Configuring Taxes

See also

Overview

You can configure taxes for all taxable regions in your Chargebee site manually. Following are some of the salient features of tax configuration in Chargebee:

- The configuration of taxes is provided at each product/service level. Country-specific taxes are also configured at this level.

- You can create and manage multiple tax profiles when you are selling products or services that are subject to different tax rates and compliance.

- You can handle tax exemption for customers.

- You can also generate tax reports. Read Tax Reports to know more.

Note:

To ensure taxes are correctly applied to invoices, make sure you've configured taxes in Chargebee for each region where your customers are located.

Prerequisites

The following setting is a prerequisite that needs to be added before you configure taxes in your Chargebee site:

Organization Address: Providing your business' address is a mandatory step for configuring taxes in Chargebee. You cannot enable taxes in your Chargebee site without providing an organization address. Chargebee requires this information to calculate your tax liability.

To add your organization address in Chargebee, click Settings > Configure Chargebee > Business Profile > Add Address.

Configuring Taxes

To configure taxes in your Chargebee site, follow these steps:

Step1: Enabling Tax

Click Settings > Configure Chargebee > Taxes > Configure Tax. Click Add Address to add your organization address if you haven't added it already.

Step 2: Setting up Price Type

Price type determines whether taxes are inclusive or exclusive with your product price. The price that you quote for your product or service in Chargebee can be either:

- Inclusive of tax, where tax is included in the product price, or

- Exclusive of tax, where tax is applied on top of the product price.

You might be selling in one currency or many. You can customize the price type for each one.

Here is an example of how Price Types work:

| Product name | Unit Price | Currency | Price Type | Sample Tax Rate |

|---|---|---|---|---|

| Basic Plan_usd | 100 | USD | Exclusive | 5% |

| Professional Plan_usd | 150 | USD | Exclusive | 5% |

In this case, both the basic and professional plans are priced at 100 and 150 USD respectively. The price type 'exclusive' indicates that a 5% tax rate will be added to this price on the invoice.

| Product name | Unit Price | Currency | Price Type | Sample Tax Rate |

|---|---|---|---|---|

| Basic Plan_eur | 80 | GBP | Inclusive | 20% |

| Professional Plan_eur | 120 | EUR | Inclusive | 20% |

In this case, both the basic and professional plans are priced at 80 GBP and 120 EUR respectively. The price type 'inclusive' indicates that this price will include a 20% tax rate on the invoice.

| Tax Exclusive | Tax inclusive |

|---|---|

If you set the Price Type to Tax Exclusive, the tax will be calculated on the charge and added to the charge to arrive at the total payable amount. Total Charge - $100 Tax applicable is 5%. In this case, $5 Total amount is $105 (100+5). | If you set the Price Type to Tax Inclusive, the tax you configure will be included as part of the charge. The tax amount will be derived from the charge. That is, the tax amount will be derived from the total charge and displayed on the invoice. When discounts are not applied Total Charge - £100 Tax included is 20%. The tax break-up will be: Unit Price - £83.33 Tax - £16.67 Total amount stays at £100 When a discount is applied Total Charge - $155 Discount applied - $50 Taxable amount - $105 Tax applied is 5%. In this case, $5 The tax break-up will be: Charge - $100 Tax - $5 |

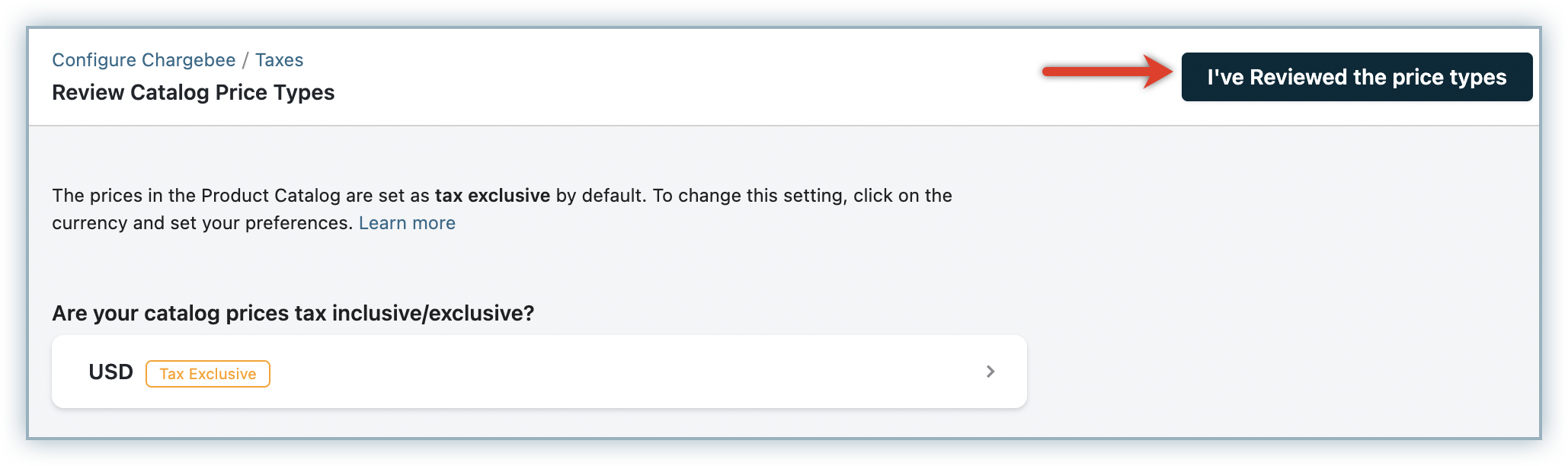

The prices of your plans and addons in Chargebee are set to tax-exclusive by default. You can customize the price type for each currency that you have added to your Chargebee site. You can edit this setting by following these steps:

-

In the Review Catalog Price Type page, select a currency to update the price type.

-

Select your preferred price type settings. When you select My prices are inclusive of the tax, you can optionally enable consistent pricing. Click here to read more about consistent pricing.

-

Once you are done, click Update and click I've reviewed the price types.

You can change the price type for your currencies at any time using the Manage Catalog Price Types link on the Configure Tax page.

Note:

-

If a customer is enabled for tax exemption, the tax amount will be deducted from the total charge while invoicing. Discounts, if any, are applied before the tax is added. Refer to the Customers page to see how to exempt a customer from tax payment.

-

If the product/addon is marked as exempted from tax, the charge provided will be treated as exclusive of tax. Discounts, if any, will be applied on this amount. Refer to the Plans page to see how to mark a plan as non taxable.

Setting up Consistent Pricing (for Tax Inclusive)

If you have a global customer base and would want to charge all the customers the same price, you can make use of the Consistent Pricing option. This option allows you to have a flat-rate charge for your product or service, regardless of the taxes applicable and the customer's country/region.

To enable consistent pricing options, follow these steps:

-

In the Configure Tax page, click Manage Catalog Price type.

-

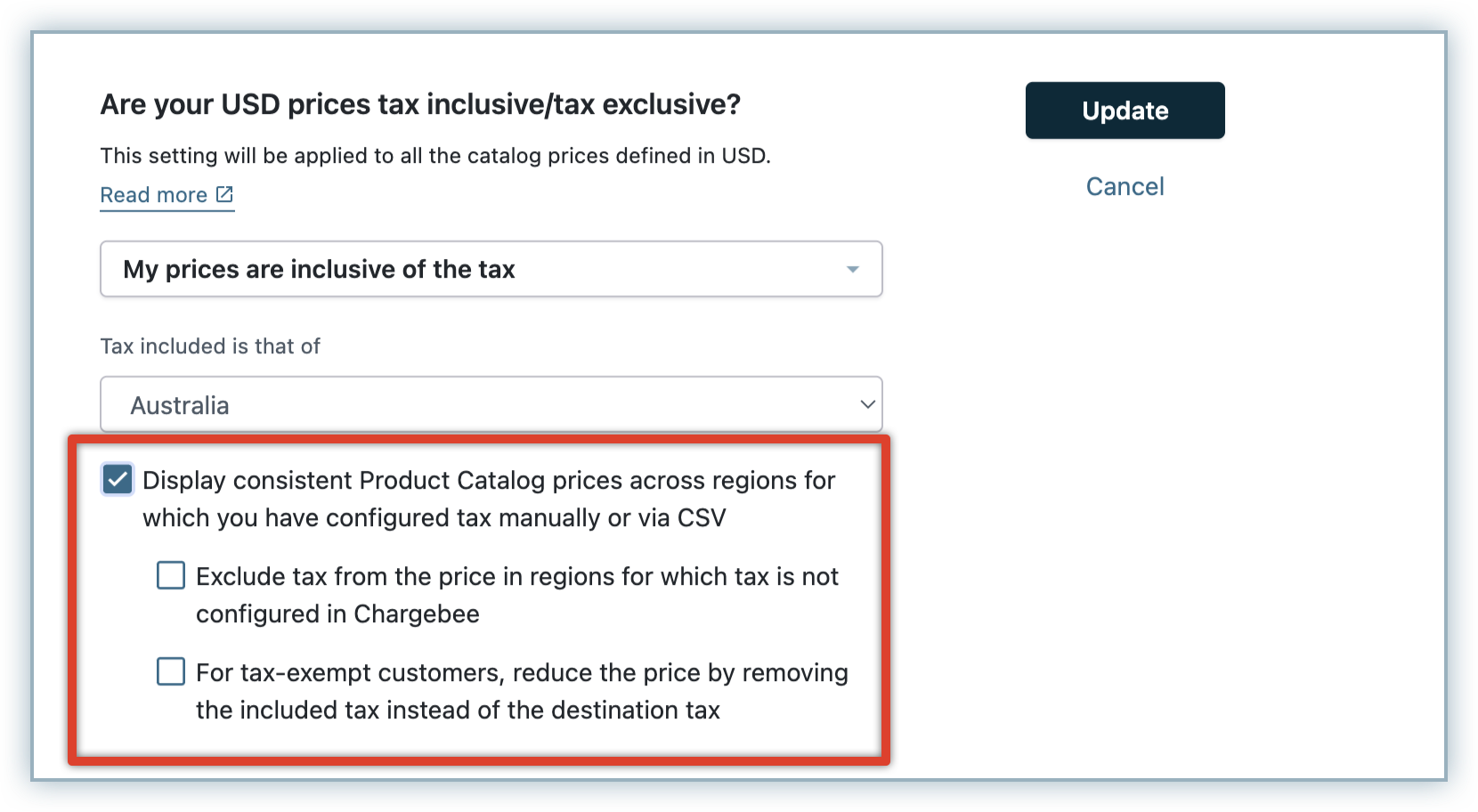

Select the currency and choose My prices are inclusive of the tax.

-

In the Tax included is that of drop-down, select the country of which the tax is to be included for the currency.

-

Enable the setting to display consistent checkout prices for all regions. You can optionally select the following settings as required:

- Exclude tax from the price in regions for which tax is not configured in Chargebee: Select this option if you are selling products in a region where you do not need to collect tax (say, from the US to Mexico). The prices are reduced accordingly by removing the applicable tax.

- For example:

- Price in United States - $100 inclusive of 15% tax

- Price in Mexico - $86.95 USD

- For tax-exempt customers, reduce the price by removing the included tax instead of destination tax: By default, Chargebee uses the customer's location to calculate the tax component to be deducted in the case of exemptions. If you would like Chargebee to remove the tax included in the price instead of applying the destination tax, enable this option.

- For example:

- Price when sold to a regular customer - $100 inclusive of 15% tax

- Price when sold to a Tax exempted customer - $100 inclusive of 15% tax (if this option is not enabled)

- Price when sold to a Tax exempted customer - $86.95 removing 15% tax from $100 (if this option is enabled).

-

Third Party Integrations: When you have integrated your Chargebee site with Avalara for automated tax calculation, you can enable this setting to display consistent catalog prices in regions for which Avalara is configured. While a consistent rate is charged for your product or service, Avalara calculates the tax included from the catalog price for these regions.

If you are using Chargebee's tax for all the regions, or if you have configured Avalara for tax automation in all your taxable regions, you do not have to select a country under Tax included is that of option.

However, if you have some regions for which you manage taxes manually or via CSV, make sure that you select an appropriate country of which the tax is included for the currency. This is to ensure that the country whose tax is included is accounted for correctly while computing the catalog price. If you skip doing this, Chargebee treats the tax included for these regions as 0%.

-

Click Update.

Note:

- The Avalara inclusive pricing support is currently in beta testing. Kindly contact support if you wish to enable this feature in your Chargebee site.

- The price type should be set as inclusive, for consistent pricing to be applied. This condition applies even for regions where Avalara is configured for tax calculation.

- If the price type is set as exclusive, then the consistent pricing does not work and tax is applied on top of the catalog price based on tax region rates. If country is not specified under Tax included tax is that of option, then the included tax rate is considered as 0%.

- You cannot make use of the consistent pricing feature if you set a different price type for a currency you are using, and a different price type for a country you are selling in.

Step 3: Adding Regions

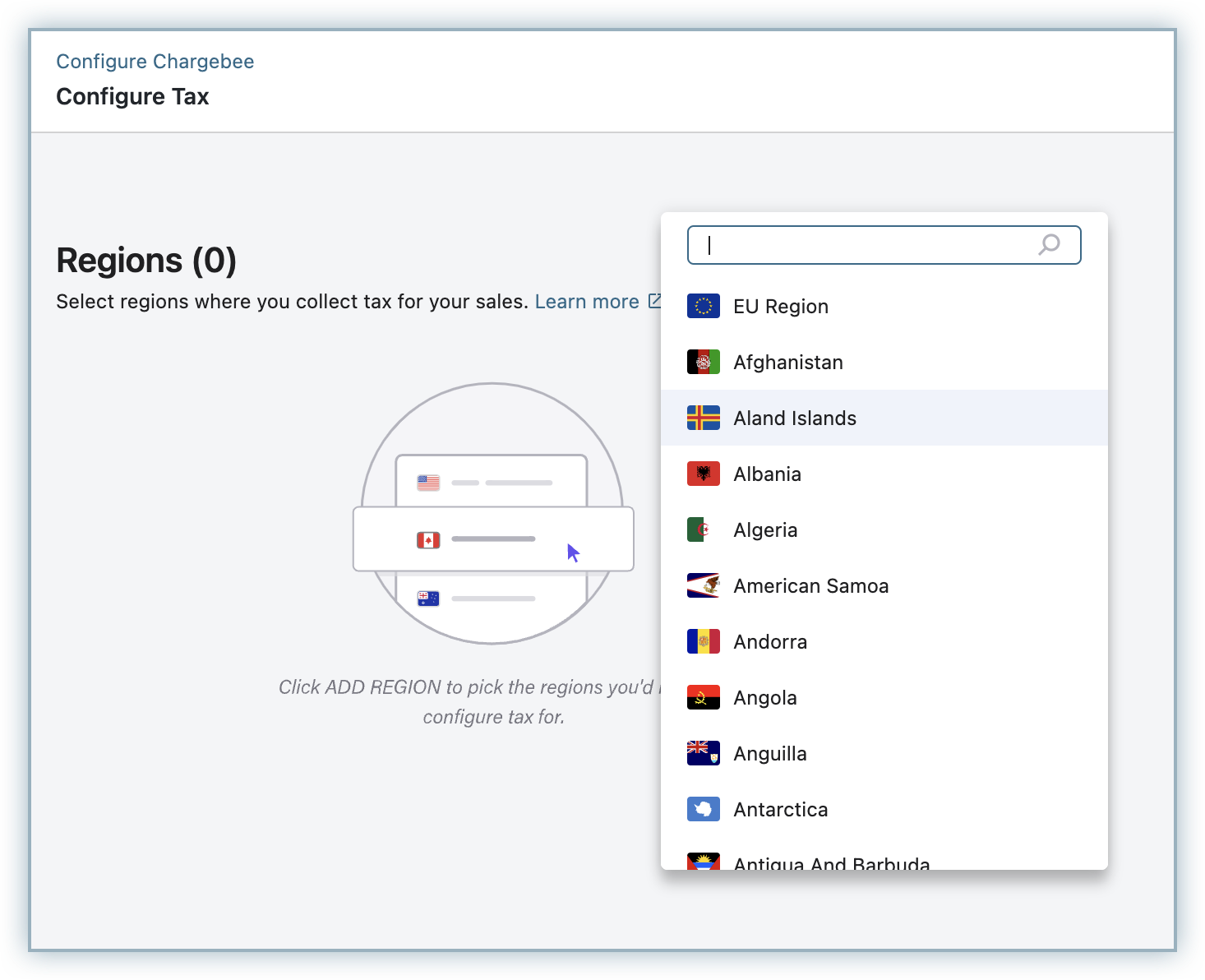

You can start adding regions where you have registered and are liable to collect tax. To add taxable regions to your Chargebee site, follow these steps:

-

In the Configure Taxes page, click Add Region and select the country from the drop-down list.

-

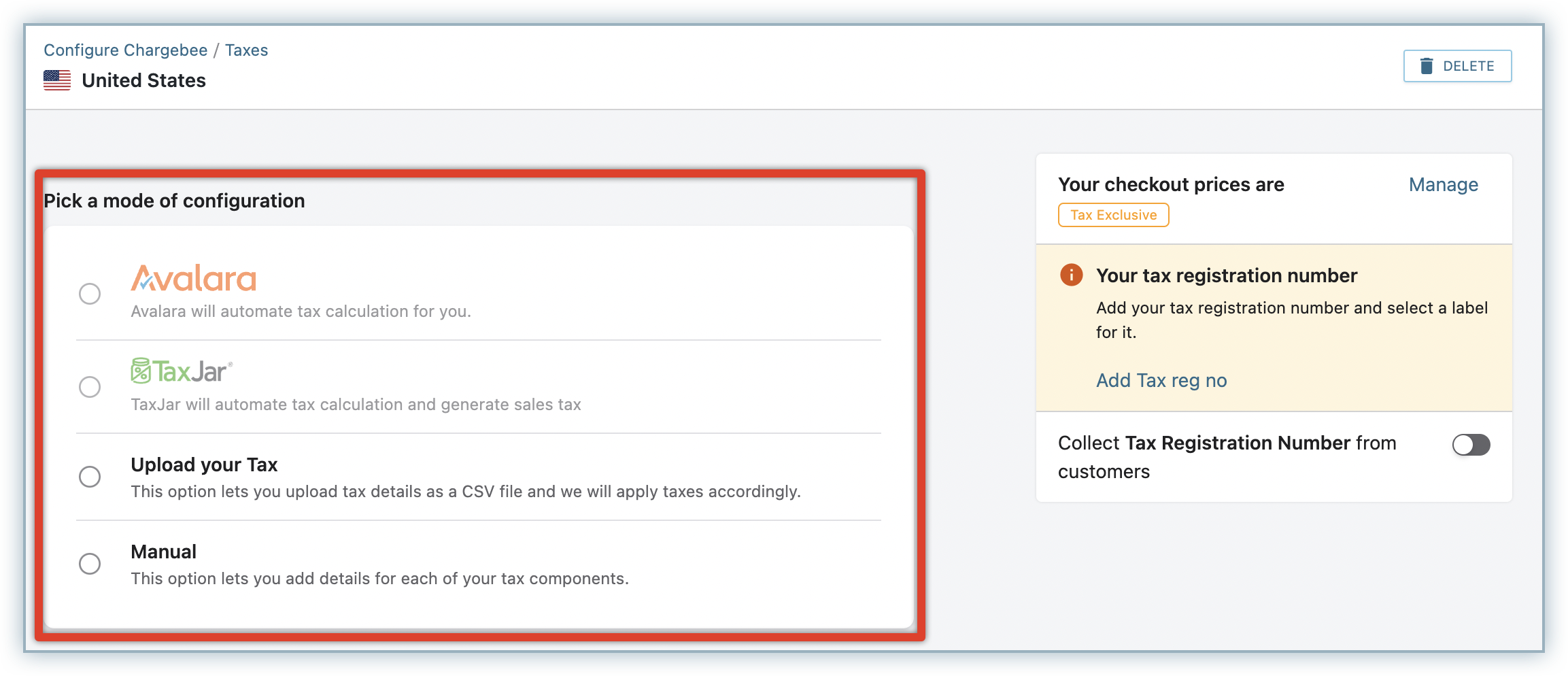

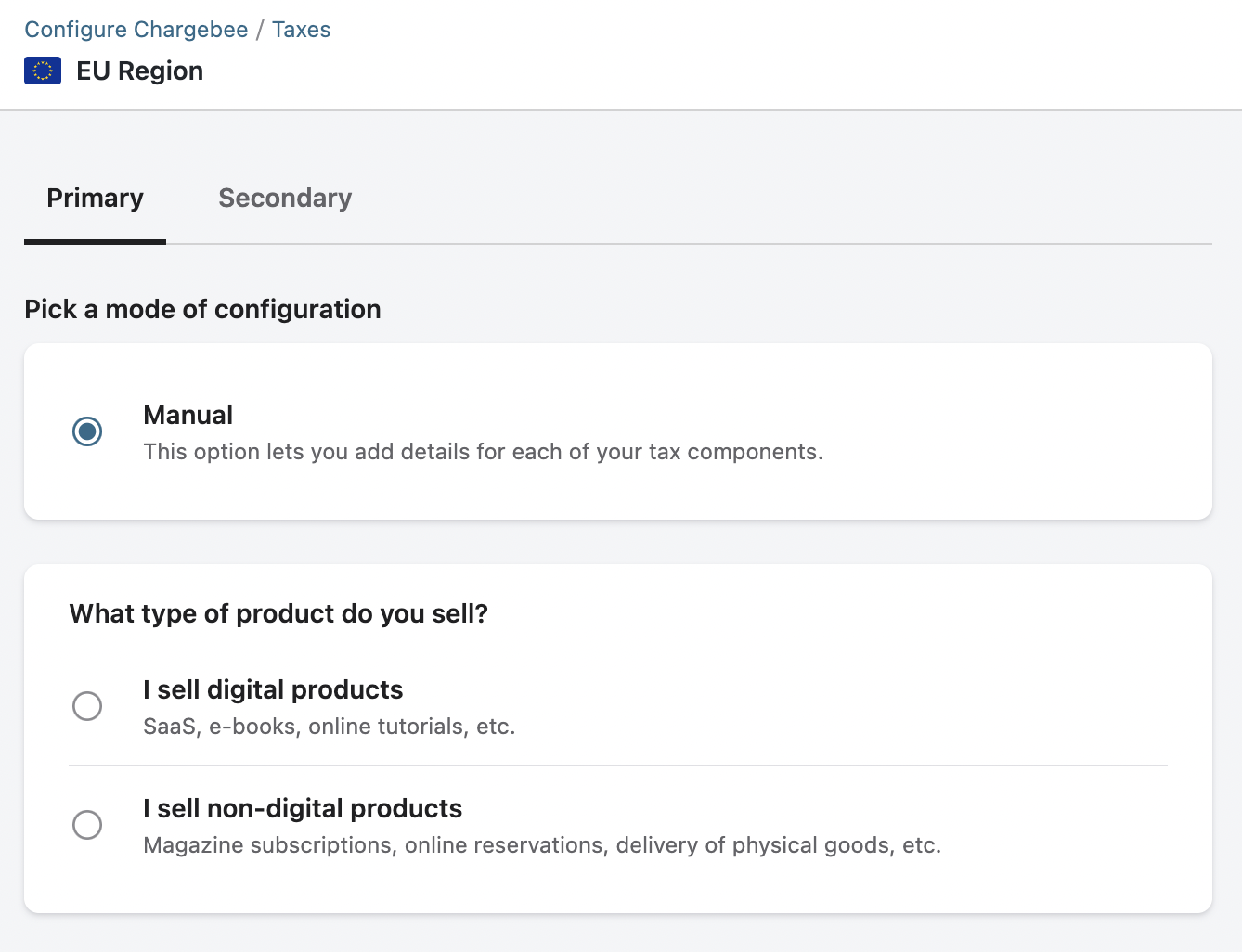

Pick your preferred mode of tax configuration for the region. You can select from the following:

- Avalara: If you are using Avalara to automate tax calculation for your business, you can integrate your Chargebee site with Avalara and use it as your preferred mode of tax calculation.

- TaxJar: If you are using TaxJar to automate tax calculation for your business, you can integrate your Chargebee site with TaxJar and use it as your preferred mode of tax calculation.

- Upload your Tax: You can upload your tax details for this country as a CSV file, and Chargebee calculates taxes based on this file data. You can download and view the sample file for reference before uploading.

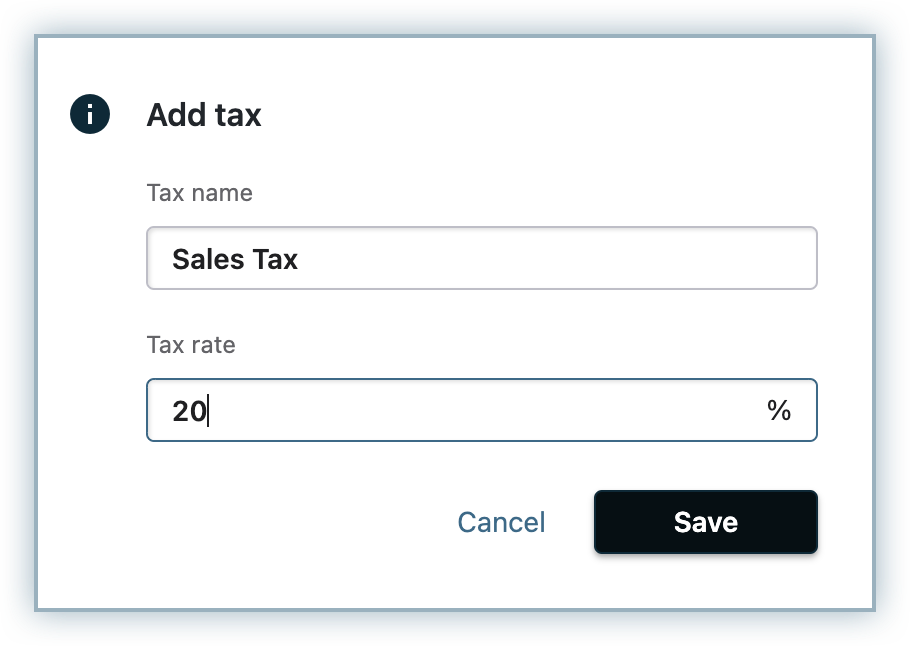

- Manual: You can use this option if you want to manually add each of your tax components for this region. In the Add Tax pop-up, specify the Tax name and Tax rate, and click Save.

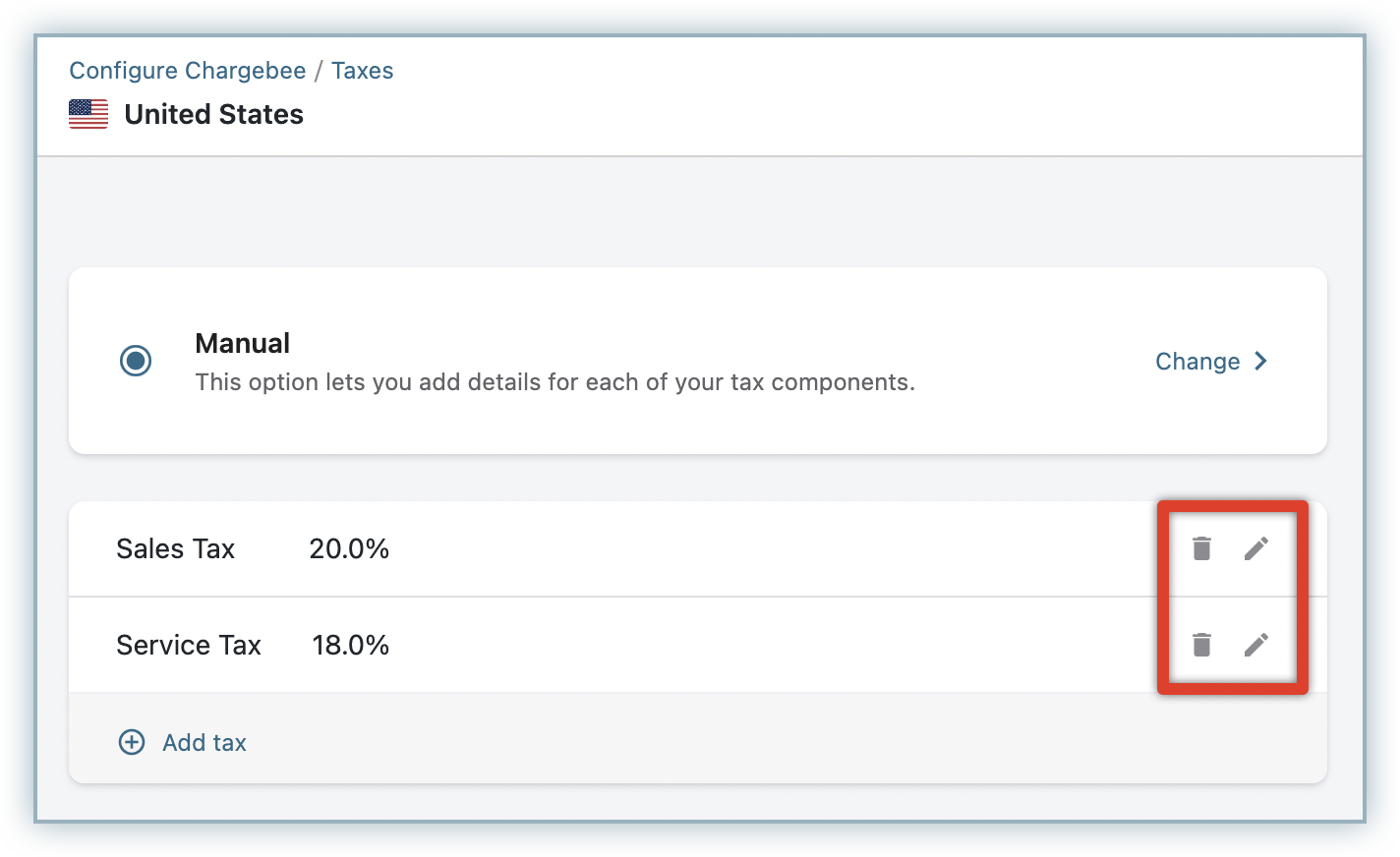

Click Add Tax to add multiple tax components for this region as required. Once, the rates are provided, Chargebee will show you a summary of the rates you have configured and provide the options edit, or delete the tax rates, if the need arises.

-

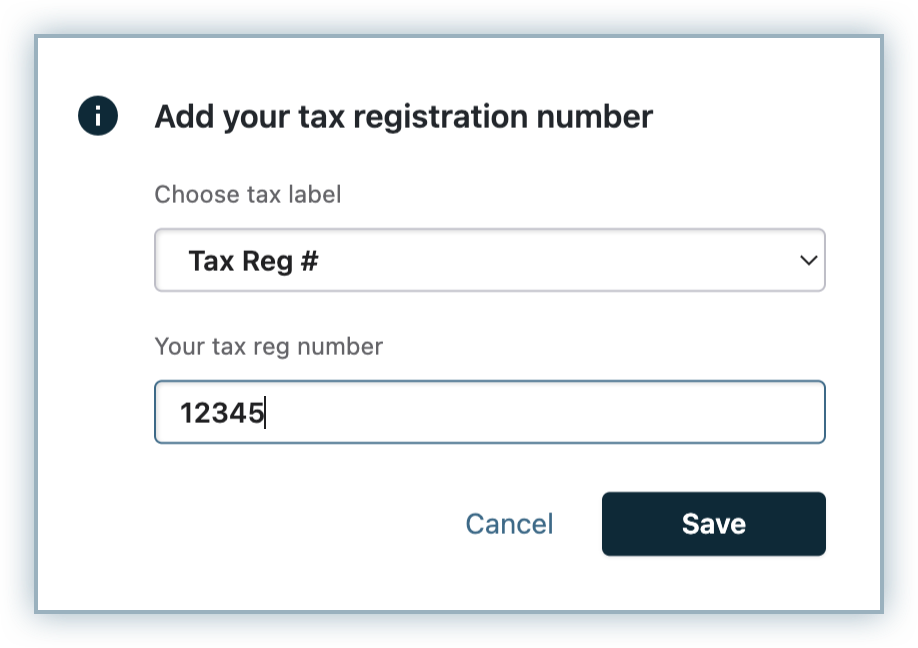

For each country being added, you can optionally click Add Tax reg no. to provide the Tax Registration number as part of the configuration.

- Choose your preferred label to be displayed in your Invoices, specify your tax registration number and click Save.

- You can enable/disable Tax Registration Number to be captured from your customers from this region.

- Additionally, you can choose to enable/disable the Tax Registration Number from customers for countries not configured for tax. If a country-specific setting is set up, it will take the highest precedence. For other countries not configured in the Tax Jurisdiction list, Chargebee displays Tax Registration number or the label you have provided in Text configuration settings for Hosted pages.

-

Once you have saved your settings for this region, you can go back to the Configure Tax page, and add more regions for tax configuration.

Via API

You can send the VAT Number via the vat_number field via the following APIs:

Setting up price type for a currency vs. price type for a region

Price type regulations differ from country to country. Some countries, like the US, allow you to set your prices as inclusive or exclusive of tax as you see fit. Others, like New Zealand or Australia, require your invoices to display a price specifically inclusive or exclusive of taxes.

With Chargebee, you can plan for a scenario like this - you can set your prices to be tax inclusive in some regions and tax-exclusive in others. If you are selling in a particular currency to customers around the world, you can set your price in that currency to be either tax inclusive or exclusive. Additionally, if some of the countries you are selling in have regulations that call for a particular price type, you can set your price in that country to be either tax inclusive or tax exclusive.

Example

You are based in the EU region, selling digital goods at a price of €100 per month. Your origin country is Belgium with tax configured at 21%. You are selling in the EUR Currency that is configured to be Tax Inclusive, and the origin EU region is set to be Tax Exclusive.

The shipping address of a customer is in France and the end customer is not a business, and therefore does not have a VAT number. The tax rate for this customer's invoice is calculated as follows:

France tax rate = 24%

Since the currency is inclusive, the €100 price of the plan is inclusive of taxes.

Actual price of the plan = €100/1.2 = €83.33

Since the region prices are exclusive of tax, a tax rate of 24% for France region gets applied to the actual price of the plan, €83.33.

Invoice total = €83.33*1.24 = €103.33

€83.33 = subtotal €20 = Taxes

To configure region-specific price type for your checkout prices, navigate to Configure Taxes > Select region > click Manage in Your Checkout Prices section.

See also

How to configure:

US Sales Tax Canada Sales Tax EU VAT New Zealand GST Tax in Other countries

Step 4: Configuring Tax Settings for Plans/Addons

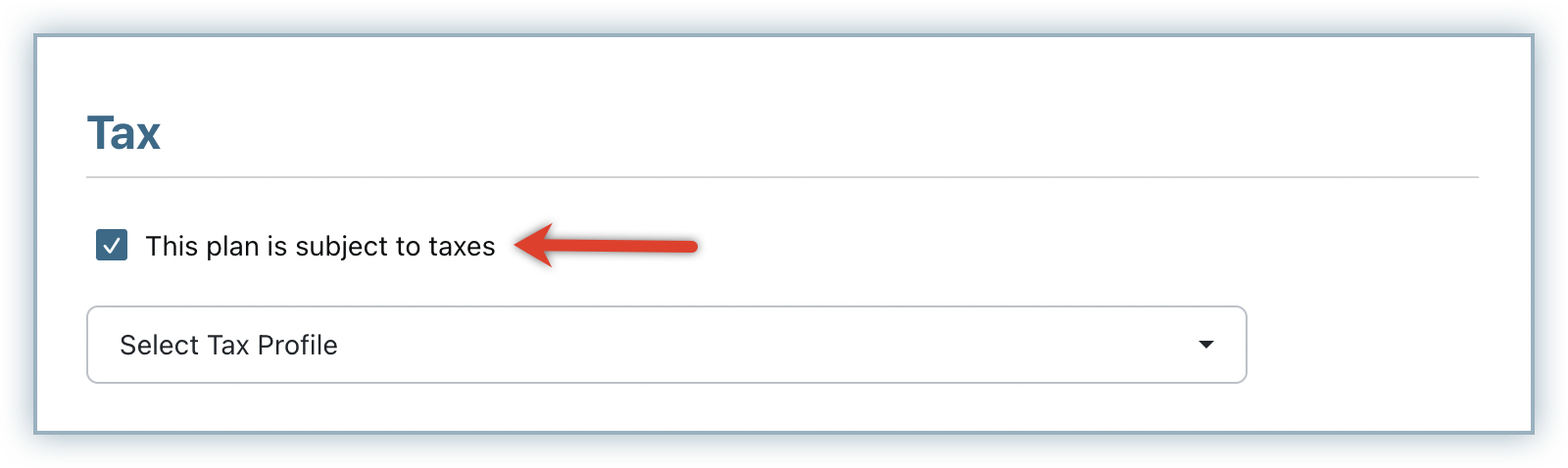

After configuring taxes and adding price types for your catalog prices, all the plans and addons in your Chargebee site become taxable. You can change this default setting for a specific plan/addon based on your requirements and tax compliance. You can update the taxability of your plans and addons in the following ways:

- Via Chargebee Site: While creating or editing a plan/addon price point, edit the This Plan/Addon is subject to taxes setting as shown in the below screenshot:

- Via API: While creating/editing a plan, set the taxable parameter as false to mark a product 'non-taxable'.

The above step is applicable only if you are using the built-in Chargebee Billing taxation. If you're using any third-party tax providers like Avalara or TaxJar, this step is not required.

Setting up Multiple Tax Profiles

If you sell different products which are subject to different tax rates in the same taxable country, you can set up multiple tax profiles in Chargebee for each of the taxable items.

Chargebee saves all your tax settings under an initial profile called "Primary" profile.

If you are selling a single category of products and don't need to apply different tax rates, you can maintain this single ‘Primary' tax Profile, with the tax rates configured across the countries you are planning to sell.

However, if you are selling products across different categories (digital and physical goods for example), and require different tax rates to be applied to different products in the same country, you can create different tax profiles to cater to the different products/rates.

Let's assume you are running XYZ Solar company and selling the following products in Europe and the UK:

- ‘Solar Monthly Digest' (online magazine) - 20% Tax in the UK

- ‘Solar Panel installation services' - 5% Tax in the UK

To configure multiple tax profiles in your Chargebee site, follow these steps:

-

Click Settings > Configure Chargebee > Taxes > Configure Tax profile > Add Profile.

-

Specify a name to the new profile that you are creating and click Save.

-

Once the required tax profiles are added, you can view the profiles in all the taxable regions that you have added.

-

You can provide the tax rates for each profile, as required.

Once you have configured multiple tax profiles, go to the respective plans/addons price points and map them to their appropriate tax profile.

Note:

If you create only one profile, it will be automatically mapped to your product catalog. In case you have enabled more than one profile, the DEFAULT profile gets mapped to all products. You can edit the plan/addon price point to map a different profile and save it. Based on the associated tax profile settings, the tax rate will be applied for the subscription.

Deleting Tax Profiles

You can delete the tax profiles(except the primary/default profile) that you created in Chargebee at any point in time. But before deleting the tax profile, you need to unlink the profile from any plans/addons that they are associated with. Unless you unlink the profile from associated plans/addons, you will not be able to delete it.

To delete an existing tax profile, follow these steps:

- Click Settings > Configure Chargebee > Taxes > Manage Tax Profiles.

- The existing tax profiles are displayed along with the options to edit/delete them.

- Click the delete icon and click Delete Profile.

When a tax profile is deleted, it gets removed from every associated taxable region/country. However, the tax rates that were applied on existing invoices are not affected/changed.

Note:

- Primary (Default) Tax Profile cannot be deleted.

- A tax profile linked to a Plan/Add-on cannot be deleted.

- If you want to remove the tax profile linked to Plan/Add-on, the Plan/Add-on need to be linked to another tax profile or it should be made tax exempt.

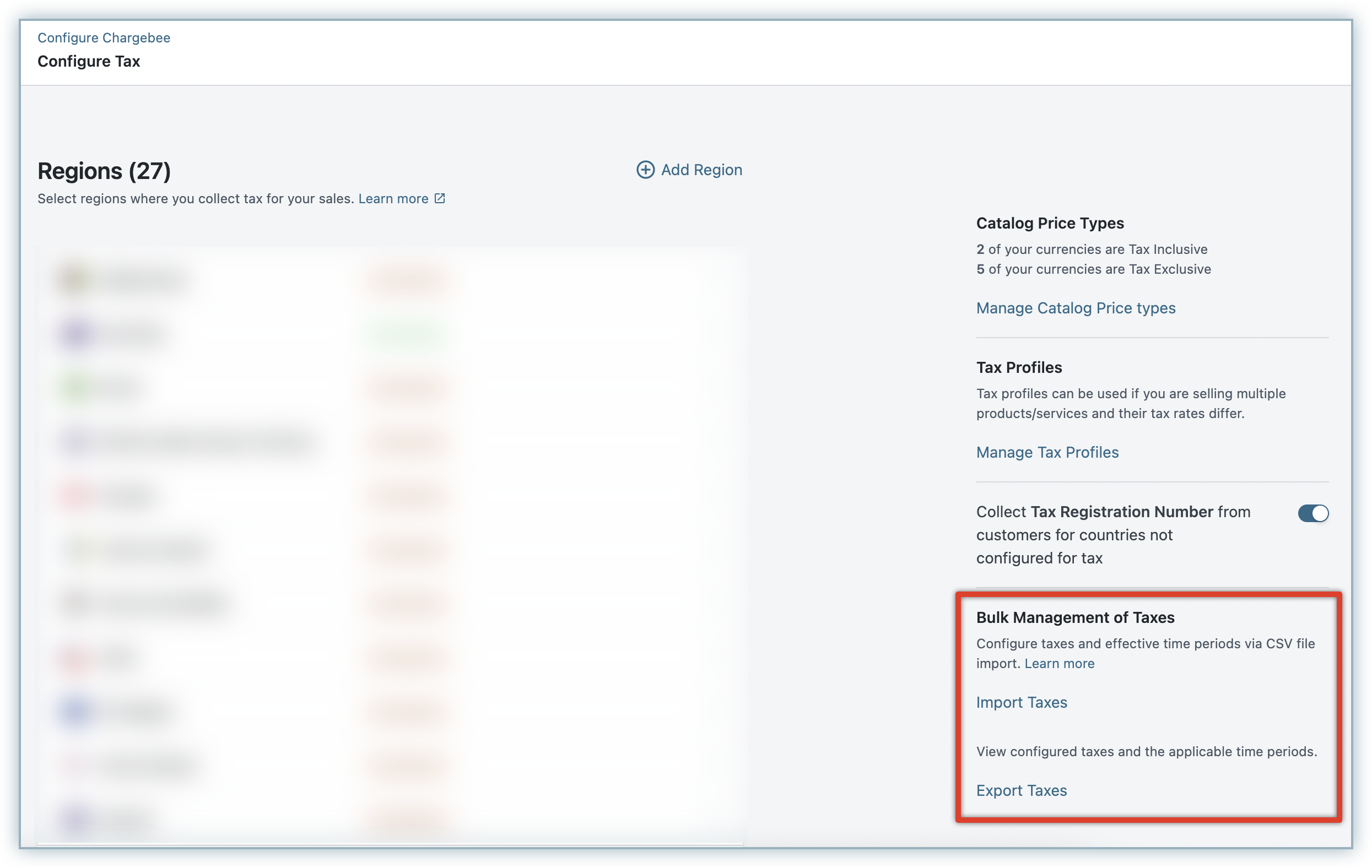

Bulk Management of Taxes & Scheduling Tax Rates

If you are running a business with tax obligations in many countries, configuring the tax rates for each country individually in your Chargebee site could be time consuming and cumbersome. You can do a bulk import and export of tax rates for multiple countries, states, pin codes, or even pin code ranges for all your tax profiles together using the Bulk management of Taxes feature. The sales taxes for your products and services are bound to change every now and then, across the world. Instead of manually updating the tax rates each time on your Chargebee site, you can export you current tax rates for multiple regions, and tax profiles, update them for select regions/time periods together and upload in bulk. You can introduce tax rate groups with effective start dates and end dates under tax profiles for each tax rate.

The applicable tax rates are automatically added to your Chargebee invoices based on the invoice dates. For example, while creating a backdated subscription, the backdated invoice will utilize the historic tax rate as applicable for the invoice date in the past. Similarly, any tax rate updates added for the future will be applied on your future invoices automatically without any manual intervention.

For example, let's say you upload a CSV file with updated Tax rate for Italy as 15% (as against the existing 13%)with start date specified as 21st of Aug, 2023 and end date specified as 21st of Aug, 2030. Invoices created with billing address in Italy from the 21st of Aug, 2023 will automatically have the updated tax rate of 15% applied.

Importing Taxes in Bulk

In order to update tax rates in bulk with effective time periods, you must migrate any existing tax rates that you've configured manually on your Chargebee site for various regions and bulk update them via CSV upload. This is a one-time migration, and you can continue to update tax rates with effective time periods via bulk upload in the future.

Note:

While migrating your existing tax rate configurations that you added manually in your UI to Bulk Management of Taxes, note that any GSTINs added at the state level in India, or VAT numbers added for EU regions will be removed automatically. You need to add them again after uploading your CSV file.

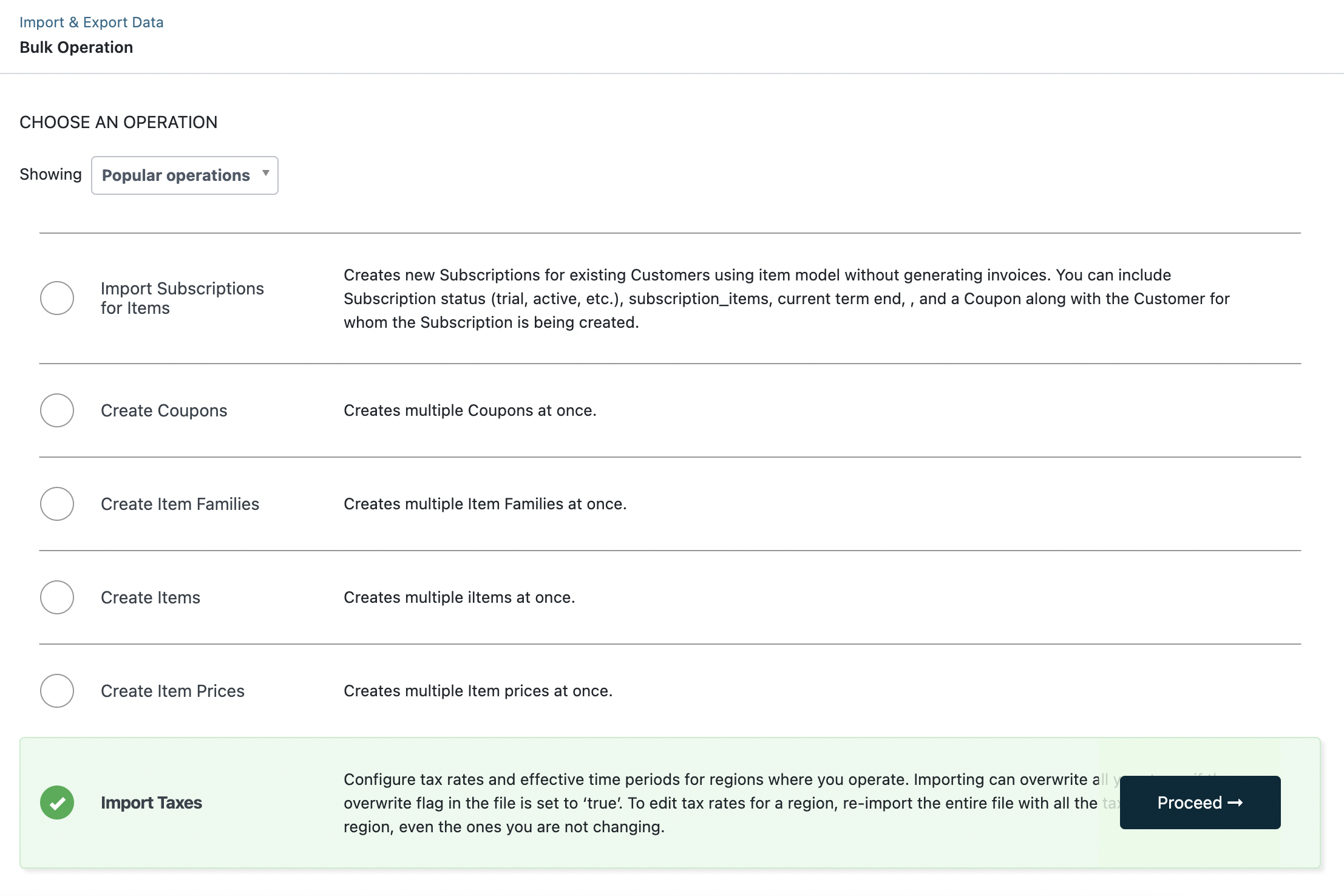

To update tax rates with effective time periods, follow these steps on your Chargebee site:

-

Click Settings > Configure Chargebee > Taxes > Bulk Management of Taxes > Import Taxes.

Before importing your file, always export your current taxes, make necessary changes on the file and update it to avoid any deletion of data.

-

You will be redirected to the Bulk Operations page with Import Taxes pre-selected. Click Proceed.

-

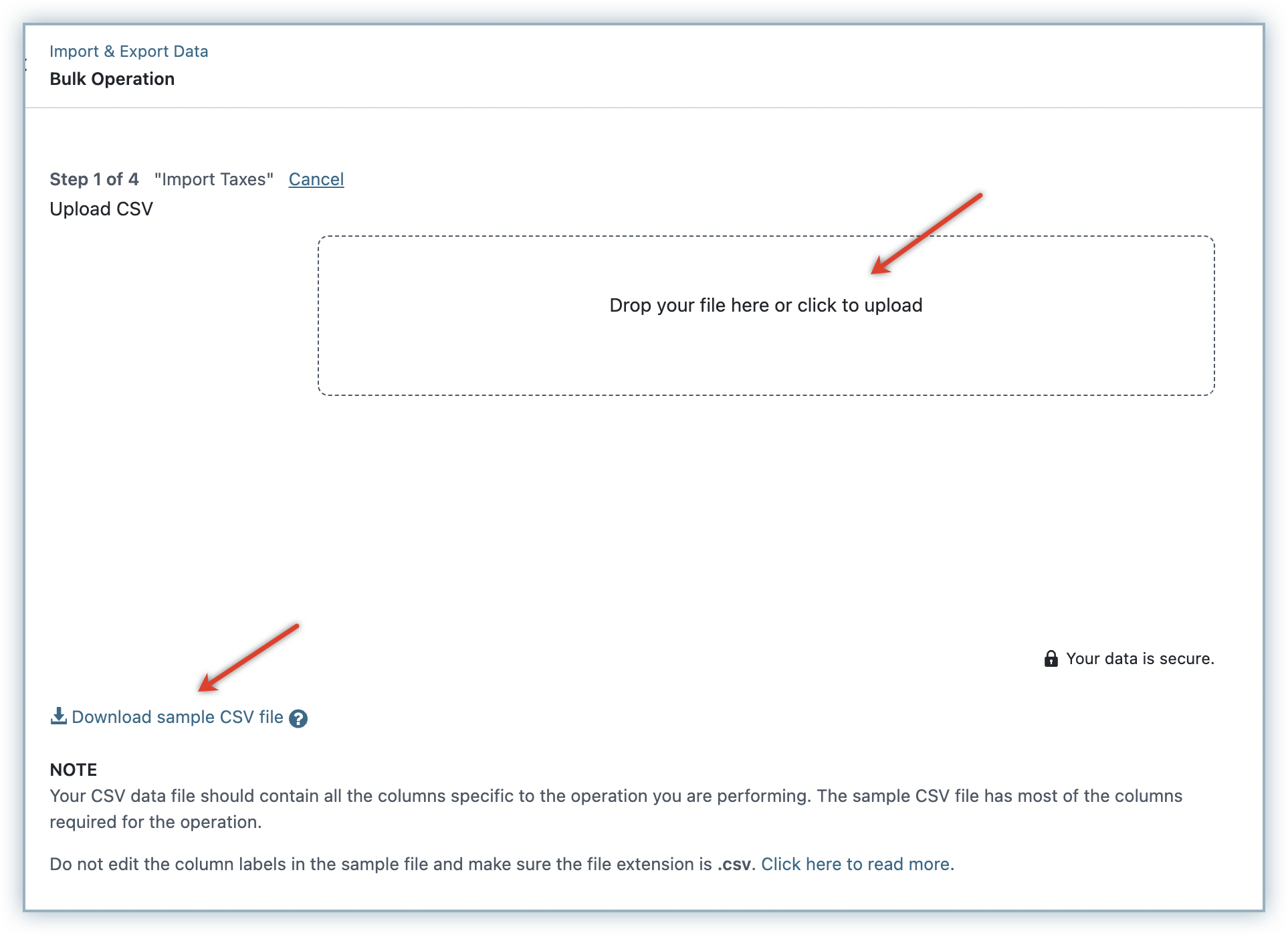

Follow the steps documented here to import your CSV file that contains your tax rates with effective start dates and end dates for specific tax profiles and regions.

You can download a sample CSV file and use it for reference. This file contains sample records that you can replace with your own records. The data needs to be added to the sheet in the same format as the sample data. Refer to this table for details on each column/field on the CSV file.

-

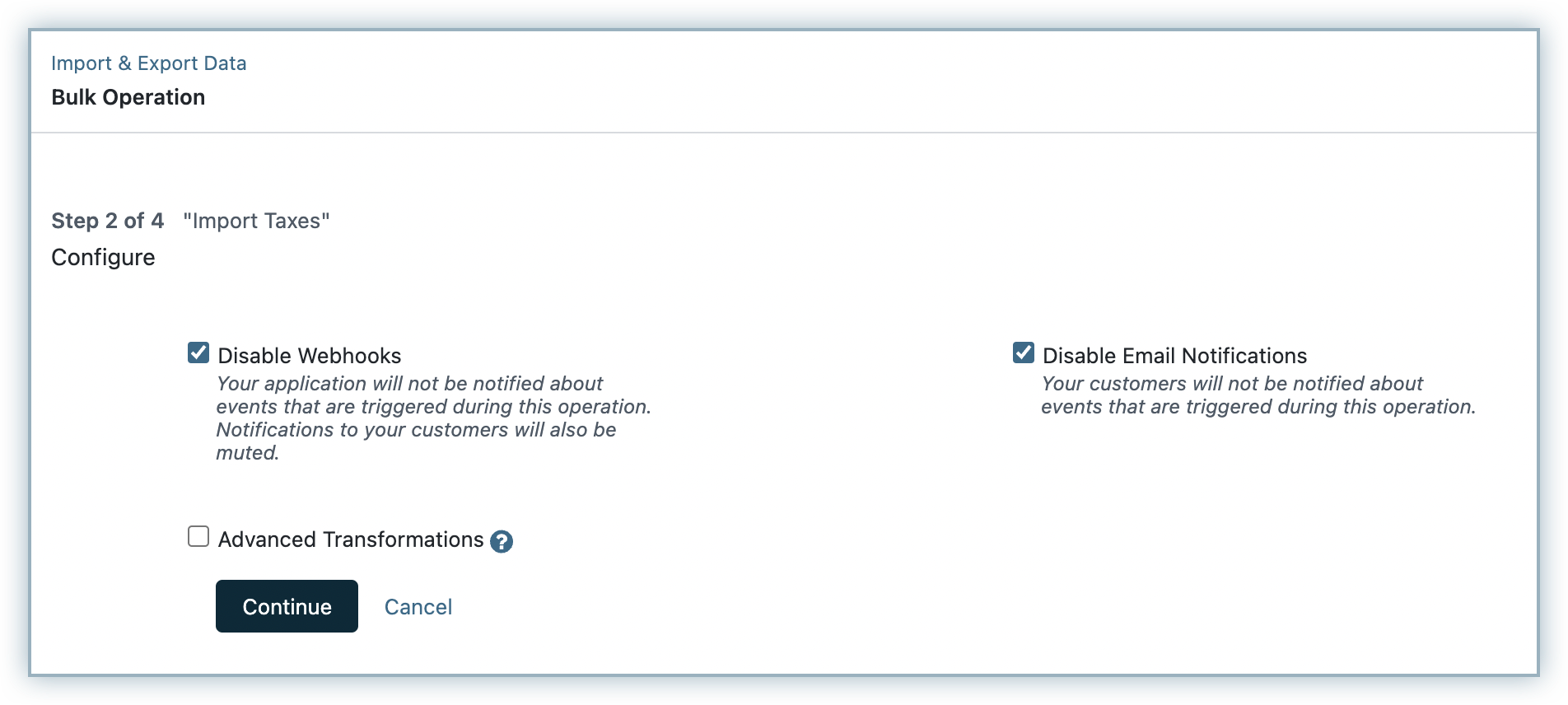

In the next step, configure your preferences on how Chargebee will perform certain actions when the Bulk Operation is underway. Click Continue to validate your CSV file.

-

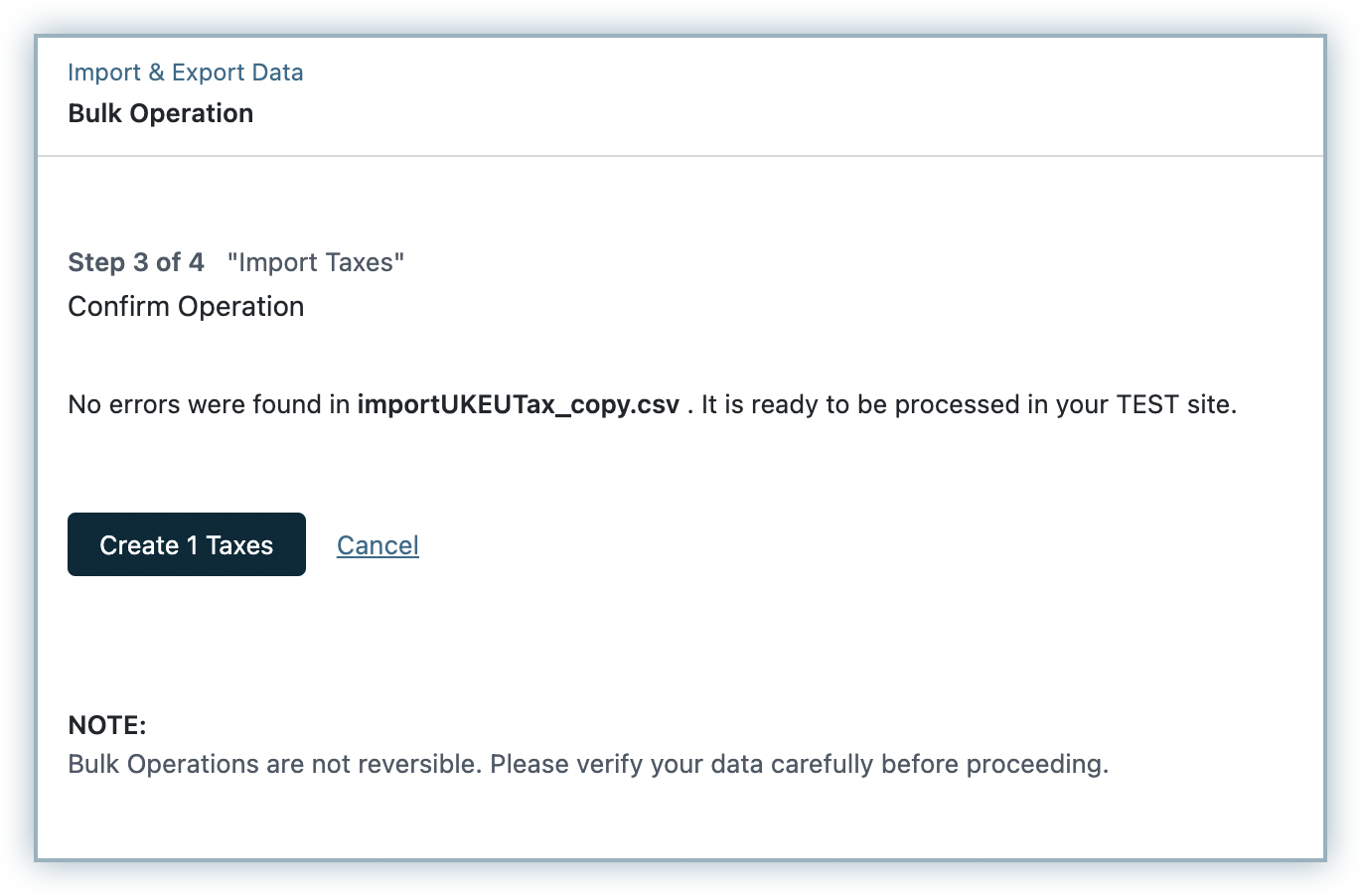

The data in your CSV file gets validated and the time taken depends on the file size. If there are any errors in the file, they will be listed on the screen during validation. These errors are also displayed on the csv file against the affected cells. The data in rows without any errors are validated successfully. You can download the file, update it to fix the errors and upload it once again. Once the validation is completed successfully, you will be notified through email. You can then come back and resume operation.

-

Click Create Taxes. Chargebee will process and import your file and update tax rates for applicable regions based on your file data.

-

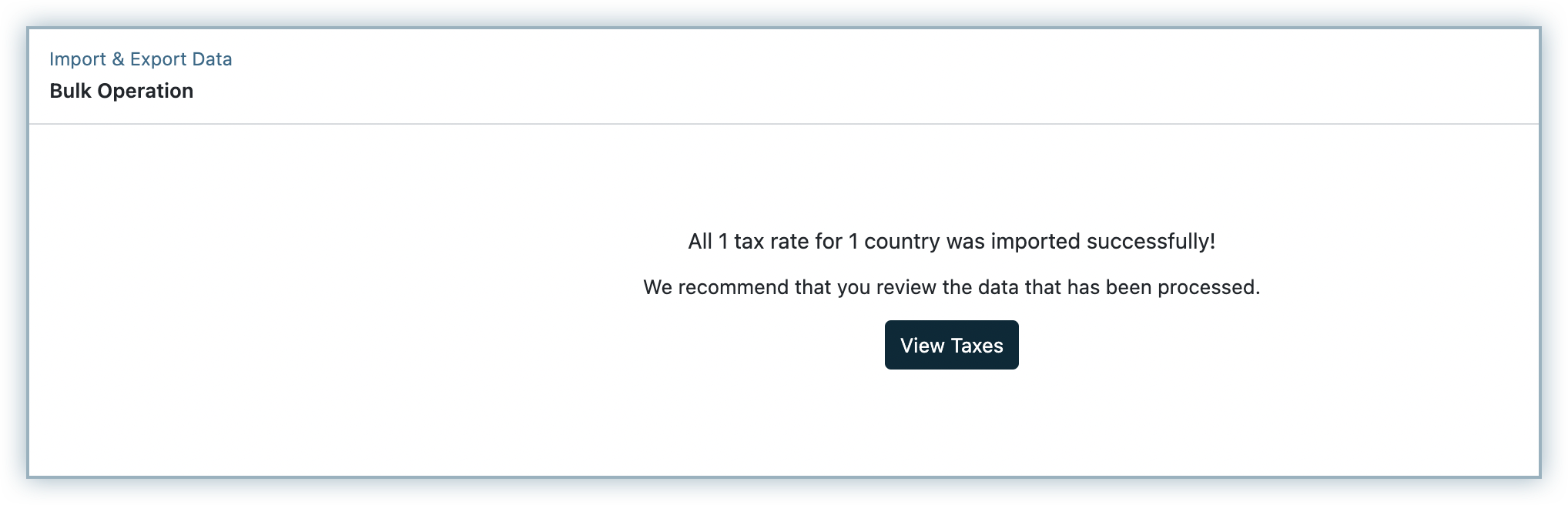

Once the import is successful, you will be notified on the number of countries for which tax rate was imported successfully.

Click View Taxes and you will be redirected to the Configure Taxes page where you can verify the newly imported tax rates.

You can configure other tax settings such as:

- Adding GST number for specific states

- Registering your VAT MOSS number

- Adding VAT number or relevant tax registration number for required regions

- Enabling Location Validation

- Configuring third-party tax providers for specific regions

- Other country-specific configurations

Limitation

You cannot modify the tax rates manually for Chargebee taxes configured via bulk import. You can however remove and update them again.

| Column Name | Description | Format |

|---|---|---|

| tax profile name | Name of the Tax Profile to which you are adding the tax rate. | Tax profile name field supports only text format. |

| country | The billing country of the customer. | Use the ISO 3166 alpha-2 country code. An invalid country code returns an error. If you enabled EU VAT in 2021 or later, or you manually enabled the Brexit configuration, then use XI as the code for United Kingdom & Northern Ireland. |

| state | The billing state of the customer. | For US, Canada, and India, use the ISO 3166-2 state/province code without the country prefix. For instance, AZ(not US-AZ for Arizona (USA), use TN(not IN-TN) for Tamil Nadu (India), use BC(not CA-BC) for British Columbia (Canada). For all other countries, enter the name of the state exactly as it appears in the customer's billing address. Postal codes may be a more accurate way to indicate tax applicability. |

| zip code | The postal code where this tax is applicable. | Zip cope field supports numeric/alpha-numeric postal codes. Zip codes can be used to apply zero taxes for tax exempt regions in Europe such as Mount Athos in Greece or Livingo in Italy. |

| zip_code_start | This column determines the start of the postal code range where this tax is applicable. If your zip codes begin with a '0', such as the range 00042 - 00044, it's essential to list each zip code separately in individual rows. Instead of providing a range (zip_code_start to zip_code_end) in a single entry, please input each zip code individually. For instance, if you have zip codes of 00042 - 00044, you need to enter 00042, 00043, and 00044 in separate rows under the 'zip_code' field. | Tax import only supports numeric postal code ranges. Make sure that all postal codes in the range lies in the same tax region. |

| zip_code_end | This column determines the end of the postal code range where this tax is applicable. | Tax import only supports numeric postal code ranges. Make sure that all postal codes in the range lies in the same tax region. The value specified here must be greater than the value specified under zip_code_start. |

| tax1_name | Name of the tax applied. | This appears on invoices. Use a name that the customer recognizes. |

| tax1_rate | Tax rate as applicable for the region. | Tax rate field only supports numeric values that gets applied in percentage. |

| tax1_juris_type, tax2_juris_type, .. | The type of tax jurisdiction. | This appears in the label, and is not used in the logic to apply taxes. Possible values are: country, federal, state, county, city, special, unincorporated, other |

| tax1_juris_name, tax2_juris_name, .. | The name of the state, country, or city where this tax is applicable. | This appears in the label, and is not used in the logic to apply taxes. |

| tax1_juris_code, tax2_juris_code, .. | The code for the state, country, or city where this tax is applicable. | This appears in the label, and is not used in the logic to apply taxes. |

| service_type | Chargebee tax product type. | Possible values are: digital, non-digital |

| time_zone | The time zone for the validity fields. | Time zone abbreviation. In its absence, your site timezone will be used. Possible values for time zone are: EST, HST, MST, ACT, AET, AGT, ART, AST, BET, BST, CAT, CNT, CST, CTT |

| valid_from | Tax validity start in specified timezone. | Use a timestamp in the format yyyy-MM-dd HH:mm:ss. In its absence, the tax is considered valid from midnight (00:00:00). |

| valid_till | Tax validity end in specified timezone. | Use a timestamp in the format yyyy-MM-dd HH:mm:ss. In its absence, the tax is considered valid until midnight (00:00:00). |

| overwrite | Flag indicating whether old rules are overwritten.

| YES/NO |

Note:

- If you do not specify a start date or end date, the system assumes the effective time period to be infinity.

- If you are using multiple tax profiles for digital and non-digital products/services, make sure that the tax profiles are mapped to the digital and non-digital type of products/services consistently across all regions. For example, let's say you've mapped the primary tax profile for a digital product in the US region. Mapping the primary tax profile for a non-digital service in India will generate errors. Make sure that you map the primary tax profile in all other applicable regions only for digital. Countries that currently support tax profile are EU, Australia, New Zealand, and United Kingdom.

- The effective time periods are validated for the tax rates in all regions. Make sure that there are not any overlapping time periods for a region/location in the file that will generate errors.

- There are currently no validations in place for pin codes.

- To mark tax-exempt regions in EU such as Helgoland, Busingen, Mount Athos, and so on, simply add rows on the CSV file for these regions with tax rates updated as 0 for their respective pin codes.

Exporting Taxes in Bulk

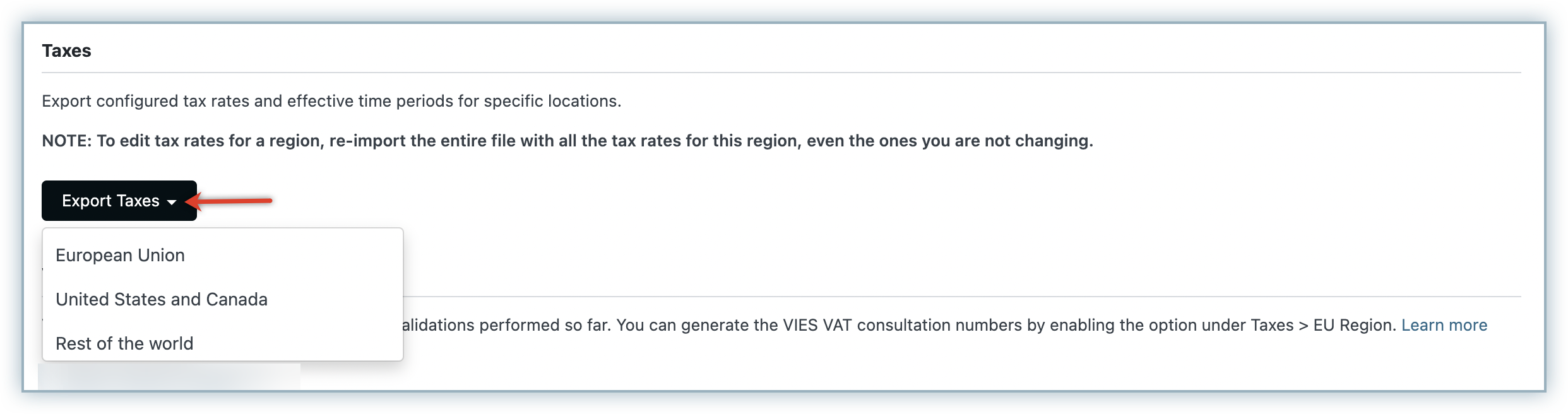

You can view all the configured taxes for various regions/profiles, and their effective time periods by exporting a file. To export tax rates file on your Chargebee site, follow these steps:

-

Click Settings > Configure Chargebee > Taxes > Bulk Management of Taxes > Export Taxes.

-

You will be redirected to the Export Data page, where you can select the region for which you can export the tax file. You can select from the following options:

- European Union

- United States and Canada

- Rest of the world

-

Click Export.

Your export operation will be initiated and once complete, the file will be downloaded automatically.

You can also download the file from under Export History for 14 days from when the export operation is executed.

Transitional Taxation

Note:

To apply transitional rates, it is essential to first schedule the tax rate changes for the respective regions. The tax rate changes can be scheduled using bulk updates feature on Chargebee.

Tax rates such as VAT or GST are bound to change anytime around the year, and it is critical to stay on top of transitional taxation rules to ensure that your customers are taxed accurately, and that your Chargebee invoices reflect the same. By default, Chargebee calculates taxes based on the invoice date. Any change in the tax rates during this service period would require you to update the tax settings on your Chargebee site manually. You would then generate a credit note for the remaining service period and raise a one-time charge with the remaining amount and the new tax rate. The new tax rates will be automatically applied for the upcoming renewals.

The Transitional taxation feature in Chargebee allows you to stay compliant with transitional taxation rules by automatically applying any tax rate changes during the invoice service period and even capturing them clearly on your invoices, and credit notes. You can upload the tax rate changes for multiple regions and periods via the Bulk Management of Taxes & Scheduling Tax Rates feature.

When an invoice spans a service period with different tax rates, different taxes are applied for relevant periods. Multiple tax line items with former and revised tax rates are displayed on the invoices to reflect how taxes are applied accurately for the entire period. Invoices raised for usage based billing use the same logic.

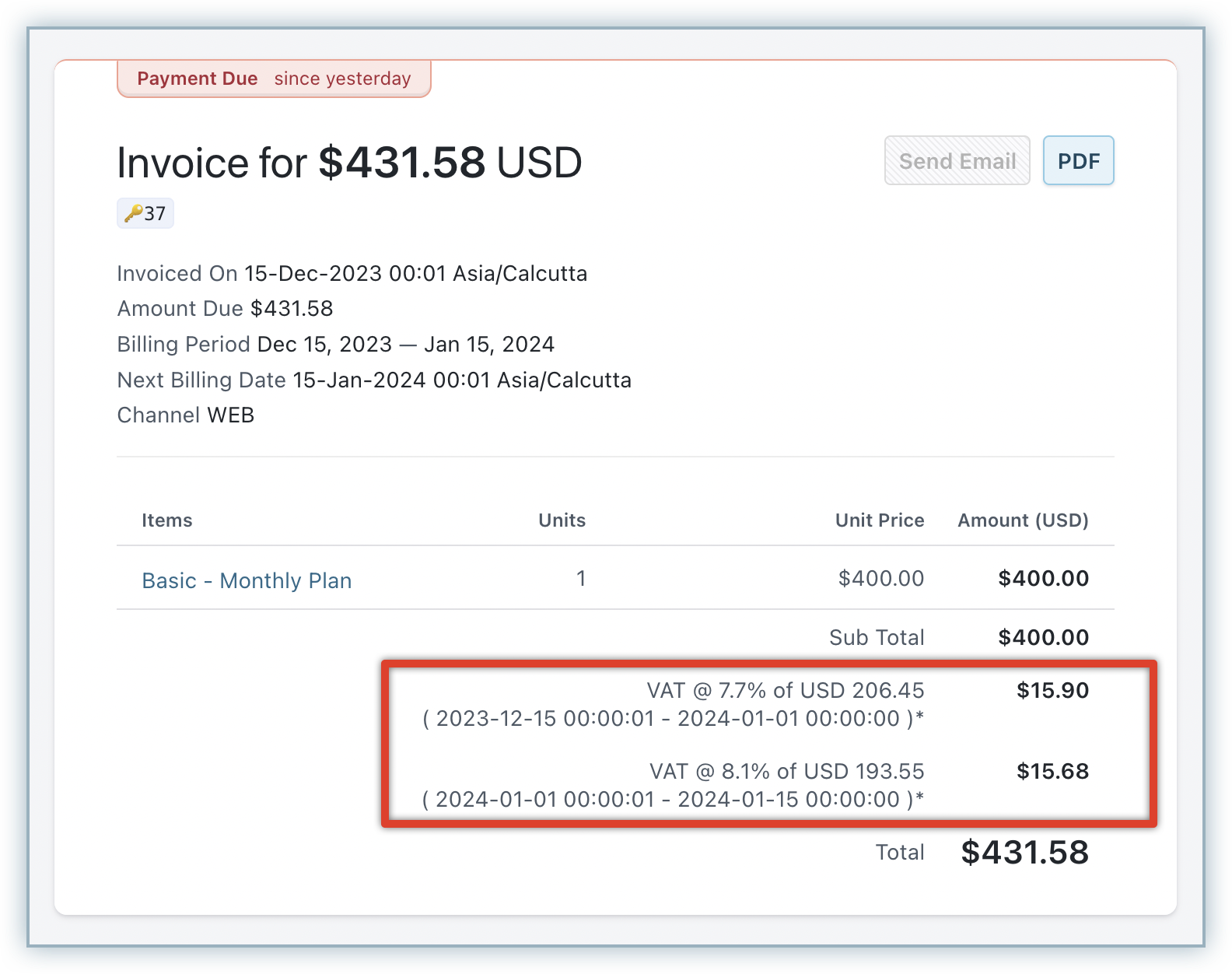

Let's look at an example and consider the increase in VAT rates effective from January 1, 2024 by the Swiss Federal Tax Administration. As per their guidelines services rendered by 31 December 2023 are subject to the current rates while the new rates will apply to supplies rendered as from 1 January 2024. With transitional taxation feature enabled for Switzerland and the corresponding tax changes scheduled in Chargebee, an invoice raised for services from December 15th, 2023 to January 15th, 2024 will have different tax rates applied accurately for the following periods:

- VAT @ 7.7% (Dec 15 - Dec 31, 2023)

- VAT @ 8.1% (Jan 01 to Jan 15, 2024)

Configuring Transitional Taxation

Note:

- The Transitional Taxation feature is currently supported only for manual taxes configured in Chargebee, and is not supported in any tax integrations.

- The Transitional Taxation feature is currently not supported for any accounting integrations. You need to handle the data model in your downstream systems as required.

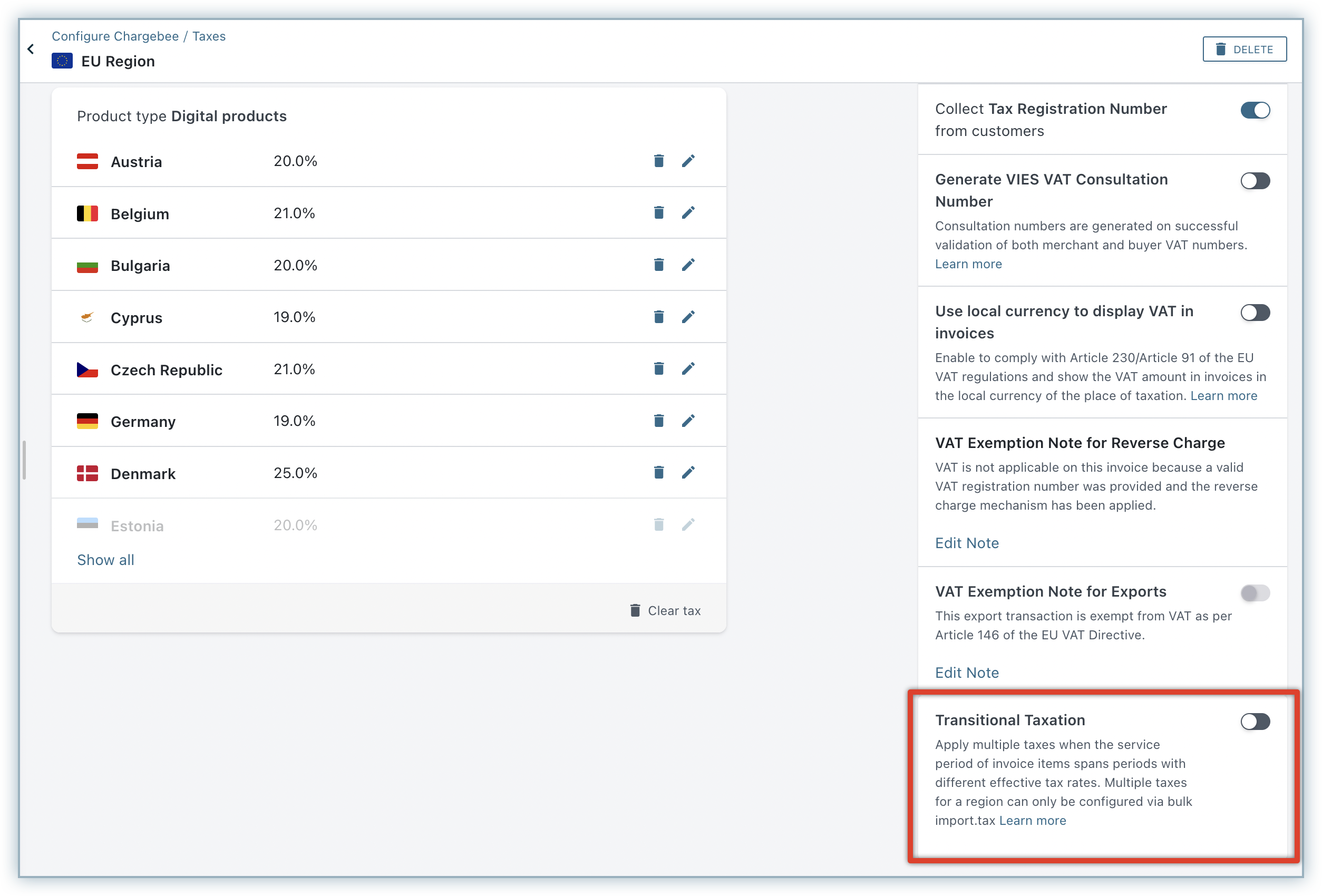

To enable transitional taxation setting in your Chargebee site, follow these steps:

-

Click Settings > Configure Chargebee > Taxes > select the region for which you are configuring transition taxation.

-

On the Taxes page, click the toggle to enable the transitional taxation setting under Transitional Taxation.

You have successfully enabled the transitional taxation setting for your Chargebee site. Invoices of the corresponding region that span service periods with multiple tax rates will now have multiple applicable tax rates applied automatically.

Tax Amount Withheld

Request access to enable this feature for your site.

Tax Amount Withheld or Tax Deducted as Source (TDS) is a direct taxation mechanism that was introduced to collect any applicable tax at the source of payment transactions, by the buyer. As per the Tax Amount Withheld, when a buyer(deductor) is liable to make a payment to the seller(deductee), the buyer deducts tax at the source and transfers the balance to the deductee. The buyer withholds a certain part of the total amount to be paid to the seller and pays it directly to the government as taxes.

Let's look at an example. Acme Inc makes a payment of USD 20,000 towards professional fees to XYZ Corp. and the applicable tax rate is 10%. Acme withholds the tax of USD 2,000 and makes a net payment of USD 18,000 to XYZ Corp. Acme Inc. directly deposits the amount of USD 2,000 to the credit of the government.

Based on your business requirements and tax compliance rules in your country, you can record tax withheld in Chargebee by specifying the amount withheld, for offline payments.

Roles and Restrictions

- The feature to record tax amount withheld needs to be enabled in your Chargebee site by users with Owner, Admin, or Finance Executive roles.

- After the feature is enabled, users with Owner, Admin, Customer Support, and Sales Manager roles can record tax amount withheld for Payment Due/Not Paid invoices.

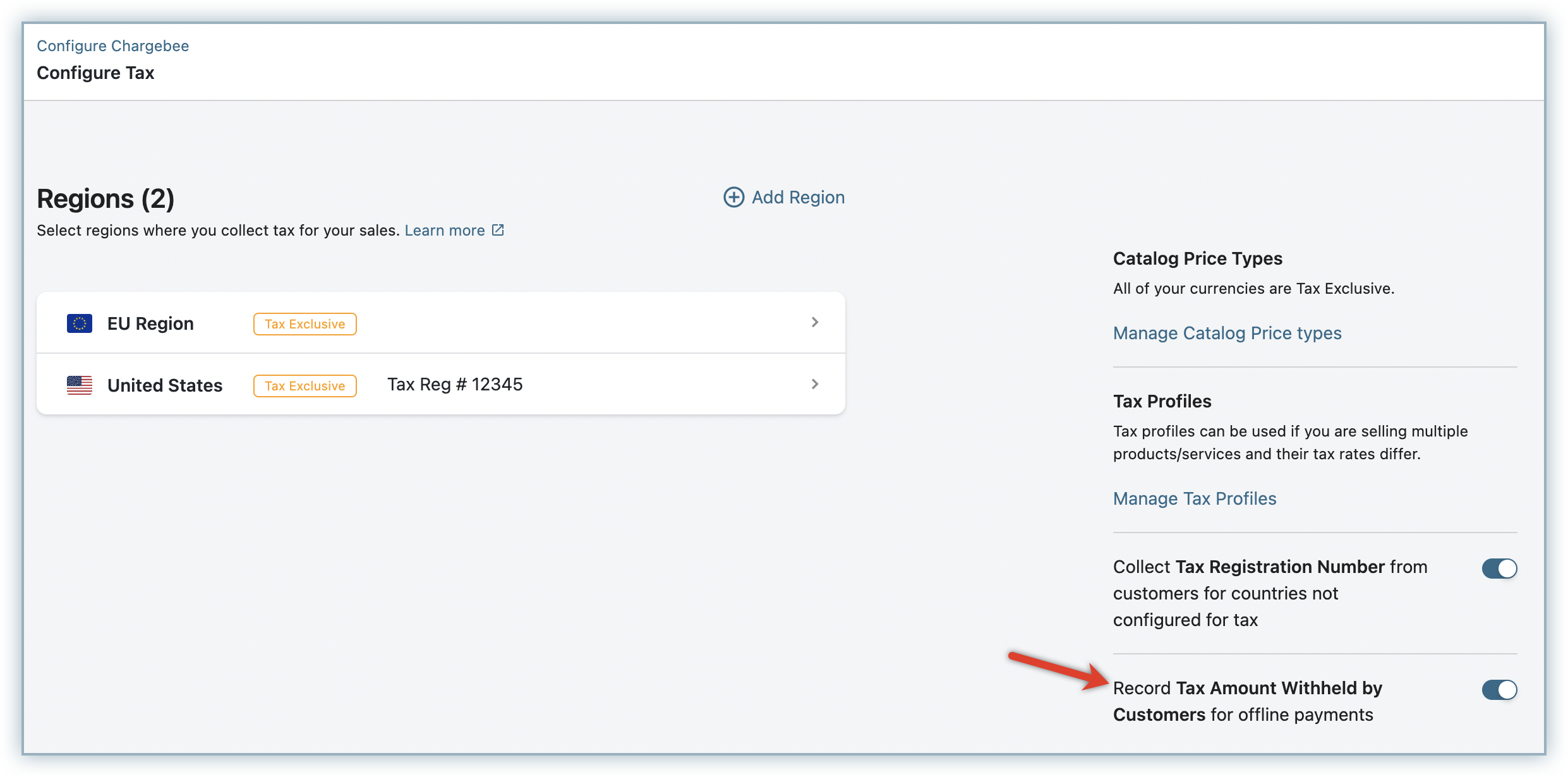

Configuring Tax Amount Withheld

To allow recording the tax amount withheld in your Chargebee site, follow these steps:

-

Click Settings > Configure Chargebee > Taxes.

-

Enable the setting Record Tax Amount Withheld by Customers for offline payments.

-

Click Save.

After the setting is enabled, users can start recording the tax amount withheld for all offline payments on your Chargebee site.

When the setting to allow recording tax amount withheld is disabled, users will not be able to record the taxes withheld for any invoices (generated before/after disabling) going forward. Users can remove an existing tax withheld line item from an invoice record, however, users cannot add the tax amount withheld again, even for the same invoice.

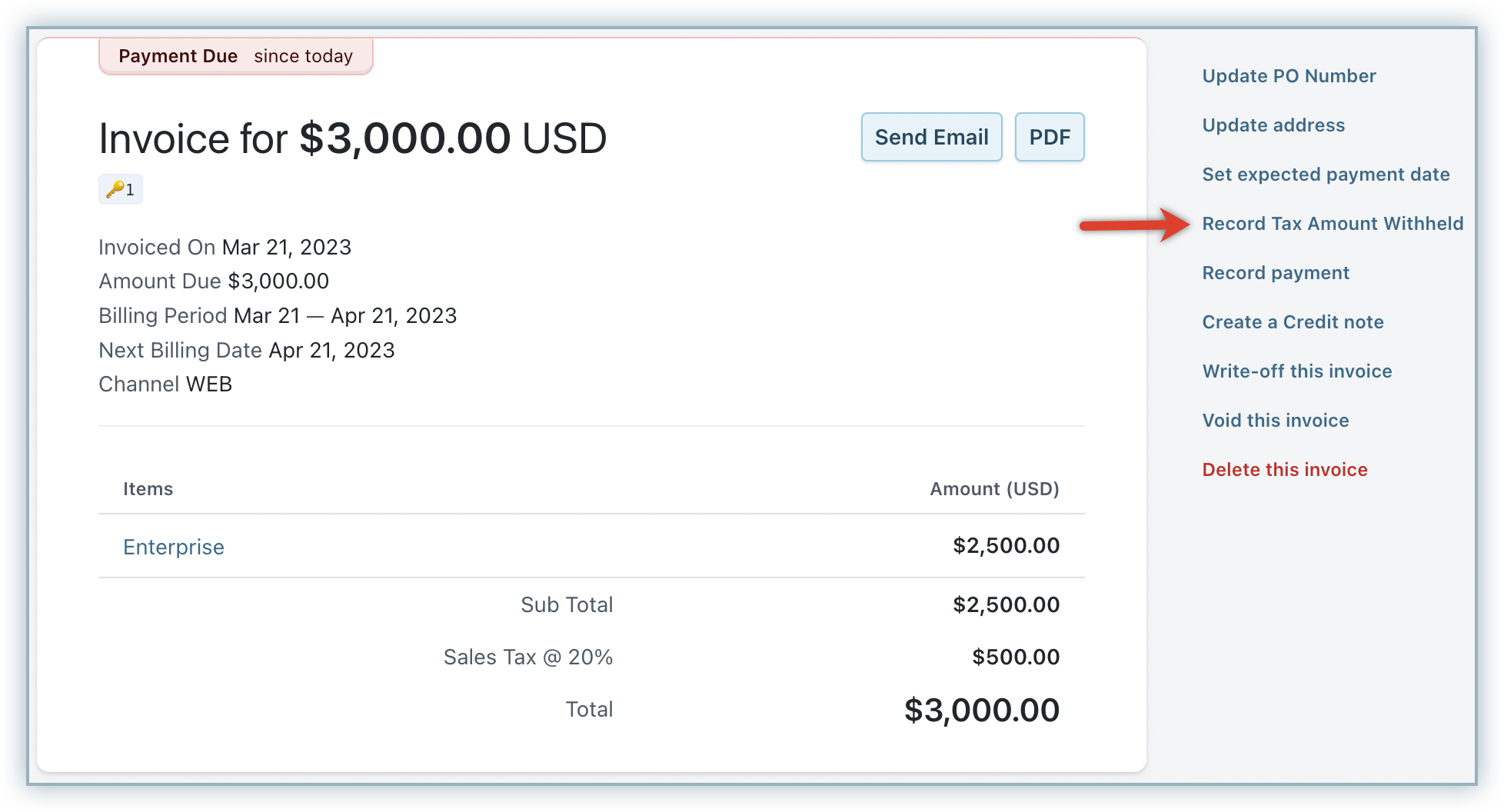

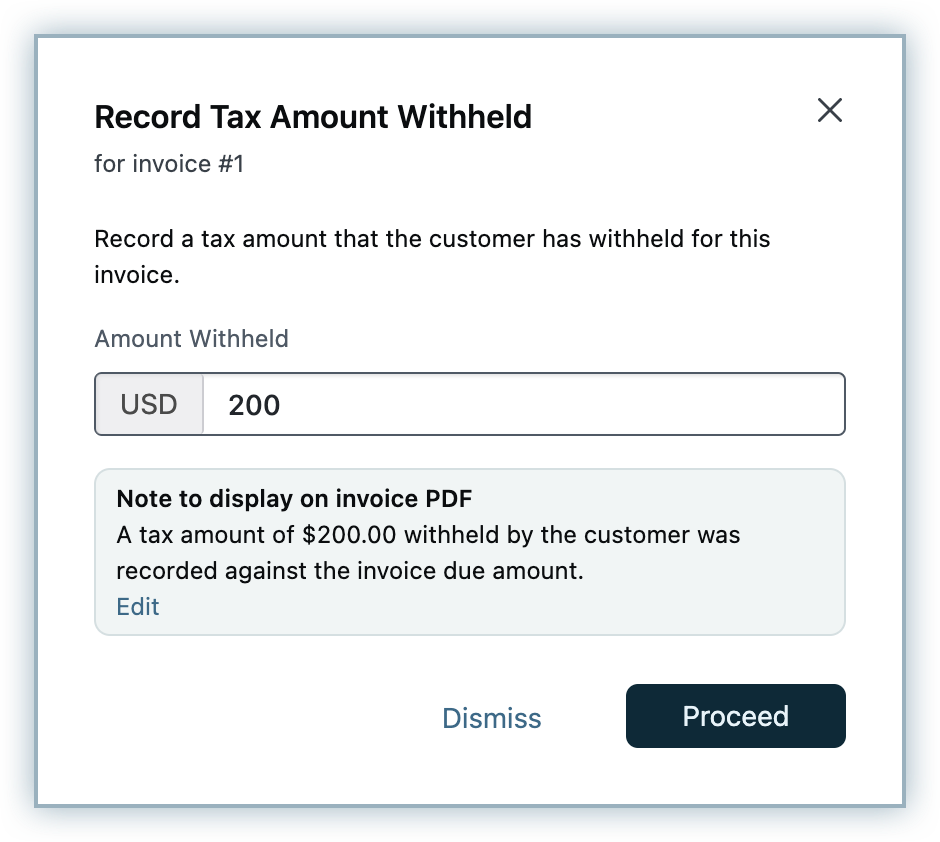

Recording Tax Amount Withheld

To record the tax amount withheld for an invoice, follow these steps:

-

Click Customers/Subscriptions and select the customer/subscription record for which you are recording TDS.

-

Click open the associated Payment Due/Not Paid invoice.

-

Click the more icon, select Record Tax Amount Withheld and specify the amount. You can specify an amount that is equal to or lesser than the amount that is due as per the invoice, at the time of recording the TDS.

-

Optionally, edit the note that gets displayed for the amount withheld on the respective invoice PDF.

-

Click Proceed.

The tax amount withheld is successfully recorded for the invoice.

You cannot modify the tax amount withheld for the invoice. However, you can remove the tax withheld and add it again as required.

The invoice PDF displays a note on the tax withheld.

Issuing Credit Notes on Invoices with Taxes Withheld

You can create credit notes from invoices with tax amounts withheld.

While creating refundable credit notes or refunds for an invoice that contains taxes withheld, the amount specified for credit cannot exceed the sum of the invoice amount, taxes withheld, and credits from any previous credit notes.

Note:

- An Invoice can have only one Tax Withheld line item at any point in time.

- Tax withheld can only be recorded for offline payments in Chargebee. They can not be recorded for online payments.

- Recording tax amount withheld is currently not supported on sites with Orders module enabled.

- When the Tax Withheld line item is removed, the total amount due on the invoice increases, however, the amount withheld is not added to excess payments.

Configuring Reverse Charge

Reverse charge is a tax mechanism where the liability to pay taxes falls upon your customer - the buyer of your products or services, and not on you - the supplier. The reverse charge mechanism is applicable in various countries and based on your requirements, you can configure to collect reverse charges from customers in specific countries.

Chargebee applies the reverse charge mechanism only when:

- The customer is from a country that is different from the country specified in your organization address.

- The customer is from a country you have configured to collect reverse charges.

Note:

- Reverse charge is supported only in cases of cross-border transactions and is not supported for domestic transactions on Chargebee manual taxation. Chargebee only checks whether the country of the buyer and the supplier are different. So even if there's a tax registration number in the buyers country, reverse charges will be applied.

- In case of third-party tax integrations, if the tax provider categorizes a transaction for reverse charge, the same will be applied irrespective of the configuration.

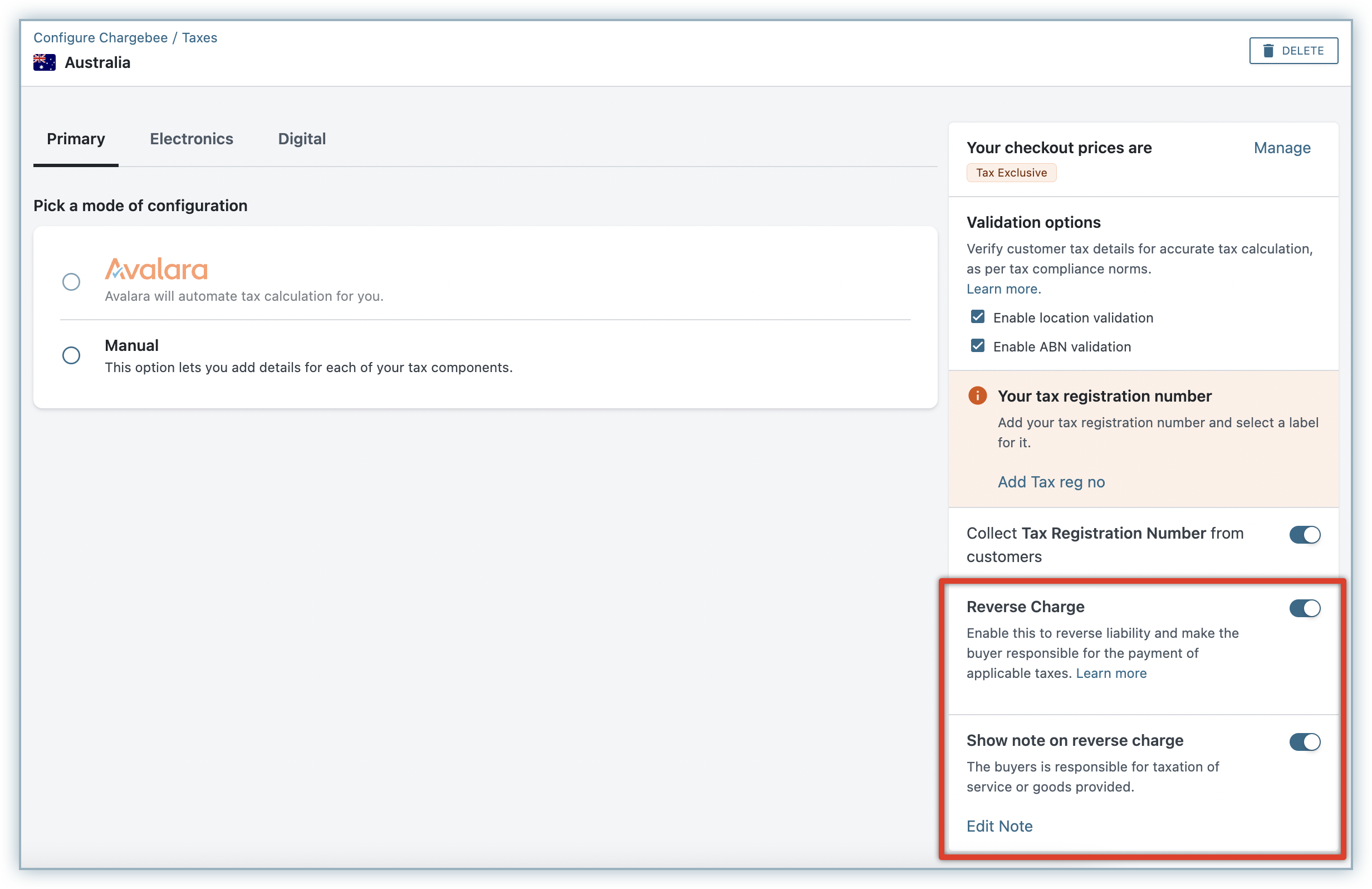

To apply reverse charge for customers of specific countries in your Chargebee site, follow these steps:

-

Click Settings > Configure Chargebee > Taxes.

-

On the Configure Taxes page, click Add Region and select the country from the drop-down list.

-

Enable the setting Reverse Charge.

-

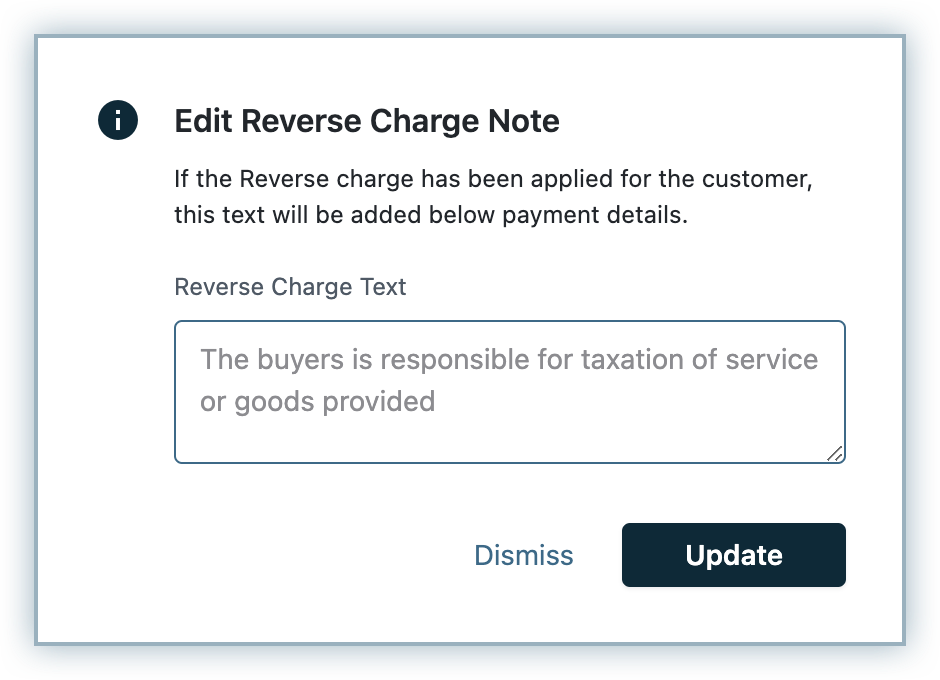

You can also enable the setting to Show note on reverse charge to display a note on invoices when reverse charge is applied. The Reverse charge note is a common feature applicable for both Chargebee taxes and third-party taxes.

- Click Edit Note to modify the default note message for reverse charge.

- On the Edit Reverse Charge Note popup, type your new message and click Update.

- Click Edit Note to modify the default note message for reverse charge.

You have successfully enabled the setting to apply reverse charges for the country.

- For certain countries like Australia and India, this setting will be enabled by default.

- However, for most countries it will be disabled by default, and you need to manually enable the setting.

- For the European Union(EU) and the United Kingdom(UK), you can only edit the reverse charge note but whether or not display VAT exemption note for reverse charge is not customizable.

When a subscription is created for a customer from a different country than your organization address for which you have configured to collect reverse charge, tax is not applied on the invoice, and the Reverse Charge note gets displayed.

Collecting Tax Registration Number for countries not configured for tax

If a customer's country is not in the Tax Jurisdiction list that is configured in your Chargebee site, you can still collect their Tax Registration number via UI, API, or a checkout field.

To enable this setting, click Settings > Configure Chargebee > Billing LogIQ > Billing & Invoices > Collect Tax Registration Number from customers for countries not configured for tax > and enable the setting.

FAQs

- How is tax calculated for physical and digital services when shipping and billing addresses are provided?

EU and New Zealand - If you are selling physical goods, Chargebee will consider Shipping Address Country for tax calculation. If Shipping Address is not present, then Billing Address Country will be considered.

If you are selling Digital products/services, Chargebee will consider only Billing Address Country for tax calculation.

For rest of the countries, Chargebee considers Shipping Address Country and then Billing Address'.

- Is the Tax profile setup mandatory?

No, you don't need to create multiple Tax Profiles. Chargebee will create a First Profile (named ‘Primary') automatically.

- Who will use multiple Tax Profiles?

You will! If you are selling different products in the same/multiple countries at different rates, the Tax Profiles feature will help you setup different profiles for each product/region, so you can apply different tax rates with ease.

- What if a particular product is sold both in digital and physical format?

At the moment, you can only map one product to one profile (either digital or physical). If you are selling the same product in digital and physical format, you will have to create two different products in Chargebee so you can map them to two different profiles.

- What happens to old invoices when I delete a tax region?

If you make any changes to your tax configuration it will affect all the invoices that are created from that point onward. Your past invoices will not be modified to reflect the changes that you make to your tax configuration - this includes deleting a region.

Was this article helpful?