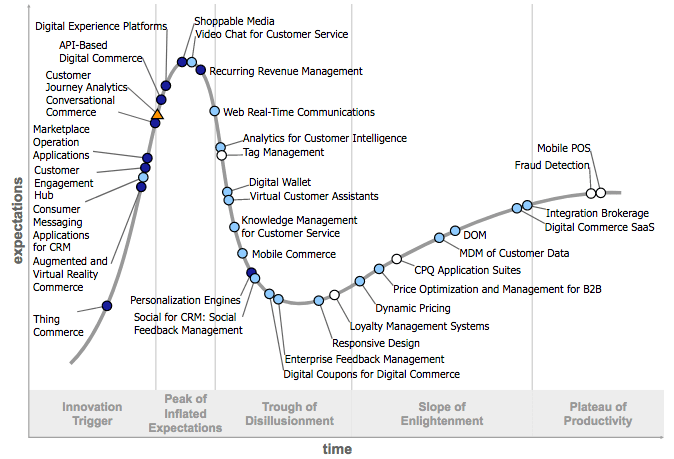

The Gartner’s Hype Cycle graphically shows where a specific technology stands in terms of adoption and maturity and how it will evolve over time.

And this is how the Hype Cycle for Digital Commerce, 2017 looks like:

For now, zoom your focus in on the “Trough of Disillusionment” zone, and you’ll find “Digital Wallets” waving at you while sliding into the trough.

The trough is essentially the toughest phase for a technology to be in, where only a small fraction of the market have adopted the technology (the early adopters), implementations don’t meet the mark, and many makers tumble and fall.

In time, the benefits of the said technology begin to shape up, second and third generation products show up, the market reception improves, and the technology climbs up the Slope of Enlightenment. The final stage for the technology is its mainstream adoption, where its relevance and usefulness bring forth tangible results.

Gartner has pegged Digital Wallets in the pre-trough spot, with a market penetration of 5% – 20% of the target audience and at an adolescent stage of maturity. And they’ve predicted that it would take at least another 2 years for them to hit mainstream adoption.

So how did digital wallets/e-wallets land here? And as a business/merchant what to expect in the US, Europe, and Asia?

Let’s see.

E-wallets – What are they?

E-wallets/Digital wallets are the online counterparts of your physical wallets, where you can store credentials — both payment-related (card details, bank account details, etc), as well as non-payment-related (tickets, loyalty cards, etc) — that will enable you to carry out online and/or offline transactions. While open e-wallets support different payment methods and can be accepted by any merchant (eg., PayPal, Apple Pay, etc.), closed e-wallets are meant for a specific payment method and can be used only by specific merchants (eg., Walmart Pay, Starbucks Card, etc.)

E-wallets Scene in the USA:

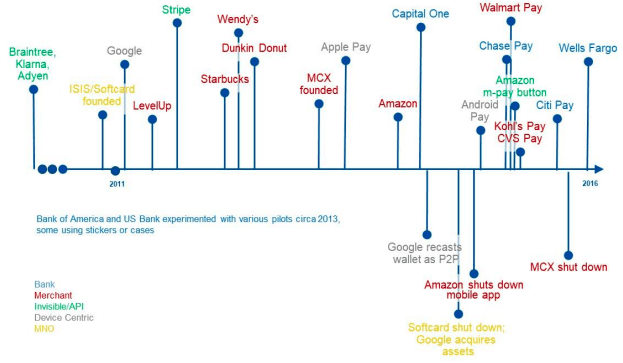

It all started in 2007, where the then-startups like Klarna, Adyen, and Braintree were founded, to enable in-app payments, bring down friction, and enhance customer experience. (PayPal was launched as early as 1998, so we’re skipping it in this timeline).

Softcard (ISIS) was launched by the telco trifecta AT&T, Verizon, and T-Mobile in 2010. They brought about the Near Field Communication (NFC) wallet, where the mobile network operators (MNOs) securely stored the payment credentials. Stripe also debuted around the same time, which made online payment processing that much simpler and faster.

2011 and 2012 were predominantly the age of merchant wallets, with businesses like Starbucks, Wendy’s, and Dunkin’ Donuts coming up with their individual wallets.

2012 also saw the creation the Merchant Customer Exchange (MCX) consortium of the largest retail companies in the US.They would go on to soft launch the multi-merchant mobile payment system, CurrentC in 2015.

Apple Pay set sail in 2014. Even though the Google Wallet was announced in 2011, they later made the wallet a peer-to-peer payment service, and acquired Softcard in 2015 resulting in the new Apple Pay competitor, Android Pay.

During the 2015-2016 trough era, apart from MCX postponing the rollout of CurrentC indefinitely, Softcard also shut down and sold its assets to Google. Amazon also closed their Wallet that was launched in mid-2014 (which could only store loyalty and gift cards, and not credit cards). A lot of bank-centric wallets were also introduced around 2015, including Capital One, Chase Pay, and Wells Fargo. MCX eventually shut down in 2016, whose technology was later bought by JP Morgan Chase to be used in its Chase Pay.

Even though cards have consistently ruled the US online payment industry, with a considerable population opting for ACH payment network transfers, e-wallets are slowly catching up as well (more emphasis on the word “slowly”).

A survey conducted by Experian discovered that about 55% consumers still prefer to pay using their credit cards because of “safety concerns.” According to another survey by American Bankers Association, even though 25% have made a payment using a mobile app, only 12% trust alternative payment providers to secure their payments.

The technology gets better and better every day. It’s not the technology that’s the problem, it’s the people that are not using the technology properly.

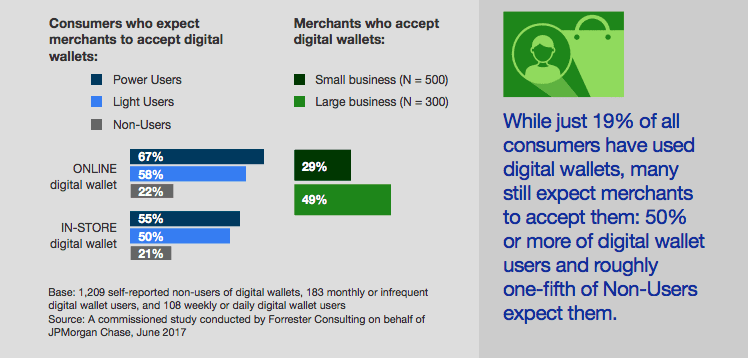

However, the future of digital wallets does look hopeful in the US payments space. According to a 2017 report by Forrester Consulting for JPMorgan Chase, US merchants and consumers alike believe that digital wallet adoption will grow in the future. About 41% of consumers said that they will likely sign up for an e-wallet in the next 12 months, while 55% of merchants said that they will likely accept e-wallet payments in the next 12 months.

About 67% merchants also opine that most transactions will happen through e-wallets within the next five years.

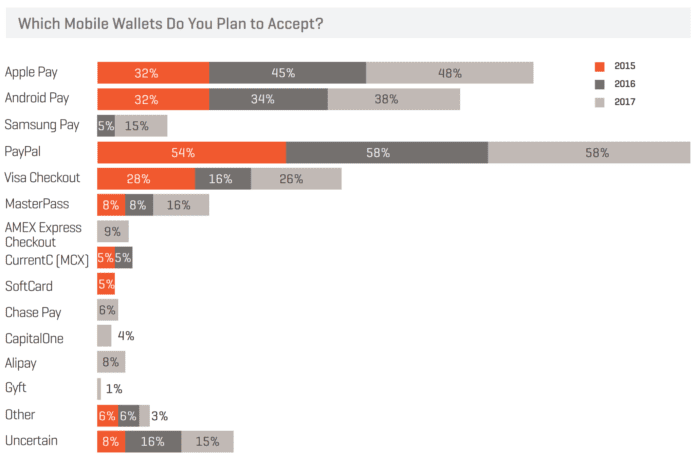

With their growing popularity, new players keep flocking the US digital wallet scene every year. And in spite of that, PayPal, Apple Pay, and Android Pay dominate the market.

In the Mobile Payments & Fraud: 2017 Report, PayPal leads the pack with about 58% merchants supporting it in 2017, followed by Apple Pay at 48% and Android Pay at 38%.

However, about 39% merchants said that they intend to support Apple Pay in 2018, which will push it to the top of the line with an impressive 87% (with PayPal coming second with about 83% support and Android Pay at the third position with 78%). In general, the support by merchants is expected to increase for almost all the major players in 2018.

E-wallets scene in Europe:

2015 appears to be the peak-year for European e-wallets, with 9 launches. The graph has since gradually reduced, with 5 new e-wallets launched in 2016, and 5 other e-wallets in 2017.

According to the World Payments Report 2017, mobile wallet transactions are expected to grow at a compound annual growth rate (CAGR) of 61.8% during 2016 – 2021.

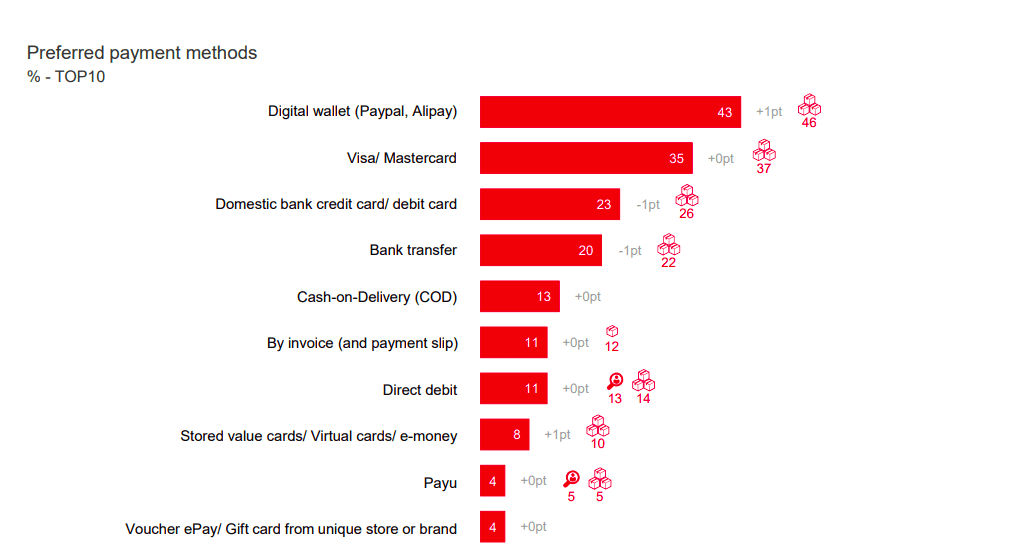

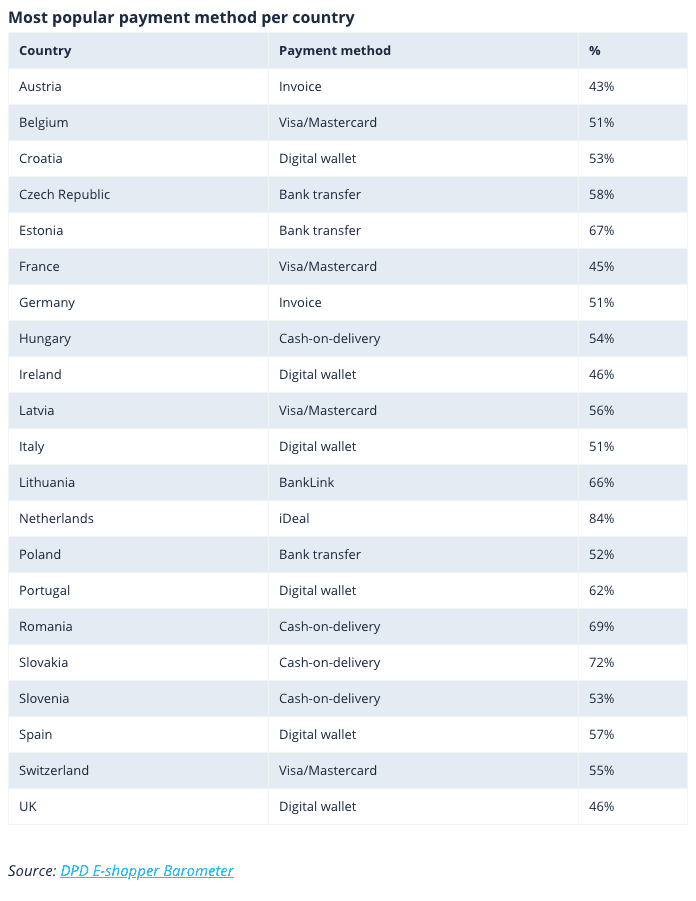

The E-shopper Barometer 2017 seconds it:

However, if we drill down, digital wallets aren’t the most popular payment method in all European countries:

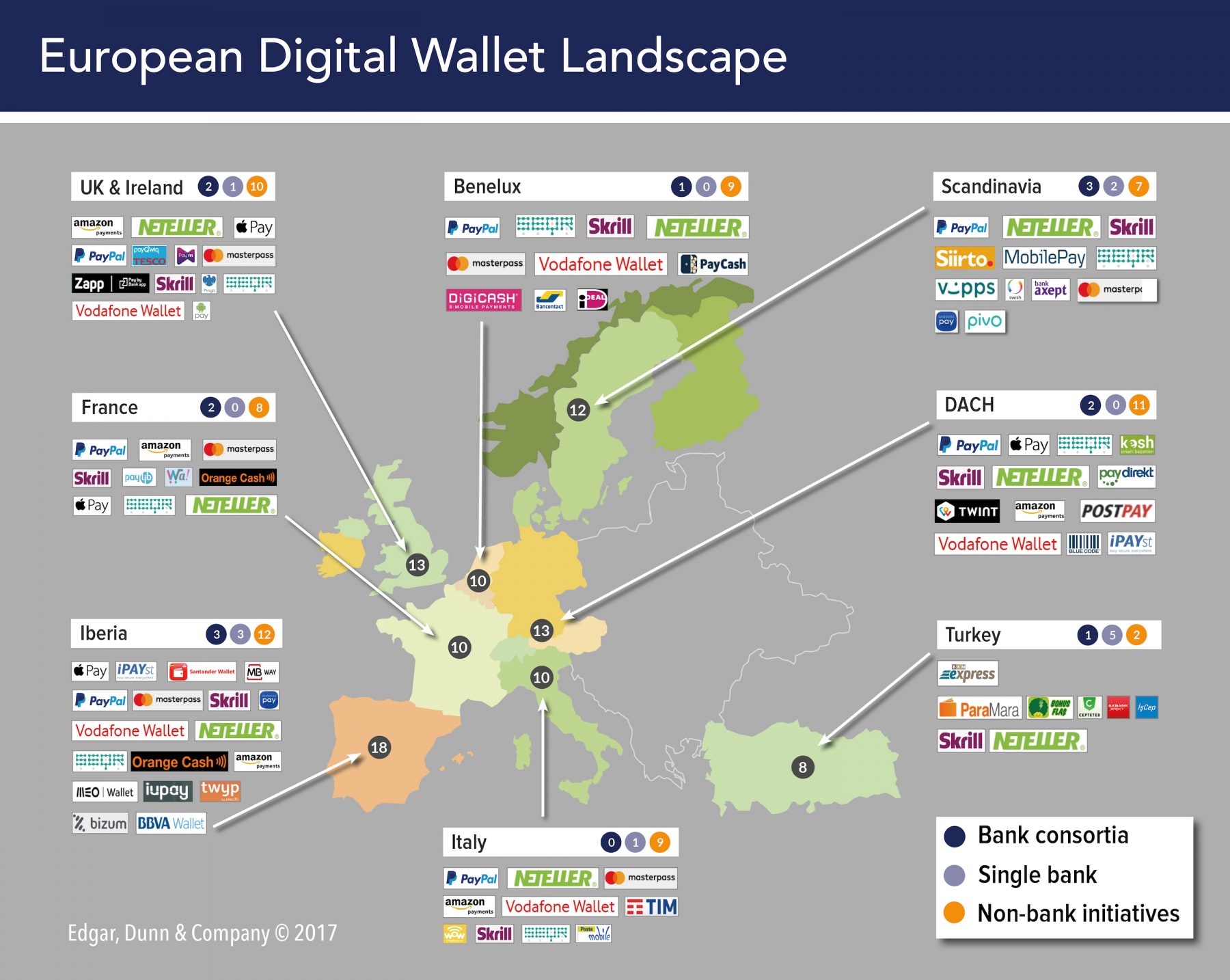

A research conducted by Mobey Forum’s Digital Wallet Working Group showed that as of April 2017, 49 e-wallets have been identified in the European market, out of which 26 are operated by banks, while the remaining 23 are from non-bank players.

A common theme that has been identified across Europe is:

- The successful proliferation of bank-led digital wallets meant for specific domestic markets – like BKM Express (Turkey), iDEAL (Netherlands), Vipps (Norway), Swish (Sweden), and MobilePay (Denmark)

- Non-bank-led digital wallets thriving across multiple markets – with Neteller and Skrill on the top, where both are spread across 8 markets, and are focused on online gambling and gaming. The other popular non-bank-led wallets are PayPal and Seqr (operating in 7 markets each), MasterPass (active in 6 markets), and Amazon Pay and Vodafone’s wallet (each with 5 markets).

- Many go for partnerships to widen their range, like Seqr partnering with MasterPass to create the “first digital wallet for shopping in all channels across multiple markets,” and the French e-wallet Lyf Pay that has been created by four banks and three merchants.

- Global players also seem to be growing in popularity in the European soil, with PayPal leading the pack and other players like Apple Pay, Samsung Pay, Alipay, and Android Pay expanding across countries.

The UK:

The UK has been the European landing ground for global e-wallets like Apple Pay, Samsung Pay, and Android Pay. Local e-wallets like Yoyo Wallet and Pay by Bank App are also giving a tough fight to the global players. Yoyo Wallet is used by about 400,000 consumers and 1700 merchants in the UK and Ireland. The Pay by Bank App was created by 4 of the biggest banks in the UK (Barclays, Halifax, Bank of Scotland, and Lloyds Bank) in 2016, and is limited to the customers of those banks.

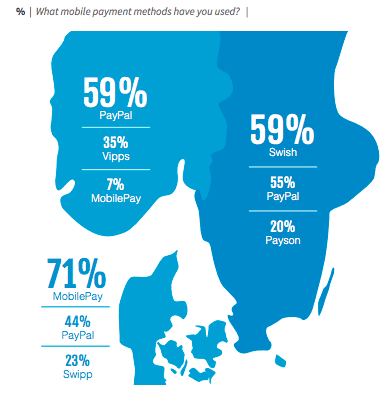

Scandinavia:

The Scandinavians use mobile apps to pay for about a quarter of all retail transactions, with e-wallets dominating the market – MobilePay in Denmark, Swish in Sweden, and PayPal and Vipps in Norway.

France:

While French consumers prefer card payments, e-wallets have become increasingly popular in the recent years. While the popularity of e-wallets is expected to increase slightly from their 2017 figure of 21.8% to 22.7% over the next five years, credit and debit cards are expected to fall from 16% and 15% respectively to 10% each. Paylib (launched by the major French banks) is the most popular wallet in France, with about 40 million users, compared to the 7 million PayPal users. As mentioned earlier, two e-wallets Wa! And Fivory merged in 2016 to create Lyf Pay, (which also brought together BNP Paribas, Carrefour, Crédit Mutuel, Auchan, Mastercard, Oney and Total) a universal wallet that covers a broad set of needs of its French customers.

Germany:

Even though internet banking solutions like ELV, SOFORT, and Giropay rule the German market (not to forget the failure of Otto Group’s Yapital in 2015), e-wallets are projected to surpass them as the most popular payment method by 2021. The Global Payments Report by Worldpay indicates that by 2021, bank transfers and e-wallets will own 23% and 23.9% of the German market respectively. Apart from PayPal, American Express’s PAYBACK seems to be a hit among German consumers, with around 30 million active users.

The Netherlands:

The online banking solution iDEAL leads the Netherlands market with a whopping 57% share, and cards are preferred by consumers from Belgium and Luxembourg. However, PayPal is growing its roots in the Benelux market, and so is Payconiq, a local e-wallet founded by the six major Dutch banks – ABN Amro, ASN Bank, ING, Rabobank, Regiobank, and SNS in 2017.

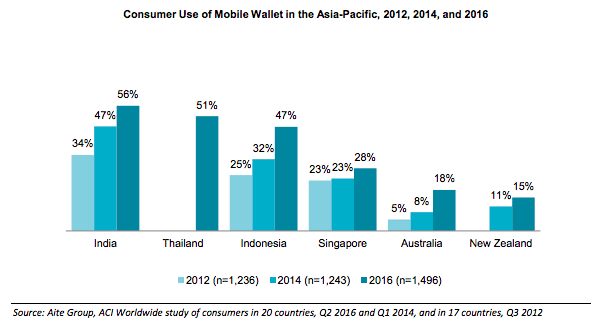

E-wallets scene in APAC:

The 2017 Mastercard Digital Payments Study showed that Asia Pacific is the world leader when it comes to digital wallet payments, with about 83% of APAC conversations, pegged against 75% of overall global conversations.

And it’s just the beginning.

According to WorldPay’s recent report, credit card payments are expected to drop from 30% to 10% of ecommerce transactions in APAC, while e-wallets are predicted to over 51% of the ecommerce market by 2021.

While there are significant variations in how consumers in different Asian markets prefer to pay, a constant is that they are shifting away from more traditional options like credit and debit cards, and instead choosing e-wallets, bank transfers and cash on delivery.

China:

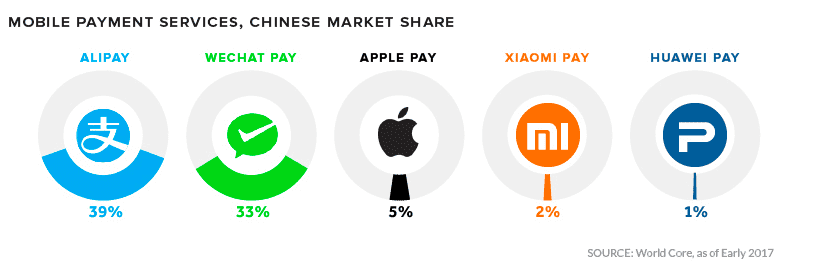

China, the current largest ecommerce market in the world and also conducts 11 times more mobile payments compared to the US, is also the market leader of e-wallets in APAC (about 60% of transactions in China are made via e-wallets). The digital wallet market is predominantly binary with WeChat Pay and Alipay fighting for market share, with other e-wallets like Apple Pay, Xiaomi Pay, and Huawei Pay trailing behind. Thanks to the growing Chinese tourists, merchants linked to tourism in Europe and the US are also increasingly accepting payments via WeChat Pay and Alipay.

India:

India is the next biggest digital wallet market, which is also the fastest growing ecommerce market in the world ($816 billion in sales in 2016 alone). The country’s mobile wallet market is predicted to hit $4.4 billion by 2022, with a CAGR of about 148% during 2017-2022. The government has been actively promoting a cashless society by introducing its own set of payment methods like Aadhar cards in combination with Rupay cards. Paytm is the market leader with about 320 million registered users, 1 billion transactions a quarter, and 9.9% of the market share. PayPal comes second with 9.8%, followed by local e-wallets MobiKwik and FreeCharge with about 2.8% and 2.7% respectively. International players like Google, Samsung, WhatsApp, and Amazon have also begun tapping the Indian market with Tez, Samsung Pay, WhatsApp Pay, and Amazon Pay respectively.

Australia:

Australia currently comes fourth in terms of cashless transactions per capita, and yet cash still remains as the primary payment method. Apple Pay is the most popular digital wallet, with Samsung Pay and Android Pay also having a considerable market share.

Japan:

Even though the concept of payment consolidation has existed in Japan for more than a decade, using a technology called “Osaifu-Keitai” (which means “mobile wallet”), only 20% of the country’s payments are cashless. The main reason that has been holding back Japanese consumers appears to be the trust placed on their cash and the lack of it on “invisible” payments. Yet, smartphones are gaining a growing acceptance in the country, with Apple Pay, Line Pay, and Rakuten’s Edy being accepted by most stores across the country, and Alipay is also set to be launched this year. Adding to that, Japanese companies Mizuho Financial Group Inc. and Mizuho Bank Ltd. are currently testing out the concept of a mobile wallet called Pring.

Singapore:

According to Worldpay, by 2021, the market share of e-wallets are expected to shoot up from 13% (from 2017) to 21% in Singapore. It’s also the first Southeast Asian market for Samsung Pay, the second market in Asia to get Apple Pay, and the third market globally for Android Pay. Popular local e-wallets include DBS PayLah!, Singtel’s Dash, and Liquid Pay. In 2017, the Association of Banks in Singapore also launched a service called PayNow, that facilitates monetary transactions between the seven participating banks by just using the users’ mobile phone numbers.

Russia:

The Russian ecommerce industry is still in the infant stage, and a majority of the consumers still prefer cash payments. As of 2016, local e-wallets have been earning the trust of more and more Russians, the most popular of which are Yandex.Money, VISA Qiwi Wallet, and Webmoney. International players like MasterPass (launched in 2014) and PayPal (launched in 2013) also sport a healthy market share. In terms of ecommerce transaction value, digital wallets have increased from 25.5% in 2012 to 26.7% in 2016. This increase in adoption has also made global players like Apple Pay, Android Pay, and Samsung Pay enter the Russian market between 2016 and 2017.

E-wallets – the road ahead:

When Google launched its wallet in 2011, its system would work only if the users had the right device with NFC chips, the right Android OS, and a Sprint data plan. What more, the users also needed to have a card that was meant for the mobile wallet, from one of the few participating issuers. Back then, only a few users could meet all the criteria and so it didn’t hit the growth pedal (they dropped the NFC from the wallet in 2015 and offered the technology only via Android Pay).

When Softcard came up with its NFC-enabled Isis wallet, customers were quite satisfied with swiping their cards at physical stores. They were, in fact, not familiar with the wallet platform and considered it to be a time-consuming option. In essence, they just wanted to replace the swipe with a more tedious and slower checkout process.

While their competitors like Apple Pay, Android Pay, and Samsung Pay offered fingerprint based native mobile experiences, CurrentC remained stuck to QR code scanning, which was not only outdated but also posed security threats, where anyone could authenticate payments by just stealing the device. In 2015, some MCX members like Rite Aid and Best Buy began accepting Apple Pay, thus further weakening CurrentC’s scope. CurrentC also failed to meet the growing trend of retailers coming up with their own closed-loop wallets with specific benefits for their customers (case in point, the wallet later launched by another member of MCX, Walmart). Adding to this, while the aforementioned alternatives were backed by international financial institutions and saw a global reach, CurrentC’s scope was limited to the American retailers.

To sum up, if we look at the successes of the successful mobile wallets, three factors play a major role:

- Access

- Interoperability

- Sustainability

According to Gartner, offline usage of digital wallets is still underdeveloped (primarily because consumers still haven’t spotted their value compared to card and cash payments), and hence most of the transactions are from online transactions (specifically mcommerce).

Digital wallet providers are increasingly focusing on removing the existing pain-points from the buying process, and the emphasis is shifting from boosting the adoption of technology (NFC and QR codes) to improving the customer experience (one-touch payments, facial recognition, easy API integration, etc).

All these new experiments will keep pushing digital wallets in the right direction, until they figure out just the right blend of value for both customers and merchants, and reach the Plateau of Productivity.

__

What are the different types of e-wallets? What do you have to do to accept payments via a digital wallet? We’ll be looking at them in detail in the next post.