Stripe Billing adds cost and complexity as you grow — from developer time to billing workarounds. Chargebee gives you flexibility, faster launches, and better control over monetization and billing without hidden trade-offs.

"Every time I need the team to work on something [in Stripe Billing], it's engineering time,

it's a quarter out, and it's getting frustrating. I want to move fast, and I want someone non-technical to own the system."

CFO,

AI Customer Service Platform

(Series C+)

We get it. Stripe Billing is deeply embedded in your workflows, and making any change to your billing stack feels like a high-stakes decision.

That's exactly where Chargebee shines. We've migrated hundreds of companies from Stripe Billing—moving millions of subscription records with their complete historical data.

There's a reason we've been rated #1 on G2 for Fastest Implementation seven years running: we've turned complex migrations into a repeatable science.

Worried about data migration? Here’s how we make it fast and risk-free.

Your Stripe tokens, customer cards, and payment processing stay untouched; we're only upgrading the billing layer.

Our specialists handle all data extraction, validation, and import—no need to worry about formats or mapping.

Purpose-built tools and templates to preserve data integrity and automate the transition.

Complete sandbox validation plus Time Machine simulation to see exactly how your billing will work before going live

Start with a phased rollout (new customers first, then existing subscriptions) or choose a full cutover for a quicker transition

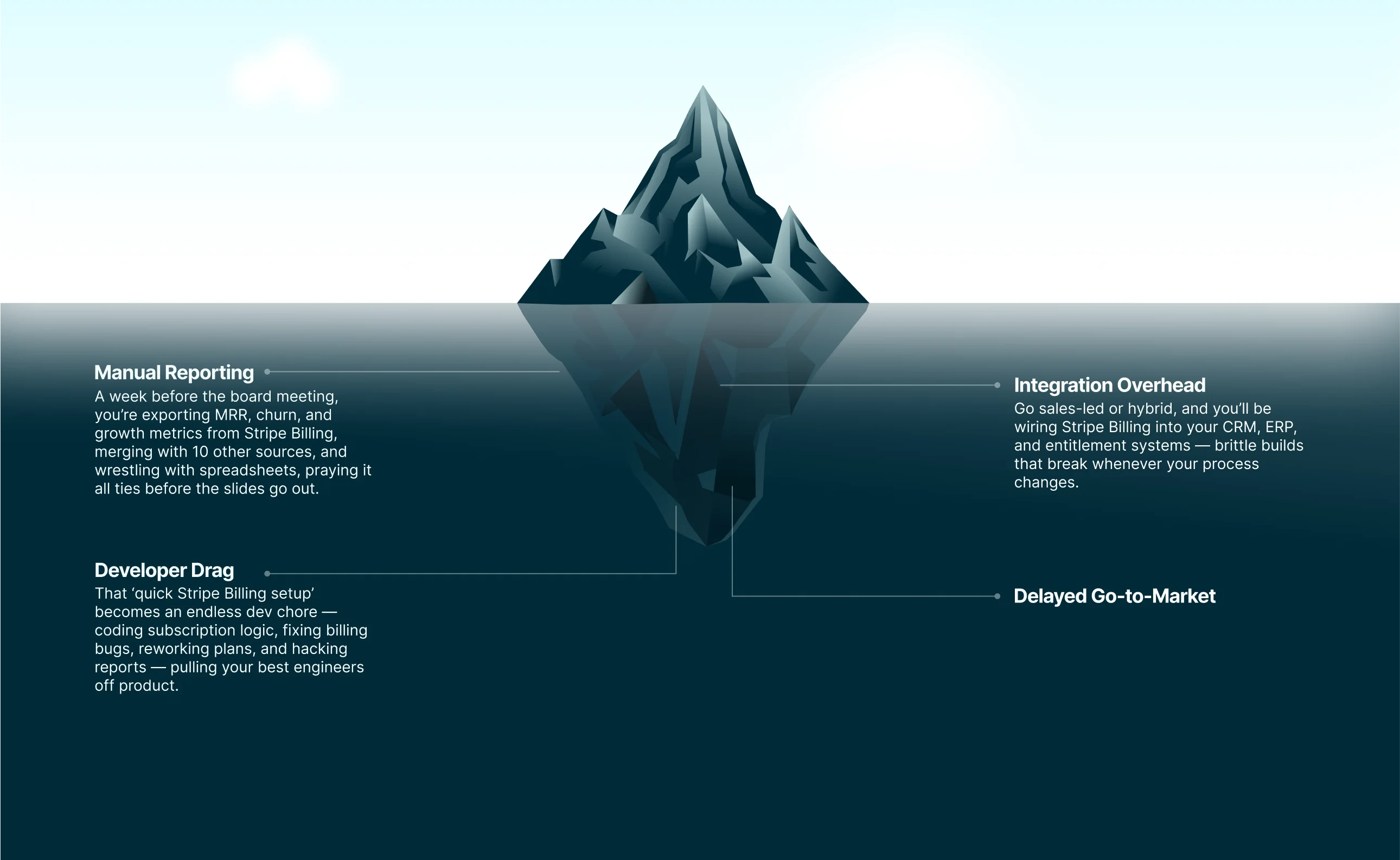

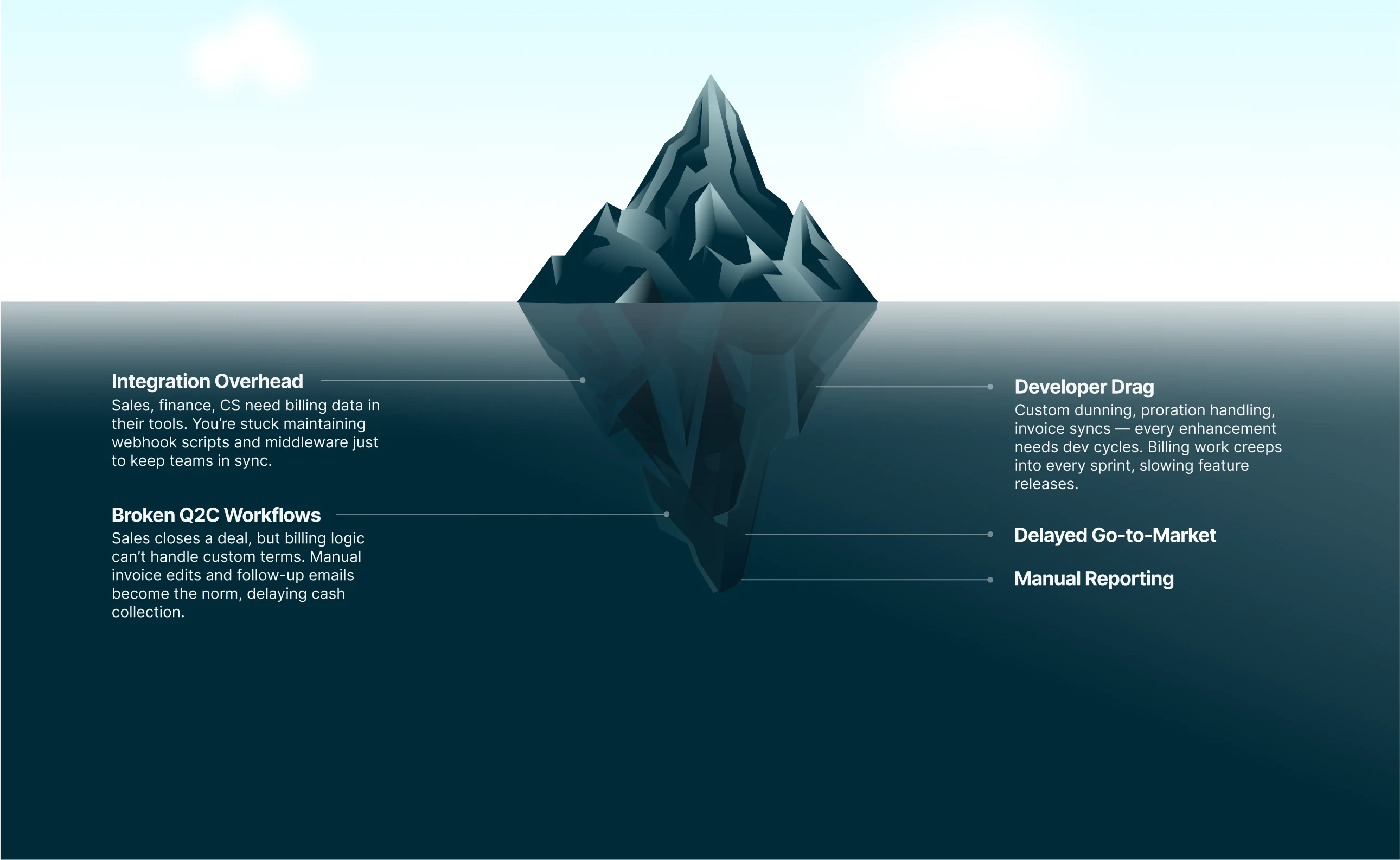

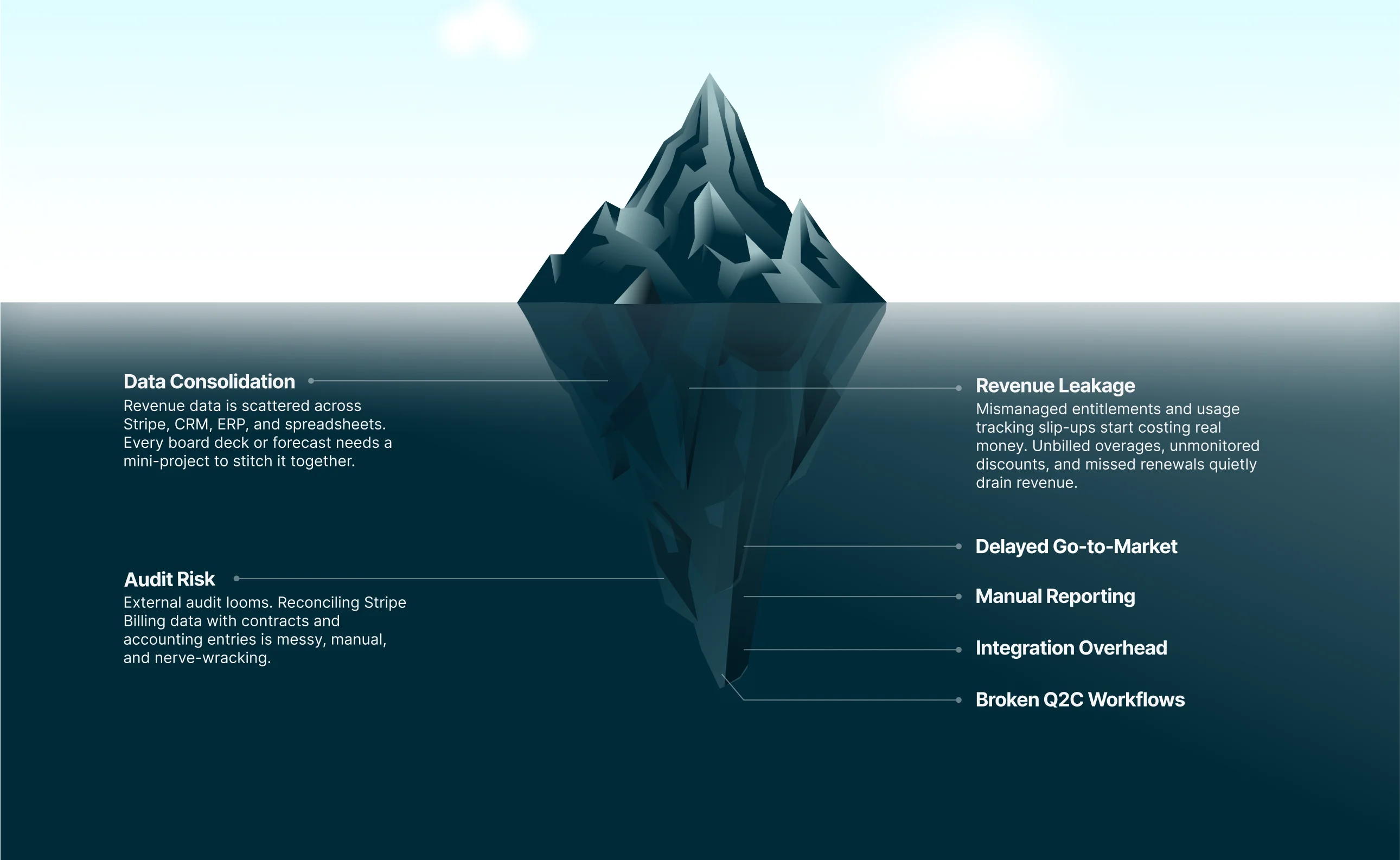

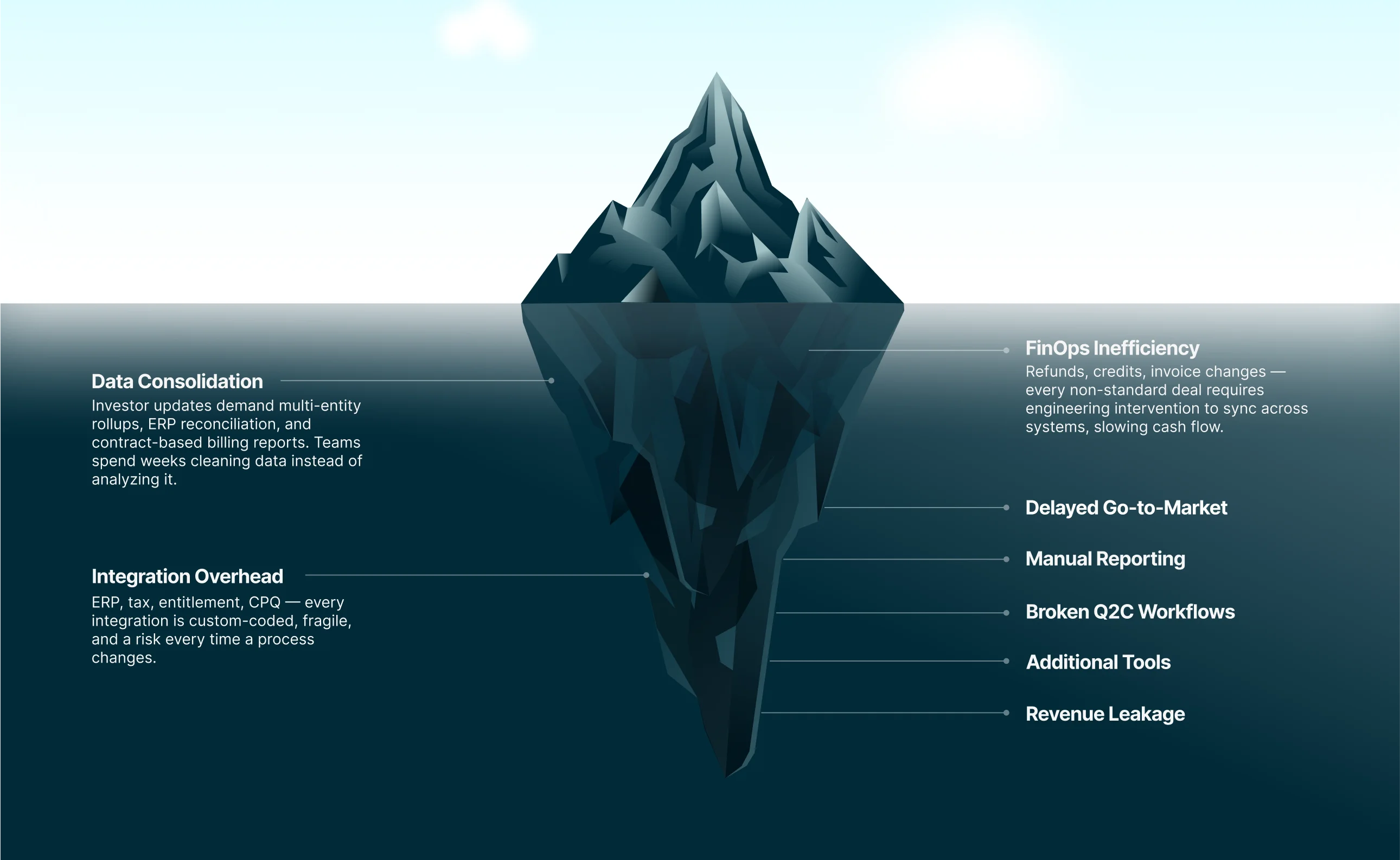

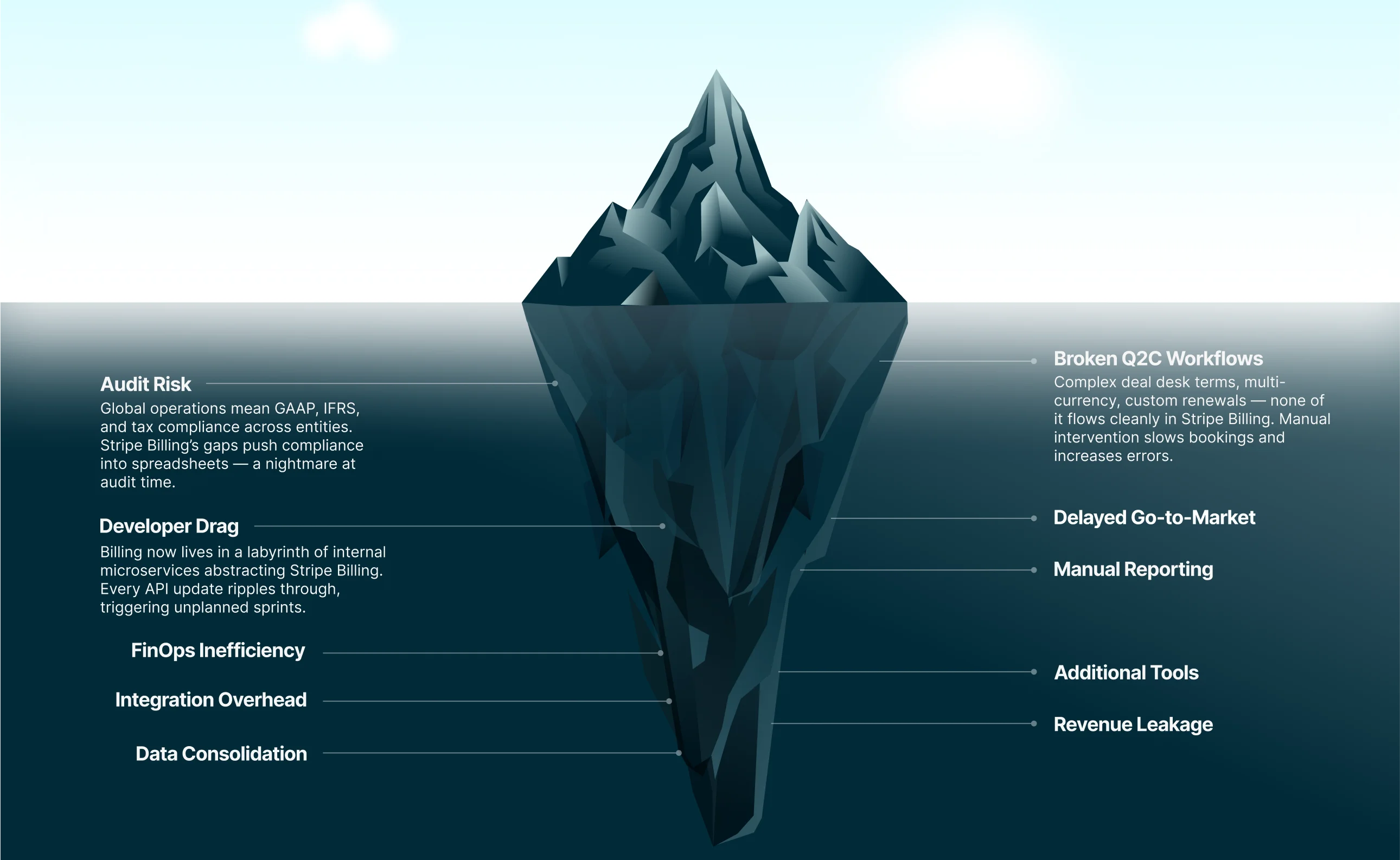

Stripe Billing may look 'simple' and 'less expensive' to get started. Initial speed advantage becomes technical debt when you go beyond basic subscriptions - costing you fees, developer time, and operational rigor. Why pay a growth tax that gets higher with every success?

| Capability | Chargebee | Stripe Billing | Stripe Billing’s (Invisible) Growth Tax |

|---|---|---|---|

| Pricing & Packaging Agility | Launch pricing tests and bundles directly from UI. Works for PLG & sales-assisted flows. | Experiments like discount scheduling or hybrid models require custom development | Delayed go-to-market, engineering bandwidth pulled from core product |

| Quote-to-Cash Workflows | Native CPQ + HubSpot/Salesforce sync with approval workflows and discount controls | Basic integrations via third-party connectors require custom work. No guardrails for sales deals | ~0.76% ARR leakage from rogue quoting and reconciliation errors |

| Usage-Based Billing & Entitlements | Purpose-built for 200K+ events/sec with near real-time metering and entitlement controls | Basic entitlements; acquired usage solution being retrofitted into core billing | ~0.5% ARR lost to silent overuse/missed billing from weak entitlements |

| API & Developer Experience | Billing logic, entitlements, and RevRec built into APIs. Low engineering effort for maintenance. | Fastest initial setup for basic recurring billing. Raw APIs give more control in the beginning. | 2-10+ engineering FTEs/month to rebuild and maintain (depending on scale) |

| Revenue Recognition | Automated deferred revenue, contract reallocation, and ASC 606 reports without custom builds. | Basic RevRec with no SSP library or complex deal structure support. Works only with spreadsheets and SQL. | RevRec gaps force spreadsheet work → Prone to errors, misstatements, and penalties |

| Reporting & Analytics | Automated reconciliation with native reporting – cohort analysis, churn insights, and flexible exports. | Raw data dumps require stitching exports or SQL for basic insights | ~12-60 hrs/month (depending on scale) stitching reports from multiple tools |

| Payment Gateway Flexibility | Integrations with 30+ gateways as strategic partners that enable your market expansion plans | Limited non-Stripe gateways with minimal optimization incentive | Missed cost savings – No leverage to lower fees or improve auth rates |

| Total Cost of Ownership | Eliminates hidden costs from developer time, tool sprawl, and manual operations | Low upfront fees masked by engineering overhead plus additional tooling costs | ~7% of your ARR (on top of the 2.9% for Stripe Payments) |

Chargebee frees your product and growth teams to run their own packaging experiments, launch new add-ons, or test usage tiers directly from the UI – without waiting for dev resources.

"Every time we need to change pricing with Stripe Billing, we think a lot, because it's a cost of opportunity... It's time we don't do product."

Handle proration, usage tiers, and contract terms from the start rather than building from raw objects. Chargebee API ships ready-made business logic, so engineering doesn't need to build and maintain new infrastructure.

"Stripe Billing API allowed for more low-level access, and we ended up just spaghetti-coding our way through. Chargebee's APIs are a good framework to structure our backend billing processes."

Prevent revenue leakage and billing errors with Chargebee's automated Q2C, so Sales can close and move fast, while Finance maintains control.

"Yesterday, we literally lost a thousand dollars on a sale because Sales applied a discount [on Stripe Billing] that they shouldn't have."

Chargebee delivers 150+ ready-made metrics, deferred revenue tracking, and automated revenue recognition so you close faster and report confidently – no SQL experience and manual reconciliation required.

"We're running SQL queries just to get basic revenue insights from Stripe Billing. We're sort of flying blind from a data perspective."

Luc Besson

Product Manager, Shadow

Shadow’s 3X Faster Launches After Switching from Stripe Billing

“With Chargebee, we confidently expanded to new countries without worrying about billing errors or manual work. I can now manage the product catalog, add-ons, and coupons myself—without relying on engineering support.”

Joonas Kukkonen

CTO, Bark

Bark’s Shift from ‘Can We Do This?’ to ‘What Can We Launch Next?’

“Features that once required 6 weeks of engineering effort can now be shipped in just 1 week. This has saved us 6 months of development time, which we’ve reinvested into core product innovation.”

Joaquim Lechà

CEO, Typeform

Typeform Consolidated Billing and Saved $1.2M

“Chargebee’s feature-rich platform has streamlined our processes, cutting our vendor count from ten to five, resulting in potential savings estimated at around $1.2 million annually.”