The famous adage “Change is the only constant” is a cliche, but it rings resoundingly true given our recent past. If the pandemic brought forth reduced demand, supply chain troubles, and the challenges of remote work, 2023 spells economic volatility, cost pressures, and unpredictable consumer demands.

Several macro trends are unraveling in 2023. There is a rising demand for businesses to incorporate sustainability and social responsibility into their initiatives. New technologies are giving control back to the consumer to battle concerns over user data and privacy. Companies are navigating new territories of hybrid work while burnout and hustle fatigue precipitate an increasing demand for a more holistic work environment.

How are these changes influencing the finance industry? What are the mindset shifts happening within finance circles? How can leaders use this moment to get ahead of the curve and create a thriving future for their organizations?

Let’s dive in and find out.

From Cost Control to Value Creation

The finance function in any organization is known for its prudence, cutting costs, and mindful allocation of resources. During the pandemic, this was a superpower; cutting costs ensured the survival of many businesses. But now, evolving market conditions demand different skills from finance leaders.

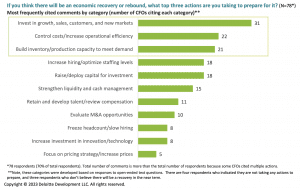

According to a 2022 Accenture report, more than three-quarters of companies (76%) cut costs to survive during the pandemic; now, 90% of C-suite executives say they must take a whole new approach to costs to transform their businesses to respond to ongoing disruption while also uncovering new growth and value.

While economic uncertainty looms, finance leaders must focus on sustainable growth while preparing for a potential recession. It could mean implementing new systems or investments in technology that drive efficiency and productivity.

Reimagining processes: One of the most significant drivers of productivity is automation, especially in a process-heavy function like finance. Ask any of our customers: you never go back once you automate.

Invoicing, revenue recognition, reconciliation, or following up on payment failures can suck your team’s resources and efforts in a subscription business. Not to mention, they can quickly become error-prone if you have a manual process in place. Automating them can lend significant efficiency gains, reduce non-compliance and manual errors, and allow your team to invest their time into better value creation, such as adopting new business models or optimizing pricing strategy – resulting in substantial bottom-line impact.

Drake Software, a tax preparation software company, saved $150K a year in operating costs by automating their end-to-end revenue recognition processes and accelerating their month-end closing and yearly audits using Chargebee RevRec.

Leveraging tech for real-time visibility and forecasting: We’ve come a long way from bulky ledgers and expansive spreadsheets to revenue management software and dashboarding tools. But despite advancements in FinTech, implementation still needs to catch up with it. In a 2023 Deloitte survey of tech CFOs, 70% cited ‘inadequate technologies or systems’ as a challenge to driving data to insights in 2023.

Data streams come in from different functions in businesses with recurring revenue models. Suppose leaders want to act quickly to changing market conditions. In that case, they should be prepared on the operational front to consolidate data centrally, distill insights and take actionable decisions in record time. In a world where everyone has access to data tools, the ones with the most streamlined systems, sophisticated technologies, and decisive leaders will be the ones to pull ahead.

The team at ScreenCloud, a digital signage software, thought all was going well when they reviewed their new MRR numbers. But when they switched to Chargebee and viewed MRR and expansion MRR in conjunction with gross churn and MRR churn, the resulting metric SaaS quick ratio – told them a different story. SaaS quick ratio, a metric that measures the efficiency rate between how much money you’re bringing in vis-a-vis how much you’re losing every month – wasn’t looking too good for ScreenCloud. Despite significant growth in new and expansion MRR, SaaS quick ratio wasn’t improving – indicating inefficiencies where churn almost always outweighs revenue growth.

Using Chargebee, they dug deep into their churn and understood that it could be attributed to their invoicing logic around annual subscriptions and planned communication. They quickly course-corrected to fix their churn problem.

From Individualism to Collaboration

Despite what rationalists might say, the whole is greater than the sum of its parts. At the organizational level, leaders who can rally their employees around shared goals can glean the benefits of knowledge sharing while fostering an improved sense of community within the organization.

There are several ways to drive a collaborative learning culture within an organization. You could ensure a minimum number of cross-functional initiatives each quarter, incentivize knowledge sharing, and encourage the personal upskilling of your employees.

“The tone at the top plays a key role in ensuring how well the finance function influences other departments and processes,” says Mike Beach, CFO at Chargebee. 86% of CFOs have increased the frequency and scope of collaboration across the C-suite. Building relationships with other business leaders and working with them to understand how finance can improve their processes is a crucial role of the modern CFO. Working relationships with other departments and regular audits of processes can ensure that risk assessments and compliance efforts are proactive rather than reactive.

“We touched base with our People Success team recently, and we were surprised to find five different ways in which they needed our help in making sense of their data,” says Timothy Keysela, VP of FP&A and Data Analytics at Chargebee.

When our People Success team at Chargebee was looking to dive into employee data, looking for insights into attrition, employee costs, talent classification, and networking data between employees, the FP&A team engaged with them over several work sessions to ensure the accuracy of data and to advise system controls to track them better. In a technology business, people costs are the largest ‘natural account’ expense and have to be accounted for accurately, resulting in data accuracy gains, better visualizations, and process improvements.

Building a culture of open communication can also be conducive to more collaboration among different departments. Creating a safe space for honest feedback, investing in tools that facilitate collaboration, and incentivizing employees who demonstrate a collaborative mindset can go a long way in changing an organization’s mindset at a fundamental level.

From a risk-averse approach to an experiment-friendly environment

Finance leaders have traditionally been seen as conservative, risk-averse folk. But when the world stopped working overnight, the pandemic pushed businesses to improve and innovate how they do things. Since 2020, the waves of change have kept coming, and strategic business leaders have been riding them successfully. “The last year has seen businesses pivot to cost reductions and a greater focus on operational efficiency. Chargebee is a great example. As the slowdown emerged, we implemented new processes and systems that enabled us to perform better,” says Timothy Keysela,

Finance leaders can invest in experimental strategies on different fronts, incorporating more sustainability into the company’s goals, a new product line in response to rising demand, or pricing experiments to maximize profits.

Besides conviction and a safe space for failure, you need solid structural support for experimentation. By having the infrastructure to set up experiments easily, accurately assess their performance and roll back the required changes, you can minimize the overhead typically associated with them.

“We need to hold ourselves accountable for investing in the right area and that the investment is getting the right result. We need a good periodic measure to tell whether we’re being successful. We need an accountability mindset; we can’t blindly charge forth and say that feels like a good market and go” – Lydia Stone, Chief Accounting Officer at Chargebee.

Rented is a leading Revenue Management as a Service (RMS) provider for property managers of vacation rentals. With properties listed across six continents, Rented reached lofty heights in early 2020 by bagging #61 on Inc’s Annual List of Top 5000 fastest-growing companies in the US.

When the vacation rental industry gasped for existence during the COVID lockdown, Karen Fleck (the CFO) and her team creatively leveraged Chargebee to retain 80% of their customers using a bespoke discounting strategy.

While it’s crucial to keep the spirit of experimentation alive, in our current macro environment of economic volatility, identifying priority areas for improvement can act as guardrails for experimentation scope to maximize impact in critical areas. And an important area that all businesses are doubling down on is retention.

Pliability, a fitness app, was trying to fix its cancellation problem when it approached Chargebee Retention. By experimenting with personalized cancel flows, exit offers, and capturing timely feedback, they were able to have product development informed directly by customer feedback. “With Chargebee, we reduced churn by 20% nearly instantly after deployment. Within a month,” Stefano Scalia, Head of Growth at Pliability.

When faced with demand and supply chain issues during the pandemic, some businesses pivoted quickly to pull a solution from their sleeves. Birchbox, a subscription-based beauty box company, faced supply chain disruptions that made it difficult to source products. To address this, Birchbox CFO Philippe Pinatel led an effort to reduce costs and diversify the company’s offerings beyond beauty products, including wellness and lifestyle items. The company also shifted its marketing efforts to focus on e-commerce and digital channels.

“The down market accelerates the competitive rivalry and leads to more innovation. When times are tough, teams are working to change and improve things, leading to an upswing in growth,” says Timothy Kysela, VP of FP&A and Data Analytics at Chargebee.

Shifting tides: Which side are you on?

As we move into 2023, market conditions grow increasingly complex and dynamic. Finance leaders willing to adapt and open to change can capitalize on this reality to make nimble strategy shifts, take calculated risks and adopt a growth mindset.

The immutable common thread that underlines all the mindset shifts we’ve discussed today is the strategic use of technology. Increasingly an organization’s tech savviness is starting to determine its likelihood of survival. The metrics you monitor, how you notice patterns in your data, and when you see them influence your business strategy. Subsequently, your tool ecosystem largely determines your decision-making personality.

An adaptive revenue management software like Chargebee can be the command center for your recurring revenue operations. With a suite of tools, you can automate your billing operations, revenue recognition, and collections process and experiment with feature provisioning, price optimization, and personalized cancellation experiences.

So do you know what your tech stack says about you? Get in touch with us to find out.