LTV: CAC ratio benchmarks

Understanding the LTV/CAC ratio is crucial for businesses, especially in the SaaS industry, as it measures the relationship between the customer lifetime value (LTV) and the cost of acquiring that customer (CAC).

A 1:1 ratio indicates that you are spending as much on customer acquisition as customers are spending, leading to a lack of profitability. Improving your customer acquisition strategy is essential to achieve a more favorable balance and increase profitability. The LTV-CAC Ratio is a good indicator of how valuable your company is––a ratio of 3:1 indicates your customer's value is three times more than the cost of acquisition.

The LTV-CAC ratios help you determine how much you should be spending on acquiring customers. If this ratio is low, you're pretty much-burning money in the long run because if you are spending more to acquire your customers than their expected return on revenue throughout the customer’s lifetime, eventually you will run out of resources to acquire any more customers.

INDUSTRY | LTV | CAC | LTV: CAC RATIO |

|---|---|---|---|

Business Consulting | $2,622 | $656 | 4:1 |

eCommerce | $252 | $84 | 3:1 |

Entertainment | $823 | $329 | 2.5:1 |

SaaS (B2C) | $2,306 | $166 | 2.5:1 |

SaaS (B2B) | $664 | $273 | 4:1 |

Customer Acquisition Cost vs. Lifetime Value

Customer Acquisition Cost (CAC) and Lifetime Value (LTV) are important metrics for a subscription business to understand the underlying unit economics and inform marketing efforts.

Now, before we get into the ratio as a whole, let's break down the components.

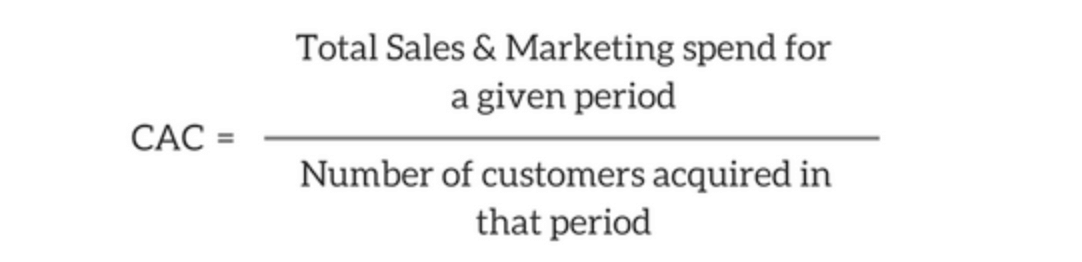

Customer Acquisition Cost

Customer Acquisition Cost (CAC) is the total cost of gaining a new customer, including marketing and sales expenses. It is a crucial metric for businesses to understand their return on investment (ROI) for customer acquisition efforts. The CAC Payback Period is a metric that measures the time it takes for a company to earn back the money invested in acquiring customers, or in other words, the break-even point. CAC is calculated as the total cost of acquiring customers, divided by the total customers acquired over a given period. The 'cost' is your total spend on sales and marketing costs.

CAC calculation

For example, if you spend $300 acquiring new customers in Q1 and acquire 200 customers, then your CAC is $1.5.

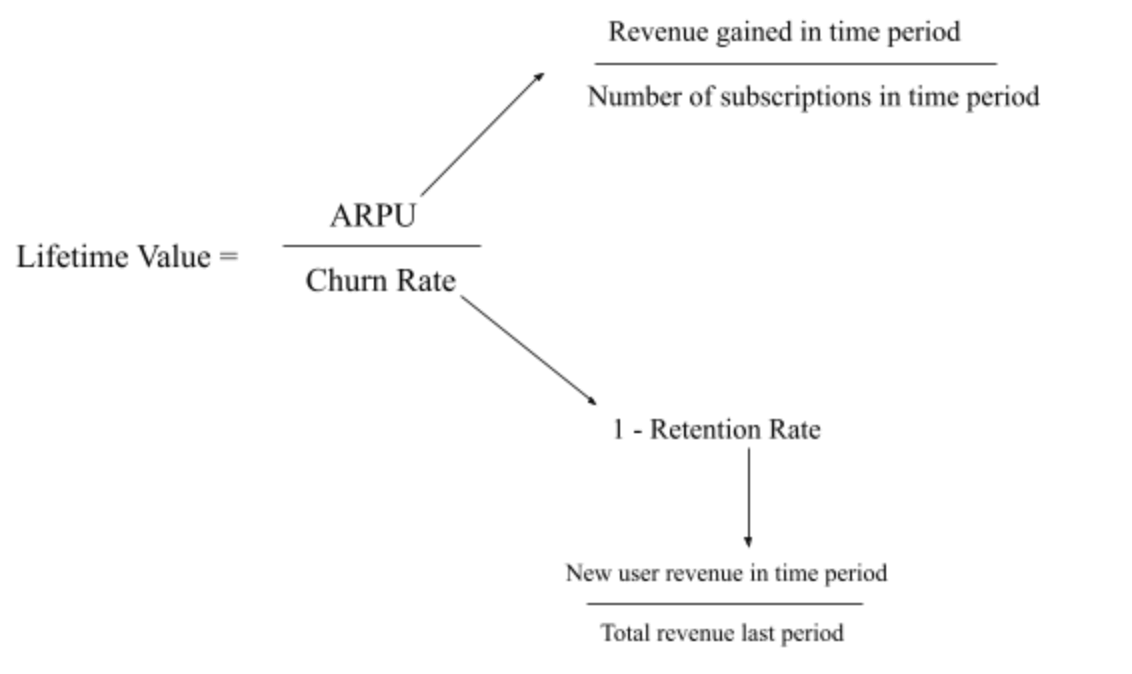

Lifetime Value

Customer Lifetime Value (LTV) is a metric that predicts the net profit a customer will generate over the entire span of their relationship with a business. It evaluates the potential value of a customer to a business, informing strategic decision-making by helping businesses identify and prioritize their most valuable customers. A low LTV can indicate that a business is not maximizing the potential value of its customers, or that customer retention (retention rate) is low. Lifetime value (LTV) is the average revenue a single customer will generate throughout their lifetime as a customer of the business.

And to calculate the Lifetime Value metric, you must first calculate the Average Revenue Per User (ARPU) and your Churn Rate.

LTV Formula

Or, you could calculate it as LTV = ARPU * Gross Margin * Average Duration of Customer Contracts

We have a very detailed blog that tells you how to calculate lifetime value that comes with a ready-to-use template too!

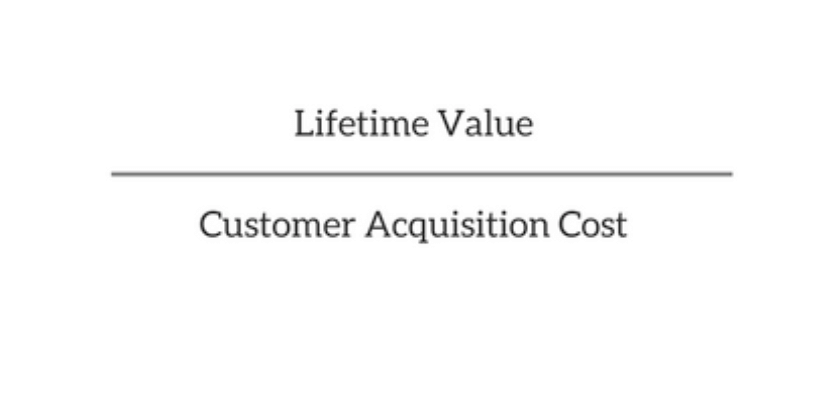

Calculating CAC-LTV Ratio

Once you've found the CAC and LTV metrics individually, you can now calculate the LTV-CAC ratio. To do that, you simply divide the lifetime value by the customer acquisition cost.

How to Calculate the LTV to CAC Ratio :

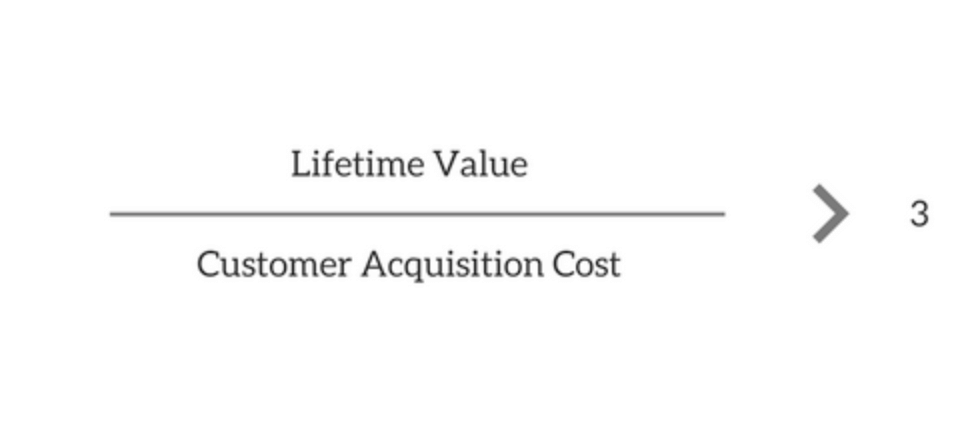

What is a good CAC: LTV Ratio?

Ideally, the LTV/CAC ratio should be 3:1, which means you should make 3x of what you would spend on acquiring a customer.

If your LTV/CAC is less than 3, it's your business sending out a smoke signal! This should be taken as an indicator to try to reduce your marketing expenses so you can sustain effective acquisition efforts in the long term.

CLV and CAC: Which is more important?

Both CLV (Customer Lifetime Value) and CAC (Customer Acquisition Cost) are important metrics for businesses, with an inverse relationship between them. A higher CAC typically leads to a lower CLV, and vice versa. Balancing these two metrics is crucial for business profitability and growth.

CLV helps businesses evaluate and plan their strategies to benefit from bringing a customer to the business, while CAC measures the cost incurred to acquire a new customer. Both metrics are essential for businesses to evaluate and understand, as they provide distinct yet related stories about the effectiveness of business strategies.

To optimize the CLV: CAC ratio, businesses can focus on strategies that increase customer lifetime value without increasing customer acquisition costs. These strategies include identifying an ideal customer profile, optimizing pricing strategies, reducing customer churn rate, upselling, cross-selling, and charging, and moving towards subscriptions and memberships.

The ideal CLV: CAC ratio for businesses is generally considered to be 3:1, indicating that for every dollar spent on acquiring a customer, a business should generate three dollars in customer lifetime revenue. However, this ratio can vary depending on the industry and business model.

How does the CAC-LTV Ratio help?

What type of customers to acquire

An enterprise customer can have a high CAC, but they'll also have a higher LTV since they tend to churn less. It makes sense to look at these enterprise customers, yet the LTV-CAC can help you uncover valuable revenue. For example, in the case of HubSpot, they had two personas: Owner Ollie and Marketer Mary. The former was the owner of a small business and did their marketing, while the latter worked for a slightly bigger company and was in charge of marketing. At first, they concentrated their efforts on Marketer Mary, which had an LTV of $11,125. But later, they found that selling to Owner Ollie through a channel partner produced an even better LTV of $11,404.

How much to spend on acquiring customers

As a subscription or SaaS business, you'll be spending significant fund on acquiring customers through sales and marketing. But how much do you spend? Knowing the ideal LTV/CAC ratio and working it backwards can inform how much you need to spend if you know LTV. For example, if the LTV of a customer you want is $30,000 and you're looking to hit an LTV/CAC ratio of 3:1, then you'll need to spend approximately $10,000 on an acquisition.

Raising investments

If your customers are worth three times the value of the acquisition, then investors are all ears. But the point here is not to parade this metric around, it’s to show the investors that "this company has a broad product-market fit and its strong LTV-CAC today is likely sustainable at similar levels over time."

How to optimize the LTV-CAC Ratio?

Before you can optimize your spend, make sure you've calculated the CAC accurately. If everything is in place, here are a few pointers to help you out.

Focus on the right channels

The channels that bring in the most customers aren't always necessarily the ones that work. If those customers churn out quickly, there's no point in allocating many funds to these groups and crying over spent costs, which is why you should invest in channels that facilitate inbound marketing. Since 81% of consumers conduct online research before buying, having a targeted and informed approach will attract leads who are more likely to be interested in your solutions over a long period of time. It gives you good quality customers while having less costs.

Experiment with pricing

If you have a freemium business model, try experimenting with your pricing to figure out the factors that could convert more paying customers. It could be an increased pricing tier, a feature-based pricing model, seat-based pricing, etc. The more quickly you can convert freemium users to a paid plan, the lower your CAC would be. But don't compromise customer happiness, because soon you will have no customers to keep or new ones to attain.

Reduce sales complexity

An arduous sales process or a longer sales cycle will lead to a higher CAC. Keeping your prospects engaged with an effective hand-holding process and proper onboarding is critical in retaining those in the sales process. Ensure you invest in setting up a tight funnel and make each step easily navigable. Customer retention is key.

If you want to be a profitable business, you have to cut your cost of revenue and as a digital business, the majority of this will come from CAC. At the same time, you need quality customers who love your business and stick with you for long periods of time, enabling high lifetime value and a chance at expansion revenue.

In Conclusion

A SaaS business (or subscription business) is no doubt a customer-centric business. You need to acquire customers at low costs and keep them happy for an extended period of time. The LTV-CAC Ratio serves as a guardrail for maintaining these conditions. So keep peeking over at these KPIs as a pulse check––it's also one of the critical SaaS metrics investors use for the valuation of companies.