Indian GST

GST(Goods and Services Tax) is a consumption-based tax regimen aimed at replacing the current complex structure of multiple indirect taxes levied by the state and central governments of India. It is applicable from the July 1, 2017. If you have a commercial presence in India and your business has a gross income of over ₹40,00,000(The limit would be ₹20,00,000 for some special category states), it is recommended that you register your business for GST. Under GST, goods and services will be taxed at the rates 0%, 5%, 12%, 18%, and 28%.

Classification of GST

GST can be classified into the following types:

- CGST-Central Goods and Services Tax

- SGST/UTGST-State / Union Territory Goods and Services Tax

- IGST-Integrated Goods and Services Tax(CGST+SGST/UTGST)

According to the modified dual GST model, the tax levied can vary based on the type of transaction.

Within India

Intrastate: When a sale takes place within the same state or union territory, both SGST/UTGST and CGST will be levied.

Interstate: When a sale takes place between two different states or union territories, IGST which is a combination of CGST and SGST will be levied. This is collected by the central government.

The organization address plays a major role in determining the type of GST applied, The Chargebee system determines the type of GST applied using the customer's region.

- If the customer's region matches with your organization address, CGST and SGST are applied on the purchase whereas if the customer's region is different from your's, IGST is applied.

- If you are functional in multiple regions, GSTIN has to be provided for each region that you are active in.If the customer's region falls within one of these regions,CGST and SGST is applied.

- When the customer is from a region which doesn't fall within any of the regions that you operate in, IGST is applied.

Outside India

IGST is levied only in the case of B2C transactions where the end customer does not have a GST Identification Number(GSTIN).

In certain situations, unregistered entities who do not have a presence in India might be obligated to collect GST and comply with the regulations. In case of a sale made outside India, GST will not be applied as it is considered an export.

Configuring Indian GST

To configure Indian GST in your Chargebee site, follow these steps:

-

Click Settings > Configure Chargebee > Business Profile and ensure that your organization address is added and up to date.

-

Click Settings > Configure Chargebee > Taxes, and click the Enable Tax.

-

Configuring the price type: You can set up the price type for each currency that you have enabled for your site by navigating to Manage Catalog Price Types in the Taxes page. The price type is set to ‘exclusive' by default. For more information on configuring the price type, refer here.

-

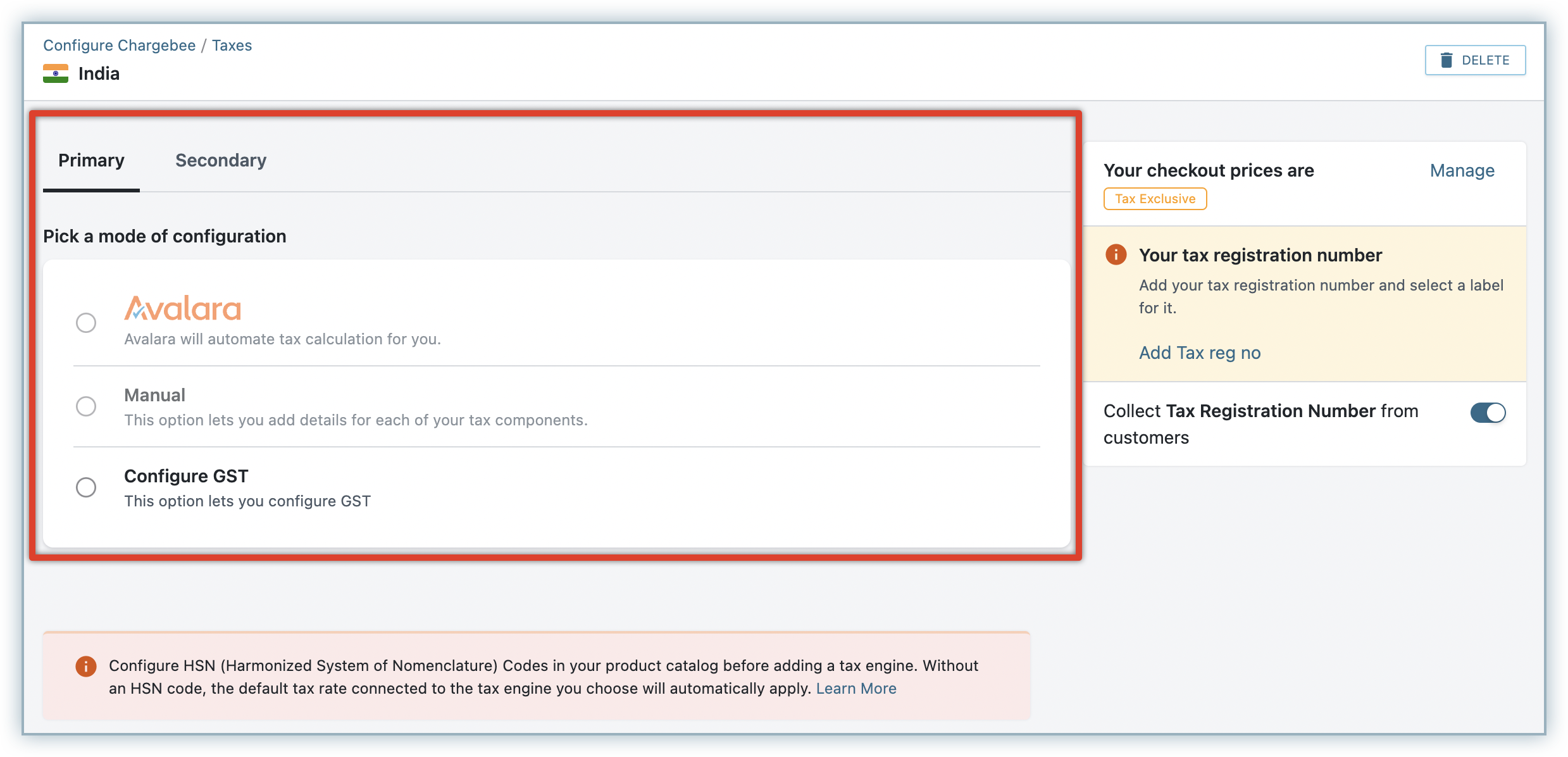

Configuring tax settings for India: On the Taxes page, click Add Region and select India from the drop-down list. You will be redirected to the page where you can pick a mode of configuration to add the taxes.

-

You can select from the following options:

- Avalara: Contact support to enable this setting for your site, if you do not have it already. To automate taxation on your invoices, if you have integrated AvaTax for Sales with Chargebee, you can select Avalara. Ensure that you add the HSN(India Harmonized System of Nomenclature) Codes for all your plans and addons before selecting Avalara as your preferred mode. The appropriate tax rate gets applied for subscription invoices based on the associated plan or addon's HSN code. In the absence of an HSN code, Avalara applies the default tax rate of 18% on the invoices.

- Manual: Select this option to add your preferred tax rates manually.

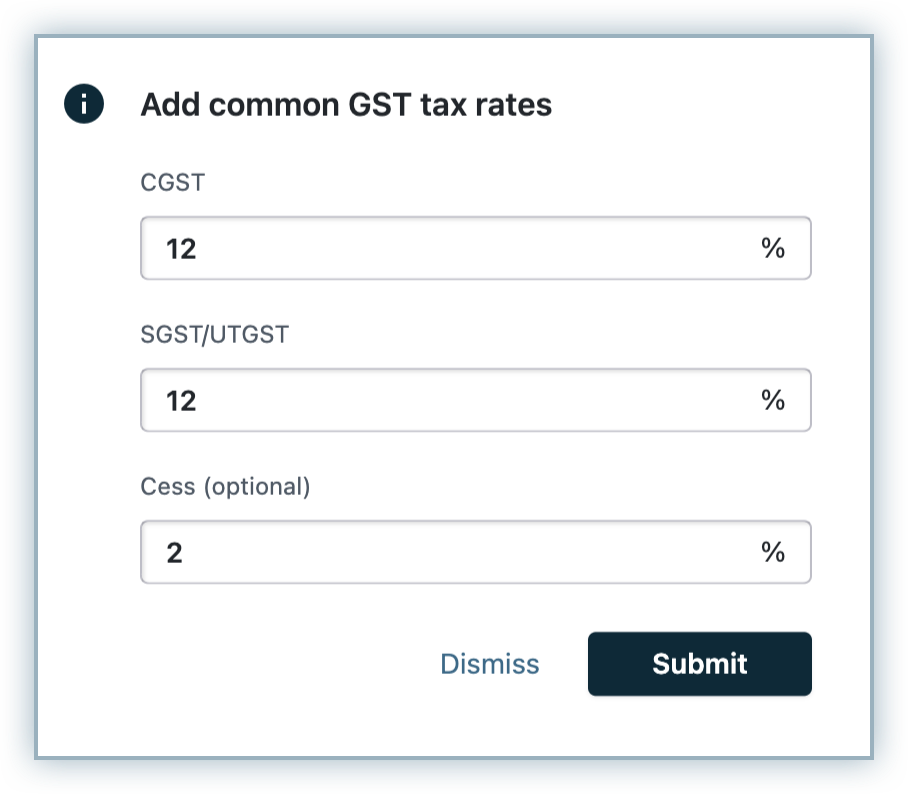

- Configure GST: Select this option and in the pop-up window that appears, you can set the default CGST, SGST/UTGST rates for all states and union territories.

-

Adding default GST rates: Click Add GST Rate and a pop-up window appears where you can set the default CGST, SGST/UTGST rates for all states and union territories.

-

Additional Cess: The percentage of additional Cess is optional and it is applied only on specific products.

-

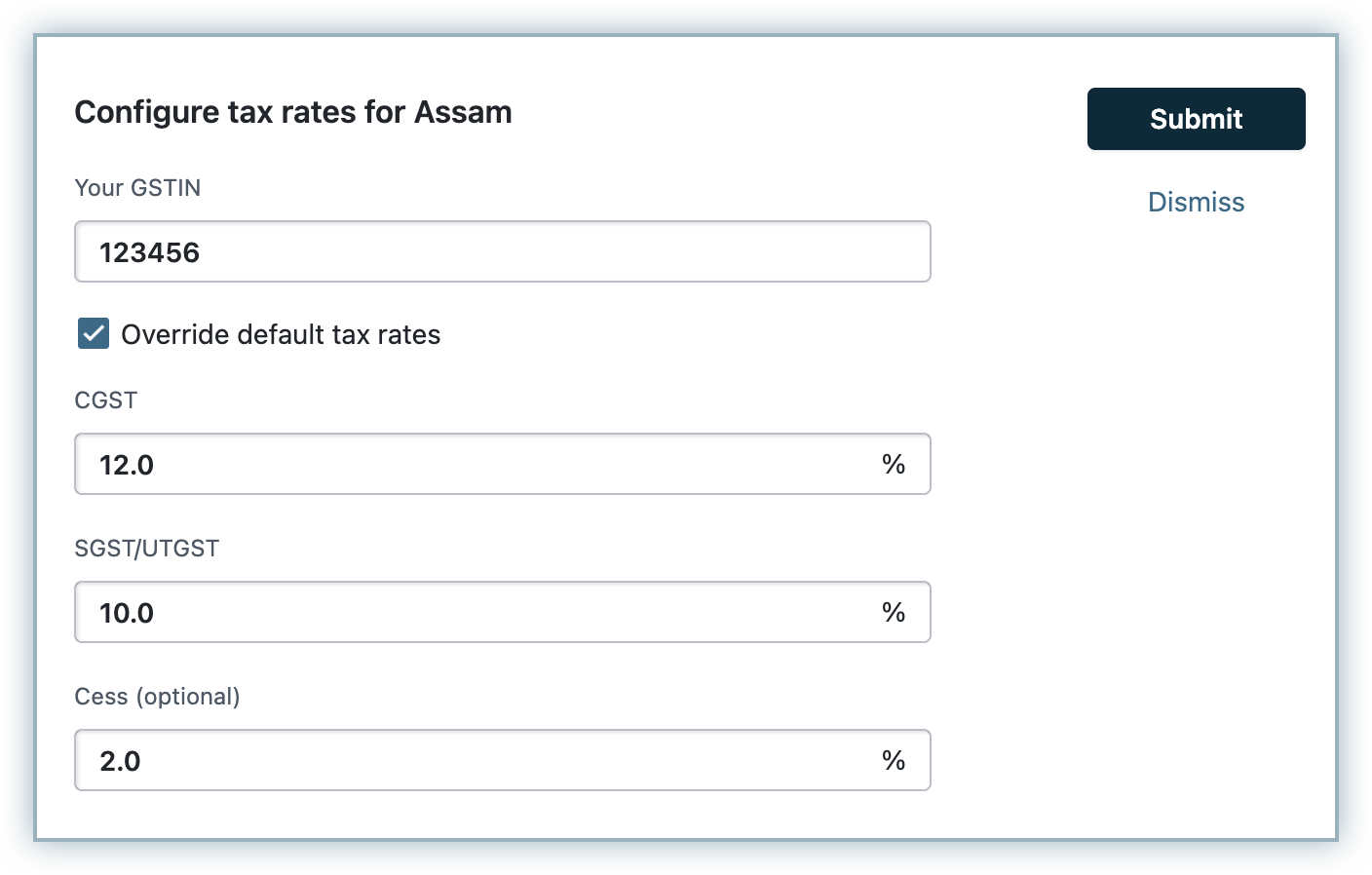

Adding state tax rates: You can add individual state tax rates by navigating to Add state tax.

There are two scenarios when this feature is used,

- Scenario 1: When you have a physical presence in multiple states in India. If you have a business presence in 5 different states, you will have to register for GST in all the 5 states which leads to having multiple GSTIN. Using Add state tax option in the Configure GST page, you can add GSTIN separately for each state.

- Scenario 2: When a particular product's SGST and CGST percentage varies from the default tax rates and you have to override it.

Let's consider the tax rate of product A to be 18%(CGST-10%, SGST-8%)across all the states in India, you can set the default SGST and CGST rates which will be used to tax the purchase of the product.

For instance, if product A has a niche market in the state of X where it is manufactured in huge quantities, the state government might demand a higher tax rate which will lead to a significant change in the SGST and CGST perecentages.You can select Override default tax rates to override the default tax rates.

Now alongside the default tax rates, state wise CGST and SGST rates are also displayed.

Note:

Tax will not be applied if the customer's billing/shipping address does not have ‘State' mentioned.

Configuring Taxes for Special Economic Zones (SEZs)

Special Economic Zones or SEZs are geographical regions within a country that are subject to different and more liberal economic regulations than the other regions in the country. SEZs in India are free trade zones that are located within the boundaries of India but are treated as a foreign territory for the purpose of trade operations, duties, and tariffs.

If you are a business selling to customers in SEZs in India, once you configure and enable GST for India on your Chargebee site, you can configure taxes for customers located in SEZs depending on your unique tax setup. To configure taxes for SEZs, follow these steps:

- Click Settings > Configure Chargebee > Taxes > India.

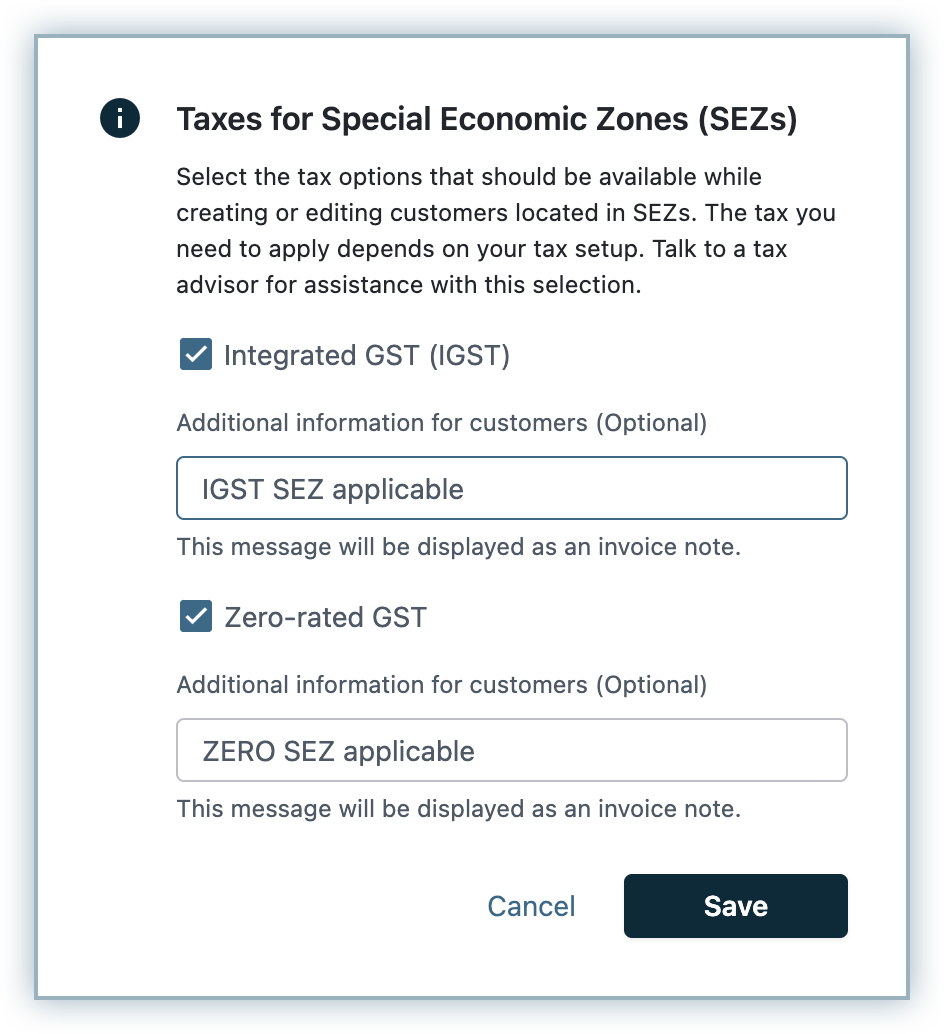

- On the Configure GST page, click Configure under the Taxes for Special Economic Zones (SEZs).

- On the Taxes for Special Economic Zones (SEZs) popup, enable the following tax options depending on the tax setup for your business:

- Integrated GST (IGST)

- Zero-rated GST

- You can additionally enter a message within the text fields Additional information for customers. This message will get displayed on your invoices when the respective tax is applied for customers from SEZs.

- Click Save.

You have successfully configured taxes for SEZs. You can update your configuration at any time from the Configure GST page.

While creating a new customer record or updating the billing info of an existing customer record, the Tax details section displays an additional option to specify if the customer is located in a Special Economic Zone. You can enable the setting, and select an applicable tax for this customer based on your requirement. The drop-down displays the tax options that you've configured under Taxes for SEZs.

Note:

Under Tax details, if you have selected both the options This customer is tax exempt and This customer is located in a Special Economic Zone, then the configuration for SEZ takes precedence and the relevant taxation is applied.

The IGST or Zero rated GST is applied based on your setting, and any additional information for customers get displayed on the GST invoice.

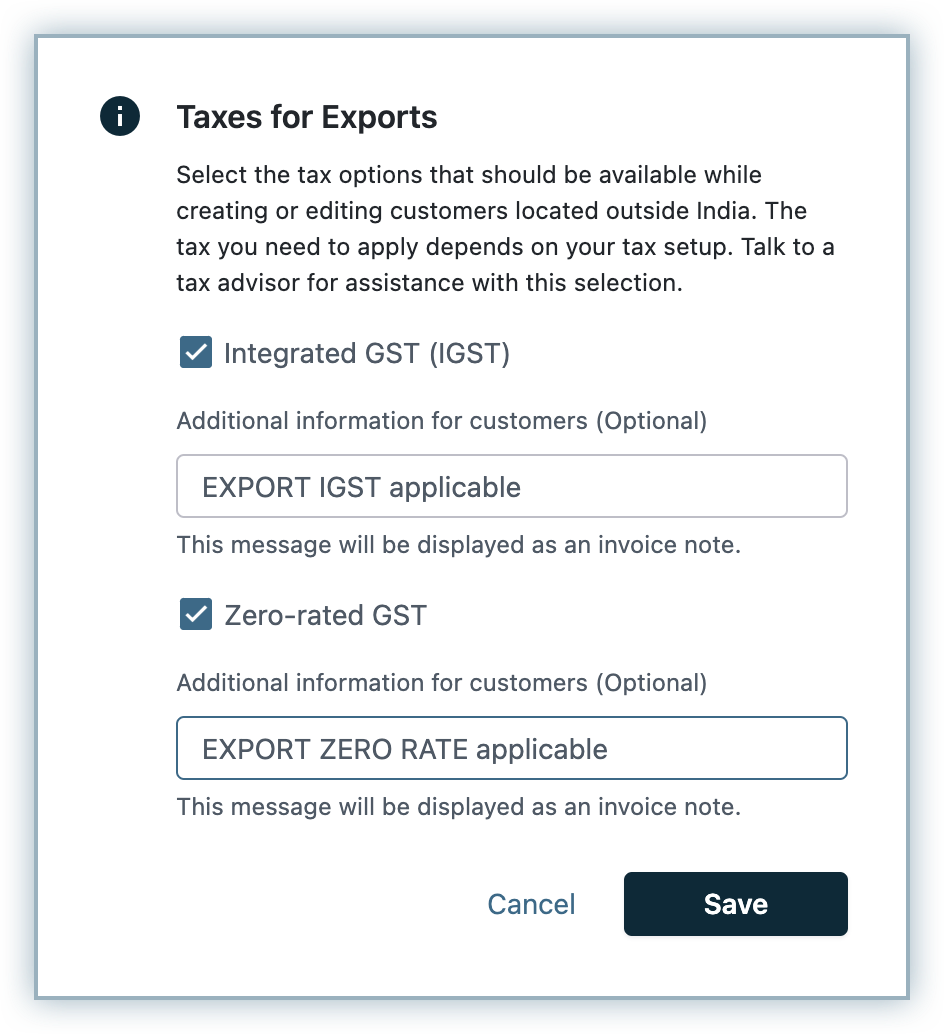

Configuring Taxes for Exports

If you are exporting products or services outside of India, you can configure tax options based on which your customers located outside of India will be taxed. Once you configure and enable GST for India on your Chargebee site, you can configure taxes for customers located outside India, for export scenarios depending on your unique tax setup.

To configure taxes for exports, follow these steps:

- Click Settings > Configure Chargebee > Taxes > India.

- On the Configure GST page, click Configure under the Taxes for Exports.

- On the Taxes for Exports popup, enable the following tax options depending on the tax setup for your business:

- Integrated GST (IGST)

- Zero-rated GST

- You can additionally enter a message within the text fields Additional information for customers. This message will get displayed on your invoices when the respective tax is applied for customers in export scenarios.

- Click Save.

You have successfully configured taxes for exports from India. You can update your configuration at any time from the Configure GST page.

If your billing address is located in India(with GST for India configured), while creating a new customer record or updating the billing info of an existing customer record with billing country other than India, the Tax details section displays an additional option to specify if the customer is located outside India. You can enable the setting, and select an applicable tax for this customer based on your requirement. The drop-down displays the tax options that you've configured under Taxes for Exports.

If you've selected Integrated GST, applicable IGST is charged on the invoices for customer records that are marked to be located in SEZ or outside India in export cases and any additional message configured gets displayed as a Note.

If you've selected Zero rated GST, IGST is charged as 0 is charged on the invoices for customer records that are marked to be located in SEZ or outside India in export cases and any additional message configured gets displayed as a Note.

Limitation

- Configuring Taxes for SEZs and Exports are currently supported only in the primary tax profile, for taxation by Chargebee Billing. They're not supported for taxation via third-party integrations such as TaxJar, Avalara, and so on.

- If a tax region is overridden, SEZ and exports configuration does not apply.

GST Invoices

Once GST configuration is completed, the GSTIN field appears in the customer's billing info while creating a new subscription.

The GST applied, appears as one of the line items in the invoice as shown below:-

Intrastate:

Interstate:

FAQ

How is the Goods and Services Tax (GST) that Chargebee collects on behalf of vendors managed? Does Chargebee remit the collected GST to us (the vendor) so that we can then make the necessary payment to the government?

In addition to payment processing, Chargebee also automates the collection and deposit of tax amounts charged on your invoices. These tax funds are directly transferred to the bank account linked with your payment gateway. For a more detailed understanding of this process, you can contact your payment gateway provider directly.

While Chargebee ensures accurate tax calculation and collection on your invoices, the responsibility of remitting those taxes to the appropriate government authority lies with you. Chargebee's role is limited to the automation of tax assessment and collection, not the remittance process.

If you have any further questions or require additional assistance, please do not hesitate to reach out to us.

Articles & FAQs

Was this article helpful?