After more than a decade of hypergrowth, many SaaS businesses are facing a recession for the first time. Investors who have consistently rewarded growth at all costs during the hyper-growth phase, now want sustainable growth. So founders have to ensure their businesses become more cost-effective while still driving similar growth and they often turn to the CFO to improve efficiency across the organization.

So in the current economic situation, CFOs need to balance long-term growth while shoring up short-term profitability. As a CFO, you need to leverage data to assess your business health and identify growth opportunities. While a robust financial tech stack is often used to improve operational efficiency, CFOs who use data strategically can gain valuable insights beyond standard business metrics. A PwC research shows that 90% of companies are trying to improve decision-making through digitization initiatives, and CFOs spend 18.5% of their time working on these projects. The right metrics can provide CFOs with a comprehensive view of their company’s financial health, allowing them to drive strategic initiatives to ensure long-term sustainable growth.

According to a recent PYMNTS survey, CFOs’ 2023 priorities include faster access to working capital, better ability to manage their cash cycles, and more actionable insights into their organization’s finances. After the great recession of 2008, Bessemer released the 5 C’s of SaaS finance. Some insights from the report can still resonate with the current times and help SaaS businesses stay ahead of the curve. We have taken inspiration from the report’s anchoring metrics but have modeled them to fit into the current recession market.

The 5 C’s you need to be aware to steer your business during the downturn are:

- Committed Monthly Recurring Revenue (CMRR)

- Cash Flow

- Customer Acquisition Cost (CAC) Payback Period

- Customer Lifetime Value (CLTV)

1. Committed Monthly Recurring Revenue (CMRR)

“When CMRR is designed correctly, it can help identify the customers who can benefit from increased usage limits or other related products (opportunities to up-sell), customers who are under-utilizing the solution, and could probably churn (at-risk revenue streams).”

To gain clarity, many SaaS businesses might turn to the value of the contract or even Monthly Recurring Revenue (MRR) but CMRR is more insightful as it is a prediction metric that combines recognized revenue, MRR, new bookings, churn, downgrades and upgrades. To explain this further let’s look into a few of the related metrics.

The duration of the contract is one such metric. It wouldn’t be a major variable but if the cash collections and monthly subscriptions are volatile, then one needs to keep a close eye on both the Total Contract Value (TCV) and the Annual Contract Value (ACV). Even then, the TCV and ACV can be flawed as they over-emphasize the contract duration and miss out on the actual value of the contract.

A major advantage of the CMRR is that it provides the clearest view of the health of a SaaS business and when CMRR is designed correctly, it can help identify the customers who can benefit from increased usage limits or other related products (opportunities to up-sell), customers who are under-utilizing the solution and could probably churn (at-risk revenue streams).

CMRR tracked on a monthly basis it can also help imprint a positive behavioral change across the organization such as,

- Good cadence between sales and product development

- Better sales compensation plans with cash flow alignment

- Heightened awareness around small MRR changes

- A deeper understanding of customer price sensitivity

2. Cash Flow

It goes without saying that cash is King — especially during a downturn.

During the hyper-growth phase, only a handful of SaaS businesses focused on the ‘cash burn rate’. But as the global economy comes under the grips of a recession, measuring cash burn, which is basically the rate at which a company is spending its money, becomes crucial.

A survey by Gartner reported that a lack of focus on the cash burn rate led to severe cash flow problems for companies during the pandemic. To battle the current headwinds, CFOs need to learn from the past and prepare better for the future.

Why is the Cash Flow analysis important?

The one thing that CMRR lacks is in giving a picture of the ‘cash health’ of a business. Cash flow analysis comes in to save the day here. The gross and net burn rate should be analyzed and measures should be out in place to bring them down as during tough economic times the capital will start drying up.

By tracking CMRR, burn rate & cash flow, a company will get to know the true picture of its cash balance and the number of months of runway available. CFOs have to track this religiously and implement a variety of mitigation plans.

Keeping the cash flow running positive during hard economic times is very important and means to ensure that has to be put in place immediately. Check out our video series to get more insights on how finance leaders can keep the lights on during tough times.

3. Customer Acquisition Cost (CAC) Payback Period

It stands by the classic adage “you’ve got to spend money to make money.” CAC is the amount of money spent on acquiring a customer. The shorter the payback period on CAC, the faster your company can grow.

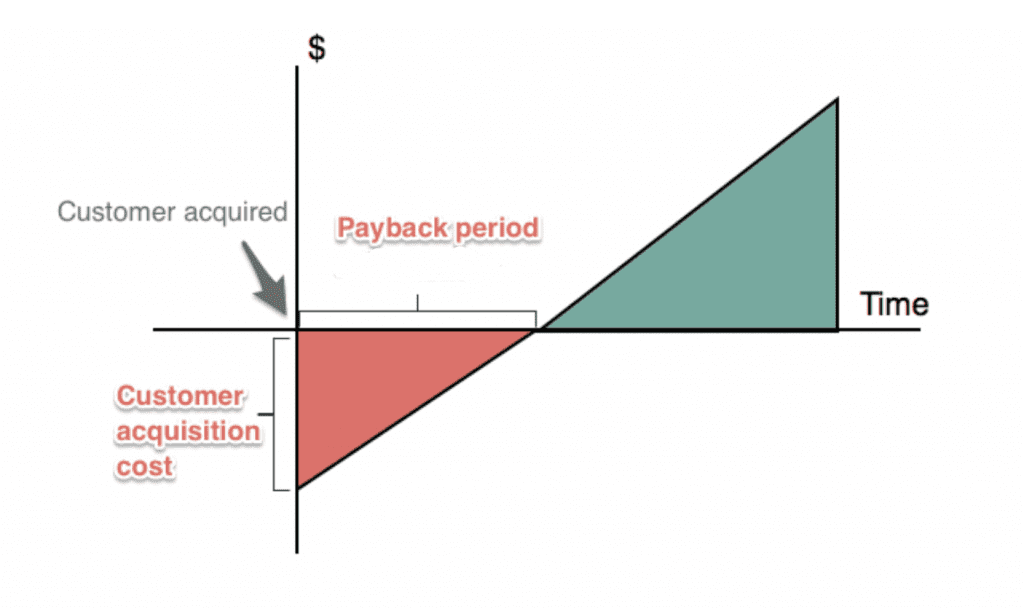

The payback period determines the efficiency of your company’s acquisition model and predicts the amount of time it takes for your company to recover the cost of one customer. Below is a diagrammatic representation of how the CAC payback model works.

Businesses hope to at least break even on the initial Customer acquisition cost. In the subscription model, as the time increases, the customer eventually pays back that initial cost (seen in red in the above figure) due to the incremental subscription payments. Once the CAC on a customer is redeemed, it is represented by the crossing of the x-axis in the above figure and the green area is the time period where the customer’s payments go towards the company’s growth.

Calculating the CAC helps a company understand its acquisition efficiency for different types of customers and its impact on the finances. It also helps measure the sustainability of the company’s strategies in the long term.

The Ideal Payback period on CAC

The concept of “ideal” could be blurry to many, however, according to industry standards, SaaS startups have an average of 5-12 month payback period depending on their efficiency of operations. When high-performing startup SaaS companies break even in 5-6 months, larger companies with more capital could have a longer payback period. In times of recession, these values might slightly fluctuate because there are many internal and external factors that could affect the payback period.

Irrespective of the changes, a company can shorten its payback period either by decreasing costs or increasing value as below,

- Reduce marketing spend: Focus on the niche of your product offering and use it to multiply your organic acquisition.

- Reduce sales spend: Deeply research the market to come to a product/market fit that would enable you to use a self-service model.

- Increase value: Understand your customer’s real pains and increase revenue through relevant up-sells and cross-sells.

- Constantly experiment with pricing: Even industry leaders don’t get it right all the time so make pricing a process of iteration. Experimenting with usage-based billing, also known as consumption-based pricing, is well-suited to economic downturns when people are more cautious with their spending. Usage-based billing is expected to be used by 56% of SaaS companies in 2023, and a survey by Bain & Company found that 75% of companies plan to expand their usage-based offerings. Several successful companies, such as Snowflake, JFrog, Amazon Web Services, and Twilio, have already demonstrated the effectiveness of this pricing model.

4. Customer Lifetime Value (CLTV)

While CAC lets you know the payback period on the cost of acquiring a customer after accounting for the variable expenses or services, CLTV lets you know if the customer is profitable over time. The longer the customer stays in the business and continues to make purchases, the higher the CLTV increases.

When CLTV is taken in relation to CAC, it would help a business measure the ROI of each customer and this could help in setting marketing and sales budgets. It is recommended to have a CAC value which is one-third of the CLTV. This metric also helps you to understand the aspects of your offering that a customer likes which in turn aids in constructing your approach towards the target market.

How to measure CLTV?

There are multiple ways of doing this. It’s always better for a SaaS company to choose the calculation which makes more sense for their business. Few of the ways to do this are:

CLTV = ARPU x Customer Lifetime (in months)

Or, using churn,

CLTV = ARPU/ Customer Churn Rate (in months)

You can read more about optimizing your CAC/CLTV here.

CLTV would help to measure profitability. Hence use it to adjust your resource, development, general & administrative expenses.

Building Customer Loyalty in a Recession

During a recession, customers might be unwilling to open their wallets. Providing discounts could be one way of being empathetic to your target market. For example, Rented, is a prominent provider of Revenue Management as a Service (RMS) for vacation rental property managers. ranked #61 on Inc’s list of the fastest-growing companies in the US in early 2020 faced unprecedented challenges during the pandemic. To cushion the blow, Karen Fleck, the CFO, and her team used Chargebee to retain 80% of their customers through a customized discounting strategy.

Another method to enhance customer loyalty would be to concentrate on what customers are actually looking for. Offering add-ons or any service that would help them get clarity in uncertain times can often be a game changer. For example, Chargebee’s subscription analytics platform, Revenue Story, helps you derive actionable insights on new sales, payments collected, monthly recurring revenue (MRR), activations, churn.

5. Churn and Renewal

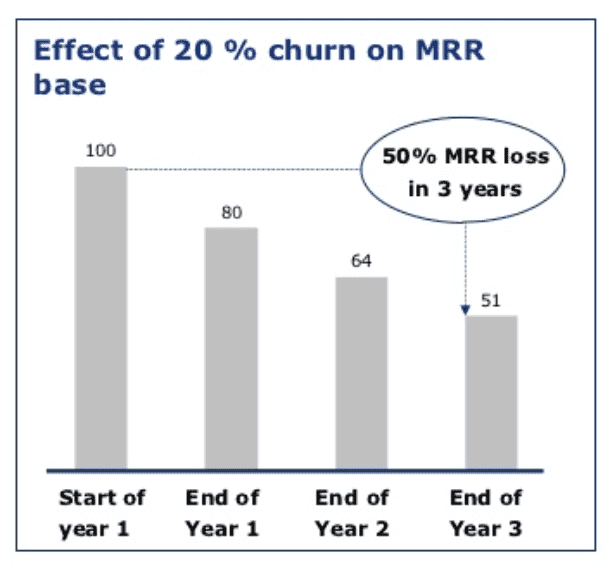

One of the biggest drivers of the long-term profitability of a firm is its renewal rate. In today’s world, acquiring new customer is 5X more expensive than retaining one. To not focus on renewal and retention strategies can spell doom for a business. For example, when a 20% churn on MRR is left unattended, it grows to a 50% churn rate in a matter of 3 years.

To tackle churn, a deep understanding of the root cause is necessary. It could be pricing, UI, or plain customer dissatisfaction.

Chargebee Retention with its reporting feature allows businesses to see the financial impact of their customer retention efforts on their revenue. It tracks various metrics, including the reason for cancellation, total revenue from retained customers (including upsells and cross-sells), total reactivation value, the average number of orders at activation, the average number of upsells or cross-sells, and more.

With Chargebee Retention, you can also implement an intelligent churn deflection funnel and provide personalized cancel experiences and create persuasive offers that may prevent churn.

From earlier studies conducted during the previous 2008 recession, it could be observed that SaaS business models are generally resilient. But no business is bulletproof to a recession, so keeping an eye on these key metrics will help your business stay ahead of the curve even in uncertain times.

With Chargebee, you can get 360° business visibility that helps you identify key performance indicators that drive revenue, subscriptions, signups, activations, churn, and a host of other metrics based on which you can make effective decisions. In order to successfully navigate this downturn, you will need a centralized view of what’s happening in your organization in order to identify areas of business you need to double down. Our real-time dashboards enable you and your team to understand critical metrics related to growth, retention, and revenue leakage to empower you to stay ahead during uncertain times. Schedule a demo with one of our experts to know more.