Imagine that you’re an F1 driver at the start of the next Grand Prix. What is going on in your mind? All your attention would be on getting to the first corner before your 19 other competitors. As soon as the red lights go out, you charge into the first turn as fast as possible.

In some ways, being a founder or a CEO to a fast-growth SaaS business is like being an F1 driver. Although, there are more than just 19 competitors.

We aren’t strangers to the fact that the SaaS market is booming. According to Gartner, SaaS is the largest market segment and is forecast to grow to $117.7 billion in 2021. Across industries, there’s an irrefutable acceleration to cloud adoption, only a part of which was fueled by the pandemic. In fact, while GDPs were shrinking, enterprise SaaS was still thriving, proving that it’s recession-proof.

So how do you stand out in the increasingly competitive SaaS market?

The answer is deceptively simple: you must grow faster.

Speed is the New Growth

It’s no secret that growth matters for SaaS companies of all sizes. But the importance of growing faster becomes more significant as the company matures.

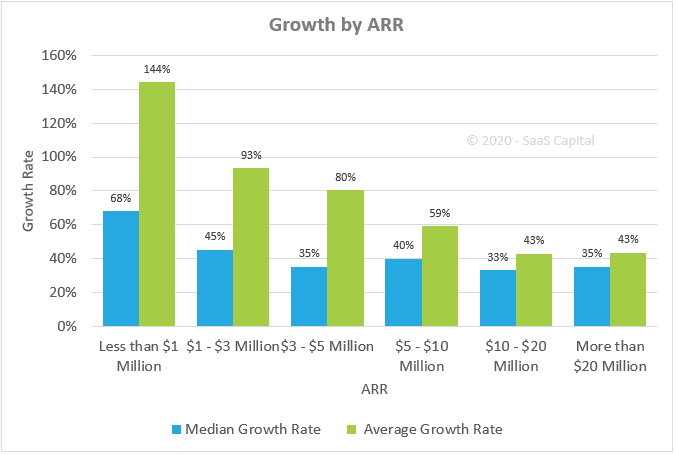

SaaS Capital conducted a survey of 1400 B2B businesses in the revenue range of $1 to $20 million. In the graph below, we can see the median and average growth rates for these businesses.

Their research shows that only the top 10% of SaaS companies have a more than 95% growth rate. While 87% of the companies reported more than 10% growth YoY, it is clear that the growth rates gradually decline as the revenue increases. SaaS businesses typically enjoy the initial fast growth, but they are likely to hit a wall soon if they remain complacent with just growth.

And that’s precisely why rapid and sustainable growth is paramount. Rapid growth can be your differentiator because:

- More growth → more returns (well, duh). Shareholders get 5x more returns from high-growth companies than from medium-growth companies. For example, the stock price of companies like Crowdstrike, Workday, and Zoom increased 100% or more after IPO.

- Companies that get on the hypergrowth path before reaching $100 million in revenue are more likely to join the $1 billion revenue club.

- High growth drives 2x market capitalization than margin improvements and is essential for value creation.

But that still doesn’t answer the question, ‘How fast can, or should my SaaS grow?’

Mendoza Line and Growth Persistence

Thousands of SaaS companies start with the dream of scaling and making it big. While sustaining in such a competitive market is a challenge in itself, what investors look for in a company is the potential to be a standalone public company one day. So what does it take for SaaS businesses to get there?

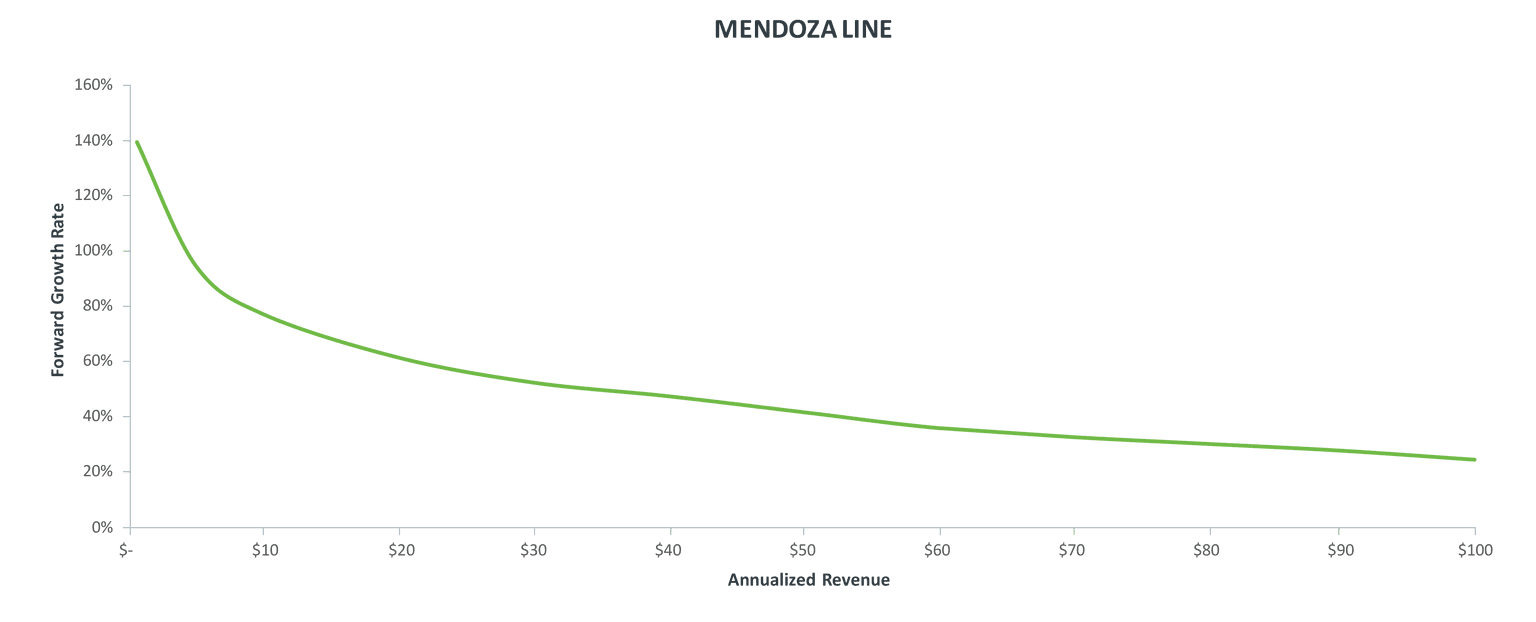

Rory O’Driscoll of Scale Venture Partners has developed a model that analyzed the growth rates at every stage of SaaS companies (revenue ranging from $1M to $1B) and identified a growth rate below which a SaaS company is not on a venture-backable trajectory.

It’s called the Mendoza Line of SaaS Growth. For the uninitiated, the Mendoza Line is a baseball term that the batting average below which a hitter isn’t considered for Major League Baseball. For companies, the Mendoza line gives a clear indication of the growth trajectory that should be on at every stage of their journey to be one of the best in class companies, making them investment-worthy.

The Mendoza Line analyzes SaaS companies based on two underlying premises:

1. What it takes to be a public company

The analysis implies that it takes a revenue run rate of a minimum of $100 million at the IPO time while still maintaining a growth rate of 25% or more in the coming year. SaaS companies are valued off a multiple of their revenue, and companies need to be of a certain size for the public markets to take notice.

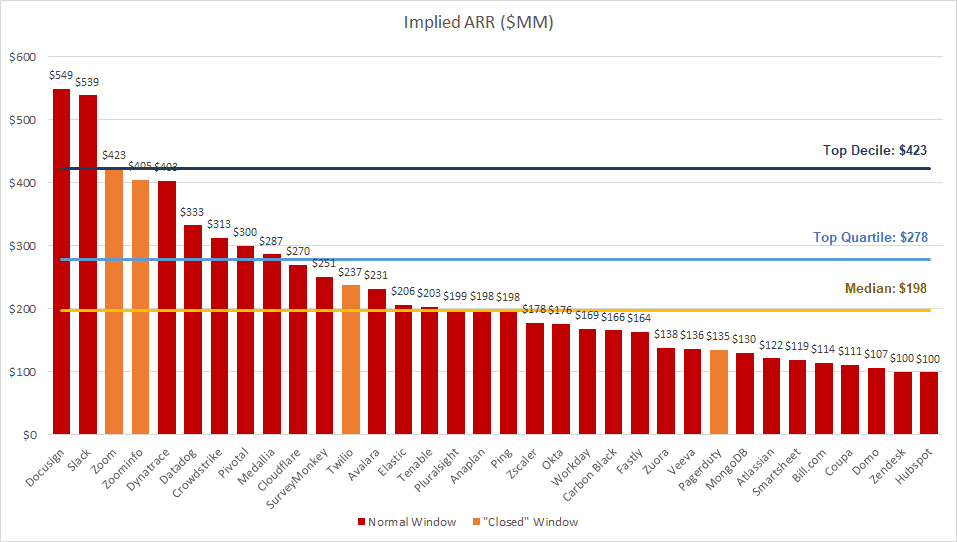

If we look at the analysis of SaaS IPOs in the 2018-20 period, most companies had ARR between $150M – $250M, and none had ARR less than $100M.

2. Growth Persistence

As revenue increases, the growth rates fall. But predictably so. As a rule of thumb, in any given year, the growth rate of best-in-class SaaS companies is between 80-85 % of the prior year’s growth rate. This is called growth persistence. It means that the growth rate of this year is highly predictive of the coming years.

So does it mean that if your growth rate is on the same trajectory as the Mendoza Line, you are on the path to hypergrowth?

Not quite.

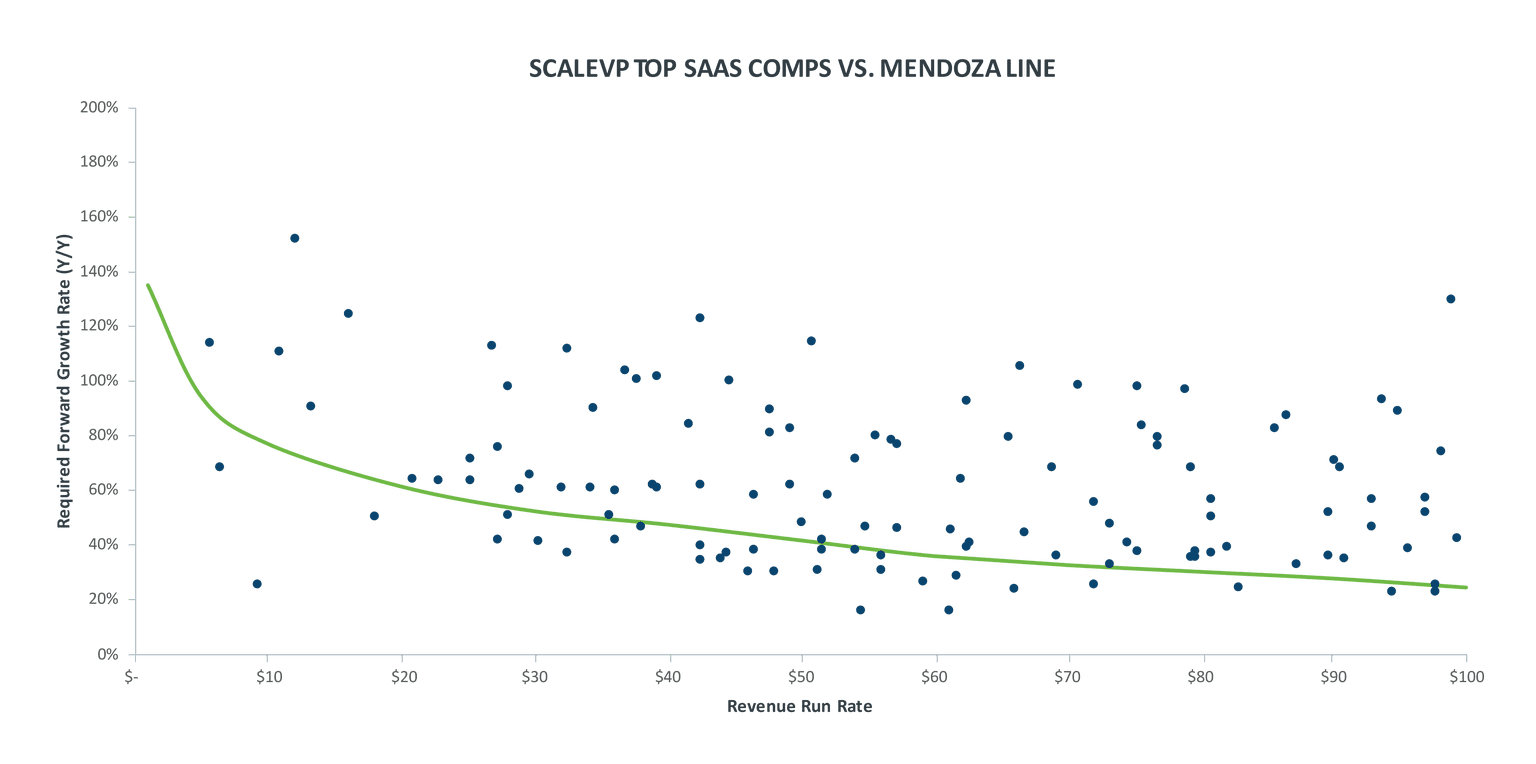

Let’s look at the Mendoza Line viz-a-viz analysis of the revenue and forward growth rates of successful SaaS IPOs for the years when they were privately held.

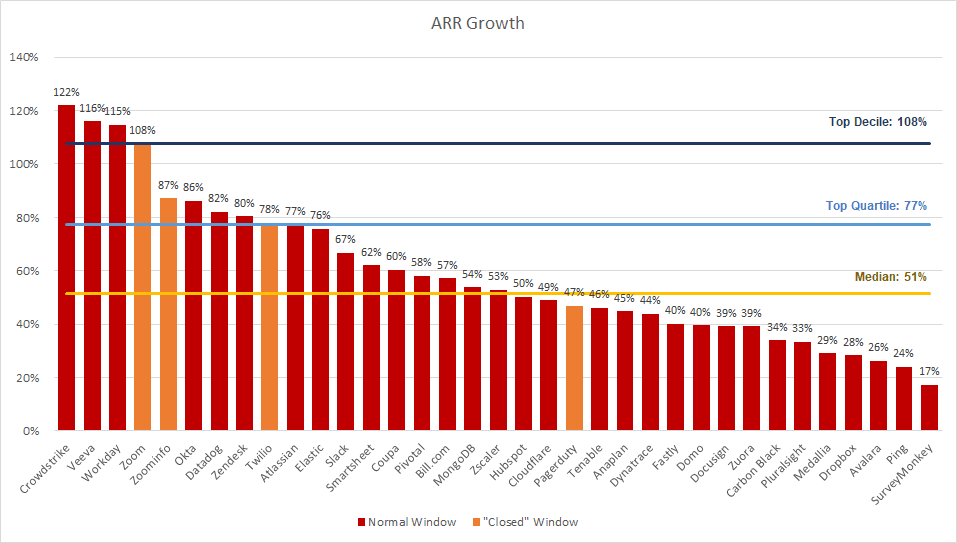

An overwhelming majority of these SaaS companies had forward growth rates that were well above the Mendoza Line before going IPO. Let’s look at the SaaS IPOs in 2018-20 again. SaaS companies with some of the most successful IPOs, such as Crowdstrike, Workday, Zoom, and Zoominfo, had growth rates of 76% and above (i.e., the top quartile as seen in the graph below.)

That’s how high growth sets you apart.

What if your SaaS is consistently growing but is not on the hypergrowth trajectory? Well, ‘slow progress is better than no progress’ doesn’t hold for SaaS. In fact, according to McKinsey, if a software company grows at 20%, it has a 92 percent chance of ceasing to exist within a few years.

The good news: you can change your trajectory to get on the hypergrowth track. The not-so-good news: it isn’t easy. There are many moving factors and it may involve new products, new business models, curbing churn, improving sales efficiency, or rethinking GTM strategy.

Growth as a Point of Parity

The bottom line is, average or slightly above the fold growth isn’t enough. In today’s highly competitive SaaS world, growth has become a point of parity.

The future of your SaaS depends on your current growth rate and persistence. To get on the hypergrowth track and sustain your growth, your SaaS must overcome the growth inertia and raise the growth trajectory. Up and up.

Aim for Sophistication, But Stay Nimble

With rapid growth comes a whirlwind of change – change you need you champion internally and externally. While you tackle changing markets and evolving business models externally, your internal processes, people, and tech stack must scale as well. Businesses that champion these changes pave the way for sustained growth.

Growing is all about adapting to the change and evolving to rise above. And that’s why, as you take on the path of sophistication, it’s vital to maintain your agility to adapt.

With Chargebee as your growth partner, you can scale your SaaS through that hockey-stick growth while we take care of your subscription workflows, processes, and revenue operations.

To learn more, check out these five growth strategies for SaaS hypergrowth along with examples of businesses that have cracked growth using them.

Happy growth! ?