Lost revenue, unhappy investors, and negatively impacted bottom lines… Churn is every business’ nightmare come true. As much as we’d like that, it is impossible to retain all 100% of the customers. While customer attrition is inevitable, analyzing it in time can help curb it significantly and give you critical insights about your business. In this post, we will explore:

4W framework for churn analysis

10 effective ways to reduce customer churn

Before we dive in, let’s get the basics straight.

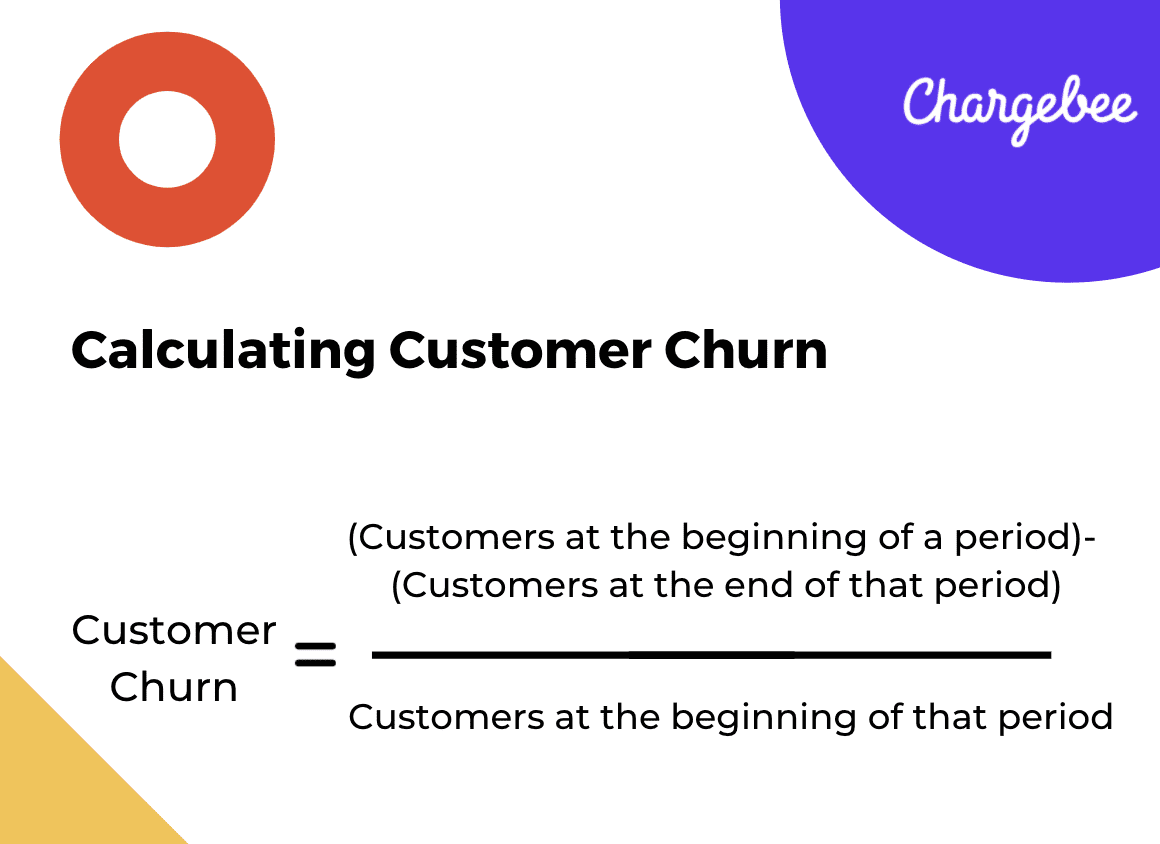

Customer churn (also known as logo churn) is the ratio of the number of customers lost during a given period (typically a month or a year) and the number of customers present at the beginning of that period. It is usually expressed in percentage terms as an annual or monthly figure.

For reducing it, it’s first important to understand the root causes of customer churn.

What Causes Customer Churn?

Your customers don’t really want to cancel. At least, not all of them. Between 15-30% of customers leave for reasons that are within your control. Understanding why your customers leave helps in managing churn better by developing focused strategies to tackle it. Here are some reasons why your customers could be churning:

Poor Onboarding

The onboarding process helps new customers ease into using your product and all the neat features that it has to offer. Training materials, video tutorials, product documentation are all part of onboarding. Many businesses metricize onboarding by defining an ‘Aha moment’ in the customer journey of product use. For instance, Hubspot‘s ‘Aha moment’ is when new customers use five key features within the first 30 days of onboarding.

A lack of effort on onboarding can lead to your customers missing out on some of your product’s core offerings and abandoning it, resulting in churn.

Poor Customer Service

Customer service is an important facet of customer experience. A survey found that 96% of customers will leave you for lousy customer service. And it doesn’t stop there; unhappy or disgruntled customers may take to social media and other platforms to leave bad reviews. That means negative word of mouth, and that’s a slippery slope. Check out this blog to know how you can better your customer service beyond support.

Value Proposition Misalignment

High churn means it is time to reevaluate your messaging and packaging. Sometimes customers churn because they do not get the value they expected out of the product. It can mean they misunderstood/misinterpreted your value proposition, and that’s why it is essential to reassess it periodically.

Here’s an insider view of how we do Continuous Customer Development at Chargebee with the help of a value prop canvas.

Rigorous Competition

Another cause of customer churn is switching over to the competition. It could be because of pricing or a better match of product features with the customer’s needs. It is crucial to keep an eye on competitive activities and keep investing in product development to match the customer’s changing needs and expectations.

Involuntary Churn

One approach to segmenting by actionability is determining whether the churn is voluntary or involuntary. Voluntary churn happens when the customer actively chose to leave, meaning they hit the cancel button or contacted support to initiate cancellation. Involuntary churn occurs when a customer doesn’t intend to leave and is generally related to payment problems like payment failures. Voluntary churn accounts for the majority of churn in most businesses, and represents an overlooked opportunity for retention-based growth. A common occurrence for subscription businesses is when a customer’s payment attempt fails and leads to subscription cancellation. It’s called involuntary churn

Reasons for Involuntary Churn:

- When an expired card is used

- Hard declines happen when a card is reported lost or stolen

- Soft declines occur when a credit card has maxed out its limit

- Banks can decline the card (due to suspected fraudulent activity, frozen accounts, etc)

Involuntary churn can be reduced, just like voluntary churn, with appropriate strategies in place.

If you want to jump to how you can prevent and reduce churn, please do so here.

How to Analyze Customer Churn?

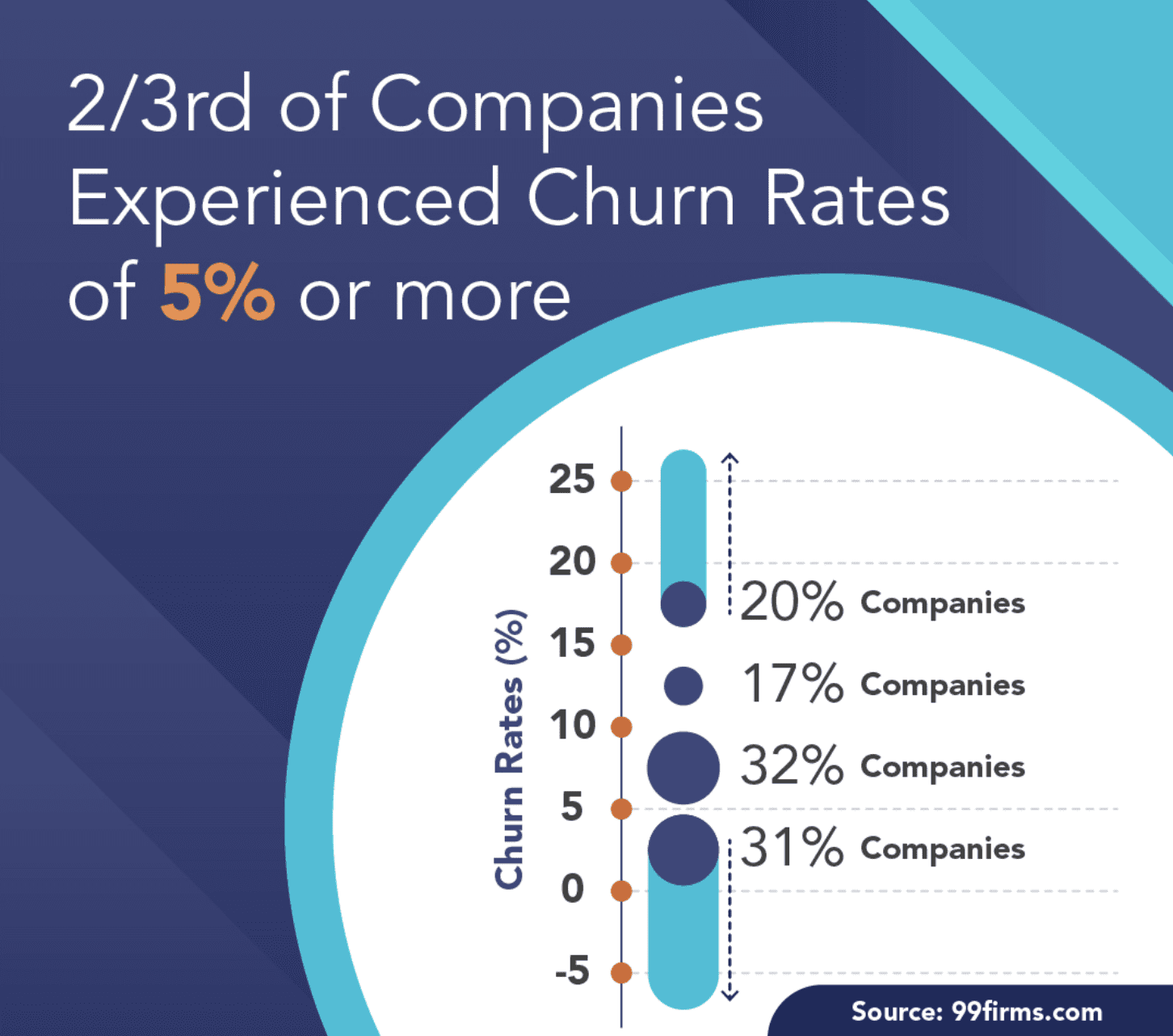

Customer churn benchmarks vary across industries. While the SaaS businesses’ churn rate benchmark averages around 5%, a survey with numerous SaaS companies revealed that most companies experience churn rates higher than that.

Since B2B sales processes tend to be longer and require more deliberation, B2C companies experience more variance in churn than B2B companies. Customer churn rates also vary with the size of the business. Newer businesses are likely to face higher churn in the early stages, while larger, established companies tend to see lower churn.

Customer churn analysis is the process of analyzing the business’s customer churn rates over a duration to prevent and reduce it. It’s good practice to do churn analysis periodically to spot red flags when something starts to go south.

Early Signs of Customer Churn

There are several KPIs that you can use to understand the leading indicators of churn, such as:

- A decrease in the time spent on the product

- Increase in missed payments

- Increase in plan downgrades

- A change of decision-makers in the account may lead to reprioritization and churn

The 4W Framework of Churn Analysis

How do you go about analyzing customer churn? Let’s apply the old (but effective) 4W framework for churn analysis.

Who: Analyze Churn by Customer Segments

Customer segmentation is the process of grouping your customers with various similar traits. It can help you uncover trends in customer churn. Churn analysis using customer segmentation can be done in the following ways:

1.Churn Analysis by Revenue

This type of segmentation divides customers into groups based on their revenue. For example, you can divide your customer base into start-up, scale-up, and enterprise segments. Analyzing churn by revenue segment helps you understand if a specific revenue range is churning more or less and devising specific strategies to curb such churn. For example, early-stage startups might be churning because of budgetary issues and this can be reduced by offering them discounts and flexibility in payment terms.

2.Churn Analysis by Industry

Every industry has a separate set of problems, and hence this type of customer segmentation can uncover churn trends based on specific industries. This analysis helps in preventing churn by implementing specific measures for each sector. For instance, the global downturn induced by the COVID pandemic crippled the travel industry, but eLearning saw a surge as students took to remote learning. To reduce churn in industries facing a slowdown, the following measures can be implemented:

Why: Voluntary vs. Involuntary Churn

It involves analyzing the reasons behind customer churn. While we spoke about the most common reasons above, you can categorize them as voluntary or involuntary churn. Exploring what % of churn was which category gives excellent insights into churn prevention workflows and strategies you would be setting up.

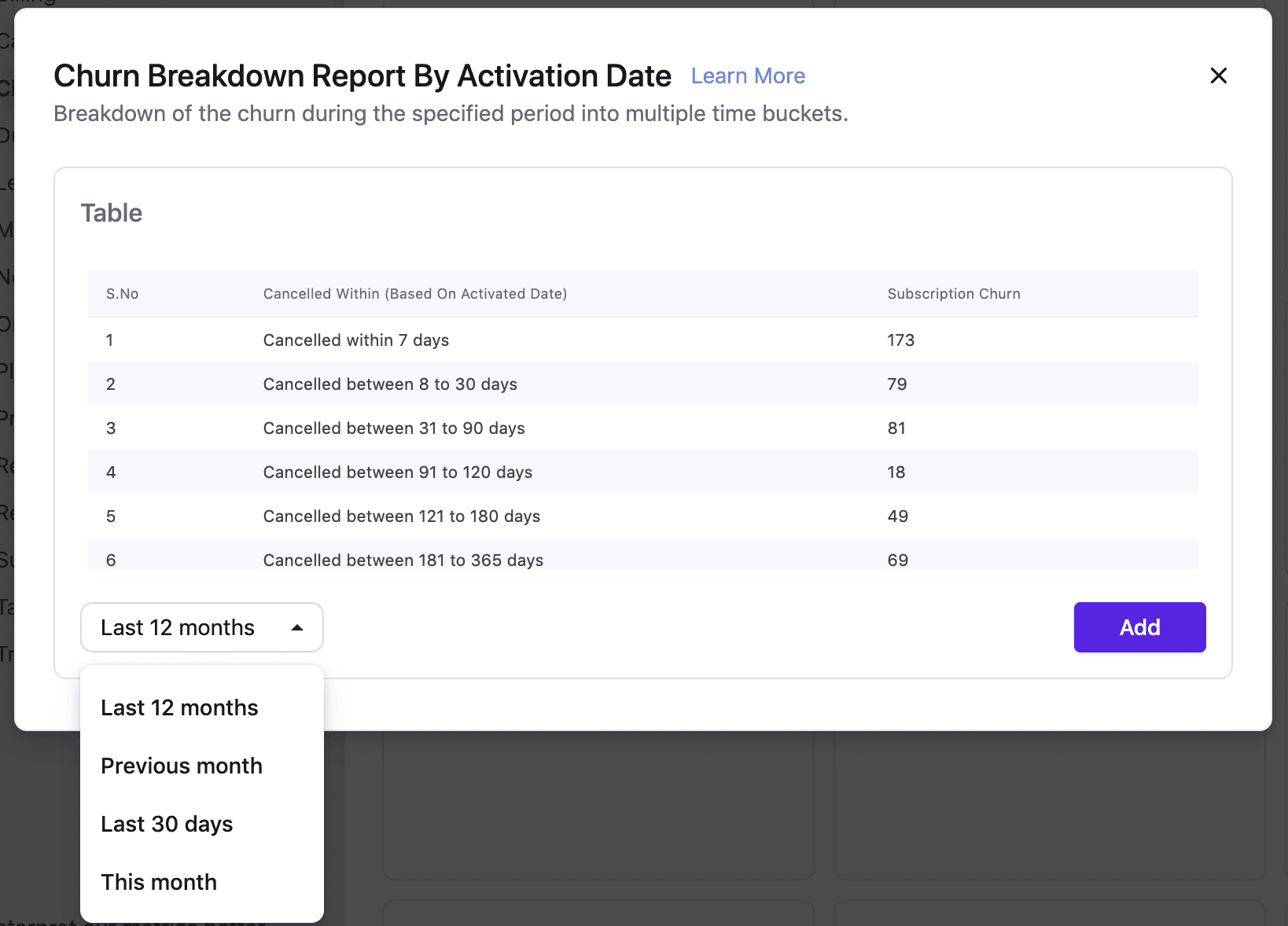

When: Early vs. Late Stage Churn

Analyzing the timing of the churn adds depth to your churn analysis. There are various ways to look at this. You can start by analyzing churn by activation dates. It tells you how soon (or not) the customer churned after activating the product.

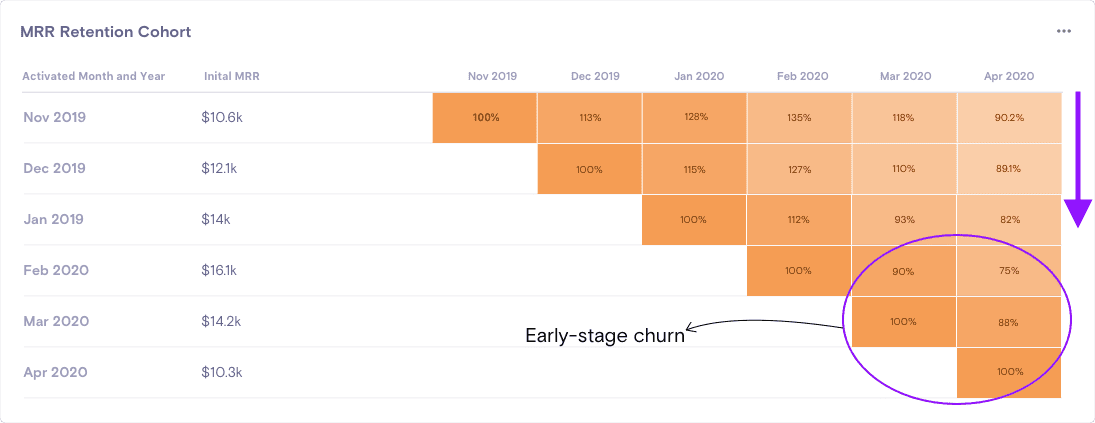

Another way to analyze this is by looking at the MRR retention cohorts. The MRR retention cohort can give you a visualization of MRR addition, growth, and churn behavior based on both when you acquired the customer and what happened in a particular month.

Moving down the first row shows you how much new revenue you could acquire month on month while going across columns shows how much that cohort expanded or contracted. In the cohort above, you can see an adverse impact on revenue growth across customers in April. But what’s more interesting is that customers acquired in the recent months seem to have churned more than the older ones – indicating a high early-stage churn.

Where: Churn Analysis by Geographies

Knowing your customer’s location adds context to why they would be churning. Tax regulations, payment gateways, and payment processing are different for every country, affecting your product’s adoption. For subscription businesses, it is crucial to comply with the local sales tax guidelines. Your subscribers could be churning due to a lack of payment options or a lack of compliance with regulations, and this analysis is a great way to spot such trends.

And that’s the 4W Churn Analysis Framework for you. Next stop: reducing churn.

Ten Effective Ways to Reduce Customer Churn

Reducing customer churn is a long game that requires a deep understanding of your customer base and changing needs. With a well-established customer analysis process, you’ve already won half the battle. The next step is to implement strategies that help mitigate customer churn. Here are a few:

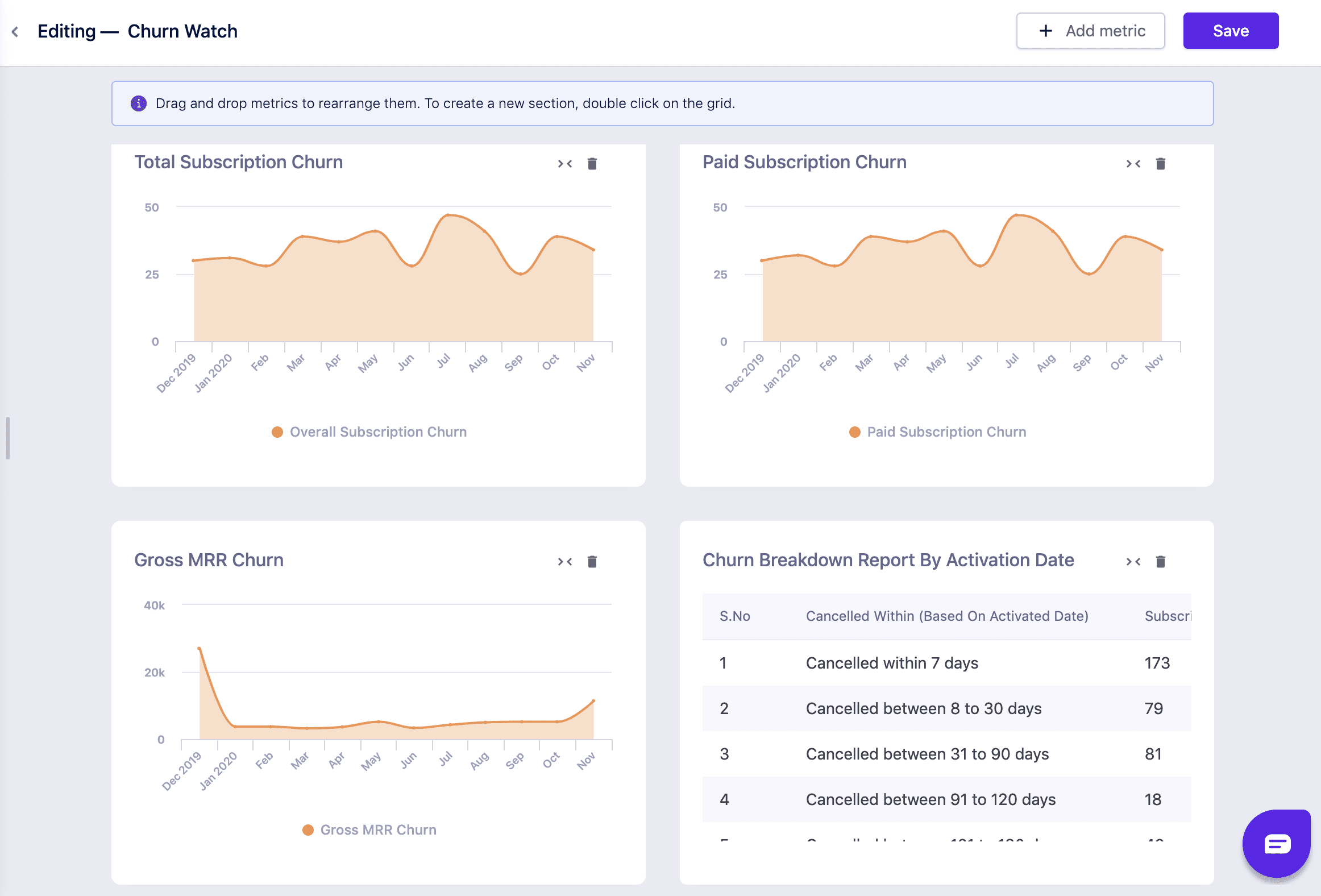

1. Invest in Subscription Analytics

Wouldn’t it be nice to have a dashboard that gives you a picture of your churn scene at a single glance? Subscription analytics tools like Revenuestory do just that and more. You have all your data and metrics in a single dashboard, with multiple ways of slicing and dicing it.

Investing in subscription analytics is incredibly beneficial in the long run, as it gives insights that you need to focus on and strategize to curb churn early on. A great example of this is how ScreenCloud course-corrected their churn using Revenuestory subscription analytics.

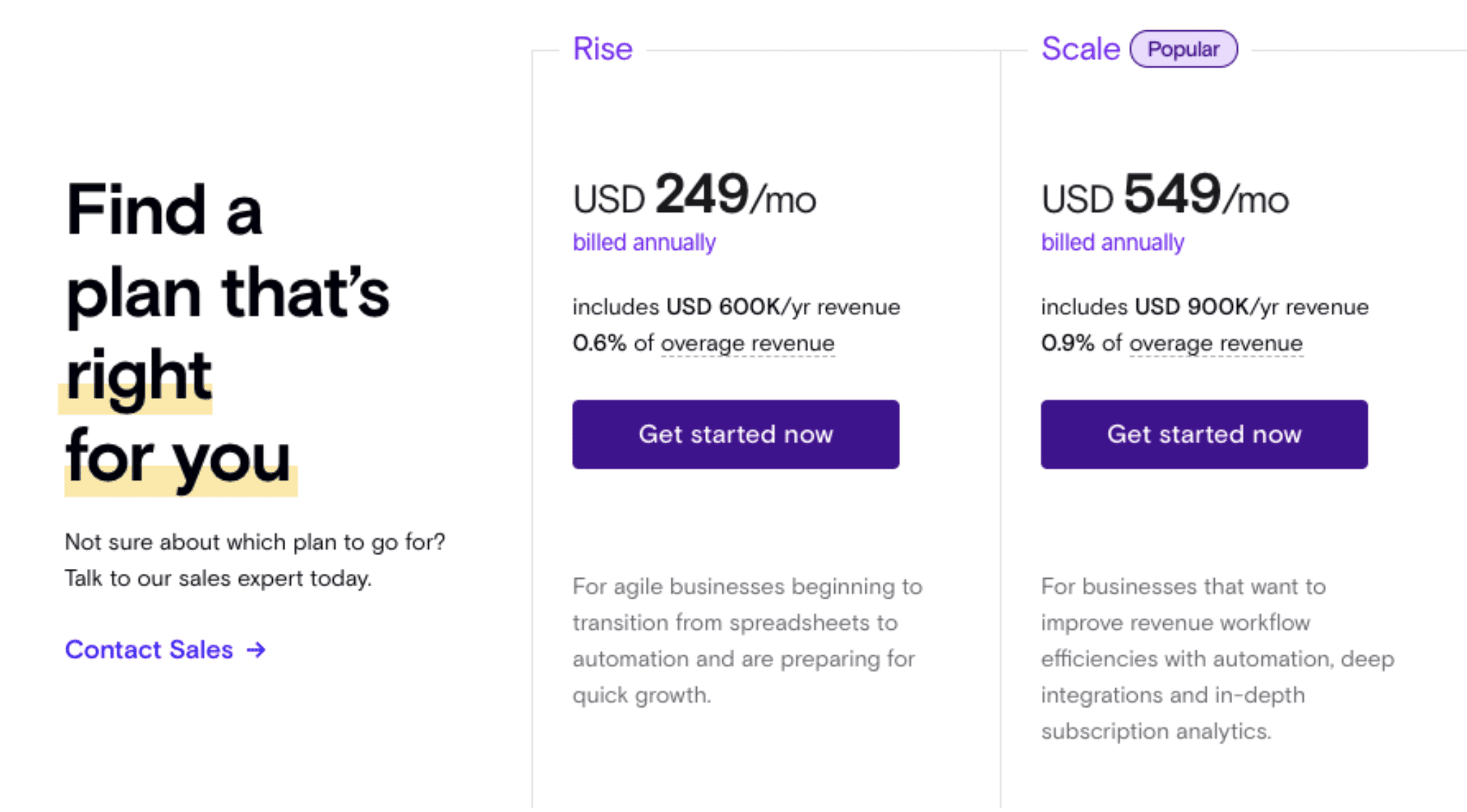

Chargebee’s Revenuestory is a subscription analytics platform built in tandem with the billing system software. Revenuestory allows you to drill-down to the deepest layer of all the metrics and reports, including churn metrics and more. Curious how? Try it out here.

2. Double Down on Customer Engagement

Customer retention is the other side of the churn coin and retaining existing customers starts with engaging them. How can you compel customers to log on and use your product on a day to day basis? The key is creating value with your product that makes customers embed it in their core tech stack. The likelihood of an engaged customer leaving is much lower if you make it difficult for them to leave your product.

3. Nail a Positive Onboarding Experience

Onboarding is often overlooked but holds the key to user retention. How would you retain users if they do not know how to use the product to its fullest potential? That’s where onboarding comes in. Provide your customers with all the training material and tutorials to get them to use your product more and help them see its value. In the long run, this helps reduce churn significantly.

4. Survey customers at the point of cancel

The subscription industry has many ways of collecting customer feedback. Net Promoter Scores (NPS) and in-product surveys are table stakes for most companies. You need a regular pulse on customer sentiment, but polling customers, while they’re still customers, isn’t enough.

Cancellation is a critical moment in the customer lifecycle rivaled only by the moment of purchase, and yet it remains a blindspot for most companies.

When customers cancel, they’re sending a message with their wallets—to effectively reduce churn, you need to know why. Surveying customers at the point of cancel is an untapped opportunity because:

- It’s timeline agnostic. Looking for feedback only when customers achieve certain milestones leaves valuable information on the table. You need insights from customers whether they’ve been paying for 3 days or 3 years.

- Customers are willing to give honest feedback. Outside of cancellation, customers may alter their answers for a variety of reasons, if they respond at all.

- There’s greater coverage of your customer base. In order to make decisions, you need to be gathering data broadly and in aggregate. The more diverse your customer base, the more important it is to talk to as many of them as possible.

- You don’t have to rely on translation from sales and success teams.

Think about churn like a funnel. As your customers make their way through the cancellation process, you can survey them to learn about their reason for canceling, and mobilize your teams to take action in the moment. In the same way companies identify, market to, and convert prospects, you can use cancellation to gather insights, make targeted offers and reduce churn.

One way to build a churn funnel is to present a standard exit survey at the point of cancel. A step further is to use a product that identifies at-risk customers and serves up a personalized cancel experience based on customer segmentation, like plan type or billing details. This is ideal if you want to automate the retention process (e.g. reaching out to customers or alerting the right teams) and save engineering resources related to integrating survey data.

Talking with every customer who cancels will arm you with the insights you need to improve your product, but only if it’s classified in a systematic way.

Identify high-risk customers that are likely to churn. You can do it by tracking the leading indicators of churn mentioned earlier, such as payment failures and slower product adoption. Provide special discounts, coupons, or flexible payment terms to this customer segment. It will help you proactively prevent them from churning.

5. Define a Reason-based Classification System for Churn

Now that you’re surveying customers at the point of cancel and collecting feedback, it’s time to organize the reasons for canceling into categories.

To build categories from scratch, start unstructured and open-ended. Ask customers to describe in a text box why they’re canceling their account. This is qualitative data, but as answers are collected, you can categorize reasons and later prompt customers to choose from a list.

When defining categories, consider who is influenced by the feedback. Ask yourself: What actions will you be taking as a result of this information? Typically, this data is most valuable for product improvement, customer and market intelligence, service feedback, monitoring sentiment or identifying new avenues for growth.

Reason-based classification has three major benefits for companies:

- Everyone in the company speaks the same language about churn, and you can revisit the reasons people cancel again and again for new insights.

- It’s easier to identify what parts of the business are in need of investment in order to retain more successfully.

- You can assess the efforts and investments made over time are having an impact on churn, especially when the data is reviewed in cohorts.

You can also explore revenue classification if you regularly include this information in company reports or use revenue types as part of your organizational KPIs. To do this, ask customers to identify their plan type, payment frequency or use a tool to gather this information automatically using a customer management solution.

Every company will look at their churn data differently, but will generally come to the same conclusions about their reasons and categories. Generally, I’ve found these categories look the same across business types and industries.

6. Connect Churn Data to a Central Source of Truth

The key to surfacing churn data throughout an organization is making sure it’s delivered to a system of record that is easily publicized, analyzed and actioned.

Most companies have multiple tools capturing product usage, customer feedback, payments, and support engagement. Data is spread across sources (like CRMs, product analytics, customer success notes, business intelligence platforms, etc.) and across departments, and this contributes to the time lag between data being collected and taking action.

When there’s a discontinuity between the source of the data and analysis, even simple acts of customer retention can be out of reach.

For example, a customer indicates their reason for canceling is pricing related. This information lives in a data capture mechanism like a survey tool or within the product owned by the product organization, but the capability to reach out and contact the customer lives in an entirely different system like a CRM owned by sales and success. This is a case of voluntary churn that could be influenced to stay if the customer’s need was met. Given a few integrations and a proactive team member, this customer could be contacted and presented with a special deal or bundle. But it becomes more and more unlikely the customer will return as the time between feedback and action grows.

Even with large amounts of customer insights, it can be difficult to actually organize teams around retention opportunities and improve the customer experience. If you can’t easily find and determine why your customers are canceling, the cycle of churn will repeat itself.

Customer retention efforts can be shared across multiple teams, so accessibility ensures data is shared regularly and frequently. As your data set grows, you can review trends and customer cohorts over time and empower your teams to use churn data as a key driver of product and company improvement.

7. Segment Customers by Actionability

Actionability measures whether you can engage the customer and get a response that meets an objective. In many cases, the objective is not canceling, but this could also be things like converting from trial to a paid account or getting the customer to expand.

Segmenting churn by actionability allows you to funnel resources to customers that are likely to respond, and learn from the ones that can’t or won’t. Beyond looking at voluntarily v/s involuntarily churning customers, it is also necessary to look from the vantage point of actionability.

Influenceable v. non-influenceable

A different approach is defining whether you believe the customer won’t churn if you were to satisfy unmet needs. This is referred to as influenceable vs. non-influenceable churn.

Examples of influenceable churn:

- Poor onboarding

- Misunderstood product

- Mismatch of value for cost

- Poor customer experience

- New stakeholder or executive owning services

And non-influenceable:

- Poor performance

- Downsized or exceeded, especially if price changed

- Security incident (i.e. breach of trust)

- Mistaken purchase

- Changing business model

This segmentation is critical to alerting the right team to deliver what’s needed to the customer. Over time, you can optimize who should reach out, where they should reach out and with what offering to meet the customer’s needs.

8. Deliver Personalized Reason-based Offers

Actionability only works if you provide an offer to an influenceable customer on the right channel, at the right time for the right reason. Doing this can solve your customers’ unmet needs and give them a way to stay, and our data shows that 5% to more than 20% of customers, depending on the audience and product, will do so.

To start, set up alerts to notify the right teams when a customer who reaches certain classification and actionability criteria decides to cancel. Alerts should include the relevant customer information needed to make contact, so that teams can move as quickly as possible armed with the reason for cancellation.

These alerts should trigger engagement with the customer, and that engagement will look different based on the offer. Think about triggering live chat with support or follow-up tasks for your CSMs.

Based on the combination of customer data (plan type, etc.), the reason for cancel and the objective for outreach, it’s time to make offers to your customers to help them stay. Here’s what those offers could look like:

- Eligibility-based discounts

- The ability to downgrade or pause account

- Free services or “let’s set you up”

- Training videos

- Live chat with support

Offers are about doing whatever you can to retain revenue that would otherwise be lost.

Customers often cancel over price, but discounts alone won’t always do the trick. I’ve seen customers have great success with a “name your price” offer that allows customers to indicate what they’d be willing to pay in exchange for extending to an annual plan and taking a training call.

In the case of a customer who didn’t have time to get set up, consider connecting that user straight away with a customer service rep or an onboarding specialist. These seemingly small actions have compounding results.

Over time, as you track the effectiveness of your offers based on cohort data, you can identify the reasons and offers that increase actionability and eliminate those that don’t reduce churn.

A great way to temper churn is also by being thoughtful in your onboarding process. Consider prioritizing annual plans over monthly tenures, to give your customers lesser opportunities to churn. This usually works in two ways – First, you charge the credit card for payment only once a year, making payment failures far less likely – minimizing chances of involuntary churn. Second, your customers are only deciding to stay or leave once a year versus every month for the monthly plan.

9. Implement Smart Dunning Workflows

It’s a strategy aimed explicitly at reducing involuntary churn. It would be best if you weren’t losing revenue because of a failed transaction, and that’s why it calls for a proactive approach. That’s why you need a smart recovery strategy. For example, Chargebee Receivables offers an exhaustive dashboard with real-time AR visibility to help you anticipate, strategize, collect, and recover payments on time. You can leverage this detailed information about failed transactions and create ‘smart’ dunning workflows to maximize your revenue recovery.

By effective dunning management, businesses can reduce their churn rates by as much as 100% (Based on a true story)

10. Test and Evolve Using Saved Revenue as KPIs

Customers who accept offers and decide not to cancel (we call this deflection) are directly attributable as saved revenue. High deflection rates can mean big things for your bottom line; customers continue to generate more saved revenue the longer they continue to subscribe.

It’s a best practice to monitor the customer for a given amount of time to make sure the deflection is earnest. Many tracking systems will enable this kind of monitoring. At Brightback, we attribute “saves” using a 30-day cookie.

Deflection can be considered a new source of retained revenue without the cost of advertising or sales. As such, it should be tested and optimized like any other revenue-generating activity. Here’s where you should be gathering data and making changes to increase saved revenue:

- Survey copy: use dynamic fields to personalize names, companies or attributes unique to your customers.

- Reasons for cancellation: isolate actionable from unactionable reasons, and track open-ended comments to mine and explore new reasons.

- Segmentation: track actionability based on customer attributes like billing, tenure, value, and product usage.

- Offer strategy: define what offers (discounts, meetings, etc.) entice customers and ultimately lead them to stay.

- Engagement workflow: look for the outreach channels that are most effective.

- Product enhancements: find the patterns in customer feedback about your product and focus improvement there.

Conclusion

For small and large companies alike, customer churn is an important metric to track. Reducing customer churn starts with slicing and dicing the churn data to analyze who is churning, why they’re churning, and when and where the churn is occurring. If you have a customer-centric product coupled with a powerful analytics tool in your arsenal, strategizing for churn reduction becomes easier and more efficient. Our 10-step process is a methodology founded on the principle that the best way to retain customers is to improve the overall user and cancel experience, and to enable win-back to facilitate returning customers to join in your growth journey.

By taking a systematic approach to measuring churn and saving customers, you gain new insights about what your customers want and improve your retention metrics which will accelerate your revenue growth and path to profitability.