Vexed by the messy ways of taxes? With Chargebee at your service, you could do better, and focus on building the recurring revenue business you've always wanted.

Tax invoices for SaaS and Subscription Commerce Businesses

Let Chargebee manage taxes for you, so you can focus on your business instead.

Same old taxes.

Just way less taxing.

EU VAT and Brexit Compliance

With 28 member states and messy tax rates, VAT in the EU can be confusing. Compliant invoices, VAT number validation, displaying the VAT amount in local currencies, or providing exemptions, we have it all covered.

Now, what about Brexit? You can configure the United Kingdom as a separate tax region, verify UK-issued VAT numbers, and customize your preferences like location validation and exemption notes. Chargebee makes your business shock-proof to every post-Brexit tax impact, so you can continue selling to customers in the UK (including Northern Ireland) without breaking a sweat.

Tax Management Integrations

With multiple jurisdictions, changing rules, and varying tax rates, tax-based workflows are complex to manage. With tight integrations with Anrok, Avalara and Vertex, invoicing, tax filing, reporting, and managing taxes have never been this effortless.

Your accountants deserve better

It sounds easy to apply taxes if rules are set, but how about reversing taxes or redistributing the credits? Could be troubling, eh? Nope. With Credit Notes to handle all the edge cases, reversals and credits have never been simpler. And accounts teams stay happy for all the manual work that's off their plate.

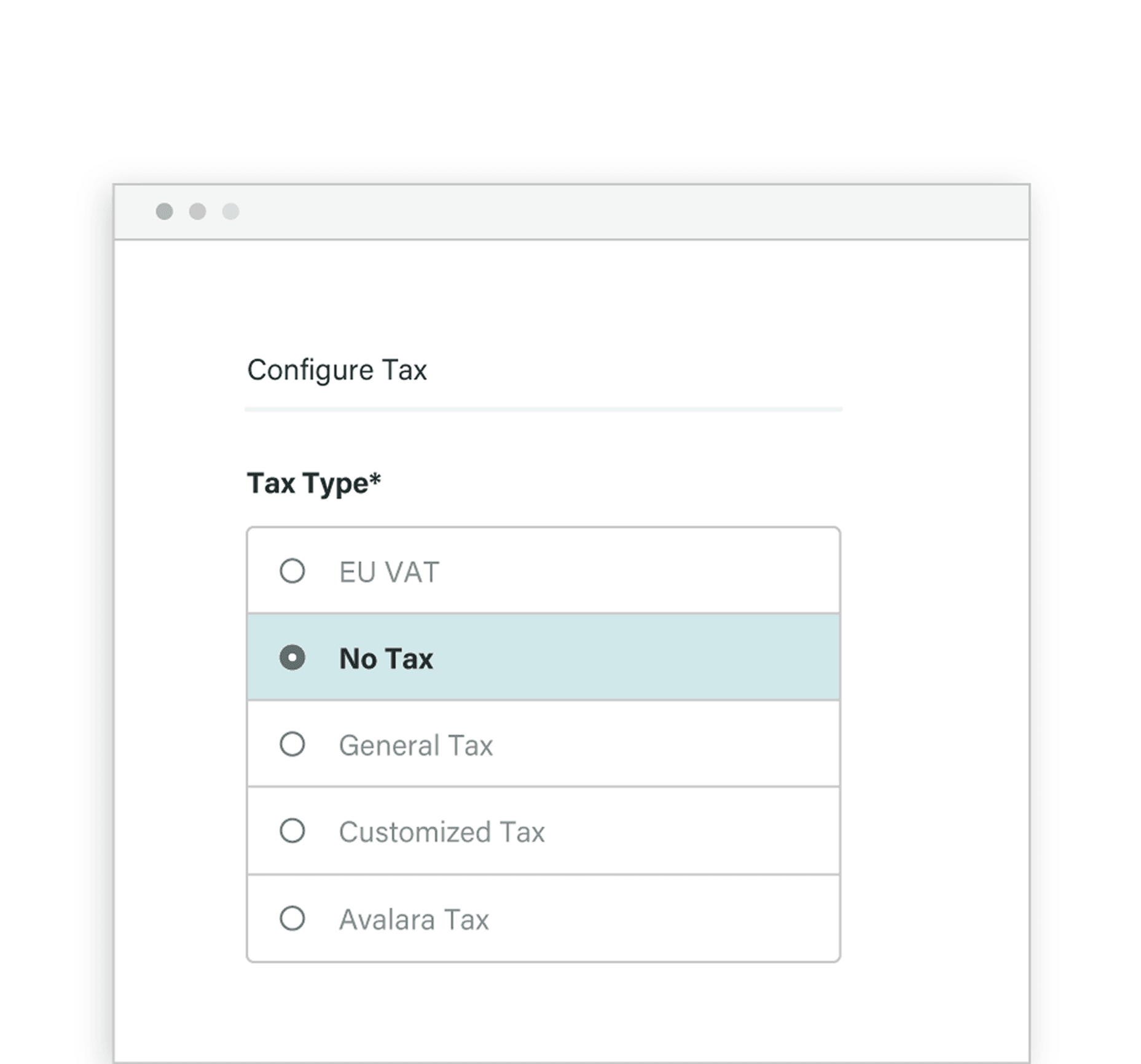

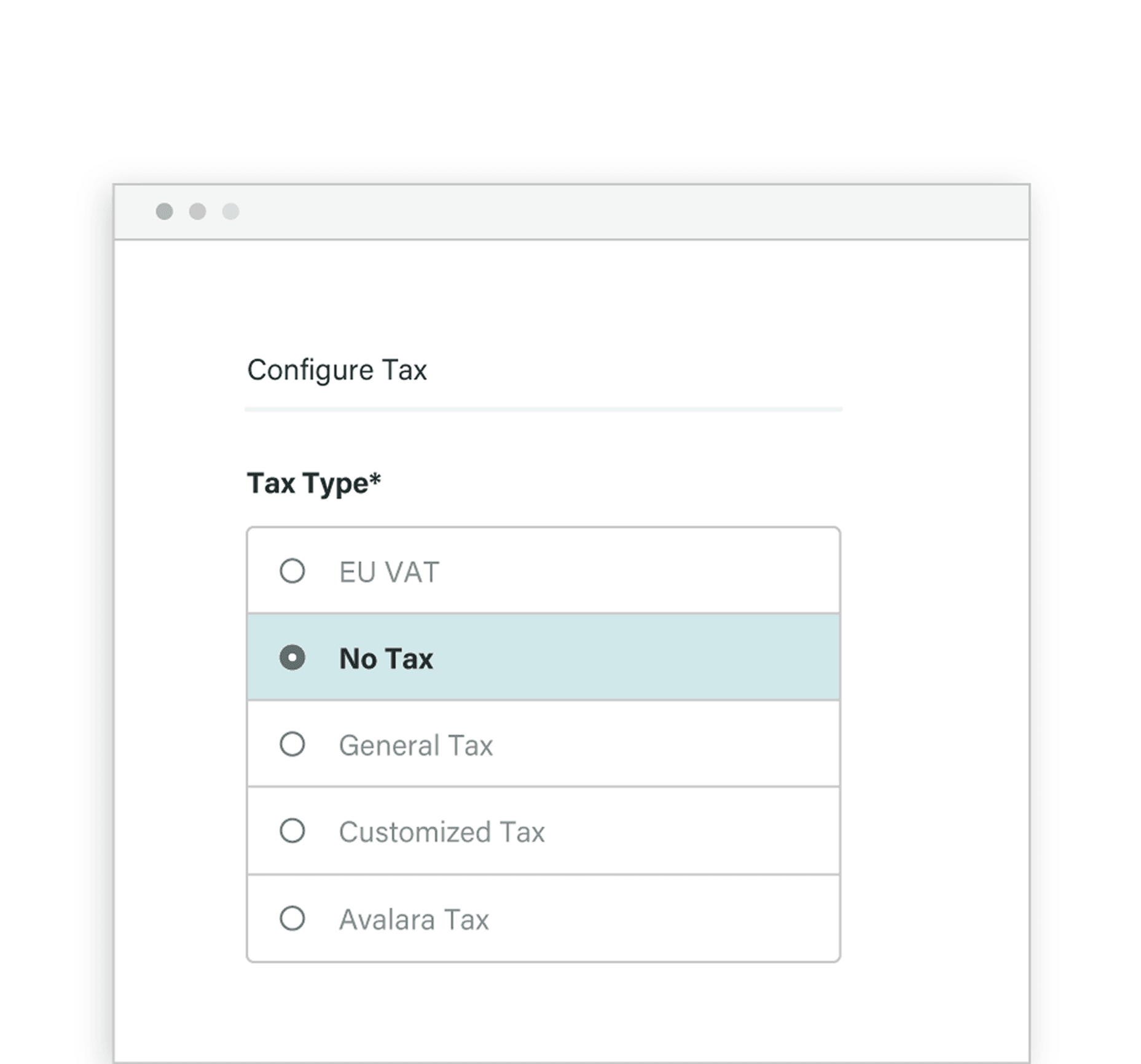

Custom Taxation rules

If your business has multiple tax rates for products along with a region-based tax that varies according to the state/province, doing the right math could get downright messy. Worry not. By just uploading CSVs of all your tax rules, all the heavy-lifting can be automated right away.

Exempt taxes - Edge cases

In some edge cases like charitable or religious organizations where taxes aren't applicable, it might be a tedious task managing taxes. But Chargebee lets you mark specific customers or products as exempt if taxes aren't applicable for them. Another task off your to-do list.