Payment Reconciliation – Process, Best Practises & How to Automate it?

Well, somewhere, a finance team is experiencing issues with their reconciliation right now. Whether that be discovering manual errors or realizing that something is missing because of a time zone difference, it is never a dull moment when it comes to reconciliation, especially if you’re doing it manually.

While we’ve covered what account reconciliation is, why you should automate, and what the best account reconciliation tools for automation are, we’re going to take a look at payment reconciliation. You may be wondering – what’s the difference between payment reconciliation and account reconciliation? Let’s jump right into the differences and the payment reconciliation process, including why you need it, what are some of the best practices, and how automation can help.

What is Payment Reconciliation?

Payment reconciliation, like account reconciliation, is an accounting process that verifies every set of records – from the bank statement to your balance sheet – is correct and up-to-date. Simple enough. It’s all about making sure that your internal records match any statements you get from vendors – what you should or have paid should match what the invoice says. If they don’t, this is when you’re dealing with payment reconciliation. It is the best method for keeping track of business expenses and income.

Unlike account reconciliation which deals with reconciling your customer accounts, payment reconciliation is reconciling your internal accounts against invoices and bank statements. And much like account reconciliation, you should be undertaking this every month, at a minimum. If you’re running the process manually, you will need to detect any errors (whether that’s on your balance sheet, from the bank, from invoices, etc.), check into potential fraud, look into overdue payments or chase after outstanding invoices.

Why Do You Need Payment Reconciliation?

Much like account reconciliation, you and your company need payment reconciliation to make sure that there are no errors in your records – for this type of reconciliation, it will be between the bank records and the internal records of business expenses and your income.

As we’ve discussed before, it’s easy to make mistakes when manually handling any reconciliation (we’ve called reconciliation the most error-prone process for the finance team in the past). To prevent these mistakes from happening and piling up at the end of the quarter or the end of the year, you should either work hard within your manual processes to reconcile weekly if possible or automate your reconciliation to make weekly payment reconciliation much more efficient.

To make sure that you’re reconciling your payments often, take into consideration some of the most significant benefits to reconciling:

- Ensure your records are accurate

- Uncovering discrepancies, unauthorized payments, or fraud

- Settle unpaid or late invoice

- Prevent extra fees, such as overdraft fees or fees from bounced checks

- Show patterns in company spending and company cash flow

- Getting a sense of company financial health

How often you reconcile it up to you; however, the more often you reconcile (weekly vs. monthly), the more likely you are to see the above benefits.

What is the Reconciliation Process?

Now that you know the benefits let’s move on to the process. Like account reconciliation, payment reconciliation can be a long, multi-step process with many substeps that you may experience depending on whether your team handles the process manually or automatically. However, at the core, payment reconciliation has four steps:

- Retrieve Internal Records: This consists of checking your business transactions and invoices, whether in your accounting software or just in a spreadsheet. You need to retrieve these documents from the source and compare them to the external records.

- Retrieve External Records: You’ll have to get the external records (for example, your bank statements) and prepare them for review against your internal documents.

- Comparing and reconciling: You will want to start where you last left off and begin the process of manually going through your internal and external records line by line or letting your automation work for you. You should compare and flag any inconsistencies and let you and your team know whatever automated system you use.

- Investigate the inconsistencies: Following in line with your internal processes, the inconsistencies you’re dealing with will need to be investigated further before you can complete reconciliation.

Best Practices for Payment Reconciliation

Best practices must be kept in mind when doing reconciliation of any type. For payment reconciliation, you should ensure that you are providing stakeholders with the most accurate representation of the organization’s current financial situation. For added accuracy, it’s beneficial to use automation to save your team time.

It is also essential to have a series of checks to ensure that the payment reconciliation process can catch any potential issues, such as fraud. You may want to use the same sequence of internal checks we recommend for account reconciliation here.

How Automation and Chargebee Can Help with Payment Reconciliation

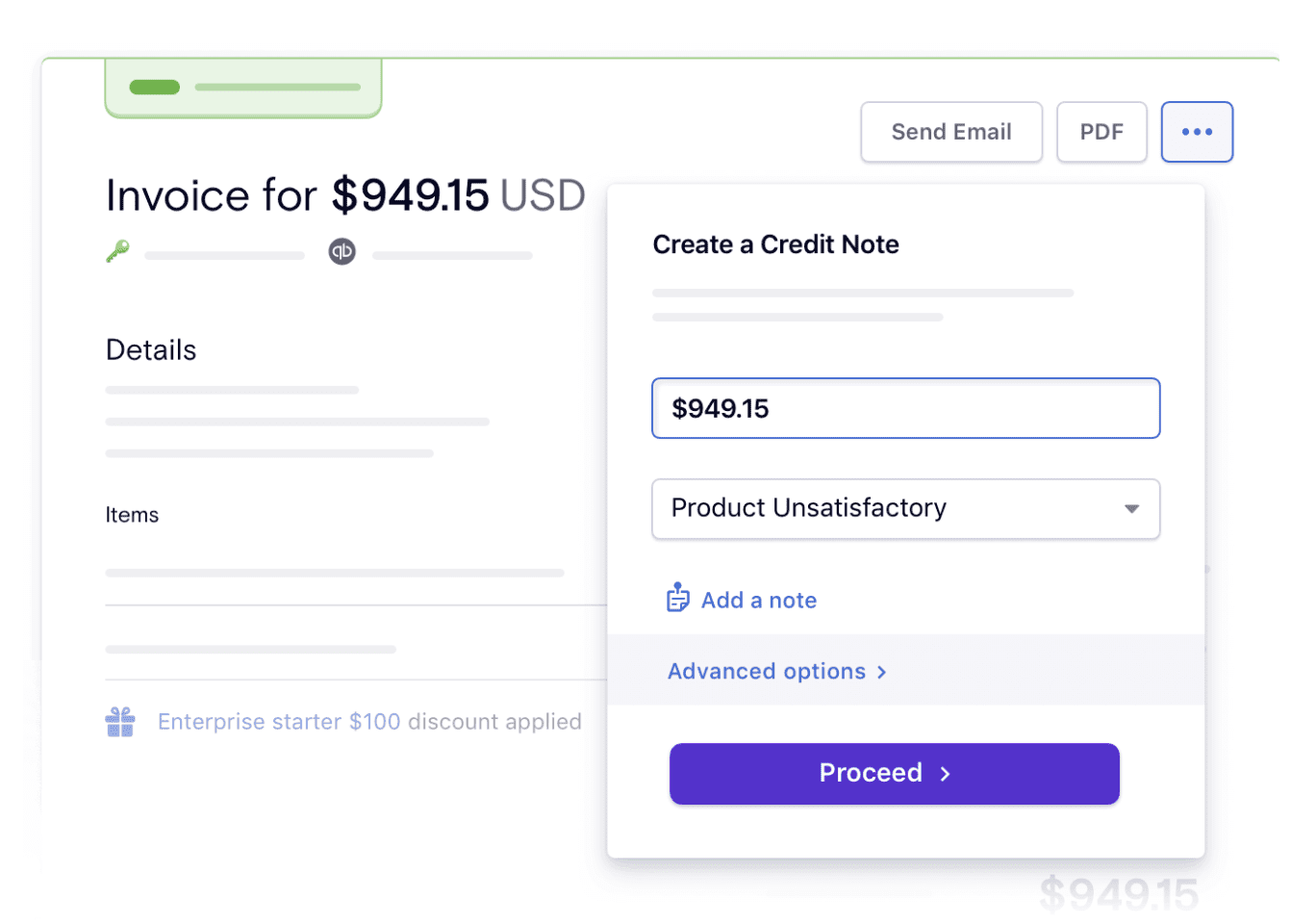

While manual reconciliation may have been the norm for decades, automatic reconciliation has many benefits, including reducing human error. With an automated reconciliation, your team can focus efforts elsewhere, spending less time on a process that you can easily manage through automation with tools like Chargebee’s tools like the Payment Reconciliation Plugin for Google Chrome.

Chargebee customers like Doctify could fix their very manual processes with invoices and customer payments with automation. In contrast, others, like Animalz, were able to streamline their accounts receivable workflow at the cost of less than 1% of their annual recurring revenue (ARR) by automating their offline payment reconciliation process and using Chargebee as the single source of truth for all their accounts receivables data.

Chargebee also has several integrations, including Quickbooks and Xero, which can help change those workflows and can help save up to 5 hours every week on the back end just by moving from manual to automated processes. And with either of these integrations, you can import transactions from Stripe straight into Xero or QuickBooks without worrying about the formatting. “The new reconciliation feature saves us a lot of time! No more sifting through Stripe to figure out the allocations.” Jens Hellberg, Managing Director, TruckScience

Conclusion

Payment reconciliation is an essential part of financial management and the finance process for any organization. Like its partner, account reconciliation, there are many steps to the process, all of which benefit from automation. Suppose you’re curious how to join organizations like Animalz, Doctify, or other Chargebee customers like Userlane (who saved 80% of the time spent on monthly financial reconciliation by using Chargebee), check out what Chargebee has to offer here or reach out. In that case, we can contact one of our experts who will show you how to change your reconciliation process.