Track churn hidden across your revenue workflow

Get real-time visibility into churn rates, failed transactions, payment retries, and churn risk accounts.

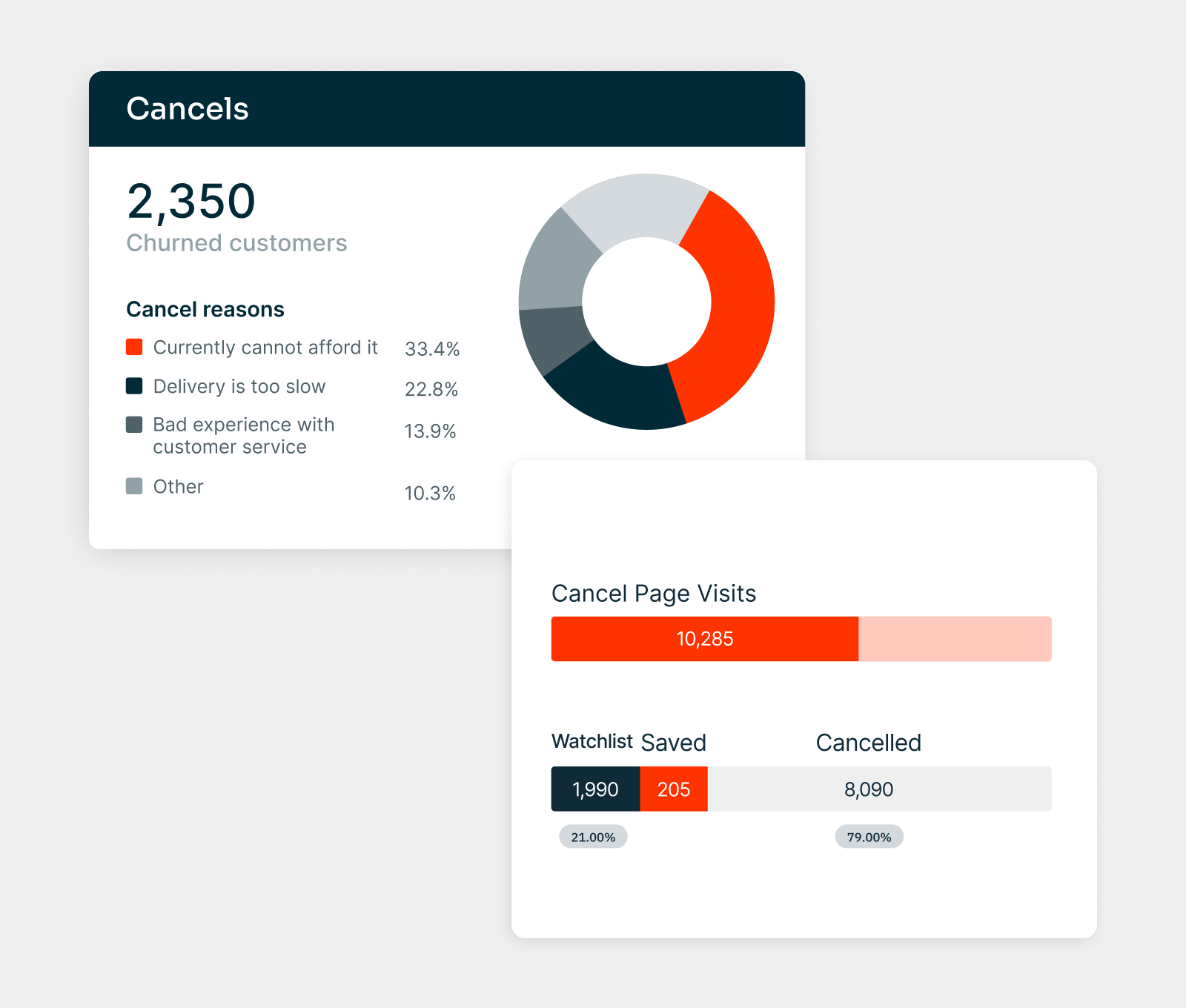

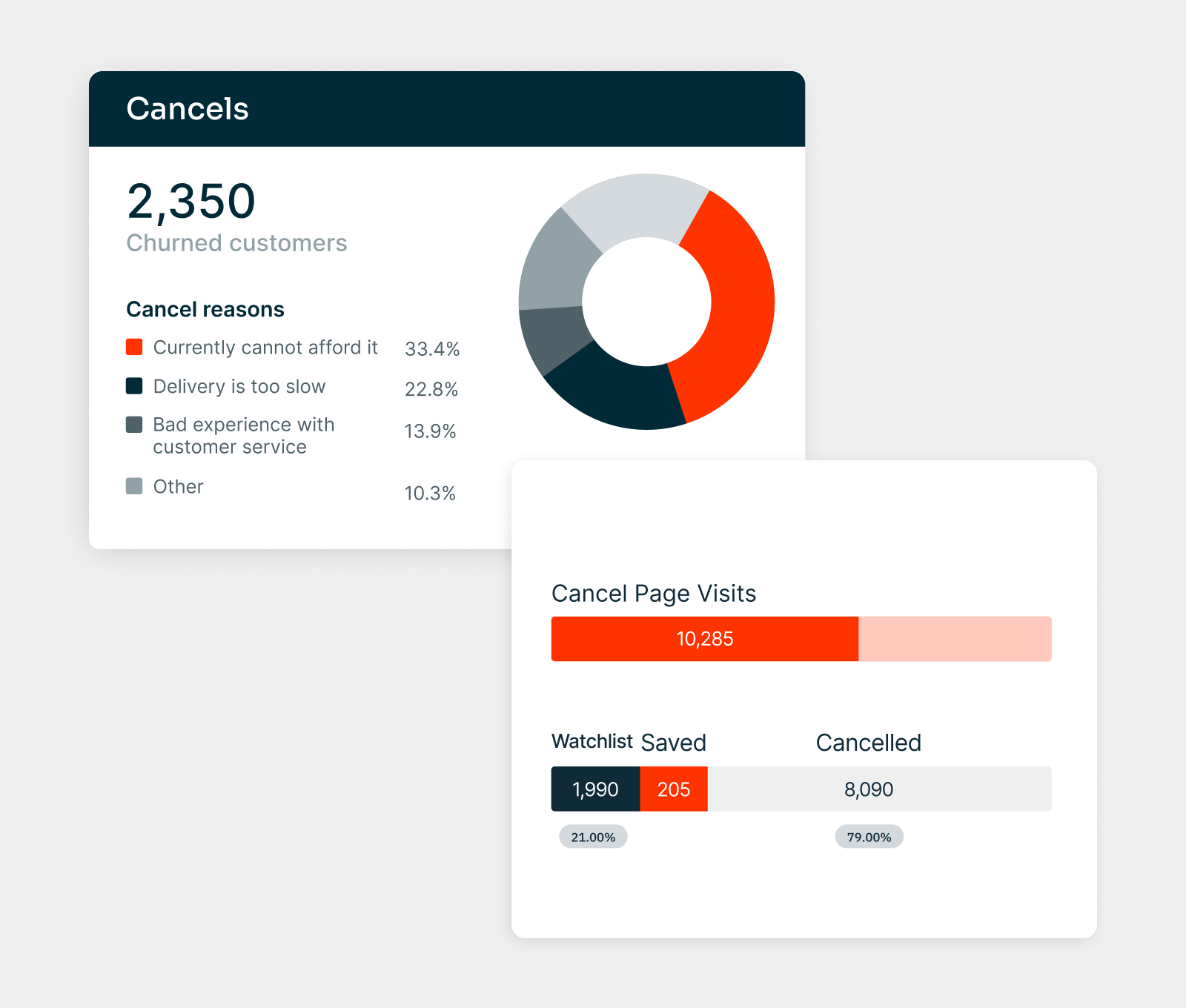

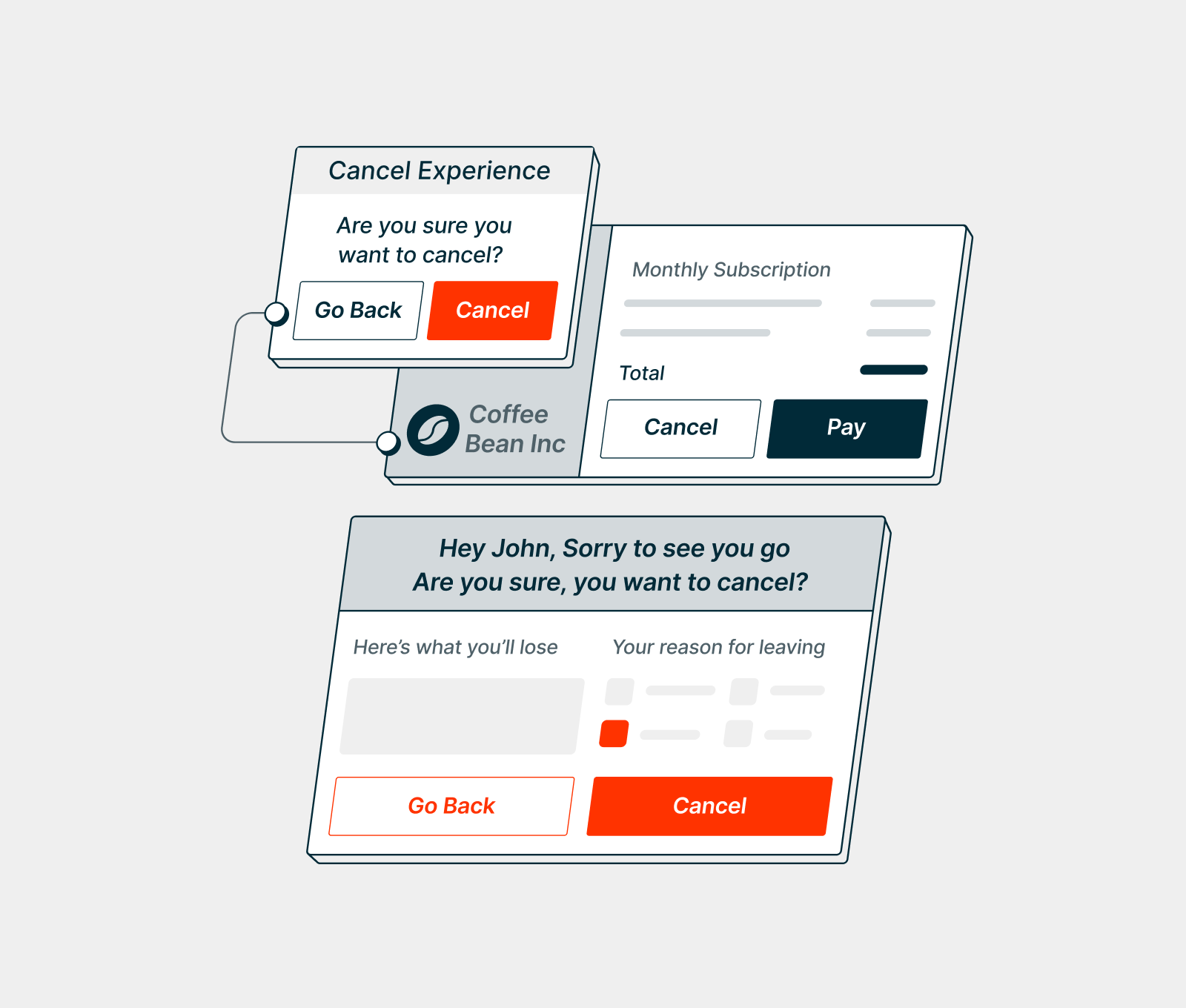

97% of customers churn silently, leaving very little feedback for improvement. Chargebee helps track customers who have attempted to cancel, who are at risk of churning, and the reasons for customer churn. This way, you get a clear picture of the state of your customer retention strategy.

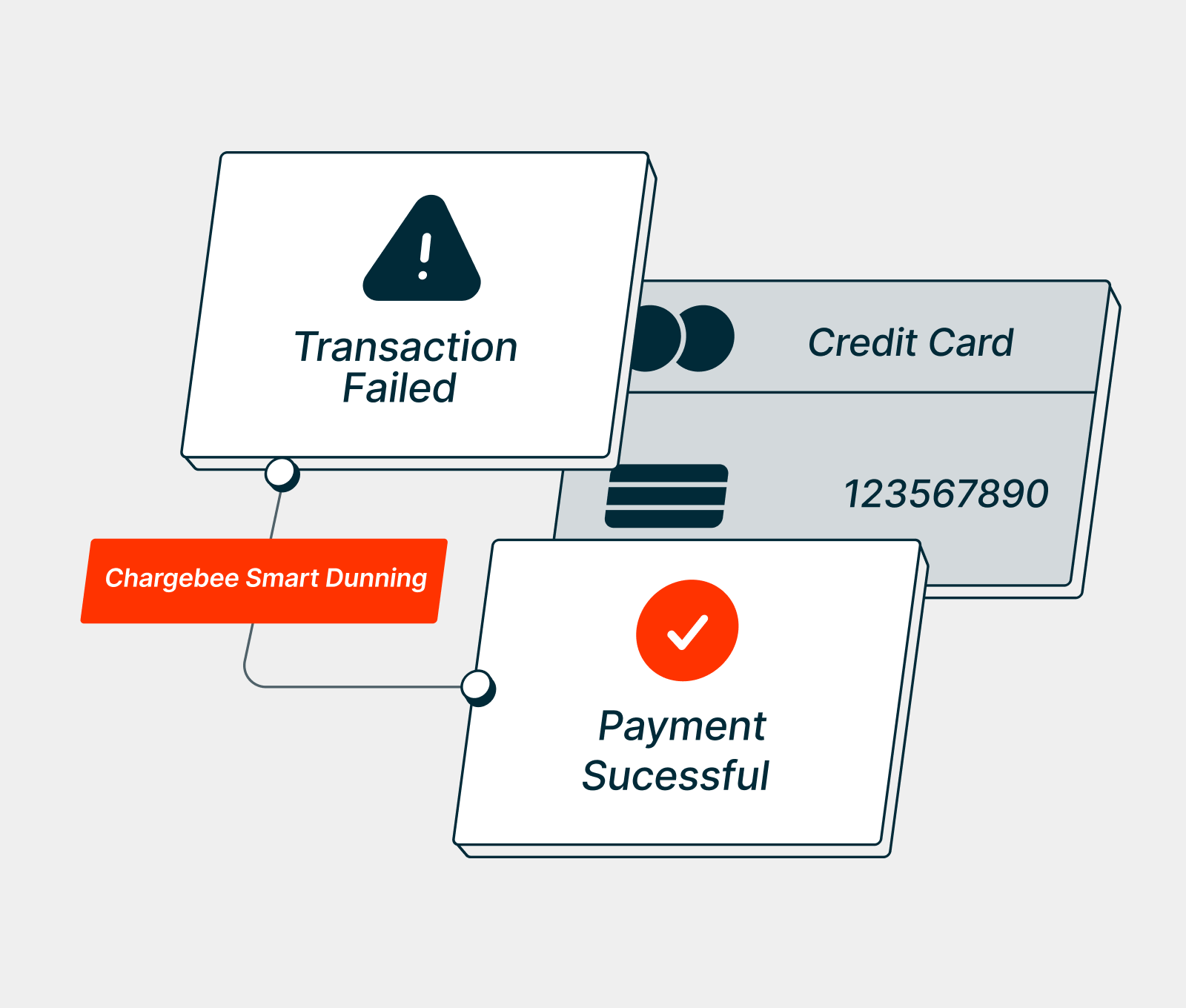

Pay close attention to payment failures when tackling churn. Chargebee offers insight into failed transactions, retries, and accounts at risk of churn. Monitor common payment errors that affect customer payments and uncover reasons for involuntary churn.

Engage customers at the right time to retain them

Develop personalized initiatives to deflect cancellations, automate revenue recovery, and retain at-risk customers.

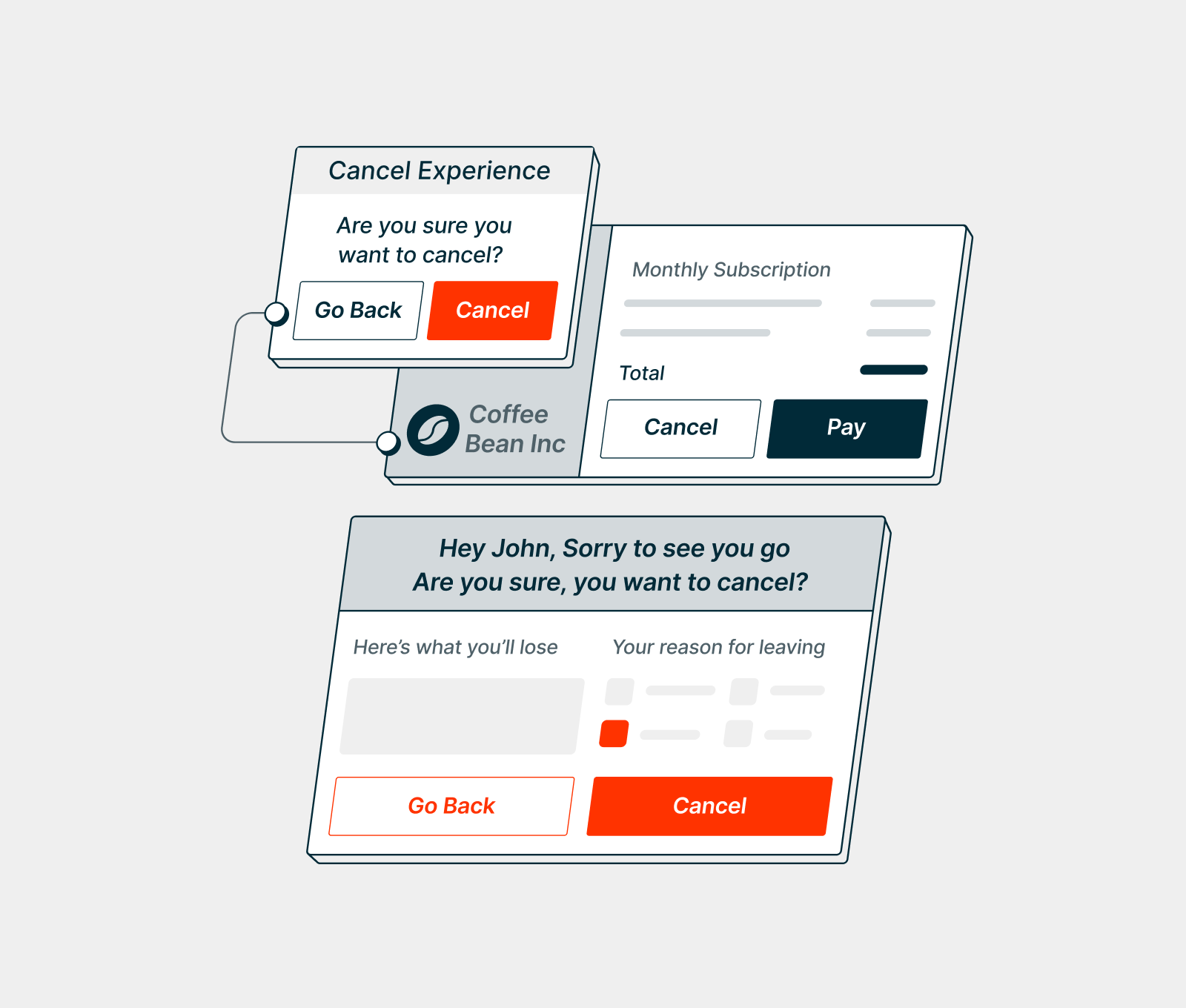

The best way to beat churn is to offer an experience a customer can't resist. Create interactive cancel pages, personalized offers, and tailored experiences unique to every customer that encourages them to stay on.

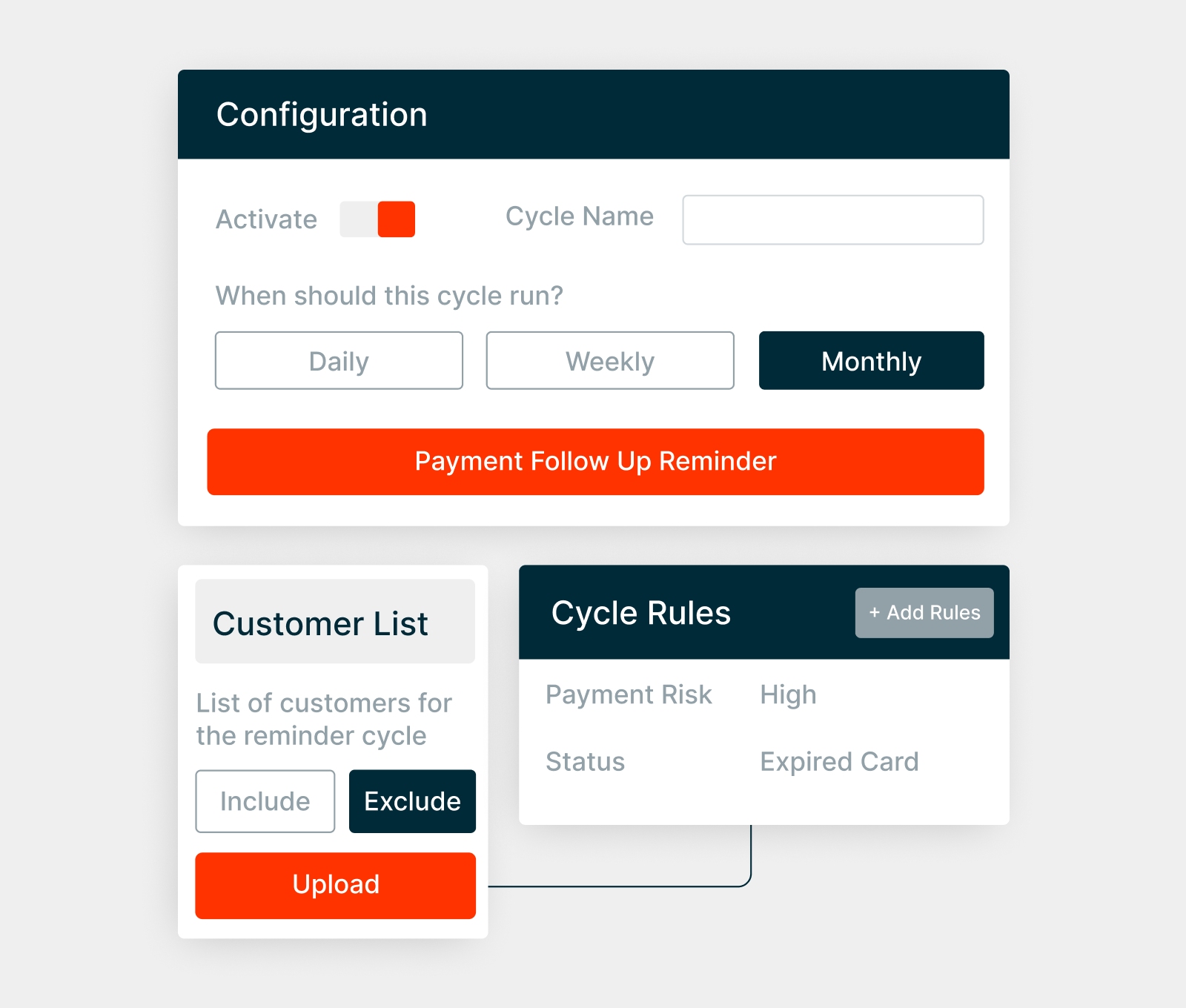

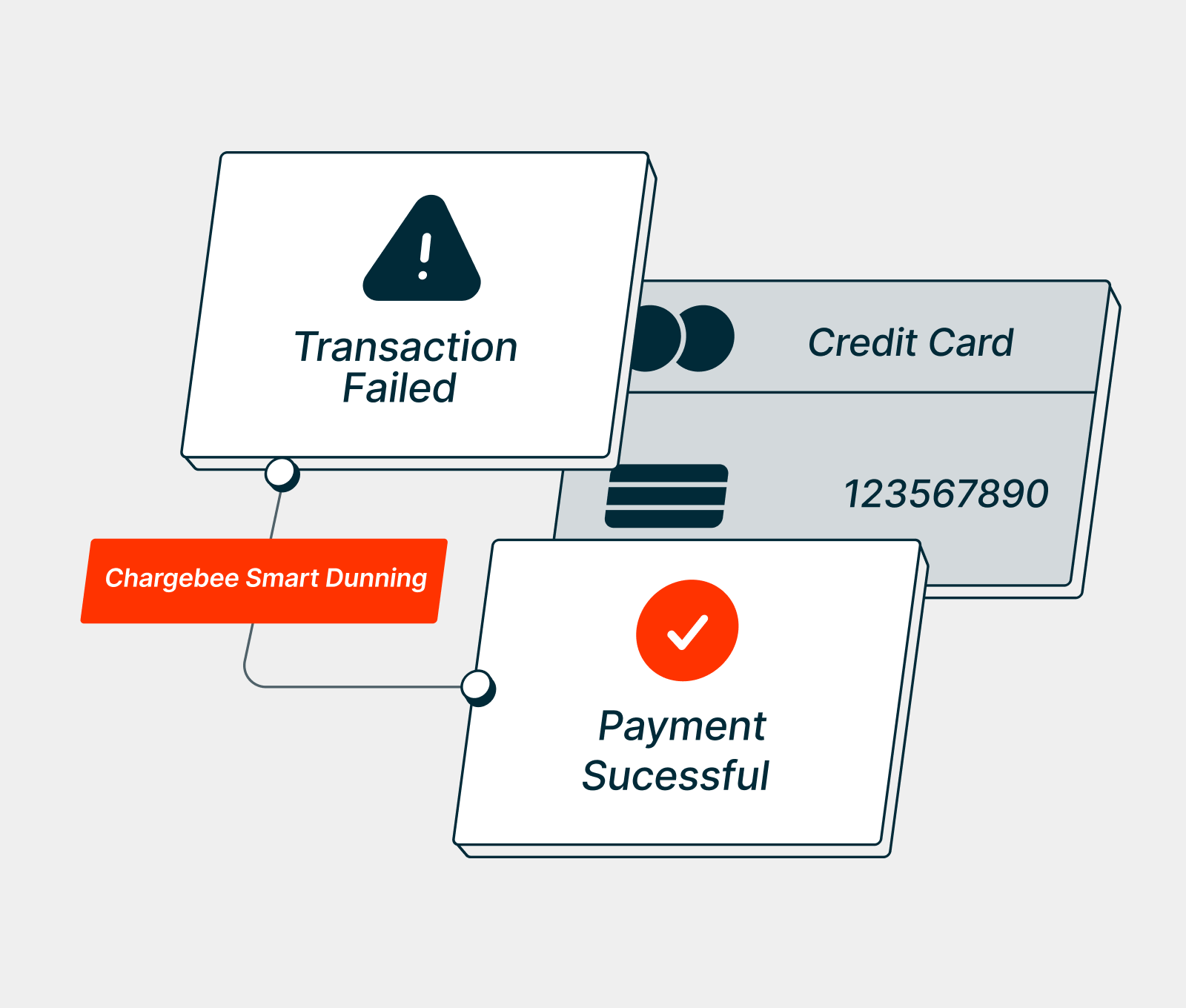

Strike the perfect balance between maximizing recovery and optimizing retries for seamless payment processing. Chargebee’s Smart Retries knows when to stop pursuing a failed transaction, ensuring efficient recovery while preserving the merchant’s reputation.

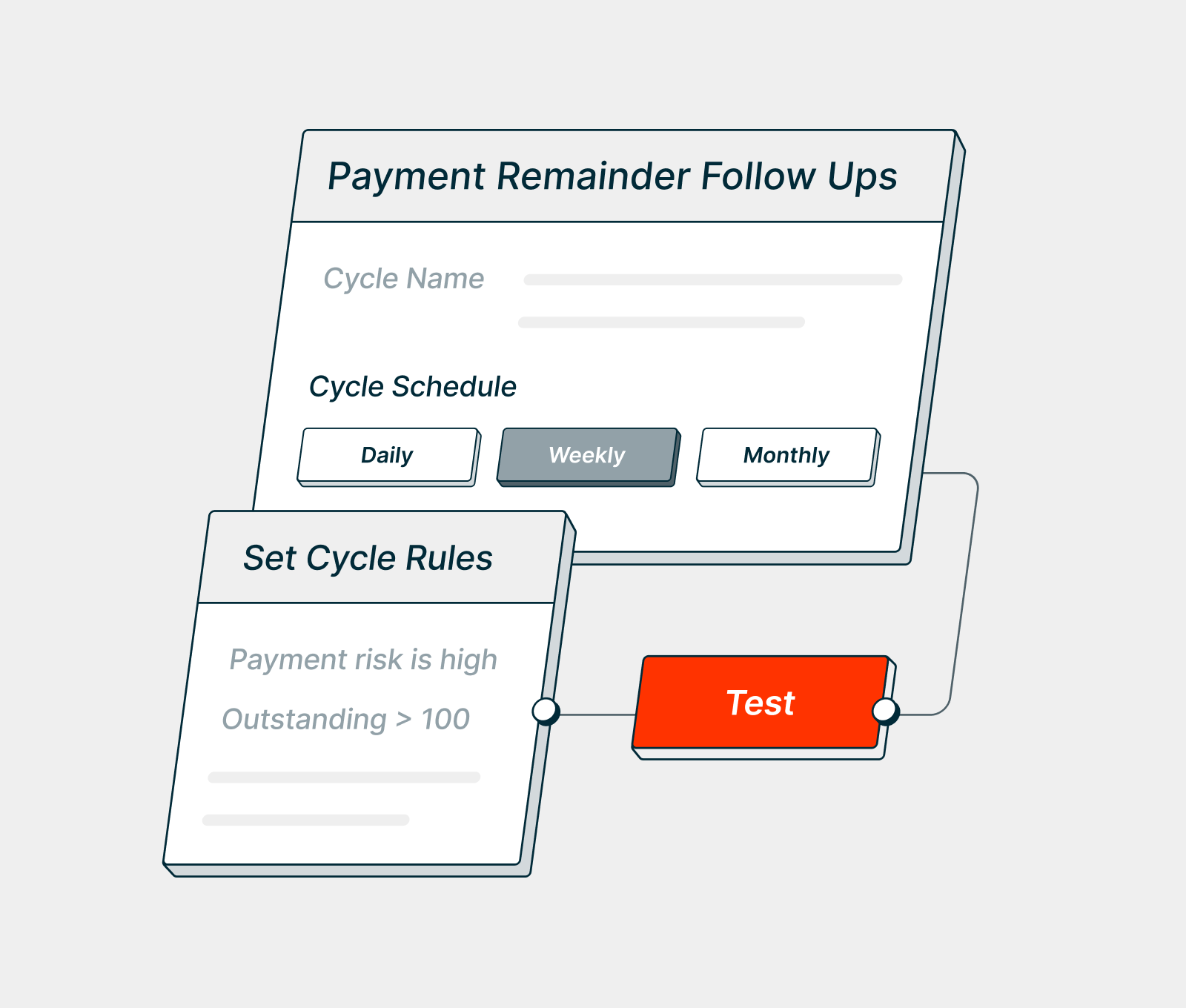

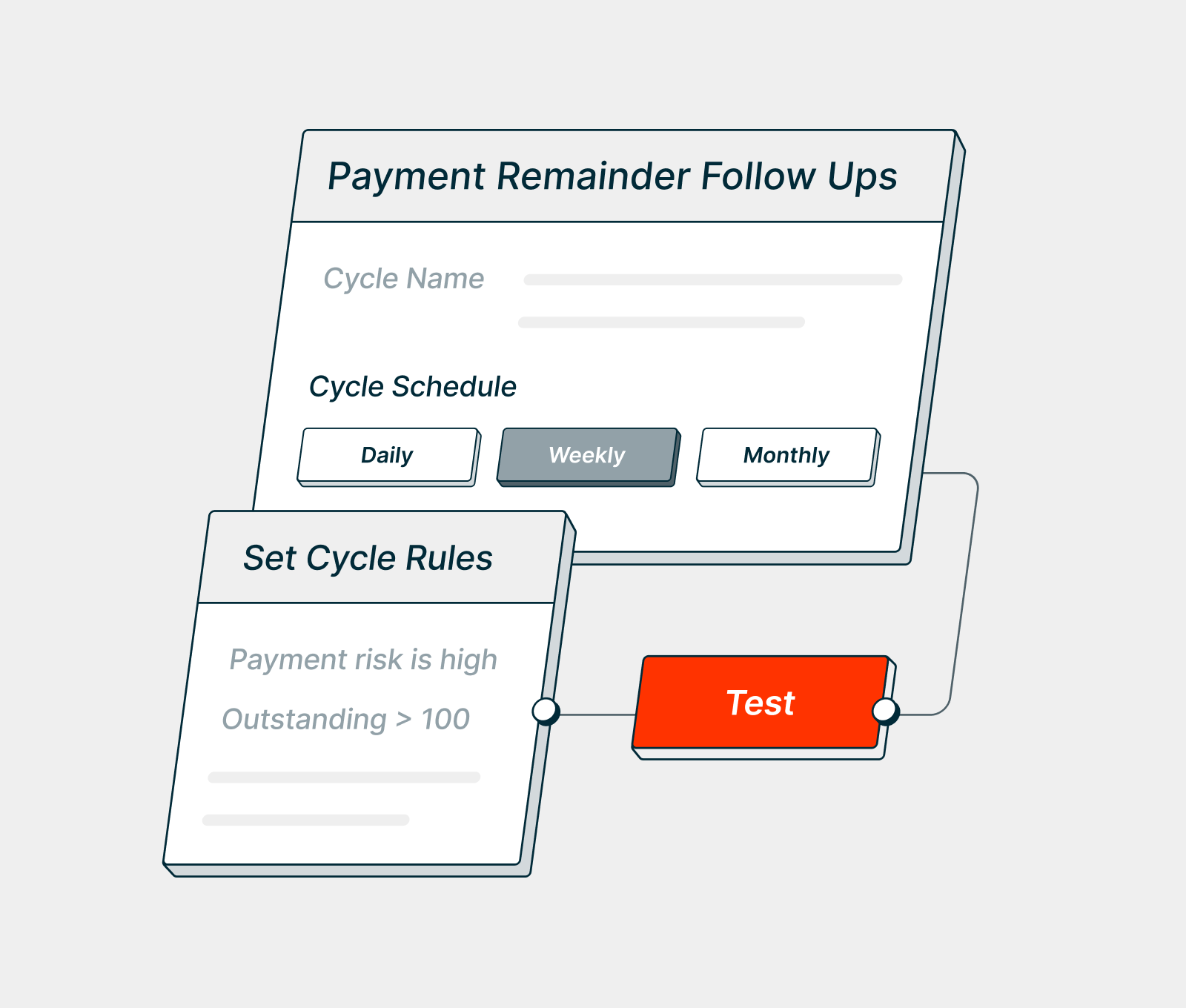

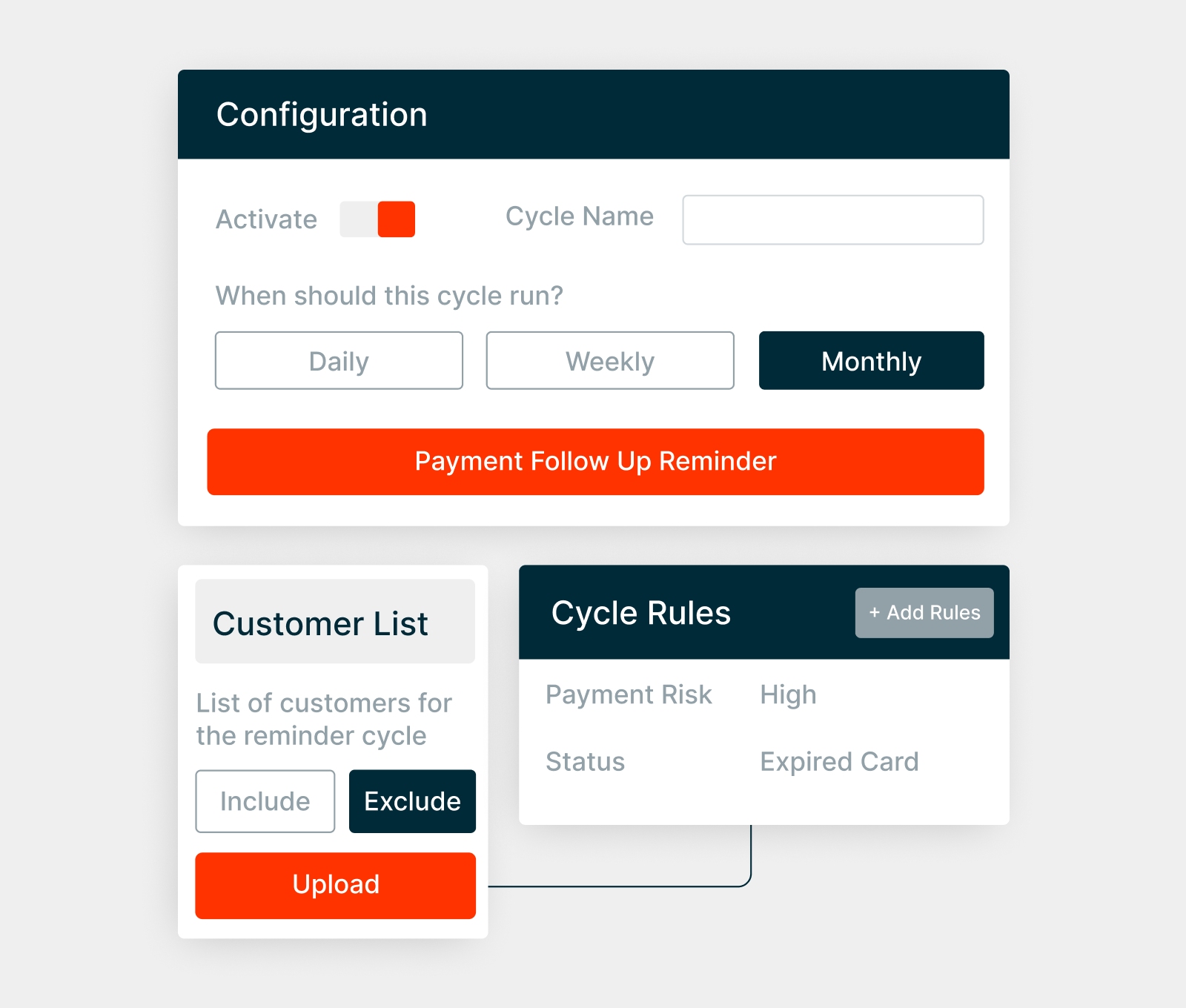

Following up with customers throughout the payment process can be daunting for your billing team. Chargebee helps set up tailored workflows to put your customer communication and revenue recovery on auto-pilot without losing the personal touch.

Detect churn before it hits you

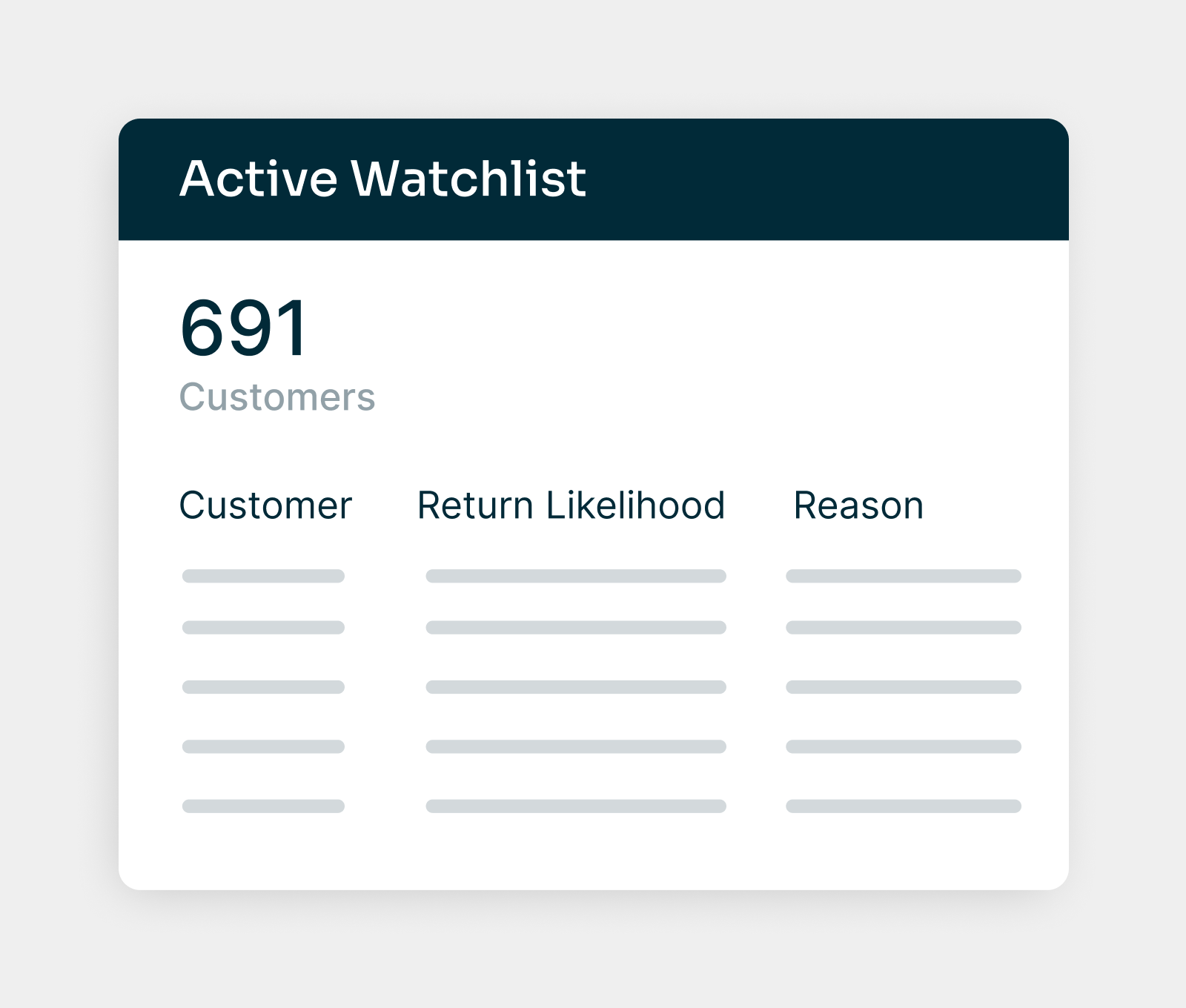

Identify high-risk customers, create a watchlist for personalized outreach, and proactively update payment details for expiring cards.

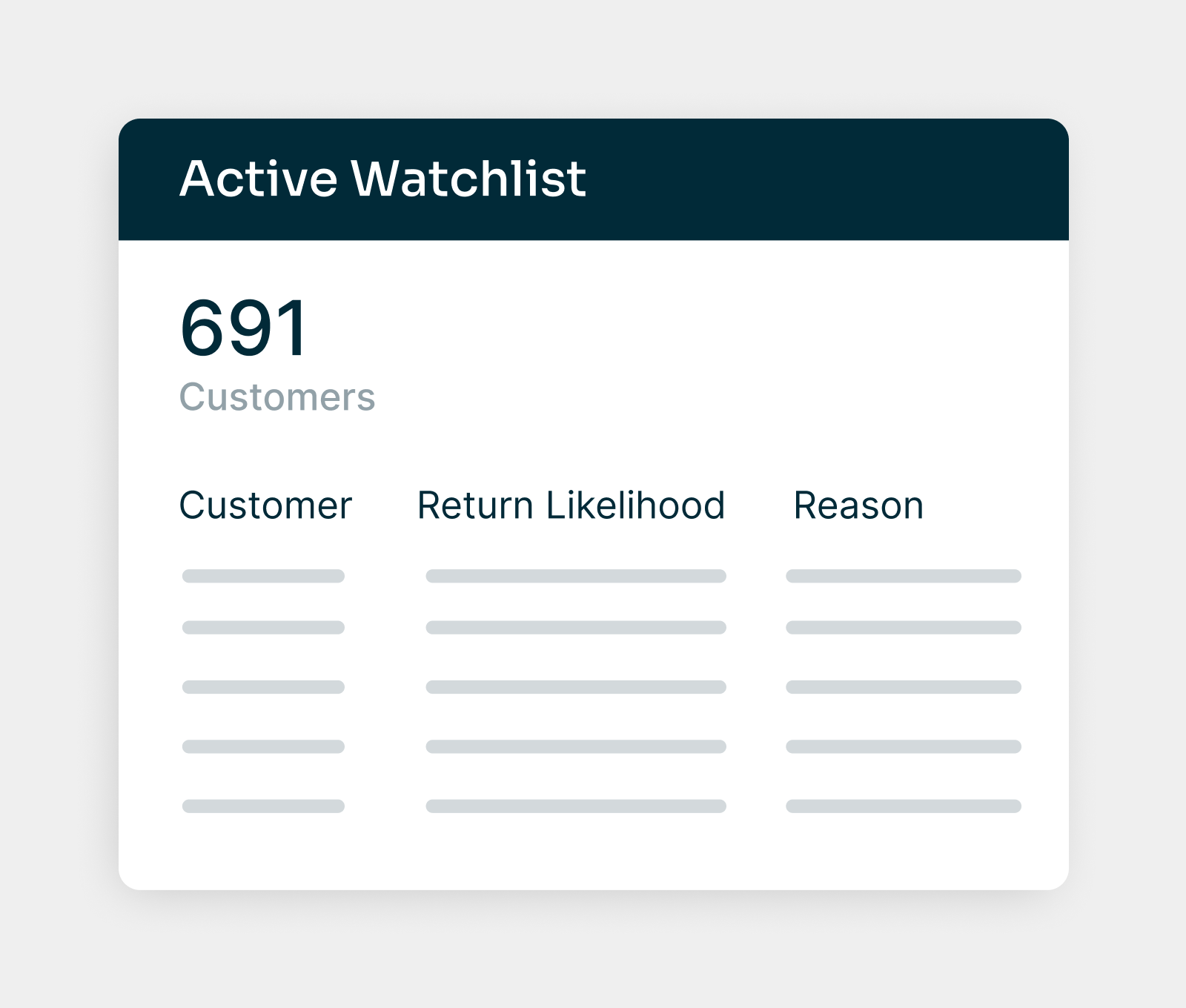

Preventing churn is all about timely intervention. Spot high-risk customers with rules, create a watchlist for outreach, launch effective campaigns, and set retention goals using industry benchmarks.

Stay ahead of payment failures with a proactive approach. Identify cards that have expired or are about to expire before the billing cycle and engage with the customers to update the payment information beforehand.