Multiple Business Entity Offline Payments

Offline payments are asynchronous transactions made via cash, checks, bank transfers, or other offline payment methods and then reconciled manually or automatically to the console. Flexibility for customers to pay through offline payment methods can help extend your business coverage to areas that don't provide support for online payment methods.

Know more about offline payment support.

Options with Multi-Business-Entity

The Multi-Business Entity feature enables you to create multiple independent entities within a Chargebee site.

Prerequisite Ensure the MBE feature is enabled for your Chargebee site and applicable entity are created. Learn more.

With the multi-business entity now enabled and entities created, you can now complete the following:

- Configure offline payments for your Chargebee site.

- Override and manage customized offline payment settings for each of your entities.

Site-level configuration

Note:

Enabling offline payments can be done only at site level.

Follow these steps to configure offline payments at your site level.

-

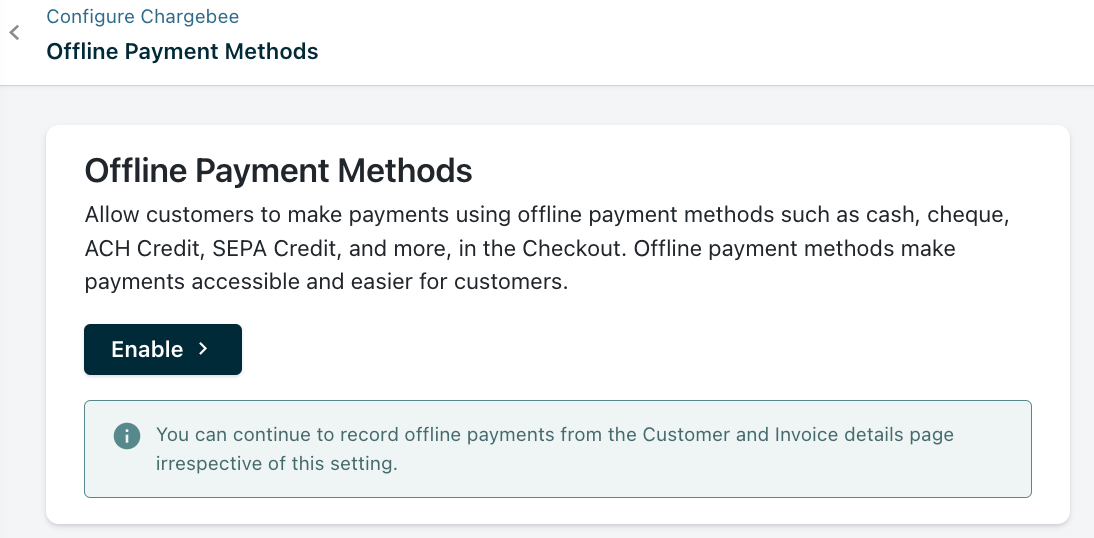

Enable offline payment methods at the site level by clicking Settings > Configure Chargebee > Offline payment methods > Enable.

-

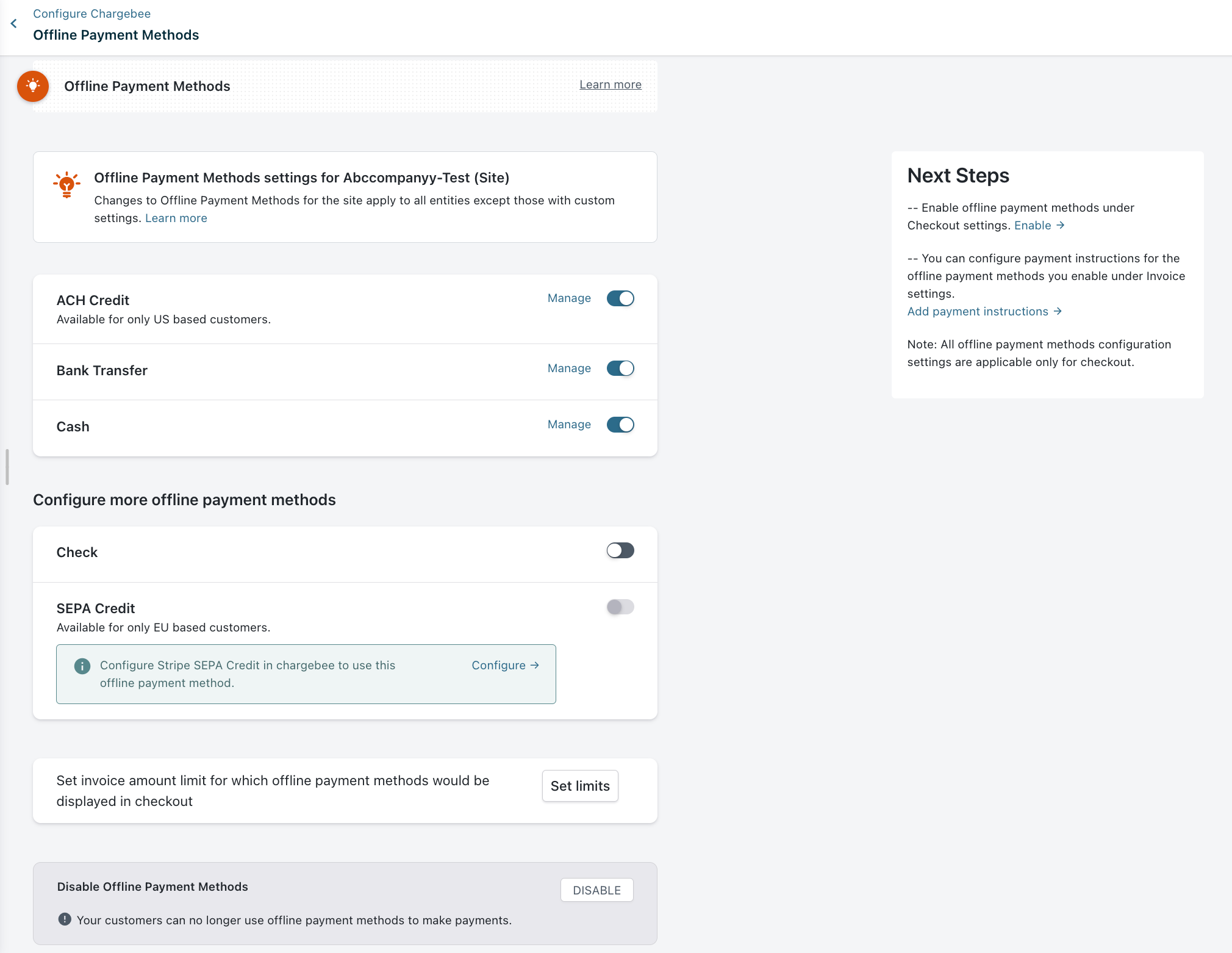

On enabling, configure the offline payment methods that you intend to support.

Offline payment methods supported in Chargebee are:

- Bank transfer

- Cash

- Check

- ACH credit transfer

- SEPA credit transfer

Note:

Following configurations can be managed only via site-level settings:

- SEPA: must be configured at the site level to be available for configuration at the entity level.

- ACH: must be configured at the site level to be available for configuration at the entity level.

Business-Entity-level Impacts

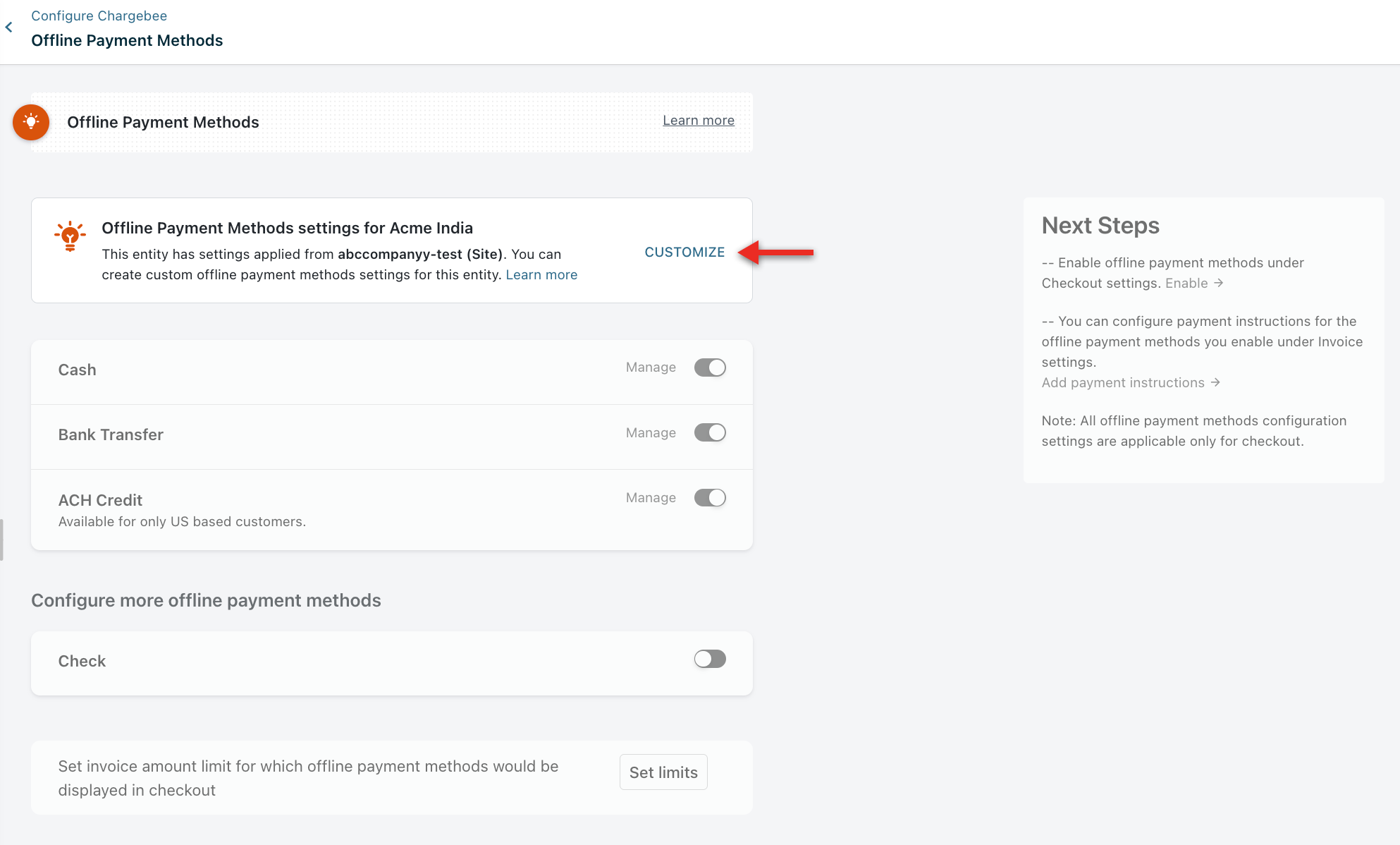

The configuration is limited to overriding the offline payments rules at the business entity level. You can access all other configurations only at the site level. All entities will use the offline payments profile configured at a site level by default. You can choose to override and set up a different offline payments profile for entities separate from the site level settings based on your business needs.

For example, the site (Acme_hq) may use multiple modes of offline payments like checks and bank transfers whereas the regional entity (Acme_europe) may want to offer additional offline payment options such as ACH.

You can override the offline payment profiles to set up this processing model in this scenario.

Note:

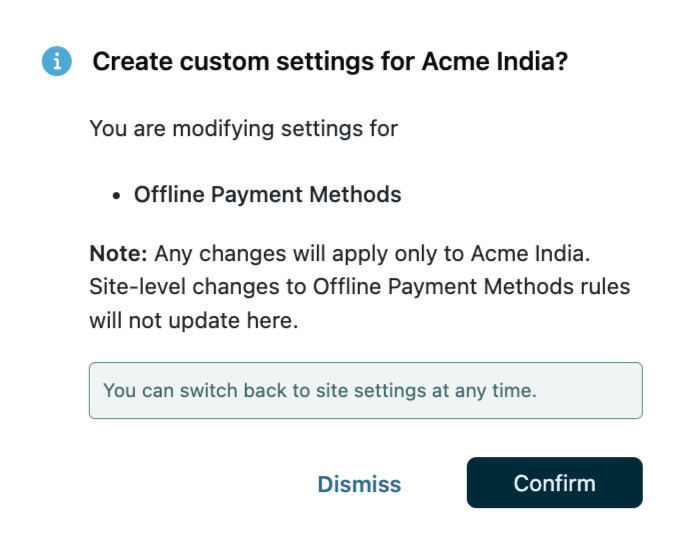

The changes made to the offline payment under a specific entity will neither be applied to the site nor other entities. Also, once you have customized the settings, no site-level changes will be applied to that particular entity.

Customizing Business Entity-level offline payments

Configure an offline payment method for a specific entity for different modes of offline payments than those used at the site level.

Follow the below steps:

-

Click CUSTOMIZE.

-

Click Confirm.

Additional features at entity-level configuration

Once you confirm, you will be able to manage the configurations for each payment method and also set invoice limits at the entity levels.

- For each payment method, there is a setting to restrict supported currencies. Select only the currencies you intend to support for that payment method. (Denoted as (1) in the screenshot).

- Set a threshold amount for offline payments, and thereby restrict the display of offline payment methods for any invoice amount below that. You can set a threshold amount for each currency. (Denoted as (2) in the screenshot).

Note:

Across entities, users will be able to record offline payments in the payment method of their choice.

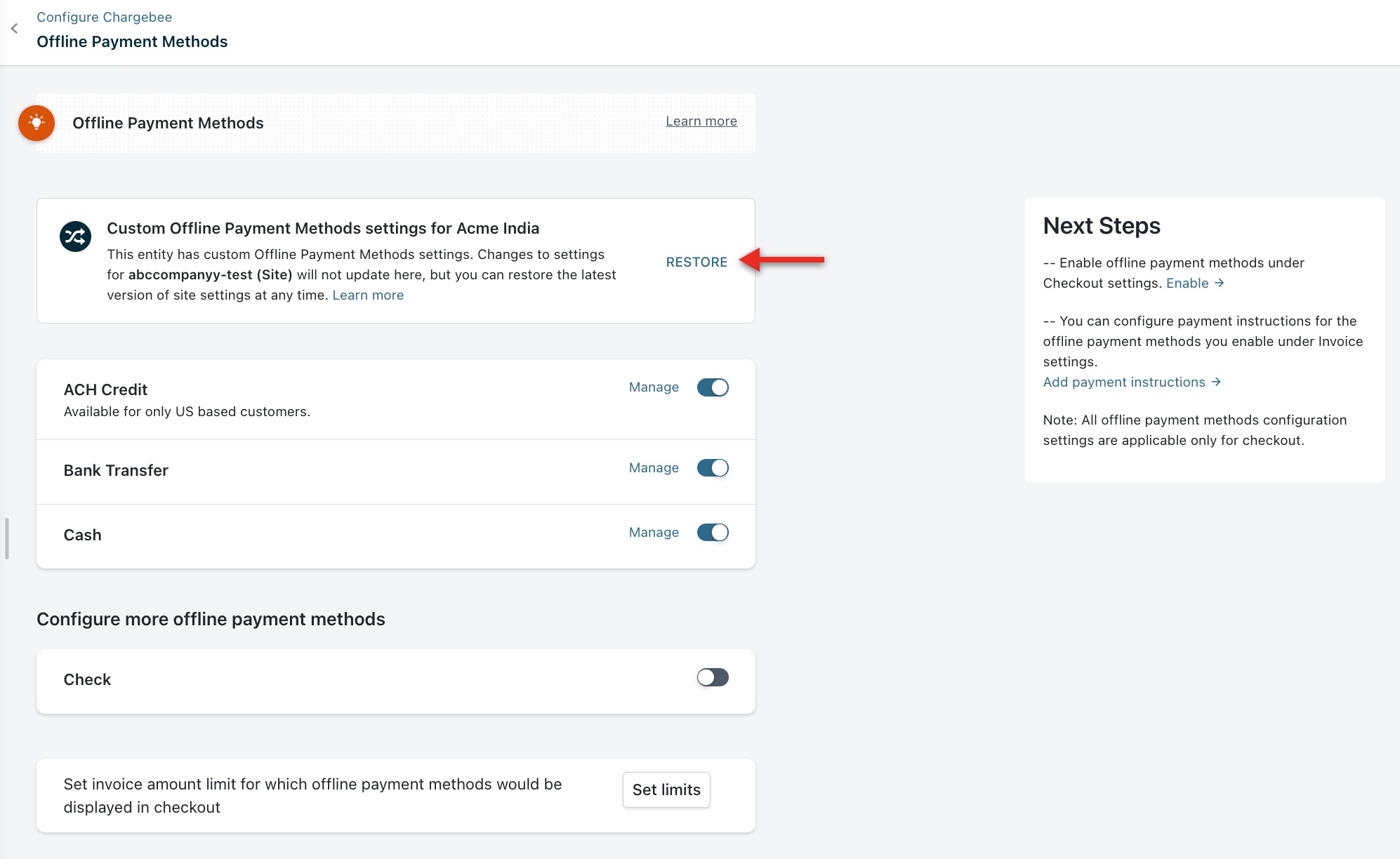

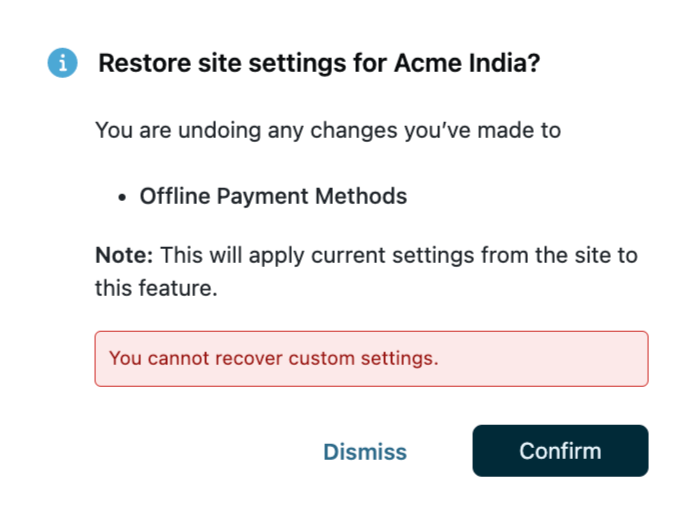

Restoring the Business Entity-level Changes

Follow the steps to restore the configurations for a specific entity, while leaving offline payment methods enabled at the site level.

-

Click RESTORE.

-

Click Confirm.

Was this article helpful?