Five Strategies to Unlock SaaS Hypergrowth

As the world transitions to the cloud, SaaS, which makes up the largest market segment, is forecast to grow to $117.7 billion in 2021. Thanks to a combination of rapid digital transformation and an acceleration in cloud adoption across industries, SaaS hypergrowth has become the new normal.

But how do you know how fast is fast enough for your SaaS? SaaS businesses today take months, not years, to join the coveted unicorn club. Despite the downturn, 2020 saw 16 SaaS IPOs, recording one of the busiest H2s in a year for SaaS companies. A closer look at the IPOs during 2018-20 unveils that the top quartile of the most successful IPOs, such as Crowdstrike, Workday, Zoom, and Zoominfo, had growth rates of 76% and above. And remarkably so, because in the initial phase of growth, it is relatively easy to achieve 100% growth YoY, but sustaining such high growth rates becomes difficult as you scale up.

That’s just one reason hypergrowth is a significant differentiating factor in a market as densely competitive as SaaS. Some other ways hypergrowth can set you apart are:

Companies on the hypergrowth path before hitting $100 million in revenue are more likely to reach $1 billion in revenue.

Shareholders get 5x more returns from high-growth companies as compared to medium-growth companies.

High growth drives higher market capitalization. For example, the median increase in the market cap for companies like Crowdstrike, Workday, and Zoom was 270% after IPO.

How do you get on the hypergrowth track?

As your SaaS scales up, identifying growth opportunities and acting quickly on them is crucial.

Hypergrowth is a function of agility and efficiency. Agility lends you the ability to stay ahead of your competitors by executing growth strategies at a rapid pace.

What do the hypergrowth SaaS companies do differently? We took a deep dive into the tried and tested strategies and learnings from some hypergrowth SaaS companies.

In this guide, we will elaborate on five SaaS growth strategies to get you on the track of sustained hypergrowth:

Experiment & Iterate Pricing On the Go

Explore New Markets Globally

Expand Revenue and Curb Churn

Unearth Opportunities with Analytics

Diversify Customer Acquisition Channels

Let’s dive in!

1. Experiment & Iterate Pricing On the Go

On the hypergrowth track, maximizing revenue is a priority. Pricing is one of the most important growth levers for maximizing revenue and ensuring your customers get the most value from your product.

SaaS pricing can be complicated, and there are several pricing strategies to choose from. So how do you know what suits your customers the best and, at the same time, maximizes your revenue? The answer lies in the ability to experiment and iterate your pricing strategy.

“#1 tip for pricing strategy is to treat it as an experiment.”

-Yoav Shapira (Product/Engineering, HubSpot, Facebook)

To run pricing experiments successfully, SaaS businesses should be able to compare pricing plans and create new price tiers or switch pricing models swiftly. It is also vital to ensure that your customers don’t churn out because of sudden pricing changes.

That said, pricing experiments can have a significant impact on your revenue growth in the long run. If you continually optimize your pricing strategy, your growth trajectory can see a dramatic shift upwards within months, as exhibited by this survey of 96 SaaS businesses with $5+ Million ARR.

And that’s why, if you’re benching pricing experiments as a multi-quarter project, you’d be leaving money on the table. Learn more about SaaS pricing experiments here.

✨SaaS in Spotlight ✨

Zendesk is an example of running pricing experiments, getting it wrong, and then rectifying it to come out glorious in the end. This is how their pricing looked back in 2008:

As they scaled up and additions to the product mix, they iterated pricing, focusing on a particular slice of the market each time. They zeroed in on the product’s perceived value and optimized pricing accordingly at each stage of their growth. For example, in 2011, after more than doubling their customer base, they included enterprise pricing as their customers’ needs evolved. Their agility in experimenting with multi-tiered pricing in tandem with new product launches contributed significantly to their growth trajectory.

Today, Zendesk has various tiers of pricing well suited for startups and enterprise customers and has crossed $1 Billion in ARR.

‘Box’ is a great example of how pricing optimization impacts every stage of growth. When they started back in 2004, they had only one pricing plan. As they scaled up, they needed to experiment rapidly by iterating their pricing and product packages. And thus, Box business and enterprise plans were born. As their customers matured, Box reimagined their packaging, targeting different customer segments. Finally, to double down on their growth, they focused on the enterprise plan.

Their agility in pivoting pricing plans for their growing customers has been one of the biggest levers of Box’s growth. Today, Box is a successful public company with more than 64 million users with nearly $800M ARR.

Takeaway:

Continual pricing improvements have a significant impact on your revenue growth. Pricing iterations do not have to be long-term projects. You must be able to implement pricing changes within minutes. This ensures that you do not lose your competitive advantage while staying on the hypergrowth trajectory.

2. Explore New Markets Globally

SaaS is built for global markets. Cloud makes it easy for your product to be accessed from anywhere in the world. Expanding your presence globally can open doors to new markets and more revenue growth, which is difficult to replicate if you restrict your SaaS operations solely within one country.

According to Stripe, 89% of unicorns expand internationally before hitting their billion-dollar valuations. For a SaaS business well on its way to an IPO, well-diversified revenue streams in home and international markets are a sign of stability.

That said, international expansion presents some operational hurdles. In addition, regulations differ from region to region. For example, European expansion can be challenging due to EU-specific compliance requirements, local tax, and laws. But research shows that for a SaaS eyeing IPO, 30% of the global revenue is derived from European markets. So there’s no denying the massive opportunities of international expansion.

In order to crack international expansion successfully, SaaS businesses need to be prepared for:

Multiple currencies

International payments via global payment gateways

Legal, regulatory, and tax compliance

Language and pricing localization

As the global SaaS market size is set to cross $150 billion in the next 1-2 years, you’re missing out on a growth opportunity if you are not preparing for international expansion.

As challenging as it sounds, rolling out global expansion doesn’t have to be a multi-quarter project. With the right tech stack, you can expand globally in a matter of days. Done with agility and efficiency, international expansion can be a competitive advantage on your journey of hypergrowth.

✨SaaS in Spotlight ✨

Zoom came into the spotlight with the pandemic-induced digital transformation and remote working with record-breaking app downloads and blinding growth. But what seems like an overnight success is the result of years of effort.

Zoom has had international expansion on its horizons long before the pandemic with a stronghold in the US. They have data centers in 17 global locations. Zoom supports currencies like USD, AUD, Japanese Yen, Euros and can operate seamlessly in multiple countries across the globe.

And that’s why Zoom was ready to take on the opportunity presented by a global pandemic. Zoom went IPO in 2019 and has crossed $4B in ARR today.

Takeaway:

Tapping the growth potential of international expansion is key to growing fast and keeping your competitive edge. You can tackle the operational hurdles with the right tech stack and ensure a swift and efficient global rollout within a matter of days.

3. Expand Revenue and Curb Churn

With SaaS, you’re essentially selling the same product offering but slicing it in different pricing and packaging options. SaaS pricing models like tiered pricing allow you to break down your features into groups to serve particular segments of customers. To get on the hypergrowth trajectory, it is crucial to design scalable revenue expansion paths to extend your customer lifetime value.

In a typical SaaS scenario, expansion revenue comes from:

Upsells: when customers move from a lower-priced plan to a higher-priced plan.

Cross-sells: when customers purchase other non-core products.

Add-ons: when customers purchase recurring or non-recurring add-ons that are not part of their current subscription plan.

Reactivation: when customers renew a canceled subscription.

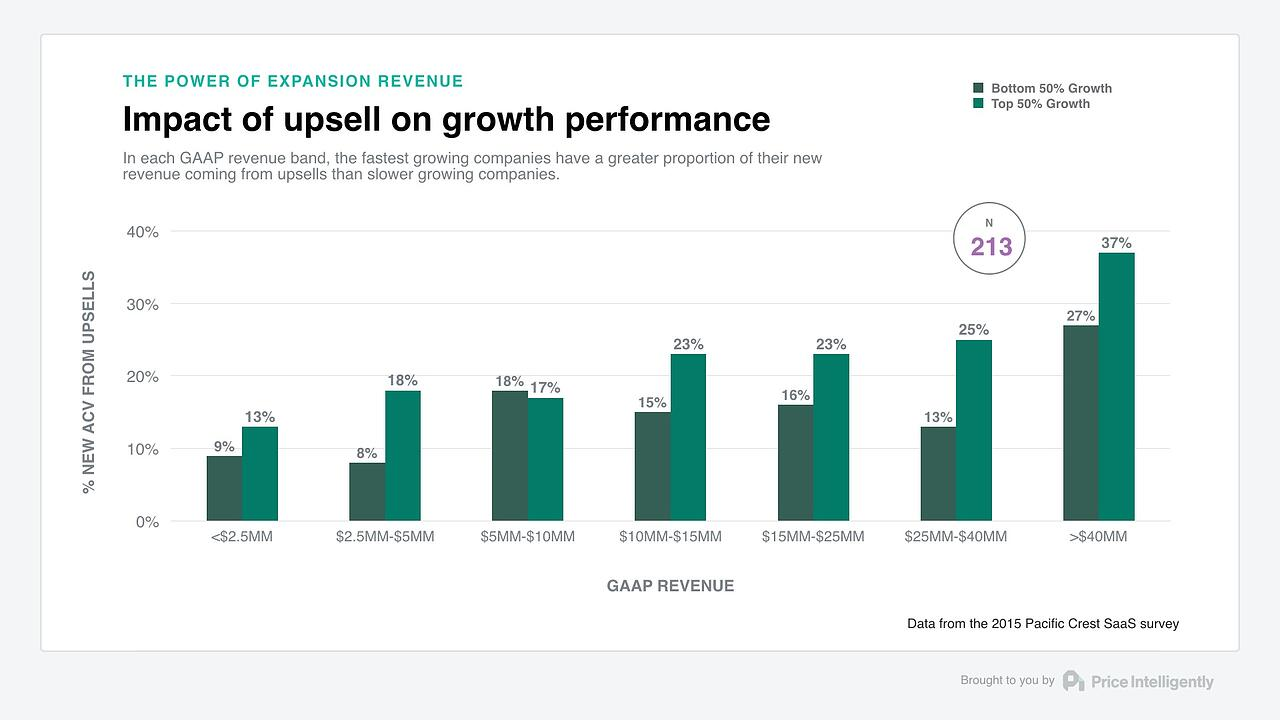

The economics of expansion revenue is critical to your growth. The CAC (customer acquisition cost) required for $1 in upsell revenue is just 24% of the CAC to acquire a new customer. That’s why companies that focus on expanding their revenue with existing customers grow significantly faster, as visualized in this chart:

Another strategy to optimize revenue from existing customers and stay on the hypergrowth track is to reduce churn. Fast-growing saas businesses lose a chunk of their revenue to involuntary as well as voluntary churn. The former is easier to tackle than the latter. Churn can be tackled by tweaking your subscription workflows, and even incremental churn reduction can significantly impact revenue maximization in the long run. Some strategies to reduce involuntary churn are:

Payment reminder emails, which reduces the risk of missed payments

A smart dunning strategy, which sets a workflow for payment retries

Predict churn with analytics, which allows you to stay one step ahead and prevent churn

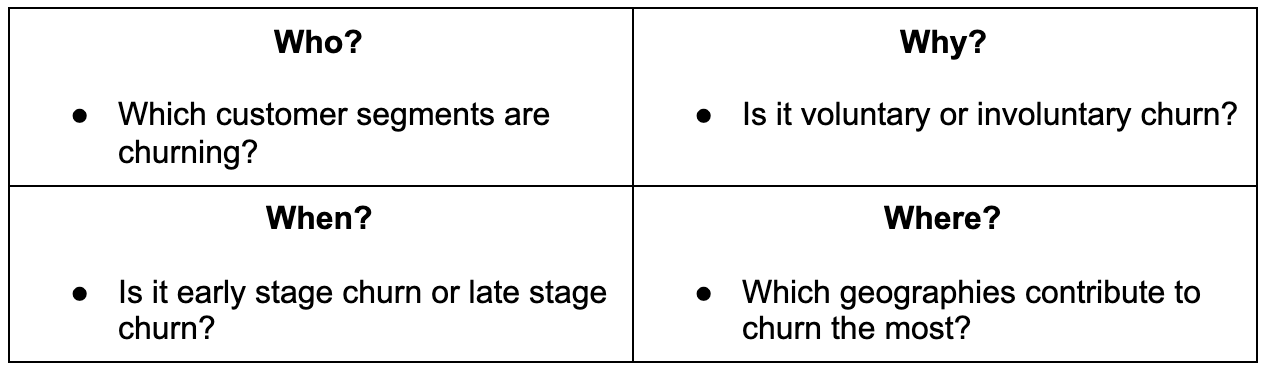

We have created this 4W framework to analyze and reduce churn efficiently.

FURTHER READING Strategies for churn reduction

Both expansion revenue and churn have an impact on your ACV (Annual Contract Value). An analysis of IPOs in 2020 shows that businesses with higher ACV took lesser time to go IPO.

Your existing customers are untapped revenue gold mines, and maximizing these revenue opportunities can help you pave your way up the hypergrowth track.

✨SaaS in Spotlight ✨

Dropbox explored expansion revenue opportunities while showing customers the added value they get. Their upsell strategy includes two facets:

1. Feature-driven

In this approach, Dropbox nudges the customer to move up the value chain because it offers more features than the lower plan with limited features. For example, their Plus plan offers 2TB of storage while the free plan only offers 2GB.

2. Usage driven

Dropbox’s pricing plan is structured in a way that accommodates various degrees of usage, naturally with higher plans allowing more. For example, personal plans allow 2GB per file transfer, while business plans allow up to 100 GB.

The combination of a smartly designed pricing plan and in-app nudges has made Dropbox’s upselling strategy a success. This upselling strategy was key to Dropbox’s growth margins. Today Dropbox has crossed $2B in ARR.

Takeaway:

Two levers of growing fast are: get the best out of your existing customers and ensure you don’t lose them. Various revenue expansion strategies include upselling and cross-selling, while a robust dunning strategy can reduce churn. Both these strategies have an impact on your revenue and, effectively, your growth rate.

4. Unearth Opportunities with Analytics

Growing your SaaS business requires you to make data-driven decisions. A complete view of your subscription analytics helps you identify historical patterns and predict the upcoming trends. Especially in the fast-paced SaaS market, yesterday’s truths may not be applicable for tomorrow.

The challenge, however, is the sheer amount of data that is available. It can be sliced and diced in various ways, and it can be time-consuming to surface actionable insights.

For a SaaS business, subscription analytics are important for multiple functions like marketing, sales, and finance. If each function looks at important data in silos, it is challenging to align and act on mission-critical initiatives swiftly.

That’s why having a single source of truth with a 360° view of your subscription analytics helps in driving data-backed decisions that keep your SaaS aligned with growth.

Some of these insights include:

Identifying revenue optimization opportunities

Forecasting and preventing churn

Tracking customer segments, their patterns, and impact on revenue

Trial management performance and conversion optimization

Pricing strategy results

Looking at the right SaaS metrics to unearth leading indicators and revenue trends can help you course-correct and stay on track for hypergrowth.

✨SaaS in Spotlight ✨

Screencloud is an example of how deep insight into your subscription analytics can help you course-correct proactively.

The most commonly tracked SaaS metrics are MRR and churn. But looking at them in silos is not sufficient to give you a complete picture of the health of your business. For example, if you have high expansion MRR, it may paint a picture that you are on the right track, but if your MRR churn is high, it offsets growth.

When investors analyze these metrics, they look at a business’s growth efficiency, which is a function of both MRR and churn. As they were scaling up, Screencloud realized they were missing crucial insights because there was no single source of truth for the subscription analysis.

With a complete view of their subscription data, Screencloud was able to identify that they were not growing efficiently enough. They were able to uncover insights about:

How their expansion MRR is growing

Why their SaaS quick ratio was deteriorating

How they were losing out to churn

This enabled them to course-correct their way to hypergrowth ahead of time.

Takeaway:

One of the crucial aspects of achieving hypergrowth is analyzing past trends and predicting future ones. Complete visibility into your subscription metrics can not only help you analyze these trends but also uncover untapped revenue opportunities that can power your growth.

5. Diversify your Acquisition Channels

There are two types of SaaS acquisition modes: sales-driven and self-serve.

A sales-driven model follows a sales cycle, with a salesperson understanding the customer’s requirement and proposing a solution that fits the customer best. For example, you can go upmarket by going after high ARPU enterprise customers to improve the ACV. But you need to make sure that your sales workflows are efficient and enable the sales team to double down on all possible revenue opportunities like flexible terms, renewals, cancellations, upsells, cross-sells, discounts, etc.

A self-serve model essentially means that customers can sign up for your product without any manual intervention. SaaS businesses implement self-serve by having a free trial or freemium. This widens your market by enabling you to move downmarket and win a large number of low ARPU customers. It is important to have a self-serve subscription management system that supports multiple payment methods, payment gateways, and local currencies to manage these customers for higher LTV effectively.

Rapid growth isn't always achieved using only a sales-driven model. Different types of customers may require different types of sales motions, such as high touch, low touch, assisted sales, or even complex cycles involving sophisticated deal desks. With the right revenue infrastructure, you can always choose to go the sales-driven way while keeping the self-serve door open.

Diversifying your acquisition channels opens up new customer segments and gives you the flexibility to experiment.

✨SaaS in Spotlight ✨

A Cloud Guru has come a long way from charging flat fees for their courses to sustained revenue growth with the subscription model. With the new model, they can experiment with scalable pricing models and reduce churn.

As they moved upmarket with a substantial increase in their subscriptions, they wanted to leave no stone unturned and explore another revenue stream: a self-serve portal.

With this addition to their subscription model, customers could go online and buy a subscription on the ACG website without talking to a salesperson. Automating this process gave a boost to their subscriptions and contributed to their growth significantly.

Takeaway:

Moving upmarket or downmarket means tapping into new revenue streams. One doesn’t have to come at the cost of the other. You should always have the option of diversifying your revenue streams and the ability to optimize the growth of your SaaS quickly.

Wrapping Up

Each of these strategies is a crucial cogwheel in your overall growth strategy. Identify the ones that have the most impact on your revenue growth and implement them first.

While unlocking hypergrowth is important, sustaining hypergrowth is a different ball game altogether, and you can do that with agile sophistication.

We have enabled several customers to get on the hypergrowth track.

https://chargebee.wistia.com/medias/8kt8pym0qo

Read more about how Chargebee can be your partner in hypergrowth.