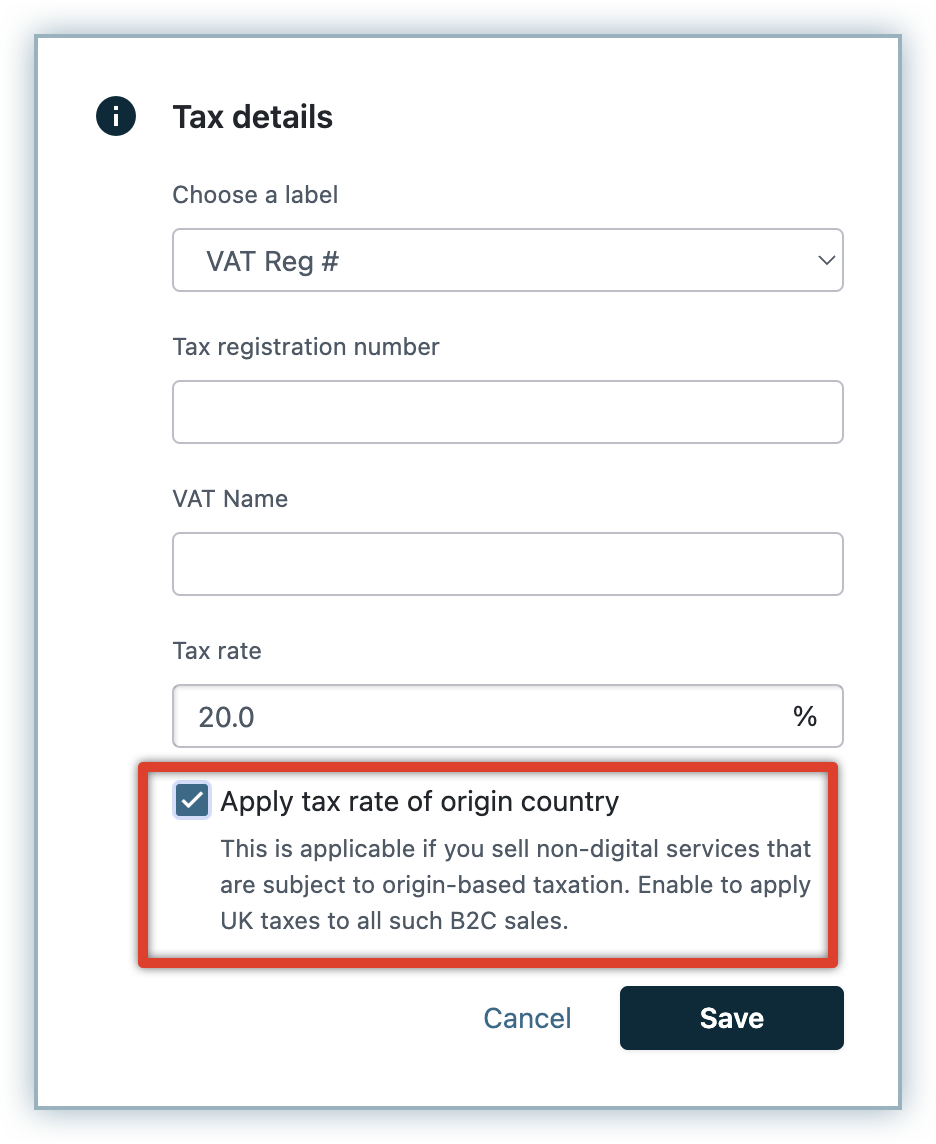

- If you are selling non-digital services to customers:

- When your service requires origin based taxation for selling to private individuals, you can select the Apply tax rate of origin country option in the UK region. This applies origin based taxes for such transactions originating from UK that is mapped to this profile.

- However, if you don't select this option, the non-digital products tax rate (if) configured for the EU region under the same profile gets applied.

- When your service requires origin based taxation for selling to private individuals, you can select the Apply tax rate of origin country option in the UK region. This applies origin based taxes for such transactions originating from UK that is mapped to this profile.

When your origin country is in EU(not UK)

Note:

If you're selling non-digital products within UK, EU, or outside EU, and your organization address is in EU, you need to do the following things in Chargebee:

- Purge current settings for UK(if overridden) from Brexit banner.

- Configure tax for UK region separately, and verify VAT settings based on the new UK tax laws.

To make necessary changes for Brexit in your Chargebee site, follow these steps:

-

Click Settings > Configure Chargebee > Taxes.

-

In the Configure Tax page, click Get Started from the Get your business ready for Brexit banner.

-

If you have configured tax for the EU region, a warning modal gets displayed. Click Yes, Continue. Chargebee removes all your previously configured tax details such as tax labels, tax registration number, tax rates, and so on for the UK.

If you are an organization selling non-digital products into the UK, you need to configure tax details for UK seperately. To configure taxes for the UK region in your Chargebee site, follow these steps:

-

Click Settings > Configure Chargebee > Taxes.

-

In the Configure Tax page, Click +Add Region and select United Kingdom from the drop-down.

-

Under What type of product do you sell, click I sell non-digital products.

-

In the Tax details modal, enter the following information:

- Select the Tax label.

- Enter your Tax registration number for UK.

- Enter the Tax name.

- Verify the Tax rate, and click Save. All non-digital products' (mapped to this profile) sales within UK would be charged at this rate.

-

In the UK tax region page, verify the following settings in context of the new UK tax laws:

- Price type: Select the appropriate price type for your checkout prices in the UK region.

- Validation Options: You can enable VAT Number Validation to perform UK VAT Validation using the validation service provided by HMRC (Her Majesty's Revenue and Customs (HMRC), when the VAT number is entered by your customers. If you sell to businesses, it is recommended that you collect the VAT Number of your business customers and ensure that it is valid. Chargebee verifies the validity of a VAT number entered against HMRC.

- Collect Tax Registration Number: Enable this option if you expect your customers to enter their VAT Number while subscribing to your products.

- Use local currency to display VAT in invoices: When this option is enabled, the amount of VAT payable gets displayed in the invoice currency as well as the local currency of the place of taxation. You can also choose to display the total amount excluding VAT and the total invoice amount in the respective local currency. The exchange rate applied for this purpose is as per the rates listed in the European Central Bank(ECB) website.

If you are an organization selling non-digital products into the UK and other EU countries, the VAT application works as follows:

- If you are selling to businesses in UK: When you have not have registered for VAT in UK, 0% VAT is applied and the export note configured under EU region, if enabled, gets displayed in the invoice. However if you have registered for UK VAT, and configured UK as a tax region, 0% VAT is applied on reverse charge basis and the reverse charge note gets displayed in the invoice.

- If you are selling to customers in UK: It is mandatory that you register for VAT in UK.

- If you are selling to customers outside the EU but not UK(and not collecting taxes in that region): The export note configured under EU region, if enabled, gets displayed in the invoice.

- If you are selling non-digital services to customers: When your service requires origin based taxation for selling to customers in UK, you can add a non-digital tax profile for the UK region and add tax rate of the same origin country set up in EU region to the UK region. This will ensure the origin rate is applied.

Note:

- The VAT validation option is displayed in a disabled state until the UK tax service becomes available. Until the UK tax service is available, the onus of VAT verification falls upon yourself.

Northern Ireland Impacts

Following the Northern Ireland Protocol, Northern Ireland holds a dual position by aligning with the EU VAT rules for trading goods and by remaining as part of the UK's VAT system for trading services(given that the UK VAT rules will apply across the whole of the UK for all service-related transactions). HMRC will continue to be responsible for the operation of VAT and collection of revenues in Northern Ireland. The tax applicability for non-digital/physical goods are as follows:

- All physical goods trade between Northern Ireland(NI) and Great Britain(GB), and within NI, are taxed based on the UK VAT rate.

- B2C physical goods trade between NI and EU countries are subject to EU distance selling threshold rules.

- B2B physical goods trade between NI and EU countries remain intracommunity VAT zero-rated transactions.

If you are an organization selling digital products/services within Northern Ireland, the UK's VAT is applied for all your transactions.

However, if you're selling non-digital products in Northern Ireland, you need to configure Northern Ireland as a separate tax region under the EU.

To configure Northern Ireland as a tax region in your Chargebee site, follow these steps:

- Click Settings > Configure Chargebee > Taxes.

- In the Configure Tax page, Click +Add Region and select European Union from the drop-down.

- Under What type of product do you sell, click I sell non-digital products.

- Click Add your origin country and select the country where you are domiciled. On the Tax modal that appears, select your tax label, add your VAT Number.

If you have already configured non-digital tax profile under the EU region, the origin country's tax rate will be applied for Northern Ireland, as it does for other countries.

For tax calculation, Chargebee considers the country mentioned in the shipping address. However, in the absence of a shipping address, the country in the billing address is taken into account.

If you cross a certain threshold of sales per annum (the threshold figure differs from country to country) you have to register for VAT in the member states where you have a commercial presence.

- Chargebee applies the origin-based tax in case you have not crossed the threshold of sales to a particular EU Member State, i.e., if you have not registered in the country.

- Chargebee applies destination-based tax in case you have crossed the threshold of the sales to an EU Member State, i.e., if you have registered in that country.

You can select and add the countries where you are liable to pay taxes.

See also

Was this article helpful?