It hasn’t been three years since subscription pricing assisted a pandemic comeback for businesses (both SaaS and otherwise), struggling with customer access and loyalty problems, and made its resurgence on primetime media. D2C businesses were using it to convert one-time sales into recurring relationships; new businesses opened with a subscription-first approach; communities, experts, and businesses (like us) were awash with the indelible potential it had, especially coming in a not-so-ordinary, pandemic-PTSD world.

The mantra — if you wanted customer loyalty and predictable revenue, you needed subscriptions.

But just when we thought we had it all figured out, the world changed (yet again), like the ending of an M. Night Shyamalan movie.

In the aftermath of sustained interest rate hikes and economic amber alerts — subscriptions became less of a relationship and more of a committed liability. The more value-centric customer-friendly models (seat-based/usage-based, among others) also zigzagged with demand volatility making them ‘aberrations’ on revenue prediction graphs.

It is within this chaos that hybrid pricing models today are finding their slow yet sure emergence.

Why are standard pricing options faltering?

If we compartmentalize pricing models based just on how much flexibility and control customers have over their transactions, we will be able to find two distinct classifications:

- Fixed cost pricing models: These are pricing models where customers have clear, defined stipulations of volume/budget of usage or features and have a contractual agreement pre-determining their amount of expense and usage in clear terms.

Examples include — subscription tiers, wherein customers know exactly how much they can expect to pay for what degree of features or abilities. Seat-based pricing also offers the same degree of visibility and predictability in revenue since the number of committed seats is known, and additional expense from ‘new/added seats’ is also a straightforward calculation.

- Variable cost pricing models: These pricing models are built to help users scale at their own pace. As such, there is little limitation (and hence enough flexibility) in terms of period of usage, number of users, or any other variable. The only determinant of the invoice amount is the dollar-per-unit value that the customer agrees to.

For example — in usage-based pricing, you agree to a fixed price ($x) for each unit of usage (could be the volume of transactions, revenue processed, amount of data stored, and any other variation of usage). While the month-end invoice will not be predictable, customers need to pay only for the amount they use, and businesses are also able to monetize customers that have scaled up.

None of them are inherently poor options when you intend to — build predictable revenue or grow revenue proportionally to your customers. However, in an economy where the customer (intending to scale down costs) and the business (looking to grow revenue) are in what seems like a perennial tug-of-war, operating in either extreme can generate negative effects:

(S)lower sales conversions due to commitment inertia

Asking users to commit to a revenue figure may work well for your growth projections, but in a distressed market, it may also lengthen the lead-to-deal time for new sales. Remember, the customers’ optics of your value is always at a premium to the amount spent and outcomes delivered through your product.

When you contractually ask a customer to commit to your business for a longer horizon, the TCV (total contract value) is larger, stoking some resistance, requests for discounts, and considerable dilly-dallying.

Sticker shocks and invoice uncertainty

In free-flowing variable pricing models, customers have no visibility into their month-end invoice amount in free-flowing variable pricing models. Unless they can actively and accurately track usage at their end (which, we know, they can’t).

In periods of heightened usage, these customer-friendly pricing models can serve a counterintuitive purpose. Higher adoption by the customer — which is otherwise a great sign of your product’s value — can also lead to sticker shocks and invoice excesses and warrant uncomfortable discussions.

Depreciating product value perception

Again, for PAYG models, driving sustained adoption is a challenge. Since users can scale up or down as they please in a market where cost cuts run rampant, PAYG businesses are the easiest to do away with.

Imagine you have two tools doing the same thing (scary, I know, but try). One that you have already paid for and the other that is free. Which one are you more likely to use?

In the typical PAYG (pay-as-you-go) model, your customers are not paying unless they use your product, which is to say the opportunity cost of them not using your product, despite having signed a formal agreement with you, is … nil.

They are also less likely to consciously attempt to find value through your product because scaling down is as easy as scaling up. In the end, you run the risk of being yet another tool lost in the labyrinth under their tech stack.

Hybrid pricing models usually combine the stability of fixed-revenue models (like subscriptions) with the flexibility of moving components through value-based components. In the end, your pricing is both outcome-oriented — which is to say, closer to customers’ derived value from your product, and predictable — which is to say, your finance team (and their revenue projections) will not entirely hate you for it.

Hybrid pricing models as a bridge between customer-centricity and revenue predictability

Before we can address how hybridized pricing can solve the looming customer acquisition, value, and retention concerns businesses may have today, we need to address a quintessential question —

What exactly is a hybrid pricing model?

Simply put – a hybrid pricing model combines two or more independent pricing models to offer a best-of-both-worlds approach and bypass the individual shortcomings of any individual pricing model.

And while redefining value-metric, reshaping your plans, and communicating pricing revision for your customers is a challenge (did you expect it to be catch-free?), hybrid pricing offers more downside protection than any individual strategy alone. Here’s how —

Offering controlled upgrades for conscious customers

Rarely will your subscribers (in a lower plan) ever salivate over all the unpurchased features in your subsequent packages. Having strict striations through tiers on features, seats, or usage is therefore, a lost opportunity to allow partial upsells for price-sensitive users. It blocks them from experimenting to find additional value-fit.

For multi-product companies, standard inflexible packaging makes qualifying existing users for additional products (upsells or cross-sells) much more difficult. Forcing users to stay in lane and operate within preset constraints means businesses aren’t able to conduct low-expense tests with other products before complete adoption.

Hybridization by adding a variably priced layer of additional products/features to existing subscription tiers can drive adoption across funnels and help identify and unlock new revenue streams.

Monetize customers proportionally to their natural growth arc

When we price and package products, we often operate under biases of how we think our customers will use them. This can be derived from a formative analysis of early adopters but is non-cognizant of a key industrial idea — every business is different and, therefore, will have its own growth curve.

Take the example of a text-based marketing platform that enables businesses to communicate with their subscribers over text. It will likely have different pricing tiers and a defined set of features for different customer segments comprising small businesses, medium-sized companies, and large organizations.

Each plan limits the number of texts users can send. Disabling a customer’s ability to send more texts once their quota is met is counterintuitive to their perception of the business as a growth partner and a huge experiential issue.

Instead, allowing them to continue engaging with their customers by charging an additional rate (usually different from the per-unit rate of your subscription tier) – also known as overages, for every new text does two things —

- Helps the business to continue supporting its customers and monetize them without a hard-ceiling

- Reduces customer friction by removing forced upgrades allowing customers to scale up at their own pace

Monetize stationary usage-based customers

In sales-led models, any customer (usage or subscription-based) requires the same legwork/exercise to be onboarded. From qualification and technical win to contracting to implementation, bandwidth is consumed across teams – even for usage-based or non-committal customers.

Then again, after a customer is onboarded (and this is irrespective of whether you are sales or product-led), you will continue to incur system costs for generating and storing data, even if they scale down to a halt. Such instances skew your CAC:LTV averages, become a drain on critical resources, and give you nothing to show for it.

Instead, supporting your usage-based model with a hybridized base subscription or fixed maintenance costs (depending on customer size) can help you overcome revenue that would be otherwise lost.

Drive product value and adoption for on-the-fence customers

As discussed previously, usage-based products are susceptible to customers scaling down. While they don’t exactly count as churned customers, they also do little to drive revenue growth. And since it is essentially free, the customer may not be incentivized to find value in the product when there is no direct fit.

Hybridizing your pricing model with a fixed revenue and a usage-based model ensures that a customer adequately tries your product to find continued post-purchase fit. Additionally, having a basic pricing commitment (in a self-serve business) can also help filter out hovering customers — i.e., individual users who are non-committal and likely don’t operate within your ICP.

This helps your pricing also become a qualifier for on-the-fence acquisitions — both in terms of keeping potential adopters on the platform and warding off non-ICP acquisitions.

Help drive customer loyalty on moving upmarket

“Large companies almost always have a procurement department. And so, if you don’t have a locked-in contract, they will audit things on a regular basis and figure out where are the places I can potentially go in and eke out the next dollar.”

Jeanne DeWitt Grosser — Global Head of Partnerships, Stripe [in conversation with First Round Review]

The further upmarket you move, the more your product is likely to invite – touchpoints with and scrutiny from – multiple stakeholders. Upwards the market segment, financial, accounting, procurement, and more such teams are often called in to validate a purchase before or after it is cleared by the primary user team/persona.

For them (as much as it is for you), having a subscription model helps bring revenue accountability, standardize budgets, and predict outgo. The added layer of variable charges on usage also ensures that you continue to monetize their micro-scaling journeys before they are qualified for an upgrade or upsell.

Even as it operates within the industry flagbearer of the PAYG model, Stripe is looking at new ways to build committed revenue over a five-year horizon to add predictability and loyalty, signaling a felt need for hybrid pricing even in the upper edges of the SaaS market.

Examples of growth-stage companies using hybrid pricing

Now that we know the benefits a well-thought hybrid pricing model lends to businesses let’s look at how some SaaS companies have implemented the hybrid pricing model.

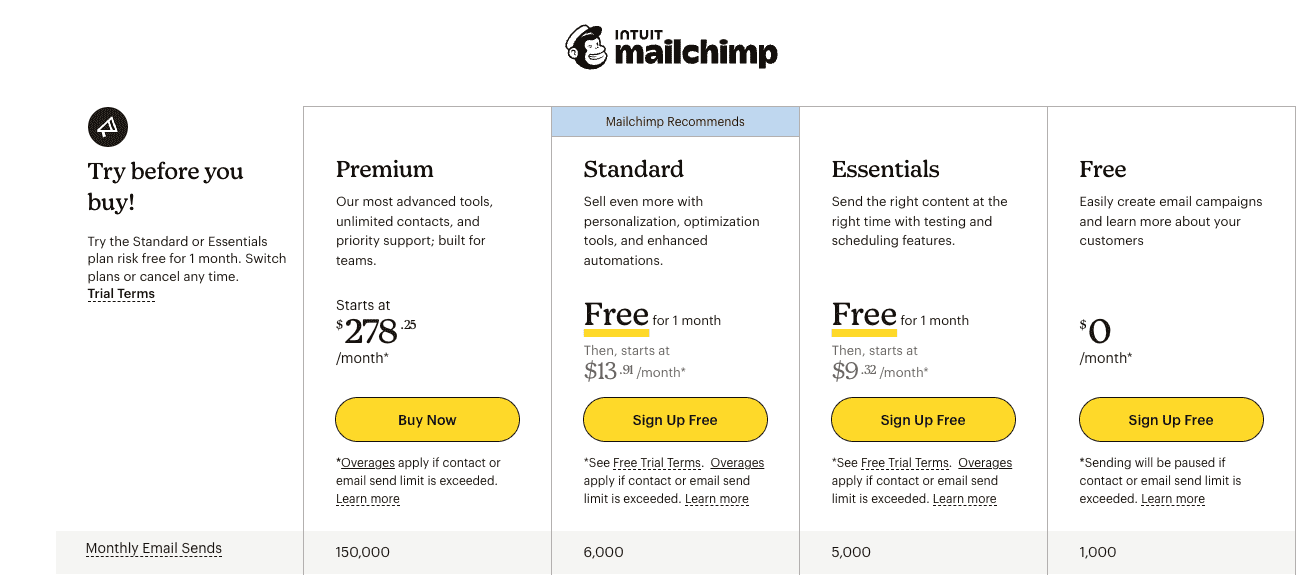

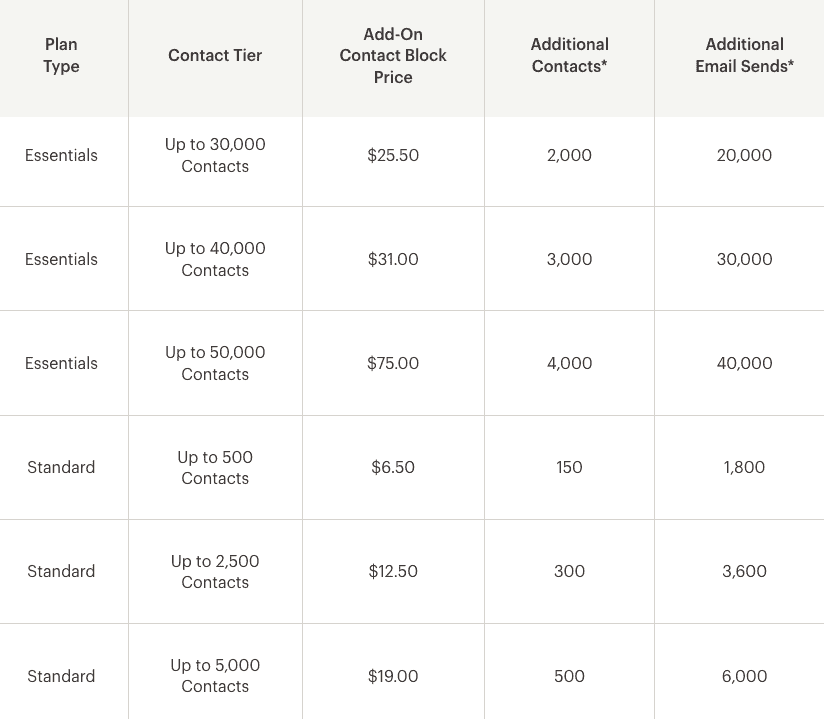

Mailchimp’s subscription-tiers + usage-based pricing model

As Mailchimp went from email marketing to marketing automation, it realized that to better serve a TAM (total addressable market) of businesses across market and team sizes, it needed to offer clear categories through subscription tier packaging.

It is important to note that while each subscription tier has different capabilities (volume of mail sent, etc.), Mailchimp has two layers of subscription tiers:

- Customers are first requested to share an estimate of the number of contacts they want to store in Mailchimp. Once that number is determined, Mailchimp offers three different packages (subscription tiers) for each quantity mentioned.

- Based on the subcategory selected (first by identifying the number of contracts and then the preferred plan), customers will have limits on the number of emails sent (among other things)

When a customer surpasses the limits – either by storing more contact blocks or by crossing the thresholds of emails per month, they are charged overages at various rates.

In this case, Mailchimp will have a different per-unit dollar value for each separate element (contacts and emails) that will be added to the month’s invoice during processing.

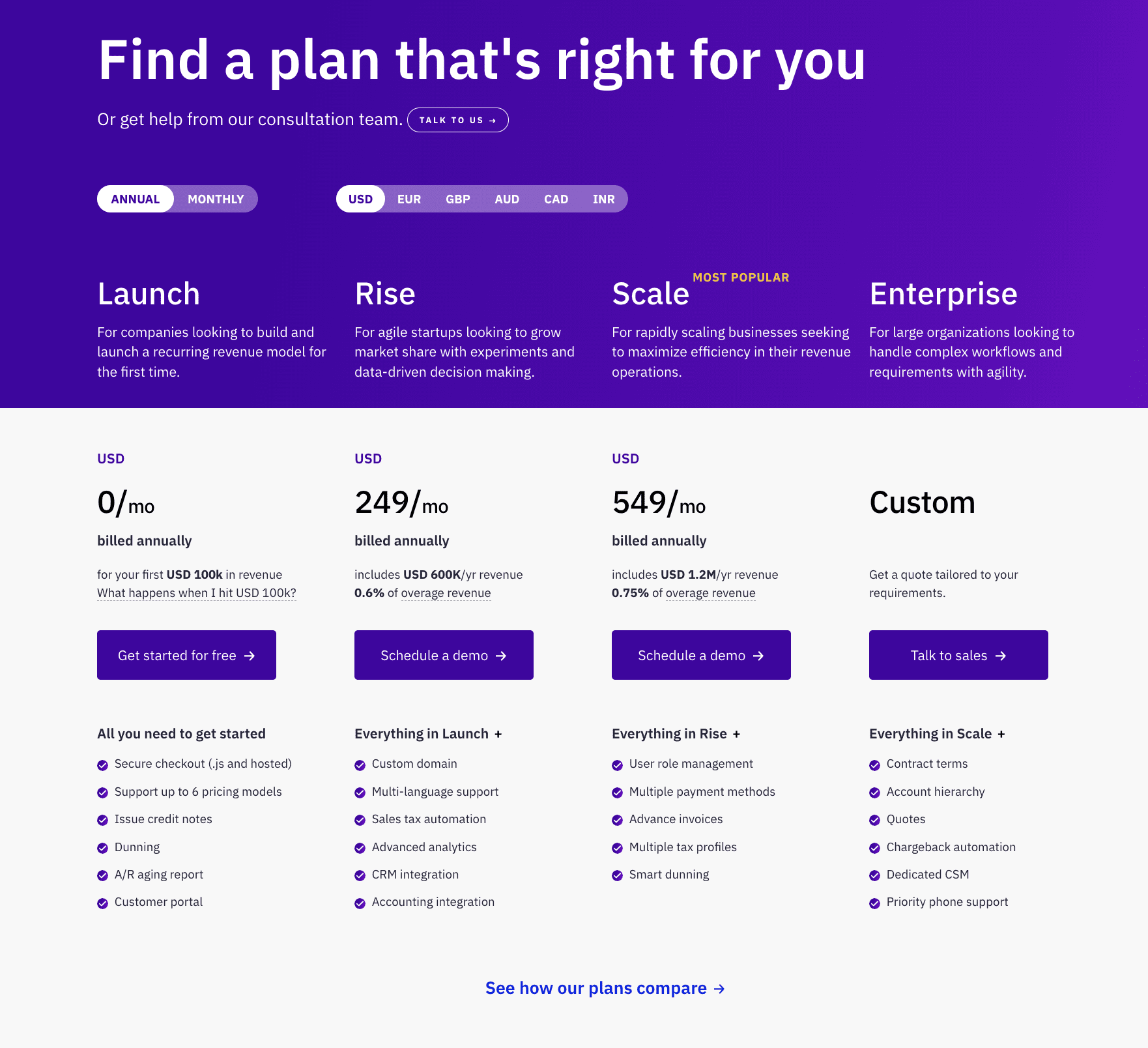

Chargebee’s subscription + percentage pricing model

We wouldn’t be doing you justice if we said all we said yet never touched upon how we implemented the learnings ourselves.

As a multi-product, multi-entity platform that is focused on helping businesses find revenue growth, Chargebee ties its value as a business directly to its customer outcomes.

Storing, processing, analyzing, and maintaining the integrity of data across each customer while ensuring the stability of the myriad features and capabilities warrant significant server and system uptime. This is why baseline subscription pricing helps cushion and qualify the right customers through the sales process.

On the other hand, to get closer to our customers’ intended usage, we only scale when our customers do. This means once a customer processes more revenue than they defined they would (when they chose Chargebee), we are able to process a nominal percentage of the surplus revenue (the difference between actual revenue and predetermined revenue) as a charge in the invoices.

This drives customer-centricity, ensuring all teams in post-purchase are dedicated to helping the customer surpass their own expectations and making the product more valuable to customers’ ideas and preconceptions around growth.

While customers end up paying marginally more for a positive difference in actual v/s projected revenue, this additional cost is interpreted as the cost of success, minimizing resistance and friction.

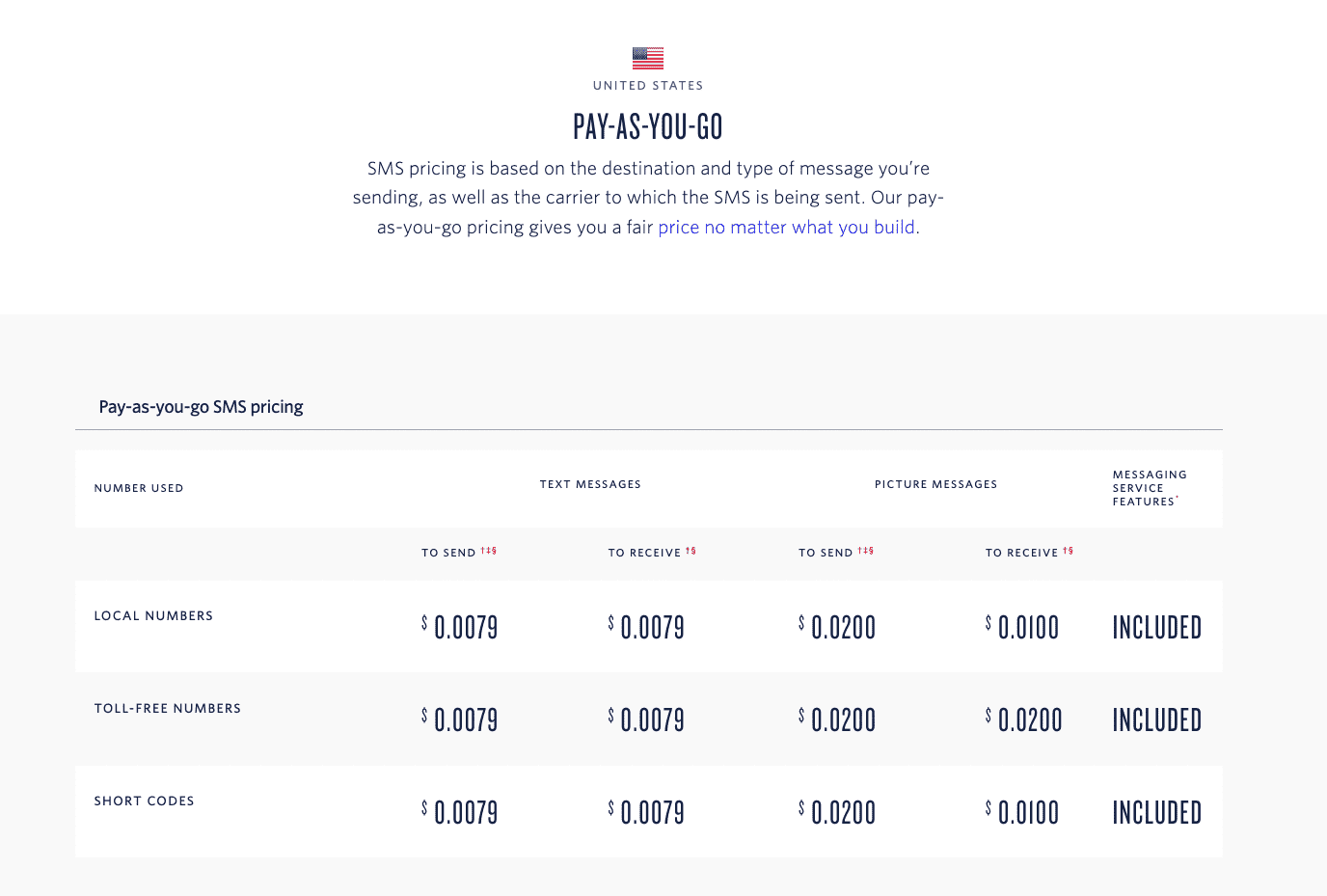

Twilio’s committed revenue layer to a winning pay-as-you-go model

Programmable communications platform – Twilio is the crème de la crème of SaaS businesses that have found success with usage-based pricing. Yet, knowing that such a model also lowers the barriers for customers to exit, it also attempts to promote and incentivize revenue predictability by ensuring long-term customer commitment.

While it championed an undistilled PAYG pricing model, a deep look at Twilio’s pricing page (for its SMS service) uncovers multiple layers added to the pricing model –

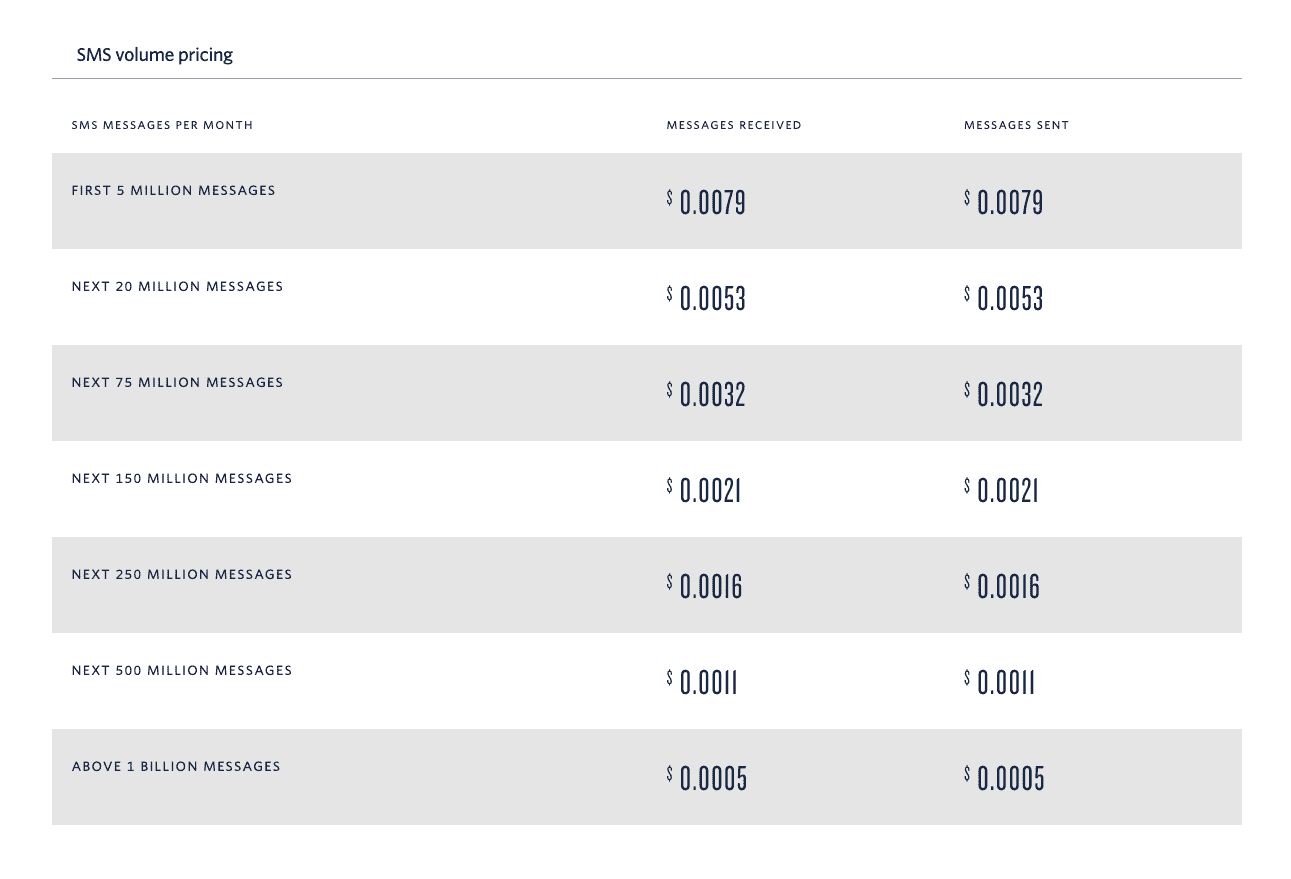

Volume-based dollar/units: Twilio has multiple per-unit-pricing layers so customers feel they benefit from diminishing costs with scale and are incentivized to grow with them. Customer success and sales, however, will have diminishing impetus to help customers continue to drive success (due to diminishing returns over time).

Incentivization for long-term commitments: A very subculture means to hybridize their rather aggressively usage-based pricing is to get customers to commit to a longer-tenured plan.

While this requires a dedicated sales conversation, Twilio encourages customers (often by offering discounts) to commit a defined sum to a wallet, which is then invoiced on a pro-rata basis over the complete horizon of the customer’s usage. This helps them stay true to their usage-based roots and yet (in a classic drawdown model) assigns definitiveness and predictability to their revenue flows.

Evolving your pricing model for hybrid use-cases

Irrespective of what business or revenue model you currently have, pricing cannot be independent of packaging. To ensure that customers find success with your pricing, you have to first ensure that your optics of value is efficiently communicated with them.

Like any form of pricing experimentation, the shift to a hybrid pricing model must be based on the following considerations:

Pricing adjustment is multiple ripples, not a giant wave

Retaining the salient features of your current pricing plan sounds like a no-brainer, but it really isn’t. Both tracking and charging based on usage is easier said than done. Add to that the invoicing complexity that comes from merging a stable pricing model with one that is unpredictable by nature.

Again, since cost of goods is not uniformly distributed (in SaaS it is not so much production, as it is the variable costs (i.e. implementation times, custom wireframes for specific customers, and the actual consumption of services) that constitute the cost of the product.

Hence, if “selling price = ‘premium’ + ‘cost price’”, you don’t only have to determine what is an acceptable premium for the customers, but also (somehow) do a better job rationalizing your (median) cost price.

To define either, you must first identify what works (and what doesn’t). The best way to change pricing is not to jump your customers, but to gradually bring them into the fold. It is where running pricing experiments become crucial.

You can:

- Run A/B tests on new v/s old pricing models to see what’s stickier, or

- Make minor adjustments to existing plans and run them to a select set of new customers

- Change discount rates or coupons at acquisitions and do a trial-run with select users to understand the difference in margin during conversion, and more

Making minor changes to your existing pricing strata and running experiments in parallel, are the best ways to not only generate, but also understand your outcomes better.

Chargebee enables businesses to accurately test, run experiments, and analyze results across 67+ unique SaaS pricing models to help you identify exactly how your customers expect and find value from your business.

Once you are able to home in on the unit of value, use it as an axle for your hybrid pricing model and add affiliate layers (either usage, seats, or percentage of processing) to determine the moving component that makes upsells easier.

For example – Mailchimp uses number of contacts (not emails sent) as a means to define plans for their customers. Additional contacts and emails becomes a moving layer on top of their standard-priced plans.

Offer grandfathering for high-ticket, legacy customers

Your legacy customers are your strongest advocates since they have been with you the longest. Shifting your pricing around might alter their (rather stable) perception of your business and lead to an unwanted recalibration of expectations.

When pricing and packaging your hybrid plan, it is essential that you don’t change what’s not broken. Identify customers with the highest value for your businesses – easily doable with an integrated revenue dashboard – and offer to retain legacy pricing for them.

Chargebee customers do that easily – by first identifying their highest-value legacy customers through their subscription dashboard/analytics and understanding what plans they are on, they can build segments for whom legacy pricing should be retained. Chargebee’s grandfathering support, allows businesses to invoice legacy customers on their previous pricing logic to continue relationships without adding friction.

This helps you capture and scale new customers while retaining high-value relationships as they were.

Ensure your invoices keep up with the changes

Changes to pricing and packaging must immediately reflect in the periodic invoices sent to your customers.

Hybrid pricing brings multiple layers to the equation – first is the recurring charges that need to be invoiced (any change in value per unit here must also be immediately reflected in the next charge). Second, the moving usage-based layer must be calculated up to the last billing date every month, automatically added as a component to your invoices, and sent to the customer.

It isn’t also enough to charge customers accurately, since lack of clarity about how they were charged may lead to friction during conversations. Instead, every invoice must have a breakdown analysis of charges making expense communication clear. (This includes additional components like sales tax, discounts, transaction charges, and more, wherever applicable)

Make the move to hybrid pricing a clockwork

While it sounds like it would need your finance, sales, accounting teams, and an entire village to update every individual customer information on your revenue software, charge everyone appropriately, ensure clarity of communication in charges, and prevent your legacy customers from a fresh heart attack.

Needless to say, customization gives you a competitive advantage and requires the right tech stack. We have a solution.

Chargebee’s complete revenue growth platform supports any business to experiment with – new pricing by changing individual values or entire models, and new packaging by making plan updates (and addition) as simple as dragging-and-dropping items on a screen.

Launch distinct pricing models for new product lines, merge and play with pricing models to create 67+ iterations, change pricing for new customers without disturbing existing customers with grandfathering, and roll out to collect revenue in literally minutes!

Get dream-like control and customization over your pricing strategy and see your revenue grow with Chargebee today.