Frequently asked questions

General

-

How can I onboard MBE feature to my account?

To get started with MBE, you can create a trial site and perform a smoke test to determine the feature’s impact on your business process. Upon successful testing, you can enable it on your existing test site and eventually on your live site. Once MBE is enabled for your site, follow the steps mentioned here to create your first and default business entity.

If you have a single live site in Chargebee, enabling Multi-Business Entity on the existing site is straightforward. All existing customers on that site will be moved into the first entity. Additional entities can be created as needed, inheriting site settings and customizable at the entity level.

- If there's a need to move/transfer customers across entities within the same site where Multi-Business Entity was enabled, you can use the customer transfer feature.

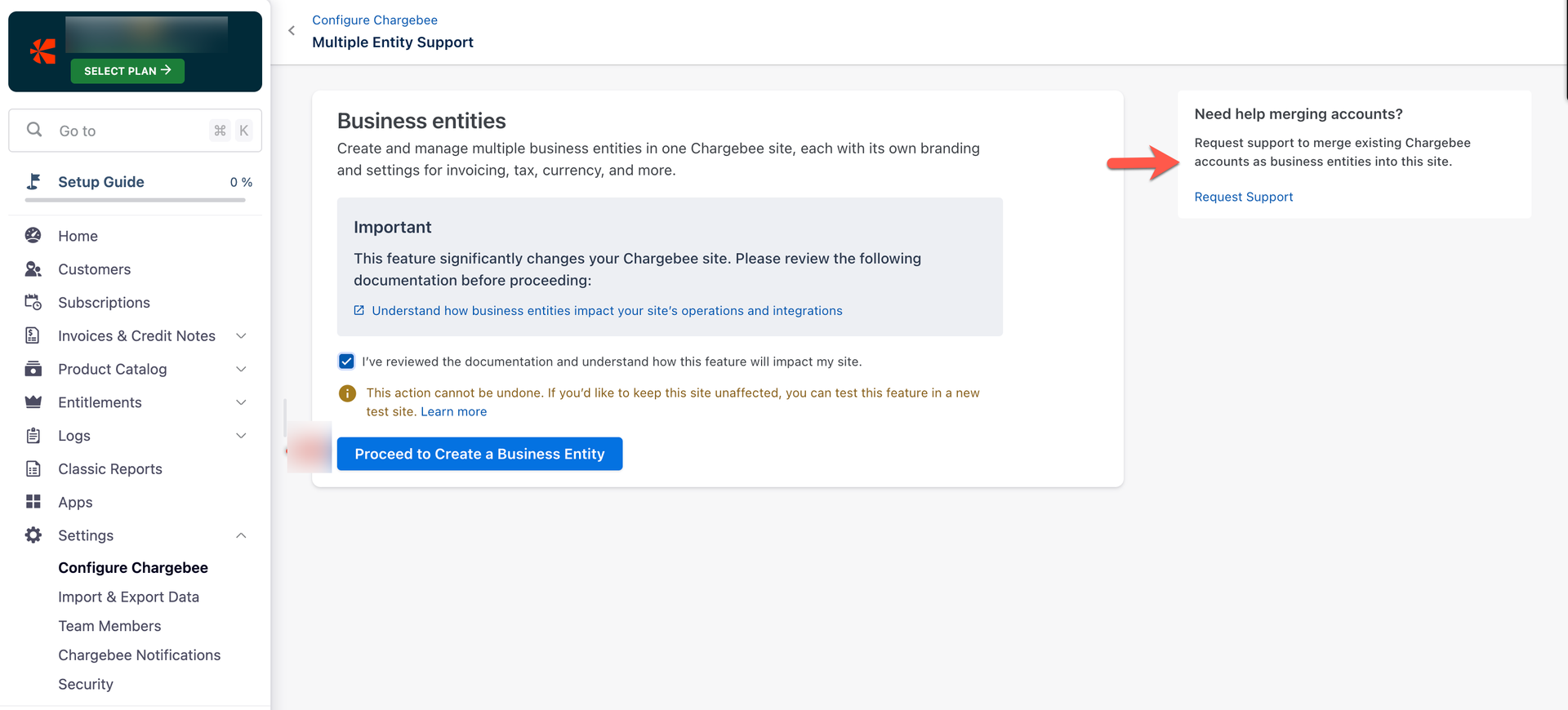

However, if you have multiple live sites in Chargebee, they need to be merged into a single Multi-Business Entity site. You can raise a request to merge sites by clicking ‘Request Support’ as shown in the image below.

-

What are the current limitations and compatibilities?

We have explained the limitations and compatibilities in detail in this article - Limitations of multi-business entity feature.

-

What is the maximum limit of business entities that Chargebee supports per site or account?

Currently, we have a limit of 30 business entities within a Chargebee site.

-

What is the API credentials access level for an MBE-enabled domain or account?

The API credentials are at the site-level API, and the business entities inherit them. Learn more.

-

Are there any public APIs for creating, retrieving, and modifying business entities?

Currently, there are no public APIs available for creating, retrieving, and modifying business entities.

-

Is there an audit trail system in place to track changes and updates made in the "Settings"? While using Multi Business Entity, including the details of what was changed, who made the changes and when?

Irrespective of MBE, we do not have audit tables for these "Settings".

-

Does the multi-business entity-enabled domain support account hierarchy?

The current implementation allows for account hierarchy within a single business entity, but it does not extend across multiple business entities.

-

Is it possible to change the business entity for a customer, if they were initially assigned to a wrong business entity?

Currently, there is no option to change the business entity for a customer once created.

However, we are actively developing a workflow that allows customers and their related resources to be moved to the correct entity. This feature is currently in development and will provide an option to move customers to the appropriate business entity after they have been created. To correct this, the merchant must recreate the customer and their subscriptions in the correct entity. Afterward, they can cancel the subscriptions and delete the customers from the original (incorrect) business entity.

-

Do the business entities and their configurations get deleted when using the Delete sample data functionality in Test sites? If so, do they get restored when using the Repopulate sample data utility?

No, business entities and their configurations do not get deleted, however, only the data from business entities are removed.

-

What is the process for deleting business entities on my site?

There is no option to delete the business entity. Also, changing the business entity ID is not allowed, but it is possible to rename a business entity on your site.

-

What is the default or first or origin business entity? Is there a way to identify it in the User Interface?

Once MBE is enabled for a site, a default business entity is created in a disabled state. When a user enables MBE from the settings page, the default business entity is updated with the provided name, and its state is changed to active. The purpose of the default business entity is to handle internal operations when no specific business entity is provided, serving as a fallback entity. This default business entity concept is utilized in the checkout and portal flow and in some aspects of taxation. Currently, there is no direct user interface functionality to identify the default business entity. However, a workaround is using the debugger tool to access the business_entity or list API. By observing the list and identifying the business entity with the lowest ID number, you can determine the default or first entity. We are actively developing dedicated functionality to streamline the identification of the default business entity in the user interface.

-

Can we do dunning at the business entity level?

No, dunning is limited to the site level.

-

Is it possible to have currencies (different base and additional) at the entity level?

No, currently currencies are limited only at the site level.

-

What export functionality is available for Finance Executives as part of their user role? We have enabled export functionality at the site level as part of the finance executive user role. Finance Executives with visibility over all business entities within the site will be able to export data from the Customer, Subscriptions, Invoices, and Credit Notes index pages when viewed from the site level.

- Finance Executives with access to all entities: Can export data from both the site and business entity views.

- Finance Executives with access to specific entities: Can only export data from the business entity view they have access to.

Learn more about business entity-related access roles.

-

Is it possible to have the same customer in two different entities? For example:

- Cust XX in Entity A

- Cust XX in Entity B

Can the same customer exist in these two different entities, as long as their email IDs are different?

By definition, if a customer is created under Entity A, it can not be linked to any other entity, so if a customer "Cust XX" holds a subscription with Entity A and the same customer is going to start a new subscription with Entity B, this will require duplicating the customer under Entity B and creating the subscription there. As a result, customer "Cust XX" will be duplicated on both Entity A and Entity B and we will have two customer IDs for the same customer "Cust XX".

Now to have a unified view of the customer consolidated across entities, we should follow this approach:

- Create a single-line text custom field for the customer object in Chargebee.

- Add the same value in the custom field for the customer across the entities.

- The custom field that you have created here must be mapped with the Unique Customer Handle custom field in RevenueStory.

- Once the mapping is done, the metrics on the customer Insights dashboard in RevenueStory will be computed based on the Unique Customer Handle.

Note: We anticipate that the feature will receive priority this year.

MBE - Onboarding and Setup

-

Is the Multi-Business Entity feature available for all customers?

No, it is available on specific Chargebee plans and pricing.

-

I am an existing Chargebee customer, how can I get onboard to the Multi-Business Entity feature?

To access Multi-Entity, enable this feature on your site.

- If you have a single live site in Chargebee, enabling Multi-Business Entity on the existing site is straightforward. All existing customers on that site will be moved into the first entity. Additional entities can be created as needed, inheriting site settings and customizable at the entity level.

- If there's a need to move/transfer customers across entities within the same site where Multi-Business Entity was enabled, you can use the customer transfer feature.

- However, if you have multiple live sites in Chargebee, the process changes. In this scenario, it needs to be merged into a single Multi-Business Entity site. There are two ways to achieve this:

- Self-serve: Chargebee will provide you with detailed steps and APIs to consolidate data from multiple sites into one MBE site. Note: Please reach out to us for comprehensive documentation on this option.

- If you prefer Chargebee's PS&I team to consolidate data from multiple sites into one MBE site, there will be associated costs. Please reach out to your respective CSM or Account Manager for further assistance.

- If you have a single live site in Chargebee, enabling Multi-Business Entity on the existing site is straightforward. All existing customers on that site will be moved into the first entity. Additional entities can be created as needed, inheriting site settings and customizable at the entity level.

MBE - Taxes and Integrations

-

What logic is used for tax calculation in different business entities?

Taxes will not be calculated if a business entity doesn't have a mapped Organization Address.

- Tax will be calculated if the country of the customer's billing or shipping address is configured with tax.

- Tax calculation is independent of business entity address, however, for some workflows like Reverse charge, VAT export note, Inclusive pricing, and more, we use the organization address of the business entity.

-

Can I connect individual companies configured within Avalara Sales & Communications Tax corresponding to each business entity in Chargebee?

Yes, we will capture the business entity-specific company codes after you have entered the Avalara credentials for the site. We allow company code addition only for business entities with an organization address. We also capture unique company codes for each business entity. Currently, the functionality to establish a 1:1 mapping of Profile ID to Chargebee business entity for Avalara Communications Tax ensuring enhanced functionality and compatibility is not supported.

-

How can the mapping of the default business entity in Avalara Sales Tax be changed from one business entity (For example, default/first/origin) to another?

No, currently we don't allow to change the default business entity. However, the address displayed in Avalara does not impact tax calculation or company code mapping. During tax estimation, the system refers to the organization address of the business entity and the company code provided by the user. The displayed address is for reference purposes only, ensuring that the default business entity address is configured for the Avalara setup.

In summary, merchants can disregard the address shown as the default business entity's organization address, and the company code will be determined during tax calculation based on the customer's information. Additionally, no specific business logic is implemented for a default business entity in Avalara.

-

How are business entities set up for customers in Salesforce? Is it at the company level? How many business entities can be integrated within one Salesforce instance?

Business entities in Salesforce are linked to customers at the account level. Within Salesforce Visualforce pages, you can choose a specific business entity to associate with an Account. Currently, there is a limit of 30 business entities per Salesforce Organization (Org).

-

What should I do if I encounter an issue where I cannot make changes to tax configurations at the entity level and receive the message "You do not have access to this page. Contact your site admin for details" for a specific region?

In order to make changes to tax configurations at the business entity level, it is essential to ensure that the tax rate is specified at the site level. If you are unable to edit tax information for a specific region, it might be because only the Tax Registration Number is configured for that region at the site level. According to our system's design, access to a region at the entity level is not possible without a defined tax rate. Please ensure that a tax rate is set for the specific region at the site level to access and edit tax information at the business entity level.

MBE - Email Notifications

-

How do email notification settings work for Multi-Business Entity (MBE) sites?

Email notifications in Chargebee’s Multi-Business Entity (MBE) sites follow the standard configuration process as regular sites.

However, there are a few important differences in an MBE setup:

Site-level vs. Entity-level settings Email notification settings configured at the site level do not automatically apply to individual business entities.

Entity-specific configuration Each business entity must have its own email notification settings configured separately, based on its needs.

For example, If a customer is created in a particular business entity, email notifications will only be sent if notifications are configured for that entity.

MBE - Invoices, Credit notes, and Quotes

-

Is it possible to have different languages for invoices, credit notes, and quotes at the business entity level with the MBE feature?

No, in the Multi Business Entity feature the language settings are common across all business entities and can only be configured at the site level.

A single language pack is used to translate the site as well as all its business entities.

-

How the manual emails for Invoices, Credit notes, Quotes, and Changes in Payment method be sent to Multi Business Entities?

Currently, users can only trigger manual emails from the business entity view. However, we are actively exploring the possibility of enabling email sending from the site view as well. Learn more.

MBE - Payments and Gateways

-

How are base and reporting currencies converted into the reporting currency?

The conversion of base and reporting currencies into the reporting currency for the MBE-enabled site is carried out as follows:

- Exchange rates are synchronized from either the Chargebee App or Open Exchange.

- The base currency is converted to the reporting currency based on the site settings.

- All other entities within the site inherit the currency settings at the site level.

For instance, let's consider a scenario where the base currency is EUR and the reporting currency is USD at the site level. In this case, both the site-level reporting and the reporting at the business entity level will be generated in USD.

-

How can subscription payments be classified or routed to the appropriate payment gateway when any two payment gateways are configured for a single currency?

It is not possible to have multiple gateways for a single currency and payment method combination, regardless of MBE. However, you can implement custom logic to control routing through custom development. Merchants can define their logic for routing and use that logic to determine the gateway account to be used. By specifying the gateway_account_id in the appropriate field, smart routing will be bypassed, and the specified gateway account will take precedence.

-

What is the precedence order for payment gateways when configuring multiple gateways for different currencies, and how does business entity-level configuration override smart routing?

The precedence order for payment gateways depends on the specific configuration of mapping payment gateways with currencies. Let's consider an example where we have configured Payment Gateway (PG1) for the currency USD, but no payment gateway is set up for CAD. In this scenario, if we attempt to create a subscription with CAD currency, the online payment method will fail and an error will be returned. This happens because there is no corresponding gateway available for the CAD currency.

When a business entity overrides smart routing, all payment logic is derived solely from the business entity's settings, rather than the site level. As a result, the precedence of payment gateways depends on the business entity-level overrides. These overrides take priority over the default smart routing logic, allowing businesses to tailor their payment configurations to meet their specific requirements.

-

What happens if no payment gateway is configured for a specific currency at the business entity level when creating a subscription?

If no gateway is configured for the currency at the business entity level, creating a subscription using checkout or API will result in a failure.

-

Is it feasible for a business entity to make use of a gateway provided by another business entity within the same site? Alternatively, can multiple business entities on the same site share a single gateway account?

Yes, utilizing a single gateway account for multiple business entities is possible. Learn more about business entity-based smart routing.

-

Is it possible to override the card or payment method verification amount in a Multi-Entity setup, similar to non-MBE sites?

Yes, it is possible to override the card or payment method verification amount in a Multi-Entity setup. You can contact our support team with the specific gateway and APM (Alternative Payment Methods) combination for which you wish to override the minimal amount. Note: If the override is done, it will apply to all entities within that site.

-

Is it possible to connect one GoCardless account with two Chargebee sites?

Currently, it is not possible to connect one GoCardless account with two separate CB sites. However, with a Multi-Business Entity setup, a merchant can connect a single GoCardless account and use it across two different entities. This is because there is only one GoCardless account at the site level. Connecting two separate GoCardless accounts to Chargebee at the site level is not supported.

-

Does the Multi-Business Entity feature support Direct Debit?

Yes, Direct Debit is supported for Multi-Entity enabled sites.

MBE - Hosted Pages

-

Can I establish a business rule or an automated process through the API that assigns a business entity to new customers based on their billing country? Subsequently, can I direct these customers to the corresponding checkout page?

Currently automatic mapping isn't supported. Customer mapping to the appropriate business entities must be performed manually. If applicable, you can modify your signup workflow to include the business entity ID during the customer creation process.

MBE - Orders

-

How can I use Chargebee's Order module with Multi-Business Entity Capability when the documentation indicates its "Upcoming"?

To use Orders alongside the Multi-Business Entity capability, please reach out to support@chargebee.com to get it enabled from the backend. The Order module will be supported at the site/master level and will not have separate settings for each entity; instead, there will be a single common setting for the entire site.

MBE - Other Features

-

How many webhooks can be configured for an MBE-enabled domain and where?

Regardless of MBE, users can create a maximum of five webhooks, which can only be configured at the site level.

-

How can selecting different data centers be handled once the multi-business entity feature is enabled?

During the site setup, the data center region is selected and remains the same when enabling the MBE feature. If there is a need to change the region later, a structured process is in place for batch migration, ensuring minimal downtime and data loss. Contact your AMs, CSMs, or Chargebee support for more information. Note: Currently, individual business entity-specific data center assignment is not supported.

Was this article helpful?