New Zealand GST

Introduction

The New Zealand Goods and Services Tax (GST) is levied on physical and digital goods that are purchased by customers for consumption within New Zealand (NZ). If you have a commercial presence in New Zealand, and your business has a gross income of over NZD $60,000, you must register for New Zealand GST.

GST Rules

Here are a few important GST rules you should be aware of.

GST Registration

If you run a business in New Zealand or provide sales/services in New Zealand and your turnover for the last 12 months was more than $60,000, you must register for GST. You also need to register if you expect your turnover for the next 12 months to exceed $60,000. Read more about if you need to register for GST here.

Note:

You must have a New Zealand's Inland Revenue Department (IRD) number to register for GST. Ensure that you apply for one before you start the registration process.

GST Rates

Starting Oct 1, 2016, merchants selling digital services/goods from outside NZ to NZ customers will have to collect 15% GST from their customers.

Refer to this link for more details about the tax policy changes.

Note:

Tax rates last updated, September 8, 2017.

| Scenario | Products | Tax Rate |

|---|---|---|

| NZ Merchant to NZ Customer | Digital or Others | 15% GST |

| US Merchant to NZ Customer | Digital | 15% GST |

| US Merchant to NZ Customer | Others | No Tax |

GST Invoices

IRD regulation mandates that you issue tax invoices for sales over NZD $50. A tax invoice must contain the following information:

-

Name and address of the supplier.

-

The words "tax invoice".

-

The supplier's GST number.

-

The date of issue.

-

The name and address of the recipient.

-

A brief description of the goods and/or services supplied.

-

Amount, excluding tax,charged for the supply.

-

Total amount payable (including GST).

-

A note stating that the total amount payable includes GST.

For more on the GST, check out New Zealand's Inland Revenue page on GST.

Configuring New Zealand GST

Ensure that you've added your organization address at Settings > Configure Chargebee > Business Profile. You cannot configure taxes in Chargebee without completing this step in your initial setup.

To configure New Zealand GST in your Chargebee site, follow these steps:

-

Go to Settings > Configure Chargebee > Taxes and click Configure Tax.

-

You are redirected to a page containing all the currencies that you have enabled for your site. You can select the price type for your currencies to be either of the following depending on where your customers are located:

- Tax Inclusive: Tax is included in the price that you quote for your product/service/addon.

- Tax Exclusive: Tax is added on top of the price that you quote for your product/service/addon, for each of the currencies.

- Tax Inclusive: Tax is included in the price that you quote for your product/service/addon.

-

In the Configure Tax page, click Add Region and select New Zealand from the region list.

-

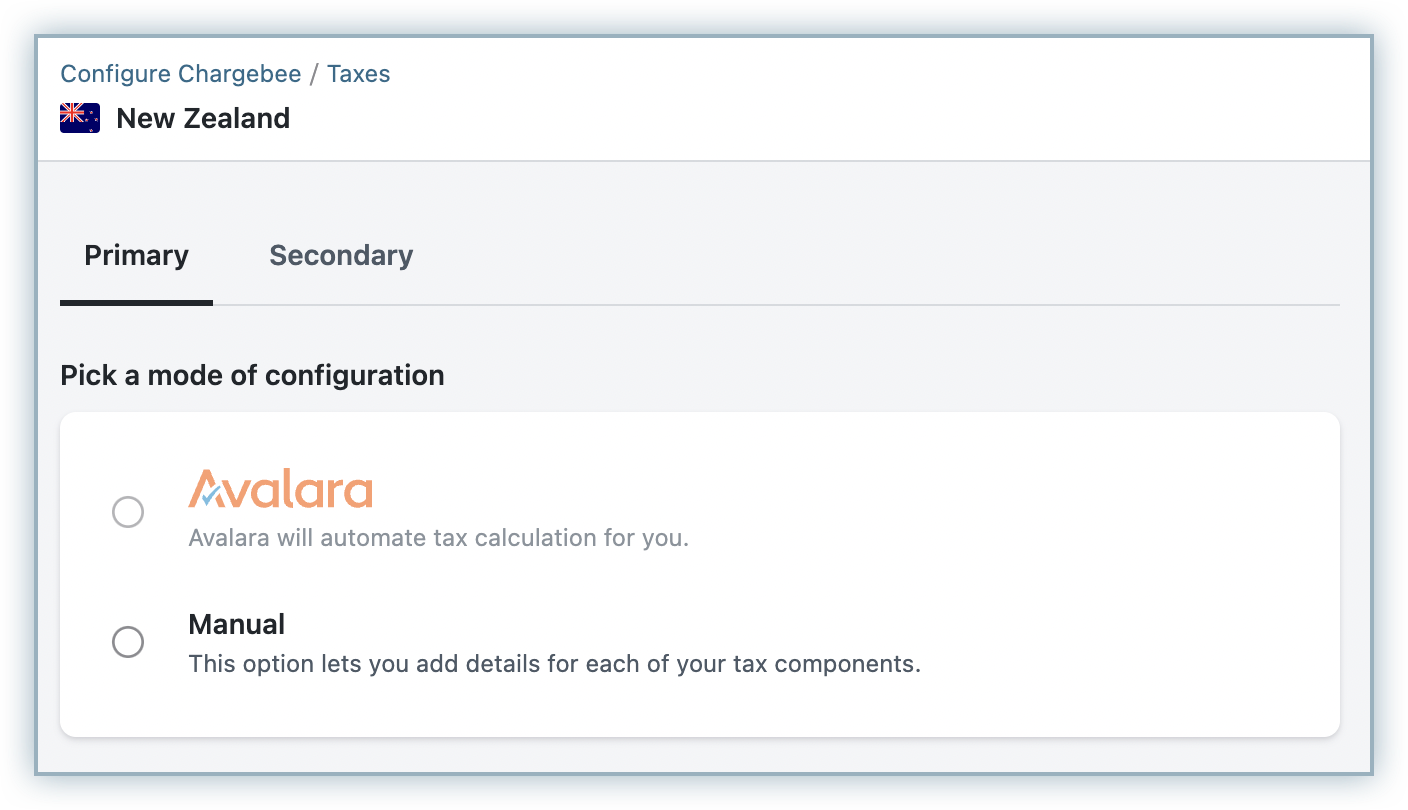

Select the mode of tax configuration. You can select from the following options:

- Avalara: if you are using Avalara for automated tax calculation for New Zealand.

- Manual: if you want to manually configure GST.

-

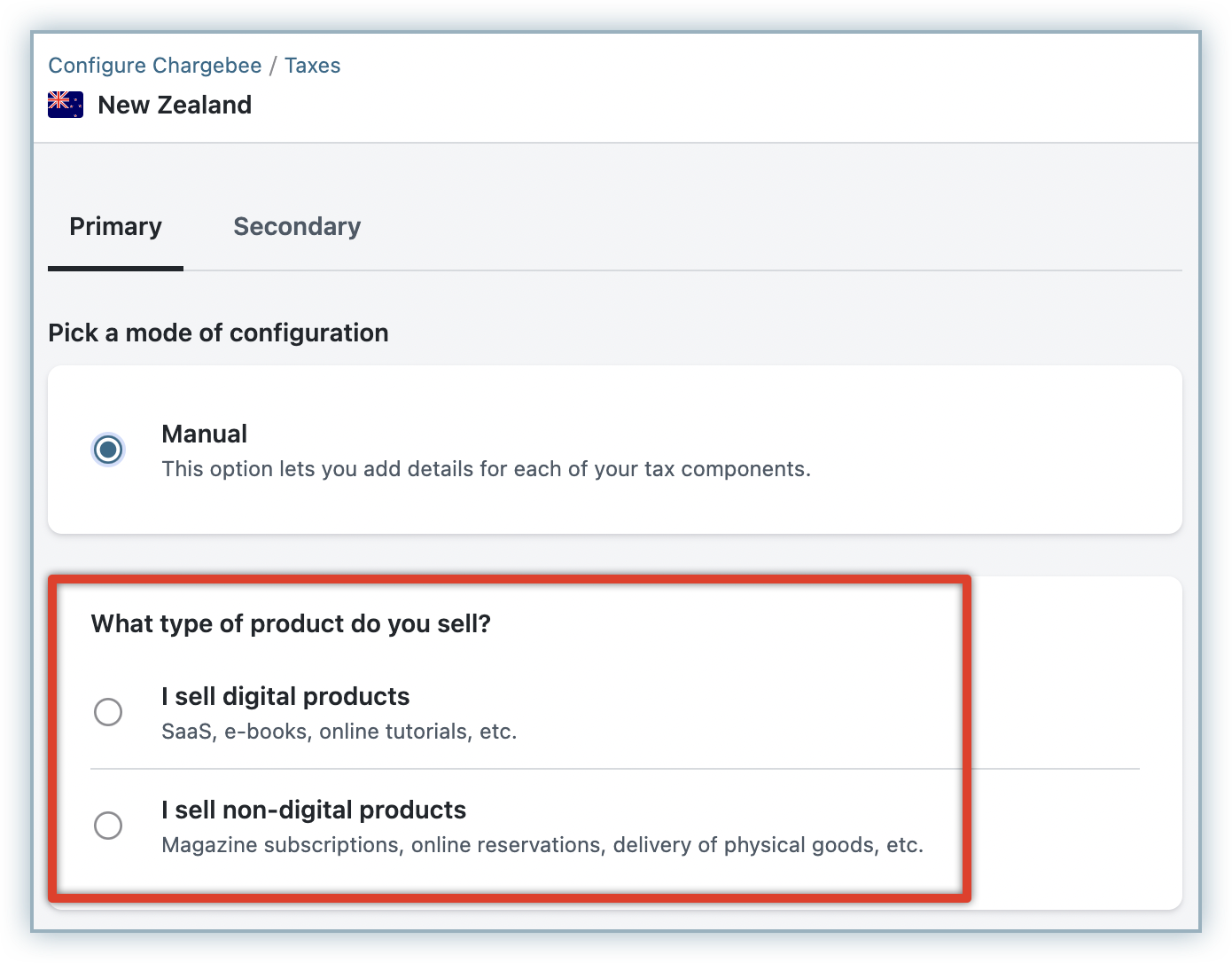

By selecting Manual, you can specify the type of product that you are selling:

- I sell digital products

- I sell non-digital products

-

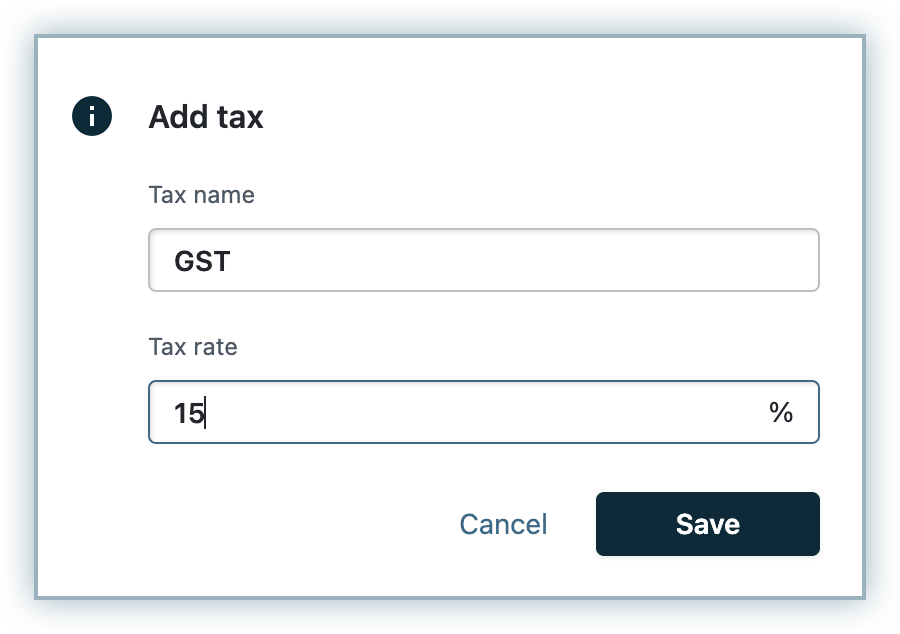

Enter your Tax name as GST and the Tax rate that you would like Chargebee to apply to your invoices.

-

Click Save.

-

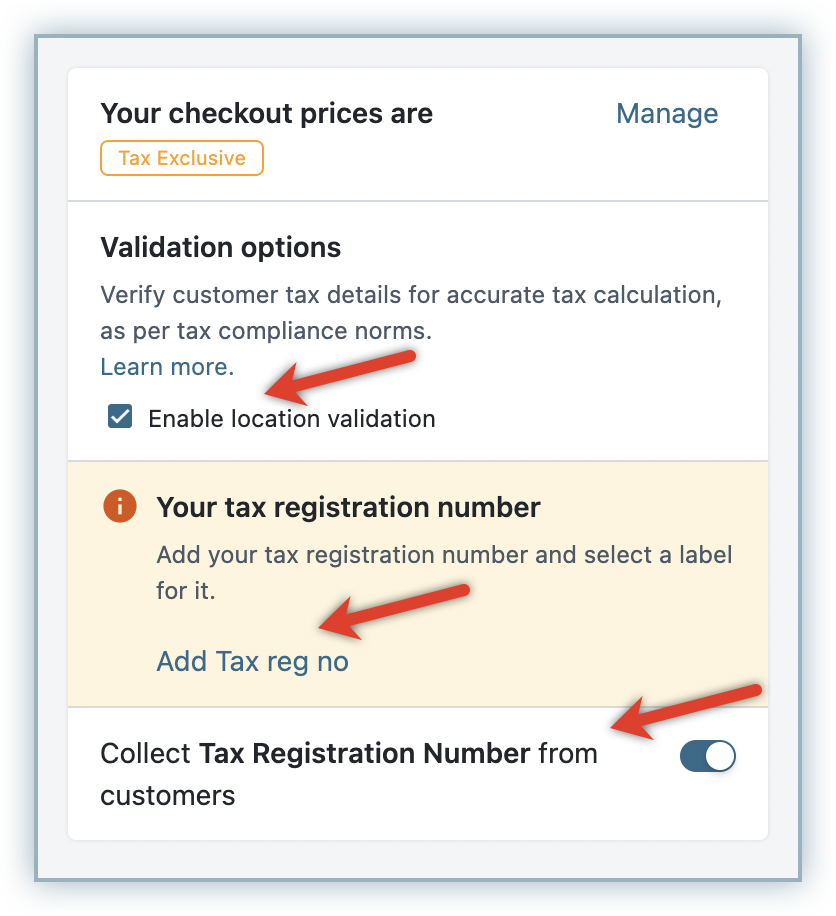

You can additionally configure the following settings for New Zealand taxation:

- Location Validation: Select the check box to enable location validation based on whether you have to collect and store your customers' address proof or not.

- Tax Registration Number: Set the tax label as GST and enter your GST Registration Number here. This gets displayed in the invoices sent to your customers.

- Collect Tax Registration Number: You can choose to collect your customer's New Zealand Business Number (NZBN) or not.

Location Validation

As per IRD regulations, you need to ensure that the customers or businesses you are selling to are, in fact, residing in New Zealand. Your customers are required to provide two non-conflicting pieces of evidence that indicate the same. The following count as valid pieces of evidence of residence:

- Your customer's billing address.

- The internet protocol (IP) address of the device that your customer is using.

- The customer's bank details, including information of the account your customer is using for payment.

- The location of the customer's fixed landline through which the service is supplied to them.

From the list mentioned, Chargebee uses the following to collect, validate and store location information.

IP Address:

Hosted Pages: If you have integrated with Chargebee using the hosted pages, the IP Address of the customer will be collected automatically.

API User: If you use the Chargebee API, you will have to pass the IP Address of the customer to Chargebee using the User Details Header API.

Card BIN of the customer:

The first six digits of a card constitute the Bank Identification Number (BIN). BIN gives us the information about the card issuing bank and hence can be used as a way to determine the customer's location.

Hosted Pages: If you have integrated with Chargebee using the hosted pages, the BIN of the customer will be collected automatically.

API User: If you use the Chargebee API, you will have to pass the BIN of the customer using the card [number] parameter in the Create a Customer API.

Note:

If the location validation fails, the customer will not be able to complete the order.

Location Validation Failure

If your customer's location validation fails, they will not be able to complete their order. They will receive the following error message:

If a customer signs up for a trial plan which involves no immediate payment, the subscription is created irrespective of whether the location validation was successful or not. The details of the customer are marked with a warning indicating that the location validation failed.

FAQ

1. How is tax calculated for physical and digital services when shipping and billing addresses are provided?

If you are selling physical goods, Chargebee will consider Shipping Address Country for tax calculation. If Shipping Address is not present, then Billing Address Country will be considered.

If you are selling Digital products/services, Chargebee will consider only Billing Address Country for tax calculation.

2. What is Netflix Tax?

Netflix tax is a common analogy for tax being applied on digital products or services sold by companies registered outside a country to a consumer of that country, in this case, New Zealand.

3. When is the new digital tax rule applicable from?

Starting October 1, 2016 , merchants registered outside New Zealand, selling digital products or services to consumers in New Zealand should apply GST to the invoices.

Was this article helpful?